WatchHimTrade.com

-

Honesty

(5)

-

Quality

(5)

-

Cost

(5)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

A very interesting trading service that specializes in day trading options in the most highly liquid stocks. Owner of the company trades inside of the live trading room with a real trading account, risking real money on every trade. 100% transparent, open and honest. This is an excellent learning experience for anyone looking to learn how to day trade and scalp primarily stock options. A verified track record of several thousand trades. A very smooth, upward sloping equity curve. At $99 a month is ridiculously cheap and packed with high value information. Highly recommended.

User Review

( votes)Thanks for reading today’s review of WatchHimTrade.Com

What is WatchHimTrade.Com? WatchHimTrade is a day trading educational company that is specifically geared towards day trading stock options. The cost of the service is $99 each month and includes a live day trading room, over 1000 hours of recorded live trading footage, educational videos, as well as 1-on-1 educational sessions with the company owner. The company was founded by Kevin Kleinman, age 25, yes you are reading this correctly. Age 25. The company is relatively new. The website came online April 2014.

Before I jump into the meat and potatoes of this review, I need to fully disclose to the audience that I have a promotional agreement with WatchHimTrade.com. Anything that you purchase from WatchHimTrade.com earns me a 30% commission of gross sales, for the entire life cycle of the customer. It is important to me that every reader is fully aware of every single promotional agreement that I have with various vendors. In fact, every month I publish a report that is highly detailed and describes the exact amount that I earn from each relationship. Some readers might find these promotional relationships as a betrayal of my core promise to always provide the most honest and unbiased reviews as possible. However, as the monthly income and expense report spells out in great detail, there is quite a bit of work and costs associated with researching this vast swamp of trading educators. Ok, lets move forward.

My number one request, and a few others

I want to take a moment and speak to the audience about the number one request I receive from readers. Each week, I will receive at least 10 emails from readers with the same sort of request. They ask me, “I have very little trading experience, and $2,000 in my trading account, whom do you recommend?”. I am usually quick to reply that they are underfunded and that their chances at surviving the markets is slim to none. This is the hard cold reality. The financial markets are quick to destroy the underfunded and under educated. In the financial animal kingdom, the weakest quickly become a tasty snack for the seasoned killers.

The vast majority of these trading newbies will often gravitate towards penny stocks. Which of course is a suckers game. The only people that make money on penny stocks are the penny stock promotional companies that pump and dump via massive email blasts, BS news stories, outright manipulation, front running, and straw man purchases. I should know, penny stock scamming landed me in a Federal Prison. I understand the game of penny stocks very well. Avoid it. You may think that you are smart and will avoid being a sucker and will only short those scammy penny stocks…don’t be a fool. 99.9% of those that attempt to play these unregulated fiestas of fraud and manipulation will quickly become sausage meat.

Many of my readers also send me emails requesting my best recommendation for a trading mentor. Someone that can show them “the secret” of the market. A wise old person filled with wisdom, goodness of heart, and willing to divulge all of their secrets. Sort of like a financial Jedi master, an Obi Wan Kenobi of the stock market. Well, if you have read my blog, and you have checked the Mentors page on my blog then you have probably noticed that nobody appears. In the year that I have spent researching and writing about trading products, I have not found a single professional mentor that I would recommend. The closest thing to a trading mentor would be Kevin Davey, a World Cup champion that focuses on developing trading systems that perform in the retail market. This is really the only guy that I would personally spend money on, or recommend.

the Mentors page on my blog then you have probably noticed that nobody appears. In the year that I have spent researching and writing about trading products, I have not found a single professional mentor that I would recommend. The closest thing to a trading mentor would be Kevin Davey, a World Cup champion that focuses on developing trading systems that perform in the retail market. This is really the only guy that I would personally spend money on, or recommend.

Too many of my readers send me private emails asking me for “the best indicators for day trading”. This too drives me nuts. There is literally a Chinese Army of indicator salesman willing to take thousands of dollars for their “magic trading indicators” that are supposedly miraculous predictors of the stock market. A good example of these types of magic indicators would by Michael Lydick’s Back To The Future Trading Indicators. These types of people are absolute masters of trading in hindsight. However, the very moment you ask for any proof that their indicators actually earn profits? Well, they have no proof to offer. My god, try and ask for an account statement that proves any sort of trading success and they scurry like vampires before the rising sun. The sad and simple truth is that the vast majority of indicator salesman are failed traders. They cant make a profit at trading and so they bag their magic horse shit and sell it to naive newbies. Why don’t these losers simply trade with their magic horse shit indicators themselves and pocket massive profits? Keep it all for themselves? Think about it folks. If it sounds too good to be true…

Next, I get requests and spend a great deal of time recording, researching and reviewing live day trading rooms. Wow, this has been an amazing endeavor. After a year of writing and researching, I have flat discovered that 99.9% of the live day trading rooms are either one of two varieties.

The first variety would be the day trading room where the moderator quickly, and using only verbal instruction, will very quickly enter and exit trades using a limit orders for entry an exit. Total scam. One of the biggest scammers in this category would be the world famous architect from NY (whom lied and is not actually an architect) Mr. Ross Cameron of Warrior Trading. A scam artist extraordinaire that refuses to show live trading via trading DOM, live trading account or otherwise that he has ever earned a nickel from day trading stocks. He specializes in a form of electronic slight of hand. Where he always gets filled on his limit orders, while the rest of the suckers that trusted him and subscribed to his service are forced into and out of trades at terrible prices because of the lack of liquidity.

The second variety of day trading rooms are the type where the vendor simply creates a spreadsheet of “real trades” and then uses this as marketing bait to lure in newbies into watching them trade on a simulator. Unfortunately, many of the trades are mystery meat, where they will populate the spreadsheet with pure fantasy, often after the market closes in the dead of night when nobody is watching. The subscribers, using live accounts and trading with live money will follow the moderator whom is using a simulated account and risks absolutely nothing. At the end of the day the moderator cant trade for shit and loses on a simulator while the subscribers lose real money. The subscriber usually discovers the fraud within a month or two and then cancels the subscription. The moderator knows this and could care less. Always looking for the next sucker that is willing to pay him to watch him trade on a simulator.

One thing all of these shady trading hustlers all have in common is that they cannot produce a real brokerage statement, and they always have an army of suckers that are willing to provide “testimonials”. These poor suckers purchased a product and are quick to defend the educator and write all sorts of glowing stories on how the educator changed their lives and how they are now full time professional traders because of the amazing wisdom bestowed upon them by the educator. However, the very moment that I ask for proof of their amazing success stories in the form of account statements, they will then scurry like cockroaches before a can of Raid. Some of these folks become quite belligerent when confronted with the hard cold reality that their trading educator is nothing more than a crafty charlatan. Once they are dealt with the ugly reality that their dreams of day trading success are built upon a faulty foundation of fraud and deceit, they become angry and lash out at anyone that could possibly tamper with the fantasy world that will soon be theirs. Some even call me on the phone and send emails that threaten to shoot me, run me over, make me disappear, sue me into oblivion, and go after every member of my family. Laughable. Ridiculous drivel.

Why So Many Traders Fail

I have a buddy that is a real estate inspector/appraiser. I ask him the single most important thing he looks for when inspecting a home or writing an appraisal. He say’s that the number one thing is the foundation. Everything starts and ends with the foundation. He can tell stories all afternoon of homes that looked gorgeous and perfect from the outside, but once he found that the foundation had a crack or was sloped, or had water lines running underneath…then he knew that it would only be a matter of time before the entire structure would have to be razed.

This analogy applies perfectly to trading educators, indicator salesman, trading rooms, trading books, and trading systems. So much of the stuff in the trading world is pure crap that has been created by people that have failed at trading. And so they package up their trading failures and sell it to us as a “foundation product”. They want us to believe that we can take their collective failures and build a foundation in which we can then become successful traders. Their pitch seems so enticing, so hot and sexy, so alluring. But what they are really offering is a sort of trading education venereal disease…where stupid, unproven ideas are handed down from trader to trader. Failure built upon failure, built upon failure, built upon failure. Sort of like how medical doctors once believed that leaches and bleeding could cure most diseases. Trading is full of nutty, unproven quakes and their predictive indicators.

A Proven Foundation

Always come back to the foundation. How does this relate to trading? Very simply, if a trading educator wants you to buy his magic indicators, trading course, mentorship, then simply ask for proof that they actually trade. No, you don’t want to see testimonials or interviews from happy customers, or any of the other BS that these frauds pump out….you want to see real, live account statements that prove that they can personally earn a profit with their trading product.

If an indicator salesman say’s, “this indicator predicts the future with 80% accuracy”. Then simply reply, OK great, now show me a minimum of three consecutive months of trading performance from a live trading account. If you can, then I would be more than happy to pay you thousands of dollars. This is a foundation in which you can build a trading career.

If a trading room promises to teach you a method that earns a consistent monthly profit. Then simply reply, OK great, please show me a minimum of three consecutive months of trading performance from a live trading account.

If a trading system vendor says that they have a system that produces profits and it can be purchased for a fee, then say OK great, now show me some account statements from a live trading account.

You would think that this would be so easy. And so painfully obvious. If you are going to purchase a trading product, make sure that the person is actually trading with a live trading account and can prove that their method is, or has worked. Its common sense. But you would be so surprised at how many people that I talk to have spent thousands of dollars on trading products but are too afraid to ask for proof that the vendor actually trades. Its almost as if the perceived dream of becoming a successful trader is so intoxicating that they lose focus on the obvious.

The last rat hole of every fraudulent trading vendor

If you ask a trading vendor for an account statement that verifies trading success and they say, “I cannot show a trading statement because it is illegal”, then avoid this vendor like your financial life depends upon it. This is the lamest, most bullshit riddled excuse in the trading world. It is true that a vendor cannot mass market account statements without certain disclosures, but there is absolutely nothing illegal with a trading vendor giving a private viewing of an account statement. They can publish it on their website with proper boiler plate disclosures, they can email it over to you, they can screen share, they can authorize their broker to speak with you about individual performance. There are a multitude of paths. Dont ever fall for the bullshit, “I have spoken to my lawyers and they said that I cannot disclose my trading performance”. Complete nonsense.

As some of my readers are aware, I cooperate with both Federal and State regulators. I provide all sorts of information, including video recordings to both civil regulatory bodies such as the CFTC and the SEC, as well as criminal investigators like local law enforcement agencies, state law enforcement agencies, and the FBI. In addition, I have also provided information to Canadian regulators. In addition to governmental agencies, I have also provided video recordings to private lawyers representing individuals in over a dozen civil fraud cases now working their way through both state and federal courts. Folks, one thing I can assure you of…the regulators, both civil and criminal are watching and reading everything that appears on this blog. Trust me when I tell you…the regulators want full disclosure. Any trading vendor that says that they cannot disclose individual trading performance because “their attorney said its illegal” is in the process of scamming you.

Now that we got that out of the way

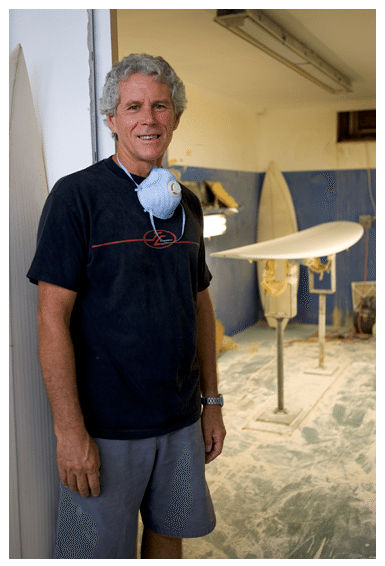

John Carper – JC Surfboards

Ok, so I have spent a massive amount of time talking about the bullshit in this industry and how you should avoid the army of failed traders looking to sell you a load of horse shit. Now, I want to get your focus back on you and your success. If you want to be successful at trading, or just about anything else in life, there is no shorter route than to find someone that is doing it successfully and copy them to perfection. Emulate them. Suck every bit of knowledge out of them. Master what they know. Perfect it. Make it your own. One of my readers is a world famous surfboard shaper named John Carper. You can read about this amazing guy here. If you are a world champion surfer, and you surf the largest waves in the world, then you are most likely riding a JCHawaii surfboard. John has dedicated his life to his craft. John and I talk via email. He has had tremendous financial success with his surfboard business, but he is also just like you…he has the trading bug. He wants to now master trading. John and myself have talked about the passing of critical knowledge down from person to person. John tells me stories of men that he brings into his workshop and he mentors them on how to properly craft a surfboard. The very moment they diverge from his methods, he is all over them and ready to toss them out. John say’s, “They can do whatever they want after they leave my shop, but while they are learning from me, they will do EXACTLY as instructed. No exceptions”.

John has passed his knowledge down to others. They have taken it and made it their own. Expanded upon it and perhaps pushed the craft to new boundaries. But only after they have learned a proper foundation. This is exactly what John and I talk about, he has been searching for years to learn trading from someone that is a master. Unfortunately, he has only found trading failures looking to sell a faulty foundation. I know how John feels, my job is to sift through the mountain of frauds and fakers and find those special few gems with something valid to offer. To date, and after a year of searching, I have only found a few worthy trading educators.

Introducing Kevin Kleinman from WatchHimTrade.Com

For the past two months, I have been keenly watching Kevin Kleinman at WatchHimTrade.com. I have to admit what is most obvious and unsettling, and that is his young age. This kid is only 25 years of age. I have read his life story, and he caught the trading bug at a very early age. His story is interesting and not what you would expect from someone that I would normally recommend.

One of the things that you will find noticeably absent from his resume is that he has never spent any money on a magic trading indicator or a trading guru. He is truly self taught. A fresh faced kid with an actual account statements, thousands of verified trades, and a proven track record. In addition, I have watched him trade live and recorded enough video to know that what I am watching is truly unique. Think about this a moment, he is self taught. His mind has not been corrupted by purchasing trading products from trading vendors that do not trade, or have no proven record of success. His foundation has never been corrupted by a “trading guru”. He came into the markets and had to learn his own approach from scratch, with no help whatsoever. He could not afford to spend money on fancy trading products. I know this might sound nutty, but the Renaissance era was ushered in by new thinkers, by people that were not “traditionally trained” or bound to the old medieval prejudices. The renaissance period ushered in an era of new thinkers that were ready to apply fact and common sense and were willing to challenge long held beliefs in things like mysticism, religious orthodoxy and alchemy.

Oh Alchemy! The dark ages equivalent of today’s technical analysis movement. What is alchemy? This was the belief that common, earthbound elements could be combined to form gold. Of course, we all now know that gold cannot be formed by combining common elements(all the gold in the world arrived via asteroid), but think for just a moment that during the dark ages, there were entire universities devoted to the science of alchemy. Crazy! People actually spent money to learn how to turn lead, combined with other common elements into gold. Just like today’s purchasers of trading products, didn’t any of these folks attending these schools teaching alchemy ever stop and ask the teacher to see actual gold? Pretty crazy, but it true. Think about it, these nutty charlatans with their magic trading indicators are really just like the nutty charlatans of the dark ages, selling university degrees on alchemy. “Make your own gold for only $5,995!”

Kevin’s Trading Performance

Kevin Kleinman does not know that he is a special rarity in the trading educational world. Until now, Kevin did not know how highly I regard not only his trading abilities, but some other qualities that are extremely hard to find, namely unwavering honesty. For instance, have a look at the following equity curve…this equity curve, I can definitely confirm and have verified was taken directly from Kevin’s TradeStation Account. These are not simulated trades, this is the equity curve AFTER commissions are paid. If you like to look at real account statements, then have a look at Kevin’s account records and performance page. Every single trade is there, from a real account statement, highly detailed at every level.

These are not simulated trades, this is the equity curve AFTER commissions are paid. If you like to look at real account statements, then have a look at Kevin’s account records and performance page. Every single trade is there, from a real account statement, highly detailed at every level.

In my opinion, this is a really nice looking equity curve of over 2000 real “scalping style” trades. However, the overall profit is tiny! Its midget sized. I have gone over each and every one of his account statements going back to April 1, 2014 until present. His average losing trade is only $35 and an average winning trade of $40. Yes, you are reading this correctly, on average Kevin is losing only $35 per trade and winning $40 per trade, after the commission is paid. When I looked over these numbers, the very first thing I thought was how in the heck am I going to write this review about a kid that averages only $200 a week in profits? And so I went back to Kevin, and I told him plainly that even though you have an extremely nice looking equity curve, have executed thousands of trades profitably, the weekly and monthly profits are so meager that the majority of my audience is simply going to laugh. Kevin just laughed and explained that he likes taking on very little risk. He is perfectly happy taking in small profits, doing it very often, and doing it with a high degree of consistency. He explained that there is nothing worse that losing thousands of dollars each trading day, and his style is to trade the smallest amount possible. Next, he went on to explain that he primarily trades highly liquid options contracts, so if a person wants to earn more, then simply trade more contracts.

The more I thought about how Kevin trades with such tiny risk, the more my mind kept coming back to that consistent and pesky stream of people that email me each week. Every week, I get loads of emails from people with only a few thousand dollars and are looking to learn and earn. WatchHimTrade.com is the perfect place for the person with the small account, as well as the large account. Kevin’s method is proven to work on a micro risk level, his style of trading is the missing piece for so many people that are looking for a bonafide, proven approach to day trading, taught by a REAL trader, and in such a way that the micro account holder can easily participate. And the best part of Kevin is that he is fanatical about teaching complete newbies. He is 24 and full of energy. When I watch him trade live in the trading room, and talk to people about how to properly trade and what to look for, what I am hearing is the voice of a person with a high degree of emotional investment. This guy cares. And at $99 a month, I know of no other service where you get a bonafide trader that is willing to pour his heart into your success. Most of these trading rooms offer a commentary service for $300 a month, and $5,000 to $10,000 in order to get highly detailed care taking. With Kevin, for only $99 a month, you get EVERYTHING he has to offer. In my opinion, once word gets out, the price is going to have to rise simply because he wont have time to provide individual attention to everyone.

Day Trading Options?

I have to admit, when I first started recording the live day trading sessions of WatchHimTrade.com, I was very leery and intimidated of stock options. I basically knew nothing about them. They seemed very foreign, exotic and confusing, but after a week of studying and immersing myself…I now get it. This is the perfect venue for the small account day trader. In fact, I am really surprised that others have not picked up on it.

Another thing that really helps is that Kevin displays his full trading screen. You will very clearly see him place his trades on the screen. He also tells you exactly what he is doing. There is no guesswork or fantasy trades or limit order chicanery. The trades are executed in real time and you can watch his live account balance adjust as the market changes. Nothing is hidden. Its is so refreshing to have such transparency.

Another thing that I really like about day trading options is that traders can trade the big cap stocks with high prices, momentum and liquidity and avoid having to maintain a minimum balance of $25k to day trade those stocks. That Pattern Day Trading Rule is real pain in the ass. Day trading options avoids all of that nonsense. Want to buy and sell 100 share blocks of Apple or Tesla, but don’t have $50k laying around? No problem, with a tiny account you can trade it with options, usually risking $200-$600 per trade.

Yet another advantage of day trading stock options is that traders can avoid having to deal with unregulated, offshore prop trading firms. I have written on this extensively and can attest to the absolute horror stories of people that sent $2k to 5k to a random person, located on a tropical island, in order to get 20X margin and avoid that pattern day trading rule. What a nightmare when these people cannot get their money out, or the stock prop trading firm refuses to pay for jackpot trades. Unregulated markets are very, very scary places for the small trader. Most traders get fleeced. Day trading stock options allows a small account holder to get more than enough leverage, all with the protections of United States financial regulators and the United State criminal justice system. The United States financial regulators and our robust criminal justice system are the envy of the world. Of course, we all hate the regulators and the criminal justice system until someone rips us off! Believe me, the regulators are not there to hurt you, rather to protect you. Trade in markets where the regulators are vigilant. Stock options are highly regulated, can be highly liquid, and safeguards are in place to protect your capital from theft.

More About Kevin

In addition to Kevin being a pretty good day trader of options, he has some other qualities that I believe are also beneficial. He is patient. He wont make you feel like an idiot because you do not understand options. He enjoys getting on the phone and talking with people. Listening to issues and helping people understand not only how options work, but also how he trades, the why and the why not. I found it refreshing that he is easily accessible. He also answers email messages quickly and does his best to provide the information that you need.

The guy is honest. In fact, I gave him an opportunity to puff up his resume a bit. He refused. I was really surprised.

He is engaged and lives with his girlfriend of three years and is very close to his parents, both literally and figuratively. They live 15 minutes away, in the same house that he was raised. These types of influences, in my opinion keep a person grounded and accountable. The financial education business tempts people into puffery and self aggrandizement (Timothy Sykes). He is also a Big Brother and has been mentor in that program for the past 8 years. His story is simple and yet interesting. I recommend that you read his biography page, which goes into detail about his life and trading influences.

Wrapping Things Up

This was a long review. And I talked about a lot of things. Mostly how people set themselves up for failure by investing money, time, and emotional capital into trading vendors that cannot trade successfully themselves. These vendors package their failures into trading products and then these faulty ideas are sold to us as a valid foundation in which to build our trading careers. Its no wonder that so many people fail, they buy crappy products from failures and then expect a different result. Many of the purchasers of these failed methods blow up their trading accounts and then become cynical about trading…and then they ultimately become trading vendors themselves. Taking the crap that they purchased from someone else, repackaging and renaming it, and then selling it to the next fool down the line. A venereal disease of bad ideas.

Kevin is different. He has not been polluted and corrupted by so many of these faulty ideas. His approach and his proven track record is proof that something special is happening. And the success appeared not from a crusty old person with 50 years of trading success, but it appeared in a place that nobody was looking. Much like the renaissance, young people appeared, with their boundless energy and willingness to see things differently, and set a new path for the rest of us.

The central idea of TradingSchools.Org has been to not only expose the frauds, charlatans, and schools of trading alchemy. But to ultimately bring to the forefront those that have the proof of success and the methods, for the rest of us to see. To draw the curtain on so many of the failures and frauds, and bring light and transparency to this dark industry. Things are slowly changing. Even some of my worst enemies in this business are now coming into the light, accepting transparency, and committing to openness.

Well, that its it for now. Sorry this review turned into a mega rant. Thanks for making it this far. Dont forget to leave your comments below. Even the trolls and haters will find a warm response from me, and even the most sour voices are always heard.

Anyone know why Kevin’s track record ends in 7/2017?

Honesty such a lonely word...Billy Joel

I have read EVERY comment on this page concerning Kevin & his trading service. As far as I am concerned, due to his honesty, and indicating he wants you to learn and not necessarily copy his trades, he is fairly charging the $99 fee. First of all, do you pay to go learn something from a community service class or a nightly adult class? Of course you do. These classes are generally taught by some one who learned what they are teaching, no different as Kevin. Second, I just started learning about Options and Markets this past Feb2016 and have been reading and watching youtube, signing up for free webinars DAILY. I even record them for reference. Mind boggling amount of info. In May 2016 I started trading. I also used 1 contract and bought some small shares of stock. I started with a small account of 4k. From May 2016 till Nov 2016 I took that account up to approximately 7K. In Dec 2016 I got…too bold & signed up for a Quarter period with a Penny stock TR & a famous “Warrior”. My account went down to just over 4.6k. Need I say more? I did better off Trading on the foundations I learned from Investopedia, TheoTrade (very good but the guy is a Quant so really have to focus & review it), CBOE, then taking bits & pieces of every recording I made, rather than trading the methods in those two TR’s mentioned. Now on average, I made $30-$80 selling Puts holding for about a month & buying & holding stock for a few months. I mostly used basic Technical Analysis of Support/Resistance & overall DIRECTIONAL Trends. I noticed any profits I made were on “better” companies, i.e, BAC, TWTR, F, ABX, BAX, KGC, YELP, USO, AA, Slow but okay with me. I will admit in my simultaneous PAPER trading account I did catch a lucky win of 10k in a few hours of trading one penny stock, but I had a 100K play money and bought several thousand shares. That’s the ONLY way I could win with pennies. Anyway, I am now leaving those “get rich with pennies behind”, taking a break from trading and reviewing the foundations I had been using earlier and strengthening my TA on charts. I do hope to be able to trade DIRECTIONAL on Weekly Options, since I have been turned down for L3 Spreads (dumb logic to me, you know what you will lose exactly, and you can always buy/sell back the losing leg of the trade if needed and keep the winning leg, but on a stock you take the chance of losing a lot more if goes against your directional bias). As for Kevin, Kudos on your conservatism and for Emmett finding a jewel. There are so many “retirees” who would not mind making up to an extra $200 a week. Supplement that on a monthly basis to their SS & they would be happy. Poll after poll, private and public, have been in line showing the average Retiree has less than 10K saved. A product of the big crash in the mid 2000’s and much more just from the cost of everyday living. So this kind of “small” conservative gain with small losses over a month would be a god send for them. Kevin states he made approximately 10k over 2 years with an account of 26k. Using these as my basis, if my math is right[(out-in)/base(in)], that’s about a 38% return, not bad. Try getting that in small account with your Mutual Fund, Broker, etc…rare. Just saying. I will probably give Kevin a look-see for a bit and learn something. In the meantime, keep up the good work Kevin & Emmet. And remember….I’ll be watching…

Did you find this review helpful? Yes No

That’s a 38% return over two years which is 19% per annum which is very respectable although assuming he make 5K each year and added it to the principle then in the 1st year it would be 19% and in the second it would be 16% return. Kevin’s a good guy and honest and his returns reflect the real world not the BS trading room returns that are pure fantasy. Of course Emmett’s also uncovered Dean Jenkins from Follow Me Trades who made 24 or 25% this year. You could also have a look at his site but I didn’t feel like he explained his reasons for getting into a trade adequately and there wasn’t any structured education on his site. For $90+ a month I expect things to be organized and in place to teach subscribers how to trade not how to follow blindly.

Thanks Stray Dog. More good info.

Though I will be giving Kevin a try next month. I am still confused about the “run around on the PDT”. At TDA it says DT Options falls under PDT, so not sure how/WHY getting a cash account by passes DT?

My account is a small IRA for speculation, with Margin enabled, so….

I thought that if you had a cash only account for trading options then the PDT rule didn’t apply. The downside to a cash account is that settlement takes 3 days. That’s not a problem if you have more cash in your account to trade with. It would be nicer if they just let us lose our money in peace without the regulations.

Man, I read things like this and it makes me want to scream:

“My account is a small IRA for speculation, with Margin enabled, so….”

When I read articles that show the median for all families in the U.S. is just $5,000 of saving at retirement age, I am like how can people not save anything all their lives. And then I read people post that there IRA account is for speculation and I see why. The riches people in the US did not get there from speculation. I dont care what the Day TR tell you. The Buffetts and etc got there by investing over a long time in great companies. Take that IRA money and invest in Real Estate or something solid over long term.

Go to Amazon and look for “The Millionaire Next Door”

I think Kevin should close his PAID room and go to trade on DEMO account.

What an idiot a person has to be to copy his trades. He is RED, burning subscribers money on his acc every week :D. JOKE vendor.

lmao yo chill he posts his track record every week lol

A Trading Room trading options is not making money. What a shocker. IMHO the best way to trade options is a hedge against your own portfolio or as a short term play on something you are expecting to happen such as maybe you think LM stock will be hit due to Trump’s F-35 statements.

Is he at least keeping an accurate track record of live trading? If he is doing that, then it is a feat 99% of other trading rooms cannot or will not do.

Yeah he actually does post his real track record… shocker!

Hey I got interested in his website and went over to look at it, unless I am reading the statements wrong, he is one TERRIBLE trader, there are weeks in which he earns 9 dollars and then there are weeks in which he losses 280!. I did not find a single week in which he made 200 dollars or more, whats even worse, he lost money for the whole month of July. Can anyone please explain if I’m reading something wrong or if he is in a slump of a year.

I believe that Kevin only trades 1 contract per trade. You can make his method pay more by scaling up, of course the losses would also be increased. How has his performance been over a year or longer? That’s the time frame you should be looking at. The fantasy is that with $5,000-$10,000 you’re going to earn $100,000+ per year in trading profits, quit your job, work 2-3 hours a day in the morning and play golf and go to the gym in the afternoon. The reality is that you should be trying to beat the market average for the year.

you are reading the statements correct Dan lol.. However, I would say he is the most transparent vendor in the game, even though he is a joke trader, at least he is 100% transparent which is extremely rare in this shady as fck industry

In an industry of nothing but smoke and mirror con artist promising fantasy returns, Kevin is 5 stars. The grade is defiantly on a curve. I know nothing about Kevin and his room and my comments are based solely on other rooms and Emmett’s review of Kevin’s room.

This is an industry of TR like Open Range that show amazing look results. The problem as he got busted by the regulators as all those amazing results were fake. And sadly he is not the exception to the rule, that is the rule for this industry. Desperate people looking to make a living off a small account and a bunch of con artist TR willing to tell them how to do it, yet none can show any real proof of their claim. I wonder why.

In an environment like this someone that shows their brokerage statement and keeps an accurate record gets 5 stars; win, lose or draw.

Sadly as I post again and again, showing proof you are trading a live account and keeping an accurate record must be the 1st thing a TR does. And guess what I am constantly blasted by the shills for daring to say such an outrageous thing.

That is the state of the Day Trading Room Industry. Seriously it makes Bernie Madoff look like Mother Teresa.

“That is the state of the Day Trading Room Industry. Seriously it makes Bernie Madoff look like Mother Teresa.”

nah. More like Jesus H. Kristo himself.

Just an update – it’s a 7 day trial for $5 now, used to be 15 days. Why the change, Kevin ?

Great review and thank you for the site Emmett. I do have a question though. In the review you say Kevin learned on his own, he did not have a mentor or put money in some type of education system. This is the approach I am trying to take but the problem is how do you get any information? Did Kevin just use play money accounts and try to grow it going off of nothing? I find that hard to believe. I am having a hard time even starting; should I choose futures, equities or options, should I use indicators, should I …. the list goes on without a mentor. I also feel like most of the information about trading is for the purpose of selling me something, when I get that feeling it turns me off of whatever it is they are talking about even if it was a free lesson that I found informative.

Thanks for any replies.

start here its a great place that will answer many questions https://www.bing.com/search?q=investopedia&form=EDGNTC&qs=SC&cvid=516861da002f478d84fcd4ca9b4e9136&pq=investiped

Sorry if my english is not so good.

I know his way of trading is good. I didn’t try it by my self, but i heard a lot about it.

but sitting full time infant a screen to make 200$ a week is not enough for living.

What is the solution to make 400 to 600 $ a week?

What is the initial account should I begin with?

regards

M.A

Get a job that pays $400 to $600 a week. Only in the fantasy world is day trading some type of salary. That is not how the real world works and why none of these TR can ever show any proof of their claims.

Another option is have enough money you invest in fixed income and make $400-$600 a week.

I’m not quite sure I understand watchhimtrade. I went through some of his posted ‘gains and losses’, and it looks like he’ll make $200 or less per week. BUT, I see trades generally throughout the day, as in, he’s doing this full-time. You can’t live on that kind of money. Furthermore, if he’s been a successful trader for this long, why still such small risks/profits?

How’s this guy live day-to-day? Why aren’t his profits much better now that he’s been doing this for a while? I appreciate the transparency, but I can get a minimum wage job and make better money, and without any losses.

Am I missing something here?

Yes, you’re missing the fact that Kevin makes the real money, aka the money he lives off, from trading room subscriptions and educational material sales. Just like any other vendor reviewed by Emmett. The only difference is that his shtick is “honesty and transparency”, as opposed to “promises of expensive cars and gorgeous women”.

Here is my view.

99.9% of Trading Rooms are not “honesty and transparency”, so we have to waste our effort in getting any real evidence they are not con artist (and 99.9% are just that – con artist)

If instead 99.9% were “honesty and transparency”, then we could be focusing on the issues we should be focusing on, such as what is their draw down, what does their equity curve look like, what is the % risk they take and so forth and so forth.

So I at least give Kevin credit to be one of the few that actually meet the most minimum requirement. But I am sure it is a lot easier to screw people out of their money just by faking all your results.

As I have repeatedly stated trading is not easy and people want to hear fantasy over reality and that is why they are conned again and again.

Im surprised that the first positive review I read from you in the last 10, the second sentence is stating a deal with that room…like all credibility to you as any sort of analyst is instantly lost my friend….I actually thought you were on to something, but you have your own agenda and pocket to fill….you run just a tiny different type of scam. Bashing everyone that probably doesnt give you a cut of the users brought in and the one’s that do you promote them to the fullest. So sad ….. prolly wont allow this comment

Hey guys I am wondering if anyone who subscribe to Kevins room could give some feedback. Are you doing well, profiting, lossing, good, bad? Maybe someone been for a few months, more?

Thank you !

Keith

What most people didn’t get here is that what they get for their money is education and not trading signals. At least 2 people said here that they couldn’t follow the trades because of slippage and such. But Kevin as an educator is incredibly cheap, some other guy charges 2.7K for one day. I think 3 months should be enough for anyone to learn whatever they wanted, the rest should be just repetition. That would be $300 with Kevin…

Now I can’t talk about the educational value of Kevin’s room, but so far nobody posted here that yes, after X months with Kevin, my trading improved a lot. So that tells more than Kevin’s nice equity curve. I don’t doubt he can trade, but can he educate? All in all, it is really cheap with a free trial, so mostly you just lose your time if you don’t find value in his teachings.

The reason I am spelling this out because some people might think that they can scale up Kevin’s trades, and make way more than what Kevin makes. But it doesn’t work that way….

Hi Kevin,

First of all, apologies for the late response to your message. I’ve been really busy with work.

Sounds fantastic, especially the Skype one to one teaching.

I’ll be in touch with you in the next few weeks once I’ve got myself together work-wise.

Looking forward to chatting to you and learning the art!!

Best regards,

Dan.

Stray Dog, many thanks. I’ll take a look.

Hi there!

My name is Dan, I’m 45 and from England. I started toying with stocks and shares about 3 years ago and made some decent money. In the last year I started risking too much and not managing my money properly. Long story short, I blew out my whole account….a huge amount of money. £67,000 to be precise. (That’s GBP). Suffice to say I’ve been incredibly foolish and this has been a assure wake up call for me. I believe I can get my money back with proper mentoring. I’ve never traded options before but from all the research I’ve done on people offering courses etc, I think Kevin will be the person I’ll be paying my subs to. I’m not really wanting to copy trades as such, I want to learn how to read a chart and gain as much knowledge from live trading as possible so that I am fully equipped to go it alone some day on my own, to trade not just options but whatever I feel would be a good opportunity to make money. Emmett, many thanks for your review. Kevin, I’ll be seeing you soon. I think I’m making the right move here. You certainly sound incredibly honest, I love that. Just a quick question, do you give advice/education on how to read charts etc etc? As I said before, I’m not necessarily looking to copy your trades, I want to learn why you are making them. Do you think I would benefit from joining your site? All the best and kind regards to both of you. Dan

Dan, Reading through the education on babypips dot com won’t be a waste of your time. A lot of it also applies to stocks.

Hi Dan,

I am sorry to hear about your loss. I have a similar story that you might have read in my bio… made some good money for myself and then blew it all by taking too much risk. It was a valuable lesson though as I think it actually opened my eyes to the REAL skills of trading: money management, trade identification, entry and exit execution, etc…

I provide whatever education you are interested in. I will work with you on Skype 1-on-1 and teach you how to evaluate a chart if that is your main learning point at the time. If you tell me you want to learn xyz, I will do my best to teach it to you. I am easily accessible by Skype which is where most of the individual learning gets done.

You will also learn a lot during my Live Trading sessions as far as the actual placing of trades. However, you will learn more during Skype because during Live Trading my main focus is on making profitable trades for myself and members. It’s easier to do more educational stuff when the market is closed and I have time to focus on that.

The fact you are not “looking to copy trades” is music to my ears. My goal is to teach you how to identify your OWN trades, not simply copy mine – and show you how to do so with discipline so that aggressive risk-taking demon doesn’t turn its ugly head!

Yeah, I don’t know, but this site is now linked to Layuptrades.com. Which doesn’t provide real clarity if there’s actual learning material offered. It just mentions “picks” and elaborations on the picks… But for $150/m or $700/y I would sure like to have some decent material to actually learn how things work.

On top of that I find it suspicious that there is no contact option AT ALL. Not even a simple web form for inquiries, like the one I mentioned above.

I may sign up for kevin’s trial after viewing his utube videos; one thing mentioned in this string was the Tradestation commissions -Thank you for that! I always suspected I was getting killed with $9/$18rndtrip options trades at Schwab- they snagged most of any profit I had! Also note re: Shecantrade.com : Sarah is sharing a low risk cash generating process, which- even if you place your stops- needs to be watched. Be very aware that opions WILL gap up/down overnight, and can blow right through any stops you place. OTOH- I’m drawn to options because of their simple scaleability- nothing else can compare. As for dough, that site was very intriguing, but I just couldn’t ignore the unremitting teenage banter (TDAmeritrade trying to recruit millenials into trading), it was just too annoying for me. good luck trading!

Just a note to those just getting up on this review. Some posters here share very legitimate opinions and you should take them into consideration before signing up to my site (or anyone’s site). However, some people just post baseless opinions. What these people probably do is look at 2 weeks worth of results and happen to see a losing week. So they assume I am in the “red.”

Please, I STRONGLY ENCOURAGE you to be thorough in your research. Signing up for a service is an INVESTMENT in yourself! You need to research that service before deciding to invest. You wouldn’t put money down on a house after taking 1 walk through the living room. No, you’d get an inspector; you’d research the school district, you’d check out the town; you’d research the crime rate; etc… Signing up for a trading service requires the same type of research!

If you are serious about finding an honest and skilled mentor then spend 2 hours researching that person. Heck try to get them on the phone if you can so you can see how they sound. Do they pass the “ear test?”

And most importantly, study their entire track record! I have over 20 months worth of account statements posted to my website. I started my account with $26,200 in April 2014 and have made over $10,000 since that time. You can verify this for yourself by adding up the gains and losses you see posted here: http://watchhimtrade.com/portfolio-tracking

And I have no problem telling the truth about my results. Maybe $10,000 off of o$26,200 in 20 months doesn’t impress anyone. But I have my own goals and I am comfortable in my own skin. I want to help people who are trying to help themselves.

Do your due diligence guys! Don’t leave it to Emmett! Use him as a tool in your toolkit but not as the end all be all when it comes to who you sign up for. Just like I teach my members, you need to learn how to make your own decisions, not rely on someone else to make the decision for you!

This is definitely an impressive result, well north of the middle of spectrum performance.

As a complete novice, who has not signed up for any service or trading room yet, here is my two cent. I want to learn to trade as an adjunct to my day job. I don’t want to be a dreamer (like those that Rob talked about). I don’t have the time to immerse myself in reading and studying on my own (like what Sam suggests). Therefore, I need a mentor, and the single most important thing I’m looking for is honesty which in this case comes down to transparency; how else could there be any learning?! Of course, I’m not suggesting to pay just anyone a monthly royalty simply because “he’s honest.” However, perhaps, if we see traders’ profitability on a spectrum, from 5-star winners to lone-star losers, for someone like me, there is a lot to be learned from the ones in the middle. Lastly, as someone who follows Emmet’s site consistently, it seems to me, from reading the threads on different review pages and vendors’ posting of their results, that Kevin and Jason (B12 Trading) very likely fit the bill.

Emmett, honest is not the only thing you should be giving 5 stars for. I am following his results week after week. And you know what ? It’s very poor.

What’s the point to pay someone 100 bucks a month and slowly bleed the account trying to follow him and plus paying him ? Kev, if you are so honest, refund the members if you are RED.

Read some books chaps and trade your selves, you will most likely will get better results than staying with Kev.

Go and trade forex if you don’t have enough capital for stocks, rather than opening an account it some kind offshore companies.

And Kevin, well maybe in a future he will get better, but as for now he is just and expense for anyone who joins.

The main advantage of the review was that he trades options, so anyone with low acc can do that too, but again look at his statements, mostly now he trades stocks, and with small account with no leverage you are lost, unless you will be buying 1 share.

That’s my 2 cents here.

Thanks for the comment. I like Kevin’s transparency. But he certainly is not for everyone.

Sam,

I know nothing about Kevin, but I do know about real world day trading and day trading profitably. None of these Trading Room or Vendors promising fantasy results can ever show proof and their is a reason for that. The reason 95% of day traders fail is they rather believe and trade the fantasy than reality. If I or other profitable traders showed you our equity curve those 95% would not even want to day trade. Real trading is very messy. Instead of straight up equity curves there are massive draw downs. Your risk is tied to your reward and tied to your draw downs. To get those massive rewards would require risk that would blow your account. Instead of the fantasy returns of turning $5K into $100K you get realistic returns. And contrary to all those that post the opposite none of them can show any proof. Before critisizing Kevin you need to research what the best Hedge fund, Mutual Funds, Managed Futures and CTAs performance has been. This is all public record as shown below:

http://www.iasg.com/Managed-Futures/Performance

All I can say is demand the same proof from those promising the fantasy that Kevin is showing otherwise you will just be another statistic of someone spending money on a system that does not work.

Hi Rob,

Well I don’t want to be negative about Kevin, he seems to be a good and honest guy. but my point is that there is no point paying money someone who loses more than wins.

It’s better to spend that 100$ a month on your own education, read books and try your own way. No one, I repeat, no one will become profitable by trying to shadow someone, no matter how good he might be. You need to learn your self and learn from your own mistakes. That’s the only one way. Of course you can take the trading ideas, but still you need to apply your own. Everyone is different.

I just don’t like any trading rooms at all. Because mostly who makes money is the vendor from his subs. And people are like guided sheep, they see some promising words some PRO lines on websites and dream about $$$ without doing nothing, that’s the main reason all these websites and vendors are here and taking money from you (not you directly)

I agree the goal should be to learn to trade on your own. But I have come across countless people just looking to shadow someone or buy a trading robot, like someone is really selling a profitably trading robot. Maybe they are too busy with work. I do not see a problem with people trying to find a mentor that can teach them to trade, I know I went to trading rooms in search of one and of course I was scammed like everyone else. The problem is that 99.9% of the trading rooms and vendors are all sweet sounding (and some not so sweet) con artist that could not trade profitably if there lives dependent on it. My advice is do not learn from anyone showing pictures of Lamborghini or jet style lifestyle.

I spent most of my life investing in real estate and people would tell me I should write a book on real estate investing and I would respond to them, “no one would want to read my book, they want the book that tells them how to just sit and relax on the sofa and make a fortune in real estate”. Everyone I know including me that made money in real estate worked their asses off. No one wants to hear that. And now that I day trade, I have had some people say I should write a book on day trading. Again I tell them no one will buy my book. They want to believe in the fantasy where you can trade futures with a $5,000 account, have an 80% win rate, a straight up equity curve, make a 1000 ticks a day like a salary and there are pictures of beautiful girls driving a Lamborghini. Give me a Break. But that is the crap that sells. Heck I drive an old 2005 Chrysler. No one want to see real equity curves with large draw downs or hear about realistic returns. I have posted them before and just ended up in fights with delusional traders saying how they can turn $5K into $100K in a year. Of course none of them can ever show any proof. I might as well be talking to a wall and the wall would understand money and realistic returns on money better.

Just make sure if you do decide to use a mentor you get actual proof they can trade profitably. These people posting amazing results are all scam artist. I have even known people who started fake journals on BM trading showing amazing results and found out people PM them and then they offer training. I hate to break the news, but 99.9% of the day trading business is a complete scam.

Sam what results are you looking at man?

I am making money every single month. Am I lighting the world on fire? No. Am I making small consistent gains and using small money to do it it? Yes.

Come with facts man. Here is my full track record, bust out your caclulator and add up the results for the last 12 months. Then go have a look at the S&P500 and see how I stack up.

http://watchhimtrade.com/portfolio-tracking

I get it Emmett, you need some cash to fund your research. However, this is a totally biased review. You certainly dig up the dirt in other reviews, but not one mention of Kevin Kleinman’s history as a stock promoter and his affiliation with a convicted stock manipulator. This information is simple to research. Seriously, think of a brighter more honest method to earn some money to fund your site.

This kid is honest. All of his trades are clearly displayed. And he includes account statements.

Thanks for your opinion.

I agree Debra, people should do their research. And as Emmett will tell you I was completely upfront with him about my past. I did not say “leave it out of your review please” or anything like that. I gave him all of the facts about my present, past, and desired future and he wrote the review you see above.

Since you brought it up though I will shed some light on the topic.

When I was 18 I came across “penny stocks.” After some research I came to realize that the only real penny stocks moved was due to “stock promotion.” Turns out, guys get paid $10k-$100k to “promote” a penny stock to an email list. So I’m this 18 year kid spending $30k on college at DePaul University thinking, “Dammnnn 2 of those promotions would pay for my entire yearly tuition!!!”

So what did I do? I messaged this guy in a chat room I had been hanging out in at the time and said, “Yo, let’s start a website and get into this promotion business!”

That guy’s name was Alex Hawatmeh. We had never met in person, but we chatted every day in the same room and we both traded penny stocks. As a dumbass 18 year old that was my idea of a “business partner.” So I met with some lawyers here in Chicago and consulted with them as Alex and I started a penny-stock focused website. We had a chat room, put out educational blog posts/videos, and collected email sign ups.

Eventually we had a big enough presence that we started receiving compensation for penny-stock promotions. The first 18 months were great. I legitimately felt like I was helping my members make good money (a lot of our promoted picks did very well). However, then I started to learn more about what was really going on in the industry and I felt like an unethical piece of shit.

So about year 2 of our business I told Alex I wanted to get out of the business and take the site in a different direction. He didn’t want to. So I took legal action and tried to force his exit from the company. But by this time Alex was unreachable and I had no idea of his whereabouts. I literally didn’t speak to him for 12 months. So my lawyer worked with me on a loophole where I was able to wind down the company without needing Alex’s signature.

Around that same time, Alex was accused (and later convicted) of Stock Manipulation. Since you saw this in your own research, you also saw that I was NOT NAMED in the accusation. Furthermore, the company Alex and I started was not accused. The government made clear through their press releases that Alex was an individual.

This is like if your best friend gets convicted of Murder. Just because your best friend murdered someone doesn’t make you a murderer (or a believer that murder is ok).

Long story short: Starting the business with Alex was a disaster from the get go (who the hell starts a business with someone they’ve never met?). I was a young kid with no real-life experience. As soon as I wised up, I got out of the business.

I really like your site, but I must say that having a promotional agreement with someone is absolutely a conflict of interest and although you have disclosed it does not mean you aren’t biased in your review.

You are correct. Hopefully the disclosure of agreements helps to take the edge off of my positive reviews.

Disclosure is important.

Janet,

I actually agree with you, but I realize Emmett is not a philanthropist. If he does not make money then this site does not make it. Maybe you have ideas of other methods or improvement suggestions he could do to make money where his reviews do not have the “Potential” of being influenced. In fact I think Emmett should have an idea section, I know I have some so I will start:

1) I think Emmett should have an Ask the Expert Section. This section would be posters who have proven they can day trade profitably by showing at least 3 months of brokerage statement (live so no doctored statements), where that expert could have a section he could discuss his thoughts on day trading or swing trading or whatever trading related and he could edit his own section and add to it and then people could ask the expert questions. The only requirement is that expert can not be selling anything. Also that person would be given some type of icon by their name so when people see post by posters they know when they are reading something by a proven day trader .vs an unknown commodity. I would volunteer to be the first expert and show proof I can day trader profitably, something virtually none of these tradings and vendors he reviews can do.

2) Add the ability for posters to edit their post,

3) Add the ability for posters to be able to add videos to their post. I would like to see posters take the trading room trials and show videos and the real result they achieved, this would also bring balance if Emmett was influenced by a promotional agreement.

I am sure I will think of more.

Do you trade only puts, calls for otions Kevin

I trade puts and calls but I also short premium to generate weekly income. For example, this week I shorted a TSLA $210 weekly put for $0.80, betting that the stock won’t be below $210 at expiration this Friday.

I also trade stocks, especially earlier in the week when premiums are still inflated since it is early in the expiration cycle. By Wednesday, a good amount of decay has occurred that makes option prices much cheaper, and that’s when I make the majority of my option trades.

i would like to see a real forum – that is easy to search etc. Thus one is just a bog comment thingie.

I agree for a better forum. But I doubt Emmett makes enough to pay for this forum. But I would love to see the ability for posters to start their own threads that way they can discuss trading rooms that have not been evaluated and tell their experience. You just have to realize most the posters will probably be the trading room operators themselves bragging about their results; no proof of course.

I agree. Users should be able to start their own threads. Lets see if I can integrate this. I didnt add that feature at first because I didnt want this to become another Investimonials.

HI

i am emailing to ask if you are aware of introducing brokers that i can work with. do you have any IBs and/or companies i can work/partner with? i work in ironfx.

thank you

vartan haladjian

Anyone who joined the room could give some feedback on Kevins performance? Looking on his website he is red for the past three weeks…

So I am just wondering how everyone else is doing.

Hi Sam,

I’ve asked some recent trial members to reply to your comment to give you some feedback so hopefully they do that! In the mean time, I’d like to point out that yes, I did lose 3 weeks in a row. However, over that 3 week losing streak I lost a grand total of $150.

In the week prior to my 3 week losing streak, I made $533 (verify here: http://watchhimtrade.com/portfolio-tracking/show/16888). Then just this last week, I made $205 (verify here: http://watchhimtrade.com/portfolio-tracking/show/17047).

In other words, it took me 3 weeks to lose 28% of the gains I made in 1 single week, and then it only took me 1 week to make back all of those losses. This may sound counter-intuitive, but that is exactly what I wanted to see. Obviously, I never want to lose money (who does?), but naturally it is apart of the game. What I hang my hat on is that when I did trade poorly over that 3-week stretch, it barely put a dent in my account. And then when I got back on track I made back all of the losses.

I think that speaks well to my ability to manage losses properly and not get emotional. Especially considering the market environment of the last month, which hasn’t been easy. Of course that’s just my opinion!

I encourage anyone reading Emmett’s review to check out my youtube channel. I have a lot of free videos there that can give you insight into my style and teachings:

https://www.youtube.com/user/WatchHimTrade

I have been in the trading room for over a week.

Kevin is honest and appears to be profitable .

This makes him the best trading room reviewed by Emmett Moore to date.

I am not a profitable trader. I will try to learn Kevin’s trading system however the system seems to be subjective and I am not very sure that I will be successful. Kevin’s Mailbag webinar this week was helpful. I wish he was able to call all trades before they are made so that I could make some profits shadow trading him while I learn. Thank you for your service and keep up the good work.

Thanks Tom.

I will be having another mailbag webinar next week. I will also continue to work on my communication with my trades so that it is easier for you to shadow trade.

What did you think about the communication on Friday? I tried to give heads up before entering my trade and repeating my entry multiple times so that it was clear. Any feedback you can provide here or to my email is greatly appreciated as I want to help you become a profitable trader.

Please review the video archive this weekend in your spare time as I think that will help also.

Thank you,

Kevin

Hello Trader Tom. You took the words right out of my mouth. I am retired and live only on my S.S. which is taken by all my bills. It would be great to shadow trade with some one to earn enough to finally make some trades of worthwhile size. It would be nice to earn for a living. I’m sick of being broke every 15th of the month. Plus I want to go to the Philippines and live there with my Girlfriend. That would be the life.

I’m on my free trial right now and the website is well organized, he seems to be honest and fair, and he does trade during the trading hours (unlike some rooms where the moderator just leaves when THEY are done). I am completely new to this so sometimes I feel lost and overwhelmed. I am hoping as I watch the videos on the site and learn more about options that this will make more sense to me. Also the stocks being traded are higher priced except TWTR and GPRO so until I build up my account if I stick with my 5% risk rule I am limited on the amount I can trade. If you are an experienced trader I am sure you will like this room and should really do the free trial.

Here is a free copy of last night’s educational webinar. I think you will find it extremely valuable, especially the discussion on how to use level 2 (starts @ 32:54 mark)

https://goo.gl/skoONH

I have been a trial member and am continuing in the room as a paid member. I find Kevin’s analysis of the stocks he follows very good and they produce plenty of trading opportunities, both the ones Kevin takes and the ones I can take based on the analysis.

Kevin is open about his performance and makes the trades taken crystal clear in the room and the analysis made in the room gives me a foundation of deciding if I will take the entry or maybe do the entry but at another price if i want to be more or less aggressive .

I am new to option trading, but have found the room and the educational material a great help until now and I look forward to continuing to learn (and hopefully profit :)) in this room.

I recommend watchhimtrade.com to anyone who wants to learn how to successfully trading options.

I just held an educational webinar tonight, here is what a trial member who signed up because of Emmett had to say:

https://twitter.com/Watchhimtrade/status/664640952351465472

Kevin,

Please make ALL your trade calls before you trade.

I’ve been in Kevin’s trading room for several days. Half of his trades were called after he made the trade.

You can’t make money by shadowing Kevin because his average profit per trade is 2% and his slippage is 10%.

Profit 2%:

Kevin’s average profit is $4.67 per trade (ex Oct ’15 profit $1103/ 236 trades). His average option trade size is $250/trade ($4.67/ $250 = 1.9%)

Slippage 10%:

When I tried to shadow trade the slippage was huge. For example: Kevin tells us he just made a Buy at $2.50/share however now the best price is $2.80. When shadowing, the slippage can be 10% or more.

Tradertom,

First and foremost, my goal is NOT for anyone to shadow my trades. That is a useless service. My goal is to teach you how to make your own trades with confidence and discipline. I want you to become a great trader. No one becomes great by simply copying someone else’s trades verbatim. That would be like copying answers on a test, what are you really learning in that situation? Nothing.

While I recognize the attractiveness of being able to “copy” the same trades as someone who is making profitable trades on their own, that is not my intention. And anyone who subscribes to my service looking for that is viewing my service the wrong way in my honest opinion.

With that said, I pride myself on being extremely clear and concise prior to entering a trade so that you can get in the exact same trade with me if you so choose. For example, yesterday (11/10/15) I entered a put on TSLA @ 9:43:10.

PRIOR TO ENTERING THE PUT @ 9:34:01 I make a comment on TSLA that if the stock “is stalling @ $223 I think TSLA can go below $220” — you can verify this in the recording which is in the video archive here: http://watchhimtrade.com/live-trading-videos/show/16817

In the minutes that follow from 9:34:01-9:43:10 I update my thoughts on TSLA and alert that I have placed a bid on the 220 strike put. I state this two times. Then @ 9:42:45 I state directly “I would like to fill my TSLA put by about 9:45.” This comes as the stock is around $222.

5 seconds later, @ 9:42:50 I say “I am thinking about an adjustment on these 220 strike puts possibly” as it didn’t look like my bid was going to fill. I mention that we are “getting some downticks here vs $222”

15 seconds later @ 9:43:05 I enter a put and state “alright I am buying a 220 strike put @ $3.40.” (the spread was $3.40/$3.50 when I entered). I immediately reiterate that “I am in a TSLA 220 strike put @ $3.40.”

The next trades that go through on that put are @ $3.40 and $3.30 and I constantly update my bias for the trade throughout its lifespan. These are direct quotes taken directly from the recording which I encourage you to watch if you have not done so already: http://watchhimtrade.com/live-trading-videos/show/16817

The communication with that trade is on par with the way I communicate on ALL trades. I don’t know what more you want but I am happy to hear suggestions as I want to offer the best experience possible.

Please though, as you watch pay more attention to education I am providing, and less attention to the exact purchases I am making for myself. My goal is for you to take the statements I am making about the action I am seeing and decide on a trade for yourself, because that is the best way for YOU to improve.

There is a reason I start my sessions 40 minutes before the open every day, it is so I can get you prepared to trade and help you understand what I am looking for. Have you been 1 of the 15 people that show up the full 40 minutes before the open? Or have you been in the second group of 20 people that shows up right before the market opens (or even worse, after the market opens)? If you’re in the first group, then I have work to do because I am clearly not doing my job of getting you prepared. If you are in the second group though, then you need to be more committed.

I encourage you to watch the recorded Live Trading sessions in the evenings, you can find every single session here: http://watchhimtrade.com/live-trading-videos

I’ve been doing this for almost 2 years now and I have a lot of room for improvement. However, my level of communication is one of the things that is consistently praised by members as positive feedback. Heck even Amarjit (commented above) who doesn’t use my service did a ton of due diligence on my youtube videos and had this to say:

“From his youtube videos it does look like he calls out his orders ahead of time, so it shouldn’t be a problem with entering them yourself. ”

So yes, if you’re not paying attention and you’re just blindly following me into trades with market orders then you will probably have high slippage. But if that is what you’re doing, then you are missing the entire point of the service.

Furthermore, I have stressed to all new sign ups to email me or set up a phone call if there are any questions, comments, or concerns. I don’t believe we’ve spoken and I certainly haven’t heard from a member voicing your concerns. So let’s talk and see if I can do a better job taking you where you want to go as a trader. (fill out this form to chat: http://goo.gl/iRyJSM)

I hope to see you at tonight’s webinar where I’ll be addressing this topic in greater detail, as well as other educational talking points.

Thank you.

Hello all.

No affiliation with Watchhimtrade, but have been reading with interest as this is an interesting one. My humble opinions are as as follows. These are based purely on reading this site, looking thru the watchhimtrade website and watching his youtube videos. So I haven’t done any free trial etc.

1. He starts from position of strength in my book, because of the verifiable trading statements as proofed by Emmett etc. This puts him ahead of the 90%+ of vendors on here who have nothing of the sort.

2. With regard to trading options. I’m no expert on options..just know what they are basically. But seems to me he is effectively trading some large stocks (GOOG, AMZN,NFLX etc) but using the weekly options as his vehicle. This is because I guess it allows trading without having the PDT rule to contend with. However the spread on weekly options is not great, and they can move fast so a potential client needs to take that into consideration in terms of what type of trader are you ? Although a free trial can give you this input, the youtube videos of his also show this. If you watch them, you can see how he trades, how fast paced the action is etc and judge whether it suits you or not ?

3. Whether you can copy his trades is another important question. As a previous poster already asked, it would be interesting to know how the Philippine ladies got on with copying his trades. I didn’t see this in the review unless I missed it ? From his youtube videos it does look like he calls out his orders ahead of time, so it shouldn’t be a problem with entering them yourself. A free trial , should give a better indication I guess.

4. The relatively “small amounts” of profit made is also an interesting part of this review. I see a previous poster has mentioned this in terms of “how relevant is this method/approach if the guy is not actually making a living out of it ?” In my view, the important questions are “why ?” and “is it scalable ?” . In terms of “Why ?” it was mentioned in the review that he didn’t want to take on more risk. I can see some business sense in this because he is trading at a level of size he is comfortable with and hence profitable. Alongside which he is generating income from chat room and subscribers etc. Personally I don’t have a problem with this, others may disagree. Increasing size can make a difference to your performance and the high performance rate he has at the moment may suffer if he were to increase size ? This comes on to the next question of scalability which is the more important one. It doesn’t matter if he is only using small size, the main point is can people use bigger ? If he uses 1 or 2 contracts, can you be using 10 contracts on the same trade ? I don’t know the ins and outs of option trading with regards to spreads and typical trade volumes and getting out with size etc. Perhaps others will know more.

5. I know this site is mainly geared towards trading rooms, copying trades etc. But imo there is an education aspect here as well. Purely on a personal level, I’m not that great a fan of just copying trades from a vendor. Because who knows what may happen in couple of years from now, he may have jumped into other avenues, raised his subs etc etc. From what I have seen, he is trading options yes…but they are mostly driven my how the stock itself is behaving. Like for example looking at and getting familiar with the specific stocks he has shortlisted and getting to know them over time, how they behave etc. Also using Level 2 and its nuances to watch the stock, but actually trade the option…what happens on Level 2, what he saw, why did he get out when something happened on Level 2 he didn’t like etc etc. There is not much out there in the market place about this area of trading, using the tape/level2 , beyond the saying “just watch it for 2 billion hours and you will get it”. If this site teaches more than that, then you have effectively a trader who you can watch over his shoulder who can explain the ins and outs of how level2, tape, previous chart action etc all combine to be able to trade. Possibly in theory you could get customers who have big sized accounts who could potentially trade the stocks themselves rather than the options ?

Anyway, didn’t mean to go on and on…don’t post much, but really enjoy the tradingschools site and having some idle time free, thought I would add my 2cents worth.