Value Charts

-

Honest

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(2)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

The triple trifecta of trading clowns: Mark Helweg, Thomas Wood, and Dave Aquino. Everyday offering useless trading information in their trading room. No live trading. No track record. No proof of trading account existence. None of these guys should be dishing out investment advise to anyone. Typical salesman of yet more useless indicators, trading rooms, educational seminars, and private mentorship. A complete and total waste of time.

User Review

( votes)Today’s review is ValueCharts.Com, a live day trading room that specializes in day trading futures and options.

The futures day trading room operates daily from 9 AM to 12 PM (Eastern Time Zone). The futures trading room moderator is Thomas Wood. The monthly fee of the trading room is $197 per month.

The options day trading room operates daily from 9 AM to 1 PM (Eastern Time Zone). The options trading room is moderator is Dave Aquino. The monthly fee of the trading room is $197 per month.

Value Charts also sells the following video courses:

[foogallery id=”856″]

Value Charts Indicator Packages, Private Mentoring, Private Consulting

In addition to the online courses, the company sells just about every trading product under the sun. An indicator package at $1497, a smaller indicator package at $997, and a mini indicator package at $597. Of course, sometimes we need professional trader consulting, and this can be purchased at $200 per hour. “For only a small fee, you too can talk with a real life, professional trader!”.

package at $597. Of course, sometimes we need professional trader consulting, and this can be purchased at $200 per hour. “For only a small fee, you too can talk with a real life, professional trader!”.

Honestly, I was a little overwhelmed and exhausted by the time I finally finished putting this list of trading items together. These guys are like the WalMart of trading. They have something for everyone. But what about the quality of the products? How do we judge if any of this stuff is any good? Who is Mark Helwig, Dave Aquino and Thomas Wood?

Weeding My Way Through The Hype

As I looked at all of this stuff. I then started weeding my way through the fancy titles that all three of these guy use, titles like Director of Trading Operations, Full Time Professional Day Trader, Investment Software Developer, Hedge Fund Manager, Award Winning Author, Quantitative Engineer, advisor to thousands of traders world wide, President of Aquino Capital Management, Partner of Supero Capital, Patent Holder, developers of next generation technical analysis, etc. I could go on. For a very long time. But the bottom line, is the bottom line. Do these guys trade?

The ONLY Thing that Matters

As a consumer of trading products, it is very easy to become distracted by “shiny objects” and fancy titles. And in the review of Value Charts, I had to really get focused on what matters the most. And what matters most is the trading room. Every single one of these products and the people selling these products is on full display inside of the trade room. The trading room is the ultimate judge of whether these guys are worth the time. If these guys can show a real time profit inside of the trading room, then an investment in their products would be warranted. All that matters is performance.

The Trading Room Experience

The first thing I noticed about the Value Charts website is that there is no performance disclosure whatsoever. Neither of these room moderators have a recorded history of even a single trade. I found this strange, especially considering that each proclaims to be a full time professional trader. And so going in, I was flying blind. No performance. And so the next step was to sign up and begin screen recordings. My first series of screen recordings began in April, I recorded a total of 4 trading sessions that encompassed 12 hours. The video was then meticulously combed through looking for specific and actionable trading recommendations. Not a single trading recommendation. Lots of talk. Plenty of talk. Massive amounts of talk. But NO TRADING. I was annoyed. But not ready to give up!

From May 11 through May 15, I once again began recording video. I recorded another 9 hours of recordings. Not a single trade. Massive amounts of conversation and hollow talk. No trading. I really could not believe that I had sat through 20 hours of video and listened and watched like some sort of neurotic WW2 enemy signal decoder…I could not find even one actionable trade. Thomas would give every detail on every little economic report and what he thought what was happening on the 15 minute chart, the 30 minute chart, 60 minute chart. I swear, after a few days of listening to this kid, I wanted to reach through the internet and strangle him. What the fuck! Everyone is sitting in the trading room and listening to him just talk about nothing. Of course, my torture must be your torture, you must also experience the ridiculousness of this trading room. And so, I took a big chunk of screen recording and edited out the areas of dead silence. What is left is just a tiny portion of the daily torture that I was forced to endure (to save my fellow traders from torture). See if you can find any trades or anything useful coming out of his mouth…

Another Thing I Found Annoying

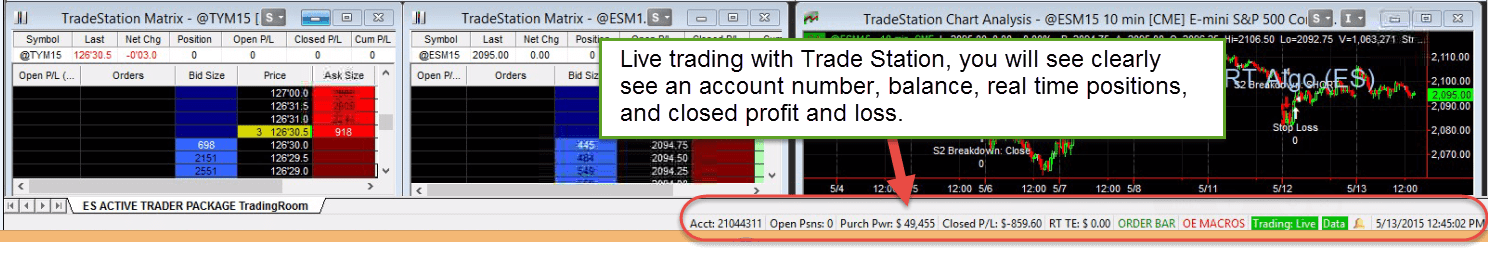

In addition to never hearing any live trades being called. Another thing that I found annoying is that Thomas Wood could of easily inserted a trading DOM, from any broker, right onto the screen sharing software.

This Trade Station account is clearly just a simulated account. A real, funded Trade Station account would have an account number, balance, real time summary of trades in the bottom right hand corner. None exists with Value Charts live trading room.

This Trade Station account is clearly just a simulated account. A real, funded Trade Station account would have an account number, balance, real time summary of trades in the bottom right hand corner. None exists with Value Charts live trading room.

Some vendors are actually open and honest about their trading performance. Below is another live trading room that I reviewed. Notice how his Trade Station account clearly shows accurate trading information.

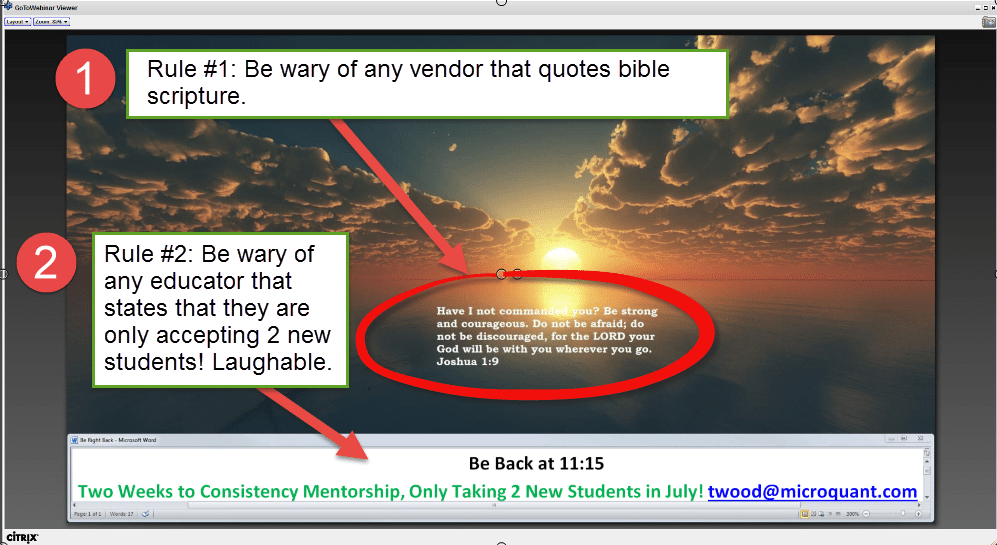

Dont Play “The Jesus Card”

I once wrote a positive review for another day trading educator named The Christian Financial Radio Network, I got suckered into believing that Christian trading vendors were more trustworthy than non-Christian trading vendors. Wrong. As I discovered shady marketing tactics about CFRN and attempted to highlight the deception, they responded with scripture about how Christians will always be the persecuted. Drove me nuts. Anyway, the reason why I am bringing this up is because every time Thomas would take a break in the trading room, he would put up the following screen share that included Bible scripture. Whenever I start seeing Bible scripture, I get worried. Really worried. To make matters worse, Thomas is “only taking 2 new students” for his July mentorship program. Total nonsense. Thomas would 200 students for July.

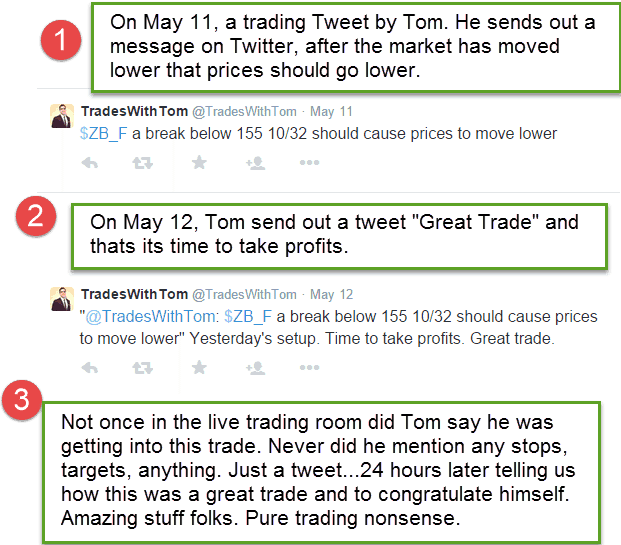

Deceptive Trade Reporting

Of course, I emailed Thomas about the trading room and the lack of performance disclosure with his own trading. He mentioned that he does in fact call out trades and posts these trades live on  Twitter and Stocktwits. And so I decided to research this further. The Twitter and Stocktwits posts are the same posts, so you do not need to scroll back and forth. Please have a look at this mess of trading advice…one of my favorites, and a very typical post from Thomas is where he posts an after the fact message on twitter… “a break below 155 10/32 should cause prices to move lower”. There is nothing about Thomas going long or short, or stop loss, or target, just this random tweet event. Finally, a full 24 hours later, Thomas is breaking his arm patting himself on the back. “What a great trade guys! Lets take profits and head to the Red Lobster for unlimited bread sticks and bible study”.

Twitter and Stocktwits. And so I decided to research this further. The Twitter and Stocktwits posts are the same posts, so you do not need to scroll back and forth. Please have a look at this mess of trading advice…one of my favorites, and a very typical post from Thomas is where he posts an after the fact message on twitter… “a break below 155 10/32 should cause prices to move lower”. There is nothing about Thomas going long or short, or stop loss, or target, just this random tweet event. Finally, a full 24 hours later, Thomas is breaking his arm patting himself on the back. “What a great trade guys! Lets take profits and head to the Red Lobster for unlimited bread sticks and bible study”.

This is the kind of stuff that drives me crazy. Where I have to work really hard and dig though a ton of recorded crap to find the core of the lie.

The more I watched, recorded and listened, it became plainly apparent that Thomas Wood is not a trader. In fact, the very prospect of him giving trading advise to anyone is pretty laughable. He is just smart enough to sound like he knows what he is talking about, but in reality, he is just flying by his underwear.

Wrapping Things Up

Sometimes when I get to the end of one of these reviews, I get frustrated. Not because I recorded hour upon hour of useless screen recordings, hand reviewed these videos, and sifted through page after page of useless trading advice, but because sometimes the truth is sitting in place sight. What is sitting in place sight?

- No track record posted Value Charts/MicroQuant for the live trading room.

- Moderators do not post live trades on screen for trading room members.

- No evidence that a live brokerage account exists.

- Clear evidence of fraud by posting after the fact trades on Twitter.

And number 5, and probably the most obvious is that the main trading room moderator is just a kid with very little real world trading expertise. Heck just a couple of years ago, he was working at Genworth as a claims adjuster. And now, only 24 months later he is a “full time professional trader” and “hedge fund manager”. This kid knows nothing about trading professionally, and more than likely does not even have a trading account. The creation of these videos that can be purchased for several hundred dollars each are about as useless as my own personal video on how to be a professional quarterback in the NFL. Sure, I can throw a football, but should I be selling videos and giving live instruction on how to be the next Andrew Luck?

Value Charts/MicroQuant Needs To Get Real

This is personal message to Mark Helweg, Thomas Wood, and Dave Aquino…when you read this review, know that the days of posting bullshit on the internet are over. Its time to stop the nonsense. All of you guys need to either start posting real time results, or go get a job at Starbucks. Stop wasting the trading communities time with these ridiculous multi-hour marathon rambling sessions on what is happening in the markets. If we wanted to listen to a talking head, we can simply tune into CNBC or Bloomberg for free.

Put out a real product. Backed by real time results. No more nonsense.

Well that’s it for today folks. Sorry if I was a little rough on these three nitwits, if you had to stomach hour upon hour of useless ramblings from these bozo’s, you would be irritated as well. On to the next review. Please feel free to leave your comments below. Even the folks that disagree will find that their voices are heard.

@Emmett Moore, some years ago you considered to write a review only on Dave Aquino’s options strategies. I’d be interested in this update of your quite negative value-charts review.

Do you see any chance that you could do this new review?

I would like to see an updated review of Thomas Wood, Dave Aquino and their new company “BasecampTrading”.

No problem! Its been on my list.

I really hate when marketers lead you along to the promised land by telling you how they are going to reveal their secret in the next video. So you listen to the video and he states that he is now going to share his secret. But he never does. He just tells you about a student who is making $10,000 per week using his secret income trading system. Then the video closes with an offer to purchase the secret for just $7. Well, if he lied about revealing the secret in this video, do you think he’s going to share the secret in the next video that you purchase? Heck no! You will be strung along until you pay Big Dave a nice amount of money to be part of his secret team of successful students, just like the guy who is making over $10k per week.

So, here’s the deal. Dave will make you pay to become a part of his service. You are never going to learn a thing about his 11 hour options until you pay up. But there is no real magic here. Dave buys vertical credit spreads one day from expiration hoping he is right about the direction of the trade. You can learn about credit spreads anywhere on the internet. Besides, there is a whole lot of risk in these trades it they go against you.

Dave knows this so he is going to make his money by selling you the system. Why don’t these option gurus teach us about their great system for free and provide a fee based service based on their great system? Because they’re not that good at picking winners…plain and simple…but they’re great at marketing all kinds of new and bullet proof options strategies!

Terrible experience

I agree with all negative reviews, especially by Emmett and Placido. I traded both with Thomas and Dave, with ValueCharts and BaseCampTrading, each time for several months. Dave’s trading options cannot be profitable, unless by pure luck. I saw (and followed) him changing positions from long to short every several minutes on SPX. Given the high spread on SPX, such trades in principle cannot be profitable.

Did you find this review helpful? Yes (3) No (1)

Valuecharts is no more, they have rebranded as Base Camp Trading (http://www.basecamptrading.com). As far as I can see the people are the same. Not sure why they changed names but maybe it was because of bad reviews of valuecharts.

Under the basecamptrading brand they have a $7 trial which I tried and then cancelled during the trial as the service doesn’t fit my style. However, I must say that cancelling was a very difficult process. According to their Terms of Service TOS, you must cancel via email and get a reply confirmation, otherwise they have the right to keep billing you $149 per month and there are no refunds. That is fine, but for goodness sake don’t make it difficult to cancel. In my case it took several email, as well as contacting them via their website, and a phone call, over a period of 5 days until they finally cancelled my account, and the rebilling. Anyhow if you try it out the service under the new name just be careful.

I purchased a 30 day value charts trial membership for $7 with access to the live trading rooms. I viewed the Futures room for pre market activity, but I mainly used the Options room to simulate live trades. During this timeframe the options room moderator Dave Aquino, never displayed his trading activity and position graphs when he claimed to have purchased various calls, puts, debit spreads, and credit spreads. Aquino also claimed that he traded in both a simulated and real money account. What Aquino did display was 12 truncated charts with various value charts indicators embedded inside each chart. Of course ample room was provided at the top for advertisements on workshops and mentorships that Aquino was trying to sell you. While your trying to make sense of the charts and setups, Aquino is a non stop talker, and his analysis is all over the place. Also, both rooms will not allow you to view questions or comments from other members. So both moderators will simply ignore your requests to display their trading activity. Here is an example of why the options room is disingenuous and deceptive. With Google at 750, Aquino sells 10 Google 735/730 put spread contracts for .25 cents on a Tuesday, which expire in 3 days. I question this trade, and Aquino tells me to purchase his power options workshop for $200 for an explanation. Dave is risking $4750, to make $250, with a 90% probability of success. Dave tells his traders not to lose more than twice the credit received for any credit spread trade. Two days later Google has dropped to 738. The loss on this trade is over 1k, which is four times the credit received, but brave Dave is going to fight on. Dave tells everyone he will purchase four Google 745 puts if Google drops below 738. As Google drops to 735, Dave tells everyone the profits from the 4 puts he supposedly purchased, has now negated the loss of the ten 735/730 put credit spreads. Google starts to rally, and Dave instantaneously sells his puts for a nice profit, and now buys two Google 730 calls. Oh but wait, Google starts to fall again, and Dave clips the calls, and puts are back on the plate. This same scenario would play out until Dave closed the room at 1pm on Friday. On Monday Dave reviewed his credit spread trades using an excel spreadsheet. Dave closed out The Google credit spread trade on Friday with a $500 loss. However, Dave generated a $300 profit on the various put and call purchases that he supposedly made to defend his credit spreads, minimizing the loss to just $200. Even with the loss, Dave still managed to make 2k on his supposed other credit spreads for the week. Dave was now promoting his new options credit spread mentorship for the price of two thousand dollars. Only two out of 12 spots remain. GEEZ, are people that effing gullible!!!! Hell, I feel ripped off for the $7 I spent. Last month they wanted $149 a month. They just emailed me another offer for $41 a month. Even if they paid me $41 a month, I would still decline. The room is totally worthless.

Honestly, I am not sure how I found out about Value Charts. The 11 Hour Option Strategy intrigued me. So I listened to the webinar.

Only because I have done my due diligence, and spent the better part of the last 2 years working very hard to learn options, I was intrigued. So I signed up for a month trial.

Now this is only day 2 and I have not had a chance to read all the materials on the web site, but I personally had many things click today that hasn’t before. ]

The trade records I keep at very thorough. I will comment back near the end of the trial an give and update on my experience.

Thanks Emmett for your work evaluating these sites. I have kissed so many trading guru frogs over the 12 years of my trading business that my lips are green. While I liked the guys at Value Chart, bottom line, I lost money.

I was with ValueCharts for over 10 months 3/15 to 1/16). I purchased several of their products and was in their rooms daily. I lost money with Thomas (@$8K) in futures and almost broke even with Dave ($858). I’ve done worse with others.

As mainly an options trader I found Dave’s trading straight Calls and Puts on Fridays the most exhilarating and most profitable. The 11-Hr trades he calls out for Thursday PM are Credit spreads on volatile stocks and the SPX. Others have commented about their appeal. My experience (and data) shows that, yes you make money on most of them. However, you are punished severely when the inevitable big loss occurs. Dave’s Friday trades were often on stocks where the Credit spread had gone against us and he was trying to mitigate losses.

Of 81 Credit spreads suggested by Dave that I took, 86% were winners. In the end my losses exceeded my gains. Some of his trades did not fill for me. I did not chase them. Some gapped against us on Friday and did not give us a good exit opportunity. Long term, Credit spreads on fast moving stocks is a fools errand.

I keep records on every trade I make. Analyze everything. You must if you want to make a living at this. In Dave’s defense, I made money on his Credit spreads on SPX, PCLN, GOOG, TSLA but got hammered on NFLX, and to a lessor extent on CMG and AMZN. The far and away winner was SPX. An Index moves less.

Good stuff Emmett, I appreciate the effort you put in and you saved me a lot of time.

Out of curiosity I went to their website, All the videos are accessible without paying a dime. No Security, Software Architect—WHO???

1. Why buy the video when you can access the backdoors!!! Sick security flaws in their webpages, you can access the videos unrestricted.

2. I have Revealed the truth being the value chart indicators, visit tradingview.com

http://chartandplay.blogspot.com/2014/10/sometimes-free-indicators-with-price.html

3. This website is just a rip off.

4. My personal Rule #1 – Do not take other’s trade setup, unless it comes with all trade management parameters

Really? Where did you see the videos? I cant afford all this expensive stuff these guys try to sell, thanks for speaking the truth!

I don’t know much about Tom Wood but I find it interesting that you have a 10 min recording of his trade room and completely miss the trades he calls out..I heard him call out at least 4 trades,2 of which he took..I don’t put much stock in your review,

Thanks for the comment Phil. Hey, even Star Wars got bad some bad reviews.

Give Value Charts a go. Trade it. If it works for you, then please come back and right a guest post. Would be more than happy to publish your findings.

I think you need to stop calling people names Emmett, even if they are not good traders. It’s vulgar and disrespectful. Just write your own honest opinion but don’t use slander. Makes me think that you are writing these from prison.

Kacey, I think that you need to think about the purpose and value of Emmett’s review before you bring out your PC credentials that respect everyone’s right to express their opinion as long as it’s an opinion that you agree with. Do you know who was writing honest reviews of trade education vendors before Emmett started this blog? No one. So if you are too delicate to read a few nasty words don’t read this blog.

I have been a member of the Value Charts live stock and options trading room moderated by Dave Aquino since Dec 2014. The $97 monthly subscription also gives you access to the futures room. Since I trade only options, I do not have an opinion on Thomas Wood. However, my experience with Dave Aquino moderating the options room has been very profitable. We day trade the weekly options of NFLX, GOOG, TSLA and PCLN. The majority of our trades take place before 11a.m. Dave will also write credit spread trades on Thursday’s around noon, that expire the next day. If asked, Dave will show his daily profit and loss on his Think or Swim trading account. I only use two of their indicators. Value Bars for an over bought/ over sold condition, and a Value charts momentum indicator. I paid $297 for both. Check out the room for free, and ask Dave to show you his think or swim account.

Excellent comment. Getting a review written of Dave Aquino’s options program could change the entire tone of this review.

I am sure that most readers believe that I must enjoy writing negative reviews. That is simply untrue. The truth, is that if I write nothing but lukewarm reviews that only highlight the positive, then the vendor will not make positive change. In my opinion, Thomas’s trading room is waste of time. Perhaps the owners of the company will read my review and make some changes. Perhaps they will focus on Dave’s product, which is working for you…and make some changes to the live room. Then I can rewrite the review and introduce the audience to a great service.

Vendors, after reading my negative review will usually do one of three things. The first is to sue me, which is waste of time. The second is to take the website down and disappear. The third, and the best option, is to make changes and improve. Then request a new review.

Thanks for taking the time to write today. Your feedback is very valuable.

Be careful. I once asked David if he used a real account or a SIM. His reply was (honestly) “both”. Reason I asked as he once showed a TOS account w/ “adjust account”, which is a SIM account. Sorry… If a trader doesn’t have skin in the game I am not interested. Simple as that.

I subscribed to the options trading room for the free trial period. Some of the trades he enters ended up being winners with very quick returns, but I found him to be dishonest at times. I say this because he will state the stock and the strike price of the call or put he is trying to initiate a position on, but he will not state the exact price of the limit order. Many times he will also state the number of contracts he bought (usually anywhere from 5-20 contracts) and when I looked at order flow for that particular leg (especially for googl or pcln which are not as heavily traded as a NFLX or AMZN) the trading volume for the day was less than the number of contracts he claimed to have traded. Pretty much I believe he is buying and selling positions but not always for the number of contracts he claims to have traded.

To anyone who is a subscriber, take a look at the options log for the stock and strike price after he claims to have been filled on a trade and see if there are positions in the log that match what he said. I remember following a GOOGL trade where he claimed he bought and sold 20 contracts. I checked the trade log and from the time he bought and sold the position there were only about 15 contracts traded which made me lose my trust in him. That’s just my opinion.

“The monthly fee of the trading room is $197 per month. ”

$197 a month for absolutely no content…(crickets). What is this, the trading fillibuster room? I openly laughed when he interrupted his news report and said “I’d like to see the S&P500 get up $####” like it was some brilliant observation. Unbelieveable. You sat through 20 HOURS of this idiocy? ARE YOU INSANE?

I’ve got an idea, we form a company and hire Thomas out to Gitmo to teach the prisoners at $400 an hour. Why waste all this talent?