Trend Trading

-

Statistically Valid

(5)

-

Ease of Use

(5)

-

Simple to Master

(5)

-

Robustness

(5)

-

Durability

(5)

Summary

We are told that “the trend is your friend.” But is it really? Have you ever seen statistically valid evidence that either proves or disproves this well-worn market maxim?

Does trend trading reveal an intraday market edge? Should you be trading with the trend, with your intraday trading?

The answer is yes. And we would like to present evidence that suggests that trend trading is the best option for new traders. Included is a practical strategy that disproves the efficient market hypotheses and serves as a launch point in which to develop your own custom trading strategies.

When it comes to intraday trading strategies, is the trend really your friend?

We often hear this oft-repeated maxim about how we should always trade with the trend. That we should, “go with the flow” and that “trend trading works.” We are told that trading against the trend is a sure-fire path to financial ruin.

And, we also hear and read about magical trading indicators and supposed “order flow” techniques that can supposedly predict market tops and bottoms.

As usual, the truth lies somewhere in the middle. This space in which market falsehoods occupy and perpetuate can seem as long, lonely and barren as a drive across the state of Texas. Those of you that have driven across Texas know exactly what I am talking about.

Anyway, I wanted to take a moment today and talk about intraday trends. And a simple trading indicator that you can use that is both elegant, statistically valid, robust, and might just save your ass from blowing up yet another trading account.

The Mid-Point of the day

The mid-point of the daily range is a simple indicator. Suppose that are you are trading the Emini SP500 futures contract. And the high of the day is 2350, and the low of the day is 2300. What is the mid-point? No fancy calculator needed. The mid-point would be 2325.

And so, if you are trading intraday, a long position above 2325, then you are quite simply trading with the trend.

Conversely, if the price of the Emini-SP500 is below the midpoint of 2325, then we would consider the immediate trend to be down. If you are short below 2325, then you would also be trading with the trend.

The concept is ridiculously simple. And it also conforms with the theory of Occam’s Razor, that which is most easily observable, and most obvious, is usually the best answer. For instance, if you observe 10 chickens in a henhouse, then you are most likely going to see eggs. If you see a wolf dressed like a chicken, and he is selling a trading indicator, then he is most likely trying to steal your eggs (or your chickens). What is most easily observable will usually yield the most statistically valid answer.

So let’s jump back into our super simple trading theory that if the current price of the Emini SP500 is above the mid-point of the trading day, then we want to only be a buyer. Nothing complicated here. We want to use this simple observation to hopefully predict the future.

Conversely, if the price of the Emini SP500 is below the mid-point of the trading day, then we only want to be a seller.

This is the quintessential meaning, and most easily defined and elegant approach to trend trading. Going with the flow. Let’s test our theory with actual trading data.

Our Mid-Point Strategy Defined

With the following test, we are going to use 5-minute bars of the Emini SP500 futures contract.

Before we take any trades, we are going to wait 2 hours. We want to simply observe the first 2 hours of the trading day. We want to let some sort of market structure develop.

After 2 hours, we then calculate and plot the middle point of the intraday range. As the market moves to new highs or new lows, then the middle point of the day will continue to adjust higher or lower.

We only want to take trades in the direction of the trend. So if the price is above the middle point of the day, then we only want to take long trades. If the price is below the middle point, then we only want to take short trades.

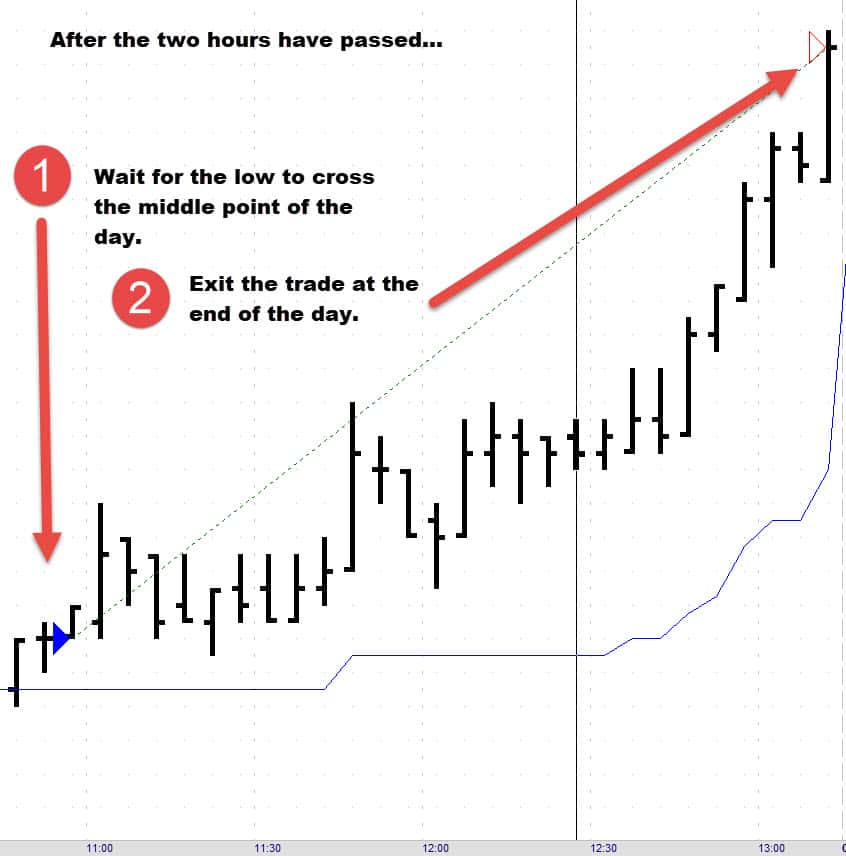

Our entry point for buy signals is exactly as follows:

- Wait 2 hours.

- Calculate the middle point of the intraday range.

- If the low of a 5-minute bar crosses above the mid-point, then we want to buy at the market.

- Exit the trade for whatever profit at the end of the trading day.

- Exit the trade for a loss if the high of the 5-minute bar crosses below the mid-point of the day.

The following example is a winning trade:

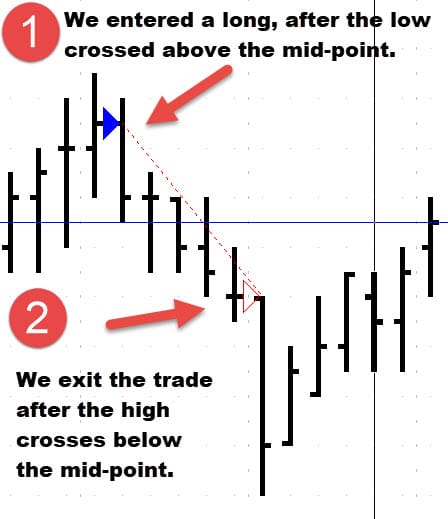

But what if we are wrong? How do we exit the trade? We will use the exact same logic to exit the trade.

- If we are long, we exit the position if the high of the 5-minute bar crosses below the mid-point of the intraday range.

- The exit conforms to our entry logic, that if the price is above the mid-point we want to be long, and if the price is below the mid-point then we want to exit our long position.

The example below is what a losing trading looks like:

The entry and the exit are simple, congruent, easy to identify and keep with the Theory of Occam’s Razer that simplicity and easily observable events tend to yield the most robust answers.

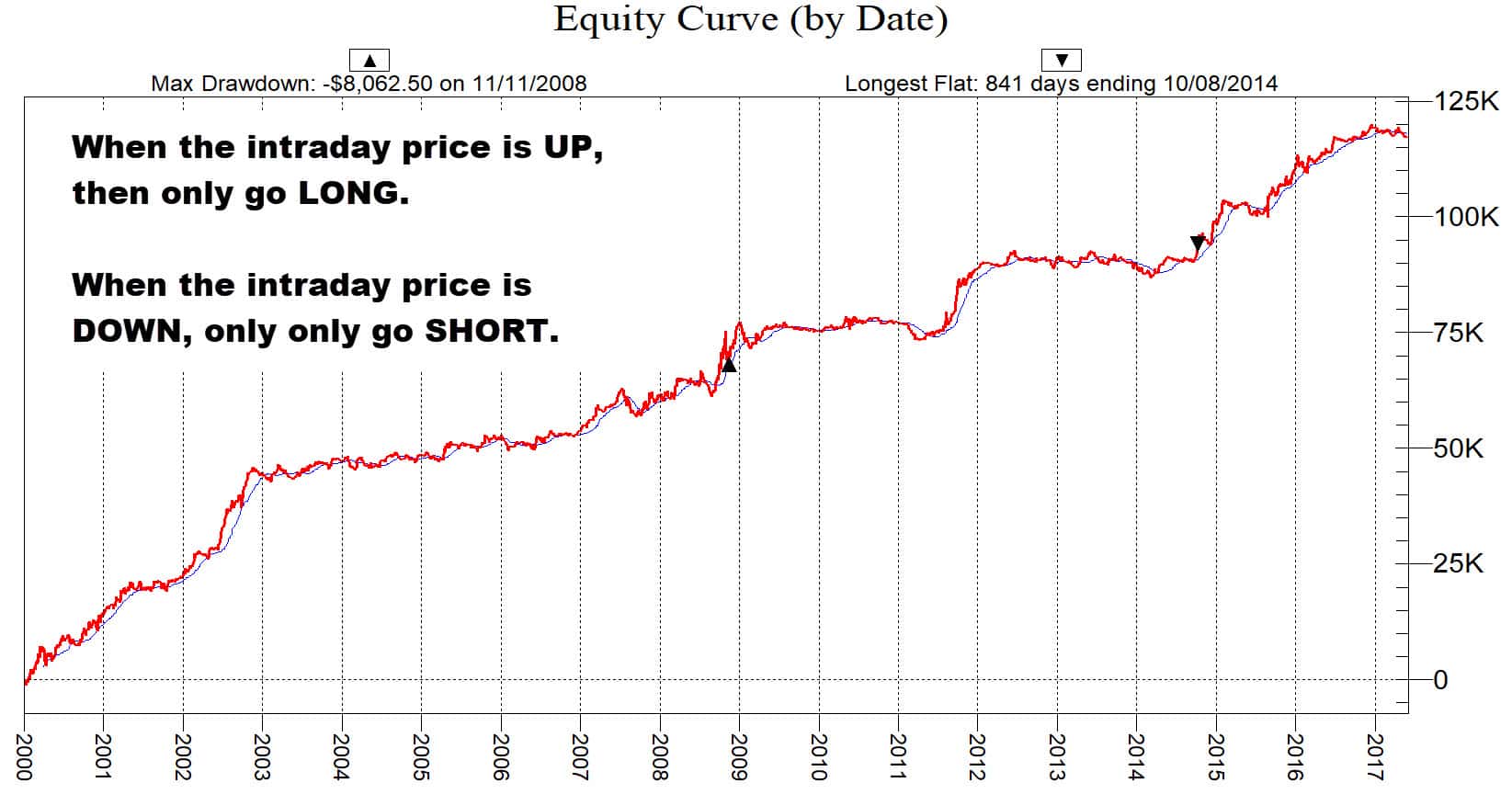

The following equity curve highlights the stupid simple concept of always “trading with the primary trend” by only using the mid-point of the intraday range.

Maybe the trend really is your friend?

With an astounding sample size of 3,654 trades over over the past 17.5 years, we can see the robustness of the approach.

But many readers are probably already screaming foul! And they are saying, “hey smart ass, know nothing Emmett, this supposed genius (con artist, jail bird, felon, hustler, scoundrel, etc) …these trades were in the stock market and are only LONG trades. And the stock market has basically only gone in one direction. Up.” Correct! So now we have to look at how our system performed on the Short trades.

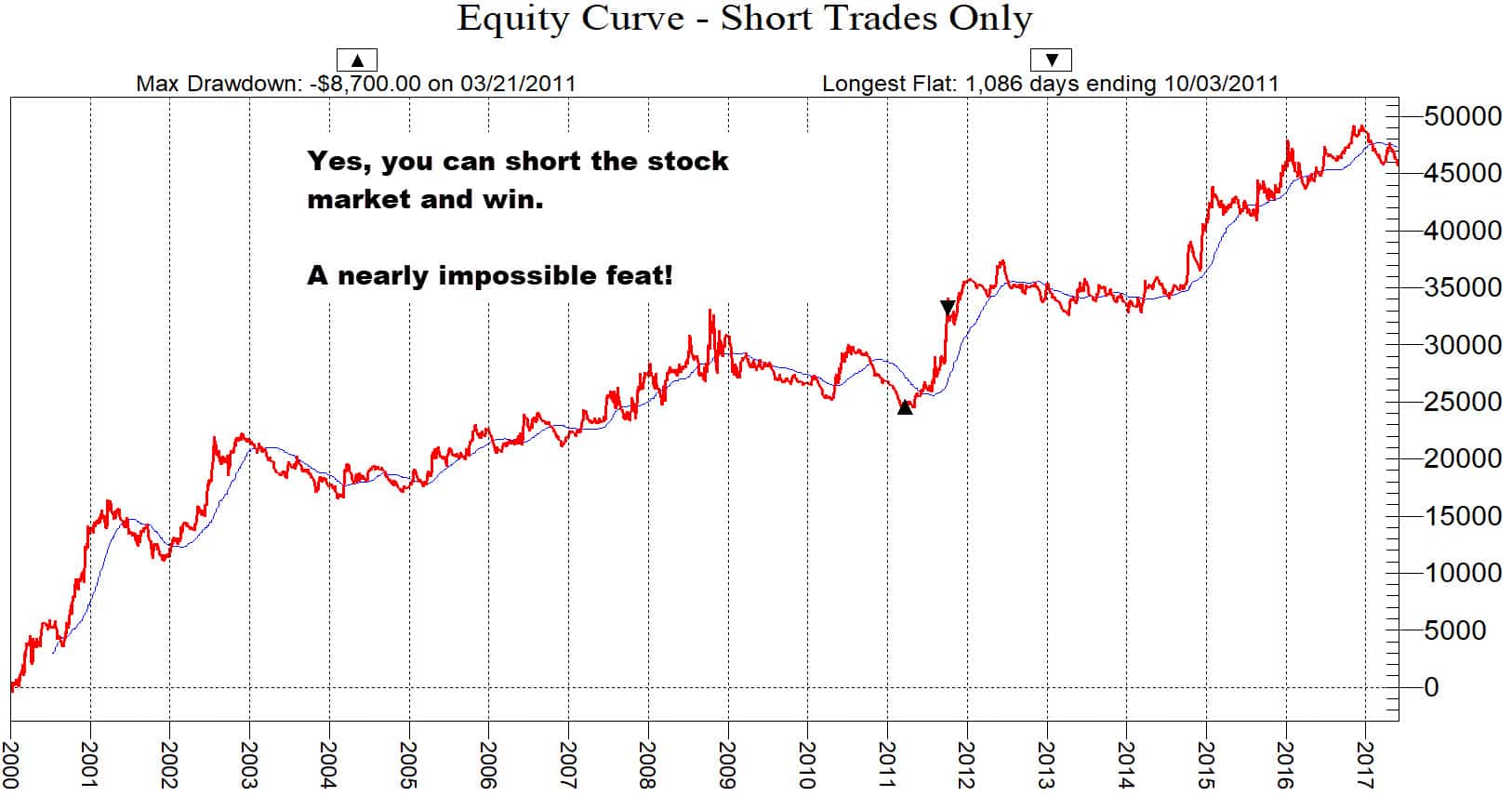

Shorting the Stock Market: A suckers game?

Now we are going to reverse our strategy, and only take short trades, trading the Emini SP500 futures contract. Which since 1929, going short the SP500 has basically been a fool’s errand.

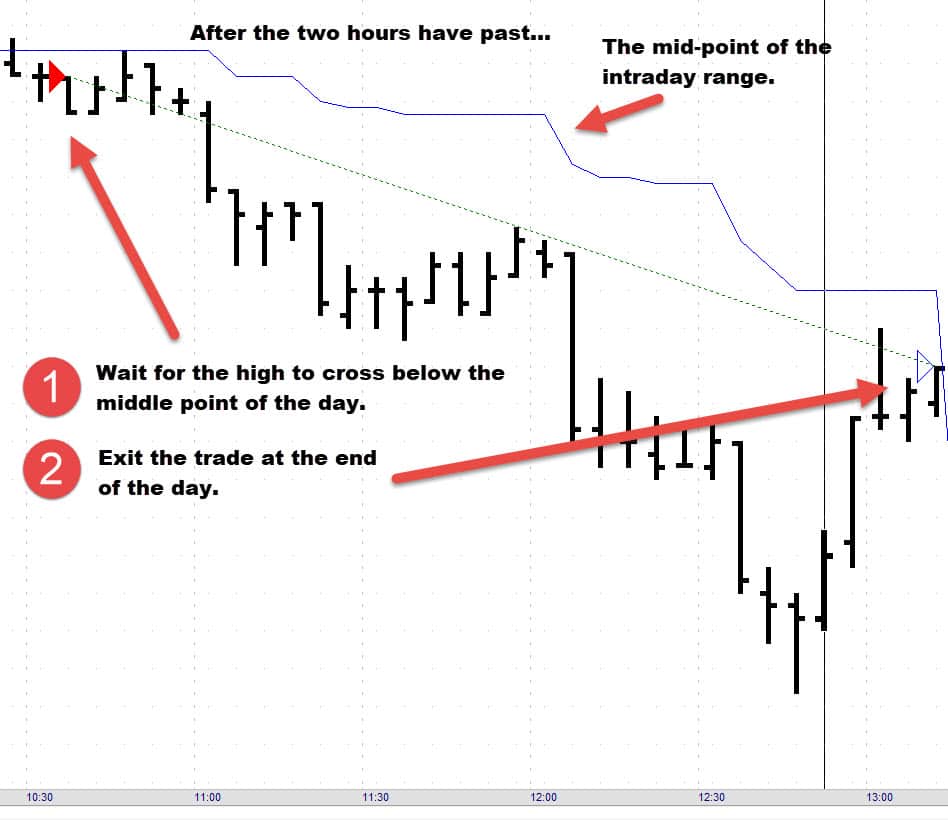

Once again, the exact rules are as follows:

- Wait 2 hours.

- Calculate the middle point of the intraday range.

- If the high of a 5-minute bar crosses below the mid-point, then we want to sell at the market.

- Exit the trade for whatever profit at the end of the trading day.

- Exit the trade for a loss if the low of the 5-minute bar crosses above the mid-point of the day.

The following is what a winning trade looks like:

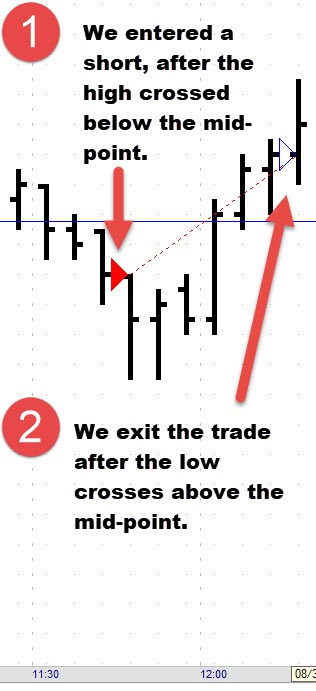

But what if we are wrong? How do we exit the trade? We will use the exact same logic to exit the trade.

- If we are short, we exit the position if the low of the 5-minute bar crosses above the mid-point of the intraday range.

- The exit conforms to our entry logic, that if the price is below the mid-point we want to be short, and if the price is above the mid-point then we want to exit our short position.

The example below is what a losing trading looks like:

The following equity curve highlights the stupid simple concept of always “trading with the primary trend” by only using the mid-point of the intraday range.

With an astounding sample size of 3,457 trades over the past 17.5 years, we can see the robustness of the approach.

So now that we have investigated both the long side and the short side, by using only the mid-point of the intraday range, let’s combine the results. The following are the combined results of trading both long and short, using only the mid-point of the intraday range.

Is this trend trading strategy robust?

Absolutely, for just the Emini SP500 futures contract, the total sample size is over 7000 trades. This is a massive amount of data. If the market were truly random, then the equity curve would be flat, and the trade expectancy would be close to $0.

Sometimes you just have to trust the Law Of Large Numbers, which simply states that the larger the sample size, the more reliable the statistical output.

But is this strategy ready to be deployed and traded AS-IS? Absolutely not. The truth is that the average trade size is only $16 per trade. Not enough to outpace slippage and commission.

However, the sample size of 7,000 gives us a huge amount of space in which to introduce and test different scenarios in which we should be taking trades and not taking trades. And these different scenarios will be the launch point of many new articles that I will be writing that find, and expose these market biases.

Trading Strategy development should be like making soup.

This might sound strange. But when making a soup, you have to start with a stock. You have to boil out large quantities of bones of vegetables. And you are ultimately left with a rich and nourishing broth. A base in which to add different ingredients, to find the right taste, texture, and nutrition.

Same goes with trading strategy development. You need to find these large biases that disprove the efficient market hypothesis. You need to find and isolate these broad and wide occurrences, like the Mid-Point Trading Strategy that we have just tested. Something that initially yields a large broth of statistical edge. And then you need to start working on the data, introducing different scenarios that whittle down the sample size and yield an average trade that financially makes sense. That outpaces slippage and commissions.

In future blog posts, we are going to be taking the Mid-Point Trading Strategy, and treat it like a soup broth. We will then be adding and subtracting interconnected data points from other markets, in the hope that we can find something that launches your own imagination into unknown territory.

Thanks for reading.

This was a pretty long blog post. And the topic might have been difficult for many to follow. Many readers are unfamiliar with trading strategy development. So we are going to take it very slowly. And release trading strategies that “stair-step” from a basic concept with a large amount of “broth” into more refined concepts that yield a full blown delicious soup. Something that will yield actual nourishment and inspire your imagination towards places from where your genius is hidden.

And if you have any trading ideas that you simply cannot program, and are curious if any legitimate market edge exists…let me know. I can program and test just about any idea that you can imagine.

Thanks for reading.

Proposal:

Modify the strategy saying at the entry point,

if long, buy an ATM ES1! Call option 7 days out

if short, buy an ATM ES1! Put option 7 days out

These quote is about 20-25 $ per contract, 2000 – 2500 $/contract

shoot for a 10% gain, means sell the contract for 22 – 28$.

An ATM option usually has a delta of 50%.

For a 2.50 upmove, it just needs the ES1! to go up 5$.

That should work for a high percentage of the trades.

If that seems too risky, use MES1! options which are 4-5$ per contract if I remember well.

Hi,

what about using the session-VWAP?

For those who asked, the midpoint can be drawn easily by using Fibonacci and disabling all retracement levels but the 50%.

That would make an interesting test. I will check it out.

Recently, I checked that goofy mid point strategy in the article and surprising it still works really well. Its amazing how somethings are so durable.

I don’t get it. Your examples show other bars crossing the midpoint before your expample bar.

Forgot to mention in my previous comment. Is there any way we can code an indicator for this that constantly shows the mid point ?

If you could let me know the basics required I could get one made.

Sure, its pretty simple. All you need is the following:

((Highest High of intraday) + (Lowest Low of Intraday)/2)

I don’t get it. How can you wait 2 hours to establish what the middle point is. Don’t you have to wait an entire day to find out what the low and high was of that day?

e.g as you mention “2350, and the low of the day is 2300”

This is where I get confused, wouldn’t we have to wait a whole day to draw the middle point, meaning we can’t trade that day as we are waiting to find what the actual middle point is first …. then we could trade the next day off that previous days middle point as a indicator?

I’m probably not understanding it correctly. Perhaps if you could clarify it would be greatly appreciated.

Very interesting article. I’m wondering how stop loss strategy will be e.g where to place the stop loss, and ideas for targets.

Cheers

Did you even read the article? All your questions are answered clearly.

Hi Emmett,

Really like your blog and want to say thank you for your review on TopStep Trader. Count me as one of the hamsters. Been doing well ever since going with OneUp Trader and have built up enough profits to soon be going out on my own.

Regarding the mid-point / median day-session price idea. I have had good success with this concept using VWAP. Much of the time VWAP and the median day-session price plot pretty close to each other in the morning and will widen the gap as the day progresses. A really great way to catch some large moves.

I’m also a huge fan of Connors work. Been trading his ideas for over 10 years.

Thanks again for all you do.

Sincerely,

Gomez

Hi Emmet, this seems promising, allow me to ask a few questions 🙂

1. Can you better define what you mean when you say mid point of daily range? When it’s 2 hours past open ( 11:30AM) and I’m looking at the chart, the day as barely just begun, how do I establish my mid point? Is it the range between 8:30 AM and 11:30 AM and I split that in 2 to find the mid point? Is there an indicator available?

2. Can you please point me toward a platform / website that provides a proper VIX indicator? I trade the SP500 through my forex broker MT4 .

Thank you!

“We want to simply observe the first 2 hours of the trading day.”

What does this mean? When does the trading day start? Obviously not at midnight Eastern (although that’s when the algos reset). 7 AM? 8 AM? 9:30 AM? The examples you show appear to be picking times to start looking for trades at different times. Please advise – thanks!

Hi Ed,

My technical writing skill is sorely lacking.

With the ES or Emini SP500, the morning session begins at 8:30 AM in Chicago.

Hello Emmett,

When you say to wait two hours, I’m assuming you are talking about regular trading hours. My question is: Do you ignore the price action during Globex (overnight trading)? I’m talking about futures only, RTY, NQ, YM, ES, CL, etc.

Thank you.

Yes, totally ignore the overnight session.

However, this does not mean that overnight data is not useful. As a matter of fact, you can create a big bunch of trading systems just based upon the overnight session. In particular, if the overnight range is greater than a % threshold, then the market will tend to perform in a certain way during the day session.

Hello Emmett,

How do you define a % threshold?

Also, regular trading hours are from 9:30 a.m. to 4 p.m. New York time. 6 hours 30 minutes total. The middle would be 3 hours 15 minutes or 12:45 pm EST. If we wait 2 hours from the open, it would be 11:30 am EST.

So when do we look at the midpoint of an intraday range, at 11:30 am EST or at 12:45 EST? I would appreciate if you could clarify that.

Thank you.

Hi John,

Can you do me a favor and ask this question and at my new Q and A website? Its located at Trader.Help.

This new site was specifically created so that I can answer these questions and will make it easier for others to contribute.

Thanks,

Emmett

Hi Emmett, you got any good reviews coming up?

Well okay then….. this is the exact strategy I’m working out now. I’ve got a few differences and nuances, but of course that’s what you are saying your future posts are for…. but you are on the right track… either that or I’m on the wrong track 🙂

Do you guys have a good book for starting out to learn futures?

Hi – So for the e-mini do I take the range of the midpoint calculated from 9:30 am to 11:30 am EST? Thanks!

The midpoint of the trading day is dynamic. As the day progresses, and new highs or lows are created, the midpoint will continuously recalculate.

Its a remarkably simple concept.

Id like to understand the entry better. Do automatically enter at the 2 hr mark? What do you do if its a trending day and its not near the mid point? Sit and wait?

Hey Chaim,

I am the worst technical writer. Sorry for the confusion.

Are you using an automated trading platform?

I have the same question, also is there any other pages w more info on this concept? Do you have an email I could contact?

Hi Emmet

I have read with great enjoyment your article. It´s a simple approach backed up with a great and extensive backtesting. I fully agree with yours and Occam´s razor view.

After reading also your article about Vix, an idea came to my mind that I think could be interesting to backtest to either discard or accept a new ingredient into the “Trading strategy soup”. If the mid point of the trading range is the one that signals the primary trend, what do you think about making the same assumptions with the VWAP (volume weighted average price), so that we also trade in the direction of the volume´s day primary trend?

So, being short only if price is below VWAP of the day, and trading long only if price is above VWAP of the day, and mixing this with the mid point value I thought about the VWAP as a possible new ingredient as it is alredy a mean of the total volume traded in the day.

Please let me know what you think about it, even if it means nonesense to you or other fellows of this great web page.

I´ve found in tradingshools.org a great community and very interesting content for us, normal people that use to trade as a full or part time job.

Thank you very much

Cheers

Daniel

Wonderful and refreshing post on what REAL trading is all about! Really look forward to future additions to this.

Thank you for all you contribute to clearing the rancid air of all the BS out there. And to showing wanna be traders how hard the game really is. It can be won, it’s just very hard. And we are only a few mental mistakes away from turning wins into losses. Emmett, I am sure you are saving a lot of starry eyed wannabe traders from blowing their hard earned money. Bravo.

Thanks Jay.

By no means, am I an authority. But am pretty good at investigating and researching market bias, and finding these patterns. Hopefully, we can encourage folks to take a more scientific, evidence-based approach to trading.

This is how the truly successful do it. They treat it like a casino, where they design and own the slot machine.

Hi Emmet,

Wonderful site. Is there an email I can contact you at? I thank you for your continuous support.

thx emmett, very well done

Thanks for the thought-provoking post. It is always nice when someone posts market theories and then backs them up with actual evidence that they do or do not work.

That is so much better than all these vendors who just espouse a bunch of theory without showing any testing to prove any of it, or showing you how to test it yourself. I guess the reasons for that are obvious.

Maybe you could do a webinar at futures.io. That would be hilarious. It would be priceless to see Big Mike announce the date of the upcoming Emmett Moore webinar! LOL!!!

Emmet, thx for the nice strategy. What are the win-loss percentage for total of 7000 or so trades and also what is average drawdown in a trade. Such numbers would really help. Given the equity curve is 45 degrees, this strategy can be easy to trade for the mind’s confidence.

Also Remember Back-testing and forward testing are not the same. There is a tendency to do data manipulation. So another question to ask is was this his only back ran test or was this after 10 other methods using different parameters all proved to be losers. I can not even begin to expand on the number of vendors selling algorithms that all work on back-testing but then lose money the second you test it live.

Yes, all strategies break. All things change. We have to accept that all things are in a state of exponential decay, or half-life.

I will make my best attempt to address this issue, and how I personally deal with it. There is no right or wrong answer. I will be writing about a specific strategy that I trade with the Treasury Bonds that performed great…until it didn’t. And detail how I personally decided to “put it on probation, and then eventually completely shut it down.”

If you dont have a ON/OFF switch, then every system will eventually destroy your account. Half-life is always working against you. It’s natural law. And we are all circling the drain! Nobody gets out alive. And neither do our trading systems.

Hi Amit,

You definitely do not want to trade this strategy AS-IS. This strategy serves as a starting point, we are going to be adding a few different things to make it a viable strategy.

In the article, I was making my best attempt at introducing simple market bias, the “trend is your friend.” Since we have a massive trade sample size, we can make a lot of different things.

Its like making soup. You need to start with the broth.

Emmett

Your trend trading strategy enters and exits positions “at the market.” In your simulation, what price did you use as the market price? Unless you used the “ask” for buy entries and sell exits, and the “bid” for sell entries and buy exits, your estimate of the strategy’s profitability is not accurate. Since the Emini S&P is extremely liquid, the bid/ask spread is typically a single tick ($12.50). Each position traded requires two transactions: an initiating one and a closing one. The most generous assumption would be that half of the time you will get filled at the favorable end of the spread; the other half of the time you will get filled at the less favorable end, costing you an additional $12.50 on average per round-turn trade (in comparison with any simulation that assumed you received the “last trade” price rather than the appropriate “bid” or “ask”). Since you are always entering and exiting when there is a local trend in effect (i.e., when a price bar has just moved in the direction you want to be in), your fills might be worse than the 50/50 assumed above. If you received the less favorable end of the spread 75% of the time, your strategy would show an approximate loss of $15,000 instead of the reported $118,000 gain, without even taking into account the commissions you would pay. If you have access to bid/ask prices and used them in your analysis, then congrats to you. If not, the Efficient Marketers are strapping on their chest plates and girding their loins.

Thanks for the thoughtful response. The strategy is definitely not ‘trade-ready’. Instead, it serves as just the stock, in which we are going be adding ingredients in hopes of creating something nutritious.

The key takeaway is that trend is important. We can quantify and measure it.

I should add this is what Kevin teaches – come up with strategies and back test them. So you are saving folks some money on not buy his course.

No good place to post this but too funny not to show. Lying Dean loves Emmett (not), but somehow leaves himself off the list or criminals. Did you forget you SOB Lying Dean you recommended Open Range Trader which the regulators came down on for showing complete fake reviews. Dean you never ask any of the TR you recommend for any actual proof they trade live profitable. Dean you are scum of the earth IMO and make Emmett look like Mother Teresa (yes a bit of hyperbole there)

https://www.youtube.com/watch?v=hEUBDJCx7vA&t=321s

about 3 minutes in to the Emmett review part.

Not to mention lying Handley also was kicked out of the pharm industry while claiming otherwise why isn’t he still in the industry instead of a history of promoting sham rooms and doing deals as exposed in the trailer kitchen video. Pathetic and probably desperate now where he tries to be another tradingschools scam whistleblower when his rushmore grand tetons of fraud failed to fool enough dupes. “not monetized”, lol. Soares showed how he proposed monetization deals caught on video! at this point, only being locked up by the feds will mercifully shut up his babbling.

http://www.youtube.com/watch?v=WYSkTPaHEh8

I hate Dean Handley more than your good buddy hates you know who. He writes articles evaluating rooms acting like he is on your side by identifying a few good rooms that he really traded. Yet it is all BS; he never traded any of these rooms and never asked any of them to show any proof of profitable trading. His list includes some of the biggest con artist TR around including GTR. I remember a long time ago taking the GTR trials and this moron was in there bragging about how he made money on trades that no one made money on. He is lower than whales shit. And yes he was involved in the drug that was investigated for fraud. If this guy is ever thrown in jail where he belongs I will throw a party.

wow, that is pretty low of Handly to be boasting about fake proftiable trades in the GTR room. It reminds me of Emmett’s report of Levin’s room where the “closer” took him to the setup trading room, where a bunch of actored shills were shouting they were “all” making money just following alone the host’s calls, lol. Even though Emmett recently reported the income stream he gets from running this blog amounts to practically poverty level, Handly phdmsgobbygook must be so desperate for anything to even try to lamely copycat a piece of Emmett’s truthful calling out scams reviewing pie. Maybe his meagre kitchen abode is undergoing foreclosure too. Lying Dean should beg Ross of the WT gray-hoodie triefecta for a job as being an actored shill at this rate. Bottom line, if his rushmore mt. tetons were so profitable why doesn’t he just trade and follow their calls for a living? Because it’s all sham and he got kicked out of the pharm industry for being a greedy lying scumbag, period.

Dean Handley and Al brooks should collaborate on a venture together. They are both doctors and professional traders. This business calls out the bottom feeders of the world and the pit seems to have no bottom.

Wow, handley is garbage…

Your Graph shows why most folks rather trade in the Fantasy world and lose money than the real world where you have a chance of making money. As you can see from your graphs there can be long periods where you are down or do not make any penny. Not exactly going to quit your day job and make a salary like the TR teach. Looking at your long only chart you can see from 2004 to 2007 you are BE. Who is going to get up everyday and trade for 3 years and BE. They will give up and then that is when the big up move happens. And this is why the con artist day TR come in and promise nonsense. The nonsense sounds so good. Make money everyday, no draw downs and so forth.

That graph will just not do! Where is the 98% win rate? The 3:1 reward/risk ratio EVERYTIME? Regularly making money every day like a salary?

How dare you show such nonsense, when Warrior Trading and others are telling us that we can start with $5k and make six figures in a year?

Yes, if you are still clueless, I am being sarcastic.

Lol. I love it.

The article post was just an opening concept, am going to start building strategies from ‘the broth’.

Hopefully, at some point, others will grab these ideas and create their own strategies.

Apropos of what you have written, I do not know if you have tested a slightly different scenario that is suggested by your price bars.

I think I will go ahead and code and run a backtest on it. For those following along, as Emmett really had only the mechanics of the method described, I have included a rudimentary, but effective, “loss control/money management method” that you might want to consider if you want to run your own backtest.

Here we go.

Long

—-

1. Wait 2 hours.

2. Calculate the middle point of the intraday range.

3. If a 5-minute bar closes above the mid-point, then we want to buy at the market.

4. Exit the trade for whatever profit at the end of the trading day.

5. Exit the trade for a loss if a 5-minute bar closes below the mid-point of the day.

Short

—–

1. Wait 2 hours.

2. Calculate the middle point of the intraday range.

3. If a 5-minute bar closes below the mid-point, then we want to sell at the market.

4. Exit the trade for whatever profit at the end of the trading day.

5. Exit the trade for a loss if a 5-minute bar closes above the mid-point of the day.

Loss control

————

– Have a predetermined maximum loss for the day. If the total loss exceeds that figure at any time, quit for the day.

– Determine a maximum number of losing consecutive trades, which indicates to YOU that the day is a crappy mess with no trend. After that number of consecutive losses, quit for the day.

Now if I could only be so clear, concise, and well written.

Do we really have 2 people who do not understand sarcasm, or do we just have 2 unintelligent nincompoops who have decided to follow me around with downvotes?

Damn pendejos.

Rob B you always said diversification is the key and that is what most new traders don’t understand from the start. You can’t make a living off trading one system because no matter how good your system is you will have draw downs. That is why you trade multiple systems and when one system is going threw a DD than others make up for it. Even though I have given up on trading , I believe it can be approached like any other investments. First you need an trading edge and then the following:

1. Enough Capital (need money to make money)

2. Diversification

I am yet to go to a day TR that talked about diversification unless their idea of diversification is micro-scalping GOLD and ES. The problem is when you look at stats on savings in this country it is horrible so how are they going to diversify. Here is what the average American has saved for retirement. And with pensions going bye bye no wonder they turn to Day trading out of desperation.

The median for all families in the U.S. is just $5,000

How the hell are they suppose to retire on that???? So in steps the Day TR telling them they can make a $1M in a few years and retire. Problem solved!

http://www.cnbc.com/2016/09/12/heres-how-much-the-average-american-family-has-saved-for-retirement.html

I assume you are mean diversification in types of trading methods Fara. I’d agree with that. still it’s so hard to just even find one method that is at least breakevener. Tom Busby’s DTI (Diversified Trading Institute) has long been a legacy sham smorgasboard of supposed various trading of different markets. Emmett did a review of one of his son’s newer shammy tradingschool venture. True RobB, there’s not much left to diversify investing in this rotting economy running on service econfumes unless in some decade in the future if there is a future, the jobs and corporations repatriate. Now you just have oligarchs who have banked from their countries buying up the real estate.

Thanks for the sharing of these strategy ideas. I’d agree capturing the trend is the ideal trading goal although I’d doubt orderflow really helps in this area except for maybe HFT microscalping ticks of a bar. Having already been through the rigamarole phase of past testing, I’ve personally ditched the automated strategy searching and have went back to manual trading. Although I’d agree it can be somewhat helpful to explore trading ideas using strategy testing tools and discovering a possible edge of a trading idea with a good size sample set makes sense. Interesting to see tradingschools start to give their own brand of education besides just reviews. I’ll say this to newbs and folks new to tradingschools. Emmett’s articles are a far better bet to learn about trading in general than any of the shamster schools out there who just immediately deluge visitors with marketing. The blog is free to read, and tradingschools is the most transparent about its own workings than any of the other review forums and blogs out there . Sure there are a few endorsed breakevener and supported vendors in the reviews and personally I don’t agree they’re all legit either. But that aside, the reviews are always subject to change if enough readers who’ve tried the vendor complain about being ripped off and duped to Emmett which has happened with DTPower, CFRN, Rightline, to name a few. It’s a great point encouraging retailers that have had hopefully a relatively shortened churning and duped phase, to try their own ideas or even fiddle around with the generic trading ideas already found for free or in forums. A shammy vendor is never going to teach something that works for the trading dream to the public; they would trade it themselves and cease to be visible on the web; so a retailer learning to test and explore their own ideas has at least started their own journey into possibly finding something that works for them and may get lucky stumbling on something worthwhile despite the odds. Anyways, looking forward to the next installments of this series of strategy trading ideas.

I am sure a lot of readers are very interested in ‘scalping’ strategies. Will be introducing some of those as well.

Most readers are looking for answers to making money. Am going to try my best to start pushing out specific strategies that can (hopefully) get folks moving the correct direction.

Thanks for all you do Emmett! You really are one in a million….not only do you expose the scammers but you share ideas that actually work! Looking forward to reading about your trade with the trend strategies!