TradingPriceActionOnFutures.Com

-

Honesty

(5)

-

Quality

(4)

-

Cost

(3)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(4)

Summary

Trading results verified through “The Robot“. Alex Soares of Trading Price Action On Futures is a decent and honest trading vendor. Vendor has several years of full time trading under his belt and is committed to providing continued transparency and real time trade reporting through The Robot tracking program. Vendor is providing a very realistic portrayal of what it takes to be a full time trader. Is mentally tough, is patient, and has an impeccable work ethic. A craftsman at the art of trading. Recommended.

Thanks for reading today’s review of TradingPriceActionOnFutures.Com

What is TradingPriceActionOnFutures.com? The website is a day trading educational company the focuses primarily on crude oil futures contracts. The product offering includes a live day trading room priced at $299 per month, with an initial free trial period of 5 days. In addition to the live trading room, there is a video course priced at $499.

The live trading room is operational during the following hours:

Central time:

– Monday 7.00 AM – 11.00 AM

– Tuesday 7.00 AM – 11.00 AM

– Wednesday 9.15 AM – 11.00 AM *Crude oil inventories

– Thursday 7.00 AM – 11.00 AM

– Friday 7.00 AM – 10.00 AM

Initial Impression

My original contact with TradingPriceActionOnFutures.com began during the summer of 2015. There are no individual names or “About Me” page on the website. This worried me. Typically, I like to see the names of whomever is offering a product. And I like to see some sort of write up that describes the prior trading experiences of the people offering the product. However, the website does have a performance page that lists the monthly profit and loss for the trading signals. But of course, a performance page does not say much, and most are just made up baloney that cannot be trusted. And so, my next step was to sign up for a 5 day trial and begin recording live trades.

5 Day Trial

During the second week of August 2015, I assigned my assistant Reyna to begin recording the live trading room using Camtasia screen recording software. In addition, Reyna also did her best to replicate the live trades on a trading simulator from Trade Navigator. During the 5 day trial period, she averaged one trade per day and at the end of the 5 day trial period she had profited $450 on only 6 trades.

Typically, after a trial period, Reyna provides me with a spreadsheet of trades and a draft review of what she considers to be the pluses and minus.

The following is what Reyna liked:

- Trading DOM always present on screen

- Trades were given well in advance and very easy to replicate

- Trade management was simple. After entry, the exits appeared on the screen and they were static and easy to follow.

- The profit to loss ratio was very favorable. In other words, relatively small stops with larger targets.

The following is what Reyna did not like:

- The trading room moderator is not a native English speaker and Reyna is a Filipina that speaks primarily Tagalog. However, even though there was a bit of a language barrier, she was able to easily copy the trades from the DOM and the trade stops were easily seen on the trading charts.

- This is not a high energy trading room, with the typical “entertainment” factor.

- The moderator does not speak very often, or give a great deal of “why” he was taking a trade.

Contacting the owner

Several days after the trial period, I drafted a very direct message to whomever was the owner of TradingPriceActionOnFutures.com. I explained that my name was Emmett Moore with TradingSchools.Org and that we had been secretly recording the live trading room and that a written review was pending. What I specifically wanted to know was whether the trading was real, and could the owner please provide me with trading records that verified the supposed performance of July 2015. The following is what the vendor claimed during the month of July 2015:

July 2015 Trading Results

The owner introduced himself as Alexander Soares, a full time professional trader living in Portugal. He explained to me that he could not show his individual trading records because he was being employed by a European equity provider that had been backing his trades for the past two years. I was immediately suspicious. I explained that many charlatans also claim the same sort of ruse, and what I needed was actual proof. He next forwarded me the name of the London based equity partner, whom I next emailed and subsequently spoke with over the telephone. Everything appeared to be legitimate and I was also able to verify the broker that manages the consolidated investment fund for the equity partner. In addition, the equity provider also confirmed the performance returns listed on the website.

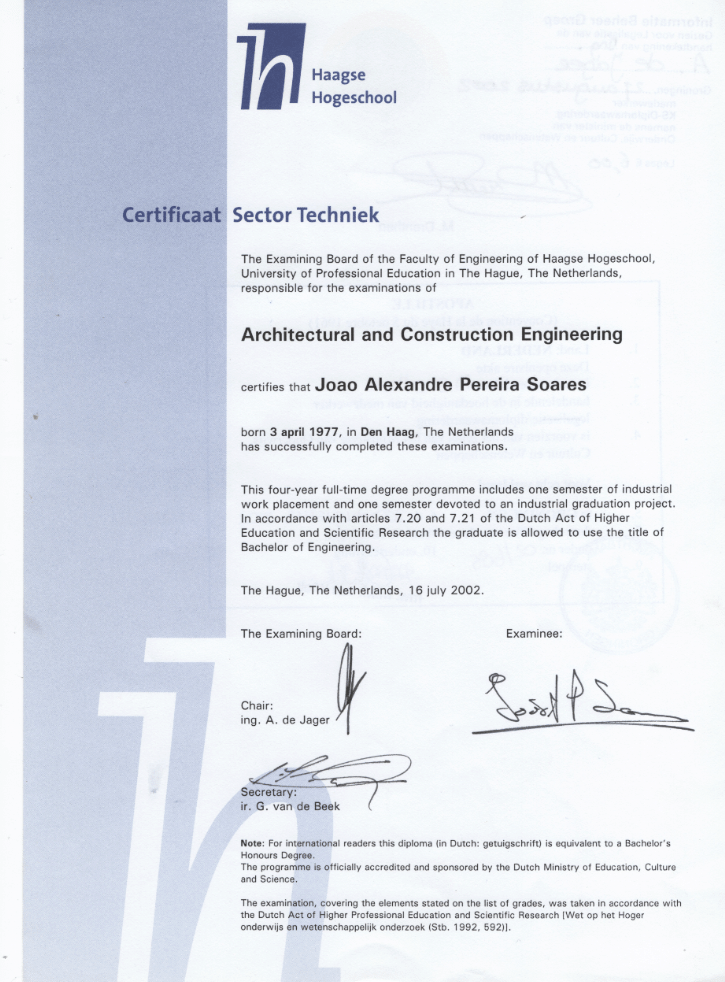

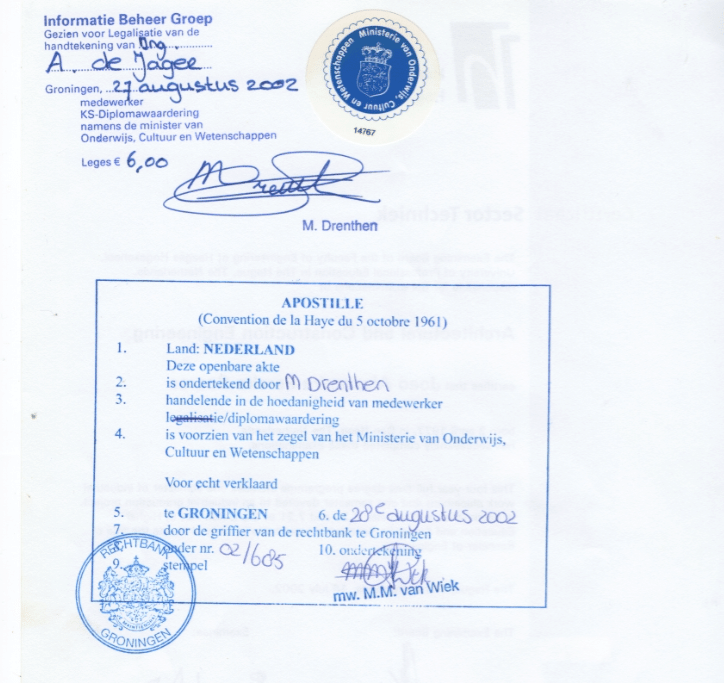

Next, I contacted Alex Soares and requested that he verify his individual credentials. In prior emails to me, he claimed to be an architectural engineer, fully licensed and certified in The Netherlands. Since I had prior dealings with another supposed Architect, that turned out to have never been an architect and a complete fraud, I explained that Alex needed to send me proof that he was indeed an Engineer and an Architect. He then sent me the following:

After I confirmed trading performance, and I confirmed the identity of the person running the trading room, I next asked Alex Soares to please write a short summary. I wanted to know more about himself, his basic philosophy regarding trading, his highs and lows, why and how he got involved in trading, and anything else that I might find useful. He responded with the following:

This will be a quick presentation of who I´am.

I was born and raised in Holland, studied Architectural and Construction Engineering. Ended my studies is 2002, you will find a copy of my Certificate in the attachment. After I finished my studies I emigrated to Portugal, my parents are from there but they are still living in Holland. I ran a company called JS Architecture and Engineering from 2002-2008. In the beginning I liked the work that I did but here in Portugal there is a lot of corruption. I have worked for almost all of the town hall´s employees that included Engineers, Architects and Construction Supervisors that are in duty for the state. With so much corruption, it made it difficult to build a legitimate business when everyone was looking for a kickback.

Regarding my trading:

I always had a strong interest in trading, I began working with my father in the weekends and on the holidays when I was 15. At 21 years of age I realized that I did not want to have the same boring life my father had. His daily routine was working hard for 12 hours a day 6 days a week and on Sunday working in the morning. I had already some money at the age of 21 and I needed to do something with it, not spending it, but putting it to work for me. I began with stocks and then options and then finally futures.

From 2008 onward, I only concentrated on my trading, I even threw away my cellphone to cut off all my relations that I had build up from the construction and engineering world. Oh man I did get some negative feedback from family and friends by doing that. But I had to do it to focus 100% on becoming a trader, and not get distracted by anything. I traded DAX, 6E, CL and GC. I hated the CL at the time and you will see this a lot on online forums. CL is not for beginners, and I believed that you had to trade other markets like ES or 6E. But this is all an excuse. Those markets are slow moving so you are only extending your dead penalty. The market has to move to earn something. The main problem is not the instrument but the trader that is not able to analyze the market correctly. Today I love to trade CL, it moves every day, is not news driven and the only news that can move it is crude inventories, non-farm numbers and Opec meetings. If you look at the other markets there is a lot more news and other factors that can move it without respecting support or resistance.

At the time I was trading from a tick chart and not from the system I trade right now. The main problem that I had was that it was not mechanical. I needed a system that would give me the same trade no mater when or where I traded it.

In 2012, after years of struggling, and barely making a profit, I finally turned a corner and developed my own approach that is unique to me. Once I was able to display some consistency and actual proof of profits, this opened up additional opportunities to trade with several equity partners and meet people that managed equity funds. Its been a rough journey to profitability.

Now back to my trading approach, there are a lot more things involved in trading than the actual execution of the trade. The problem I see with other people is that they are focused on the small picture, trying to get 10 or 15 ticks, but they have to do their homework and look at what these small trades do to their outcome statistics. They look at win% instead of looking at win/loss ratios. They do not practice, I practice every week. I will trade the market in market replay and will look at the outcome live and in market replay. A football player trains before he is going to play a match! A great example is from last Friday, if I did not break my rules and did take every trade per the rules I would have made:

1 short +60 ticks

1 short +120 ticks

1 short +120 ticksInstead of this I did:

1 short BE

1 short passed with the excuse of large stop loss

1 short +120 ticksSo instead of taking 120 ticks I would have made 300 ticks. Just because the day was up, it will not mean that it went OK.

So a lot of work is involved with effective and consistent trading.

Worst period I think was not being able to trade, I was simply too afraid to trade. I have overcome this by taking a break. The worst drawdown is about 5k, I never blown up an account but was close to it when I had the bad habit to raise my stop just to not get stopped out. Best month is about 10k, but remember that I´am still trading 3 contracts and will not add contracts until I´am following my rules without mistakes regarding money management.

With regards to the video course I have made an active account for you so you can have access to the material. I have to say that the course material will not teach you how to trade, it is like buying your school books and not going to the classes. The vast majority of people that are buying the course think that they can learn it in one or 2 months but the reality is that they will have to study the material, understanding what a setup looks like on the trading chart, and also come into the trading room and follow me in real time. There are things in trading that you only will see after a good amount of time, and I would say that they will need at least one full year as well as follow me in the trading room. One thing is looking at a chart and seeing things in hindsight, and another thing is having to identify it in real time. The market will only give you a few opportunities per day if there is any opportunity at all, and that is why trading is so boring. You have to stay focused for a large amount of time just to take action in a few seconds.

Another thing is when there are some bad days and this subject is really important, we cannot eliminate this in trading, you will have bad days. What I see is that people tend to lose faith, they begin to come late in the room or even not coming into the room for a couple of days just to miss the good days or the good trades. If you have a bad day at work you don´t stay at home the next day because you will get fired, this will be the same in trading. You must be committed to the task and be determined that success is your only option.

An honest trader

After interacting with Alex and getting the above response, I could sense that this guy was different. There is no puffery or ego to this guy. He is very much an engineer and is very “normal”. He does not claim to drive a convertible ferrari and throw lavish parties on a yacht. He does not date super models or claim to own a mansion. There are no claims of turning $5k into $500k in only three days. Instead, what I believe we are witnessing is a dude that is scrambling and hustling for every single winning trade. In my opinion, he represents more of the realities of actual trading, instead of the fantasies that the educational community has been selling us for years.

When I asked Alex why is he offering this service, he simply explained that has a new baby and is a stay at home dad. He could use the extra monthly income. He hopes that it will round out the bad months and give him a bit more income stability. This is a really honest answer, and I really like it. I also like knowing that for every trade that he loses, he is losing real money. This changes everything.

“The Robot” test pilot

This past December 2015, I asked Alex if he would be interested in being the crash test dummy for a trading robot that I was developing for the day trading educational community. The idea behind “The Robot” was that it would provide a tracking mechanism for trading educators, trading signal providers, live trading rooms, and trading systems. The signals and trading results would be collected into a central database that would be displayed on the TradingSchools.org website. The end result would be a 3rd party tracking mechanism that could not be gamed and readers could trust the trading results of the trading educator. Alex agreed to have all of his trades tracked. Initially, the Robot was simply a program that attempted to collect trades and in real time, email the trades into a database repository. It was a disaster. Many of the retail trading platforms are filled with bugs and constant updates which would render the Robot quickly obsolete.

After this initial disaster, and wasting poor Alex’s time, we went back to square one and built a real time tracking engine that is now (mostly) working correctly. In short, we have been collecting and refining the trade tracking capabilities using the live performance that Alex was generating on his retail trading platform.

Though the graphical interface for “The Robot” is still being built out. I can report that the results on Alex’s website for January, February, and March 2016 do in fact match the results that we were able to accumulate using The Robot. In short, you can trust the results that Alex is reporting on his performance page. During the month of March 2016, we added more robust performance metrics and I can report that The Robot gave the following results by copying all of the trades from within the TradingPriceActionsOnFutures.com trading room for the month of March 2016:

- Total Gross Profit: $4,500

- Estimated Net Profit after commissions paid: $3804

- Profit Factor: 1.39

- Max Drawdown: -$1,980 (three contracts traded)

- Contracts Traded: 174

- Averages Trader Per Day: 5.61

- Largest Winning Trade: $600 per contract

- Largest Losing Trade: -$180 per contract

- Average Time In Trade: 13.5 minutes

Sorry that I don’t have a fancy graphical display for this data. But the software developer is currently building this for “The Robot”. But these results are accurate and what we were able to generate using a simulator that required a pass through for all limit orders.

Wrapping Things Up

In the coming weeks, you will be able to soon visit the TradingSchools.Org blog and see actual results that will be updated daily. These cannot be gamed or manipulated in any way. These results will also largely negate the need for “professional reviewers” like myself. And the truth is that being a professional reviewer for trading services is really not the best solution for trading products. The Robot should simply display performance metrics that are beyond fraud, and a person can evaluate whether the risk is worth it.

Recently, I read a quote from a film critique at the Star-News, out of Pasadena California. He wrote, “Most critics are educated beyond their intelligence”. This really made me laugh because its so true. Sometimes I think that I am really clever and that people should care about my opinion, but it reality what is more important is actual performance metrics. Hopefully The Robot turns my opinion into nothing more than a simple description and maybe an interesting jab at a trading fraudster.

At the end of the day, what we all want is to make trading profits. My goal is to continue to weed out the charlatans, fakes and frauds. And lift up the people that are committed to the craft of profitable trading. And most importantly are committed to long term transparency.

Don’t forget to leave your comments below. Thanks for reading.

Please Beware: Changed name to AvisTrader.com and received complaint here–>https://futures.io/trading-reviews-vendors/44662-avistrader-com-review-alexander-soares.html

I-m looking at his results on whole 2017. Total is 17k USD.

But, considering the cost of the room and a 4.3$ RT commish per lot the net profit is only 8.5K for the whole year.

If you misconduct you trade management and your results are just 25% less good as those published your net profit for the year would be just 3.5K USD.

I tried the room recently and hes not doing well in his trading. Drawdowns are too much for the limited gains and now hes increasing his costs, see email, probably to cover his drawndowns. Teaching durig or after trading is not much and room is not worth the price.

—————————————————

Dear Trader,

To assist you in planning, we are writing about upcoming changes to the price of the Online Video Course .

On May 15th of 2017, the price of the Online Video Course will increase from $1199,00 to $1499,00.

The system generated a total profit $56.429,00 in the last 2 years Trading the crude oil futures live. The system can be used in any markets but I highly suggest using it on instruments with a fixed underlying value like Crude Oil, Gold, 6E, 6J, NG and RB. Indexes like DAX, TF, NQ and ES tend to generate too much noise when not moving and they do not respect support and resistance like instruments with a fixed underlying value.

If i open a course I have same reason with this guy, For covering my bad time trading. That’s it. Finally you must do your homework. Even george soros experience lost trading. We can’t predict the future 100 %.

Emmett, there must be something wrong here. They PLAINLY say on their website “DOM with simulated (not real money) trading”. And, now it is $399 per month not $299. Should not be rated 4 stars. Performance not updated. Not impressed.

It’s obviously changed perhaps a month or longer after the review. Emmett is often too busy to get back to revising reviews unfortunately and there are others that need updating such as GTR. Good catch on the monthly room churn increase from $300 to $400.

While I am not impressed either, the price is still 299, I don’t know where you got that 399.

https://www.youtube.com/watch?v=Oa9_gxCKEVQ

Emmett, are you planning to out this conman?

Emmett …..Alex operates same as JJ from School of trade and are you going to continue to support this con man

You are now leading the new traders on the same path as the Vendors who want to rip them off their hard earned money

They will see you review as a rubber Stan of your support

Do another urgent review

https://www.youtube.com/watch?v=HrsbrOy1J9M

https://www.facebook.com/TradingPriceActionOnFutures/photos/a.397643383747432.1073741827.390304097814694/657602241084877/?type=3&theater

https://www.youtube.com/watch?v=y2jTvlSdLxI

is this trading room still on? haven’t seen any updates since April 2016.

Hello,

You just can subscribe to my news letter and you will get every trade that has been taken in the room in your mail box. Trades are recorded without sound so you can watch it and see the outcome for every day.. Better than a track record!

Today´s trade:

https://youtu.be/GGhogBAWP-Y

Weekly recap:

Up by $2490

https://www.youtube.com/watch?v=ewPcrEfj_Sc

Just move on:

https://www.youtube.com/watch?v=gIrbwpphgmw

Emmett, when are you going to update your review on this cherry picking market charlatan?

Just move on:

https://youtu.be/EwxE8cWOJO8

https://youtu.be/7Tc3uCLcHSA

Cherry picking:

https://youtu.be/JNrUoUANHks

https://youtu.be/lOBxZBHLnpk

https://youtu.be/yCuQOTrk90s

Trading Price Action on Futures is already showing signs of other failed and scammers of so called vendors..Alex is a systematic liar and goes on other forums under a pseudo names and always tries to be someone else and writes against other rooms in negative way. He always promotes his own room under pseudo names and lately he got kicked out of Big Mike Trading forum where he was caught doing this. Alex thinks people are fools and he hasn’t worked out infact he is the biggest liar and fool.He is the one who has anger issues and he is the one who tells new traders how easy it is to trade, however we all know it is very difficult to be a profitable trader, as it needs years of practice and training.

Go on Alex tell us the truth and put up your Broker Statement here for everyone to see.Do that and you will get the greatest respect …Fail to do that and you will be seen as a scammer who hides the truth….

Not every month will be the same!

https://www.facebook.com/TradingPriceActionOnFutures/

You post just part of the month, end July and August are missing plus one month gone completely. And why suddenly facebook not website?

Any update on this “best” trading room, Emmett?

At this time no account performance since April 2016.

I assume a big DD during this time.

You are correct, he has not been profitable for a very long time now. The fact that he refuses to post his trading performance proves that he’s just another market charlatan.

Yes, your right guys.

https://www.facebook.com/TradingPriceActionOnFutures/

Lucky7, you forgot to post the recorded session.

Just move on!

What is that? 2 weeks? Why don’t you show your PNL since April?You’re not showing it because it WILL reveal that you’re negative or barely breakeven for the year. I talk to one of your room members so I personally know your ups and downs. Your strategy only works in trending markets, which coinicidently, is what we’re in right now with CL. You always give all of your profits back and more in choppy markets which is 80% of the time. Anybody can get lucky for a few weeks, even months. Post your full track record or go away. You’re appearing shady as hell.

How much did you get paid for this half decent review Emmett?

So sad! Another one bite the dust! You should be very ashamed … you starting to be nothing more than another con artist… please say i´m wrong Alexandre!

Emmett, have you been able to get a reply from Alexander Soares to clarify why he’s hiding and refusing to post his trading results?

any news about this room

Been with Trading Price Action on Futures for one week, and its the best room I have tried. I am sure it might not be a fit for everyone’s style. By watching him, I have learned to be patient and stick to your rules. He is like a robot, shows no emotion, I envy that.. I don’t follow him to a T, wish I would have though. Would have made many more ticks. Still learning. He is expensive, but after attempting to trade on my own and losing 4k in a week, I decided to give him try. I have regained over 2k the last week with Alex. I don’t only trade CL, but also ES and GC. I have also tried Day Trade warrior and Oil trading group. Those rooms didn’t fit my style. I don’t need to see Alex’s statements, he has made me a better trader and that’s all I care about. Draw downs will come, it’s inevitable, But I feel I am getting better as a trader. Thanks Alexandre “Mr. Robot”

Regards,

Solomon

” I don’t need to see Alex’s statements, he has made me a better trader and that’s all I care about. ”

He has made you a better trader in a week? Really!

First this is about transparency. Come back in a few months and let us know how it is going. You remind of the guy who posted he was making all this money with David Adams and then a week later posted he lost it all. One week tells you nothing.

I agree about it only being a week, I will keep you updated on my results. Thanks Emmett for a great website.

I bought the course and feel it is worth the $500. It allows you to

duplicate his method. It will require time to learn to recognize the setups.

The room at $10 a day, will enable you to participate in his trades, thus make money while learning to fish yourself. A rather laconic person, but he does CONCENTRATE on trading which is what you are paying for. He is more than happy to help AFTER business. Patience IS the key. I never likes fishing, but now have to discipline myself in order to be profitable. Paying Alexander one tick a day…NO PROBLEM!!! Wish that an AutoTrade system could be setup. I hope he enrolles more people, so as to ensure he’ll keep the room open.

THANKS ALEXANDER…VEEL BEDANKT.

So apparently, Alex does not care what people at tradingschools.org think about his trading. He straight up told me that his trading results were “good” for May and June (I know for a fact he was down for May). He also told me that he WILL NOT be posting trading results on his website from now on. There we go folks. A good, transparent trading room turning to shit… I think it’s unfair that Alex gets to ride the coattails of this 4 star review while hiding his trading results and being unprofitable. Alexander Soares – the market charlatan. Please, PLEASE fix this review Emmett!

I agree, trading results can be good or bad – can happen to all, but he got stars for being transparent and he isn’t – so time to update the review.

I know nothing of Alex TR, so my comments are based on transparency. I agree 100% with what you said about transparency, so it is suspicious of who exactly is down grading you.

There needs to be some minimum standard to receive 4 Stars and I think honest transparency is one of them. If Alex has stopped posting his results because he is in draw down or for what ever reason then that is not honest transparency.

I think Emmett has to follow up on these few 4 star rating and see if they are maintaining transparency if not contact them regarding the matter and if they refuse then update the review.

To me the Minimum to get 4 starts should be (and I am sure I am forgetting some stuff):

1) Must be trading a live account, we have seen enough of the Sim non sense. And I am still laughing about David Adams who started to trade live and blew his account in 1 week.

2) Must post an accurate track record of live trades,

3) Must provide brokerage statement showing their entries and exits and P/L and they must match to the posted track record,

4) Trades must be clearly shown with DOM or Chart Trader on,

5) Other must be able to match or get close to the same results, so no pump and dump nonsense.

That to me is 4 stars, anything else is complete con artist illusion stuff so scam you.

Sadly I am still waiting to find a room that even can do the minimum.

Rob, I think it’s obvious who’s doing the dowgrading! As far as I’m concerned he needs to be downgraded to a “1 star” review like all the other trading vendors who refuse disclose their trading results. Especially since he “doesn’t care”. Let’s hope Emmett see’s this BS.

No track record updates since April…? I rest my case. Why is this room still rated 4 stars!? He removed the free trial period and stopped uploading trade results for months now. His method obviously stopped working and is not profitable anymore. It’s not fair to keep this review up for the new people who will potentialy see this not knowing the owner is failing, the review should at least be updated to reflect these points. 300$/month for a trading room who is negative for the whole 2016 overall , where do I sign up? lmao. My guess is Alex is going to give back all the profits he made in 2015 back to the market within a year. Tradingpriceactiononfutures.com – yet another market charlatan, beware.

Ah!! the infamous Emmett Curse strikes again.

Maybe its not so much a curse brought on by Emmett, but rather not of these trading room operators can actually trade, so when some of them have a lucky win streak and that is when Emmett review them, they get a favorable review and sooner or later statistics will catch them and expose the fact they weren’t good at all, just lucky for a while.

So in this case (and in any trading), the expression “better to be lucky than good” just doesn’t apply:)

Is that an excuse to not disclose his trading results? The least he could do is disclose his results or shut down his room until he at least is profitable again don’t you think?

The vendor has just shown his true colors… whats troubling is the review stands giving this vendor high marks on transparency and honesty, when it fact it seems very difficult to get information as a prospecting customer and furthermore there is a series of unfounded claims on the vendors website – so this review seems ripe for an update.

Or he is just in the drawdown that is a concomitant part of all trading?

Too bad, Alex should be showing the results good or bad. He seemed to be one of the more transparent ones. And we know after the Emmett review the room fee was raised from 150/month to 300/month. What’s happening with the ‘robot” results btw? Wasn’t there going to be something like a tally page of vendors who use the robot? Also, that the robot is recording sim results like Adams’ “3 months” of McD salary needs to be addressed. Bob “mortgage fraud” Amico is charging 400/month for their room “magically” up 7500% since they started. Supposedly they were doing the “robot” too.

It’s the month of June and this guy still hasn’t uploaded his performance for MAY. What a sham. So the guy has not been consistently profitable since 2015, removed his 5 day free trial, refuses to update his trading results and gets to keep a 4 star rating while he leeches off new members which have no idea he’s going through a massive losing streak? You should update your review Emmet. This trading room has turned sour.

Can anyone provide trading results for may ?

He’s in no hurry to update it which probably means the results are not very good.

After a first look without reading the comments, here is their recent performance. The first 4 months of 2016 is slightly profitable, but only up $600, using 3 contracts. Last year was good, although January is missing and the very good February (10K) might have been an outlier. Since I tend to think that only recent performance should be counted, the last 12 months are still profitable, up about 15K. But once we subtract the annual cost of 3.6K, we end up with 1K per month gains. Way less impressive than the 2015 monthly average…

So assuming those performance numbers on their website are from live trades, one should trade it with at least 6 contracts, to make it more cost effective…

Up $900 for the year. WOW!

One option for people less capitalized is to use a CFD broker tracking oil futures. There are some legit ones out there. I have seen a couple people suggest USO…I do believe that would be pretty difficult due to needing to be constantly calculating the targets and stops in relation to percentages.

The catch on the CFD is that you will be paying a higher commission or spread than you will with a full futures contract. Most commissions on full contract are around the equivalent of one CL tick. The best I have found on CFDs are 4-5 ticks. I haven’t done the math so I am not sure that the low winning percentage here would make these extra ticks detrimental to the system or not.

If you could trade microlots (.01 of the full contract) and open an account with $500 you would be within the risk profile that the owner recommends. On the best months this system makes 3-4K which would be $30-$40 here less the extra ticks that you need to pay on each trade.

In addition, with a room at $300/month you are going to be spending an amount equal to half your capital every month on the trading room, lol.

So , in closing, you should probably not do this unless you are extremely patient!

The indicators, charts and even order of the video course look exactly like Charles Booth’s as someone mentioned…Can Alex comment on this?

Emmett, you mention in your review there’s an initial free trial, but on the website for the trading room it states “60$ for a five day trial” and the free trial is down to one day pr week, like GTR did.

Just a note to thank Rob B and Osikani,

your comments about trade size finally got through to me. Nothing more to say, but your comments didn’t fall on deaf ears

If you look at the stats, you´ll see that Alex is having a serious drawdown and from my point of view it doesn´t make a lot of sense to join the room now. For the year 2016 (and I believe/assume that the stats on the site are true) Alex managed to create a net profit of 663$ (4 trading months). Alex charges 299$ a month for the membership. That´s 1196$ YTD…..consequently everybody who followed every official trade in the room is down 533$ for 2016.

In 2015 Alex was good. I don´t know what exactly happened. Maybe his system will never create the same profits as especially in the first half of 2015 again or the system explodes from today on and the results will even be better. But as I said….for me watching the results is the better option for now than tarding with a system that obviously isn´t working right now !

I have been under a tremendous pressure, it is not easy to trade in front of several people, having to take a loss or several losses and having to deal with comments from members. They are happy if there are gains but when I have a couple of losing trades, they complain and even get really mad. Right now I have overcome this issue and I really don´t care about what they think about my trading results , I just have to perform. Not all my clients are the same, I have met some good traders, one of them is still with me, taking all the heat and I want another Italian trader back in the room that left me in December, this people know what trading is and are not expecting winning days every single day.

People just expect a 80% win loss rate every single day and that is not what they will get or see in my trading room.

With regards to the system performance, there is noting wrong with it. The outcome of the system for the months of 2016 had to be:

JAN: +1702 ticks

FEB: +335 ticks

MARCH: +1295 ticks

APRIL: Still working on, but this had to be the first down month for 2016.

Now those results are not in a steady up move, down days or even weeks are present and there is nothing wrong with it but most of my clients are not aware of that and they will complain an get mad, with an end result of me going into stress. I have overcome this issue now, in the month of April I did exactly what I had to do and in the upcoming months will do exactly what the system will give me.

For the people that are looking for a 100% win loss rate they just add to be in the room today:

https://youtu.be/pGoMYwsrLUs

https://youtu.be/9Qg9LNQEhFs

I totally understand that, Alex.I just summarized the facts and the results posted on your website. This shows a loss of 3249$ for the month of february and a loss of 972$ for april. There were gains of 1364$ in january and 3529$ in march. This is what counts and this is not too great so far in 2016 as you know…..But I understand (and know from my own trading) that every system has drawdowns and weeks or months with negative results.

I will be monitoring your results closely and if the performance gets better again, I´ll be in your room some day.

All the best to you and congratulations ! Great trading today !

http://www.tradingpriceactiononfutures.com/strategies/

“In our trading room we always trade with a 3 lot entry and exit strategy. We enter with 3 lots and use 3 different exit strategies. The first lot is going out at a fixed 15 tick. The first exit strategy is back tested for about 3 years and will give us a steady 70%-80% win percentage”

I did not find these claims to be accurate in the room in actual trading. But of course it may be true in backtesting. Certainly if those claims had held up I would not have left.

Robert, please stop blaming me for your stupid mistakes.

You probable have lost money every single day because of your bad trading habits, I noticed this on Friday and Yesterday again. You left the room in the middle of a good trade and you even mentioned that you only took one contract on the trade. How can you make money if you are going to reduce contract size after a losing strike?

I have uploaded the video on youtube:

https://youtu.be/n-zN-p2U7uI

You can see me taking profit at 15 tick, 30 tick and finally hitting my stop loss for an additional 31 tick profit on the last contract, Total profit of the trade +76 ticks. Making 10 ticks or 76 ticks is a big difference! You never see me taking profit at 10 ticks! Risking 16 to get 10???

All my trades are recorded in case something like this happens, please stop blaming me for your mistakes and just admit that you have a problem. If you cannot take a trade or manage the trade accordingly, you are not going to have any success in trading.

The context you posted here is just an intro, if you go to my performance stats you can see that my best trading month was 68%.

All the best,

Alex

I am not in Alex room, i just follow this discussion. But if you have a 75 % win rate (just as an example) in your system, it doesn´t mean that every 75 trades out of a 100 is going to be a winner. Sometimes it will be 40 or 50 of a 100, and sometimes 95. It seems like a lot of newbie traders don´t understand this. They just look at a system and think it´s going to have the same win rate all the time. It doesn´t work that way.

Hi Alex

can you clarify for us.

How did you come up with the “STEADY 70%-80% win percentage” that you claim on your website.

You say that this is “just an intro”? So what does that mean, is it true or not. Did Emmett ask about it?

I agree and have stated that you are great on patiently waiting for trades and holding on for every tick. It is admirable.

However it is also true that most members of your room are not going to be present for every trade( even if they do enter with 3 contracts each time).

If they miss one of the profitable trades out of the 40 or 50 a month then that could mean they are in the red, not the green for the entire month.

You haven’t updated the performance for 3 weeks – did that last trade that you mention on Friday take April into the green ?

good luck with your trading

robert

Robert,

You can find my stats online and you can see that my best trading month was 68% so just stop asking me stupid questions.

What do you mean by:

´´However it is also true that most members of your room are not going to be present for every trade( even if they do enter with 3 contracts each time).

If they miss one of the profitable trades out of the 40 or 50 a month then that could mean they are in the red, not the green for the entire month.´´

Do I have to wake up all my members to be there on time and glue them on there seats and only release them in the end of the trading session?

It is totally up to you if you are going to be there on time and trading until the end of the session, if you miss a trade that is your problem not mine.

You asked me a question yesterday about the stats and I answered that, they are going to be posted on Wednesday. You can find them online and the last trade from Friday did make a difference like every trade is going to make a difference.

Alex

Dear Alex

The point I am making is that while overall profit is the main factor when trading, when it comes to live rooms win rate is also an important factor.

This is because if the win rate is over 50 %, then missing a day, or coming in late, or even trading one car rather than 3 on a trade does not impact much, as the odds are that the missing win will soon be made up.

But with low win rates even missing one trade during the course of a month can have major impact on profitability. Now you can say a member is stupid for missing a trade or only placing one car : it might be true. But sometimes live rooms are such that one steps away or something.

If one is using an automated system one can be sure of never missing a trade : I had one running on a vps once but had to stop it after a month as the market changed( but it took every trade).

If your system could be improved so that the win rate was over 50% (it doesn’t need to be the 75 -80% you claim on the website) then I would be first one to rejoin.

robert

Robert, I cannot make the market move. The month of April was in my opinion a terrible month. Crude was barely moving and when it was moving there were no pull backs to get in.

With regards to missing a trade, this is like running a shop. If your shop is open from 9:00-17:00 you will have to be there from 9:00-17:00 if you open it at 10:00 you will lose clients and losing clients is less profit. If you com in late you can miss a move of 105 ticks and 105 ticks is $1050.

With regards to the performance, I never lied about that. I can handle a trade that made 1 or 2 ticks in profit as a winner and instead of the X that you will find in my stats I can change that into a W.

I get this question over and over from people, why is your performance sitting at 60-65% and the other ones are all sitting at 80% or above?

You guys don´t like to see the truth but instead of that believe in a dream and that is why so many people are scammed.

You are beginning to sound like all other trading room operators, making excuses and blaming the market when you loose. You state “crude was barely moving in april” – how did you come to that conclusion exactly? When i Look at movement for april it moved, on high volume and the average daily range wasn’t bad either – so can you elaborate on your statement?

I was never blaming the market at all. If you look back at April you can see big moves during the London session then a tight trading range from about 60 ticks at the US session. When we get a tight trading range all I can do is taking the trade and we can make a couple of ticks but most of the time I will lose money. There is no way to predict if the market is going to move or not….. locking back is just judging something after the fact.

The message that has been given here several times is that if a specific trading strategy is making 60%-65%-70%-75% or whatever number, it does not mean that if you get 10 trades in a day you will have 7 winners and 3 losers but instead of this you can have 5 losers, 0 winners then 4 winners 1 loser and so on. NOT EVERY SINGLE DAY IS GOING TO BE THE SAME.

It seems like CL a lot of times has its big move in European session then does nothing in US session. This is why I personally advice people against placing all their eggs in one basket. What happens during extended periods when Crude’s ADR is low in the US session. Can they handle the draw down. For most the answer is no.

Just something to be aware of. You do not control the market. The market decides if you will make or not make money.

I give Alex credit for not presenting the fantasy trading world most TR operators present. You know:

$5,000 account can trade a highly leveraged highly volatile instrument like crude, have an 80% win rate, make a 100 ticks a day with little to no draw downs. Virtually a replacement for a job with a steady salary. Complete non sense, but this is what people what to hear so the TR Operators give them what the want. A win win, except when you try and do it and just lose lose.

I am trying to figure out what the issue here is with Alex. I have not been in his room but I feel like I am missing something.. Does he trade in front of your eyes with a DOM present and make clear calls? Does he show his results and is what he posts accurate? Isn’t that just about everything we are looking for?

If he is false advertising in some way, I can understand why one might complain, and call him out on that… I get it. But as far as transparency and clear trade calls, is he not doing that or am I missing something?

I feel like I am missing something. I would just like to understand if someone can help. Thanks

The only thing you are missing is that a lot of traders who go to trading rooms have unrealistic expectations: especially regarding win rates, large profits on every trade, and small drawdowns on every trade.

It is impossible, but that is the dream, and they are disappointed if they do not get that; and they especially hate any trading room operator who dares to admit that that scenario is fantasy, not reality.

This hole discussion is just getting no were, people will continue blaming about stupid win loss ratios, this numbers are just available on the website. I lost 127 ticks today and if you look at the chart for today you can ask yourself how did he do that but the reality is that when the market is moving you have to take action, you can make money or lose it.

I have always discourage people trading with small account, minimum for me is 15K per contract but if it is really needed 10K is not impossible. They just have to remember that for every contract you are trading, you are trading with 100.000$ and not 10 or 15K. A loss of 1k is only 0.33% of the total buying power if you trade with 3 contracts.

” They just have to remember that for every contract you are trading, you are trading with 100.000$ and not 10 or 15K. A loss of 1k is only 0.33% of the total buying power if you trade with 3 contracts.”

Whereas that is true, it is also a demonstration of how leverage can be a killer, and why one should trade with only reasonable leverage. The 0.33% loss in buying power represents a 10% loss in equity for the trader who thinks that he can trade 3 cars with a $10k account. Guess what, we cannot withdraw and spend ‘buying power’, only equity.

So much was mention, I will not even reply to most as I already said my peace. But Osikani you are nailing it on the head. TR telling you to trade with 500 to 1 leverage. It is insanity. This is why most blow their account. I will say something that will only get me hate mail and no one wants to hear it. To me trading CL is for Goldman Sachs and large investors who can actually afford it. $30K to trade 3 cars IMO is ridiculously underfunded. How many losses can you withstand before you quit.

Remember trading is a very skewed curve. You will have periods and they can be long periods of draw downs and you have to survive those. That is what is important.

And this is where the real world and fantasy world presented by TR differs. They would have you believe you can risk alot and make a lot. But in reality if your risk alot you blow your account. It is all tied together, the amount you risk is tied to your return on investment and tied to your draw downs. This is why the fantasy returns they promise is impossible. To achieve it you end up blowing your account.

I am going to go a step further. As if I already was not going to get enough hate mail and state exactly what I would do if I was Robert. I know the 95% that lose money will not want to hear this. I know because I talk to them until I am blue in the face. They would rather trade the fantasy world than the real world. So please skip over my post. But those that understand money, return on money and that day trading is not some miracle that bypasses the law of economics I post this.

If my account was $30K and I wanted to trade 3 Cars in CL, I would open an account with a stock broker (IB) and not with a future’s Broker. I would trade USO instead. I am looking at USO right now and there is only a 1 cent Bid Ask Spread. And I would only risk $150 per trade. That is right I would risk .05%. I could have 200 full stop outs before I blew my account and I would not be reducing my risk after 2 losses in a row.

But on the flip side I would not be making those fantasy highly leveraged returns that the TRs promise. But I could make decent returns and slowly build up my account. Sadly few follow this path.

That is my advice. Take it, insult it or leave it.

Rob B, if you and I started a trading room, we would have no clients. LOL.

1. What do you mean that I cannot trade commodities with $5k?

2. My broker gives me $500 day-trading margin. What do you mean that I cannot trade 10 cars with my $5,000?

3. How can you ever use a stop like that when the target is not 3 times the range to the stop?

4. What do you mean that you do not have an 80% win rate?

5. What do you mean that I cannot use a 5 tick stop on /CL and a 50 tick target?

6. But the problem is that sometimes a trade loses money.

7. Sometimes I lose many trades in a row, so why take the next trade?

8. I am losing too many trades in a row, so I should move my stop, so that I can have a better win rate.

9. Too many of my trades turned from small winners into losers, so let me take this 3 ticks after I moved my stop and ended up sitting though a 30 tick drawdown. Now I can put this one in the win column and improve my win rate.

Moderator Rob: “You cannot do any of those things.”

Client: “You are a bad trade room. you dream-crusher.”

Sound familiar? LOL.

Yes i agree win rate is an important factor when evaluating a strategy/TR ( though low win rate does not necessarily mean bad as other factors need to be considered ). win rate was also missing in Emmett’s review/stat which I had pointed out in my comment above (under name AC).

***

AC 29 days 18 hours ago

Emmett Thanks for providing stats for March 2016, an important thing i find missing is what was win% for March 2016 for TradingPriceActionsOnFutures.com.

Robert,

Never been to Alex room, but I am guess the win rate is a bit promotional (probably before getting fame due to Emmett and he was not prepared for all of this) and YES Alex should showing his actual win rate over the entire time and maybe on top of that the actual true monthly win rate. That way would be prospects could accurately evaluate. So Yes Robert if Alex showing a somewhat misleading win rate I 100% agree with you and he should change it.

But I must add, at least from my trading experience, the win rate is not some flat line curve. In fact I would run from any trading room promising that. For example my win rate is low, at least compared to the fantasy most TR promise, but for illustration purposes lets say it is 30%. So you might say I can live with that to be profitable. Out of every 3 trades I make money. But that is not how it works at all. That statistic is over thousands of trades. And the curve is very skewed. There can be times I just lose lose lose lose and after that I lose more. If you looked at my equity curve it is more like a roller coaster. And I think most real traders equity curves are like that.

When the market is working for me I fire on all cylinders and when it is not I suffer draw downs.

I am telling you most traders fail because they believe the laws of economics and money and realistic returns some how do not apply to day traders. They are wrong!!! I know no one want to hear that, but that is how it works. Which is why I say you have to be properly funded. And when you said after a few loses you reduced the number of contracts. That screamed underfunded. You cannot trade like that. Which is why I said trade an oil ETF where you can risk what you can afford and take small risk to slowly grow you portfolio. I scream this theme again and again and I just feel like I am talking to a wall, not specific to you Robert, but others I talk to. They are just looking to trade in the fantasy world being promised by TR operators, which is why they lose again and again. They are looking for the fantasy and the TR operators are offering it. There is a reason none of those TR operators can show no proof of profitable trading.

OK folks I think I was fair and balanced on this one.

To your point, there is a reason to reduce trade size, but it is not because of 2 losses in a row, or indeed any number of consecutive losses specifically.

The only reason to reduce trade size is because the risk/equity money management calculation says so. If that happens as a result of a string of losses, then that is why we reduce trade size, not because of the string of losses themselves, but because we no longer have enough equity to trade the current size. Of course, such a method assumes that one also increases size when the risk/equity rules allow it, per the WRITTEN rules. Winging it is another of the reasons that indisciplined traders lose their shirt and go on revenge trades, which only makes things worse, usually.

Let us illustrate. Assume that we have $30k in equity and our written rules say that we can trade 1 contract for every $9k that we have. (That is still pretty steep leverage, but not germane to this example). We will trade 3 contracts with a 15-tick stop loss. After 2 losses in a row, our equity is now $29,100. So at $9k/contract leverage that we use, we must still trade 3 contracts, not reduce it to 1 contract and not even 2 contracts. We must stay with the system as we wrote and tested it.

Why is it important that we must stay with the system as we designed and tested it? It is a matter of statistics: the statistical edge is the only thing that we have. We can NEVER tell which of our trades is going to succeed beforehand. (Of course if we are a scammer room operator, we do not have losing days so that is a different matter). All we can do is take every trade with the correct amount of risk and wait for the trade statistics to play out in our favor.

Does this mean that EVERY DAY, we must continue trading no matter how long the losing streak. Of course not. We must have rules which determine the maximum loss we shall take in a given period, and when we hit the loss, we tell ourselves: “The market is not doing what I need it to do, so I am taking my ball and going home. I will come back when the market is more cooperative.” Usually that means “I will come back tomorrow.” Note that this is a different situation. Again, it is money management. If we are on a losing streak, we cut the trading itself, not the trade size.

Of course, every one does not use similar rules for quitting, and I know that. But this was really about when to cut size, not when to quit.

Osikani,

I agree with you especially about the 9K per contract is a lot of leverage in oil. And I really agree with you have to know and trade your stats. I constantly say you are your stats.

But I would ask how would Robert and others even know their stats when they are following someone else’s trades? Which is why it makes no sense to to me to be trading CL 3 cars if you do need even know the stats. If 2 loses in a row is too much draw down for Robert to maintain trading 3 cars, then by default he is underfunded. I have created a new under funded definition.

Exactly my point. Just said more succinctly, and might I say, a tad more elegantly.

Perhaps i can explain more Robert. My account has $30,00 roughly at the moment. My reason for not taking the the full size was based on almost 2 weeks of losses . Also another room member pmed to to let me know he was happy he didnt take one of the losing trades, that morning.It all works together.

it is impossible to remove emotion from trading. Sometimes a trade doesn’t look to warrant the full 3 cars. Both of Alex’s earlier trades looked completely wrong to me but I decided to follow anyway – and they combined to give me almost $1000 loss that day , not to mention losses in previous days. If I had followed my “emotion” i would have left days ago.

He states on his website that his system gives 70-80 % win rate. I was having some doubts about this as i had been doing some more study of the system over the last week: obviously he knows the system much better than me- and can trust it well. But I was having some issues.

So at the time of taking the LAST trade, with one car – which did look good to me- I had already decided to move on.

You asked me to keep you updated with how it went(after I said I joined) so i gave my opinion, other wise I would have just slunk off.

You and Osikani might want to trade 3 cars with Alex for over 2 weeks as I did. You might be on one of his winning streaks: and do let us know if you take every trade and never miss one. and with 3 cars everytime.

“Sometimes a trade doesn’t look to warrant the full 3 cars. ”

Then you should not take the trade. You either have enough to trade the system or you do not. Repeat: “We can NEVER tell which of our trades is going to succeed beforehand.” which, your quoted statement just illustrates.

“You and Osikani might want to trade 3 cars with Alex for over 2 weeks as I did.”

Sorry, but no. I trade my own system, with my parameters and rules, and I most certainly do not require, or expect to have, an 80% win rate.

In any case, it is again a question of money management. I do not have enough excess equity to trade 3 cars of /CL at the low leverage rate that I use. My money is tied up in my own trading.

Even if I did, BEFORE I would start trading, I would most assuredly want to know the statistical returns, and be able to calculate my expectations for the system; not jump in, then complain because of a losing streak. In other words, BEFORE I started, I would know the median losing streak length, and how much it would set me back, and I would not even start the system if I was not willing to accept that kind of drawdown.

That is just one statistic that I would demand, and check/verify. And no, again, I would not dismiss the system because I did not see a >50% win rate. System evaluation does not die on that. YMMV, but if that were so important to you, then you should have verified any such statement before you started, not afterwards.

“You asked me to keep you updated with how it went(after I said I joined) so i gave my opinion, …”

Yes, you gave your word and you kept it. That is commendable, and I mean that in a truthful way, not a sarcastic one.

However, that does not preclude us commenting on your opinion, and relaying our opinion of your opinion.

here is my modest trading for today.

http://imgur.com/qJO4ETl

Now these were relatively small size low risk trades for small gains.

Do I like to trade this way:? no, actually I dream of having a system that makes huge gains.

I love the way Alex , when he has a winner takes so many $$$. My way takes intense concentration and goes up in little fits and starts. BUT it doesn’t have such large drawdowns (well not very often. Well anyway when I lose at least it is MY loss , not because I followed someone.).

If I could meld my win rate to Alex’s way of holding for big gains we would be millionairres in a year: and there is the rub, The ways are too different.

Edges are subtle and Wall street doesn’t give its booty easily to the retail trader.

Robert, with this one post, you have validated Rob and I’s points, and to boot, you have returned to trading with sensible leverage, in a manner that you find you can tolerate the drawdown and wait the trades through. That gave you a 0.75% return on equity in one day.

Have you ever actually sat down to make a proper plan for your trading? Do you realise that an average of a mere $200 a day represents an almost $50,000 profit for the year, and you would not have had to sit through drawdowns that made you uncomfortable. Will you make $200 every day? Of course not, but as long as you stay with a method that allows you to stay in your trades to completion, there will be those rare days when everything is going gangbusters and you make maybe $1k, that will compensate for those days when you make a mere $50 or a loss.

Hi Alexandre,

I send you an email to webiste and i didnt get any response.

Waiting for it.

Thanks.

Hi Hamza,

I have received a seat for your for next Wednesday.

Email that I receive on Friday is normally responded on the next day.

Best regards,

Alexandre Soares

I Have reserved a seat ………….

Thanks Alexandre.

so I finally did join the room for a month, plus bought the course (see my earlier reviews in this thread).

so far we lost on monday and won today overall, adding up some large losing trades and much larger winning trades. he can stay in a winning trade minute after minute , the dips and sideways action is all par for the course : and that is with hundreds of dollars on the line each trade. He lest it run until his targets are met. and his calm “nothing we can here” said in his calm Germanic accent, whther the market is going his way or not, is reassuring as my heart pumps up or down depending on the each tick ..

Cool. Keep us updated with your experience.

so I have lost money most days so far, since I rejoined. This morning we start off with a losing trade: down $450 to begin. then another loser, another $450. then a winner, but by this time I (feeling crushed) reduced to only 1 car, so i only make $100.

I think this system takes someone with amazing confidence to hold through the big drawdowns and make sure they don’t miss a single trade as that might be the one to get them back to breakeven.

It would be great if it had more winners than losers but unfortunately the percentage of winners is below 50% – at least in the last 5 months.

Of course the system might turn around and start making more winners. But it will be doing so without me..

Alex is honest and it is easy to enter his trades however.

Robert,

My advice, take it or leave it. One of the biggest reasons most traders fail is they are way underfunded to be trading futures. Yes I know the fantasy straight up no draw down equity curves most TR operators claim. But that is fantasy.

My advice is if you do not have the funding to live through the draw downs and I think Alex has had draw down months, see if you can trade an Oil ETF and then risk what you can afford. If you can only afford to buy 3 shares do that. Then slowly build your account.

my account is 30,0000 plus rob And I could add much more.

. I was simply using 3 contracts usually, same as Alex.

Since i have been trading for over 10 years I know what suits me.

I tried this room, lost a small amount, and now its back to my own methods. Naturally it would be nice to just rely on someone like Alex, but that is just part of the dreaming process, that most traders go through on a recurring basis. We think someone must be doing it better than us:

And as I was turning a corner on my own – and getting better (albeit only from scalping, so not enough to give up my day job), it doesnt make sense for me to stay.

It was worth it to learn from Alex’s patience, but my scalping has high win rate, with low drawdown, (And consequently also quite low winnings).

Over the course of a year it would be interesting o see who makes more actually..

I will open my own room one day and we will see then. For now I am abandoning live rooms: time is better devoted to mastering my little edge.

Hi Robert,

It is really sad to see that you are giving up. Henry mentioned your comment after the trading session and I have noticed a bad trading behavior that you have and was going to talk about it after the session but apparently you just gave up.

Losing 2 trades in a row is nothing special, I only can look at support and resistance and take the trades accordingly. I highly recommend you to take a look at the stats and look at the DD.

The first thing a trader has to do is look at the trading account and calculate the maximum amount of contracts traded for that specific account. If you lose a trade or even more consecutive trades you cannot reduce contracts just based on the fact that you have lost a couple of trades, if you do this you are going to lose money. You did this on Friday and today again. On the winning trade I made 76 ticks in total and you only made 10 ticks that is a difference of 66 ticks and that will add up in the end of the month.

Use your time you still have with me and work on your bad trading habits, don´t hesitate in contacting me and just ask for help.

Alex

If I may make a comment? Good that you have made this offer, but the reality is that you have come up against the problem all seasoned traders face when dealing with newer traders. New traders have this fantasy of a 70%+ win rate using targets that are 3 times as far away from the entry as the stop loss, then expect a minimal to zero drawdown with their overly narrow stops.

The reality is of course very different. If one wants larger profits, one must use larger stops; must be willing to sit through the concomitant larger drawdowns; and expect a lower win rate.

There are only 2 results in trading. High win rate, very small scalping profits, if any; low win rate, large profits, large drawdowns. One must decide the size of drawdown one can tolerate, then accept what needs to be done. But newer traders (I was there once, so I speak from experience) want a high win rate, big profits and small drawdowns.

There are no small drawdown; just tolerable ones. Ask all those new traders with their narrow stops who keep getting stopped out before the market turns around and goes to the erstwhile target.

Well, trading is somewhat a parallel to any other building project. You can have it up to spec, on time and under cost estimates. The only problem is that you can only have 2 of them, not all three, and often only one of them; sometimes none.

Hi Osikani,

You just hit the nail on the head here, the hole problem here is that people think that they are going to make money every single day but the reality is that 50% of the time you are going to try to survive the other 25% you are going to lose money and the other 25% you are going to hit big home runs.

As a trader you are going to be here 5 days a week so you are going to have bad days, BE days and winning days. There is now way that we can predict if the market is going to move or not on a specific trading day, ranging trending blablabla… you will only know that after the trading day. If a trade sets up you have to take it and manege it, if you cannot take it because of fear you will miss an opportunity (despite the outcome), if you screw up your trade management by taking profit early or moving stops etccc, you are going to be screwed.

The 70% win rate is rater low, they are expecting a 80%+ rate. Real world numbers are more like 60/40, my best month was 68% a great example is the July 2015 results were my win rate is only 38% but I made money.

People have to stop dreaming and begin looking at the reality.

Shhhh. Do not tell such truths when people like Ace Trades and Major Mongo are busy peddling such niceties as 6 months trading with not a single losing day, and 100 tick profits with 5 tick stops!

Please stop destroying scammers business with your honesty and transparency. They may come after you, you know?

See what I mean? With Ace Trades latest promise to give you 90% accuracy, I agree, Alex: 70%+ was rather low! LOL.

http://screencast.com/t/qMkEgseig

And a 1 to 10 risk to reward to boot.

Then, all you folks want to question his trading genius? Yeah, right. How do you question such a master?

For they that are dense enough to believe this nonsense, that paragraph before this is called “sarcasm”.

Can anyone tell me what’s going on with this room right now? I’ve tried out the free trial and managed to lose more than 1000$ during the week… Thankfully this was all sim money. I would have been really upset if this was a 300$ purchase that I bought as a beginner. I believe the owner is in the middle of a drawdown right now and must be down quite a bit this month. Alex, your April trading results have not been updated since early April. Why is that? Now I’m not saying this is a bad trading room I believe he was on a hotstreak last year but you can’t expect people to pay 300$/month for a room that will not offer a free trial. Honestly, I would have signed up and taken a chance for a longer period if it was around ~100-150$/month. I’m still looking for a room with a more reasonable price although most do not offer the transparency so I have to give it up for Alex in that regard.

Thanks for the comment! Its useful.

Another option for traders that want to trade smaller size and be able to scale would be to trade the crude oil ETF, symbol USO. It tracks identical to the crude oil contract and the liquidity is very, very deep.

I agree on the price point, and I agree on the trial period. Alex is definitely not a marketing genius. In fact, he is plain terrible at selling his service. But I have been following him long enough to know that he is all trader and a no BS sort of person. I hope he makes it and his service grows.

Also, I have been collecting his trades from The Tin Robot. However, getting the user interface to work has been a real pain in the butt.

Lost $1000 in a week trading a highly leveraged future instrument. What a shocker!!!! Welcome to day trading. Those 100 tick up days rain or shine and straight up equity curve only exist in the fantasy world of Trading Room Operators who could not trade profitable if there life depended on it and can never show any proof of profitable trading.

Real Traders equity curves look more like a roller coaster.

But if you do not have a large account, then Emmett gave great advice, instead of trading using 500 to 1 leverage (yes I know that is what the TR operators tell you) trade the ETF and just risk a little to slowly build up your account.

The whole premise of paying 300$ month for a room and then going on a 3-5k drawdown just doesn’t sit right with me. There’s no guarantees you’re going to make that money back as past performance is not blablabla. So my point was the trial helps people decide if they are willing to pay for those wild rides or take their trading account elsewhere. I believe this trading room was at 130usd/month before the review anyway.

PJ,

I think a job from 9 to 17 will fit you perfectly.

I have raised the price back in October and the review was out 3 weeks ago, but if it is because of the price I will do the old price for your first month and then you will have more information to decide if it really fits you or not.

Here are today trades:

http://www.4shared.com/photo/qAosBgVhba/daily.html

And here is the weekly performance:

http://www.4shared.com/photo/LXVg7oSpba/Week_totals.html

Have a nice weekend,

Alex

Hi PJ,

The first thing that I recommend trial members have to do is looking at the stats instead of going into the trade room, there are more than 1 year of valuable information. If you analyze the stats you can clearly see that a DD of 1000$ is a small loss.

I´am not a scalper and I always look for big moves. If the market is in a tight trading range 50-60ticks I will loose money but when the market is making moves of 100-200ticks I will make all those loses back and even take some profit and I don´t hear people complaining about that.

(https://www.youtube.com/watch?v=SvIi545aLkQ)

Can we look for signs if the market is going or not? Not really, you just have to give it room, there will be no profit without risk!

When I get email with the question, what account size do you recommend? I always advice people to trade 10k-15k per contract, so to trade a 3 lot you have to have at least 30k. I could lie and just tel them you can trade with1K but that is not the reality, it would take a couple of days to blow up there account and me having some angry costumers.

If you are interested in my services let me know and we can arrange a special price that will include the video course so you can begin right away.

WOW! Anyone that has read my posts in the past knows I never agree with trading room operators, but I could not agree more with your statement:

“Can we look for signs if the market is going or not? Not really, you just have to give it room, there will be no profit without risk!”

This is what I tell people. Most Trading Room operator are nothing but con man preaching fantasy, where day trading is like a getting paid a salary every day. The fact is you do not control the market and the market will determine when you make money.

Thanks Rob B, people just have to stop day dreaming and begin to look at the true about day trading and I know that this will be difficult with so many trading rooms out there claiming that they make1k or more a day.

Alex

Great example:

http://www.4shared.com/photo/rRYjIhEzce/22_04_2016.html

This trade took 1 hour to get 15 ticks and now almost hitting 30 ticks!

http://www.4shared.com/photo/ncY3oHz0ba/22_04_2016.html

New link, 30 tick target is filled.

Adding 3 more contracts:

http://www.4shared.com/photo/_qNfw8CMce/add_22_04_2016.html

error on link new link:

http://www.4shared.com/photo/hzK9X0kTba/add_22_04_2016.html

Beginning the day with +98 ticks

There is something crazy going on with this thread. I go to respond to Alex’s post about someone selling his course and now it is gone. Maybe it will reappear. Very odd.

Anyway, Alex no one has a right to sale your course without your permission, but this could happen to any trading room operator that sells a course. In fact I am pretty sure the most well known ones are on the torrent sites.

Even if you eliminate trials that does not stop some scum bag person from scamming you.

It is kind of sad that basically this is the 1st room that actually trades live and gets a good review and they are doing away with free trials and monthly subscriptions. I for one with you the best and hope you reconsider.

I always have said anyone that can actually trade profitable would never run a trading room. I guess this is one more reason I did not even think about.

Rob B,

I removed the comment. I think that I reacted without thinking sorry.

I know it will probably be impossible to battle against fraud. I will be offering the trading course with the trade room subscription in the past.

With regards to the trial I will not eliminate this but it will be on a specific day of the week.

So there is still hope.

Thanks,

Alex

Alex,

How did you delete your post. I want to be able to edit and maybe delete a post.

Oh, my God. This new system is worst that horrible. Emmett this is ridiculous. My new comment is not placed at top or bottom but thrown in the middle with the 0s and place in an arbitrary position. The whole thread flow is gone.

At the very minimum one need the option to order this by newest first.

I vote 1000 “-” to this new system!!!!!!!!!!!!!!!!!!!!!! and Immediately fire the person that implemented this.

I hope Emmett reverts back to the original thread system. I’m surprised the shills hadn’t upvoted or downvoted yet. Maybe they wait a month or so to put another plant post. Either way, I agree, it’s confusing, and I think the original chronological history of posts is more useful to viewers trying to make sense of the reaction to the review. Another suggestion is to have more or separate forum categories on topics so it can be a real competitor to bmt/futures.io where people can really speak their mind.

I see where you can click “oldest” now to have the posts sorted chronologically. maybe that should be set on default instead of “most voted”. just my opinion.

Dont worry Rob, nobody is diminishing your ability to be grouchy. Lol. Simply sort the comments by clicking the sort feature in the upper right hand area of the comments section.

There is no appropriate place to leave this comment, but I see it here so I commenting here. I think this rating system is flawed. I think this would only work if you had paid subscribers and the names of the person are left with their + or – rating.

The problem I see is the Trading Room Operator is highly motivated to promote his site as he has money on the line. So he will have all his shill Hit + on the Good reviews and – on the bad reviews and even create various IP address to rate his site high, while regular folks are not going through all this effort.

This just allows one to buy positive reviews with a 1000 fake users.

I agree with Rob B plus the + – feature could also distort the continuity of the discussion it the thread.

This will be a quick reply to all of the angry people I see posting stuff, trying to bring me down without having any proof.

With regards to the system rights, a surgeon needs tools to operate and as a trader I need indicators to trade.

Wyckoff, Nexgen, CJ Booth, I just use the same indicators and there is nothing wrong with.

With regards to CJ Booth, in the last year that I have run the trading room, I have had several ex students of CJ and they all have the same problem. The only thing that they have learned from him are bad trading habits. When they take a trade they just want to get out of the trade as quickly as possible.

With regards to the trading room from CJ there was 0 transparency, no chart was displayed, no DOM, no trading from the chart, you could only hear him. It was rather distracting, on every trade there was something wrong, terms like ´´I just made 16 ticks´´ or ´´I made all my losses back after the close of the trading room´´ were well known by all the ex students.