TradeZero.Co

-

Management

(5)

-

Support

(4)

-

Cost

(5)

-

User Experience

(4)

-

Safety and Legitimacy

(5)

-

Trading Technology

(5)

Summary

TradeZero.Co is a Bahamas based, retail stock brokerage offering FREE execution of all limit orders. This is a real game changer. Trading costs are nearly zero. The company is also offering 6 to 1 leverage to small account traders. The company is owned and managed by a highly reputable industry veteran with over 16 years experience managing retail stock brokerages in the United States. Company is offering several different trading platforms, all are proven and battle tested over many years, with several major trading firms. Company is extremely compelling, has a highly enthusiastic following of existing customers, and excellent customer support.

User Review

( votes)Thanks for reading today’s review of TradeZero.Co

What is TraderZero.co? Trade Zero is an online stock and options broker located in Nassau, Bahamas. The main selling point for the company is that all limit orders for stock trades are executed for free. In addition to free limit orders, the company is also offering intraday leverage of up to 6 to 1. However, there are a few caveats: a deposit of $500 includes no leverage, a deposit of $1,000 brings 4 to 1 leverage, and a deposit of $5,000 brings 6 to 1 leverage. What does this mean? If you deposit $5,000, then you have purchasing power of $30,000, via 6 to 1 leverage.

What exactly is a limit order? A limit order is an order that adds liquidity to a market. In practical terms, suppose that you are looking to purchase 100 shares of ACME (not a real stock). The last executed price of ACME was 12.56 per share. If you are looking to execute a limit order to buy ACME, then you are looking to purchase ACME at less than, or equal to 12.56 per share. You are not lifting the price higher to 12.57. Therefore, you would be adding liquidity to the price of ACME. This is an extremely simplified example. Should you be using limit orders? Absolutely. In fact, most professional traders will use limit orders almost exclusively to enter and exit trades. A limit order trade is always closest to the best possible execution price that a person can pay for a stock. If you are an active day trader, then not using limit orders is a near guarantee of failure. Why? Because you are constantly moving the price and paying a premium to drive the price higher, or lower. To be a successful day trader, you absolutely must master the use of limit orders.

How could a limit order be a free trading transaction? The reason is because there are multiple venues in which a stock trade may be executed. Each of these venues is constantly fighting for market share of the daily trading volume. And so, each venue attempts to capture the highest amount of trading volume by offering discounts, free access, and sometimes actual rebates if traders will execute their trades on their venue. A real world example would be if several grocery stores were located on the same street. In order to drive customers to a certain store, this store might offer a gallon of milk at cost or slightly below cost, knowing that the customer will also purchase other items with a higher profit margin. Same goes with trading venues, the more volume that a venue commands, then the more overall opportunities to earn profits on a whole host of different trading products.

Does using a limit order make a big difference in trading results?

Absolutely. An example would be my own personal trading. In 2008, I executed over 3600 round turns trading the emini SP500 and mini Dow futures contracts. Out of the 3600 trades, 2800 were executed using a limit order. I currently pay $4 per round turn. If I were to receive free limit order execution, then I would of saved myself $11,200 in broker commissions. This is nearly $1,000 per month in extra income.

Free limit order trading presents some very interesting dynamics regarding the futures markets vs the stock markets. Lets compare the highly popular emini SP contract vs the SPY ETF. The emini SP is a futures contract that executes primarily over globex through the CME Group. This contract typically costs the average retail trader about $4.25 in commissions to execute a single trade. This contract has a daily volume that typically exceeds 1 million contracts per day. The SPY ETF tracks nearly identically to the emini SP, and its daily volume typically exceeds 1,500,000 shares. As you can see, both securities are extremely liquid, and both move in lock step throughout the trading day. So the question that traders should be asking themselves is why trade the emini SP futures contract at $4.25 per contract, when a person can trade the exact same thing (SPY) for nearly free?

Another advantage of the SPY over the ES emini contracts is that a person can reduce exposure down to only a single share of stock vs the emini contracts, where a person is exposed to a uniform tick amount of $12.50 per tick. On some days, the emini contract can whip up $2,000 and then close down $2,000, which is a hair raising experience for any newbie trader. The SPY can be scaled down to only a single share. A person can trade and learn on even the most scary days, trading the bare minimum.

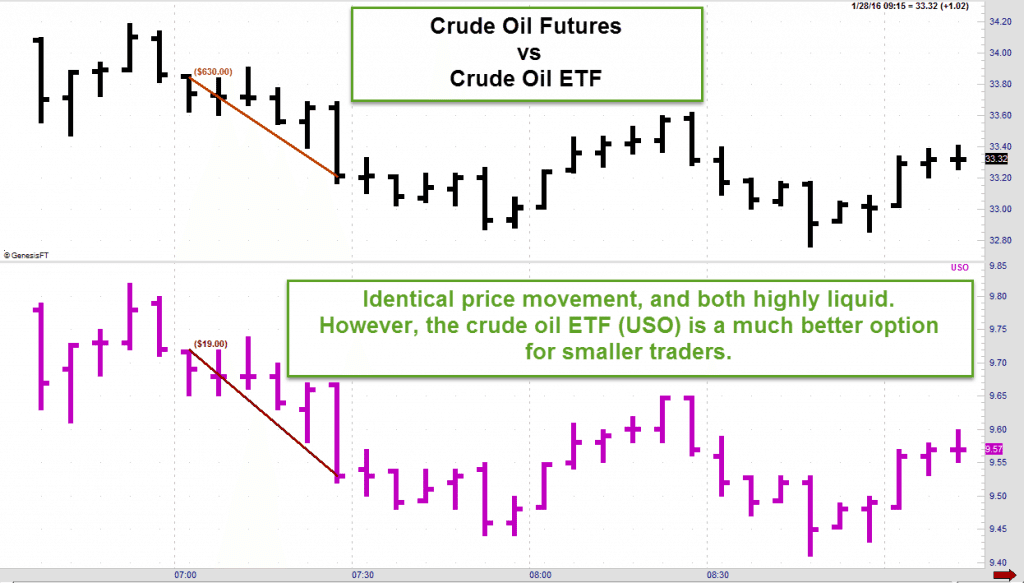

Yet another very popular futures contract is the CL or crude oil contract. This contract also whips around several thousands of dollars on any given day. Its not uncommon to have $5,000 dollar swings happen in only a matter of minutes, which is just too volatile for the newbie looking to learn. However, a person can just as easily trade the USO ETF, which tracks lock step with the crude oil contract. The USO ETF is now averaging about 50 million shares daily…its a giant market. The advantage of the USO ETF is that a person can trade only a few shares at a time, learning and growing, and then add more or subtract more as the equity balance rises and falls. Lets take a look at the following example…

Suppose that you are a newbie trader looking to learn how to trade the crude oil market. You read my review on Jason Love’s Oil Trading Group and you think that it might be a good method for you to learn. However, upon reading the review you discover that Jason trades 3 crude oil contracts per trade. And you also read that it is not uncommon for Jason to experience $10k draw downs. As a newbie with probably only a few thousand dollars to trade, is Jason’s trading method a good fit for you, as a futures trader? Absolutely not. However, trading the highly liquid USO which moves identical to crude oil, you can actually follow along without the likely risk of being slaughtered on each and every trade. Look at the following example chart of crude oil.

The date is January 28, 2016. Suppose that Jason makes a call in the live trading room that he is going long at exactly 7am (PST) at 33.85 and he is going to hold the trade for the next thirty minutes and exit at exactly 7:30am (PST). Jason really believes that a bullish window has opened up and he goes long. Ok, thirty minutes have passed and Jason was wrong on the trade. He is now going to bail on this losing trade. He is long 3 contracts and each contract is at a loss of $630 plus $4 commissions. He dumps the trade and his net loss is $1894. However, you are trading with only 300 shares at 9.72 per share. You dump your trade for a loss of $19 per hundred shares, or a total loss of $57 and you paid zero commissions because you entered and exited on a limit order. The chart below is a comparison, and as you can see, the movement of the USO vs the (CL) Crude Oil contract are identical.

Astute traders have probably just read this prior scenario and are probably wondering, “Yes, Jason was able to quickly enter and exit the highly liquid futures market, but the person trading the USO ETF, was there liquidity for him to enter and exit at the same price as Jason?”. This is a valid question, and it can be answered simply by looking at the volume of trading during this 30 minute period. Lets take a peak…from 7am to 7:30am the CL traded 44,915 contracts, while the USO traded an amazing 3,988,000 shares. Looking at these volume figures, it is obvious that either trader would have absolutely no problem with trading volume.

In today’s highly liquid financial markets, the ETF’s are nearly ubiquitous to the futures markets. And with multiple venues now fighting over market share, and offering free limit order trades, then it is becoming very difficult to remain a futures trader, when a person can trade for nearly nothing with an ETF.

About TradeZero.Co

Thus far, I have only talked about some of the advantages of trading ETF’s vs futures. And have spent nearly zero time talking about Trade Zero.Co. Lets jump into this…

TradeZero contacted me in June 2015 and requested that I write a review of their trading platform and their product offering. The website and business had just gone live in May 2015. The website looked terrible. Seriously, it looked extremely unprofessional and quickly thrown together. Splashed across the home page was the offer of “Free Trading”. Immediately, the red flags came out and I thought that this has to be yet another offshore, stock broker scam. My initial thought was whom would be crazy enough to send this company any money to trade stocks? The website gave me zero confidence. To make matters worse, they are located in the Bahamas, and so what recourse does a person have if they suddenly close up shop and disappear with depositor funds? There was no possible way that I was going to recommend this business to TradingSchools.Org readers. Heck, I had just written a piece on a company named Nonko, which was operating an illegal broker dealer/bucket shop, and once I published the article, that company promptly shut down and disappeared. In a nutshell, I wrote back to the owner of the TradeZero and simply told him that they were not going to get a positive review. They were too young, unproven, and located in a place better known for pirates, conch fritters, and coconut smoothies.

Over the next several months, I started to receive private emails from readers requesting that I write about this “insanely cheap” stock broker named TradeZero. The messages were almost fervent and overly enthusiastic. One guy wrote that he had spent thousands of dollars in trading commissions with another Bahamas bases stock broker named SureTrader. Nearly all of his trading profits had been consumed by the $4.95 per trade fee. At the end of the year, he would of done well, but the only guy doing well was Sure Trader. He took a chance and opened an account with TradeZero, which is located up the beach from SureTrader. After a couple of months, he was amazed at how much he was saving in commissions and fee’s. In addition, he was surprised at the high level of customer service that he was receiving from TradeZero. During the trading day, he could always get on the phone and speak with the owner. And during the evening, someone was always available through the live chat feature.

Its one thing when a trading vendor contacts me, and tells me that they offer a great product. Its an entirely different thing when I am receiving anonymous emails and messages about a company that is offering something great. TradeZero has some really hardcore fans. Yes, its a new company, but in the short period of time that they have been in business…a lot of people are really, really enthusiastic about them. A really good sign.

Antonio Libreros, CEO

With all of this new information and positive customer feedback on TradeZero.Co, I decided to really dig into this company and investigate. Over the last two months, I researched and snooped and collected as much information as possible. During this time, I developed a good and open relationship with the owner of the company. Here is what I found. The owner of TradeZero.Co is Antonio Libreros. Although this name might not sound familiar, I am sure that many readers have heard of Lightspeed Trading. If you have ever had an account with Lightspeed, then there is a very good chance that Antonio was your broker. During Antonio’s tenure at Lightspeed, he was responsible for handling over 1000 of the firms 4000+ traders. In fact, Antonio came to Lightspeed Trading when Lightspeed Trading purchased his brokerage: Noble Trading. If you go to NobleTrading.com, notice that the web address forwards to Lightspeed Trading. Some readers might not be familiar with Lightspeed Trading, if not, its one of the largest and most respected retail stock brokerages in the United States.

During Antonio’s tenure at NobleTrading.com, he grew the company from nearly nothing, to up to over 4000+ traders. In addition to having a series 7 and 63, he learned all of the ins and out of the retail brokerage business. And more importantly, he understands SEC compliance issues. A deep search of Finra and the SEC reveals that Anthony has a clean record and no blemishes. In fact, in speaking with Antonio, you get a sense that he is very well organized and very risk averse.

Prior to starting NobleTrading.com, Antonio also worked at Cardinal Capital and Spencer Capital, LLC. In total, Antonio Libreros has over 16 years experience at running and managing different retail stock brokerages.

L. Sydney Saunders, Chief Compliance Officer

L. Sydney Saunders is the full time Chief Compliance Officer. Mr Saunders is a Bahamian citizen that has extensive financial experience and training. His education and registrations include being a former Series 7 General Securities Licensed Broker, a CPA registered in New York, Florida and Nassau Bahamas, as well as a former Vice President and current Member of the Bahamas Institute of Chartered Accountants. Mr. Saunders work experience is even more extensive than his training. His list of positions include: Senior Auditor for Bahamas Government in the Auditor General Department, auditor and audit manager for KPMG, a Financial Controller for McDermott International Investment Co., as well as a Senior Securities Manager for the Securities Commission of the Bahamas. Mr. Saunders provides TradeZero with its KYC and AML plans and is responsible for approving all trading accounts with the firm.

The Clearing Firm

In addition to TradeZero.Co having a reputable and capable CEO, and a full time time Compliance Officer, Trade Zero.Co has also partnered with one of the most reputable clearing firms in the United States: Vision Financial Markets. From January 20-25, I was able to confirm a positive relationship between Vision Financial Markets and TradeZero.Co.

Order Routing

In my conversations with Antonio, I asked him to provide a clear and concise description of how orders are routed…

The limit order trades are routed through DirectEdge (EDGX), and all marketable orders are routed to either NASDAQ (NSDQ) or the Apex Managed (MNGD) route. TradeZero does not in any way internalize orders. As we offer US market trading and clear through a US based clearing firm, they, and as a result TradeZero, are obligated to provide all clients with the best execution price available at all times. The stop limit orders are routed EDGX and market orders are routed through either NASDAQ or Apex Managed. These routing rules are subject to change as various rebate and take rates change. At this point in time, we are using EDGX as we can get the highest rebate there.

Trading Software

Currently, TradeZero.Co offers three types of software packages: ZeroWeb at $25 per month, ZeroPro at $79 per month, and ZeroMobile at $10 per month. The software is free if a customer trades a preset minimum of shares per month. If you are really curious about the individual capabilities of each of these software products, then please refer to the following page. Some traders might already be familiar with the TradeZero.Co software. Why? Because the TradeZero.Co trading software is just a white label version of the proven and battle tested Turbo Tick software that was developed by TurnKeyBroker.com.

No United States based customers

As many readers are already too aware, the SEC has some very robust regulations regarding stock brokerages and how they deal with a United States based retail client. For better or worse, these regulations are meant to protect investors. In 2001, the SEC passed the PDT rule or the Pattern Day Trader rule which in effect eliminated stock day trading for accounts with less that $30k. This rule was passed in response to the tech crash of 2000, and was supposed to eliminate bubbles from forming in the stock market by removing the small day traders from the marketplace. However, the PDT rule never really worked as intended. (like most governmental regulations) The net effect is that small stock traders were simply pushed out of the mainstream financial system and into the waiting arms of various schemes meant to circumvent the PDT rule. A good example would be Nonko trading that accepted client funds and then simply allowed people to lose their money on a trading simulator. Another example would be BullsOnWallStreet’s CliqueFund which allows traders to open an account with as low as $2,500. However, the customer must first purchase thousands of dollars in “education” and then are subjected to egregious daily fee’s that quickly drain the account to zero.

A sort of happy medium, that has been able to avoid SEC scrutiny would be SureTrader, also located in the Bahamas. They are essentially identical to TradeZero, but each trade costs $4.95 per trade. To enter and exit a trade, a customer is going to pay $10 in total. This commission structure guarantee’s that a day trader is going to lose. No day trader on the planet is going to be able to outrun that commission. However, SureTrader has devised a model that has been able to weather the scrutiny of the SEC for several years. Its a good bet that they are not going anywhere. Sure Trader accepts US based customers.

If SureTrader and TradeZero are essentially identical companies located in the Bahamas, then why will TradeZero not open US based accounts? In speaking with Antonio at Trade Zero, he explains that he is very cautious and he is looking into how SureTrader is operating. However, at this time, he simply does not want to risk the ire of US regulators. At some time in the future, this will change. However, at this time, he is taking a wait and see approach. Another thing we talked about is how the SEC has gotten much more loose in the interpretation of securities laws. A prime example would be the Jobs Act, which the SEC just released final rules on October 30, 2015. What is the Jobs Act? Essentially, the Jobs Act allows the securitization of just about any idea through the use of crowd sourcing. Have a magic hamster wheel that supposedly churns out cash whenever a hamster completes a loop? You can now sell this wonderful investment idea to the general public without incurring the wrath of the SEC. Try this a year ago, and the SEC would of kicked in your front door. However, the Jobs Act has essentially changed the basic foundation of the SEC. The Jobs Act is truly the wild, wild west of investment ideas. And considering how the SEC is now taking a hands off, non regulatory approach to the insane world of crowd sourced investing, then its a pretty good bet that they are taking a more liberal view of day trading. This is just a theory, but it seems to hold water. Especially considering that the SEC has been allowing many of the day trading groups to operate in the United States, for several years, unmolested.

Day Traders are a crafty sort. And of course they are going to find a way around the PDT rule. I spent a couple of weeks working every possible angle with Antonio on how a US citizen can access an account with TradeZero. Of course, everyone wants free trading. But how can a US citizen pull it off and actually get the account opened? Here a few possible scenarios, and I am sure that Antonio is not going to like what I am about to write.

- “If the person has a spouse that is not living in the US and have an ID and a mailing address in another country.”

- “If a US citizen is living outside of the US and has a government issued ID from that jurisdiction, they are a good candidate.”

- “If a person is part of a trading group or partnership that is based offshore and is not advertising US based customers, then we have no control over private parties.”

Truthfully, I could write another 3000 word article on how a US based trader could open an account with a reputable offshore stock trading company. There are plenty of angles and creative workarounds, but this is another topic altogether. And since I know that US regulators read this blog, I am not going to stir up any problems or start any fires. So for now, lets just stay focused on the review of TradeZero.

Special Offer for TradingSchools.Org readers

Thanks for getting this far into the review. It should be pretty obvious by now that I am a big fan of TradeZero.Co. They are offering a trading model that is a game changer for many traders. A lot of US based traders are probably pissed that they cannot open an account. And I am sure that a lot of US based futures brokers are probably upset that a person can trade ETF’s that trade exactly like futures, but without the commission costs. In short, this review is probably going to upset a few of my readers. However, for the few traders that can actually take advantage of what TradeZero.Co is offering, they have given me a special deal for my readers. If a person clicks through and opens a TradeZero account, then they will receive the following added benefits, that are exclusive to only TradingSchools.Org readers:

- Web Trader reduced to $20 per month and free after 20,000 shares – A $5 monthly value

- Free mobile platform – A $10 monthly value

- Discounted Level 2 platform of $69 a month. This is a $10 monthly discount.

- Level 2 free after 80,000 shares instead of 100,000 shares

- 6:1 leverage with $2500 opening balance. 6:1 remians as long as $2000 minimum account balance in maintained. 4:1 between $500 and $2000 and 1:1 below $500.

In addition to these added benefits, your patronage also supports this blog in the form a $20 referral fee that is earned for each new account that is opened as a result of TradingSchools.Org.

Wrapping things up

Thanks for reading this review. The two most important take away’s from this review are number one, that TradeZero is a real company that I sincerely believe that you can trust. I have spent a great deal of time vetting the owner, confirming every aspect of what he is offering, and checking that all of the industry relationships are in order. To be able to execute limit orders, for free, is a real game changer. If you are an active day trader, then this is going to massively reduce your monthly commission costs.

The second aspect of this review is that some traders, in particular small account traders should consider trading ETF’s instead of full blown futures contracts. At least in the beginning. Too often I correspond with readers of the blog that only have a few thousand dollars to trade with. They want to trade futures, but their chance of success is nearly zero simply because they are under capitalized. Trade Zero is offering TradingSchools.Org readers 6 to 1 leverage on a $2,500 account. This is PLENTY of leverage and enough to trade considerable size in the many markets.

Well that its it for now. Thanks for reading. And don’t forget to leave your comments and questions below.

IS this still a great deal?

https://www.sec.gov/news/press-release/2022-88

wonder what is next….

Thanks to the writer who wrote the review for TradeZero. I’ve been writing reviews as well both for non-regulated and regulated brokers. But my question is, is it really a good broker TradeZero is?

Is there any problem to withdraw? I don’t care about the fees to withdraw as I do not plan to withdraw frequently. But, once I wanted to withdraw, am I going to face any problem?

I really trust your reviews, so I would be glad if you have anything to say on this matter.

Thank you in advance.

Trade Zero is a high-quality and high-trust company. Geez, I wrote about these guys when they first launched, its been years. They have only gotten bigger and better.

Yes, they compete with the likes of Robinhood. But Robinhood has no comparable browser-based platform, like Trade Zero does.

I would like to see Trade Zero go public. In fact, why have they not already? Would be a great company in which to invest.

Can you guys do a update on this?

Will there be an update review on TradeZero? Has anything changed in regards to how they service U.S. clients trying to circumvent the PDT rule? Do they also do CFDs and if so how are they different from F1 and the others in that regard? Lots of recent newcomers to daytrading stocks are asking about circumventing the PDT these days and keep coming across F1, CMEG and Tradezero.

Trade Zero in the Bahamas will not accept US clients. I spoke with Dan Pipiton, the Chairman of Trade Zero, he is obsessed with compliance and staying legal. Of course, if you are a non-US client, you can open an account and avoid the PDT rule. Another possible workaround would be for US clients to open an offshore corporation and then open an account under the offshore name. That’s perfectly legal and I know a bunch of people that pooled their money and are doing this now. They are all using sub-accounts with position limits and liquidation rules.

Trade Zero in the US is for US citizens and they have all the US rules and regulations.

Is there any difference in Trade Zero Bahamas vs Trade Zero US? Nope. Its the same clearing agent, same software, same technology, etc.

Sure, the PDT rule sucks. It should be eliminated. But the counter-argument is that we have forgotten about the chaos of the 1990’s tech bubble and the masses of day traders that destabilized the stock market and exacerbated the crash.

No CFD trading with Trade Zero Bahamas. I spoke with Dan about this as well, he said, “CFD trading is a scam” and “Trade Zero is not in the business of fleecing our account holders.”

Additionally, he replied, “I could make a killing offering CFD trading. But do I really want to become the Devil?”

TradeZero is bad news. Their platform doesn’t work properly. VWAP is different on every chart. They have horrible customer service when there is an issue. You cannot get your money out. Avoid at all costs!

No one talks about withdrawls. They offer an aff program so of course lots will blog and say they are great. How about some actual users sayimg I have withdrawn X amount..this many times and am happy?

I”ve been using TZ for 4 months. All the PROs Emmet posted are true, but he did not mention some of the CONs:

– Free trades are for 200 shares or more

– Locates can be quite expensive

– Overnight shorts are 7x the borrrow cost on the first night. After that, the price is 1x.

– You can’t short stocks under 1.

Other than that, they are OK, specially if you want to surpass the PDT rule. The borrow list is good.

Hope this helps

Thanks for reviewing trade zero. Hows shorts compared to sure trader. HTB shorts i mean.

Its not free at all for all limit orders. Only limit orders over 250 shares is free. I found out this after. And high prices on overnight holds as well. Tradezero is not what they should be called by any means.

I am planning on opening an account but would like some update on their performance as well as any issues getting funds in and out. any updates on tradezero?

”

i haven’t heard anything new about them in a while from people who have used them.

are these guys legitimate?

can you see orders on level 2?

has anyone been able to wire out profits?”

any updates on tradezero?

i haven’t heard anything new about them in a while from people who have used them.

are these guys legitimate?

can you see orders on level 2?

has anyone been able to wire out profits?

Hi between this comments someone called anonymous has written that tradezero increase the losses,that to fill an order it takes up to 5 minutes and that the platform blocks itself.

Is that real ? Hope not..

I am very intrested in these 0 fees but the point above should be adressed and discussed.

Does someone know something about these aspect of tradezero?

How does it cost to withdraw the money?

Thanks

Please do not use Tradezero. they are wolf in sheep clothing. You will have to study your trading blotter because they will always mess up your PnL and increase your losses. Their trading platform is horse shit – some generic off the shelf platform and a very primitive web platform that they overcharge for (that hardly works) sometimes it is impossible to hit order buttons on level 2 because the platform freezes up. Last but not least they’re customer service is just terrible. They are a bunch of assholes that behave as if they are doing you a favor and do not take responsibility for their shitty platform.

Do not let their ‘free commission’ marketing scam work on you. you only get free trades if you put size of over 200 shares and add liquidity – but heres the catch – the execution is atrocious. you will be waiting on your fill for up to 5 minutes, by that time the market would have moved against you. they also have a very terrible short locate list and outrageous locate fees. Unlike most brokers they do not destroy their customers through commissions but a tonne of hidden fees. They charge a stupidly high amount for platform and ridiculous wire in and wire out fees.

AGAIN STAY AWAY FROM THESE SHADY BASTARDS. YES THE PDT RULE AND LOW COMMISSIONS ARE TEMPTING BUT YOU GET WHAT YOU PAY FOR SOMETIMES IN LIFE.

I have never written review for anything in my life. I have used various brokers for different asset classes from stocks to currencies but the quality of tradezero motivated me immensely to do my best to steer people away from these scumbags. I hope they get shut down very very soon.

Hi I want to speak about what anonymous has written.

He said that they increase your losses and that it takes 5 minutes to fill an order.Plus the platform blocks itself.

I think it’s important to discuss about that and understand if it’s real or not.

The fact that they charge basically no fees is extremely interesting,but the points above have to be adressed.

I’d like to hear someone about that.

Could you please elaborate a little on their funding and withdrawing methods? Cuz wiring money to Bahama is costly.

Hi, I found this site very valuable when looking into trading so thought I would give some feed back. After reading Emmetts review a few months ago I opened and started trading using Tradezero. I’m a beginner when it comes to trading and liked the idea of low or commission free trading especially as I was starting with a smaller amount of money to practice with. I have only opted to use the webzero platform at this stage as it is only 20 bucks a month (if you go via the links on this site). I will be changing over to the full service once my account grows and I can warrant the extra costs. The downside of webzero is you are dependent on the quality of internet connection, now this is not normally a problem except I travel around the world and don’t always have a great connection. All in all I have been very happy with not only the product but also the service that has been provided when I have had questions or needed help.

3 quick questions.

– Does the trading platform have a Premarket/ Unusual Volume Scanner/ Screener like ThinkorSwim and DasTrader (SureTrader)?

– is Level 2 included in the in the $69 Platform Fee?

– Shorting stocks… would you say more than 50% or 80% of stocks you wanted to short were shortable?

These are great questions. I am also curious about this 3 things.

good questions, and an even better question would be how the hell it is possible to day trade commission free with them! They clearly state that the limit order is commission free if and only if it is unmatched for at least one second. Now, that may work for swing traders and investors, but in no way for day traders; when you see an opportunity you must get in immediately, not setting an order with a price that cannot currently be filled. I surprise Emmett didn’t mention this. The other trades cost 0.005$ per share, which is a lot for low priced stocks.

i would not agree with it, all depends on style, i trade on small pullbacks to levels of high liquidity that are known many seconds if not minutes in advance

Has anyone deposited and withdrawals with them

anyone using this broker?how are they

Emmett I see you mentioned 3 work arounds for opening an account with Tradezero from the USA. Can you provide me with a few more? You can either post reply here or even better email me. I’m currently with Suretrader and the fees are too much for me. Thank you very much in advance.

I feel ya. Just signed up to trade bitcoin with them. Pretty easy but have funded the account yet. You might check it out…….

Would it be legal if I traded from the US but signed up to TradeZero under a friend that lives in another country? So basically with his permission I would be trading under his name. Is this legal?

Well, if they don’t find out. As most brokers are shutting down on different residences living outside USA, I have a brokerage account on my friend name who lives in USA and I trade on it.

TradeZero may be opening up for Americans? Funding with Bitcoin?

From the faq section: Are accounts accepted from the US?

“US and Bahamian citizens cannot open accounts with TradeZero. US citizens can open Bitcoin trading accounts.”

Emmett is there a way to open an account with TradeZero taking advantage of dual-citizenship status?

I believe you need an address outside of the US.

Emmett, Ive a dual citizenship and Ive got and address overseas too, will I be able to open an account with TZ ???

Yes.

I have had no complaints about TradeZero. Nothing. A good company. Well built. Responsible management.

oij;

Opened my account yesterday and funded it today. Hope i am not getting scammed. Support was very helpfull the otherday, today it was a bit dissapointing bcaus i needed some additional information for the bank wire which they didn’t had (the adres of the royal bahamas bank). Hope my money will be in my account soon and i get my login information. Want to get in contact with other traders @ zerotrade. Please send me an email r*iekus#ritskes*@ the populair google mail without the *#*. Or twitter @Biervergelijker.

Hope it turns out all well. Will keep this updated.

3 quick questions.

– Does the trading platform have a Premarket/ Unusual Volume Scanner/ Screener like ThinkorSwim and DasTrader (SureTrader)?

– is Level 2 included in the in the $69 Platform Fee?

– Shorting stocks… would you say more than 50% or 80% of stocks you wanted to short were shortable?

Any new expirience with this company?

I tested desktop software , its a bit limited, but still functional, had problems with layout. If I add something new, or resize chart bar, and save it for future use.. once i exit and start again , I can’t see TradeZero Window. so I need to close everything, uncheck “Save Layout” and start again. Im planing to put a bit ove 1.000$ in next few months with them. So if anyone have recent expirienc with them , please share with us.

Thanks for the comment. Have not heard anything negative…yet. The platform is well tested and has been used my thousands of traders, most notably Lightspeed Trading.

Hi Emmett

I try to open an account the trade zero.co but was told i can not open because i live in the us. Is there a way around this?

hey Emmet, i want to sign up via ur link,but answer my questions pls:

1. have u funded and traded through their platform?

2. what if i want to trade only stocks for starters? not emini, futures, etc; what min amount should I own to deposit?

Why not ask Trade Zero question number 2? They should be able to answer it and tell what the minimum amount is that you can deposit.

tradezero don’t have futures trading, only stocks, EFTS and cfds.

I have not opened an account with TradeZero. However, since the review was published, I can definitely report that over 20 accounts have been opened. No complaints thus far.

so i joined the broker. I cant resist the cheap trades , I hope it works out. The trading platform is a bit limited compared to some i have used. I will keep my interactivebrokers account as well.

Emmett, are you still positive about this broker?, I plan to send money on Monday..

i d like to follow u up with trade zero robert! i want to join but scared of scams that burned me (((( how can i get ur contact?

hi . yes I am a bit worried too, I plan to move most of my Interactivebrokers account if it is the real deal- for now I am planning only $5000.

i would like some more reviews before i do though.

Emmett can you please send obama my email address, I dont want to post it ere.

and honestly we need a full fledged invision style forum

thx for quick reply, waiting for Emmet to send ur email to me, so we can keep in touch, i may have useful experience to share with u.

Trying to find the best solution for the forum. Testing a few versions now.

Hi guys I’m right in the same place you were when you wrote this comments. I don’t feel very confident wiring funds to Tradezero, any update on this broker? Easy to withdraw funds?

No problems from my end. Am very confident that I would have heard about any issues from users.

Hello,

I’ve been trading with TradeZero since February – and I cannot be happier with their platform / executions.

Their Short list has also been improving and I can imagine much greater things to come in the future. Their support team has also been quick to respond to any issues you may have and try their best to really help you with your problems.

Thanks Antonio and team at TZ!

Did you find this review helpful? Yes No

This may be “insanely cheap” for stocks , but their comms for options are $2 flat fee + $1 per contract…… you didn’t mention this? That is insanely expensive!! And it’s regardless of account size they say….

Outgoing wiring fees $99

Incoming wire fee $50.00.

That’s too much.

I would gladly pay a wire fee and have free commisions! Over $1,000 commisions to Suretrader last month so Tradezero has something good if your a small trader and don’t to trade prop.

pay 4.95/trade is better? do the math

If you transfer in or out through Neteller is 4%, so up to 2500$ out and 1250$ in it is cheaper option

I have been using tradezero since December, and my experience with them is very good. Platform is fast, fees are free or too low and the customer support is very helpful and they always solve your questions.

If you have a small account and don’t want to burn it with other brokers that charges a lot of fees, then choose TradeZero, it will give you more room and fees won’t influence your trades.

Thanks for doing this, can you guys expand on the risks with CFD vs regular stocks? This had me concerned since I didn’t know about such a thing.

Thank you,

cfds run parrallel to stocks. Even large brokers liek Intercativebrokers offer them (but not to US citizens) . they circumvent the PDT rule but are more expensive than trading the actual underlying.

I think tradezero must offer both cfds AND the actual stock – . Much better to trade the underlying stock as the cfds always have more spread.

This is awesome!

Keep rereading this! My trading is going ok, but the commisions at Suretrader ($10 RT) are really dragging down my overall return. TradeZero’s awesome fee schedule could really gelp me step up my game! Hopefully they will accept Americans soon.

I am not currently day trading, but I did for several years until recently. As I recall the PDT rule required a minimum of $25K in your account for day trading, not $30K as stated above in the review. Has it changed recently, or was that a misprint?

Hi Emmett,

You say, “Without the implicit guarantee’s of Finra compliant company.”

Having been involved in two FINRA complaints I’m here to tell you that FINRA sides with the broker or other entity much more often than not. In addition they are slower than molasses in Canada in the dead of winter. I suspect they hope you will give up and go away.

Proof of FINRA’s failure to be fair can be found in Bank Investment Consultant May 2015 issue on page 11 which says in the article:”The $1.2 million award, while significantly less than the amount the claimants sought, was nevertheless a big win for the Samuel family as FINRA arbitrators rarely side with consumers, Pearl said.” (Pearl was the trustee’s lawyer.)

I agree!

I do not want to be an Alarmist but I am an overseas trader and went to checkout tradezero got account opened was pretty easy BUT when it came down to fund the account , my wire was rejected. My bank account is in biggest bank in my country so went to main branch to find out what occurred and turns out that no banks in my country are allowed to wire or receive wire to tradezero for reasons of suspicious activities, basically some kind of fraud or loosely translated laundering money. I had to spend next 2 hours explaining that am a day trader and was looking for a better broker and not some Central American Capo trying to hide my money. So FYI

MY bank in a foreign country wouldn’t allow me to wire money to ETrade. Does that mean that Etrade is a dodgy company or that my bank us useless?

well I have no idea about your situation but I was sharing my recent experience with tradezero and the reason given to me, no where in my post I am bashing tradezero or trash talk.I was actually looking forward to fund and trade with them since Emmett gave such a great review.

@BigLou I didn’t mean to suggest that you were bashing Trade Zero. I was trying to point out that banks can be difficult to deal with especially when they are asked to do something that they don’t do often.

The real reason that suretrader accepets US clients and Zerotrades does not is the least offers CFDs only which is not legal in the US and that’s why it also offer free commisions. They are not the same as the article tried to describe.

I am a Tradezero client and the above post is totally inaccurate. CFD is a separately traded product that regular stock trading. I am using TZ for both of these types of accounts. CFD trading also has nothing to do with free commissions.

I am very happy at TradeZero and I hope that they never change their pricing model.

Emmett, are you not contradicting yourself with this write up? I have seen where you have consistently excoriated trading rooms for using Limit orders, claiming that it is almost a red flag for fraud. Yet here you are telling folks that it is a great idea to use Limit orders.

So are you now going to update all those reports where you claim that Limit orders for trading are an indicator of a scamming trade room?

There is a difference in evaluating a Trading Room using limit orders on entries to scam you and a brokerage company offering free limit orders due to the rebate. By the way if you trade enough you can get commission rebate with IB and other brokers. I cannot speak for Emmett but I think the point is if a trading room is using limits for entries you have to take that into consideration as it can be a scam whereby only the TR operator gets the fills. This trick is more common in micro scalping.

Its only a problem when a trading vendor claims to get limit orders, but is not willing to prove the execution. Of course, everyone should attempt a limit. But not everyone should sell a trading system claiming amazing success that uses only limit orders from within a scalping regime.

Ah. I must have misunderstood. Are you then saying then that it is not simply a matter of using Limit orders: it is more a matter of the operator being transparent about the fills, and being willing to verify those fills? Record verification is important, no matter the type of orders being used.

I guess that I was reading more into it than you meant, and thought that you were simply against trading rooms using Limit orders, period. My fault; I should have read a bit more carefully.

I signed up with them yesterday, so I haven’t placed any trades yet. But the signup process and support until now has been good, so its a good sign.

hey kenneth, can you now tell us , about your experience with them? since ..i assume u already placed trades with them?

Thank you

I don’t think its cfc’s they state the ECN for market orders and limit orders, so should be real stocks

ECN brokers can be cfd brokers and market makers even if they state other wise. While you may not be trading directly against your broker, you might be trading against another cfd broker. Call up a cfd broker and ask them where they get their liquidity. If they give a generic answer of liquidity providors, banks, it´s a good chance they are a market maker. Not against their clients, but against a cooperating brokers clients.

Many new traders think they are not paying a commission when using a cfd broker. But the spread is the commission. Lets say you are trading the SPX, the spread for cfd spx is usually 5 pips. Not that bad ehhh? Lets say one enters a trade of $10 a pip. Thats leaving $50 bucks on the table. While you are not paying commission per say, your broker made $50 off the trade to enter and another $50 to exit the trade which equals $100 to the broker on the trade. Sounds kind of expensive to me.

Here is a good link that explains ecn and stp brokers.

http://www.fxkeys.com/the-difference-of-true-and-false-ecnstp-brokers/

It is not clear from their site but it seems you are trading CFD not real stocks?

If it is so, I do not think it is a good option for traders. Trading CFD Broker looses money when trader earns. Good for beginners who can get familiar with trading but understand first deposit would be lost. Bad for ones who are going to earn.

This is similar to Colmex/Tradenet. If you earn they just raise your fees till you can not trade with them anymore.

It is never a good option when broker is interested in trader loosing money.

Or I got it wrong and you trade real stock?

They have LII & T&S in the platform so if you have a live account you can possibly check whether your orders are in the book & executed. I have seen the CFD part on their website but it doesn’t refer to specific products so I would like to have it clarified as well. I want to check them out but if it’s CFD’s, then I already have an account with cfd stocks through an English broker and they charge no commissions as well.

Just chatted with them at 7:34 PMT. Cool that someone is even available. Unfortunately it took 20 seconds for them to ask my location…sigh. As a small time, U.S. based trader, i’m stuck with Suretrader. Hopefully this new firm will put some pressure on Suretrader to have more competitive fees. Btw, SpeedTrader in the U.S. and Suretrader in the Bahamas are said to be owned by the same individual. intresting that TradeZero’s founder came from SpeedTrader? The pro platform looks a little like DAS trader also…Wait n see.

Hi Emmett,

Thanks for this. Great read and very exciting as well. Really appreciate the effort put in to validate the company.

You were working on a review for a company or vendor over X-mas, was this it, or is that one still forthcoming?

Regards,

Josh.

One thing I did not mention in the article are automated quant firms, like Virtu, whos sole purpose is to do nothing more than execute limit orders and add liquidity to markets. They operate to simply capture that rebate for executing limit orders. People wonder how these quant firms make profits, month after month, and have one losing day a ear. Well now you know. The more limit orders that a firm can fill, then the more profit it makes.

Traders should think like market makers. Stop being so directional and think about taking the other side of people that are willing to move the market higher or lower.

Yeah, it was supposed to be someone who was ‘paying their bills’ by trading, and wanted Emmett to wait until after Christmas because they didn’t want an influx of people over the holidays. I’ve been looking forward to that one.