The Trading Zone

-

Honesty

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(1)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

Yet another trading Guru with absolutely no record of ever trading successfully. Greg Weitzman wants us to give him $5,500 to learn how to day trade, and yet he simply refuses to provide even the minimal amount of proof that he trades successfully himself. The live trading room is a complete joke. No trading DOM present on the screen, no trading from the charts, no record of trades called inside of the trading room. A complete and total waste of time.

User Review

( votes)Thanks for reading today’s review of The Trading Zone

What is The Trading Zone? The Trading Zone is a day trading education company that is owned my Greg Weitzman. The site has been operational since 2003 and I would consider this to be one of the older educators on trading scene. The Trading Zone has three educational products available for sale: bronze 6 month membership at $2,700, silver 1 year membership at $3,700, and gold lifetime membership at $5,500.

Each of these educational products comes with open access to a self paced, home study course that includes basic concepts in technical analysis, tape reading, money management, and trader psychology.

In addition to the self paced home study course, there is a live trading chat room that is moderated by a person named “Gator” or Larry. The concepts that are taught inside of the home study course are meant to be used in conjunction with the live trading room. The more a person spends, the access that the person received inside of the live trading room.

Who is Greg Weitzman?

During the month of November, 2015 using an alias, I reached out to Greg Weitzman and asked for proof that he has ever had a successful career as a day trader? Unfortunately, Greg could provide absolutely no proof of any trading success whatsoever. I explained to him that I was ready to send over my $5,500 for the lifetime membership, but I just needed to verify that he could actually trade successfully himself. He refused to provide any proof, instead he fell back on the age old excuse that he could not show me his trading statements because “that is illegal”.

During the month of November, 2015 using an alias, I reached out to Greg Weitzman and asked for proof that he has ever had a successful career as a day trader? Unfortunately, Greg could provide absolutely no proof of any trading success whatsoever. I explained to him that I was ready to send over my $5,500 for the lifetime membership, but I just needed to verify that he could actually trade successfully himself. He refused to provide any proof, instead he fell back on the age old excuse that he could not show me his trading statements because “that is illegal”.

Is showing trading account statements illegal? Absolutely not. In fact, many reputable vendors show trading account statements on both their websites and in private viewing. A quick look at my website and you will see various vendors that have absolutely no problem showing that they actually trade with a real money account, and with the methods that they teach. Its preposterous, rediculous, and absolute nonsense that “its illegal” to show someone that you can trade successfully. Some of my favorite vendors that have no problem showing trading statements is WatchHimTrade.com and B12trader.com.

As many of my readers already know, I am a cooperative witness with the CFTC or Commodity Future Trading Commission. I remember the very first time that I asked the CFTC investigator if it was illegal to prove that a person can trade successfully by submitting trading account statements? The investigator laughed at me and asked why I would even ask such a question. During our conversation regarding this topic, the investigator kindly explained that any educator or signal provider must disclose whether performance summary is actual or hypothetical, and in addition must include the standard summary that past performance is not indicative of future performance.

The bottom line is that anytime a trading educator tries to toss that BS line that they cannot show trading performance, then this is a sure fire clue that they are trying to hustle you. Don’t fall for it.

Regardless of Greg Weitzman’s complete and total BS excuse for not showing any sort of personal trading performance, I continued with the review.

Who is Larry “Gator”?

Larry is the moderator for the live day trading room. From the biography posted on The Trading Zone website, Larry proclaims himself to be an ex floor trader at the Chicago Board of Trade. He claims 18 years experience. How true is this? Its hard to tell. Anyone can write whatever they want on a website. I can proclaim to be Mickey Mouse and a super bowl winning quarterback, but its obvious that I am neither. With Larry, we dont really know the truth, but at least we have him inside of the live trading room, and we can watch how he conducts himself.

Larry is the moderator for the live day trading room. From the biography posted on The Trading Zone website, Larry proclaims himself to be an ex floor trader at the Chicago Board of Trade. He claims 18 years experience. How true is this? Its hard to tell. Anyone can write whatever they want on a website. I can proclaim to be Mickey Mouse and a super bowl winning quarterback, but its obvious that I am neither. With Larry, we dont really know the truth, but at least we have him inside of the live trading room, and we can watch how he conducts himself.

The live trading room should serve as the ultimate test of trading performance. If Larry could produce a verifiable, and winning track record, then maybe The Trading Zone has something going on.

Before I attended the live trading room, I emailed Larry “Gator” and requested any sort of proof that he could trade successfully. Once again, he could provide none. I asked him how could I possibly spend $5,500 for his trading knowledge, accumulative experience, and teaching if I could not verify that he had actually ever traded successfully? He could produce no proof. Instead, he simply asked that I watch him trade live inside of the live trading room. Fair enough, and so we proceeded with his offer to watch him trade.

The Trading Zone – Live Trading Room

From November 15 through December 6, we recorded the live trading room in its entirety. All recordings were obtained by using several different alias’s and captured using Camtasia screen recording software. In total, we captured approximately two weeks worth of live trading. What did we see? Almost immediately we had problems. The first problem is that at no time did we see a live trading DOM present on the screen. Nor was there ever any trading from the charts. Everything was done verbally by Larry “Gator”. To give Larry some credit, he did give the audience entries and exits on stops and limits. The trades were easy to follow. And Larry does have a voice that just sounds like he knows what he is talking about. To be honest, I quite enjoyed listending to him talk.

Another problem that I have with Larry is that he keeps absolutely no record of his trades that he calls inside of the trading room. He can call a trade in the morning, and then you can ask about this same trade only a few hours later or on the next day, and he has limited or no recollection. This creates a problem because I could not build a track record of trades.

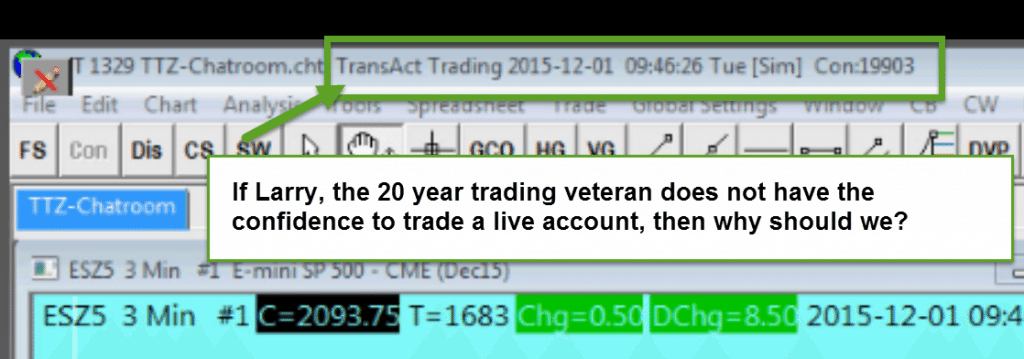

Furthermore, Larry is not trading with a live account. Instead, Larry is only trading with a simulator issued through Transact Futures. I find this particularly troubling that Larry, with all of his years of trading experience does not actually trade live. Instead, he expects his students to simply trust him, and to trade their own live trading accounts based on nothing more than trust and hope that Larry is a good trader.

One more thing that I find troubling about Larry is that he leans too hard on “Pit Action”. What does this mean? Larry came from the trading pits in Chicago and his individual experiences place a higher emphasis on what is happening in the pits. On several mornings, Larry would become loud and excited because of “large institutional money was flowing into the SP500 trading pit”. However, I have no idea what Larry is talking about. I checked the daily volume of the SP500 trading pit and the daily volume barely hits 10k contracts on a good day. However, the ES500 mini contract regularly hits 1,800,000 contracts during the trading day. Yet Larry somehow believes that the trading pits in Chicago (which will be closed shortly) somehow still move the markets. Sorry Larry, but I have some bad news for you…the trading pits are irrelevant. All of the trading is happening on electronic markets. But Larry spins this stuff in the trading room with such confidence and excitement that you cannot help but want to believe him.

Larry is not attempting to be deceitful or be dishonest. The truth is that Larry’s pit trading experience is simply not relevant to today’s electronic markets. Larry sort of reminds me of my late grandfather. During my first school dance, which was the 6th grade in elementary school, I had no idea how to dance. But my sweet grandpa decided to bestow upon me his “old school” dance moves from the 1920’s prohibition era. Yes, I practiced his moves with great vigor because my grandfather was the smartest and most awesome guy I knew. However, when I showed up for the dance…nobody was dancing like the way my grandfather had taught me. To say that I struggled is being generous to my grandfather. The truth is that my grandfather’s experience was from another time, and what he had taught me was no longer applicable. I get the same feeling with Larry, he is attempting to teach from the perspective of a pit trader. Unfortunately, the pit traders have not been relevant since the 1980’s. Once electronic trading hit the scene in the 1990’s, then everything changed.

I would love to give Larry the benefit of the doubt. I would love to believe that his old school, pit trading mentality is still relevant. However, since Larry has no verifiable track record, no live trading account in which he trades, and no record of the trades called within the live trading room…then why should I, or anyone else pay attention to what he is saying or teaching.

If Larry were trading a live account and gave me a private viewing of a minimum of 4 months worth of trading statements, then I would be the first to pay him $5,500 for his trading wisdom. But as it stands now, he has absolutely zero proof of any trading success whatsoever.

My brother has a saying, many of you are probably not aware that he is a retired FBI agent, and an exceptionally smart guy, anyway he loves to say “garbage in equals garbage out”. In other words, when conducting an investigation, if you put garbage in the investigation, then you can expect to get garbage out of the investigation.

Garbage In = Garbage Out

When selecting a trading educator, there has never been a saying more true than “Garbage In = Garbage Out”. If your educator cannot trade successfully, then how can you possibly expect to take his methods and expect a better result for yourself? Too often I receive emails from readers that describe to me horrible experiences with other trading educators. How they paid thousands of dollars for the “advanced mentor” program, or the lifetime access to the guru program, or the mastery program, and they later learn that the trading educator simply cannot trade. Their stories arrive daily and although the words are different, the story is all the same. They paid and later discovered that the guru was just a charlatan that masqueraded as a successful trader.

Very often, I ask these folks if they would like to write a guest post on TradingSchools.Org. So they can share their experiences and warn the trading community. The most common response that I receive from these folks is that they do not want to write anything bad towards the guru/charlatan because they do not want to lose the lifetime access to the educational materials.

Folks, if you purchased a trading product and you later discovered that the guru was actually a charlatan, then you need to simply accept the hard and cold truth that the methods taught are going to only lead to further pain and frustration. If the guru does not trade, and cannot provide no proof any trading success, then whatever you have purchases or whatever stories you have been told is not information based upon fact, but on truisms.

If the trading educator cannot trade successfully, then he is inserting garbage into one of various holes or insertion points on your body. Inevitably, this garbage is coming out, and its going to look even worse than it did going in.

Wrapping Things Up

Another day and yet another trading guru with absolutely no record of trading success. The Trading Zone is quite simply a complete and total waste of time. None of these clowns are willing to provide even the most measly morsel or proof that either can trade. I would love to come back a write a new review based upon some of sort of verifiable proof, but I have a feeling that Greg is going to cling to that BS excuse of “its illegal” for me to show my trading records until folks finally stop buying his BS.

What typically happens with vendors like The Trading Zone is that the reviews that I write are so painful and deliberate that they are forced into providing additional disclosure and showing the bare minimum: a trading DOM and a track record. Guys like Greg wont do it until this review follows him around like flies follow cow manure. He will cling and cling and hope that I simply fade away, but it wont happen. I will keep writing about him until the entire trading community knows the BS that this guy is pushing.

Thanks for reading and don’t forget to leave your comments below. Even the haters and trolls will find that their voices are heard.

From someone who has been in the TTZ chatroom for around 4 years now, this review couldn’t be further from the truth. Go and spend a decent amount of time in the TTZ chatroom (it is completely free access for everyone) – Gator calls his trades live, spells out the targets and stops. You can record all the trades he takes and see for yourself that he knows what he is doing.

The charts displayed in the room are sim, those aren’t Gator’s charts. An attempt by the reviewer to mislead you.

I have learnt more about trading in the TTZ room than anywhere else. The reviewer of this article needs to do some proper research.

I remember Greg Weitzman before he started The Trading Zone. He was helping moderate a room on PALTalk (about 2003) in which he discussed the movements in the E-Mini S&P 500. He later started his own room which the previous room owner was not very happy about. One day there we has a discussion about a name and he finally settled on The Trading Zone. In the room he would indicate if something was setting up but it was for the individual to make his own trades. He was not selling anything at that time. I did visit his room on PalTalk some years later after he started selling his courses and he was about the same but he had helpers that sounded like they were pushing the course. I made a call on S&P 500 movement for the later part of the day which

worked out exactly in the room and later one of his helper was claiming they made the call. Trying to make their room look good. Last time I visited the room.

This review is not at all correct. Gator trades live with all the stops. They do not even charge monthly fee for their trading room. I wish you would revisit the room when Gator is trading for a week and I bet you would reverse your views and recommend the room to others. I have been member for the last one year

and I found TTZ is one of the few honest trading rooms out there.

Please use correct English in your Greg Weitzman text. Out of many errors, watch for: It’s hard to tell …. ” NOT “Its hard to tell… “, “It’s illegal” not “its illegal”. Just that lessens YOUR credibility as a serious source for traders.

Agreed. If you read my early articles…it’s a horror show. Errors galore!

But my recent writing is better? I hope so!

@Grammar Nazi Thomas – No need to capitalize the “i” in the phrase “it’s illegal.” Making mistakes like that lessens YOUR credibility as a pathetic grammar Nazi. (Also, you forgot a missing double quote in your comment, you improperly have punctuation outside of double quotes [unless you are British], you have a backwards double quote and an improperly formed last sentence.)

Well, I actually appreciate the comments regarding my poor grammar. How does anyone get better without critique?

Critique is good, if offered in the correct way.

“Praise in public, criticize in private.” – Vince Lombardi

Speaking of POS scam artists…I think Emmett takes the cake. Nice Job Emmett on this rave review of just how trustworthy and honest your endorsements are…who’d listen to a fraudulent con artist such as yourself…just idiots who can’t think for themselves.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

I did a free trial with these guys. I saw NO trading results recorded or published. The mods made a few live calls (most of which did not make money). The calls were also suspicious (slightly after the fact), e.g. in a fast market saying, “I bought NQ there at 55, and am up 4 ticks”.

I was continually hassled to buy their full package, when I pushed back they kept offering discounts. It was all hard-sell. No substance. Of course I bought nothing and left, the whole thing looked rubbish.

These guys at The Trading Zone are nothing but scam artists. They offer nothing in regard to a trading edge or insight. Keep away.

Just an FYI – you’re incorrect with your picture of the charts in the article. Yes, those are in sim, but those are not Gator’s charts. Those are provided by Josh Harris from Infinity Futures as a courtesy to the room. As a member, you’re provided with templates that contain the actual indicators used in the methodology. Also, I have seen both Greg and Gator’s live charts and trades they have taken. No, they don’t have a track record, and I wish they did to disprove the naysayers, but that’s their prerogative.

1221 Hiddenridge

hav e you ever rated slick trade or nadex solutions.

Yogikeung, to properly respond to your question I would have to write a paper and frankly I sort of hate to respond to your question, because I will just piss off the delusional day traders out there. I make my living as an investor not just off day trading. I also invest in real estate, bonds, long term stock, and etc.

But first to Ben, seriously I sound like Rob Booker? The funny thing is I actually joined Rob and Jennifer’s room a long time ago. I remember his Knoxville Indicators with his inverted Risk to Reward crap that required an 80% win rate. Everything I write about is how trading rooms that teach this sorta stuff are complete BS, so no I am not Rob Booker or sell or plan to sell anything trading related.

Now back to Yogikeung, in many ways trading rooms are giving people the product they want. It does not matter that it cannot be traded profitably by anyone. It is a fantasy after all. It starts with the fact most people that try to day trade are just clueless about realistic returns. And frankly I am sad to report I was one of those people. It took me years to finally wake up from my Kool-Aid state.

Here is how some of the delusion starts. You get people who do not have $25K to invest in stocks so they invest in futures. Just because they let you invest in futures with a $5000 account does NOT mean you should!!!! It is impossible to invest using real world trading techniques in futures with a small account so trading rooms invent the Matrix, a complete fantasy trading world with fantasy rules in order to be able to con people who are completely underfunded to invest in futures. It does not matter that none of them can trade using those rules profitable. Just look at GTR and the comments there or any of the trading room mentioned here. Look how often Emmett begs these people for any proof, just a small lick of proof they can trade profitable yet they cannot produce any. I have seen rooms use Footprint to say they can see those iceberg orders and can nail the exact turn around point and risk 5 ticks to make 100 ticks. Yea right! It is all BS for the Matrix Trading World. I have never met a profitable trader that trades like that. Maybe they exist, but I have not met them. It is like looking for Big Foot.

Without me going through a long explanation of why you need multiple cars to trade profitable and a long explanation of how you have to trade market structure and not some arbitrary 10 tick or 4 tick stop loss based on nothing but your funding ability, I will just say in my opinion to trade future profitable you need to risk around $1,000 per trade (based on trading multiple contracts). I can see the disbeliever replying now. The fact is the market does not care if you are underfunded and cannot hold a proper stop, it will take your stop and laugh all the way to the bank. I was talking to someone that planned on making a living on a $25K account and I was like are you planning to live in a tent.

In the real world the top Hedge Fund managers are doing cart wheels if they make a 25% return a year. I am going to give you a homework assignment. Look at the trading world cup competition and see what returns they get. Remember these are the top traders in the world and they are risking 30% sometimes in order to even get those returns. You will not get anywhere near those returns, yet most would be day traders have expectation of returns way higher than they get. It is insanity!!!!!

In my previous fantasy explanation I talk about the person with a $5000 account who expects to make $250K a year, but the sad fact is it also applies to a person with a $50,000 account. You are not going to make a 400% return year after year.

So what are realistic returns? If you are a good investor and having a good year I believe you can make about 150 to 250 R. Remember that is a good investor having a good year. There will be years that you actually lose money. This is how the real world works. So if you are risking $1000 a trade you can make $150K to $250K. I would have to go into a long explanation of real win rate as opposed to the fantasy 80% win rates. But you are not going to be risking $1000 with a $5K, $10K, or even a $25K account. And you are going to have gut wrenching drawdowns.

But here is the good news. Let’s say you do have a $50K account and forgot all the crap the trading rooms teach you. You can risk $250 a trade or 0.05% a trade and make $37K to $62K if you are a good trader and having a good year. Now anywhere in the real world that would be considered a great return, but yet most day traders expect insane returns which cause them to trade in the Matrix with Matrix trading rules. As I have stated before people would rather trade in the Matrix where they will never be profitable then trade in the real world and make money. And I tell you trading in the real world is tough and mentally devastating. After trading in the real world you might be like cipher and say, I do not care if the steak is fake, “I want back in the Matrix”, where with a $5000 account I can trade futures and just risk 4 ticks and have an 80% win rate and make 100 ticks a day or more, have a nice straight up equity curve and take home a nice pay check each day. Man that does sound sooooooooo Good.

😀 😀 Sorry man, just seeing your name and reading your post… 😀

Yip, his divergence strategy (triffecta 6 now) is the gift that keeps on giving! 😀

I too contributed to the Rob B. fund 🙁

Good post man!

I agree with you, been at the trading game for 4 years nearly.. and yes, very underfunded!

But FX and futures micro lots you can trade a 5k acc, obviously not for a living.. like renting a car before buying it out right… to see if it works 😕

Then it’s a mater of scaling up.

Funny how no educators touch the micro’s, but volatility isn’t in the daily range but in weekly and monthly range.

Your right again about educators teaching mostly what’s in demand and not what’s actually helpful… which is the start of the scam.

I think educators/brokers want the 95% of losing traders, to stay losing and keep spending on education/commissions,.

The never ending cycle of: hopes and dreams, the blind leading the blind, sheared but never slaughtered, .

There’s no holy grail, only what suits the individual.

Jokes a side… educators can only teach what they themselves like/know/trust/understand most of it is repackaged free info from forums, but some have small jewels mentioned in passing which you’ve never heard before… and you click with it and can action it successfully..

The more you learn the more ‘jewels’ you have in your plan and the more successful you are.. but always balancing the search with your current plan… and like Rob said, he has a few plans.

Eventually, you’ll just give up in complete confusion or you’ll be profitable at one or a few things.

So educators are necessary, trading rooms… must be a Gen Y, millennial thing.

Oh man, I just have to comment here and I’ve got to say a few things about comments made above. I love coming to this site especially when you guys/dolls (sorry I just saw the play last night) gang up on these scammers led by the fearless chief Emmett.

I make my living as a trader (and I’m not selling anything). I’ve been at it for about 15 years and believe me it took quite a few of those years to learn how to do it right. Look at it this way — a doctor, lawyer, writer, engineer, spends 7-10 years “training” to get good at what they do and to make a respectable living. Why do you think you as a trader can learn it in 6 weeks? Ask yourself, “am I dedicated enough to spend an enormous amount of energy and time aside from the money to be a consistently profitable trader (and I emphasize “consistently”)”. I think what many new to trading people want is simply to be shown the trades, maybe learn a few concepts but basically let the real trader just make money for them. And that’s not a bad thing, assuming you can find a true trader who’s not a scammer — which is why this site exists.

Someone above mentioned that you can’t use an arbitrary 10 or 15 tick stop on all trades. That is the truest of the true and any trading room that defines their stop in this manner isn’t really trading. Any stop should be based on the market, not on what you feel you are willing to risk, what you feel comfortable with — that’s what the scammers are selling — you can be comfortable trading because you only have to risk 4, 8 10 ticks — easy. But wrong. The market doesn’t care what you are comfortable with. Your stop has to be based on the chart. If the risk is too big for your comfort level, go down to a smaller time frame.

Example: I trade multiple time frame charts (and by the way, trend is determined by the time frame you are trading so the cliche of “the trend is your friend” can be defined by which chart you are trading). Now I can trade a 3 minute Crude chart with 14-20 ticks stop (that’s not an arbitrary number, it is based on where I find pivots that the whole market can see. Sometimes it may be 12-14 ticks, other times maybe 20, if Crude gets extreme (which it does), then based on the chart I might have to use a much much larger stop or pass on the trade). Cause that’s where everybody else is lining up (remember who you’re playing against!!!). Now if I’m trading a 60 chart, I probably can’t find a trade where only 14-20 ticks would be appropriate; I’d have to look at the chart and find a pivot that would define my stop and see that I was comfortable with that (not comfortable arbitrarily but that my stop was placed where it should be, based on the chart, and I am comfortable losing that much money if I enter the trade and it turns against me).

And to comment on another commenter, it’s not a get quick rich profession. It takes hard work, dedication, concentration and tenacity. Believe me, I made every mistake in the book, you can’t name something bad in trading that I haven’t done, including all the psychological and emotional toil that goes with trading. In fact, I was a great philanthropist in my early trading days; I gave and gave to any market or stock that caught my eye.

Sorry to go on.

Great comment. Really appreciate that you took the time to write this note.

Agree totally true. id say 5 years minimum and then you never stop learning and are not guaranteed success.

Id say more difficult than any of those professions, Doctor, lawyer etc.

If you do gain an edge and a consistent method then there’s the emotional battles to deal with on a daily basis. If you are not strong minded then forget trading.

Lots of wisdom in this comment.

RTChoke, thanks a million for your post and being very transparent here, especially on paragraph #2 when it comes to the craft of trading! My main language isn’t English, yet I command respectable fees as a writer and that specific paragraph #2 is a golden gem in its own!

Not selling anything, me neither from now on. A fan of this site and your great comprehensive response brother. Thx for the good read.

Hello Rob,

Thanks for your comment.

I can’t say I’m in the know in regards to trading rooms. Hence, my frequent visits here at Tradingschools.org for some education. You’ve highlighted some very important points to consider. A big take away for me, and I can attest to it by the battle scars on my face, that “the real world (of trading) is tough and mentally devastating”

Peace

and just when I wanted to start with $2k to $5,000 to earn at least $20k-$30k a year part-time instead of my traditional poker sides! Thanks for your post to the OP, been reading offerings and basics in websites or Amazon $2.99/free kindle’s would be great to a degree, but those hard doses of reality would be great for guys just like me that are into binary options and forex learning. It went to the gut and jugular on my end, but great to read your huge reply as well Rob.

Francis

Rob,

Your point to huge amount of sadness yet lots of comfort on my end to study way more then I thought I was required to trade and get at least 40-100% returns each year on my end. Anything else and I think it won’t be worth it counting the amount of study time I have as I am a web developer at day and linguistic student at night (apart from family full-time ends on the weekends!) so my edifying point to you sir, would be!

– Would $5,000 be the bare minimum to expect 40% returns in spot forex/currency futures?

– How many productive (in the zone learning hours without any distraction!) average folks (education, agility, intelligence, capital) should have in their belt before attempting to trade Forex or ETFs?

– If you were to start all over again – everything you do in trading – what would you do differently? Read a better book, more education, better funded? What exactly?

Would be awesome reading about the above if at all possible as I still can’t find these exact ones yet, 1-2 sentences should suffice if possible.

Thanks a ton.

Francis,

First Congratulations you are actual wise enough to ask Good questions instead of believing in the fantasy so many people perpetuate. I have written many posting explaining my position and sadly fighting with others. I wrote many post here in a fight with others:

https://www.tradingschools.org/reviews/bulls-on-wall-street/

Read all my post and you will get a good idea of my views on daytrading, but I will try to give you some brief answers to your questions:

“Would $5,000 be the bare minimum to expect 40% returns in spot forex/currency futures?”

Returns are tied to your risk and tied to your draw downs. Only you can decide. I will tell you I personally will not risk more than .05%, which means if I had a $5,000 account the most I would be willing to risk is $25 per trade and I would not allow more than -3R loss in a day. I am just not willing to take the bigger draw downs that come with bigger risk. But that is me and each person has to find what they are comfortable with.

“How many productive (in the zone learning hours without any distraction!) average folks (education, agility, intelligence, capital) should have in their belt before attempting to trade Forex or ETFs?”

I am not sure how to answer that question, here was my experience. Big Mike says it takes 2000 or more hours. But I say if you are trading in the Matrix like I use to trade it does not matter if you spend 2000, 10,000 or 1M hours you will never be able to trade it profitable. I just lost money trading that way. Once I switched over I just traded very low R as I learned, which is impossible to do trading futures. I am still learning and learn more every day. I can only tell you I spend a lot of hours.

“if you were to start all over again – everything you do in trading – what would you do differently? Read a better book, more education, better funded? What exactly?”

This one I can answer. I was a real estate and long term fundamental stock investor. When I started day trading I was clueless. I believe the trading rooms and vendors were sincere and actually profitable traders. I had no reason not to believe them. Man was I a fool. I got suckered into a trading room that showed years of profitable results. I had no clue they were all fake. After that I could smell a scam trading room from a mile away with the murky unclear calls and etc. I would try trials and every one of them was smoke and mirrors. I was like what the F@## is every trading room a complete scam. Emmett’s site started during that time frame and I then realize I was correct all these TR are ran by con artist who goal is not to teach you to be a successful trader, but to scam you out of your money. At that point I final wore up from my Kool-Aid induced state and said how the hell do the 5% profitable traders trade. I then researched and actually talked to some of the great traders of our time and even got to see some of their equity curves. And I tell you it is not the fake straight up equity curves the TR show you. You can refer to Vlad site for some of them. And you know what; they all said the same thing. None of them traded the way the trading rooms taught. At first I could not understand why in the world are TR teaching complete BS. Then I realized it, they are teaching what people want to hear. They create the Matrix telling underfunded traders how they can make amazing returns trading. It is all an illusion. Once I accepted reality then I started created what I called my Holly Grails (HGs). And not one of my HGs is about a set up. As I tell people again and again it is not about setups. And I started trading using those concepts. Here is the basis of my HGs:

1) You must trade actual market structure, no arbritatry stop loss and targets based on your funding. The market does not care if you are underfunded it will take your stop loss and laugh all the way to the bank. And if you are not properly funded do not trade that instrument,

2) Cut my loser,

3) Add to my winners, and finally

4) Let me winners run,

Now my actual HGs are pages long, but this is the gist of them. And then I spent hours trading based on these basic concepts. No longer trading 1 car in CL and doing 20, 4 tick micro scalps. I cannot even believe I was actually that stupid. I get angry even thinking about it and the TR that teach that crap.

If you are realistic with realistic expectations and want to talk then let me know your BIG Mike id and I will PM you or let me know you Skype ID and we can talk if you are interested.

I think it’s a great service getting these scam sites out of the way, those that charge up to $5k to $10k and extra. They try to use a high price to sell the dream of making ten times that amount the first year. Like this site, the tradingzone, charging 5.5k supposedly due to inflation raised up from 5.0k being around for many years, yet no proof students have become successful for that fee. And with reports of losing membership to the room even having paid the lifetime fee. Pertaining to the article’s about pit trading being closed. On other forums there were more than a few former pit traders who struggled with online trading yet people flocked to hear them when the stories of a golden pit past now seems to be history. An example is tradingadvantage which should be reviewed someday where the pit trader mostly made his money by advantageous never available to a retail trader, now purporting to sell online trading methods at the the same time they have a store selling custom desktop trading pc systems. Not to mention their shill spam posting on the forum trade2win.com some years back when losing students spoke up.

The pits traders used to make their money by simply being in front of the orders, as they flowed into the pit. For instance, in the pre electronic trading era, you would have to call your broker over the telephone. The broker would fill out a slip of paper, and then hand the paper to a runner, the runner would signal to the guy executing within the pit. This was true order flow trading where you knew the orders were coming into the pit, and whom was executing those orders. The guys in the pit had a technological advantage over the guy trying to trade through a telephone ordering system. Those days are long gone. Yet these pit guys are treated like they have some special abilities, but they are just people that quite literally happened to be in the right place at the right time.

Yogikeung

I am going to respond to your post. There is a reason that 95% or more day traders lose money and here is where I will get the hate mail. Trading rooms teach fantasy to individuals who are completely clueless about money and return on money. These day traders do not teach you to slowly build your account but teach how to gamble shooting for that 1 in a million shot.

These would be day traders have heard the story about the person under the right once in a lifetime market conditions turned $5000 into a million dollars and they base their entire trading on this believe. Here is the fantasy trading world that most of the trading rooms teach:

With a $5000 account, in just a short time period of taking their education course, you will be trading futures (what a joke) with an 80% win rate and make 100 ticks a day or more, have a nice straight up equity curve and take home a nice pay check each day. I call it the Big Foot Fantasy. It is complete BS. But this is what the Trading Rooms teach and it is want people want to hear. Every time I see a trading room trade CL with some arbitrary 10 tick stop loss talking about how they are making 200 ticks a day I get ill. You have a better chance making money playing the lottery than this happening. You are not going to get a 1000% return on your money a year. I will not even mention realistic returns, because it would be such a burst of the bubble from what the trading room talk about. But I will give you some good news, you can day trade with a small account and slowly grow your account. But you cannot do it using an arbitrary Stop Loss the way trading rooms teach. Seriously do your really think a 10 tick arbitrary stop loss in CL is the right stop loss every day for every trade. How could it be?

The reason most traders lose money is they rather trade that fantasy world and lose money than trade the real world and make money. I know it sounds crazy, but the fantasy world is so comforting and the fantasy ROI they show are just so compelling and hard to resist.

I talk to real traders and I am yet to meet one, I am talking not a single one, that trades that fantasy world profitable. It is like looking for Big Foot. When you look at the equity curves of a real trader it will make your stomach turn. As opposed to the straight up equity curves the trading rooms show it will have large draw downs. That is the real world. I tell traders this all the time and even tell them do some research and see what realistic returns are. But they do not want to hear it!! I will tell you a true story.

I was talking to a typical day trader, one that is part of that 95% losing category, and got on a caulk board and showed him his expectations where complete fantasy. It was simple math. I showed if he could make the type of returns he is expecting in just a few short years he would be one of the richest men on earth and I guarantee you the richest man on Earth did not get there via day trading. Yet he did not get it; nor want to hear it. The Big Foot fantasy is just too powerful. It is hard to stop drinking the Kool-Aid.

Hello Rob,

Thanks for your comment.

Agree, any trader who subscribe to a trading room that do not and cannot show an edge to consistently extract profits from the markets, put lightly, will not do well. Needless to say, cannot trade for a living. Emmet’s reviews clearly show this to be true.

If I read correctly, I think you alluded to that if a trader focused less on fantasy profits and traded with more realistic strategies and expectations, they will be consistently profitable? Can you please expand on what “real world” trading is?

I hope this is not too personal, but are you a consistently profitable trader and trade for a living?

The subject of trading for a living has intrigued me for a while now. I am not able to do it, but it does not mean it cannot be done. I just would like to meet one, who does not get income from a newsletter, part time job, trading room, sell training materials, run money,etc….(and yes, I have read Market Wizards)

Regards

It’s has to be Rob Booker, he’s a scammer educator.

He’s a great entertainer, marketer etc.. but can’t trade to save his life…

He breaks his rules when he feels like it.. with a joke.

And he loves traders, gahh.. he loves their dumb money!

“Don’t believe his lies!”

Emmett – a good review of course, delighted to see you expose another scammeister from the ranks of this putrid industry. But, man, how depressing the vast majority of these reviews are. Given the festive season is upon us is it unfair to hope that you will bestow us with the gift of a couple of 4 or 5 star rooms this side of 2016!? Seriously – are there any rooms remotely positive looking on your radar?

Yes, I have a good one being published on Thursday or at the latest Friday. A real trader that actually pays his bills by trading.

Hi Emmett, How come you don’t have a donation button on your website ?

For the service you provide, donating is the least we could do.

Another great review Emmett. I wish to echo Joe M’s sentiment, I too, feeling a bit gloom. Sometimes I wonder if there are any traders out there that actually trade for a living, someone that actually pays bills from market profits? Starting to believe the % of losing traders is much higher than the proclaimed 95%.

So,…for lack of a better word,….Looking forward to this!!!!!!!!!!!!!!!!!

“Yes, I have a good one being published on Thursday or at the latest Friday. A real trader that actually pays his bills by trading”.

Peace

Did I miss something? I haven’t seen any positive review lately.

Another scammer scumbag exposed!

Entertaining read