The Tech Trader

-

Honesty

(4)

-

Quality

(1.5)

-

Cost

(2)

-

Support

(2)

-

Verified Trades

(1)

-

User Experience

(1.5)

Summary

Harry Boxer of The Tech Trader is a ‘legacy’ trading educator. Incredibly, he has been in the trading educational game for the past 17 years. With such a long history, you would think that many complaints would be spread throughout the internet like venereal warts in a Thai whorehouse. However, his reputation is very clean and reputable.

Harry Boxer offers a live day trading room with daily swing trading alerts. As good as his reputation is, the live day trading room and swing trading alerts is a mirror opposite of murky trading signals, slippery speak, and little to no transparency.

No track record of trading history exists. Nor is Mr. Boxer displaying a live trading account during the live trading sessions. He appears to be a chart reading witchdoctor attempting to divine the future with “chicken bone” technical analysis and pseudo-analytical mumbo jumbo.

Dear Harry, I was expecting so much more.

Thanks for reading today’s review of The Tech Trader with Harry Boxer

What is The Tech Trader with Harry Boxer? The company is a day trading and swing trading educational service. The monthly cost of The Tech Trader is $99 per month for the basic, live day trading room that is moderated by Harry Boxer.

For an additional fee of $199 per month, the subscriber is also given access to live day trading alerts and swing trading alerts.

The service covers primarily stocks, and in its truest definition should be considered primarily a ‘chat’ trading service. There are no additional courses, mentorships, or upsells.

About Harry Boxer

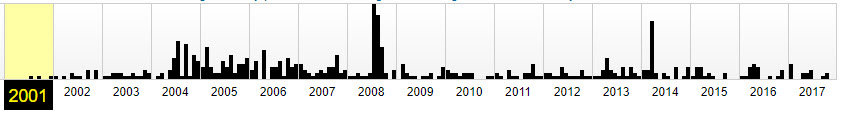

Harry Boxer is what I consider to be one of the ‘dinosaurs’ of the trading educational universe. In fact, a review of archive.org reveals that Harry Boxer has been selling trading educational services since 2001.

Its pretty amazing to consider that he has been around for 17 years. That is a very long time. For this sort of business.

Considering that Harry has been plying his trade since before Jesus walked the earth–you would think that the internet would be chock-full of various complaints and gripes. Next, I searched all related keywords looking for any sort of bad history. To my surprise, hardly any exists. Everyone gets complaints. But for Harry Boxer, nary a complaint exists.

In addition to scraping the internet, searching for ‘dirt’, I also searched Finra.Org looking for any regulatory misdeeds and or any professional financial accreditation.

According to Finra.Org, Harry Boxer was a registered stockbroker until the year 2000. At that time, it appears that he let his license lapse. My best guess is that during this time, the stock market was undergoing radical change and stockbrokers were essentially becoming an extinct profession. Electronic trading eliminated the high fee’s associated with executing stock trades, it appears that Harry Boxer got out for this reason.

After being a stockbroker, it appears that Harry threw up a rough looking website and started offering a $149 a month stock picking service. I can imagine that he was probably wondering how he was going to earn a living after leaving the stock brokerage business. The late 2000’s were a tough time for anyone earning commissions from stock trades.

While Harry Boxer was running the stock trading service, it appears that he also started an employment agency primarily for those seeking jobs in accounting and finance. The name of this business is Century Group. According to Archive.Org, the business was started in the year 2000.

It appears that the Century Group has prospered and grown into four separate locations in southern California, with multiple employees and a solid reputation.

It appears that the Century Group has prospered and grown into four separate locations in southern California, with multiple employees and a solid reputation.

As you take a ‘forest view’ of the life and entrepreneurialism of Harry Boxer, you get the sense that the guy really hustles. You also get the sense that he is honest and trustworthy. I feel quite confident speculating that if Harry Boxer were to find a wallet on the ground–he would naturally and without hesitation, return it to its rightful owner.

Now that we have established a basic framework of the person running The Tech Trader, lets move onto the actual service itself. In short, is it any good? Is it worth our time and investment?

The Tech Trader Live Trading Room

On December 5th, 2017, a TradingSchools.Org reader requested a review of Harry Boxer and The Tech Trader on our new ‘Question and Answer’ website located at Trader.Help. We established this website so that users can make orderly review requests and also ask trading related questions.

On December 6th, we signed up for The Tech Trader’s two-week trial and proceeded to record the live trading room using Camtasia screen recording software. In total, we recorded an entire week of all of the activity within The Tech Trader trading room.

What did we see? Harry Boxer offers two varieties of trading suggestions: swing trades and day trades.

On average, Harry will suggest 10 separate day trades, per trading session. The trading suggestions are his interpretation of ‘chart reading’. There is no statistical assignment to each of the suggested day trades. Instead, Harry will simply look at the screen and say things like, “Bull flag forming you might want to buy” or “It sure looks weak, if it goes lower, you should consider selling.”

At no time did he make concrete entry and exit points. Instead, everything is expressed as generalities and is firmly entrenched within a sort of verbal gray area.

The trades were he did (sort of) verbally commit to entry, he would then offer only suggestions of where to exit. In addition, the exit points were often expressed as “zones” where a person should consider exiting.

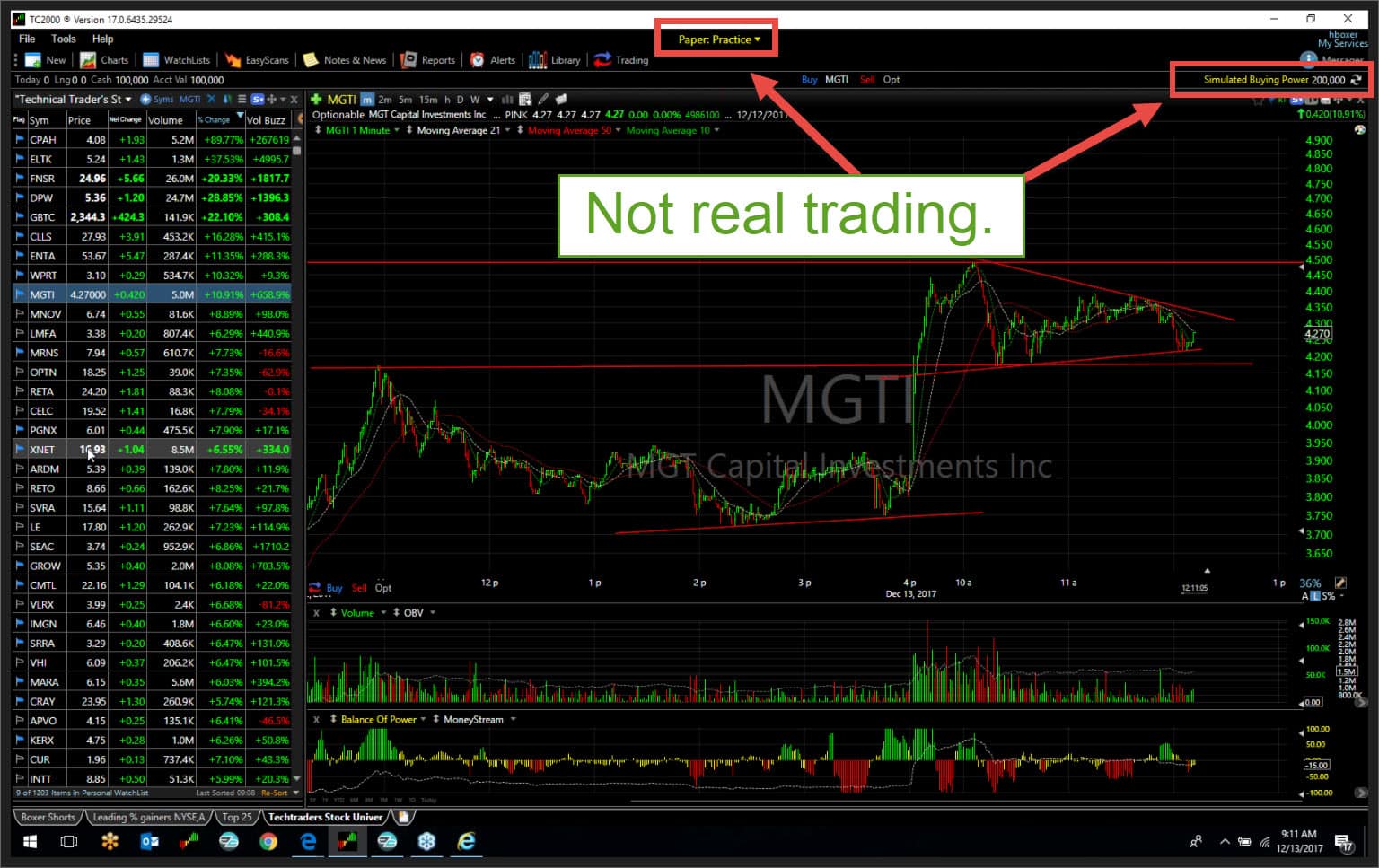

Although we had recorded a considerable amount of screen time, we were never able to capture the concrete and elusive “I bought here and sold here.” Additionally, we were never able to verify whether Harry Boxer was actually ever trading. Instead, what we witnessed was a display of charts with the dreaded simulated trading account on full display. Even with the simulated trading account on display, no trades were ever entered or exited on the trading simulator.

Inside of The Tech Trader trading room, with Harry Boxer

Harry Boxer has a sort of gruff and short communication style. Often, he would scold and or belittle attendees that asked questions like, “are you really trading?” Or, “do you keep a track record of these day trades?” Harry does not like these sorts of questions.

In my opinion, these are valid questions and deserve a response. But Harry was not interested in answering, at least at that time.

The Tech Trader Swing Trading Advisory

In addition to day trades, Harry also offers a swing trading advisory and something he calls the “weekend watchlist.”

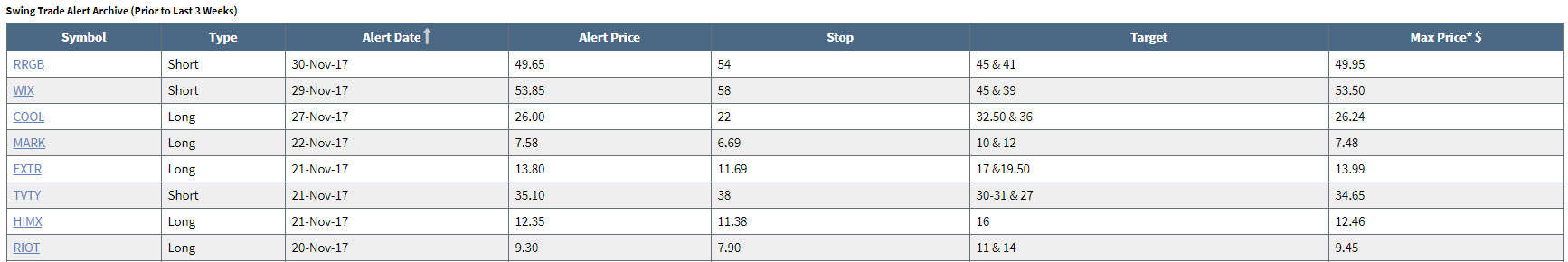

The swing trading service does give an entry price, stop price, and multiple target prices. The screenshot below is a recent archive…

Although there is certainly more transparency for the swing trades, it falls short of the ‘full transparency’ threshold. Notice there is no outcome for each trade? The closest we come to a declaration of results is the ‘Max Price*$’ column for each trades.

Somehow we are supposed to guess whether each trade is profitable or a loser. Its a process of deduction, is laborious and annoying. Why not just post “We entered here, and we exited here, and we profited/lost this amount.”

In my opinion, it is disingenuous at best and outright fraudulent at worst. A lot of strange things can be stuffed into this sausage casing.

Regardless of my opinion, all could be answered by speaking with the wizard himself. By pulling back the curtain and discovering whether any of this was real, or do any verifiable trading results actually exist.

Contacting Harry Boxer

Next, we picked up the phone and called Harry Boxer. We were not able to get Harry on the phone, but we were able to speak directly with his ‘trading concierge’/salesperson.

The call was pleasant enough. There was no hard sell, outrageous promises, or shady behavior that we too often witness.

Instead, we were able to quickly and easily discover through our conversation that Harry was not actually trading, does not have a verifiable track record of actual trades, nor were we able to verify the existence of even a live trading account.

However, we were pleasantly advised that The Tech Trader live trading room is “an educational experience” and “that we had the opportunity to interact with a Wall Street legend.”

Truth be told, I appreciated the direct answers and candor. The Tech Trader trading room is simply a chat room. A place where people can decide for themselves whether the information is of value, or not.

Wrapping things up

The Tech Trader is not a live trading room where a person can simply ‘copy and paste’ the trades of the supposed “Wall Street Legend.” Instead, the live trading room has more the feel of financial entertainment. Sort of like a paid version of Jim Cramer of Mad Money. And in my opinion, I am not so sure that Harry Boxer is any more accurate or inaccurate than Jim Cramer.

This is the problem with posting an accurate and verifiable track record. The truth rises to the surface. And the truth of Harry Boxer, in my opinion, is that he probably is not a successful day trader. In fact, I am 99% sure he has no idea what he is doing. But he talks a great game, and to the financially naive he probably sounds authoritative and knowledgeable.

He is honest. But a good trader? There is a huge question mark.

Thanks for reading. And don’t forget to leave a comment below. If you have ever had any experience with Harry Boxer and his services, would love to read your opinion below. And thanks to the reader that took the time to request the review at our newest ‘Q and A’ website located at Trader.Help.

With respect to the comment Harry Boxer made on the Worden Bros platform’s “volume buzz”. It doesn’t do exactly what Harry states, but it does show high volume movers, though I would not count on it in placing trades. Like anything else, it is lagging

Just get the chart and info off his free Youtube post. The service was worthless to me, ask a question you get harassed via pm by one of his moderators or him with a ghost account. All the charts look great, but all macro charting. This means once you enter, he goes to a larger timeframe and the stops get bigger and bigger. Don’t expect real time calls, everything is in “theory”. I just saved you money, watch the free Youtube videos and that’s all you need

I’ve been trading online in both day and swing trading for 14 years, and have gone from a mostly losing trader for just over 10 years to becoming consistently profitable over the past 4-5 years. One of the reasons my trading has improved is because of trader’s like Harry Boxer. Though he may not trade much these days, if at all, Harry Boxer has paid his dues, and is willing to share his over 50 years of experience in the market. Though I’m not much for chat rooms, I’d recommend his book, Profitable Day and Swing Trading, and his videos. There are many more teachers out there that I have benefitted from. People like John Person, Ken Calhoun, Steve Nison, David Elliott (RIP), Tony Oz, Rob Hoffman and many more. I would rank Harry Boxer among the best out there in helping me become a consistent profitable day trader.

Shill. Sounds like the same guy who posted “i made money” on Boxer’s book review comments on Amazon. And shilling Nison, Ken Clownface, and Rob Hoffman? sheez (Hoffman now exposed in ts review also). Per the review, he seems to admit being a charlatan with his website. Another “education only!”, have a nice Steve Primo laugh, etc. It’s just until tradingschools and the web, these ancient legacy charlatans could not be exposed more clearly to the public. They probably still have some shamshow business, because there always seems to be new hapless newbs to churn that unforunately had not wised up until too late.

I’ve seen Harry present at the TraderExpo in Vegas several times over the past 12 years. It’s always the same dog and armadillo show. IMHO his charts are a mess; pretty much the worst of any technical trader I’ve investigated. He still uses TC2000 with a black background, which I think is a throwback to 2004 at best. And then he slobbers up his charts with way too many dark red trendlines. What a godawful mess. And all the while muttering non-committal musings about ‘coils’ and breakouts and pullbacks. It gets really repetitious and tiresome. I guess anyone who wants to see for him or herself can do a one-month gig with Harry and see if what I said rings true. A hundred bucks worth of Harry and you’ll know if you like his style.

This is disappointing. I’ve seen Harry present at the TraderExpo circus in Vegas, and also at our local Meetup here in Scottsdale. I’ve been aware of him for quite some time, and he always seemed to have the possibility of being “the real deal”, if only b/c he’s a pure technical trader – hence the name. Also, he uses a tool called “Volume Buzz”, or something like that, to pre-screen stocks that are experiencing WAY more than avg volume for the day, which is the premise for his picks. I’m honestly not expecting him to tell me where to enter and exit, but just to do the “heavy lifting” of analyzing which stocks are “in play” for the day/week/month, since I frankly don’t have the time to do that, with over 5000+ trade-able securities listed. I’ve been wanting to do the “free trial” for over 2 yrs now, but I am the ultimate procrastinator. Ironically, I was planning to do that in the coming week, but decided to look here first to see if you’d reviewed him – thus my disappointment. (Not in you, Emmett, but in having my expectations significantly lowered – and they were admittedly over-inflated to begin with.) I’ll still give the “free trial” a “free try”, and let you know what my experience is. Thanks again for your diligent work.

“The Tech Trader trading room is simply a chat room. A place where people can decide for themselves whether the information is of value, or not.”-the best you can really hope for with a day trade chat room. It should be noted that there are other rooms out there that pick entries and exit points and announce them ahead of time. Whether these rooms actually trade is suspect, but you do get the calls in advance. This was a good review.

Just watched one of the videos on website. Very basic price pattern discussion. Anyone reading Edwards and & Maghee Technical Analysis book can talk the same.

Wall Street Legend with no track record? There are services available for way cheap price per month where entry and exit points are formal. Like Emmet already mentioned “it is disingenuous at best and outright fraudulent at worst. A lot of strange things can be stuffed into this sausage casing.” Boxer is a good marketer of his “educational experience” chat room.

exactly, great for people who paper trades..