Sound Advice-Newsletter

-

Honest

(5)

-

Quality

(5)

-

Cost

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

A recommended way to slowly build a long term stock portfolio with extra cash. An excellent newsletter that performs in all types of market conditions.

User Review

( votes)A Newsletter Worth Reading

Stock trading newsletters are mainly garbage. Over the years, I have literally seen hundreds of authors and newsletters come and go with the changing market cycles. The picks of these newsletters hardly ever outperform the average of the SP500. In fact, on average they under perform the SP500 and are hardly ever worth the paper they are written upon. Part of the problem is that the vast majority are long only stocks, and the stock market has basically done nothing but gone up for past 100 years. So why am I even writing about a stock newsletter? Because there is an exception to every rule, and some authors are just damn good at picking stocks. Today’s review is about one of these exceptional stock pickers by the name of Gray Emerson Cardiff with Sound Advice-Newsletter. I know, the name of the author sounds like a stuck up douche bag, but actually Gray is really nice guy. And he is ultra sharp at picking long term cycles.

Stock trading newsletters are mainly garbage. Over the years, I have literally seen hundreds of authors and newsletters come and go with the changing market cycles. The picks of these newsletters hardly ever outperform the average of the SP500. In fact, on average they under perform the SP500 and are hardly ever worth the paper they are written upon. Part of the problem is that the vast majority are long only stocks, and the stock market has basically done nothing but gone up for past 100 years. So why am I even writing about a stock newsletter? Because there is an exception to every rule, and some authors are just damn good at picking stocks. Today’s review is about one of these exceptional stock pickers by the name of Gray Emerson Cardiff with Sound Advice-Newsletter. I know, the name of the author sounds like a stuck up douche bag, but actually Gray is really nice guy. And he is ultra sharp at picking long term cycles.

Why Long Term Cycle Investing

I am an ultra short term trader. And I generate cash flow. My trading style is myopic. I carry a general mistrust of the stock market and believe that the entire structure is a hustle to steal from the weak and give to the poor. Of course, this is not true. Its actually a place where investors come together to expand enterprise and exploit capitalism and commerce. But sadly, I cannot break my idiot mentality, yet I also understand that my suspicions are unwarranted and very faulty thinking. Regardless, I cannot nor will I ever be a long term investor. But I do generate lots of cash. So what to do with my cash?

Investing Extra Cash

As a short term trader, every few months I will typically generate about 5k-10k in free cash. Sitting in the bank is basically an insult. It earns zero interest and yet is being deflated by inflation of typically 3% annually. If you believe government figures of 3%, then you are probably a bit naive. In truth, its probably closer to 5%. So do I buy gold as a hedge against inflation? Sometimes I do. But the problem with buying an ounce of gold is that you typically will spend $80 per ounce in commission over the spot price. It earns nothing, certainly is pretty to look at, and acts as a bank account of last resort. But in truth, precious metals are really just a hobby. So what to do with extra cash? I maintain a stock trading account at Interactive Brokers. I use this account to randomly pick up a few shares, here and there, that are recommended by Sound Advice Newsletter. In total, there are typically 20 stocks in the portfolio. I will buy a few shares and just forget about it. The advantage

As a short term trader, every few months I will typically generate about 5k-10k in free cash. Sitting in the bank is basically an insult. It earns zero interest and yet is being deflated by inflation of typically 3% annually. If you believe government figures of 3%, then you are probably a bit naive. In truth, its probably closer to 5%. So do I buy gold as a hedge against inflation? Sometimes I do. But the problem with buying an ounce of gold is that you typically will spend $80 per ounce in commission over the spot price. It earns nothing, certainly is pretty to look at, and acts as a bank account of last resort. But in truth, precious metals are really just a hobby. So what to do with extra cash? I maintain a stock trading account at Interactive Brokers. I use this account to randomly pick up a few shares, here and there, that are recommended by Sound Advice Newsletter. In total, there are typically 20 stocks in the portfolio. I will buy a few shares and just forget about it. The advantage![]() of Interactive Brokers is that you can keep your cash parked for free, and buy or sell stocks at $1 a trade. Broker like Schwab charge $5 to $8 per trade. Might not seem like much, however if you are only purchasing 2 shares of 10 different companies, then the Schwab route is too expensive. Interactive Brokers is the best route for passive cash, savings investor.

of Interactive Brokers is that you can keep your cash parked for free, and buy or sell stocks at $1 a trade. Broker like Schwab charge $5 to $8 per trade. Might not seem like much, however if you are only purchasing 2 shares of 10 different companies, then the Schwab route is too expensive. Interactive Brokers is the best route for passive cash, savings investor.

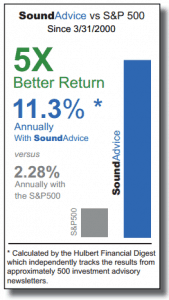

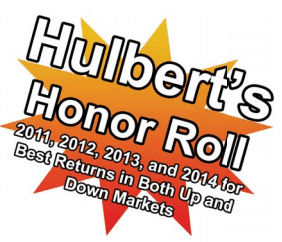

Performance Of Sound Advice

Sound Advice is well diversified. It does well in up markets, and it does well in down markets. It does well in high interest rate markets, and low interest rate markets. Inflationary and deflationary, high fuel prices and low fuel prices. The bottom line is that your money will grow slowly and steadily and will do OK in all sorts of markets. I can say this with confidence because Gray has been doing this for 20 years and his performance is proven across a wide variety of investment climates. The key as an investor is to just slowly throw extra cash at his picks, and do it as cheaply as possible.

Sound Advice is well diversified. It does well in up markets, and it does well in down markets. It does well in high interest rate markets, and low interest rate markets. Inflationary and deflationary, high fuel prices and low fuel prices. The bottom line is that your money will grow slowly and steadily and will do OK in all sorts of markets. I can say this with confidence because Gray has been doing this for 20 years and his performance is proven across a wide variety of investment climates. The key as an investor is to just slowly throw extra cash at his picks, and do it as cheaply as possible.

Big Trend Indicators and Common Sense Approach

Gray has created some unique indicators that only use fundamental data. Things like the difference between stock prices and the cost of an average house, or the cost of oil vs natural gas. The way he describes his indicators are just common sense approaches to markets. And he is not a a long only stock picker. In fact some are quite contrary, depending on your perspective. For instance, he has been recommending an ETF that gains value as interest rates rise. Sure, we know that rates are going to rise, but try and time that market! Well, he includes these scenarios in the portfolio. And other big trend, common sense type picks like buying the worlds largest miner of copper. The world cannot live with copper, and sure copper is in a bear market, but Gray got us into a stock that yields a nice fat dividend that reduces the pain of falling share price. I highly recommend that if you are sitting on free cash at the bank, take at look at slowly building a portfolio of stocks, it just works.

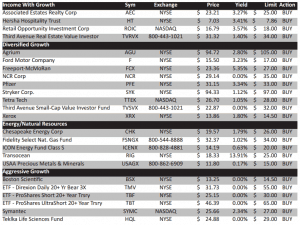

A Typical Monthly Portfolio

Contained within the newsletter you will see a grid of all of the picks. He also includes a limit price, so make sure you pay less than the limit price.

Contained within the newsletter you will see a grid of all of the picks. He also includes a limit price, so make sure you pay less than the limit price.

Low Price And Loaded With Value

Firstly, he offers a risk free trial of 4 months. By the 2nd month, you will really begin to see the value of his approach. At the end of the four month trial period, you will gently be given the opportunity to subscribe at $85 dollars for 15 months. Every month, in the face of all the geopolitical BS, global warming, wars,  droughts, famine, ebola, wild stock markets, debt defaults, plunging or increasing oil prices, wars and terrorism, interest rate indecision…you will receive a news letter that very calmly sits you down and explains everything that is happening and where you should be investing. For the frenetic day trader like myself, this guy is a godsend. Else my free cash would just be wasting away, slowly being eaten away by inflation.

droughts, famine, ebola, wild stock markets, debt defaults, plunging or increasing oil prices, wars and terrorism, interest rate indecision…you will receive a news letter that very calmly sits you down and explains everything that is happening and where you should be investing. For the frenetic day trader like myself, this guy is a godsend. Else my free cash would just be wasting away, slowly being eaten away by inflation.

Contact Gray today. Sign up for the newsletter, it wont cost you a penny.

Thanks for reading, and sorry If I am gushing all over myself about this newsletter, I just find a lot of value in this guy. Once again, thanks for reading and make sure to leave comments or questions below.

He has raised his prices.

Sound advice had a horrific year, Chesapeake energy down. 80%, transoceanic down over 60%, his no brainier selections all down 50% or more. I tried to contact gary by email, useless. Stay away unless you love to lose money by a conman

I have been subscribing to SoundAdvice newsletter for over a year. I have not been very impressed. I have e-mailed Mr Cardiff several times asking to provide his returns during bear markets and never hear back. He only toots his horn when his stock picks are doing good. Whenever his stock picks are doing good he will mention the YTD returns and since first recommended in his monthly portfolio updates. However, when his picks tank he fails to mention YTD returns. To be fair to Mr. Cardiff, I have only been a subscriber for a year so not sure how he provided updates in the past. I signed up for a two year subscription which expires November 2016 and will not be renewing.

Hi,

I am sorry but I could not reproduce in backtesting the incredible results advertised in this review.

I downloaded the available newsletters from 2006, converted the tables into actual trades and I could get returns using a part of the total data (3200 trades over 4000). Missing trades are due to errors or data I do not have access to. Anyway, the overall return is nothing different from that given by just going long with the SP500.

Likewise Emmett

I hope all is well. I often visit the website to see if any new reviews or comments have been added. I hope at some stage you are able to re-commence the excellent and much appreciated reviews you undertake.

Best regards

Joe

Emmett,

I found that Sound Advice Newsletter website gives no way to track its portfolio performance. There are only 19 most recent newsletters out of 168 possible stored on the website (14 years x 12 months = 168 newsletters since 2000). I sent e-mail asking for previous years newsletters and had no answer. Then I searched internet and found some negative references. I am confused now. I know how thoroughly you verify trade room performance. How long have you been using Sound Advice Newsletter for your own investing / trading?

Hi Andrei,

I was first introduced to Sound Advice from my cousin Carl, nearly 10 years ago. My cousin, now deceased, managed a mutual fund named Olympus Fund. A really smart guy.

Why do I like sound advice? Because my own short term trading tends to generate irregular amounts of free cash that I need to do something with. I do not want to blindly throw my cash into an index fund hoping that the market continues upward forever. Instead, I like how Sound Advice takes advantage of big themes. For instance, we are entering an environment of higher rates, so we have been net short on rates, and investing in such a way that we have been offsetting this losing position by being net long on realty stocks and dividend stocks.

Keep in mind, this is not a short term newsletter. This is a long term method. Very long term. And its cheap.

Hi Emmet,

Wasn’t sure where else to write this.

Just hoping your ok all things considered?

-RV