Thanks for reading today’s update of SchoolOfTrade.com and SidewaysMarkets.com

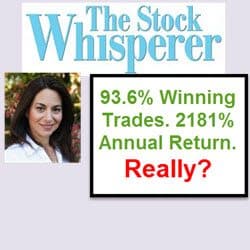

On November 22, 2015, TradingSchools.Org published a negative review of SchoolOfTrade.com and SidewaysMarkets.com.

The review was direct, concise, biting, and downright nasty. Over a 3-month investigation period, TradingSchools.Org recorded dozens of hours of highly questionable activity within the “live trading room” and interacted with many individuals that had been allegedly scammed by SchoolOfTrade.com and SidewaysMarkets.com.

The response from SchoolOfTrade.com/SidewaysMarkets.com was predictable. The owners of the company claimed extortion by TradingSchools.Org. That they were being threatened with a negative review unless they paid a fee. That they were the victim. And they refused to pay, “out of principle, courage, morality, and a sense of justice.” Some individuals quickly came to their defense and posted highly complimentary comments of SchoolOfTrade/SidewaysMarkets on the TradingSchools.org blog. However, the overwhelming majority of comments came from individuals that had experienced extremely negative results.

Many of the individuals that were interviewed by TradingSchools.Org also took the additional step of registering a complaint with the United States Commodity Futures Trading Commission.

The CFTC responds

It appears that the cluster of complaints from various individuals triggered an official investigation by the CFTC. What the CFTC uncovered was shocking. The following is a list of bullet points from the official investigation:

- The owners of the company were using fake names. There is no Joseph James, or Meghan James. The real owners of the company are a husband and wife team named Joseph Dufresne and Megan Renkow. Currently residing at 1521 Addison Road, Palos Verdes Estates, Ca 90274.

- Since 2011, the company has sold at least $2.776 million dollars of trading educational materials and live trading room memberships.

- June 2016 through April 2016, the company was averaging $60k per month in sales volume.

- The company claimed that purchasers of the $4,999 educational package could expect to recoup those costs within an average of 16 trading days, by simply following the live trades within the trading room.

- Joseph Dufresne claimed to have started trading in the year 2000. And after 3 years of successful trading, he opened his first hedge fund in 2003. Claimed to be a “Professional Day Trader” at Vantage Capital Advisors LLC in Los Angeles since 2000.

- Claimed to have received an award, “Trader of the Year” in 2001; and was named “Top 30 under 30” by Professional Trader Monthly in 2006.

The CFTC discovered that all of Joseph Dufresne and Meghan Minkow’s claims of performance history were fraudulent, the employment history and hedge funds claims were bogus, and no awards were ever issued.

Furthermore, the CFTC discovered that prior to September 2007, Joseph Dufresne had no trading experience whatsoever.

Prior to September 2007, through 1999, that Dufresne worked as a maintenance worker at a country club, worked the front desk at a fitness center, a student worker at Arizona State University, and a salesman at various mortgage companies. In fact, from November 2007 through October 2008, Dufresne was altogether unemployed.

The CFTC also discovered that Dufresne had been incarcerated for 6-months in 2005, a felony conviction for attempting to sell narcotics in Maricopa County, Arizona.

Joseph Dufresne Trading Performance

Joseph Dufresne claimed to be a hugely profitable day trader. The CFTC discovered that Joseph Dufresne was a terrible day trader. In fact, in a review of his trading records, the CFTC discovered that between September 2007 and April 2016, that Joseph Dufresne was a complete and total failure at trading. His total net losses were over $119k.

A deeper review of his trading records revealed that from December 9, 2014, through July 20, 2015, Dufresne had not placed a single live trade. Yet, his daily marketing materials claimed that he was consistently profitable. During the TradingSchools.Org investigation, we discovered that Joseph Dufresne was using the following spreadsheet as proof of supposed performance. Notice the claims of nearly $500k profits for 2014.

The CFTC’s investigation revealed that Dufresne claimed the following, real money results to purchasers of his trading products:

- 2011, $411,715

- 2012, $433,861

- 2013, $491,145

- 2014, $626,864

- 2015, $716,104

All of these claims of profits were fraudulent.

Ninjatrader Brokerage/Ecosystem

The big question that readers should be asking, how did this douche-bag double-team, Joseph Dufresne and his wife Megan Renkow pull off this scam? Did they spend massive amounts of money on Google advertising? Did they advertise on AM radio or direct mail? Nope.

The root of SchoolOfTrade.com/SidewaysMarkets.com can be traced back to the earliest promotional efforts of NinjaTrader Brokerage/Ecosystem. In fact, for several years, NinjaTrader Brokerage/Ecosystem was the feature promoter for SchoolOfTrade.com/SidewaysMarkets.com.

Ninjatrader Brokerage/Ecosystem exposed their prospective customers, numbering the thousands, directly into the arms of these scam artists.

Some readers might be thinking to themselves…”Oh, there he goes again, picking on NinjaTrader”. Maybe I am being unfair. But in the past 2+ years of writing reviews of trading educators, the reoccurring theme is that the overwhelming majority of trading scams are originating from the direct promotional efforts of NinjaTrader Broker/Ecosystem. Sorry folks. But that is just the reality.

Until someone starts calling out NinjaTrader Ecosystem/Brokerage, they are going to continue with their terribly irresponsible promotionalal behavior.

Thanks for reading. And for those that like to get into the nitty-gritty details of the CFTC investigation…the following is the court filing:

SchoolOfTrade/SidewaysMarkets

Does anyone know how these guys are still in business? It makes no sense. Is it just because now they have a disclaimer? So does every other trading “guru” out there from the legitimate ones to the wannabes-everyone has a disclaimer if they are offering any kind of education wether they actually know what they are talking about or not. I have never taken his course but I feel bad for the people that were scammed. I have to say though that after watching his vides on youtube he does seem to know what he is talking about and presents what I think is a decent interpretation of the charts in his weekly videos. He has some great trade ideas. Idk. Maybe he has had enough time to learn it all by now. This whole scam though obvioulsy rubs me the wrong way. Especially knowing that he claims to be a 23 year old veteran and professional trader. It also seems like they have done a good job of keeping this fairly well hidden. All I can say is karma is a bitch.

Can someone answer: how is this possible?

In 2017 they were fined 5 million: https://www.cftc.gov/PressRoom/PressReleases/7651-17

They are still operating, still using false names and selling a course for $ 5000:

https://schooloftrade.com/

Lol, JJ is still going on with his mad harping about how to trade videos. (https://www.youtube.com/channel/UCqLB48bfuOrZmHWb9IrrpmA) Looks like the TS spotlight has long since passed. At least the site now has ” CFTC RULE 4.41 – These results are based on simulated or hypothetical performance results that have certain inherent limitations. ” on it now admitting quietly it’s all a typical “education only!”-duck under the desk shamshow. The snakeoilers just can’t resist all the new hapless flock lured by the zero-commission robinhood effect and all the ads and shilling, who either miss or don’t heed tradingschools’ warnings about all these shamshows’ tricks so they have to find out the hard way and get monthly churned. maybe, maybe someday tradingschools can be part of the cftc or some organization affiliated with them to have multiple tradingschool exposing capabilities where past victims are free to “testify” in a safe cftc/fbi protected forum how they were scammed and ongoing scam shenanigans by these vendor fakes so finally exponentially more of these fakers can be handcuffed in the middle of their shamming like Laandgarten when the FBI moved in on him showing for real to the watching chat members how much of a shitcess scamshow these fakes had been doing for so long with no live trading.

how is this guy still operating? seem slike all this, all your work etc is for nothing? you can join his chat room and buy his courses still. Website is still up. What a bunch of bs.

You want a futures trader who actually is successful and live trades/would be willing to show his actual account go here: https://www.secretsociety7.com/

Two friends of mine that have been around for a long time and don’t have complaints all over the internet. They like their members making money.

Ah bud definitely my mistake. I’m way too trusting in this area for some reason. I need guys like you and your great and seemingly dangerous work to help me stay out of trouble. Funny, I’m almost 50 with multiple businesses I am involved with but these chumps get me? Thank’s Emmett for stepping out and helping guys like me who just want to trade well and not get ripped off on our journey. Too late for me though. I’ve lost alot of my families money and I’m freaking disgusted. 9 yrs later, back to square one for the …. time. I’m going to go read Kevin Davies’ book I bought over a year ago.

This bastard took my money as well in 2012. I wanted to learn order flow so he and his wife fooled me good. Once I paid and watched him trade for a week I knew i had been scammed. Got me for over 3k before I cancelled my credit card. I want my money back!

Really sorry I couldn’t get this done earlier. Might of saved your money and frustration.

Well, this is a long shot, but would you still have access to his course by any chance?

November 28, 2017

Federal Court Orders California Residents Joseph Dufresne, Megan Renkow, and Their Companies to Pay More than $4.9 Million in Restitution and a Monetary Penalty for Fraud in Connection with Offering and Selling Futures Trading Strategies and Systems

http://www.cftc.gov/PressRoom/PressReleases/pr7651-17

Emmett, please explain to me how SOT is still making you tube videos with the intention of fleecing new customers. Weren’t they banned from all aspects of selling products related to futures? His carnival act is like a bad infection that keeps reappearing. I would think this violates his settlement with the CFTC. Do they have to give him jail time for him to stop?

The CFTC is a civil regulatory agency, they do not handle criminal. The FBI and US Attorney handle criminal.

Currently, there is little appetite and/or resources available to attack consumer fraud. Specifically, fraudulent educational vendors. The course is set by the US Attorney, and it appears that the majority of resources are focused on immigration, drug trafficking and gangs, and terrorism.

Considering that Trump University sold a fraudulent $65,000 investment educational package, and got away clean with only a $25 million dollar settlement, I doubt there is going to be much effort in this area.

So we have to take things into our own hands. Not rely on the government to solve our problems. We have to police things ourselves.

Ok that’s a great point made, but this guy just finished up his hearing with the CFTC then he has the audacity to continuously post new videos to fleece new suckers. I understand resources are always limited, but doesn’t there become a point where committing a crime directly in front of a police station becomes a must prosecute.

Guys like this dont stop. Until the FBI arrives.

I should know. When I was running my boiler rooms and various penny stock scams, a week never passed when I did not receive a cease and desist letter from a state regulator. After awhile, you figure out that the civil regulators cannot do very much, other than issue a fine. Maybe, just maybe a judge will issue an order to cease business. But these things take time to work through the courts and justice system.

Good point. Even Ross of WT won’t be stopped until his hands pushing the simtrading shortcut keys (that he espouses give a “speed” edge), are handcuffed and forcibly escorted away from the gray hoodie trifecta’s simshow room. The state of the retail trading education industry is so fraudulent and so disguised by years of shilled info sites that some of the worst scammers keep milking it even for those who are initially caught by the cftc and incur minor slaps on the wrist as there are just so many aspiring retail traders new to this wild west snakeoil industry every month. Even shadowtraders.com is back in business after being fined for stating their sim accounts of their trading room were “live”, real-time “trading”.

I will throw out a crazy theory. I think their is a negative view of Day Traders period. They think of the short sellers who they blamed during the Great Recession. Remember all the talk about stopping those evil short sellers. So in my folks opinions Day Trading is associated with Wall Street and the evil 1%. Yes the truth is far from the common perception. But in general I think Day Traders are not looked upon in a favorable light.

No one views day traders as folks struggling to pay their bills trying to make a little extra money, even though that is the case most of the time. In stead they think Evil GS screwing it to the little guy!!

So bottom line stopping scammers screwing Day Traders is not really high anyone’s list.

Just some food for thought.

Yep. I completely agree.

And, the internet has decentralized everything where its difficult to track down whom is actually doing what.

Just took a picture of one of those wonderful regulators in action. He will get on that case any minute now.

Does says right on the website that just informational only not for trade or investment advice.

What happened to this guy getting prosecuted. He is still selling his BS to retail traders as of 2/17/17. I mean really!!! I thought that finally one of these charlatans went down. How can a man wake up every morning knowing his goal is to separate people from their hard earned money in a fraudulent manner. He talks nonstop about nonsense. These people don’t have an honest cell in their body. Don’t know how they live with it. I am a true believer in karma and I know his day of reckoning will come whatever that may be.

Emmett,

Can you please explain to me as of yesterday this guy has the balls to post on you tube and sell his bs online again? Doesn’t this create new legal issues for these husband and wife scam artists? They have the audacity to thumb their nose at the regulators and peddle their waste as if nothing happened. I really don’t know how this guy lives with himself. He evaluates trades like he knows what he’s talking about. If one doesn’t know any better he may seem knowledgeable with his used car salesman pitch. Please explain to me how he can continue without facing consequences. I am also a huge believer in karma and the ledger of life has to be balanced eventually.

People like Joseph and Meghan are con artists. And I know con artists, I used to be a professional con artist. The problem is that they do not know any other means than to lie, cheat and steal for their income. It is deeply ingrained within them. The only things that make people like this stop are handcuffs and a prison sentence. Truly. I ran for 10 years with all sorts of investment frauds, always being chased by the civil authorities. Eventually, the criminal authorities got onto my trail and locked me up. After going to prison, this was the only time that I actually reflected on the damage and harm that I caused others.

The same will happen Joseph and Meghan. Only a matter of time.

In the meantime, we will continue to watch them and warn others to avoid the scam.

Emmett,

I know your history and I truly commend you on shining light into this cesspool of trading educators. I was duped many years ago, but I got off relatively easy and I was in the business on the professional side with all the necessary licenses which still didn’t help me to make the correct decisions when looking for some education. Until I started reading this site, I truly didn’t know how bad it has become for new traders. The type of fraud committed on a daily basis is mind numbing. I know there are limited resources, but how is it that when you are licensed you are put through the grinder if there is a hint of unethical behavior. I am talking about crossing stock with the wrong account numbers, clerical stuff, get ready for a visit from regulators. On the other hand, these scam artists are bilking customers out of their last dollar. It is just crazy to me. I just couldn’t believe these people aren’t worried about jail time or can still look in the mirror at night. I hope investors continue to get educated and start making the correct decisions.

To Emmet and all others here. My name is Paul Anthony Iglesias. I was a big supporter on this forum of SOT and JJ. I spent $5,600 on his course and ultimately stopped trading with him as my trading results did not materialize. I have read the CFTC complaint and feel totally duped. I stand corrected.

Paul

One of the room mods of SoT did the “Amico split” and started his own site.

“lifetime” fee.

http://www.slingshotfutures.com/product/lifetime-membership/

hilarious “about” bio blurb:

“I started right where everyone else did, in the gutter. Working jobs all over the place with more W-2’s in my history than I would like to admit. I understand what it is like coming out into this profession with nothing to your name and having to build from scratch. Buying some crazy course for ten’s of thousands of dollars like the ones advertised online just doesn’t cut it for folks with barely that much in their accounts like most start with. I want to be able to help traders from all walks of life with this journey and help them to get to their goals! I have been trading for almost 10 years primarily in the futures markets with a heavy focus on Crude Oil futures. I have traded all over the place from grains to currencies but have really found a home in Crude Oil. I have spent thousands of hours developing my own personal system and teaching it to traders around the globe. That is where this site comes in — so I can get this information out there to folks who are starting out in the hopes of helping them build their accounts and make the money they deserve.”

, i.e. monies they “deserve” to contribute to his monthly churn.

I noticed some of the links posted here regarding Ninja willing to speak to Emmett so I thought I would contact them, I can bitch about the eco system which I have done or I can also try and remedy the problem so I contacted them.

I spoke to John who is the VP of customer service and before speaking to him I was able to confirm that he would be someone who had the authority to do something. Apparently John is a co-founder of Ninja.

I told him I have no connection to Emmett but that I did file a complaint against a vendor they currently promote in their eco system and also have filed a complaint against Ninja for promoting them.

We spoke for nearly an hour. My impression is that he cared and realizes this is a problem. We both agreed psychological issues prevent the majority of traders from being profitable so many will always complain of a vendor. I suggested that they simply provide a basic test for profitability- in addition to identification of the owner and site so that their identities are in the open in addition to open feedback on their site. We discussed their current vetting system and used it against the vendor who I complained about who was still listed. He showed no problem with them- When I have him a simple search he saw the pages of complaints. I suggested starting with this simple search on all their vendors.

I am a nobody in their world- But in Ninja’s defense they did take the time to talk with me- After our conversation the vendors ( and 2 more I know of) that are frauds were removed from their eco site. He said changes will likely take some time – I am a totally satisfied Ninja tool product user ( not brokerage) so I definitely want their software business to succeed. So I have that bias.

I also have Multicharts and it is more open to different brokers but for everyday execution with my trades I value Ninja more.

I don’t give a shit about Ninja 8 – Simple guy with simple needs. But I think

if Ninja is open to suggestions perhaps Emmett could create an area for everyone to submit requests for policy change for vendors like Ninja to improve.

It’s fun to bitch – but it would also say a lot to be able to turn that into a positive.

BMT has proven it is not capable of such things it would be great if this site could actually be a positive force of change.

Now Back to my emails!!

Al Brooks implies his high IQ and exceptional analytyical ability is why he is so consistently profitable unlike 99.999% of futures traders.

Not to mention it is easy to be a self-proclaimed consistently profitable trader when you never show a live trade in your life or any proof of profitable trading. I tell you if I ever hit rock bottom I am going to open up a Scam TR. After watching all these con artist; my room will be the best most over the top ever. Pictures of me growing up dirt poor in the Appalachian Mountains with me having to take a shit in the outhouse.

And then I discover day trading and now want to be Mother Teresa and share my good fortune with others. I will be next to jets and the top models. Hmm I wonder how much Kim Kardashian charges for a shoot and being able to say you dated her. But I kicked her out of bed for eating crackers and now onto the next super model.

Man my room is going to be GOOD!

Oh Rob!!!!! I’ve followed all your posts since I started watching this forum and agree with almost everything you say, especially about showing brokerage statements (the only real proof). But I have to now draw the line . . . You kicked Kim Kardashian out of bed for eating crackers. Jeez. You must either have been lying too dormant for too long and are some sort of super gigolo. Crackers! Please. Next super model. What then? You’ll kick her out for Tootsie Roll Lollpops!? C’mon man. Life’s too short, take advantage of all those opportunities before it’s too late.

When I am start my TR and making all the money my BS TR says I am making Kim and her 8th wonder booty is just a drop in the bucket.

To digress away, I never understood what was so sensational about Kimkardashian. She isn’t attractive. Isn’t a model, except supposedly for a standard of lower living. And is a disgrace to armenian-americans.

A picture is worth a 1000 words

http://screencast.com/t/9EyDYYYpl

Tell me that is not the 8th wonder. LOL!

I visited the zerogravityroom. man was I underwhelmed. It was the same kind of talk I’d seen before ad nauseum for years. if they are not willing to show broker statements, they aren’t trading live. It was nowhere close to trading for a living. But then again you won’t find a trader who makes a living i.e. > 200k a year showing broker statements. They wouldn’t be teaching or running a room. To be positive, it was a pleasant room and may be ok for newbs who want someplace to hang out.

Alex is not called Alex Zobell. His real name is Alex Sielaff.

Just type into Google search alexsielaff129_ta61vdz9 and it will bring up part of his Zero Gravity Trading website.

Then just google search alexsielaff129 it will then bring up his other website alexwon the dream eater.

Look under affiliates and have a laugh. See if you fit the category he is targeting.

Then search Alex Sielaff 129 and it will bring up his twitter account Alex @mr pink 129 you will find 3 or 4 postings of his trades probably in sim but no posting of losing trades. All his retweets are •18 years-old •Professional Futures trader. Enough said!

unbelievable. this is really him? “sample page”

http://www.lexwon.com/sample-page/

http://www.alexwon.com/membership-costs/

this is the same person? unbelievable. “design plan”

alexwon.com/sample-page/

alexwon.com/membership-costs/

Lol. As previously stated, this was for a web design class with business integration. This was my idea! Look at when the site was last edited! Nothing to hide here guys. You all think you “busted” me when all you did was Google my name.

I must say, I underestimated the ability of you all to get so worked up over fairy dust. 🙂

Emmett needs to start giving out awards for the best Journalist Investigators. I nominate you. And man when I was arguing with this 18 year old kid claiming to scalp ES profitable everyone was like give the kid a chance.

But after seeing he is associated with GTR, the biggest con room ever, I think he has had his chances.

http://screencast.com/t/Ot18XnVi

And people wonder why my post about TR are 99% negative. Just once I would like to be wrong about these Day TR con artist.

You’re right as usual RobB. amazingly it seems like futuresfx.ca is some kind of canadian sister site version of GTR.

futuresfx.ca/services-and-specials.html

just what the ‘industry’ needs, a new protege of simonjousef. and I thought zerogravity was going to ‘change the industry’ too. shame on me.

I have another one for you here. Remember Emmetts review of MES he said the website was owned by Sattam Alsabah.

Well this new website for funding new traders is coming SOON is also owned by him https://oneuptrader.com

http://www.bizapedia.com/trademarks/ONE-UP-TRADER-87091781.html

I have another one for you here. Remember Emmetts review of MES he said the website was owned by Sattam Alsabah. Well this new website for funding traders is coming SOON is also owned by him www dot oneuptrader dot com

www dot bizapedia dot com forward stroke trademarks forward stroke ONE-UP-TRADER dash 87091781 dot html

futuresfx.ca is the original site for GTR, not a sister site. GTR was the new and improved version. Futuresfx.ca is still in use though. I am not a protege of Simon’s. Quite the opposite. I quit because we fought too much over business practices as well as other things.

Not only that, I do not use his methods of trading nor will I ever.

Alex you are a CRANK. I am a good detective I am the Pink Panther. Yes I am advertising you as a CRANK. Don’t dig the hole any deeper. Just move on. BYE Mr Sielaff. Go and play with your teddy’s.

Lol. “I am a good detective”. You sure are a stellar user of the Internet! Congratulations! I sure am a CRANK! I will go play with my teddy’s!

Hey Alex how is Chris or are you Chris or are you Alex? Or are you Charles IX (anagram) Or are you just using your Son’s name.

Just found another website registered at your address called crossfiretrading dot com. Owner is Chris Sielaff. It was registered 1 year ago in the state of Minnesota. Why would anyone call their business the same name as a business in the same State as the one which was prosecuted by the CFTC back in 2009 for running a Ponzi Scheme. Unless Charles Chuck Hays is their dad.

I see Chris/Alex you is still part of the Crew with Simon Jousef . Check him out here www dot hedgefundbvi dot net under Our Crew LOL.

Chris/Alex is also the Market Wizard on Futures io under the name rocksolid68 who happens to be Alex who started a new journal on there. The whole Journal is pure BS.

Here is his facebook profile www dot facebook dot com stroke chris dot sielaff question mark fref=ts check his friends list . I found this video about Emmett www dot facebook.com stroke futuresfx dot Canada stroke videos stroke vb dot 100001605446818/978528278877344 forward slash question mark type=2&theater.

Man this guy is a 48 year old man pretending to be an 18 year old. How bad is that. Someone tell Futures io that ALEX/CHRIS you are BUSTED.

Lol. This may be the most comical post yet!

My father works in an office space for one of the largest healthcare providers in the nation. I, Alex, am not my father. I think it is funny though! Thank you for the laughs.

What you mention on FIO is widespread knowledge there? My dad and I share an account. I am the one who regularly posts there.

The crossfiretrading was the original idea for a trade room. However, we decided to not follow through on it. Regarding the Charles Chuck Hays, I am not even sure what you are trying to say.

I am laughing pretty hard at this Pink Panther guy. I am still trying to figure out if he is joking or not! Lol.

So, what exactly did you “bust” us for?

I don’t see how you can call Alex a CRANK. He isn’t charging anything to be in his room and on the times that I’ve attended it I’ve found it to be an informative experience.

I think that if his intention is to help educate people then it would be better to formalize his core teachings into either videos or PDF documents but since it’s not costing anyone anything you can’t complain about that.

If I had paid to be in the room then I would expect lessons about core concepts of this approach to trading but once again it’s a free room so why the hostility?

Thank you very much Stray Dog for the honest thoughts. I am not so sure why everyone here is so angry at me when I have done no wrong. The information that they found is not anything bad. I have all of it public as I have nothing to hide. Not only that, the stuff they “found” was not even bad? I am not so sure why the hostility. Anyways, thanks again. I hope that these people will lose the bitter attitude at some point…

Well to be fair it seems to be a nice room and so far it’s free. Sorry, all I can say that it’s just not for me. I’ve seen too much, done my share of modded indicators and scores of strategies for NT, tried other markets and platforms besides futures, and been to too many rooms and been around bmt close to when it started and been on elite before that. And the old thread on GTR (which for some reason has been deleted by Emmett when it has the real meat of the amico fiasco, not the current review thread). and WT has left a bad taste in my mouth. So yes, if there is a good record of proof eventually, it could be a good starting room for noobs.

See my reply above to Alex/Chris

Then don’t come to the room Rob! If you don’t like it, don’t come! No one is telling you to!

I have gotten absolutely nothing but positive feedback on the room!

Read the other comments on the “breaking news” you all “found”

If we are giving medals away to people that know how to use Google, can I get one? 😉

Will someone mention this in his room today?

Go for it! I have literally nothing to hide! Read my other comments. Everything you guys “found” was public information for a reason. Everything was either stated on my website or here on this blog.

So I implore you to say something in the room if you would like me to reiterate the same thing again! 🙂

If you have nothing to hide why in the room do you only show your chat box and members can only chat with you, so they can not scroll through the questions or post chats to everyone and also members do not have the ability to see all members present and PM if they wanted to. Maybe you are posting all test you get, but one certainly could filter using this method.

There is one other thing that bothers me. Look you might be for real and trading a live account, but the way you are using chart trader could be misleading used. If you are not for real you will get angry at what I say, but if you are for real you will fix it. You are not showing chart trader order entries prior to making a trade at least from what I say. Instead you are just announcing a trade and exit and then we see the position on Chart Trader. The problem with that is many con artist TR rooms do this using a lenient sim generator to produce positive slippage which is unrealistic in real world trading.

If you want to set the Gold standard for a TR then you need to show evidence you are trading a live account and display your trade entries prior to taking them and if others can not duplicate the results then something is wrong.

And frankly being complimented by a bunch of naive people who have not been scammed by a TR is not much to brag about. I have high hopes you will set the Gold Standard for TR and prove you are the real deal.

I think your point about setting the gold standard for trading rooms is valid but you could reframe how you talk to Alex about it.

As for the chat setup and display issues, I think that this has more to do with not knowing everything about the software and how to configure the chat than deception. I keep coming back to “if the room is free what’s the scam?”

Maybe no scam. Maybe a scam. For the same reason his journal on BMT might be scam. I have seen it before done by scammer, that does not mean he is doing it even though he was affliated with GTR.

So how do they scam. Many ways. People PM them and then they well you trading education on the side. I know as one of them did that to me or in so case they are brokers and try and talk you into using them. There are tons of way to scam with a supposedly free room

But I will give him the benefit of the doubt. I am not saying he is a scam, but if he wants to set the gold standard he needs to show he is trading life as we all know trading sim can be completely fake.

I thought I would give a perfect example of a Broker giving free chart analysis:

http://www.ltg-trading.com/

You know the old saying nothing is as expensive as when it is free.

Thank you Stray Dog for the continued honesty.

Rob, I am grateful for the lack of hostility and the benefit of the doubt.

I know that there are ways I could try to “scam” people. But listen, if I were to do so, you know how quick it would all fall apart? One person talks and I would be done. Not only that, I have no interest in scamming people. I don’t even have too much interest in making money off of others!

As far as the PM thing goes, Big Mike and I have chatted quite a bit to find a balanced way for me to do this. I am sure that he is hawking my PM’s for he has his own suspicions. Big Mike is a cynical dude, as is everyone in this industry that has been around for a long enough time. He would not let me get around him.

Lastly, if I were to start scamming people I would lose all of my favorite things. Comradery, friends, and the knowledge base of FIO. I absolutely love FIO! As you can see, I am a Market Wizard, I have Legendary Status, as well as having the Activity Award. This is all because I spend so much time out there and contribute a lot! If I were to be banned, I would lose all connections to the community that I love. Nothing is worth that.

Thanks again, I hope you continue to work with me, Alex.

“But listen, if I were to do so, you know how quick it would all fall apart? One person talks and I would be done.”

I wish that statement was true in this industry. First before this site there was no place you could even get an honest review and even with tons of people calling warrior trader a complete scam he continues to scam right and left.

That statement has nothing to do about you, but the comment.

As for Big Mike I know members that have a fantasy journal and then sell trading education as they tried to do it to me. Again not saying you are doing it, but just that it is done.

Lastly I do not think Market Wizard is representative of profitable trading but number of posts.

All that is good, but the one and really only thing that matters in this business is can you show proof that you trade a live account consistently profitable. I wait to see and hope for the best.

Hey Rob, I figured out the chat box thing! I told you I would do it if we could figure it out! 🙂

Indeed you did. I am pulling for you believe it or not.

Thank you very much. I am very grateful for that. You have very good reason to be a cynical person in this industry, but let time show that I am not like the rest. Thanks again, Rob. I hope to see you in the room again! 🙂 (maybe under your real name? ;))

So how does one get into the room?

Either go to the website, email me, or go to my journal on FIO!

Rob! Thank you so much for the genuine response! I am very happy to respond! 🙂

The chat box. Someone asked something similar before. I honestly am not sure how to get it so the viewers can see the chat! I am being serious. I can not find it in any of the settings to allow the attendees to see the chat. That being said, I am open for receiving help on this! The chat you see on the screen is the real one. I do not think I can edit stuff out of it. If I could, you would see me do it since it is my only chat box. I am more than willing to fix this. It would make life a lot easier for me :).

Regarding the chart trader; I am not 100% what you mean, so if my answer is not what you were looking for, forgive me. I just may need some more clarification! The attendees are able to see the trades the second I take them. When I click “Buy Market”, the chart trader is up the second I get filled! As far as using something for good slippage, I am not sure what that means. Assuming you have been in the room, you see my trades are never under 20-minutes long. Honestly, people are more likely to get better fills than me if they wait till when I take some heat. Lol. But since I am in trades for so long and for larger targets/stops, I do not know if a few ticks slip is too big of a concern since attendees would have plenty of opportunities. That being said, I totally understand what you mean. I do not use limit orders, so when I say I am buying, when you see the marker on the screen, that is the second I bought. There should be no delay between what I actually do and what appears on your screen. The chart you all see is my trade chart with the little trade box removed since there is no purpose to have it on yours.

I am not sure what you mean by showing trade entries on the chart. I try to say when and where I will enter/exit. If there is a better way to do this, I am all ears :).

Many of the people that give me good feedback mention that they have been in other trade rooms. You should be able to see them say that in the chat box on screen (and hopefully in your own if we can figure it out).

Lastly, I want to thank you Rob for being civil and genuine with your replies. I am grateful that you are working with me on this. I hope that with yours and other’s help, we can achieve that Gold standard you are talking about! 🙂

Thanks again, Rob! 🙂

Alex,

Just saw this post. I am not sure how to respond without being harsh.

The point I was making, which I am sure you are aware of, is that if you are trading sim one can set a sim generator to give you fills that you cannot get trading live. In fact I have been to TR that have sim generator that will actually give them positive slippage. It is a great con artist tool to make it look like they are trading. When you use a sim generator that gives you positive slippage and pay no commissions you can trade noise profitable. Sure on any given trade as you pointed out you might take heat and a member could get the same price. But over time a Sim generator results is not representation of live trading in any way.

Here is my biggest complaint, the first rule to setting a Gold Standard is you must be trading a live account.

Yet so far that I am aware of, you not only refuse to show any proof of trading a live account you will not even state if you are trading live or sim. Maybe for fear of being investigated if you are lying.

So that leads me to believe you are trading sim. And then that begs the question why? Why does a self-proclaimed trader who say he can scalp ES consistently profitably trading sim.

I hope you are going to set the Gold Standard and trade live, but first you need to say if you are trading live or sim and if trading sim then have a HUGH warning:

“I am only trading SIM, therefore this is for Entertainment purposes only. If I am not willing to trade my method live should you?”

How did you find “alexsielaff129_ta61vdz9” to begin with?

I just put the full address into a Google search box and clicked on the one that says Hello World then clicked on the uncatergorized section. On that page to the left you will see alexsielaff129_ta61vdz9. The rest was easy.

I put “zerogravitytrading.com” in Google search, but I don’t see anything in the results about Hello World. What am I missing?

Use the http : / / zerogravitytrading dot com

4th Search down

The kid is running a free trade room and you guys are spending this much effort to dig into his past? He did briefly work for Global Trade Room and I think he mentions something about that on his site. Free room is a free room, nobody getting scammed or ripped off for a change.

thanks!

That IS my real name! I go by Alex Zobell for marketability reasons. My other website was for a web design class I was in. Look at the website, it is obviously not active.

I did work for GTR for a bit. I disagreed with some certain business practices so I left them.

That is also my Twitter handle! Thank you for posting it here! Free “advertising”!

My screenshots were PnL’s for an entire day, not a single trade. But good try!

Your last sentence makes no sense, but I will try to address it. My bio mentions my age and profession like the rest of Twitter.

None of this is a secret, but thanks for pointing it out anyways! I wrote about working for another trade room on the website, so good “detective” work!

Good back story there Rob but I think it needs a little work. I like it up till the part where you were taking a shit in the outhouse but then you got bitten on the ass by a copperhead or a black widow spider. While trying to such the poison out of your own ass you discovered the full head but empty wallet karmasutric position and then Jesus and Buddha and gave you the trading holy grail and commanded you to go and do good works.

Al Brooks talks about growing up poor as well. AL has woven a very intricate web, which will take much skill to unravel.

Only?!? No Ferrari, Lamborghini and a good ol’ Rolls? No expensive fake wine vintages? No truffles on the barbie?

Feigned humility, not bling-bling, is how you win a client’s trust for a trading educator like Al.

And reading in context and being able to recognize hyperbole and irony/sarcasm is how you let people know that you can write and read idiomatic English.

Ha ha – clever Cyn and very droll 🙂

I also contacted Ninja some time ago. Here is there response.

Wed 7/09,

Wed 7/09, 6:50 a.m.

## Reply ABOVE THIS LINE to add a note to this request ##

Hello ******, and thank you for your note. NinjaTrader has an initial vetting and ongoing audit process for ecosystem directory participants. This includes but is not limited to risk disclaimers required by regulatory bodies, background investigations and general complaint searches. If a vendor passes these checks they receive conditional approval for a listing in our vendor directory similar to other companies that support 3rd party apps or add-ons.

Specific to Kongzaga, in 2013 when they were added to our vendor directory we found site owner Valdemar Kazana had no customer issues, reports of wrong doing or industry violations. As such his company was provided a single text listing in our directory which remained until a recent audit found a complaint against him when his text listing was removed. In the 3 years that Kongzaga had a vendor listing, they were never promoted by NinjaTrader other than a forum post when their listing was added. Additionally we have never received a complaint about him, his company or his services yet if we find any issues with a vendor they are removed from our site which was the case for him.

Vendor compliance and code of conduct are important items that are already part of our vendor listing requirements. However we are always looking to increase what we can do but there are limitations to what we can require so it’s also important that traders conduct their own due diligence. Additionally it’s important that traders report any issues to us since if we see a pattern of issues we will and have removed vendors previously as a result of this input.

Reading a vendors disclaimer will provide insights into the vendor and these are the type of items I would suggest traders look at before making any purchase decisions. Traders can also ask the vendors questions to understand these items. NinjaTrader takes many steps to list only credible vendors, we are looking to make improvements to this process to protect traders but every trader should also conduct their own due diligence prior to purchase or trading with a vendors tools.

Lastly, certain websites play-up our involvement with many of the vendors listed well beyond what is provided. For example, one website states that for KongZana they were “highly promoted”, “had a prominent listing” and given “free webinars” none of which is true. I am not sure why this is done since it is a disservice to traders. It would be better for everyone if they accurately reflected items instead of embellish them.

Thank you again for your suggestions and all the best in your continued trading.

Sincerely,

John

NinjaTrader Customer Service

The award winning NinjaTrader platform is always FREE TO USE for advanced charting, strategy backtesting and trade simulation.

You see, this for me is where NinjaTrader slip back into the water of the cesspool and are quite happy wallowing in the shit. That shit being Plausible Deniability.

I think Emmett is right, all NinjaTrader do is give us some lip service about how they are going to become more diligent within their ecosystem, but it is all bullshit. They may not receive direct compensation, but you can bet your bottom dollar they are compensated in other ways (links to their trading platform download, new traders signing up to their brokerage, advertisement banners etc. etc.).

NinjaTrader already claimed over on FIO that they didn’t have any affiliation with SOT and Emmett was stating a falsehood.

And then somebody dug a bit deeper and found proof that NinjaTrader did promote SOT in the past. NinjaTrader should be concerned because with all of the current CFTC busts and new ones coming, they will be continue to be a laughing stock as their name gets dragged deeper into the eco-cesspool

But again, if Emmett is right, NinjaTrader won’t care one little bit no matter what they say. If they did actually care, they would pull the EcoSystem right away.

In my conversation with him that was my initial thought and response. The canned crap that they are not responsible- that they had disclaimers – that people are advised to do their own diligence

ad-nausea. The 1st part of our conversation was quite colorful.

He really seemed to not have a clue to how much weight people give to Ninja with their recommendations and associations with Ninja. When I provided the numbers who attended one vendors I attended a few years earlier ( over 1000) and the number of sign-ups he seemed quite surprised.

Especially since Ninja probably did not receive a fraction of what that fraud vendor did in revenue. The 1st thing he said is that they receive no compensation or kick backs from the vendor.

When I pointed out this vendor made at least 300k in one presentation with their endorsement ( They had a sales meter ticking) the tone changed with him. This is also when we performed the 1 on one search making his search look rather foolish and many of their existing eco partners as bad apples.

Contact them and complain directly. and keep complaining here

until they make a change. The more the info becomes searchable

the more it will effect their bottom line. That’s what I told him.

They need to get out in front of it because they have made a lot of

enemies imho- Especially when they entered the broker biz.

AGain- I respect and appreciate their trading software – That’s where my loyalty ends.

Agreed. As a trading platform NT7 was great. NT8 will be great too once it comes on full stream.

My loyalty ends there too.

Any vendor associated/promoted by Ninjatrader via the EcoSystem or an “Education Partner” should be regarded as pure fantasy horseshit belony. Why? Because NinjaTrader have been complicit in promoting vendors that have been proven fraudulent and/or have charges laying against them.

Who knows how many more are sitting there waiting to be busted. NinjaTrader will quickly remove them once the shit floats to the top and they are exposed and claim all is good, nothing to see here!

NinjaTrader need to start listening and just pull the ecosystem, right NOW. All the other trading platform vendors out there must be laughing their socks off at how ridiculous NinjaTrader are looking right now.

He did say that Trade Station has a similar situation and felt they (Ninja) were being unfairly singled out.

I am not familiar with Trade Station so I do not have

a point on reference. Anyone know?

I know MultiCharts has a few like Roy Kelly but nothing to the extent of the eco system of Ninja.

Reported their site to youtube, including reference to CFTC complaint. Youtube reply: “We’re unable to identify a violation of our Community Guidelines within your recent report to our Safety and Abuse Tool.”

99% of this so called industry is an utter and complete scam. These business models are nothing more then late night get rich schemes wrapped around trading.

All you need is to think about is this. If they are able to make 10-50K / month trading this system, why even sell it. Just do it, dont tell anyone , and collect your cash.

Common sense people … I mean even the clowns on CNBC never show their P&L because the media knows that will destroy their entire network.

Last but not least , INDICATORS … Another milk machine for software developer / engineer types who suck at trading to make money. Even Tom Sosnoff from TastyTrade.com / Think or Swim. The guy pawns himself off as this great trader, but he made all his money selling Think or Swim software to TDAmeritrdade not trading in the PITS. Oh ya he loves telling stories about when he was down trading, but his fortune was developing software not trading. And just because you are a good developer does not make you a good trader…

So just use your head and avoid all these places. They are just a mirage …

Amen,

It is so nice to respond to a post from someone living in reality as opposed to someone like Paul who is completely delusional. Thank God there are others that get it.

It is like Alex in the other thread who is going to teach his method to scalp ES profitable. If he could and that is a big if to put it nicely, the second it was out every hedge fund would be doing it and by default it would no longer work. There is no Mother Teresa out there. All these folks have ulterior motives even if they say they do not like teaching for money on the side. Anyone that can do the scalping these TR claim and do it profitable are hidden away with their mouth’s SHUT!

Rob ,

Must have been a huge moment when you found this website. Something akin to one finding NIRVANA. Can just imagine you saying to yourself and looking in the mirror. WOW, I finally found a place within the trading fraternity where I fit in.

Another non sense post by Dilution Paul. Now he has to fill up all threads with his nonsense. Paul are you defending Sideways Market TR as this is the topic of this thread. I will keep things simple for your apparent low IQ.

GOT PROOF OF ANY OF YOUR BS CLAIMS??????

Dilution is a good word,,,lol

Paul is another majormongo shill. They must be losing members in his room.

dtdchurn,

That is so funny. I swear I just posted the same thoughts before I even read you post. Great minds think alike.

And if Paul thinks I am bad he better hope he never gets in a fight with the Stray Dog

http://screencast.com/t/eNReygPL2

Yes- USE YOUR HEAD- and THINK!

That is what is in short supply here and everywhere else it seems. People seem not to want to think for themselves so these fraudsters will gladly do that for you- for a fee. Then when the non-thinkers realize they have been deceived what do they do? They whine- Then they start the entire cycle again. and again.

Indicators- As you say another illusion- People think the more indicators the higher probability of a trade which total BS. This leads to more emotion being tied to a total arbitrary setup. But people seem to love the star wars indicator look.

Is the market really that difficult? Not if you think about it. What does it do?

It moves in a trend or a range or a wedge on any given day- That’s about it.

You know that the ES is traded 80 %> algorithm’s. Are these algos AI

type algos? do you really need AI to define a trend a range or a wedge?

Are the algos stuffing orders? Ya think? What might that look like on a chart?

( Think SCALP)

So you define the market by it’s characteristics – You define your questions and break it up piece by piece – You think- You produce answers and test your theories and you build your method.

It is your method based on your thoughts and your work no one can take

it away from you – and if you are like me you don’t give a shit what

anyone thinks of it and would only share it with the closest of people

who may have a mastermind with.

It’s hard but not impossible. What is absolutely amazing is to witness

the inability of people to think or even want to think for themselves

and to blame others for their inability to do so. Some people absolutely

refuse to think for themselves! Look around It’s not just trading of course.

Now these trade rooms are definitely scams but there would be no market

for them at all if people took the time to use what they already have- a brain.

This site does a wonderful job of exposing both the fraudsters and the victim mentality that follows.

I will worry if the day arrives that the scam rooms are no longer making $$ and people are no longer complaining about them. That will be the day when my edge disappears and the time when people think for themselves.

But I will be president by then and you will all be in chains so it won’t matter lol.

So far we have seen two kinds of rooms. 1) complete sham rooms that fake spreadsheets and results and do sim or fake trading on screen. They haven’t touched a live account for years as evidenced by the cftc reports in the reports lately, just as I’ve suspected. 2) “breakeven” trading rooms where no way they can make a living from trading but they can put on a show for newbs trading so small, or limited sacrificial account where even just losing a small amount per month is considered realistic breakeven struggling trading.

You wont’ ever see a trader who makes a consistent living trading for over a year. They have no incentive to teach or put out a trading room for the public. They would only teach a few significant others at best. To make a living one needs to make at least 150k a year with expenses and the new president Hillary taxes on retail trading. But you’ll never see statements from any vendor showing statements for even one year.

CFTC Charges, Open Range Trading LLC, with Commodity Trading Advisor Fraud – CFTC case: http://www.cftc.gov/PressRoom/PressReleases/pr7465-16

CFTC Charges Schooloftrade.Com, with Fraudulently Marketing Commodity Futures Trading Strategies and Systems – CFTC case: http://www.cftc.gov/PressRoom/PressReleases/pr7464-16

CFTC Orders Advanced Trading Workshop “ATW”, Inc. of Jamesville, New York, to Pay a Total of $940,000 in Disgorgement and a Civil Monetary Penalty for Solicitation Fraud and Failure to Register – CFTC case: http://www.cftc.gov/PressRoom/PressReleases/pr7453-16

TradeMasters USA, LLC with Fraud and Failing to Register with the CFTC – CFTC case: http://www.cftc.gov/PressRoom/PressReleases/pr7429-16

CFTC Orders “Shadow Traders” to Pay a $140,000 Penalty for False Statements to the CFTC and for Not Disclosing that Profitable Trading Results Were Based on Hypothetical Trading – CFTC case: http://www.cftc.gov/PressRoom/PressReleases/pr7253-15

I’m glad those scammers are finally busted. Great job Emmett! I mentioned your excellent work in my latest article – https://steadyoptions.com/articles/schooloftrade-another-guru-busted-r218/

These guys really have some balls. Faked like I was trying to sign up yesterday and they were pushing the $5,000 course. Then accused me of being another site. I was surprised to see that they were still trying to sell the courses after landing in hot water.

Asked for statements and they said “they could not release at this time.” I was almost waiting for them to make up some BS about not being able to release because “they were in an investigation.” They were really pushing the course. When I brought up the civil suit they told me to call the office so they could explain, but did not want to type it up. I put a link there and asked if they had traded and they suggested that it was all hot air.

WOW!!! They are digging their own grave!

Isn’t it amazing? Still selling and pushing this crap, even after the CFTC filing.

I can tell you from personal experience that when I was running my boiler rooms, I got cease and desist letter from State investigators and they went right into the trash can. The only thing that stopped me was being raided by the FBI and arrested. Criminal prosecution is the final stop. It appears that Joseph and Meghan are “dead-enders”. They are going to keep scamming until the handcuffs bind their wrists and they are lead to the cell block.

When I am elected president I will get these pasty guys..the notorious ones in trading education with over five years of revelling in this game…into the hardest most violent California prisons with hard blacks and Mexicans so fast your heads will spin. On my first day in office I will indict the unrepentant and retroact laws making their past behaviors felonious and they will be talked about in prison like they are pedophiles. I’ll get live streaming from the prisons to broadcast the events in 4K pixels and multiple angles, slow motion replays, transmitting this corrective action worldwide and throughout the galaxy. The video and these reviews will be buried in time capsules for future civilizations to discover and learn our newly evolved ethical values. Disclaimer.I am not implying any of these future criminals are currently in violation of any current laws.

Does your plan involve building a wall anywhere?

What will they get? 2 months of community service maybe, the CFTC has no teeth hence why there’s a small country worth of these scammers. Your case was in the hundreds of millions from what I read so you would of been a big fish but a couple of million here and there is not a concern

Same with WarriorTrading Ross scameron. Only will be stopped handcuffed by the FBI away from the keyboard which he only touches to control the sim screens and mic. The hands don’t move when entering and exiting trades as someone noted before they reacted by moving the webcam away from the hands at a different angle.

So what is it going to take to get the feds o their trail. These scumbags could use a good few years in the graybar motel. I for one would be up for a plan to put these shit heads where they belong.

NT response on BMT / futures io

https://futures.io/vendors-product-reviews/4964-school-trade-legitimate-www-schooloftrade-com-22.html

“Improving how vendors are listed and continually audited has been a high priority project for us over the last few months.”

Man, was that good for a laugh. They do no vetting!! How about asking those con artist to actual show a brokerage statements proving they ever made a live trade; more less trade profitable. NT will never vet any of these scammers as if they did they would have no more educational partners.

No vetting whatsoever. Its not in their interest.

Scammer sells BS trading systems, BS trading room, BS trading indicators, BS educational services. But in order to make it all work, the victim has to purchase a copy of NinjaTrader and open a trading account with NinjaTrader.

And then, after the CFTC, SEC, or FBI busts these guys, never a mention of NinjaTrader. Going to keep on writing about it.

I remember that horrible broker mirus who had either college teens or yelling blowhards at the front desk when zenfire was imploding, taken over by ninjatrader to become ninjatrader brokerage. Sadly, it seems I have to prepare to move away from nt and code up my settings and indicators on another platform if the day comes where the feds go after Ninjatrader for their ecocesspool and they shut down everyone’s nt platform who paid for lifetime ownership.

Recent NT Forum threads on EcoSystem:

http://m.ninjatrader.com/support/forum/showthread.php?t=88756

http://m.ninjatrader.com/support/forum/showthread.php?t=88032

Emmet, Ninja Trader left this post to you on the thread at Big Mike’s about the School of Trade Scam.

There are a lot of inaccurate statements about NinjaTrader being construed as facts in various articles published at tradingschools. Emmet, I know you are listening…Your website is void of your contact information. Can you kindly reach out to us at platformsupport@ninjatrader.com, reference this post attention to John. We want to ensure that what you write about us is accurate.

https://futures.io/vendors-product-reviews/4964-school-trade-legitimate-www-schooloftrade-com-20.html#post599948

Ninjatrader is pretty crafty these days. Now the list of educators in the ecosystem only show up in a search instead of a page with links. Not how vendors are just called part of the “ecosystem” when before they used to be called “partners”. Someone said they never heard of SoT? Emmett is correct in saying they used to be a partner.

https://web.archive.org/web/20130622075145/http://www.ninjatrader.com/partners#Education

Yep. The web archives don’t lie. The recorded histories of the Ninjatrader Ecosystem/Brokerage contain a swamp full of shady hustlers.

While the competing brokers and platform providers have kept things much cleaner. I have lost track of how many upset brokers have contacted me and begged that somebody write something.

The platform and technology providers have suffered as well.

My lord, just last week NinjaTrader Brokerage/Ecosystem promoted a webinar for a guy with some nutty “auto-trader” system. Did NinjaTrader vet this guy? The guy is selling bullshit that can only be used through Ninjatrader Brokerage. Hey NinjaTrader…here is a novel idea…before you promote these guys, why not ask for some sort of proof that they are even trading their own product? The investing community should be outraged as the irresponsibility of NinjaTrader.

bery, bery good, what kind of penalty could they get? fines or jail or both?

Emmett I don’t see my comment posted why?

This is one example of why it’s important to have review sites like tradingschools that show the truth of how hard retail trading is. Having seen what a former vendor said it’s all too easy and tempting as a retail trading vendor to stop trading live and coast along on fake and sim results especially if they are a good salesman or marketer and able to sell dreams and put blinders on newbs. I had contacted vendors in the past where I was assured they were using live accounts only to realize it was all a sim sham. There was a post on elite recently where the guy claimed he worked at a hedge fund and said his firm would never give away or sell a working method even for a million dollars. We continue to hear where a trading “school” claims they were threatened under “extortion” to pay a fee for a good review. when it’s more like Handley ~phdmsmbajd who defends his grand tetons who paid a fee to be in the mountain range , then recently tries to look legit by being harsh on Felton.

If someone’s boasting of their educational credentials that should immediately be a red flag. Dr Handley, Dr Brooks, etc. If they are suggesting they switched careers and can prove that they are making a living trading then that is different, credentials are ALWAYS used in place of evidence of trading success by these guys. Even Duchefresne probably had a framed G.E.D. in his office, LOL.

These trading room operators are brilliant criminal masterminds. I am embarrassed how long it took me to figure it out. That was before this site. They have their fake testimonials, there fake results and then have their shill screaming how they just made 20 ticks on 3 car on that last CL trade that you took and lost money. All fake. The shills are just the TR operator himself. And they all sound so sincere and caring. It really is a brilliant scam.

I tell you a true story, I was in a room and the TR operator made a call that just lost money. I then in the little text box stated, “that is not where you said to enter” and he just uses the mic to bully and has his shill (himself) post ROB B must be smoking something. And then shills post how much they made on the mysterious trade that was not even the trade he called. Everything to make you believe it was somehow your fault.

In fact it is so brilliant that the people being scammed think it is just there fault they cannot trade the method profitable. Something is just wrong with them. After all the TR operator and his shills are hitting it out of the park. So they just disappear and never even post a negative comment. I know as I Skype with these people and tell them it is not you, the scum bag TR operator could never trade profitable in the first place.

That was before Sheriff Emmett came to town.

Look in the past I have at times been critical of Emmett, but prior to him there was absolutely no honest review. Even BMT who claimed to be so honest and ban vendors allowed scum bags like Al Brooks to give Webinars.

I am not an advocate of the death penalty, but for TR operators I think we should bring back tar and feather and I am talking boiling hot tar.

“Even BMT who claimed to be so honest and ban vendors allowed scum bags like Al Brooks to give Webinars.”

Cant wait for Doctor Brooks,MD to get exposed..his fraud has been going on for too long..

when you start review on him make sure you point out his last name and its not Brooks lool..i see a big can of worms from this one

I agree, BMT is a potentially dangerous place for new traders. In fairness, there is a lot of good advice from Mike and others such as don’t scalp, don’t try to trade for a living unless you have a very large account, don’t trade futures in a 10k account, etc. It’s also good that he keeps rude behavior out of the site. But there are some significant problems for a site that is pushed as a ‘different kind of trading forum’.

First problem is that despite banning rude people he always allowed people of poor ethics to remain part of the community, folks like Jaguar Trader Ed, Vince Virgil, MFBreakout to name a few. Mike was a former “student” of Ed so he knew the guy wasn’t what he claimed to be, yet he allowed Ed to remain and continue pulling more new subscribers from BMT’s ranks. Some operated as “stealth vendors” on BMT, posing as successful traders and taking in money under the table from interested users or by launching a subscriber site once they built up enough following on BMT.

The other problem is he brings in all these vendors to give webinars and none of them have been vetted in any way. Some of the webinars are good and provide value. Others are absolutely useless and dangerous… all talk and theory and perfectly marked up hindsight charts. It paints a false and misleading picture of what trading is really like and what kind of returns a trader can realistically expect.

Who are you- and who is Big Mike to tell people how they should trade? Do not scalp- Minimum account size etc.

Scared money aside – account size is the business of no one except the trader.

Why should people be forced to trade and believe in certain

ways? Why do some of the bigger names on that site get a

pass for not following Big Mikes advice?

FT71 and jigsaw for example. People need to learn their

own method and style of trading and work within their own

mental and physical constraints.

It is not your or Big Mikes business to make those decisions

for them. If you have horrible psychology and need to hide

away in some shit hole country then perhaps- yes you need

a huge account to make up for your weak mind.

But just because you have mental weaknesses does not

indicate that everyone suffers the same dementia.

So it is unwise for you to speculate on the behalf of others.

Worry about yourself -but don’t shadow others with your internal weaknesses.

Some people trade much better with smaller accounts and by scalping. You may not be able to accept this fact- But it’s

something you will need to get over.

The acct size stuff comes from the many noob traders who show up with 10k to their name, ready to quit their jobs and trade for a living. In that case I believe Mike is doing them a favor telling them to forget making a living for now.

Fair enough on the scalping, you have a point. Short term or long term is a matter of preference.

I agree completely that one should not be

trading with scared money- Trading capital is

all risk in my book. We never know when

our broker may be the next MfGlobal or

PFGBest.

If you need to trade to put food on the table

then you are absolutely correct – Get a job

because psychologically there is no way

you will win in the market.

But Big Mike and his cronies criticize others for their style of trading because they are different than his. He has to control the narrative.

As you pointed out with the AMP lawsuit it displayed perfectly his inability to control risk.

A person with solid psychology of risk management would never have let that lawsuit

become an issue.

It proved beyond doubt the serious head issues Big Mike has and is unfit to trade. IMHO.

There are many things BM does I disagree with such as allowing vendors and con artist to do webinars without vetting them. But if everyone that jumps off a bridge dies then BM certainly might warn them that is not a good idea. And if every underfunded person that thinks they will make a living by micro scalping CL bust there account, he certainly has a right to warn them. I am sure he knows a lot of them.

You say people can decide for themselves. Who says they cannot. But people also need truth information to make an informed intelligent decision. And this is an industry is nothing but liars and scammers. Day Trading Room Operators and their shills that post fake results, BM that give legitimacy to con artist by allowing them to do webinars, NT saying they vet there vendors (what a joke that is), invest-o-scam u where fake testimonials are posted and Lying Dr. Dean publishing articles in magazines while his endorsed trading rooms are being filed with criminal fraud for being a complete scam like Open Range Trading. And Gosh I did not even touch on Top Step and that scam which Emmett exposed. How can anyone make an informed decision about Day Trading in this mist of all the false information being spewed?

You have better odds of making a living betting on the horse, playing BJ in Vegas or playing the Powerball than you have of making a living by micro scalping a highly volatile highly leveraged instrument like CL with a $5,000 account using 500 to 1 leverage. So I guess that puts me in the BM camp.

If you look at what you just said it describes why so many people fail.

Everyone is looking externally for

the answer to trade. Everyone

wants to get the answer from

someone else.

What if the perfect method was

inside you ( assuming you have

market experience).

People keep searching outside

for answers that are inside. As long as you do this you perpetuate the real issue of not honoring yourself- and you will never succeed in trading.

Trading requires you to be bold and to do the things that are uncomfortable. If you follow someone- anyone- you are already behind. If you follow Big Mike you are already lost. lol

I agree with this post, but when people are being told complete nonsense trading by trading rooms and shills and others, it becomes hard to know the truth .vs the fantasy. I have written about this many times.

And I am the only one here that I aware of that has stated I will show my brokerage statements to Emmett showing profitable trading if and only if he gives me a thread where I talk about the reality of trading .vs the fantasy world the day TR present.

One person responded to one of my post saying so you are saying the turtles are not real and am I saying swing trading can not be done profitable.

Absolutely not. I trade profitable. So that is non sense. But the Day TR teach complete nonsense to sucker people into trading a fantasy world. They teach you to trade white noise. And anyone encouraging people to do that is clueless about trading and never has made any money doing it.

I have also stated if I had the time to deal with all the fake brokerage statements I would get, I would offer an open challenge with an prize to anyone that can show they can trade the nonsense way the TR teach. I would outline the rules they teach which include:

1) You can trade a highly leverage highly volatile instrument such as CL,

2) You can do this with some small account like $5,000,

3) You will have an 80% win rate,

4) You will have virtually no drawdown,

5) You can come in everyday rain or shine no matter what the market condition and take numerous scalps in CL every single day,

6) You will have a straight up Equity Curve and

7) And you can quit your day job (with no other source of income) as you make money every day trading like a salary. Day after day, week after week, month after month, year after year

Yes Crooked, I say that is nonsense and if BM says it is nonsense I agree with him. And worst the amount of time and energy and money you will lose trying to do it, could have paid for a college education.

You manifest your beliefs- Plain and simple. There are people who trade small accounts profitably everyday and have for years. Some of these same people have been funded with large accounts and blown them.

Likewise on large accounts. Everyone is different there is no one who determines who is right.

People get what they want from the markets. Despite what they say.

“There are people who trade small accounts profitably everyday and have for years.”

Who said there are not. You bring up general statements. I am being specific to what the day TR teach.

I do not have to jump out a window and try and fly to know it cannot be done and warn others you might not want to jump out that building with out a parachute.

There is enough evidence to show what they teach is nonsense.

As I have stated many times I am a full time investor that includes Real Estate. I can show you Real Estate investors all day long that can show actual proof of their profitabilityI .

Yet no one can show proof of the claims these Day TR teach. NO ONE!!!!!

I remember when Emmett was demanding 3 months of proof. Gee in his last post he asked for 1 month of just BE. How low can the bar be.

Crocked Hillary, I say you are as crocked as the real deal. I can not prove one cannot fly. The person that can fly needs to prove it. You say what these TR preach can be done then prove it. It is that simple. Show you brokerage statements to Emmett proving it. Do that and I will eat crow. But you have to show the claims made by these TR as I posted earlier are true.

Go ahead I am waiting.

Do you have any evidence to suggest an individual’s beliefs determine or are highly correlated with their trading success?

Sorry to keep you waiting I have had appointments all day. Beliefs and ideas are everything not just in trading but in life.

You may think this is all BS and that’s fine. I post for some who it may resonate with.

Let’s talk about physical death:

When you die a few things happen.

1. Your body becomes a flesh salid for various bacteria maggots and vermin

2. Your Pure consciousness ( Beliefs/thoughts) separate from

your physical body

3. Your false or little self ( Ego) separates itself from your pure

consciousness.

At this point realize who you

thought you were all this time was

your ego or your false little self.

Oh Shit!

You may also realize the formula

given to every person granted a

physical life and this is important

because it explains why some

people managed to accomplish so

very much with so little and others who were given so much

accomplished much less.

Here are the formulas:

Pure consciousness ( Beliefs/thoughts) + Emotion +

Action == Creation of originating

thought/belief

Creation begins with thought and beliefs and are important.

This is the secret defined in 1 sentence.

This is also trading in the zone.

Ego (Little me) + Pure

consciousness ( Beliefs/thoughts)

+ Emotion + Action == Something

other than the desired

thought.

The Ego putrefies the equation.

This is where the majority of

people live their lives.

This is the space where most people trade from.

How can any of this be proven?

Well that’s a tough call but it is one area where I think all or most religions agree.

All spiritual teachings of

enlightenment ultimately point

towards letting go of this “little me”