Pristine Trading

-

Honesty

(2)

-

Quality

(1.5)

-

Cost

(1.5)

-

Support

(3)

-

Verified Trades

(1)

-

User Experience

(2)

Summary

A stocks day trading room that is moderated by nice folks, but not much of a track record. They claim to make about $14,000 per month, but can provide no proof of fantastic returns. No record of trades called within the live trading room, I asked but none were provided. Trading room needs to improve by being more transparent and providing an accurate record of trades. Until then, you should avoid.

User Review

( votes)Thanks for reading today’s review of Pristine Trading

What is Pristine Trading? Pristine Trading is what I would consider one of the “legacy” trading educators. The site was founded way back in 1996 by Greg Capra and Oliver Velez, both are long time educators and salesman of various trading products. I wont go into too much detail regarding both of these men, however I can tell you that Oliver Velez is definitely someone to avoid at all costs. He has a long history of running various fraudulent trading activities, including a prop day trading firm named Element Trading. What was Element Trading? Element Trading pooled small traders together into an omnibus trading account which allowed small traders to avoid the $25k day trading rule. It worked for a short period of time, until Oliver Velez closed up shop and disappeared with the trading deposits of everyone that had contributed funds into the omnibus account. This happened back in 2012, and it was quite ugly. At about that time, Oliver Velez, with all of his fraudulent baggage broke away from Pristine Trading and started a new company named IfundTrader.com. A review of Ifundtraders will be published shortly, however lets just stay focused on Pristine.com.

Is it fair for me to mention Oliver Velez with Greg Capra? Some might say that since Oliver Velez left the firm in 2012, then everything since his departure should be considered fresh and new. However, I believe that it is important to at least include a broader history of Pristine.com so that we can bring some contrast and comparison to the new Pristine.com.

What exactly is Pristine.com offering? In a nutshell, Pristine is selling an educational package for $9,000. A quick review of the website claims that the $9,000 trading educational package is everything that a person will need to become a professional full time trader. And they also promise to continue to work with a trader until they reach their goals of becoming a successful trader. In addition to the $9,000 trading educational package, Pristine also offers a live day trading room titled “The Black Room”. This room comes at a cost of $197 a month.

The “Black Room” is considered to be the marquee trading experience, where Pristine’s very best traders display live daily stocks trading. This live daily trading experience is supposed to include entries, exits, profits, etc…and be fully trackable by the subscriber. If the $9,000 trading educational experience has any value, then we should be able to fully witness this value within the “Black” trading room. When I think of the word “Black Trading Room”, this elicits feelings of exclusivity. Like a black american express card, or a really exclusive night club, or a private portion of a topless bar where the lady is going to give me the “special show”. In short, I had really high hopes for this exclusive trading room.

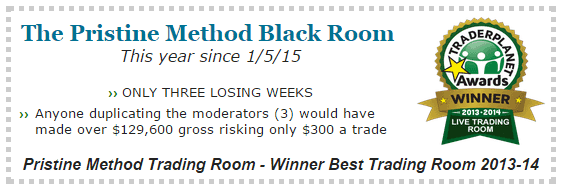

In addition to the sense of exclusivity for the Black Trading Room, I have also been receiving a steady stream of marketing emails highlighting the Black Trading Room as the Trader Planet winner of the Best Live Trading Room of 2013-2014. The marketing piece claims that anyone duplicating the three moderators would have over $129,600 since January 5, 2015. Furthermore, the marketing piece claims that the Black Trading Room never risked more than $300 per trade and had only three losing weeks. Below is the marketing piece that is emailed to prospective purchasers…

Lets take a moment and put this into context…$129,600 in profits since January 5, 2015. This means that the Black Trading Room generated an average of $16,200 in profits each and every month. Pretty impressive stuff. Especially considering that they never risked more than $300 per trade, and had only three losing weeks. I am not sure how to calculate the mathematical probabilities, but this seems on the outer spectrum of believable possibilities.

Asking For Proof

One of the things that you will not find anywhere on the Pristine.com website is a record of trades called inside of the Black Trading Room. I emailed several times and requested a spreadsheet of trades, however Amber Capra could not furnish me with any records. Next, I asked for account statements that prove these magnificent performance numbers, once again I could not seem to coerce Pristine into providing any proof of these returns. I attempted to collect verifiable performance figures several times, using several different personas, emails address and identities etc. However, I was roundly ignored. The best that they could offer was that I should attend the live trading room and that all of the trades would be called live and in real time.

My last attempt at verifying the above performance came when I said that I was ready to spend my $9,000 for the premium education package. I said that my payment was contingent upon verifying the claimed performance, however I was once again ignored. Apparently, it is OK for me to spend my $9,000 and trust that my educational package is based upon the stated performance metrics. But it is not OK to for me to verify the claims of $16,000 average monthly profits. This scenario represent everything that is wrong with the trading education industry.

Inside of the Black Trading Room

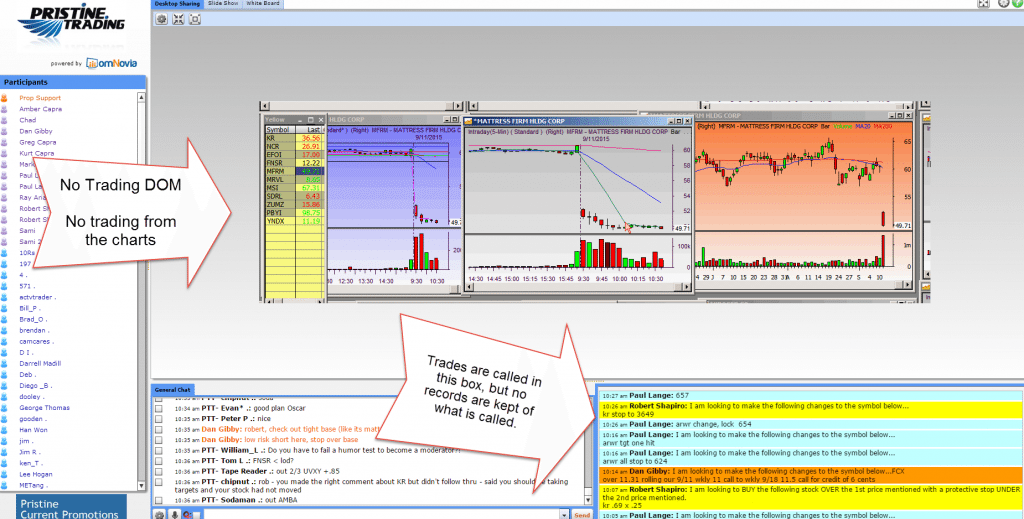

The Black Trading Room is moderated primarily by Robert Shapiro and Paul Lange. It appears that they are calling trades from a charting package provided by Lightspeed Trading. At no time did I see a trading DOM present on the screen, nor did I see any trading directly on the charts. The following is a visual of what you will see inside of the trading room…

In total, we recorded 8 complete trading sessions. As I reviewed the tapes of the trading sessions, one of the things that I found to be confusing and annoying is that the moderators never did tell you how many shares they were trading per trade. For instance, they would enter a trade and if the trade would gain in value then they would declare that they were out 1/3, after it moved some more in their favor they would declare that they were out 2/3, and then finally out 100%.

Another annoying aspect would be that sometimes a trade would be initiated, and then the chat box would scroll through and new trades would be introduced, however the original trade would just be forgotten about. No mention of it. Sometimes a person from the general chat would call this into question, if the trade was a winner then the moderator would say that we are still holding. But if the trade were a loser, then the moderator would declare that he dumped it earlier.

Over the course of the nearly two weeks of recording trades, (those that we could actually record) we discovered that the Black Trading Room was basically a scratch trading experience. Equal amounts of losers to winners. But again, everything was so informal and difficult to follow our records could be off. My overall impression is that no records are being kept because there is no real trading actually happening. It appears that the moderators are just sort of winging it, fumbling through charts and making comments about this or that. No real concrete trading was happening, just slippery comments rolling through the chat box. The whole experience is to give the impression that actual trading is happening, but in reality what was happening is a lot of chat and commentary.

Pristine Needs To Improve

Based upon what I saw inside of the Black Trading Room, it would be a waste of time and money spending $197 each month for this sort of experience. Pristine needs to make some major improvements to this trading room. The first would be using a trading DOM or trading directly from the charts. This way customers can actually see what is happening. The second, and most important would be keeping accurate records of the trades being called inside of the trading room. If I am going to spend $9,000 to learn from one of these moderators, I want to make sure that he actually has a track record of positive performance.

Pristine needs to also provide some sort of proof that the stated gains of $129,600 in profits over the prior 8 months is legitimate. An account statement would suffice, and if you are considering spending your money with Pristine, then you should demand proof of these returns.

As it stands now, this is yet another trading room making some outrageous claims of massive profits, but unfortunately cannot provide even the most scant amount of evidence to substantiate these fantastic claims.

Well, thats it for today. Another crummy trading room. Please don’t forget to leave your comments below. Even the haters are cherished.

I appreciate education and knowledge, but, not for a stultifyingly high price nor with promises of producing a profit. I enjoy the analogous ironies presented in this classic paragraph. Read:

“If the $9,000 trading educational experience has any value, then we should be able to fully witness this value within the “Black” trading room. When I think of the word “Black Trading Room”, this elicits feelings of exclusivity. Like a black American Express card, or a really exclusive night club, or a private portion of a topless bar where the lady is going to give me the “special show”. In short, I had really high hopes for this exclusive trading room.”

——————————————————————————————-

With the sentiment as the “Black American Express Card,” or the lady with the “special show,” we all know what’s coming — more hustle and more bustle. A total scam and sham!

Hi, Emmet. how are you?

When are you going to talk about ifundtraders?

Oliver Velez has lived here in Colombia since 2012, that is, since the creation of ifundtraders.

Oliver continues swindling here in the third world countries with Daniel Tirado, he is an Influencer, and he dedicates himself to divulging Oliver in events, conferences and social networks.

I am considering joining T3 trading and have been offered a prop trading position after I pass the series 57 test. T3 Live is the new educational arm that offers the Pristine method training and the Black room. In addition they are offering me options trading and a options trading community. Since both Amber Capra, husband Greg and Sammi Absuuud are the principals in T3 live and the Black room , I worry about the negative review by Emment and some others. The Valez guy is famous so I will ask Amber about him and the relationship. However, can Emment update his review or someone else share their experience with the education offered. Note Amber gave me trade history for the options trades but not Sammis in the Black room. I will ask for it now. I can join T3Trading without T3Live but feel like I need training to adjust from the position trading intermediate term trader that I am to more swing trading along with options income because my own capital is low.. I want to make a living.

There are a lot T3 offices. Amber, Greg, and Sammi have their own shop.

As far as T3 being a good firm. It is. I wrote an updated review on T3 Trading which can be found here.

Is the education that Amber, Greg and Sammi offering any good? I am sure there is some good to what they are offering. There are also a few things I don’t like. Are they ‘bad people?’ No. Nice folks.

I just found tradingschools.org and I really like this site. I wish I had found it earlier.

I would like to give my experience with Pristine. But, first, I would like to say I have nothing to gain by the positive things I’ll say about my experience. I will also list as many negative things as I can remember about my experience. I am just a wanna-be trader that that is searching for something out there to make me more successful. I started trading with Pristine around January of 2014. I traded with them for 6 months. I traded in the Pristine Room or TPM room (I don’t remember the exact name), but it was not the Black Room. I never paid for any training. I just paid for access to the room. Paul Lange was the main Moderator with 2 others. I don’t remember their names. But they were the most profitable for me. Before trading started each Mod would list their WATCH LIST before the opening bell. This was based on gaps or patterns before opening. I’m not really sure because I didn’t have the training they offered, to spot or recognize what was being sought after. In the room, the paid members could actually see each others posts. The long time or better members would recommend trades to the room, that the Mods might have missed. The lead Mod would give the member a short critique of his trade recommendation. If it was positive they would use that trade also. I never recognized any patterns, again, because I never paid for the training. Every trade that each of the Mods would be preparing for, would pop up and be permanently put in an Alert page. The trades would consist of Entry, Stop Loss and Target. That Alert page would stay up until the close of the day. I would screen shot that page everyday. The next day, the Mods would post all the trades taken the day before. I would copy that also. I would compare the 2 to make sure they were being honest and accurate. In 6 months I never found any discrepancy. Pristine used a method called “R”. It may be common and I just never heard of it or they may have originated it, I don’t know for sure. The R is how much a trader is willing to lose (or make) on each trade. The Stop that was posted, for the Trade, was based on the pattern and never on a Dollar amount. If a member had a small account and never wanted to lose more than $100 per trade, that member’s R was 100 (determined by the member only). When the Mod would post their trade, I would put the Entry price and the Stop price into a spread sheet I created (with my R of $100) and my spread sheet would tell me the number of shares to trade. The Mods usually hinted at their R as being $1000. Over the 6 months that I recorded ALL the recommended and ALL the “next day” Profit and Losses, I found that, on average, the Mods would make 0.6 R’s. In Other words the average trade would make 60% profit over there losses. Now I will list some negatives and positives mixed together, as I remember them. Paul Lange was a Machine, a Robot! He took every trade regardless. Losses didn’t effect him one little bit. Even the HUGE Losses! And he didn’t have the best “bedside manner”. He was very blunt. But he never wavered in his trading or justifying his trades or opinion. The other 2 Mods were a lot more personable. All 3 were good traders. Some days I would see the Mods lose as much as $13,000 a day (based on a $1000 R) and then the next day make back $16,000. I, personally, did almost everything wrong when I was in the room. I would cut a loser short (before the stop) only to have it turn around and make target. I would move my stop, only to take a much bigger loss than the trade recommendation. I would cut my winners short and not let them run to target. I would double my R or cut it in half at random. And worst of all, I would try to cherry pick which trades to take. I missed the best and took the worst. I traded the day they lost $13k and skipped the day they made $16k. I just didn’t do what I was being told to do. Some negatives that I remembered were, you had to be fast. (It would have helped if I had the training to spot the trades early) You had to calculate how many shares to trade as soon as you got the recommendation. If you were slow you missed the trade. Sometimes the Mod would place his own trade then type the recommendation as the trade was passing. (again, lack of training hindered me). Some of the trade recommendations were shorts. Sometimes my broker didn’t have any shares to borrow HTB or NTB. Where the Mods broker had the shares to borrow to short. I’m going to try and wrap this up now. I would recommend Pristine to the “Right Person” IMHO. Who is the “Right Person”? That’s up to you. I tried to list as many Negatives as I could remember. If you can over come those Negatives and any bad habits I practiced, you might be the “Right Person”. I think I have come a long way in discipline since the days that I traded with Pristine. One day I will go back to them, BUT with a larger margin account. I’ll trade like a Robot. I also traded with Momentum Trading systems. What a pair of lairs. I caught them in many discrepancies of their bogus P&L Logs. They probably thought nobody would scrutinize the Logs.

NO, NO, NO!!! I personally witness an offshoot of Pristine (old moderators left to start new scam room) and saw the same circus con artist tricks. They buy a lot of stocks with big bid and ask. Plus several moderators with the one off video making all the money. A complete scam circus act. I could go on and write a long response, but due to time constraints I will keep this simple as you said it all when you wrote:

“I caught them in many discrepancies of their bogus P&L Logs.”

I saw that exact same thing. There is only one reason and one reason only you have to fake your P/L and unless you are brain dead you should get it. Trading the real world and putting actual money buying those stocks with big B/A spread is quite different. Go put real money to work for 6 months taking all their trades then report back here showing your real results, not bogus P&L Logs like they show. And that 60% return will disappear real fast.

http://www.businessinsider.com/the-hopeless-quest-for-the-perfect-investment-helaine-olen-pound-foolish-2013-1

hello emmett, do you know of any other prop trading room we can follow?

Mike thats strange as i just got an email from pristine saying hes doing a webinar in febuary. Can you post a screenshot of what youve read please.

I attended the seminar today. Greg Capra was part of a presentation by t3 live today. He ended it with an offer take his course for 2K . Don’t know him or his course. I know t3 and know they are real traders. Dont know why they supposedly bought Pristine.

fyi paul lange left or was let go from the pristine room today

I appreciate you posting your experience with Pristine. I was interested in their trading offer but I never bought into any of their packages. After reading your post along with other replies I am grateful I didn’t lose my money via a purchase from Pristine. I am curious… Did Greg Capra produce proof of P&L for trades?

No proof.

If you need proof I can bet you 100% that Sami in the black room is better than any of you guys commenting and he always shows his P&l when he’s up 20k ,6k Etc …..

hello emmett, do you know of any other prop trading room we can follow?

Hey Emmet –

I just saw your review this evening and read some of the comments. I am not surprised!

I happen to attend their open house today. Paul lost on every trade he called. And he called a lot of them. I was blown away honestly! He’s a horrible trader.

He’s also the head guy in the room, which makes you wonder how good the rest of their team is. I mean if their best trader can’t trade, how good can the others be? Needless to say, I won’t be going back again. And the PRitine Method – probably a scam!

Testify – show me that software, and then I might take your comment more seriously.

Why wouldn’t he….well, it’s really simple, his calls don’t make money. I took his calls for OVER SIX MONTHS…EXACTLY LIKE THEY WERE CALLED….AND I LOST MONEY….

And when his calls did make money on paper, at the end of the week, i still lost money due to bad fills, uptick, spread, etc.

Has he ever shown you proof that he takes his calls? again, it’s not just me, read comments above. Every single person i talk to from the room itself says the same thing…he’s a nice guy and a really awesome educator, but a terrible trader.

I agree with your review Emmet, especially when it comes to the part about transparency!!

I have been in the Pristine Room for over 1 year and can tell you Paul does NOT trade real money. It is soooo obvious. He has never shown his P&L or fills – ever! I have never even heard him say this stock is hard to borrow for me, I got a bad fill, got skipped, etc. In fact, he has to be told that his trade reached target or stopped out, almost on a daily basis. The people in the room (i am one of them) know he doesn’t trade real money (every single person I talk to knows), but we don’t say anything because there is no point. The only thing that could come out of it is to get banned from the room…it’s unfortunate, but that’s what it is. I am in there because I got the room free for life.

LOL! How ridiculous. I can manipulate software in a P/L screen to show whatever amount I want for a trade. It wouldn’t make any difference to me if I saw your’s, Paul’s or Greg’s P/L. I only care about my own.

Let me ask you, eagleeyes, why would Paul take the trades he calls? I am a PTT. I’m in the room. The guy knows fully what he’s doing. He’s beyond you I’d bet. Anyone else at Pristine who you think does not trade his calls?

“why would Paul take the trades he calls?” That should read “why wouldn’t…”

Roger – i am NOT. I am actually appletrader that agreed with you that anyone that refuses to show his P&L has things to hide (I just picked rogerthat for fun).

But, clearly you are one the mods at livetraders. Now you’re promoting that they offer personal coaching. Go ahead and promote. Your desperate attempts to get clients speak much louder than all your marketing emails.

To Rogerthat’s comment LOL..nice name btw

That comment makes you look like one of the moderators at pristine but in anycase…you and livetraders are free to fight it out amongst yourselves..Let me focus on my trading…also read TradingWikiLeaks comment above LOL would that leave any doubt about pristine…Its shocking to see even after all that is posted…Dan Gibby is a paid moderator at pristine and they call him an expert..what a freaking joke

Fair Enough Rob…that makes more sense the way you just explained it now..And no, i am not affiliated with them though however i am a member in the room now and am starting my personal coaching with them next month…Hoping for the best…From a losing trader, i have finally transitioned into a breakeven’ish trader..Hoping to get myself off to a winning trader..Will keep you posted

Roger, my guess is you are affiliated with the room. Why else criticize me, someone you know nothing about, instead of discussing your experience with the room. First you must not have looked very hard as I can show links of traders with negative comments about livetraders.net including comments about their hedge fund. But my goal is not to be negative. I have not even made a final decision about LiveTraders.net. I just gave my opinion of my experience so far in a fair and honest way. Heck compared to Emmett’s reviews of most trading room I thought I was very kind in my comments. I will even go as far as to say they are more transparent than most trading rooms, but that is not much to brag about as most trading rooms as you can see from Emmett’s reviews and other posters are complete con artist. First I stated some traders from Pristine moved to LiveTraders. That is just a true statement.

Secondly I commented on their hedge fund. Livetraders.net has been talking about their hedge fund and how they were going to let members be able to trade for the hedge fund giving them $50K or more in capital to work with. I thought that sounded odd and I stated so. They have been unclear IMO in explaining how it would work. If I had to guess I bet they will have the would be traders pay for educational course and / or pay to take a test like Topstep does; that most of the traders will fail to pass. And that money will be used to fund the traders. But honestly I have no idea. Maybe I should have just said the implementation of how that would work is very unclear to me. Is that better?

In addition, I stated so far I have lost money in the room, which is true. I also stated I have only been a member for a little over a month and maybe they are having a bad month. The reason I do not leave the room is I fully understand a trader’s equity curve does not go straight up and giving them a chance over a reasonable period of time.

I do not mindless take their trades. I look at their stock selection along with mine and take the ones that meet my criteria and I enter and exit based on my trading methodology. But I also compare the trades as they traded them to my results and the posted results. For example today they had several trades and I traded C, NTAP and TWTR.

Here is my challenge. They have a one week trial for $29. Take the trial, trade their picks, their method or using your own, and post the results here. Heck maybe that week they will be on a roll. I would love to have other posters state their experience and I would like to chat with other members. Also Rogers if you are not affiliated with the room or personal friends with the traders, I would be like to Skype with you as a fellow member.

Clearly Roger is one of the moderators at livetraders.net. Read his first comment trying to promote livetraders by saying Pristine’s best traders left to start livetraders.net. And now look how defensive he got when Rob posted a negative comment about them.

Pristine’s best? Yeah right. You guys all learned from Greg, and now you’re out there bashing him on every platform you can find. You guys are full of it. I attended every one of your open houses. Fake as hell! STAY AWAY!!!!!!!

The only thing that matters to me is which organization stables the best traders. Who is giving the the customer the best shot at success. Pristine can certainly make some improvements to transparency and accountability, and hopefully at some point I can write a new review. As far as LiveTraders.net, I do not have an opinion because I have not reviewed the room.

Are you not trading live with them?

Emmett Moore April 29, 2015

Thank you for the kind words. I am no saint. For sure. Buy maybe I can make a bit of atonement, not by asking for forgiveness, but by expressing honesty.

I have two weeks of new video on Trading Mission. Just have not had the time to review. This truth will be in there. But it takes a little time.

I understand that finding a good trading service is difficult. For instance, I am doing a live review with a real money account at LiveTraders.net. I know these guys are real, I can clearly see the trades P and L, but these guys are young gun slingers and I am getting old and slow. In short, I cannot keep up. They make money, but I cannot execute fast enough. Frustrating. Its a bit like being a horse, and your three best friends (also horses) get to race in the Kentucky Derby. Low and behold, they have an extra slot for me, the old horse. Sure, I can run in the Kentucky Derby, but I am terribly over matched.

Forget I mentioned LiveTraders.net, I dont want the owners to know that I am trolling.They believe I am widow from Louisiana.

One thing i notice is that , everywhere online i see only good things about livetraders.net. When i tried them out, they even showed P&L and brokerage statements…

Funny thing however is that the only bad thing i see is by Rob, under comments on all tradingschools blogs, Rob is the only one posting bad stuff, Then i am on elitrader forum as well. I see good things about them, Then 1 negative comment, Guess by who ? Rob again LOL…So Rob, not sure what you have against them, But all the best LOL

When room results are down, they post down results as well, They even showed P&L of them being down some days as well. If you cant respect the transparency , thats your fault.

On one hand, we want all trading room educators to be honest and transparent. Now when one room is transparent and they show down day, You beat them up on having a down day…No wonder why these educators do false practices and smoke and mirrors is because some people like Rob just have unrealistic expectations. You cant make money every single day…

Every community needs a troll. I don’t sensor anyone. Well, actually I have only scolded one guy that was a jew hater. Even then, I let him post comments.

That is a great policy. Censorship is should be feared above stupid statements. Kudos to you.

As some mentioned Traders from Pristine moved to LiveTraders.net. And I will tell you so far in LiveTraders.net all I have done is lose money as the results they post are not real results, but it has only been a little over a month. I am not sure if they can trade profitably or not. But there is so odd things going over there. They talk about their hedge fund and they plan to allow traders to trade within it, but when someone ask what is the name of the hedge fund and is it registered with the SEC, they get angry and say it is none of your business. Then they have there shill post comments like how dare you ask that totally legit question. The whole thing just seems odd to say it nicely.

Rob – Are you still with livetraders?

It’s really simple, anyone that refuses to show his P&L is either a fake trader or has things to hide. It does not get any simpler than that!!

If you’re so good, you’d show your P&L so people can buy your courses, right? It’s the best way to prove how good your methodology is. So, why don’t these fake educators show their P&L’s in the trading rooms? BECAUSE THEY’RE FAKE!!

Bingo! Such common sense. Appletrader needs to be in tonight’s Republican debate.

Here are screenshots showing Dan Gibby’s Trading Performance and other moderators at Pristine…Enjoy !!

http://postimg.org/image/ib2niyyid/

http://postimg.org/image/bw3mmarsl/

http://s10.postimg.org/4rltd9kjd/img3.jpg

OMG. That is so hilarious.

wow, i cant believe even after all this…that dan gibby guy is still a moderator and pro trader at pristine LOL in their pristine black method room…i guess now i know what that name black room means lol

funny to see reviews on all different educators out there…finally truth coming out

I had taken a week long training from Pristine about 10 years. During one the days lunch breaks, I had lunch with Dan Gibby. He told me with his massive educational background and being a seminar instructor at Pristine he was going to leave Pristine and go to Tuco trading and show everybody how to be a trading wizard. Dan Gibby was such a condescending asshole and arrogant prick during my lunch meeting with him I could not wait till lunch was over. His failure couldn’t happen to someone more deserving.

Not is only everything about Pristine a Joke, but all its offshoots including Live Traders.net is nothing but a circus of a scam. In fact they opened up a Forex room with Dan the Man. Seriously this guy was like a cartoon character used car salesman. I guess he was so bad they had to get rid of him and replaced him with Dale Pinkerton. He is this Forex trader with 40 years of experience trading Forex.

Now let me ask you a question, what is your picture of a successful Forex trader with 40 years of experience. I am thinking in the top 1% with the best health care money could buy. I am certainly not thinking of someone struggling to pay his bills. Yet on the simplest of Google searches I find this.

https://www.gofundme.com/Dale-fights-cancer

Now getting cancer is tragic. But why does a person with 40 years of successful trading need funding. Should he be worth millions and have the best insurance money can buy. Heck he can get Obama care as last resort.

Just further evidence that shows all the promises these supposedly traders make is nothing but non sense.

By the way I give Livetraders.net some credit, they are about the best con artist out there. They know all the right things to say.

Umm I think your math is backwards

Mr Capra.

You say..

“As to there being no documentation of trades provided to you when asked. I don’t know why” – I can tell you why.. Because you and your company are full of shit.

I just noticed..that screenshot of the room emmet posted shows Dan Gibby in there..he was moderator in 2006 2007 and maybe even before that..even in 2008 i think

He recently came back and i saw him in the room today as well…LMFAO…That trader has known to blow up every single account he started…His statements are available online thanks to Tuco Trading…he lost money every single year…only had 1 profitable month which was $10 LOL…and he moderated pristine’s advnaced room and now is still moderating there room….

Please don’t deny this since i have screenshots of all his statements..i can post them to prove it if anybody wants me to

please publish it if you actually have it

The scammers are being reeled in one at a time. If anyone wants some info on these forums below let me know, I’ve been a member at every one of them.

Daytradingradio

mojodaytrading

greatstockpix

the lincoln list

shareplanner

winningstockcoach

tradewithkavan

Shareplanner was the best and most transparent, next Lincoln list and the rest where horrendous, tradewithkavan aka picksthatmakecents was the worst

Rogue… please share your thoughts on TheLincolnList as I am contemplating giving them a try… Thanks much!

If you wish you can e-mail me dgrier777@gmail.com

Hi Dave,

I was at LL for a few months, I tried both the day trading and swing trading room. The swing trading room was a ghost town, very little activity, once in a while Doug would pop in say a line and leave, the trades were far and few, he held on to trades that were down as much as 15%+ and would add to them, no volume, cheap stocks, wide spreads.

Day trading room – Doug would call out a play once he enters, he would also write it out, he called out stops most times but rarely adhered to them (uses mental stops). He trades a small caps with no volume, wide spreads, he also traded large caps. This room was his bread and butter, 95%+ of his time would be spent in this room. He also trades pretty wide, he would let his positions go down 30-50 cents, because of that he trades fairly small, 200-1000 shares, if he uses large shares it’s for cheaper stocks. Allowing the stock to take a bigger dip against him I believe was his success, most people who scalp/dt are putting their stops right under a support (.10-.15 from entry) that get thrashed just for the stock to rip higher right after. He shorts just as much as he goes long.

Summary – Doug is a good trader, pretty transparent, he wrote out his entries, exist and share size. The problem is that he can’t be followed, mainly due to the cheap stocks he trades as well as the nature of his trading, he’s a in the moment scalper usually looking for breakouts, I feel that he’s more of a feel trader using some basic charting, he would average somewhere around $300-$500 a day, sometimes less sometimes double that. He hardly had any losing days, in fact if he was down he managed to at least break even most times.

Rouge,

Any of these traders trade profitable

LL and Shareplanner are, the rest use voodoo to cover up their losses. Transparency is the key here, they both put out entries/exist and size in real time, so it’s easy to see if they’re making money, whether they trade real accounts is anyone’s guess but I believe they do, otherwise it would be a waste being profitable and not trading real money.

Some guy on ebay is trying to sell his copy of The Pristine Method (part 2) for $195. Unfortunately he paid over $5,000 for the course. Don’t know how good his trading has turned out if he’s worrying about $200.

I spent some time in the pristine room and while they seem like nice guys, Paul, Sami and Robert, I can say that while I was in the room not ONCE did I see a moderator trade with their order entry open or show their actual results for the day. In fact, I challenge Mr. Capra to refute this point that Paul Lange, Robert or Sami’s don’t show real executions and P-L. I doubt he’ll even reply, because similar to your experience Emmett I emailed them and even called Amber and she was somehow never able to obtain even 1 single trading day from those 3 moderators. I don’t mean trades they ‘called’ in the room, I mean Paul’s actual trades for the day with executions etc…Like I said, they seem like nice guys, relatively friendly, (Robert kinda boring to be honest) and Mr. Capra even came into the room at times and he seemed nice…but as for showing any real trades, I didn’t see that at all. Which was surprising considering Paul mentioned he has over 15-20 years of trading experience and I think he’s even their Vice President as well. Odd for a guy with so much experience and ‘cache.’ As usual nice reporting Emmett!!

Ok Mr Capra, Time to get some easy advertising by making us all eat humble pie and showing us some proof. What a dream opportunity for you. The likely alternative unfortunately is that you have bitten off more than you can chew and will not post proof which will hurt your business in the end as more and more people read these reviews. Please take this opportunity to show us all just how good the pristine traders are. In particular yourself and Mr Lange,

Looking forward to your reply.

-RV

The website looks like it hasn’t been updated since the 1990s but the most worrisome part of it is that none of the courses have a price. You’ve got to call their friendly consultant so that you can be harassed at home by them. First rule as a consumer is that if they won’t tell you the price it’s because it’s too expensive.

wow….Here is a post from Olver’s facebook account that i found online

http://www.elitetrader.com/et/index.php?attachments/pristine-png.150485/

How clear is the post in there which states, he is a majority owner ? How much more clear can it be..

Look forward to talking with you then Emmett

To address a comment that was made.

Some people that post comments at sites about about others often have no idea what they are talking about or have an agenda of their own for saying what they do.

For example, Kevin’s post.

People may think that Oliver has some connection to Pristine because he talks about his past there. The early years were a time to be proud of for him and I don’t fault him for wanting to keep a connection to it. It likely helps to deter a focus away from other less pleasant memories at occurred later.

The negative stories about Oliver’s business activities – after Pristine. Some that think there is a connection to Pristine are making a wrong assumption.

Or it is a competitor’s way of trying make that negative connection to Pristine. Obvious why one would do that.

Velez in no way is connect to Pristine or has ever received a kickback of any kind. Terminating him from Pristine was many years ago as mentioned and dated in my prior post. There has been zero affiliation afterward. My comments make that clear. There was a buyout.

My and T3’s decision to come together is one that many business decide to do when each has something missing that the other has. Together 1 + 1 makes 3 as it is said.

Greg Capra

Hello Emmett,

There are many points covered in your review to be addressed. But let’s start with some correct history. Pristine was founded in 1994 and began providing a fax letter to one subscriber in 1995. That subscriber was my own broker at the time that worked for Prudential Securities. Eventually, that fax service grew into one seminar, a hotline call in service, which in time became the first trading chat room that could provide text in real-time. Voice technology was not yet available.

As Pristine grew, I provide live trading mentorships in our office where students came there to learn and trade alongside me with real money; some for 6-months at a time. To promote Pristine services I traded my own account at Trader Expos in front of audiences. Maybe you attended one of them. I do what we teach.

As you may not know based on your review, we offer various classes from foundation, advanced price pattern strategies, money management, gap and scalp trading. Your review that stated our education was $9000 dollars was in part inaccurate.

If someone chooses to take all classes with lifetime retakes, one-year of chat room, Pristine SRS learning program and follow-up lifetime support, then yes the cost can be that much and worth it. However, that is not required.

That being said, anyone thinking that they are going to learn a complete knowledge of the markets from a $297 dollars deal they are deluding themselves.

Oliver Velez’s time at Pristine ended in November of 2006 and was made official February 21, 2007 when he was terminated by a unanimous vote by shareholders at the time.

His partnership with Charles Vacarro of then HLV Trading formed Velez Capital Management or VCM. It is alleged that they stole funds of independent traders when the two came to difference over losses of their “Trade for Life” business model. A variation of that model evolved into Ifundtraders or IFT.

To be sure that is clear, neither Pristine nor I ever had any involvement with Velez, VCM nor Vacarro after Velez was terminated from Pristine. Your mention of Element Trading and Oliver Velez being part of that entity, I believe – but not positive – is inaccurate. Element Trading was Charles Vacarro’s version of IFT after he and Velez parted ways.

As to there being no documentation of trades provided to you when asked. I don’t know why, but I will follow up and have that sent to you if you email me so I have your email address. The trades are posted and time stamped in the chat announcements, which you showed.

A list of all trades called for the week; month and even year are kept. In addition, those that are members of the Pristine group on Facebook can see one of the moderators P&L he is post there. Sami is a fantastic trader that is loved by members of the room.

Lastly and frankly, for you to say that “Moderators are just sort of winging it, fumbling through charts and there are Slippery comments” You or your assistant just didn’t know how the room operates, didn’t ask and wrote what you thought. Sloppy reporting and I invite you to a follow up review with access to moderators and/or Amber for questions on details of what is happening.

Anyone that knows me and how I run Pristine knows that here is no snake oil or slippery comments that are going to be allowed on my watch. That being said, no moderator that presents in the Pristine room would ever do such a thing.

Why? Because that is the type of people that they are.

I look forward to speaking with you,

Greg Capra

Thanks for reaching out Greg. I know that reading a negative review about your company really sucks. I have written negative reviews at other times in the past, and then once we were able to establish some transparency in reporting, then I simply wrote another review with lots of stars. Will reach out to you in the next couple of days.

Hi Emmet,

So what was the result of your correspondence with Crapra?

-RV

I agree with Emmett: He knew what he was experiencing, the lack of communication and transparency in a timely manner. Even you, Greg, indicated that the amount needed in order to get the Pristine service would be as stated, 9000 dollars. Even you had indicated that Oliver Perez had taken funds from the company and you are distancing yourself from him. As you had written:

“Oliver Velez’s time at Pristine ended in November of 2006 and was made official February 21, 2007 when he was terminated by a unanimous vote by shareholders at the time.

His partnership with Charles Vacarro of then HLV Trading formed Velez Capital Management or VCM. It is alleged that they stole funds of independent traders when the two came to difference over losses of their “Trade for Life” business model. A variation of that model evolved into Ifundtraders or IFT.

To be sure that is clear, neither Pristine nor I ever had any involvement with Velez, VCM nor Vacarro after Velez was terminated from Pristine. Your mention of Element Trading and Oliver Velez being part of that entity, I believe – but not positive – is inaccurate. Element Trading was Charles Vacarro’s version of IFT after he and Velez parted ways.”

———————————————————————————————-

I do not believe that trading the markets are the way to go for everyone — and certainly not worth the thousands of dollars needed for one to establish the comfort level of procuring the best training and education without any gaps in the flow of such. Why didn’t Emmett get the timely trading information when he requested this? Why was he shunned? Where was the proof of these successful trades at that time?

I hope he didn’t succumb to an insidious buttering-up session in order to write a positive review. I have a notion of how this works.

They recently sold themselves to T3 which is perhaps good because their chatroom numbers dropped every year as people could see past all the BS. Shockingly enough, even though they disassociated themselves with Oliver Velez, he was still a stakeholder at pristine and they continued to give that fraud kickbacks.

waiting for review on velez, he is marketing really heavy these days on facebook and youtube ..trying to lure people by showing cigars, wine, destinations, trade from anywhere bs..basically following the tim sykes model of sell the dream but yet, all these guys are frauds..stay clear

here is one of the screenshots floating around on forums where it shows oliver still was the MAIN guy at pristine…just stayed in the background with his new firm in order for them to make money and not be affected by his reputation. http://postimg.org/image/kmnyh20f3/

Velez=BADNEWS

That guy is really shady. Wow, I didnt know that he was still a minority owner at Pristine.

The funny thing about these rooms is even worse than the claims and lies is they are breeding grounds for more scum, moderaters gain a following by giving good trades, see how much the owner is making by doing nothing and go and start another room. Lol, good review I had been told a few times this room was run by some successful people but found their site to be from the 1900s so I stayed away lol.

Great review…they are definately a scam…they had their best traders leave and start their own thing at livetraders.net those guys used to be at pristine.com before but said they left due to not being satisfied with them and how they operate.. I am liking livetraders.net quite a but after i joined them couple weeks ago. I tried to be your undercover research guy and did ask those guys all tough questions to show me their statements, fills and P&L.. refreshing to see they actually showed it infront of everyone unlike Pristine

Have had LiveTraders.net on my radar for awhile. Need to get that review written. Regarding Pristine, those returns are outrageous, they need to prove that. Am hoping that they make some changes, would love to do a new review with verified performance.

With LiveTrader.net you can actually feel the hair grease coming through the screen. A review soon would be appreciated.

Ugg…that bad?

Lee,

I tried their room because they claim to show brokerage statements and trade live. What a complete scam. In fact I rate it as one of the wort scams as they know all the right words. In addition they come up with one education course after another to push on you. The only way these guys are making money is via the trading room and selling their education package. They constantly brag about their 20 R months, but if you follow their trades you are more than likely to lose 20 R.

The results they show never include slippage and they are buying stocks with that can have HUGH Bid Ask Spreads. Plus constant late calls. Right after a stock explodes they post they went long and of course then they can move their stop to BE. You buy it and you just get stopped out for a loss while they come out at BE.

Emmett talked about being in their room a long time ago and promised a review, so I started collecting their calls and inaccurate results posting to show proof of what a scam this site is. But for whatever reason Emmett never does the review.

And the worst thing about this site is there shills, so I have no doubt they will come on here. I call Ironman, lying scum bag Ironman. Makes money no matter what the market does. Always in the high flying stock of the day, after it moves up of course.

I double dare him or any of those shill to show proof of profitable trading.

What is the reason for the delay in this review Emmett???????

Sometimes I get the video collected and I dont have time to write the review.Then the video gets old and stale I have to start over.

The problem with writing these stupid reviews is that it cannot be outsourced. You have to go through these trading rooms with a flea comb and write at a granular level. Frustrating.

Pristine is a lot like Livetraders.net it seems.

Emmett, another brilliant review of a Scam Trading Room that Trader’s Planet gives an award to.

I am starting to think trading room and trading educators are like psychics where members/ customers believe without any proof what so ever. And these trading rooms use some of the same tricks to deceive their members by keeping their comments vague and flattering the member into feeling good about themselves. Physics will say things like you are an open minded person and people are like WOW that is me! The trick is everyone thinks others are not open minded but they are open minded. Here I will show my physic ability, I can feel you are compassionate and an old soul. Who is saying; Yes, that is me!

Trading rooms in addition to not showing any real trades, do the same trick saying the failed traders are using bad money management, you know risking 30% per trade, and are looking for the Holy Grail and not willing to work hard, but if you use proper money management and work hard you will make it. After meeting many traders I realized this is brilliant. Most traders think the failed traders are just incompetent and not willing to put in the effort. Yet pretty much every trader I met is using cautious money management and willing to put in a lot of time trying to become a successful trader.

How many educators you seen say if you use proper money management, work hard and put in thousands of hours of screen time you still will more than likely never make money day trading.

Emmett, I think you should start a petition to the regulators and I will be the first in line to sign it. This false BS advertisement needs to end. The trading room should only be allowed to advertise trades done with real money and must show an accurate return on investment and if they make false claims they will be fined BIG time.

The sad thing is if they did that I think there would be no trading rooms. Until traders demand these rooms show honest results this is what you will get. But maybe the fantasy is better than reality. Maybe Cypher was right. “I want back into the Matrix”!!!!

What a spot on and excellent comment. I agree with you 110%.

I think that a lot of these trading rooms take the attitude that if my competitors are showing false returns, then I need to also show false returns in order to stay competitive from a marketing perspective.

As far as the regulators, they used to be much more proactive. However, the internet is so fluid and difficult to track that a site can be pulled down on a Monday and have a brand new site up on Tuesday. Complete with new names and a new pitch.