Market Delta

-

Honesty

(5)

-

Quality

(2)

-

Cost

(2)

-

Support

(4)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

A excellent piece of software that is unfortunately accompanied with a poorly executed trading room.

User Review

( votes)Thanks for reading today’s review of the Market Delta Trading Room.

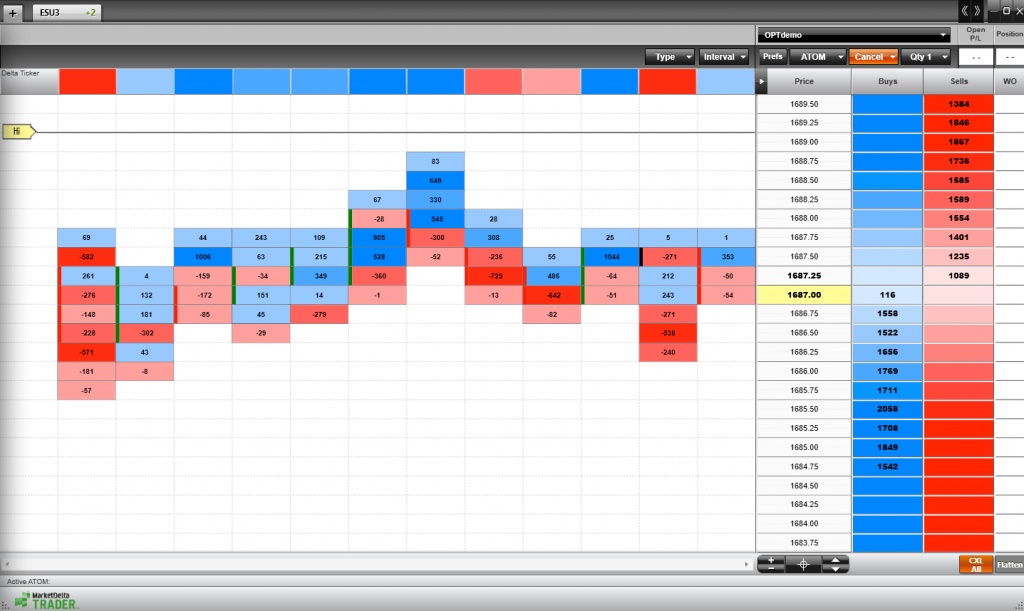

What is the Market Delta live trading room? Market Delta is actually not so much a trading room, rather it is a software program that specializes in trading off of the footprint chart. I have known the developer for several years, and this review is not really a review on the software itself, but rather a review of the recent addition of an educational trading room that is now an optional purchase. The monthly fee for the trading room is a modest fee of $99 per month. The trading room is moderated by Anthony Drager, and this review should be mainly confined to only what I was able to record inside of the live trading room, and the general experience of the live trading room.

Before I jump into the review of the live trading room, let me take just a moment to give my general opinion of the software…its great. The developer, Trevor Harnett has devoted his life into developing a world class piece of software. The software program is a stand alone program with world class features that have been endorsed by some of the futures biggest brokers in the business. A broker would never simply endorse any piece of software unless they were confident that the software is not going to cause any blow back. The Market Delta software program is robust, stable, the trading execution features well documented, reliable with fast exchange connectivity. Furthermore, I have spoken to several brokers that maintain large and active books of clientele. By speaking with actual brokers that have to deal with software issues on a daily basis, I can tell you that any complaints about Market Delta trading software are few and far between. And when bugs are discovered, the software engineers at Market Delta are quick to make improvements to the code. Once again, I want to make sure that readers understand that Market Delta is a very good piece of trading software that is well engineered.

Market Delta Trading Indicator

Footprint Chart

Market Delta’s intraday “footprint” charting came onto the trading scene about 10 years ago. At the time, it was groundbreaking. I remember the first few months it was released, at that time I was personally trading through Interactive Brokers and still in the phase of trying to find the perfect indicator. Every trader goes through this phase. As traders, we get into the trading game and start using indicators, and are fascinated by all of the cool and interesting things that indicators can do. Everyone usually begins using a moving average, then a stochastic, or a keltner channel, then we start to drift into the more esoteric like chaos charts, moon charts, or gann…it all leads to more and more complexity. But we never quit exploring new ways of looking at the markets simply because its fun and interesting to see what others have created. Like the universe itself…I rather suspect that the universe of available trading indicators will also continue to expand into infinitude.

My personal experience with using Market Delta’s footprint chart was a short love affair. I used it for 3 months. I found the charting to be very pretty and interesting. But very subjective. In fact, very often I would email Trevor and ask him, what do these charts actually mean? And how should I use this information to make a profit? And specifically, how does Trevor use his own software? In a nutshell, I could never really define an edge, nor could I test the hypothesis that the footprint chart contained some sort of statistical inference. Of course, years later I would learn to program and discovered that all indicators are pretty much the same…useless at the forward application of price prediction.

Market Delta Expands

Over the years, I have watched Market Delta expand from a “one trick pony” piece of software that only displayed a footprint chart, to a robust trading application that includes multi-tiered entry and exit algorithms that fully integrate with many brokers. They have also added all of the fancy indicators that every standard indicator package now employs. In addition to indicators, they have also added a back testing and system optimization module that allows the building and deployment of footprint charting. This is both a boon and a curse.

Why is the addition of a back testing and system optimization module both a boon and a curse to the footprint chart? Because back testing has opened up some real scrutiny as to the viability and true differentiation of a footprint indicator vs any other indicator. The conversation has expanded from, “hey that footprint chart allows me to see inside of a bar chart” to “does seeing inside of a footprint chart test out on historical data”? In my opinion, in the past 10 years since intraday footprint charting has been introduced, I cannot name a single system that has been able to produce a result more or less effective than any other indicator. That does not mean that it does not exist, but I cannot find a trading system offered through any of the usual vendors that are auto trading a system.

Perhaps this article will spur Trevor into action. Perhaps he is aware of some commercial systems that have had effective and positive outcomes that employ the footprint chart. I hope he reads this honest critique. And I hope he does something.

Evaluating Market Delta and Footprint Charting

Since we are left with only a collective soup of differing opinions on whether footprint charting is effective or not, I was hoping that the Market Delta Live Trading Room would give us some guidance on the effectiveness of foot print charting. A live trading room is the perfect venue. Market Delta can employ their best and most proficient trader to highlight and showcase the effectiveness of the footprint chart. For all of these years, I have been waiting for someone to get into the mosh pit of real time markets, and show me what Market Delta footprint charting can do.

How else are we to judge the authenticity of a trading method? Its one thing to read about why a method should work, or to look at a carefully selected group of market screen shots, or watch a carefully rehearsed video that shows a stream of perfect trading set ups. But it is an entirely different animal when real trading is on the line for all to see. And so I attended the Market Delta Live Trading room, in hopes of getting my long lingering questions answered.

Market Delta Trading Room

During the weeks of May 4th through May 15, I signed up for the Market Delta Trading Room. The trading room offers a two day free trial. During this period, I used several consecutive free trial periods using several different alias’s. Each alias used a different IP address and at no time did the Market Delta Trading Room know that I was using Camtasia screen recording software to record the trading sessions.

In total, from May 4th through May 15, I recorded nearly 30 hours of live trading sessions. The end result? Not a single trade was called in real time, nor was their ever a trading dom present on the screen. Rather, the entire time period was filled with conversation that I found essentially useless. The worst part is that the moderator somehow seems to muster the energy to talk non stop. And since no trading dom was present, or any trading from the charts was present, I was forced into listening to and scrutinizing each and every spoken word that occurred inside of the trading room. I kept waiting and hoping that a trade would occur. But not a single trade. Plenty of opinion. Plenty of sound. But no money making. No risking of money. Just a lot of talking. Very frustrating. About as useful as watching CNBC.

I have to give credit where some credit is due. If a person were a complete newbie, then a person could gain some interesting perspective on potential market happenings. But to a person that has to parse, record, and then write about actual trading events…I was bored out of my eyeballs.

On a final note regarding the room, I was a bit frustrated about no live trading during the May sample period. Perhaps there were no good setups? Perhaps the moderator only takes one or two trades each month? With this in mind, I signed up for one last review June 15 and June 16. Unfortunately, more of the same. Plenty of conversation but no actual trading. Below you will find a 10 minute snippet of the live trading room. This video snippet was a random selection taken from many hours of footage.

Conclusion

In conclusion, I really did not want to drag the Market Delta trading platform into the muck along with the poor quality of the Market Delta Trading Room. Again, the owner of Market Delta is a nice guy that loves his software. I get that. However, the addition of an educational component really opens up scrutiny to the central thesis of whether a footprint chart is very useful. Yes, Market Delta has all of the other indicators that we all know about, but the foundation of the Market Delta platform is built upon the premise that the footprint chart is a uniquely useful indicator that gives us some sort of a quantifiable edge.

The trading room is the showroom for that edge. And as far as I could observe, that edge was never on display. There was no live trading. Rather, the trading room was more an extended sales presentation of the software. I hope that Market Delta reads this review, makes some changes and provides a more robust presentation of why a person should consider using the software. Hopefully, I can revisit the trading room at a later date and observe some real trading. At the end of the day, what matters most is real money profits, and not another fancy indicator.

Well, that’s it for today. A pretty boring review, free from the usual controversy. Please leave your comments or suggestions below. And once again, this is just my opinion, if you are reading this and you are a current user of the software, then your comments would be extra appreciated.

what platforms would you suggest instead using market profile?

which ones using a diffente approach and more efficient?

Zero trading going on in this room. I joined on trial and politely asked the guy who runs this room, Anthony Drager, if any trading happens in the room, and he said that it is “not a piggy back room”. Sure Anthony, but difficult to respect someone’s opinion as a trader when they just sit behind a microphone saying ‘if you were trading, this could possibly be a good time to think about going long’. This guy is the most pathetic bullshit artist I’ve come across, and I’ve been in a few crap trading rooms. Not only does he not lead from the front in this ‘trading room’, but he doesn’t ever commit to which way a trading instrument (e.g. the emini 500) is going to go, until it’s happened. Only AFTER price has moved does he then go back and say ‘yeah about 5 minutes ago would’ve been an excellent place to go long…if you were trading’. I mean really, this guy is feeble. Should just be honestly marketed as a marketdelta commentary/strategy room.

Thanks

Speaking of POS scam artists…I think Emmett takes the cake. Nice Job Emmett on this rave review of just how trustworthy and honest your endorsements are…who’d listen to a fraudulent con artist such as yourself…just idiots who can’t think for themselves.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

Major Moron is one of the vendor (probably Ace Trade Review) who got an honest and bad review from Emmett. He’s back trying to discredit this blog which can only mean that Emmett’s investigations and record of the numerous scams are hurting these scammers. That’s the reason they set up the site Major Moron refers to, it’s a clumsy attempt to discredit him. You can read all about Emmett’s past on his own blog under the “Warning” tab.

All Emmett is asking for from these vendors is to provide him 1month of verified, real trades and none of them can even demonstrate that minimal amount of success. It would be the easiest thing is the world for a vendor to discredit Emmett, simple provide your verified trading statements that support your claims. To date only 3 or 4 have been able to do this. The rest are fraudulent scammers.

I’ve was a member of this room for about a year, Anthony is great and it’s not really a trade calling service. But I often found his commentary very useful and was like a secondary set of eyes on what was moving. kind a sqauwk service on a more micro level. Anyway, seems most of your reviews are looking at all rooms as a trade calling service which I don’t think is fair. Traders should think for themselves and not try to mirror someone else.

I agree with you comment. Anthony isnt a bad guy. In my opinion, the room was lacking.

But the software is great.

“… looking at all rooms as a trade calling service …”

Sorry, but what are paid live trading rooms for if not for calling trades? What, I’m paying the TR operator a (sometimes hefty) monthly fee so that every day between 9am and 4pm I can hang out with other dudes and talk sports and women?

“What, I’m paying the TR operator a (sometimes hefty) monthly fee so that every day between 9am and 4pm I can hang out with other dudes and talk sports and women?”

No, that is not what you are paying for. But, you should be paying only for a few months, in order to learn the method until you can call the trades yourself. At that point, you no longer need the room, and really should just go out on your own unless you really like to “hang out with other dudes and talk sports and women” as you put it.

Treating it as a trade calling service is a mistake in principle. What happens if after a year, you still cannot call the trades yourself, and the TR operator gets hit by a bus?

It also means that you are being lazy and copying something that you do not understand. What happens when the drawdown starts? Not understanding the method, how can you have confidence to take a string of losing trades. Or is the plan to go look for another trading room calling service when this one goes into the inevitable drawdown?

IMHO the best ones are for learning and idea generation. Trying to copy someone else isn’t really a sustainable business model. If you are that shitty at trading then might as well just pay to have some one trade the account for you.

Great review. It is as you have documented. Yet, having looked into the MD software, It seems that Volume imbalance may yet be a nice tool for traders. Does that justify paying the monthly subscription for their charting package is something that is open to debate?

Mostly after the fact commentary and idle observations of numbers anyone can see. Kind of funny actually to watch the micromanaged reads of obvious pivots…usually missing the latter. Incredible that anyone would pay for a subscription. The software is great, but don’t get sucked into the room’s nonsense. Learn to actually trade instead.

totally agree, anthony completely ignores key support/resistance points, and then when price bounces from a pivot he goes back and points to an order flow imbalance as the key evidence of why price moved. He seems to have it the wrong way round i.e. when price is at a key pivot, THEN look for an order flow imbalance. Really odd that an apparent veteran trader doesn’t use key support/resistance

I tried out the Market Delta trade room I think it was probably 3-5 years ago. I had tried the trial of the software, and as Emmett said it was robust, and wanted to see if the room would help me trade it. So I did the two day free trial.

Basically the only thing I remember is that the moderator (Anthony Drager?) kept trying to fade a strong uptrend the whole session and got the crap beat out of him. That was it for me and Market Delta and the trade room. Software was too expensive for me especially when even the moderator of the trade room couldn’t make money with it. The End. lol.

Emmett is a convicted felon, just thought you’d like to know that

(Famous line from our friend Mr Jousef ) .. LOL

This guy Steve late to the party I guess.

Guess he doesn’t use grammar check either.

Order Flow, Footrprint, Tape, DynaFlow, Even Flow, WTF ….

All these software guys are not traders. They are software salesman .

Don’t try to bullshit people that you can trade because you can create trading software.

This is where all these guys go off the rails.

They create these great software packages, then they think they can actually trade using it.

So they jerk around in a trade room trying to convince people they are trading to sell their software …

It’s a horrible vicious cycle.

You guys are all nuts! The Footprint is the single best aggregator of order flow data that is based on the AGGRESSIVE volume. I what executes that matters. BTW…. you might want to read what GTR has to say about your boy Emmett http://globaltraderoom.com/emmett-moore/

Steve

The idea of the footprint sure sounds great. But I have not been able to find a trader, or trading educator that has been able to execute with any verifiable performance.

Regarding GTR, they are cute. I appreciate the publicity.

During my footprint phase a couple of years ago, I tried the free basic version of MarketDelta, then balked at the monthly fees for MarketDelta charts along with advanced extras. It does look like a robust nice piece of software. For the longest time I got email about the “live trading” room from market delta. Thanks for the review of the room. So now I know it’s just the same talk about bulls being strong or weak, but no substantive ideas on taking a trade.

Another great review!

Impressive!

Can I suggest: http://globaltraderoom.com/

I’ve been recommend them.

Ben, I was in some free trials there.

I could not cope with them: at the beginning was okay when was only 1 guy but soon were 3 guys in the room speaking and calling trades simultaneously not showing charts (it is obviously impossible since they are in 3 different locations with 3 different computers). Didnt see any trades on the screen, they all been called but not only the one from the guy with the screen were not shown.

At the end of the day when I looked on their trade log only a bunch of ticks were shown so no way to verify.

Thanks for the reply..

Yeah that sounds pretty bad.

I don’t think it’s impossible, sharing 3 screens.. google hang out does, i’m sure other platforms can… obviously they didn’t want to.

Anyway thanks for that.

Ben.

I hope Trevor finds a really good trader for that room. Would love to draft an excellent review. He has a great piece of software.

How did things work out at Trader Shark?

Trader Shark was very vague and I had a very hard time knowing when he was in or out of a trade, let alone manage it. I am sure he will disagree with me and I am sure I am the problem…just another bad student.

Talking about trader Shark, I am not implying they are dishonest but when Trade Rooms, in general, do not actually show their trades (so, so easy now with EVERY charting platform) you never REALLY know if they are real. It is so easy that it amazes me that they don’t just to put to rest any controversy and it also makes it easier to manage their own trades, as well as help the students. Some of them say it takes up real-estate…’cmon!!!…and as far as me being a bad student, well as my father used to say ,”I’m not as dumb as I look”.

I had endless discussions with TraderShart at the beginning of this year to put a clear log of his trades on his trading results page (not that funny sum of ticks at the end of the week). The guy, Brian replicate that he does not put these things because quote: “autobots and artificial intelligence programs cannot capture the data”

I still wonder how this trading room is top of the Titans from dr. Handley point of view since this guy not only do not provide a trading log but he does not show his trades at all.

hank you Emmett…At least that is two days I will not waste…lol

“Of course, years later I would learn to program and discovered that all indicators are pretty much the same…useless at the forward application of price prediction.’

(Sigh) Yes, this is the biggest hurdle for traders, herd think. Every trader’s career should start out using a coin flip until they learn to do the right things, because no indicators can outperfom doing the right things. Then when you fold the indicators back into the process, they would emotionally accept indicators are a very small part of the process.