-

Honest

(4)

-

Quality

(1)

-

Cost

(2)

-

Support

(4)

-

Verified Trades

(1)

-

User Experience

(2)

Learn To Trade The Market

No live trading. But at least Nial Fuller is honest about that. First and foremost, Nial is an expert marketer that not only understands how to craft his message, but also how to game Google for maximum web traffic. Nial Fuller’s sales strategy is to drive massive traffic to his website and then convert into purchasers of his trading course, and he does this all without trading performance. A clever salesman. But not to be taken as a serious trading educator.

User Review

( votes)Learn To Trade The Market Review

Learn To Trade The Market is website and blog by Nial Fuller of Australia. For $275, you receive the following:

- Chart Reading Instructions

- Access to a private forum

- A morning update of markets

What is included in the Chart Reading Instructions?

A member sent me the original course, you can also find free copies of the course floating around cyber space. It is a simplistic and basic instructional on how to read chart patterns. All of the patterns are hand picked by Nial. Nothing new or original. The same material that can be found in any book that describes double tops, double bottoms, failure patterns, breakouts, support and resistance, etc. Nothing is statistically validated. Which of course is the basic problem with chart reading, everything is subjective. On a 5 minute chart, you can easily see a breakout. But then switch to a 60 minute chart, and you can now see a clear downtrend with a pullback. However, I have to give Nial Fuller credit where credit is due, he is extremely good at making chart reading  look simple and entirely conquerable. He is also a clean cut and well spoken young man. The sort that shows up at your house to take your teenage daughter out for a date, dressed nicely and clean. The sort of guy that shows up with flowers for your daughter. He also shakes your hand and calls you Sir. His car is clean and polished and free of dirt. You are having visions of the wedding day and perfect little babies, your wife is getting excited as well. But of course, we are not going to be so easily taken in by such a charming young man with no dirt under his fingernails. We are going to bring him into the house, and when our pretty young daughter and excited wife are upstairs giggling and chatting…we are going to start asking this Nial Fuller some tough questions. As an old Dad, we also used to be young and played this game with varying degrees of success. Lets talk a closer look at Nial Fuller, lets ask tough questions and make him feel uncomfortable, lets test this young man.

look simple and entirely conquerable. He is also a clean cut and well spoken young man. The sort that shows up at your house to take your teenage daughter out for a date, dressed nicely and clean. The sort of guy that shows up with flowers for your daughter. He also shakes your hand and calls you Sir. His car is clean and polished and free of dirt. You are having visions of the wedding day and perfect little babies, your wife is getting excited as well. But of course, we are not going to be so easily taken in by such a charming young man with no dirt under his fingernails. We are going to bring him into the house, and when our pretty young daughter and excited wife are upstairs giggling and chatting…we are going to start asking this Nial Fuller some tough questions. As an old Dad, we also used to be young and played this game with varying degrees of success. Lets talk a closer look at Nial Fuller, lets ask tough questions and make him feel uncomfortable, lets test this young man.

Access To A Private Forum

Nial’s private forum is a well organized area where members access course material, videos of chart patterns, written articles, and plenty of opinion from various members. Thankfully a reader whom purchased the course gave me access to the private forum. And I was thankful to have a look around and judge the material on its merit. This would be similar to sneaking into the apartment of this young man, while he is taking your daughter out on a date. Of course, we will dig around and look for any drug paraphernalia, pornography, condom wrappers in the trash can, guns, filth of any sort, etc. After a few days of snooping around and reviewing everything, I have to report that I did not find anything terribly out of place or worrisome.

The one issue that I have with the private forum is that Nial Fuller does not post his trades. He has plenty of opinions, and he draws up a nice chart, but not a single trade is posted anywhere. There are mounds of tantalizing bits and pieces of information that Nial presents, but the bottom line, he is only presenting conversation. And once Nial introduces a new conversation about a market or market event, a horde of people from what seems all over the planet then jump onto the conversation and start posting their trading ideas. The conversation is quite lively and fun. Unfortunately, Nial is not putting on any actual trades. Plenty of conversation, but Nial the resident Guru never places himself in a position where the Guru can ever be wrong.

The Morning Update Of Markets

Every morning, Nial puts out an opinion of about five different markets, and what he feels like will happen. He will show a chart that is marked up, and an arrow pointing up or down, followed with a question mark. He will say something like, “This looks like a Pin failure, could we now see the rally???”. As I sat there reading these updates, I could not help but ask myself how this is useful? After all, I am reading this material to make money, and I am here because I need help. I am not afraid to go into battle and risk my life, but I would feel much more comfortable if our battle commander was also willing to risk his life and fight along side me. You will never find Nial willing to climb out of the trench, willing to charge the machine guns and possible death. You will find handsome Nial blowing the whistle from the safety of the trench, signalling the charge, giving everyone a pep talk. Telling everyone that the chart pattern says that the machine guns are pointing away at the fools farther down the trench line, and that its safe to exit the trench and charge into battle. His videos and course materials all prove that he is correct, we just need to trust the course videos and the course material.

For some reason, I keep having visions of my pretty daughter. She has just concluded her dinner date with Nial. She is sitting in his new car. Its clean and shiny and expensive. It smells nice and so does Nial. He is so handsome and his hair has just the correct amount of pomade. Spiky, but not too spiky. He leans in for a kiss, and of course my daughter is more than obliged. Next he starts getting clever with his hands, judging whether he might be able to get further, trying to capture the ultimate prize of my daughters virtue. He starts to get aggressive and suddenly my daughter has visions in her head of everything I told her regarding men. How they are all dogs. The clean looking and the smooth talkers are the ones she needs to worry about most. She snaps out of it and does the right thing, she then asks Nial to be taken home. Good girl.

Getting Tough With Nial Fuller

Over the past several months, I have used various pen names from various email addresses, questioning Nial directly about his personal trading performance. I always ask the same question. Do you trade Nial? What is your track record? What is your performance? I always receive a clever response from the handsome young man. Over and over he explains that he does not talk about performance, or call trades.. He leaves this up to the enlightened member. To take the course materials and learn to trade for ourselves. Learn to be like Nial. But who is Nial? Does he even trade? There is no track record to speak of. No nothing. Just a cacophony of conversation and talk. Of course, I am a rabble rouser and I always keep pressing forward, seeking the truth. At times, I have posted on several of his many blog postings, questioning whether he really trades. But these blog posts never stick. They always disappear.

So what is Nial Fuller and Learn To Trade The Market?

At its very core, Nial Fuller is a excellent communicator, very skilled salesperson and a savvy web marketer. He is well organized and understands how to sell his product. If you were to believe how many students that he claims to have taught, then you he would have north of $3,000,000 just from selling his trading course. These types sales figures can fuel an impressive online marketing machine. What do I mean by online marketing machine?

The key to capturing massive amounts of free web traffic is to convince Google that you are an authority figure within a particular niche. If done correctly, then Google can send a huge amount of traffic which you can then convert to sales. The key to convincing Google and driving traffic is to produce a massive amount of written material and then spread it about the internet. If you visit Nial Fullers website, you will find massive amounts of written articles. They are all cleverly written and expertly produced. But what is more interesting is in how Nial distributes his information.

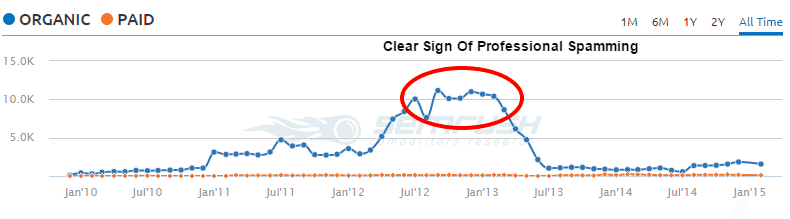

Since I am not a professional web marketer, I needed a second opinion on how Nial Fuller was able to generate so much web traffic, I contacted SEM Rush marketing and asked them to analyze his website. The project manager at SEM Rush Marketing sent me a report that clearly demonstrated that Nial Fuller is a prolific web spammer. The chart that you see below is the amount of organic  keywords that Nial Fuller has ranked on page one of Google. At one point, during the later part of 2012, Nial Fuller had an astounding 10,000+ keywords that ranked on page one of Google. SEM Rush calculated that the traffic value, at that time was worth over $50,000 a month. A truly astounding number. But notice what happened in January 2013? The Learn To Trade The Market website plummeted. What happened?

keywords that Nial Fuller has ranked on page one of Google. At one point, during the later part of 2012, Nial Fuller had an astounding 10,000+ keywords that ranked on page one of Google. SEM Rush calculated that the traffic value, at that time was worth over $50,000 a month. A truly astounding number. But notice what happened in January 2013? The Learn To Trade The Market website plummeted. What happened?

SEM Rush explained that Nial Fuller was using a scheme of spamming the internet with fake back links to his website. Once Google caught onto the scheme, you can see that Google gave Nial Fuller a huge penalty and crashed his traffic.

Why This Matters

So why should we care if Nial Fuller devised a scheme to cheat Google, and drive traffic to his website? This is important because it gives us a clue as to his real character, this is a subtle clue. If he is willing to cheat Google with shady marketing tactics, then it is also safe to assume that he is more of a professional marketer than an actual trader, and we probably cannot trust him with our daughter.

At the end of the day, I have to congratulate Nial Fuller for his marketing prowess. It makes perfect sense that he does not post trading performance, he does not need to! When thousands upon thousands of people are coming to your website each day, for free, you can afford to be cautious and focus on selling your product. Unfortunately, there is not much focus on actual trading.

One Final Thought

The problem with professional marketers like Nial Fuller is that they mute the voices of those that actually do trade, and actually do sell a worthy product. I have interviewed and reviewed many excellent trading vendors, and their complaint is always the same…they cannot get their message heard, they cannot beat the professional marketers selling junk trading products. Hopefully, we can change this dynamic. But I doubt it.

Thanks for taking the time to read this review. I know it is probably longer than you wanted and had more information than you probably needed. Don’t forget to leave your comments below. Even if you disagree, your voice is important.

Thanks for the review. I just joined his course yesterday, and was surprised that nothing on the webste had been updated for years. Oh well, at least the course wasn’t too expensive.

Day trading for beginners is like lion taming, except more expensive. It’s a risky and challenging pursuit: buying stocks and selling them again in the same day, making money off tiny fluctuations in the price of a stock over a twelve hour period. For many years the tools of day trading were not available to the average investor: real time stock results, analysis tools and access to instant trades.

http://www.livetraders.net/

Thanks for this review. Saved me from purchasing this fake course! keep the good work! cheers

Hello,

I have looked for some opinions about Nial on internet. That’s why I landed on your page. Briefly: thank you for this review. Apart from the fact that it is nice to read it, I also changed my view on the Nial’s “professionalism”.

Emmett, just read about scammer Nial. What do know about Aussie Ray Freeman( rayfreeman@iamadaytrader.com)

Perfect analysis and observations. The disappointment is when you discover you have no new lesson or idea after the membership. And you are as alone in the trade as before….Good job in the analysis.

Very good article. And I was just started reading his site. Of course the 369% win was a telltale sign + the huge amount of content was also a bit strange. How does he have time for this (if he trades as well)?

Well researched. I too have always in my mind that, how could a successful trader be such time spending person for teaching others ?

But for me it is important that he is a good teacher. Only by reading Nial’s articles since last 2 years I have developed my own successful trading strategy without paying a single penny to him for any course and now I am earning satisfactorily only by trading.

TI love this review. It is GOLD.

Thanks for taking the time to investigate and write it.

I’ve read Nial’s blog and articles and found them quite good and sensible. I agree with keeping it simple. I was even thinking about guying the course, but I started to get suss when I read the ‘press release’ about him winning the million dollar competition, and that the competition was by Axitrader. Hmm, just seems too cosy..

Great stuff Emmett. Thank you for your efforts.

Did you see the news piece on Nial Fuller winning a Million Dollar Trading Competition? It can be found in excerpt here

http://www.prnewswire.com/news-releases/nial-fuller-wins-million-dollar-trading-competition-300270438.html

You are helping me to be much more scrutinizing of all of these folks selling the snake oil. Thank you.

I know from a very good source that Nial losers consistently as a trader. Nial makes about a million per year in rebates from suckers who lose trading his strategy in the markets.

Excellent article! An analysis that worth reading, deep investigation and really clear conclusions. You just confirmed what I thought about him, Thanks and keep it going! 🙂

Here is some advice for the reader…

Forex is just another “Get Rich Quick” scam. Get rich quick scams are old as the hills. Statistically, most rich people started their own businesses. Go to the wealthy part of town and ask the owner of the home what they do. Look at the rich in the media. Most of them are self made business owners..even the trading houses or hedge fund managers are all businesses. Jim Rogers said if you do not know what you are doing in the markets then start your own business..do something you love.

For love of god or money, please avoid forex, shares, gold, commodities. The whole system is rigged against the individual trader at home on their computer.

I gave up on the markets even when I started winning trades because even then I got wiped out by the market on market crashes (which ALWAYS happen), or the broker will reset the price and talk about slippage or glitches or whatever other nonsense they can think of to keep YOUR money. Brokers are rich, the sole trader is broke, and will remain so.

Maybe property is ok to invest in. Or the bank is safe. But otherwise, invest in yourself, either an education or start up business.

These are the words of someone who has traded everything and learned the hard way over several years.

Some of the best advice on this site. I am still waiting to meet that rich day trader. It is like the old saying, what to know how to me worth a million dollars day trading; start off with 2 million. LOL!!!

Wealth is made by long term investments, whether real estate, running a business or long term stock holdings. Warren Buffett and Bill Gates did not make their fortunes day trading. Yet people think they will make their fortune from day trading by using 500 to 1 leverage. Of course most of those people have no idea about realistic returns.

There is a reason 99.9% of the vendors reviewed here can never show any proof of profitable trading and that is because what they teach is complete nonsense. And this advice comes from an investor who also trades. Think about it.

I think Nial Fuller has some connection to axitrader. I do not trust the man. The markets are a scam anyway. You cannot trust any broker. Keep your money. Invest in property or keep it in the bank.

After several months of live trading, AxiTrader is pleased to announce the winner of the first Million Dollar Trader competition.

https://www.axitrader.com/au/market-news-blog/axitrader-news/2016/05/million-dollar-trader-winner-announced

Thanks for sending this over. Looks like I might be writing a big fat, Mea Culpa.

I hope this checks out. Nothing makes me happier than being wrong.

Disappointing, surprising and suspicious that Nial wouldn’t provide proof of his trading. I joined Nail’s site years ago for a one time payment of $247. I felt it was good value for the course plus access to the members website for the rest of the life of the site.

Oh, call me skeptical, but I would hold off on the Mea Culpa. An Australian FOREX and CFD Broker (which is prohibited in the US) that was started in 2007 running a competition and awarding a million dollars. How could that not possible be honest, surely not a scam to drum up business.

What where the rules to this competition? Where the live trades posted live somewhere so they could be followed. What was his draw downs? Was there any proof of the trading besides AxiTrader’s word on it? Maybe I will owe them a Mea Culpia but how about doing some investigation work on this company and their trading competition first. It is not like we live in a world where any Tom, Dick and Harry could start a Forex Brokerage Company and feed a bunch of bogus trades to Myfxbooks to fake great results and con people out of money. How could I even say such crazy things. I must have an overally active imagination.

Certainly there are plenty of questions to be asked and plenty of skepticism is warranted. If you think the stock trading industry is full of scammers then double that for forex. However, Australian financial regulations are not third world and are comparable to those in the US or they exceed them. “Prohibited from trading in the US,” yes but that has more to do with limiting access to the US market so that taxes can be collected than it does with meeting US regulatory standards.

The whole thing just seems suspicious to me. Has this guy ever won a competition, like World Trading Cup, where he did not have a business affiliation? The very 1st post in this thread talks about AxiTrader and Nial Fuller’s business relationship. How can anything be believed under these circumstances. Anything is possible in a 3 month period, especially if you take insane risk to win a competition, but the winner needs to be someone with no affiliation or IMO there is no credibility.

There are a lot of unanswered questions and for Goodness sake I hope no one gives this questionable competition any credence and throws money at Nial Fuller, who has never shown he can trade profitable.

Again maybe I will owe a Mea Culpia, but this whole thing seems like a movie I have seen again and again in this industry and the ending is never pretty.

Looks to me like to be part of the competition you have to open an account with Axiselect which is a division of Axitrader. What you get is “support” whatever that means, to be all that you can be as a trader. If you win you get a US$1,000,000 account to trade. I suspect that what that really means is that with leverage of 100:1 in Forex you get a US$10,000. Not worth the effort in my opinion.

Upon further reflection what I think is going on here is that traders are being duped into opening accounts with Axiselect with their own money. They then get funneled into a competition which encourages them to trade often, perhaps even over trade. Axiselect (Axitrader) makes more money on the spread because these traders are in a competition and this induces them to trade more frequently. Axi ends up ahead on money earned on the spread, lots of traders lose their own money in the competition and a few get a funded account the biggest one being only US$10,000. Nice business model.

Yet another group that claims to fund traders that it finds. Hm.

Hold off on that Mea Culpa, Emmett.

In the best case scenario, he got lucky. Worst case, he colluded with AxiTrader for mutual benefit. I summarized the case here: http://www.jltrader.com/2016/05/12/nial-fuller-the-unexpected-winner-of-axitrader-million-dollar-competition/

I noticed that he wrote his own press release. That made me suspicious as it would be in the mainstream media if it were legit. Couldn’t find anything more about it but it led me to your articles. Thanks for this!

I was at the point joining this guy (sick of losing). So, thanks. Best to stop trading I guess and go back to take a hard look at myself and trading;-)

I have followed his blog and daily commentary for long time and just recently realized it was waste of time. Well, almost – you can still learn something from his articles even if they are written for completely different reason (i.e. to pose as a genuine mentor, gain your trust and sell his course). After this experience I would never pay for course without live trading record. Daily charts can be profitable, but again, Nial is using them for different reason. With so few trades ( 1 or 2 a week) it will take very long time to master and verify his “method” and then to realize you are not making money. In his articles he sound so clever and convincing because he has experience in the markets. Before he realized that selling courses is much better business for him than trading he probably got burned many times and understands how others got burned. That is why he knows how to communicate and knows how to sound genuine. He is nothing more than a skilled marketer praying on unaware and hopeful people.

Luke you are so right with your statement. I don’t really want to burst anybody’s bubble here but i’ve been trading Forex now for 2 years and have just recently started to become profitable. I am self taught because i realized some time ago that if anyone is a profitable trader why would they give themselves un-needed stress in trying to teach people to trade and respond to countless emails for a fee when a simple large trade in a trending market would give you a nice payday. I advise everybody to just spend the hours learning how to trade and see where mistakes are made and learn from them do it with a demo until your account is growing daily or weekly then just take small live trades and see how you go. that’s what i did and now Forex is my sole income

No course for 329 is going too make you money.

No profitable trader would donate hours of there time each week too teach students.

The only reason you would sell a course and deal with the ongoing training commitment is because you cant make money trading.

You all better off actually doing the work yourself instead of looking for the easy way. Lots of free basic info on the net, read it and put in some serious screen time.

Interesting article by the way, thanks for taking the time to write it

Nial is just a copy & paste from Al Brooks techniques. He is a double face salesman, because he is copying the work of others.

If you would like to be a successful trader, then you have to read Lance Beggs ( Price action), Bob Volman (2 books) and Al Brooks( a course and 3 books). That is all you need to know. I don’t recommend anyone to go to Al Brooks first, because his Price Action is very complicated. After you read from these three authors, you don’t need to read another trading book again.

Even Kevin J. Davey techniques require a lot of captial for absorbing the drawdown. In addition, his technique are derived from the indicators. Unless, the trader are fluent in Mathematic Algos for programming the Bots. Otherwise, it is just waste of time. Not many traders can go through 4 years of University for the sake of programming Algos. The Algos worth a million dollar for a reason.

However, I credited his method of Walkthrough Backtesting. It is very useful.

TopDogTrading of so called Dr. Barry Burns is similar to this. $250 to $500 for a so called basic and intermediate course all with material that can be found for free. Never any proof of actual trading results. Just occasional scrolling after the fact videos. He tried to start a price action course then it was taken down when the preview contents was almost organized the exact same way as Al Brook’s original book. Brooks PA should be the required reading background. I would skip Beggs and Volman. Nothing but failure and wasted time in journals on Big Mike’s by people who tried those two. Learning Brooks PA won’t guarantee consistency either, just a starting point of learning to read the charts. Makes sense now to hear Nial Fuller was copying Brooks. Back then I was trying to decide who to go with as Fuller was very visible on the web at the time. I decided to go with Brook’s original book. There is still controversy about Brooks whether he trades or not however he does watch the markets the whole session in his trading room practically non-stop which is commendable but never makes any calls. Occasionally he would mention where he entered in the recap.

I wouldn’t skip Bob Volman and Lance Beggs. Those two author have different perspective on Price.

Bob Volman is focused on Trading Range Break out. Lance Beggs is a simplified version of Al Brooks. If you begins with Al Brooks, then you would have a hard time to read Al Brooks 3 books.

Reading Al Brooks is not enough. It is just the beginning of the journal. You need to understand how the institution process works. They spend 80% of the time, generating ideas from the fundamental framework. They only spend 20% on Technical Analysis. Technical Analysis is really the last leg of the Analysis. Technical Analysis is already a lagging indicator. Technical Analysis is only good for 3 days swing trade or scalping. It was never meant to be a trend.

I never said Al Brooks was enough,only that it was a required beginning. Volman and Beggs are full of it. I have seen others on BMT waste more than two years trying each method with thorough journals and recorded stats with the same lack of success as any lagging indicator, so newbies would be best to skip them. I never said to skip learning about fundamentals either even though good luck trying to be an institution for any retailer.

Can I start by saying I love the site. Being an Aussie I also found this post very useful. That said one comment did give me cause for concern. You said the Nial bought links in order to deceive Google therefore that shows a history of deceptive conduct.

Likelihood that he knew this was happening is very low. Back before Google’s Penguin blitz, linkbuilding was the done thing. In fact Google made sure that everyone knew that without links they would not rank you. Then they realized that crappy links were being given the same level of importance as good links (e.g. a favorable coomet in the Wall street Journal was equal to a comment and link in a small blog. So Google changed the rules (Penguin changes).

I am not saying Nial is a good guy or a bad one? What I am saying is plenty of reputable companies got smashed by Google’s Penguin. Those were the rules of the game & Google went and changed the rules. So whether you got the links by fair means or paid $2 per hour to a link building company there was no differentiation in Google’s eyes. Penguin smashed everyone.

I think it is unfair to say that because he had a lot of links he did so to deceive Google & therefore you should use that when you assess his course. Being a marketer he would not have built any of those links himself. He would have hired an expert SEO company. Those experts would have been paid on performance. Ranks, in those days, required a lot of links & that requirement was the brought about by flaws in Google’s own algorithm & logic.

As I say, I think the rest of the comments are fair. I see no reason that Nial should not be called out if he is unwilling to disclose at least why he won’t prove he has the abilities he claims to be able to teach. But on this one point, Google holds a level of blame.

Hi Brett,

Thanks for the comment. With Nial, since I could acquire no track record and he refuses to verify the existence of a track record, then I had to make a best guess on his character. The marketing tactics that he is employing is quite clever and deceptive. If he is willing to game Google on a large scale, then perhaps he is willing to cut corners in other areas. When there is smoke, then maybe there is also fire.

Regardless, all of this could be easily cleared up if we had some sort of track record.

Thanks for reading and I hope to read more of your comments in the futures.

Emmett

He could have simply have hired an SEO person to optimize his website or may have been approached by an SEO person, who had done all this link spamming as part of the service, unknown to Nial.

Thanks for making this review Emmett. I was going to purchase NIal’s training course today. I’m glad that I made the decision to do a little more research before I did.

Does anyone know any legit training course for FOREX that’s around the same price; or better yet free?

Go to “baby pips dot com” for pretty comprehensive and free education but Nial’s course plus access to the members website is only $247 for the rest of your life. His education is OK. For about the same price you can sign up with ” the forex guy dot com” and his site and education is OK too. Lastly, again for about the same money you can also get “forex school online dot com” with the similar deal education plus access to members forum etc. for a one time fee of about $300 I think. You could also look at daily fx dot com and forex peace army dot com as well

As Mongo said above it’s all Price Action stuff which I’m sure you can get for free somewhere but no one who ever says that tells you where you can get it for free. One more site swing-trading-strategies dot com has so many strategies that it’ll really confuse you.

Apologies to everyone for the multiple posts but for Tom two more free sites to check out are informed trades dot com /f389/ and investoo dot com / advanced-technical-analysis/ Don’t know how good they are but they’re free. However, Tom, later you may want to find an active trading community to bounce ideas off. This is where the paid sites have additional benefit.

Hi there Emmett,

Thank you for your website information. I was thinking of buying this course with Nailer to learn a little more about price action. Now I shall spend my money elsewhere .

I thought this guy was real genuine too – went to his website , checked it out looked all good , I would have just been another sucker if I paid .

Thanks

Fuller is from the same school as Jonathan Fox (Forex School Online) as well, Nick Benito (4x for Noobs). Fuller came from James16 Group and Fox and Benito were birthed from Fuller. All PA oatmeal. Yawn. This stuff id Free!

As a trading course for the cost (about $300) it’s not that bad. There are lots of other sites that charge you that per quarter and don’t deliver as much. I’ve read that Nial ripped most of his education ideas from the posts of a very successful trader on Forex Peace Army or maybe is way BabyPips.com, in any case he at least pilfered good information from a good trader and put it into an organized curriculum.

But is he a good educator?

Does he teach a good strategy?

Your review doesn’t even mention any of this which is what a review is supposed to be?

No, he doesn’t teach a good strategy, otherwise he wouldn’t be afraid to post some track record. Think about it, he’s been selling his course since 2008-2009 – that’s 6 years right there. Doesn’t he have even one successful year that he can show? Obviously, no.

I too find this review kind of strange with a big internal discrepancy. First Nial Fuller gets high rating for honesty and then we’re told that he doesn’t do live trading and he’s honest about it. He describes himself as a professional trader…how can one be a professional trader without trading ? I had guys like him in mind when I wrote this: http://www.jltrader.com/2015/07/21/you-call-yourself-a-professional-trader/. Further down we find out he’s been spamming Google for traffic. How is that the behavior of an honest man ?

Here’s my experience with this guy. I bought the course a few years ago and he tried to get me to go with Axitrader because I did not have the New York close charts. He gave me a link and when I clicked it I was logged into his trading room. I told him I bought the course to learn how to trade and not to get a broker. I told him I wanted a refund because he didn’t mention anything about having to have certain charts in order to learn his method properly. He said because I logged in (which I was trapped into doing with the link) I could not get a refund and when I accused him of looking for a finders fee for Axitrader he became very defensive and professed that was not the case and that he was genuinely trying to help me. Funny thing is when you go into his trading course he talks about getting a kickback from Axitrader when you sign up with them using his reference. He’s as dishonest as they come. I don’t know if I’m more pissed at him or myself for being naïve.

Thanks for reaching out. Sorry to hear that you got taken in. Its a common occurrence. And you are in good company!

Using a broker that provides New York close charts” is a basic and standard requirement of all the forex groups that I am a member of. Without these charts the signals will not be evident on your charts. Axitrader are a good brokerage firm and they comply with all government requirements so your money is protected. When the CHY crashed back in mid January Axitrader were solid because of the sensible financial operation they run. The same can’t be said for other brokers. I don’t know how recommending that you join Axitraders was a deal breaker. You still could read and study the material but I guess if you were determined not to use NY close charts it wouldn’t have been as effective. It’s a strange decision since, as I said before, NY close charts are pretty must an industry standard.

I may be wrong but I heard axitrader is the only legit broker that can introduce you to funds. Meaning if you are good you will get recruited. If nail is good he would be able to brag about being recruited or getting offers. I would look into that. There is a big clue if he trades live or is even good at it.

Oh yeah. It is callwd the axitrader axiselect money manager program.

Thanks for this review. I came across Niall’s website some time ago, and was impressed with the presentation of the website. I put it down on my list of trading-related sites to try out.

Since then, I’ve learned to trade on my own, but love to see that someone’s out there investigating these sites to see what they’re really about.

As for whether or not he trades, I’d say the answer is a clear NO. Anyone who legitimately trades would have no reason to dodge the question, let alone erase those questions from his forum.

He won a competition last year. The trades are risky. No stop losses in lots of the trades. There is a twice the risk compared to reward in lots of other trades. If that is how he teaches in his material, then I wouldn’t want to be a student of his.

Well researched. Thank you.