Buy the Fear, Sell the Greed: 7 Behavioral Quant Strategies for Traders

-

Clearly Described Trading Strategies

(5)

-

Verifiable Statistical Edge

(5)

-

Easy To Read

(5)

-

Cost

(3.5)

Summary

Larry Connors has published a new book. And its a doozy. An excellent read.

The book contains 7 strategies that are built upon solid and easily understandable logic. I have programmed all of the strategies and will be publishing new reports of each strategy, on a weekly basis.

What I find extremely interesting about this book is that Larry is publishing a very unique strategy that is SHORT only. And its filter based that scans the entire stock market searching for a specific set of unique conditions. Top level stuff. Very unique.

The best trading book I have read in many years.

Thanks for reading today’s review of Larry Connors newest book: Buy The Fear, Sell The Greed

Over the past couple of years, I have written several articles regarding Larry Connors systematic trading strategies. I am a big fan of Larry Connors trading books. It’s not that Larry is a gifted writer. He certainly is no Hemingway. Those sorts of books are meant for entertainment. Larry is direct and to the point.

What I really like about Larry Connors is that he has the balls to write about trading strategies that can actually be programmed and backtested by the newbie, DIY programmer. He provides the statistics to back up his bluster. This is a rarity in the world of investment books. In fact, there is a cottage industry of absolute con artists proffering all sorts of investment nonsense.

Most trading books are filled with hot air. They usually begin with many pages dedicated to the inspiration provided by Aunt Mabel, the friendship of a neighbor, the loyalty of the family dog, and to the tireless efforts of a $5 graphic artist that designed the awesome book cover. They will then transition into the usual investment parables about cutting your losses short, letting the trend be your friend and a bunch of fluff about having a passionate attitude.

This crap pisses me off. I just want rules that are clearly defined. If the author say’s that you should be a buyer on Monday because the ‘magic spasm’ indicator flashed green, then he better provide the logic begin the ‘magic spasm’ indicator, and the statistics to back up the bluster.

Larry provides statistics. So let’s jump into this.

Buy The Fear, Sell The Greed: 7 Behavioral Quant Strategies for Traders

The book contains 7 specific strategies. Each strategy needed to be coded and individually tested. Since each strategy contains different logic and markets, we are going to be focusing on a single strategy for each blog post.

Each week I will be posting a new blog post that contains the next strategy, the markets tested, and the results from the test.

Also, I will be creating a separate and unique webpage where users can check back daily to see the results in real time, on a spreadsheet.

I know, plenty of readers are probably rolling their eyes and thinking to themselves “fucking lazy Emmett never keeps his word.” But I promise I will actually keep this up! If I don’t, then scream at me in the comments section.

Strategy 1: RSI PowerZones

The following is LONG only trading strategy used on the SPY, or S&P500 EFT. The strategy hold time averages between 3-5 trading days. The strategy contains a ‘cannonball’ method that adds a second unit, or double position if the condition persists.

Here are the rules for the RSI Power Zones:

- SPY is trading above its 200-day simple moving average. This tells us we’re in a longer-term trend.

- The 4-period RSI of SPY closes under 30. Buy SPY on the close.

- Buy a second unit if the 4-period RSI closes below 25 at any time while the position is open.

- Sell when the 4-period RSI closes above 55.

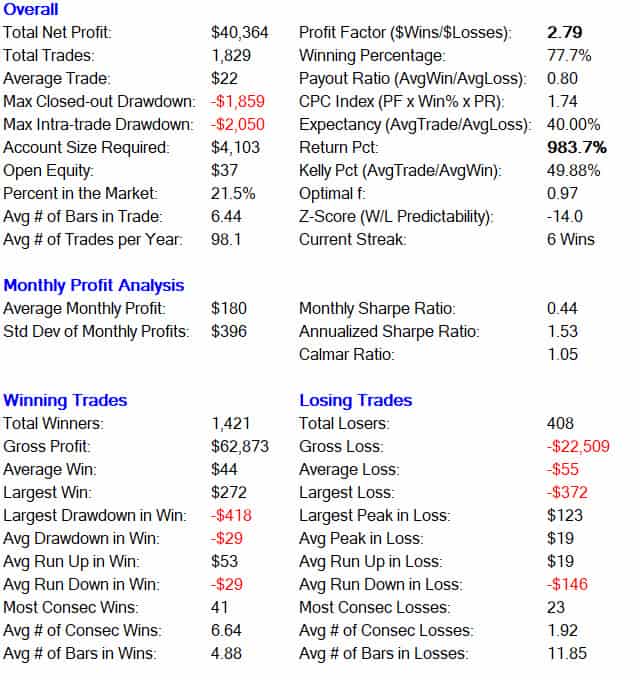

The following results represent a standard investment size of $2000 per trade. So if the SPY is $200 per share, then the position size would be 10 shares. The test period is from 1989 to August 2018.

In my opinion, what is really impressive about this strategy is the Profit Factor of 5.35. Let’s have a look at the equity curve…

The blue line is a 100-period moving average of the equity curve. Why include this? For me, if the equity curve of a trading strategy breaks that average, then it’s broken. Turn the strategy off.

The flat periods that occurred during the bear market of 2000 and 2008 signify that the strategy worked well at “shutting itself down.”

How I recommend trading this…

In my opinion, this is an excellent method for passive investing. The strategy usually kicks out 1-2 trades each month and the entry is stupid simple–enter the market on the close.

Another thing I like is that it shuts down once the market enters bear mode–no trades when closing prices are below the 200-day moving average.

Once again, I promise to get a page up so that readers can check daily for any signals. Give me a few days to complete, my wife has me working on a long-promised project of painting the garage.

How to be AGGRESSIVE with this strategy…

There are SO MANY WAYS to expand upon this strategy. I really didn’t want to open this can of worms, but I will give you another angle to consider.

- Expand your list of tradable ETF’s that cover different sectors and global economies.

- Only take trades after a crash. In other words, adjust your RSI settings from 30 and 25 to a much lower setting of 20 and 10.

Let’s take a look at our Global list of tradeable ETF’s, with “crash” settings of 20 and 10:

| Symbol | Linked to Complete Description | Quick Description |

| DIA | Diamonds Trust | The Dow Jones Industrial AverageSM (DJIA) is composed of 30 “blue-chip” U.S. stocks. |

| EEM | iShares Emerging Markets | Exposure to large and mid-sized companies in emerging markets. |

| EFA | iShares MSCI EAFE | Exposure to a broad range of companies in Europe, Australia, Asia, and the Far East. |

| EWH | iShares Hong Kong | Exposure to large and mid-sized companies in Hong Kong. |

| EWJ | iShares Japan | Exposure to large and mid-sized companies in Japan. |

| EWT | iShares Taiwan | Exposure to large and mid-sized companies in Taiwan. |

| EWZ | iShares Brazil | Exposure to large and mid-sized companies in Brazil. |

| FXI | iShares China | Exposure to large and mid-sized companies in China. |

| GLD | SPDR Gold Shares | The first US traded gold ETF and the first US-listed ETF backed by a physical asset. |

| ILF | iShares Latin America | Exposure to large, established companies in Latin America. |

| IWM | iShares Russell 2000 | Exposure to small public U.S. companies. |

| IYR | iShares Dow US Real Estate | Exposure to U.S. real estate companies and REITs, which invest in real estate directly and trade like stocks. |

| QQQ | PowerShares NASDAQ 100 | Exposure to largest non-financial stocks on Nasdaq. |

| SPY | SPDR SP500 | The S&P 500 Index is a diversifed large cap U.S. index that holds companies across all eleven GICS sectors. |

| XHB | SPDR SP500 Home Builders | Exposure to home building products and producers. |

| XLB | SPDR Materials | Exposure to materials producers: chemical, construction, packaging, mining, paper, etc. |

| XLE | SPDR Energy Sector | Exposure to the energy sector of the SP500. |

| XLF | SPDR Financial Sector | Exposure to insurance, banks, thrifts, RE trusts, mortgage finance, consumer finance of SP500. |

| XLI | SPDR Industrial | Exposure to defense, aerospace, marine, machinery, airlines and air freight. |

| XLV | SPDR Health Care | Exposure to pharmaceuticals, health care equipment, health care related produces and services. |

Wrapping things up

Well, that’s it for today. Next weeks blog post will be really interesting. It will be titled “CRASH.”

And it’s not a long-only trading strategy that uses Larry’s well worn RSI method. Instead, we are going to explore a method that targets individual stocks and uses an indicator that I never knew existed. It’s really fucking interesting and when I programmed it…I just scratched my head and wondered where in hell have you been hiding!

The best part of this strategy is that it is SHORT ONLY for individual stocks.

Short only, stock trading strategies are as rare as a leprechaun riding a unicorn. So tune in, it’s going to be a fun blog post.

Need to buy this book right now?

The following link will take you to straight to Amazon. Oh, and I must disclose, if you purchase this book, I will earn a whopping 14 cents. LOL.

Thanks for reading. See you next week.

-Emmett

REVIEW on AMAZON By JJK on September 10, 2018

1.0 out of 5 stars

Recycled free systems

Format: Hardcover

1.) The section on stops is the best part. But not news to anyone w/a brain. Stops can kill.

2.) At least one of these systems is not truly quantifiable.

3.) Short systems (esp on VIX) are something you can only do w/popcorn money because you never know when it will blow up on you, and it will/has… recently. Lots of books/articles lately on trading VXX, UVXY, and SVXY. Nothing new there. Also, he ignores the high cost to borrow those (and other shares), sometimes as much as 25%/year! Plus, when shorting, you will sometimes get pulled out of your short (yes, shorts can and do get recalled from you), and, when that happens, those are the times you really wish they didn’t, as the product is about to move (big) in your favor. But you don’t get squat because you were forced out of your short before the big move.

4.) The 4RSI system is the only useful system in the book, but it’s a re-hash of dozens of 2 and 4 RSI systems that have been written about (and continue to get written about) for the past decade or more – and certainly not a “Behavioral Quant Strategy” imo.

5.) Too many of his other systems are for individual stocks (bad idea — individual stock risk sucks vs trading indices) or just re-hashes of his 4RSI system. Changing the entry from 30/25/20 or the exit to 55/65/70 (or some short term DMA) is not a “new” system. Nor is changing from traditional RSI to his (self-congratulating) “Connors” RSI (CRSI) any really special insight or even a “new” system.

Finally, NONE of the above is a “BEHAVIORAL QUANT STRATEGY”… that’s just new lipstick on the pig.RECOMMENDATION:

Save your money. Do a search on RSI and VIX trading systems. It’s all out there — for free.

I read that review. Its true that he does rehash the RSI like the menu at Taco Bell.

However, the Historical Volatility system in the article, even with the RSI component removed is still an excellent system.

In my opinion, the RSI is a pretty good ‘quick and dirty’ method for defining a simple pullback.

Also, I took a look at the Connors RSI, you are correct…it is self-congratulating. Maybe I should create my own RSI and sell it for $3,995 with a special bonus. The special bonus would be the magna-rythometer trading indicator. It cooks a chicken, washes your car, puts a smile on the wife, and solves all your financial woes.

“Stops can kill.” And not having stops can kill. Try one of Connors’ trades on a leveraged ETF right before a Black Monday (down 20% in one day) if we ever have another one. Cesar Alvarez (who helped test/design many of the systems–now has his own site) has shown these RSI systems haven’t been nearly as effective after being made public. Published systems (whether free or not) tend to saturate the market and lose their effectiveness if they’re popular.

Thank you……………….

“Each week I will be posting a new blog post that contains the next strategy, the markets tested, and the results from the test.“ – hi Emmett, I know you have a lot on your plate but was wondering if this is still on the cards.

Promises are made to be broken. He has miles to go before he sleeps.

But Where the heck is Emmett????

(Hope he is all well & busy making millions running his strategies :))

I would hope before posting any more strategy results, Emmett would fix his simulator parameters in order to post accurate numbers.

As Amit pointed out and Emmett’s own response revealed the numbers posted are not even REAL; “During the massive global crash Feb 2 through Feb 9, you would have been long 22 positions, which is 44k”. So on a $4K account size he had 44K invested, which is more than his entire gains over almost 2 decades of investing.

This is the difference in Real World investing and Back Tested Results.

Basically he allowed this strategy to martingale, which can only be done if you have infinity amount of money. Based on his comment, in reality he would have continued to add to his losers until he busted the account.

I have actually invested using an RSI strategy in the past and you are only in the market for relatively short periods of time and I can assure you, you are not getting a 983% return except in some simulated fantasy world.

I don’t think fixing it is in Emmett’s hands. As it is a bug in the software he uses so the maker of that software would need to fix it, probably until it is not fixed he can just put a warning comment.

But still the question remains where has Emmett vanished? He has not updated other reviews as well which he said he would do by certain date which is now in the past.

Martingale? Not sure what you are referring too?

The strategy takes a max of 2 positions from any single ETF.

Per your comment, “For instance, during the massive global crash Feb 2 through Feb 9, you would have been long 22 positions, which is 44k.”

So on a $4K account size you had 44K invested, which is more than your entire gains over almost 2 decades of investing.

Maybe not Martingale, but something does not add up.

Hi Emmett,

First thanks for your research. The numbers do not seem to add up , it looks like a bug in the software you are using. Here is the issue i see:

Avg # of bars in trade: 6.44

Avg # of trades per year: 98.1

Multiplying to get bars per year i.e 6.44 * 98.1 = 631.76

But in a year we have only 251 trading days.

So it means on certain days it has 3 or more trades open. Now you are investing $2000 on each trade so on 3 or more trades you would be investing $6000 or more. This conflicts with the Account size required : $4103 mentioned above. Also this makes Return Pct :983.7 mentioned above incorrect.

Please let me know if i am missing something.

I believe what is happening is that the software is calculating that both entries and exits are occurring on the same day, at the close.

In the real world, since our accounts are limited, then the broker would require exiting first and then new orders to placed as margin permits. Since all orders are placed at the close, this would be an impossibility.

So if you are going to be taking a portfolio approach, then you better have enough funds to cover all positions. For instance, during the massive global crash Feb 2 through Feb 9, you would have been long 22 positions, which is 44k.

Another option for portfolio trading a smaller account would be Call options.

“I believe what is happening is that the software is calculating that both entries and exits are occurring on the same day, at the close.” – This does not seem to be the case as then it should have put “Avg # of bars in trade” always 1.

If it is showing 22 positions long then with 44k needed the “Return Pct” becomes less than 100% in 18 years.

Thx again Emmet for another review. The win percentage of 84 and 77% is mouth watering. However, what is the stop loss in both strategies. Is it based on price or RSI reading.

The Larry Connors trick to get such great results is always: Never use a stop loss. *lol

Yep, and it “works” until we have another Black Monday (down 19% in a single day) or 8 straight down days for a 15% loss, etc. Those kind of “black swans” don’t happen often, but it just takes one to ruin a system like this and maybe get a margin call (especially if you use leverage).

That’s the problem with all unlimited risk/limited reward strategies. I found out the hard way as I had several systems that sold options and/or bought emini futures during market dips. It worked great until Feb. 2018…then took huge hits on several accounts. And that wasn’t even a really big drawdown.