Trend Trading with the VIX

-

Statistically Valid

(5)

-

Ease Of Use

(2)

-

Simple To Master

(3)

-

Robustness

(5)

-

Durability

(5)

Summary

We know that the trend is our friend. We proved it with our Mid-Point trading strategy.

But what if we want to be more than “just friends?” What if we want the trend to drop her drawers and dance naked on our bed? Today, I would like to introduce the VIX. A potent and sometimes powerful “love potion” that might just work magic in your favor.

Furthermore, I would like to talk about trading strategy automation. How we can use modern tools to make life, and trading a little easier.

A Workable Trading Strategy

Today’s article is a trading strategy session. A trading system for the Emini SP500 futures contract. Complete with exact entry and exit rules with accompanying statistics.

This trading strategy is a follow-up article to ‘Intraday Trend Trading: Is the Trend Really Your Friend?‘ If you did not read that article, shame on you. That article serves as the starting point, and this article serves as the follow-up. If you continue, without reading and understanding the original concept, then much of this will seem very confusing.

In that article, I defined a broad market bias in the stock index futures market.

Essentially, I presented statistical evidence that trading in the direction of the primary trend is a valid approach. This article is going to take that clearly defined market bias, and improve upon it. Without curve fitting or over optimization.

At the end of this article, you will be able to deploy and (hopefully) profit.

Introducing the VIX or Volatility Index

Most people have no idea what is the VIX. The VIX is a volatility calculation of the options contracts that are traded at the CBOE, or Chicago Board Options Exchange.

The VIX is recalculated every 15 seconds throughout the trading day. The VIX is a standard feature on nearly all modern trading platforms.

What exactly is the VIX? In a nutshell, it is a volatility calculation of the nearest options contracts prices for the stocks contained within the SP500. The VIX serves as a quick and dirty way for market participants to judge whether stock options prices are moving aggressively, quickly, or slowly.

The VIX also serves as a proxy for stock market direction. Generally speaking, when the VIX is UP, then the stock market is DOWN. And when the VIX is DOWN, the stock market is UP. I have included a visual below.

At first glance, the inverse relationship of the VIX appears to be 100% constant. To the casual observer, it looks like a seesaw. When the stock market swings lower, then the VIX swings higher, etc.

However, this is not always true. In fact, the relationship is valid only about 80% of the time.

The VIX is not a perfect predictor of future stock market price direction or stock options pricing volatility. However, in the land of the blind, the one-eyed man is king. So we are going to attempt to use this somewhat confusing, arcane, obfuscated and imperfect measurement tool as a filter for our trading system. We are not interested in the daily movements. We are only interested in “shock” movements of the VIX. Specifically, when the VIX crashes lower by < -4% intraday.

When the VIX crashes lower by < -4% intraday, we are seeing two things happening:

- Stock prices are moving higher

- Options volatility is decreasing

The ‘secret sauce’ is the combination of both. The rapid movement of both, moving in the same direction.

Let’s now move into the strategy rules.

Trading Strategy Rules

- Wait 2 hours.

- If the intraday VIX is down < -4%.

- Calculate the middle point of the intraday range.

- If a 5-minute bar crosses above the mid-point, then buy at the market.

- Exit the trade for whatever profit at the end of the trading day.

- Exit the trade for a loss if a 5-minute bar crosses below the mid-point of the day.

Trading Strategy Results: Stock Index Futures

Results for the Emini SP500 are as follows:

- Profit Factor 1.72

- Total Trades 441

- Ave Trade $65

- Max Drawdown $2,750

Let plunging options volatility pricing work in your favor.

Results for the Emini Russell 2000 are as follows:

- Profit Factor 1.80

- Total Trades 468

- Ave Trade $51

- Max Drawdown $1,880

As you can see, the results are quite robust. However, this is just the tip of the iceberg. The truth of the matter is that I have only touched the surface of this concept. We can dig even deeper, and show yet more profitable trading strategies. With even more robust equity curves. That are nearly 100% accurate and are so compelling that your mouth with water with anticipation.

But I will not give away the entire store. Rather, I hope to inspire you. To get off your ass and start programming these basic concepts. To take control of your own destiny. Build your own trading models that are deeply rooted in science, common sense and valid theory. To veer away from the incredibly ridiculous world of magical trading indicators.

Trading System ON/OFF Switch

One thing that drives me crazy about trading system vendors, they never talk about when to turn a trading system OFF. All things change, especially financial markets. What is great theory today, will soon enough be a terrible theory. Will drain your account to nothing. So you have to have a method that turns a trading system off.

There are so many opinions of when to turn a trading system OFF. But I have discovered that by keeping things simple, and not overcomplicating, we can achieve a pretty good result. My own method is sort of like using a hammer in a sword fight. To put it plainly, I use a 100 period moving average of the equity curve. It’s not perfect, but it works for me.

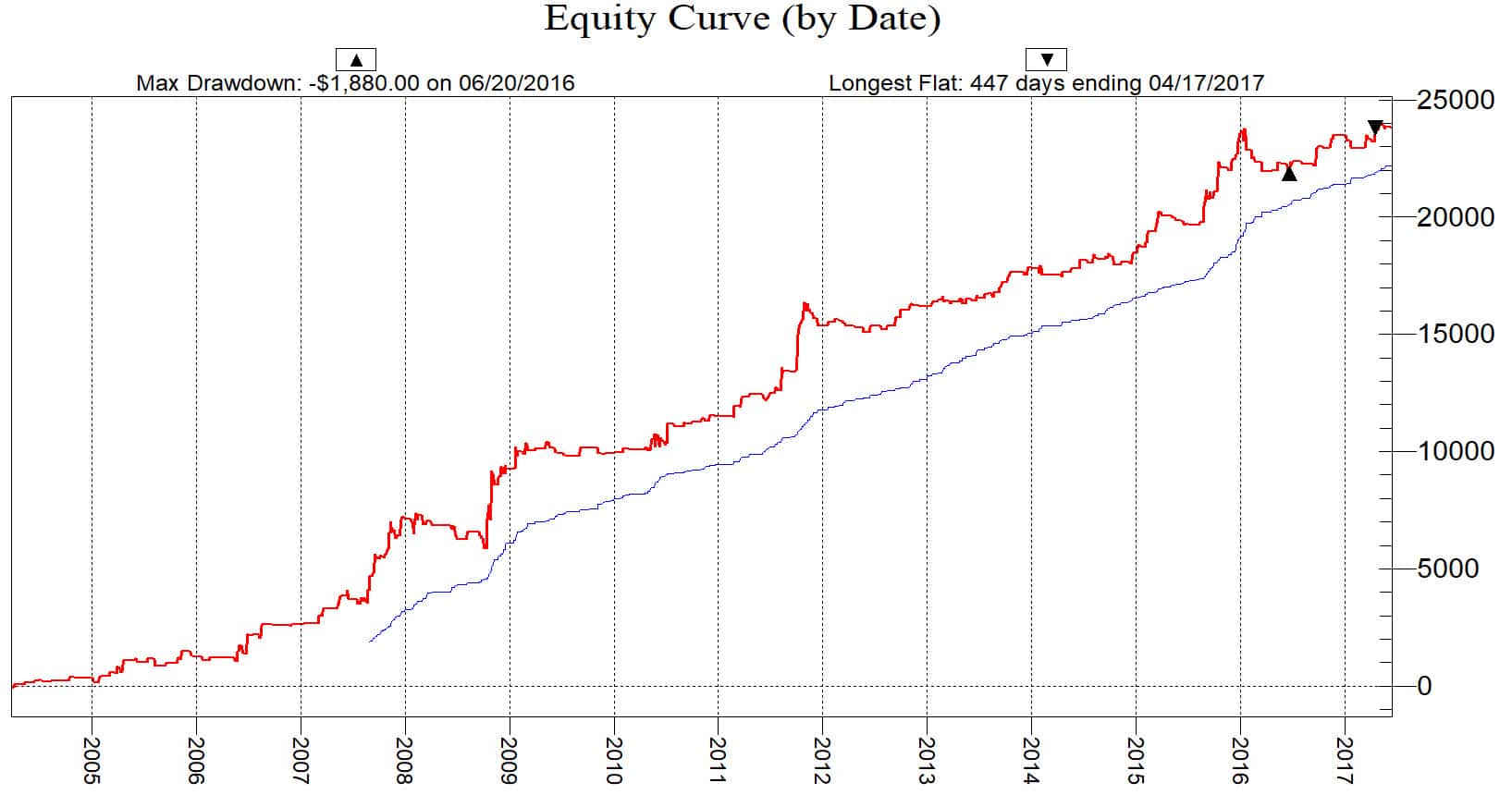

Once the equity curve breaks the 100-period moving average, then it’s time to shut it down. On the above charts, you will see a blue line which represents a 100-period moving average of the equity curve. During periods of low volatility and underperformance, the system will shut down. But when volatility begins to rear its fearsome head, the system starts kicking off profits, and the equity curve shoots higher (hopefully).

The Importance of Automation

With the above strategy, a signal will fire off a trade only 2 or 3 times per month. However, some months might fire off 15 trades. The truth is that nobody really knows when plunging options volatility pricing will occur. The VIX resets every 15 seconds. So you have to have a regime that is constantly waiting for this situation.

Automated trading solves this problem.

A Stable of Automated Strategies

Finding these bits and pieces of an exploitable market edge are not easy. You need to think in terms of running a casino. Your strategies are just little slot machines, all lined up, waiting for someone to insert their money. To take the opposite side of your trade.

Since markets are always in a state of change, you need trading strategies that work across a broad spectrum of environments. You need strategies that exploit not just the stock market, but also currencies, and commodities. Use modern computing to find only the choicest, most juicy trading scenarios.

Conclusion

Thanks for reading today. A bit of a long article. With a technical aspect, which requires clarity in explaining a complicated, multifaceted scenario. These sorts of topics, I am not very good. I apologize if I confused you.

If you need any help with strategy development or just an opinion. Please do not hesitate to contact me. I can program most any idea in a few minutes.

I will leave you with a breadcrumb, that might lead to the bakery. In the above strategy, we explored the stock index futures contracts. But these stock index futures are just groups of stocks. Try this strategy on subsector ETF’s, or individual stocks. You might find something truly amazing.

Thanks again for reading. And don’t forget to comment below.

Good points to saw in your article. Thank you very much.

Thank you for the article.

Can you point me in the right direction to properly calculate the daily range?

Thank you

Hi Emmett,

Thank for your great website.

What is a good software to back-test strategies and find out if they have any statistical edge?

Thank you.

Adriano

Ninja Trader, MultiCharts, Tradestation, Trade Navigator, MetaTrader are a few of more popular ones.

I really like Trade Navigator. Not that its any better or worse than Ninja, MultiCharts, TradeStation, MT4, etc.

But for the newbie. Or the person that does not have the time to learn how to program in C# or Python, Trade Navigator is just stupid simple.

Hi Emmett, when you say it is stupid simple, do you mean you don’t need any programming knowledge whatsoever?

Because of your reviews, I got interested in Kevin Davey’s work, but it seems I might have to point in another direction as a newbie because in order to follow what he preaches I would need to know about programming…

Also, and I apologize for being off topic in this thread, what day trading strategy could you recommend me to investigate? Please note that I’m just starting in this world.

Thanks for your advice and the great work you’ve put into this website!

You are not off topic. Actually, you are completely on topic.

The hard and simple truth is that you MUST learn to program strategies. You must learn to backtest.

You must learn this crucial element not to find ‘what works’ but to discover what does not work. Nearly all of my time is spent disproving theories. Every once in awhile…you will find something that works and is robust. But it’s hard work.

The problem with the vast majority of the trading platforms that offer backtesting is that you must learn C#, R, Python, .Net, or Java. But let’s get real…to learn these programming languages requires years. It’s just not feasible for 99.9% of people. These platforms all promise that “it’s so easy to learn.” What a load of crap. Pure nonsense. Once you become confused trying to program…then an army of developers will be offering their programming services for yet more money. A vicious cycle of misery, frustration, and never-ending expense.

In my opinion, the easiest platform to learn is Trade Navigator. Which has a programming language named TradeSense. It’s stupid simple to learn. You can download a copy from the

following address, which gives you a free trial.

Once you have it setup, I can start feeding you some basic strategies that are pre-programmed. No, I am not handing over the ‘keys to the castle’, but you will be light years ahead of everyone else.

Once you learn how to quickly test ideas…look out. You will be like the ‘one-eyed king’ in the land of the blind.

Congratulations dtchum. You have written and on topic and helpful reply to a post.

Here is another good website for VIX related ideas..

http://www.tradingvolatility.net/p/our-strategy.html

Hi Emmet

I´ve read with enjoyment your two articles about this Vix strategy and the Intraday trend trading. I find them really simple and loaded with objectivity as well as a great backtesting. Thank you!

An idea came to my mind after reading your two articles. What do you think about implementing this same strategy but adding the VWAP (volume weighted average price) to the backtesting on ES? I use to trade using price-action and volume as a guidance, and I thought that the VWAP may be the “primary trend of volume of the day”, similar to the mid-point range of the day as the primary trend of price.

The hypothesis also conforms with the theory of Occam’s Razor, as it is easily observable and simple. The VWAP is just the mean of the total volume of the day. And it supposedly signals the trend of volume, so that we only go short when price is below it, and long when the price is above it, (5 min chart also).

I wonder if this could be correlated with your primary trend mid point theory as well so that we go short only when the price is below both (the mid point range of the day and VWAP), and vice versa wih going long.

Please, let me know what you think about this new ingredient either to add it or discard it to the “strategy soup” 🙂

I´ve recently found tradingshools.org, but I am enjoying the fresh air, great community and articles that are shared here. It´s an oasis for all of us, normal people who enjoy trading and do it as a full time or part time job.

Thank you very much for your articles and sharing your ideas Emmet.

Cheers

Daniel

That’s a great idea for testing. Lets take the VWAP, add the Mid-Point, and see if we can find a robust edge to exploit.

Sounds like a great article to me. Its on the list.

Hi Emmett,

Please bear with my question,I’m a novice in coding.

Is there any indicator/software that will automatically plot the mid-point of day on a 5 minute chart?

Regards.

Hi Emmett,

I am finding the following statement a little confusing : “If a 5-minute bar crosses above the mid-point, then buy at the market. ” – Assuming we are trading emini S&P500 as an example, do we mean if emini S&P500 crosses above mid-point here ? or if VIX crosses above mid point? .

I thought VIX is being used for reference so it would be emini BUT Since VIX went down so emini would have gone up, so now emini would have to go down to cross the mid point.

If the emini SP500 crosses the midpoint, then buy at the market…AND

The VIX is < -4%.

Hi Emmett,

Thank you for your informative and well written article. You mentioned that you have cheap laptops for back testing and also a long time ago you said you use a certain platform to back test even if you don’t know programming although more recently you said that you wouldn’t recommend it.

Can you walk us through how to backrest what platform to use and how to find data etc. Also how an American citizen can legally sign up for the cheap overseas brokerage for ETFs? Thank you so much. Also is your email Emmett tradingschools.org? I’d prefer not to put my email so its fake and I apologize if I can’t do that so please delete if it is against your policies. Thanks so much.

You might look into Sierrra Chart. I am switching to it. I was and still am using MC and using TS as a data feed. You could also just use TS.

Emmet,

Thx for the further update on this strategy. What is the win/loss percentage for total trades taken. Also, is this only LONG strategy. Lastly, do the results show or include allocations for slippage. Although for 3-4 trades on average month, slippage should mean little. Thx again!

So … questions:

1. If the blue line is the equity, what is the red line?

2. The system works only if the intraday VIX is down 0 – 4%, but not if it’s down let’s say 6%? If it’s 6%, stay out?

3. Do you recalculate the middle point of the intraday range the entire trading day? (important for calculating the SL)

4. Does “a 5-minute bar crosses above the mid-point” mean “low of the bar is above mid-point” like in the previous method?

5. What if at 11:30am when I’m doing all these calculations the price has been above mid-point for 4-5 bars already? Do I still apply the method and go long?

6. Does “a 5-minute bar crosses below the mid-point of the day” mean “high of the bar is below recalculated mid-point”?

Hi Goagal,

1. The red line is the equity curve. The blue line is a 100 period moving average of the equity curve. When the equity curve pierces the moving average, then the system needs to shut itself off.

2. The system needs for the intraday VIX to be down a minimum of -4%. Yes, you can be more selective (-6% etc) and achieve results over $100 per trade, but you sacrifice sample size, which increases the likelihood of a random outcome.

3. The middle point is a dynamic calculation, it recalculates as new intraday highs and lows are achieved.

4. Yes, for a buy signal the low must cross above the 5 minute. By requiring the low to cross, it acts a slight noise filter.

5. You can, and the results are good as well.

6. Yes, correct.

Emmett

After reading this a couple times I think you are saying only trade when the VIX is down by greater than > 4% Or the VIX is less than -4%.

Not to be nit-picky or maybe it is just me but saying to trade when the VIX is down by < 4% is confusing – I think the

less than .. Anyways.. great article Emmett!

Hi Chuck,

I am a terrible technical writer.

When the VIX is < 4%, intraday, then we want to be a buyer. Only longs.

I like how you use the VIX as your trading indicator. For some more successful VIX trading strategies check out these links..

https://seekingalpha.com/instablog/5806521-macro-investor/4988771-tested-new-algorithm-trade-volatility-etfs

https://www.quantopian.com/posts/vix-trading-algorithm-return-150-percent-a-year-over-past-5-years-but-has-50-percent-drawdown-from-2015-meltdown

Personally I short TVIX as a long-term investment. Short interest is only 3% and seems like there are always shares available. It goes down a lot so you will continually need to add to your short positiion.

Good stuff.

There are a lot of good systems floating around that revolve around the VIX. However, the vast majority are executed on Daily bars. And so the sample size is too small.

I like to see thousands of trades for a trading strategy. A large sample size eliminates virtually any chance that the results are random.

VIX is highly volatile. Better hope there is not an overnight devastating event.

Great article on at least getting people to think for themselves.

Is Kevin giving your private lessons on Auto Trading?

Your whole post is a study in why TR fail, and why so many traders fail too.

You say, “With the above strategy, a signal will fire off a trade only 2 or 3 times per month. However, some months might fire off 15 trades.” Huh? With all those dreamy-eyed newbies and unrealistic traders looking not to think and trade, but just copy someone else’s trades? To come and sit down day after day and not take any trades? The TR operator will start forcing trades, just to satisfy the punters, then BOOM, everything blows up, and we have the would-be traders all calling and texting and emailing Emmett to say just how bad things are.

On the /ES, a flat equity curve for 2 years? It is obviously a scam, right? Another email to Emmett. That just will not do, when we come into the TR every day and want to take out money, just like a salary.

How dare you present such nonsense? Only 3 trades a month and not making money every day like clockwork? It is a scam.

Once again, yes, if you lack the ability to understand sarcasm when you read it, this post is an example of such.

On a more sober note. That is a nice, simple, workable system, for those who are realistic about trading, and have the patience to only take trades that have a high probability of working out, and with a good return, and not too much risk. Still, I doubt that many of your readers would be able to trade with such a low frequency.

I keep telling traders that trading is not like a job, where you have to be doing trades all the time, just so that the boss can see that you are working. When trading, one must be more like a cheetah in the grass, patiently waiting until a straggling gazelle comes into view, then striking fast and hard with no hesitation. Rinse, repeat.

Then you say, “These sorts of topics, I am not very good. I apologize if I confused you.” What the heck are you saying here? What you wrote was a really good, clear, understandable explanation of the system. 🙂

Your post reminds of what I keep saying and many folks do not get it when I say it. The TR set up a pure fantasy world and most folks rather lose money trading in that fantasy world, whereby one with a small account makes a salary like clockwork from day trading, than have at least a chance to make money trading in the real world.

I will also add as an engineer with a math background and who did data analysis for a living, that it is easy to do data manipulation to come up with a system that works on historical data, but having it work in the future is a different story. So be very careful you are not doing data manipulation on any back testing.

“When trading, one must be more like a cheetah in the grass, patiently waiting until a straggling gazelle comes into view, then striking fast and hard with no hesitation”

WOW talk about empty metaphors. A cheetah and a trade have nothing in common…one is a cat..cats don’t trade. Nothing about a CAT that will help a trade.

OMG, DTChurn was right you must be Pete. No one else would make comments like this. James you have lost all credibility.

i’m not anyone just average guy that got interested in daytrading, and i got damn good at it if i do say so myself.

Based on you nonsense post; everything from starting a trading room to meaningless trade calls to claim of made X dollars Today posts, I would seriously doubt it.

You really should go to a place on BMT and start a journal, those folks over there might be dumb enough to believe your nonsense.

i’m up 289 but still have positions on

Another Fact Free post by the local lunatic James.

Here this can be your post for tomorrow:

I’m up $477 by noon.

Hmmm, which reminds me, did you not post you would be up $500 by noon the day before you even traded. So you lied again!!

I hear you RobB. I could sniff out the b__ks disease even in his pathetic attempt to hide his manic persona. I wouldn’t be surprised by now if he was actually Pete. He not only lost credibility now calling out supposed trades and flirting with the idea of starting a monthly churning shamshow site , but before as dtchurnNO and dtchum when they were trolling on the side of the shams which makes his words even more untrustworthy.

Your inability to understand English must be boundless.

Thanks Emmett for sharing your strategy. One question – what if VIX is down > 4% , say 5% or 6% or more ? . Usually when we use arbitrary numbers it becomes curve fitting.

The system works across all VIX % regimes. But you need to find the sweet spot in terms of sample size vs trade size. For instance, you can be more selective and require the VIX to be down 8%, and your profits go way up. But you lose sample size. I like to see a minimum of 300 sample size. This eliminates the possibility of randomness.

1. Can you walk us through how to backrest what platform to use and how to find data etc. If we don’t know how to program?…

2. Also how an American citizen can legally sign up for the cheap overseas brokerage for ETFs? Thank you so much.

3. Also is your email Emmett@tradingschools.org? Thanks for your reply Rob and looking forward to your reply Emmett.

Yes, thats the correct email. Sorry, I don’t splash my email on the website. My email tends to collect a lot of odd stuff.

Regarding the backtest platform, I will set up a new page with the platform and code that you can import onto the platform. That way you can backtest, play with the code, test different symbols, etc. Just give me a couple of days to get that together.

Hi Emmett,

I didn’t see any update on the backtest platform, I understand you must be overwhelmed with so many scamsters in this industry, wondering if there has been any change in the plan?

thanks