Global Insight Research

-

Honesty

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(1)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

Yet another highly touted Ninja Trader Brokerage/Ecosystem trading educator with no track record of trading successfully, and no account statements that verify claims of 100% winning trading signals.

Bruce Moschella of Global Insight Research is a long time operator of all manner of investment hyperbole. A former stockbroker that has worked in a TradingSchools.Org world record of 6 FINRA expelled stock brokerages. This guy is a financial train wreck that has worked for the worst of the worst boiler rooms.

Is currently doling out his financial wisdom with a trading advisory and a $5k magical indicator that one purchaser described as “a complete and total rip-off.”

A highly touted and prized “investment educator” that is receiving marquee marketing treatment from Ninja Trader Brokerage/Ecosystem. A complete farce and is entirely outrageous that a regulated investment brokerage would promote this obvious investment charlatan. Avoid.

Who is running Ninja Trader Brokerage/Ecosystem? A bunch of investment idiots?

Thanks for reading today’s review of Global Insight Research

Global Insight Research is a trading signals service that provides commentary and price targets for the SP500, Nasdaq, Russell 2000, Dow, Gold, and Crude Oil. The reports are issued nightly and additional commentary is available via private Twitter feed.

The cost of the service is $99 per month.

Global Insight Research claims that their price targets for each security contain a verifiable accuracy of the following:

- Price Target 1= 100% accurate

- Price Target 2= 80% accurate

- Price Target 3= 65% accurate

- Price Target 4= 55% accurate

- Price Target 5= 50% accurate

Looking at this, you should immediately be suspicious. Price Target 1 is claiming to be 100% accurate. No losing trades.

In addition to promising to provide 100% accurate price targets, the company is also willing to sell this ‘secret formula’ for a one-time fee of $5,000.

Highly Promoted by Ninja Trader Brokerage

Global Insight Research is a prized and highly promoted “certified educational provider” with Ninja Trader Brokerage. The Global Insight Research website contains a highly coveted position on the Ninja Trader Ecosystem list of prized, cherished, and 100% verified trading vendors.

One has to wonder what exactly is the vetting process at Ninja Trader Brokerage. Do they attempt to curate and find the most wholesome and honest trading education providers in which to promote? Does Ninja Trader Brokerage research and investigate the legitimacy of the person providing investment advice?

When a trading vendor is outright promising trading signals that promise 100% accuracy, can the futures brokers that work at Ninja Trader Brokerage tell their clients with a “straight-face” that Global Insight Research is really going to deliver 100% accurate trading signals?

For several complaining parties…this is exactly what they have described to TradingSchools.Org.

Introducing Bruce Moschella of Global Insight Research

Global Insight Research is owned and operated by Bruce Moschella. Bruce claims that he has been providing solid investment research to the investing public for over 15 years and that his super-secret scientific financial model is cherished by hedge fund managers everywhere. And that above all else…we can trust Bruce.

This prior paragraph contained one truthful statement. That Bruce Moschella has in fact been providing investment advice for over 15 years. But this is where the truth ends, and the bullshit begins.

According to Finra.Org, Bruce Moschella was a registered stockbroker from 1999 through 2010. Remarkably, Bruce Moschella worked for 15 different stock brokerages throughout the United States.

A perusal of his employment history shows that Bruce would work at a stock brokerage for sometimes as little as 30 days before bopping to yet another stock brokerage, and just when his seat became warm, Bruce would bop to the next stock brokerage. Over and over this continued for 10 solid years.

And the reputation of these stock brokerages? An absolute rats nest of stock brokerages that were nothing more than “pump and dump” boiler rooms that peddled all manner of financial fraud.

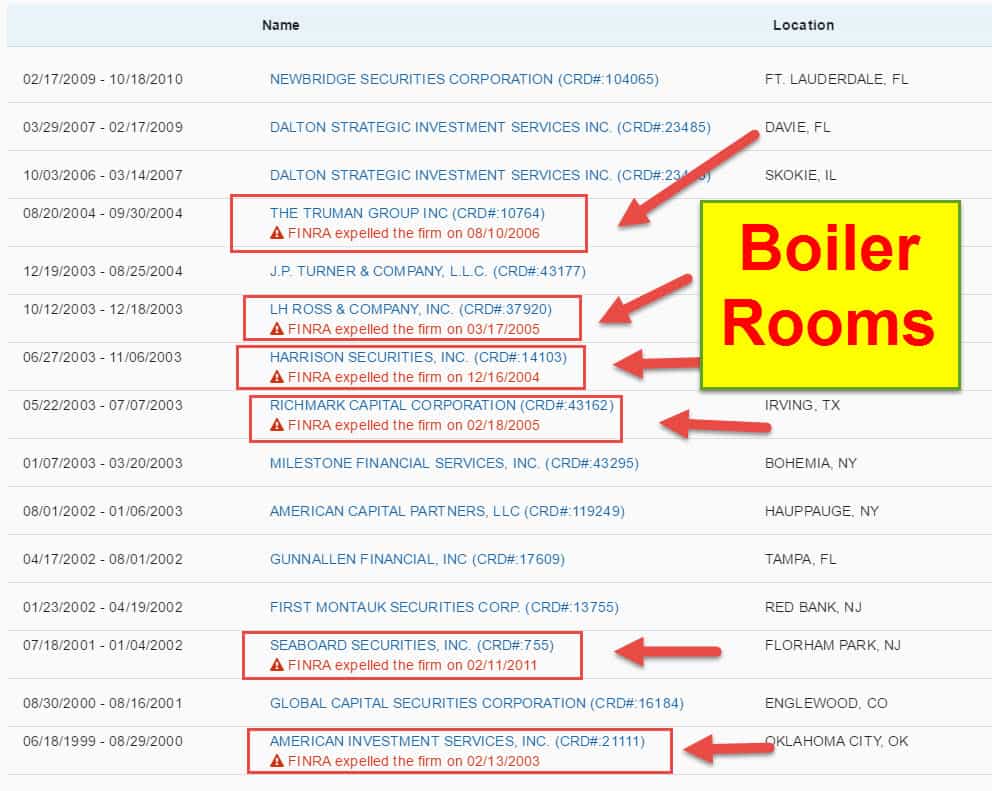

Incredibly, of the 15 different stock brokerages in which Bruce Moschella has slithered through…6 of these firms were outright expelled by FINRA for financial fraud. And we are not talking about a little bit of fraud, we are talking about fraud in the hundreds of millions of dollars.

Some of these firms, I am uniquely qualified to speak about. For instance, Seaboard Securities is one the firms that promoted one of my own financial frauds, which sent me to prison for securities fraud. The list of firms in which Bruce Moschella has worked is a venerable “whos-who” of fraudulent penny stock and private placement investment promotion. Below is a screenshot listing that was pulled from Finra.Org:

Employment history of Bruce Moschella, Global Insight Research

One has to wonder how this guy never went to prison. He appears to have an uncanny knack for jumping ship, just before the fire starts. Perhaps he has some sort of super-power or instinct that warns him before FINRA investigators show up and kick the door down of the boiler room. Maybe his DNA contains a bit of rat or other vermin which has given him the ability to sniff out law enforcement just moments before the door is kicked in. It is truly incredible.

With such an outrageous employment history of working for nearly every fraudulent boiler room known to mankind…how in the hell did Bruce Moschella ever become an investment advisor listed at Ninja Trader Brokerage? My God, a blind turtle with little ability to type could have found this information in 5 minutes…but the merrily ignorant brokers at Ninja Trader put this guy on prominent display!

Contacting Bruce Moschella

During the month of May 2017, TradingSchools.Org reached out to Bruce Moschella in hopes of writing a review. We did not mention his shady past. Instead, the approach was simple…if the guy could provide a verifiable track record of performance, then we were willing to write a positive review. Everyone deserves a second chance. Maybe Bruce could perhaps show an account statement that verified his supposed 100% win rate? Maybe he has turned a corner, and perhaps he has actually found some super-secret scientific investment model that produces robust returns?

Unfortunately, Bruce Moschella was entirely uncooperative. He wanted nothing to do with anyone asking him tough questions. Of course, we sent multiple emails and were as friendly as Sunday church service. But Bruce Moschella prefers to remain silent…and hopefully continue this charade of a being a highly touted investment educator via Ninja Trader Brokerage.

The super-secret scientific investment algorithm

During the month of November 2016, TradingSchools.Org began receiving a stream of complaints about Bruce Moschella. One customer, in particular, was very irate. In fact, he was so upset that he had a hard time writing about his experience. And so we spoke over the telephone. He included his narrative which began with finding Bruce Moschella via listing at Ninja Trader Brokerage Ecosystem. He felt that since Ninja Trader had listed Bruce Moschella as a certified educational advisor, that he could trust Bruce Moschella. That the Ninja Trader Brokerage listing implied trust and conveyed confidence. If Ninja Trader trusted Bruce, then he could too.

The customer signed up for the investment advisory with Bruce Moschella at Global Insight Research. Once signed up, he then began receiving a series of phone calls from Bruce Moschella. The customer describes a situation where Bruce made grand promises about the performance of the super-secret investment algorithm. He described Bruce’s voice as “dripping with honey.” Over the course of several phone calls, the customer was slowly broken down and eventually conned into bank wiring Bruce Moschella the $5,000 fee for the ‘super-secret investment algorithm.’

Against his better judgment, he signed a series of documents that locked in his purchase of the super-secret algorithm.

Bruce Moschella then sent the customer the super-secret investment algorithm which came as an importable trading indicator. Once he opened the trading indicator and viewed the code, he was shocked. The super-secret investment algorithm was nothing more than a moving average indicator that Bruce Moschella had exported from the trading platform, and had sent to the customer.

The customer was shocked and outrageously upset and what had been sent to him. And Bruce Moschella’s reply, “You signed the documents, it’s yours. No refunds.”

All of this was verified and documented through the email chain between the customer and Bruce Moschella, which was sent to TradingSchools.Org.

Thanks for reading. And don’t forget to leave a comment below.

Thanks for this review and your shared experienced insight on it Emmett. Obviously this guy successfully leap-frogged his way one hop continuously ahead of the law. This should help future retailers be more careful of so-called professionals with supposed “years” in the darker corners of the financial industry now running a ninja endorsed signal service. In my early search , I asked a lone signal service guy for what indicator he used. He had promised to show me and kept delaying where I kept asking and to my shock he sent me a simple stochastic formula smoothed out over several days. I’d also kept trqack of his signals, and he was stuffing his delayed spreadsheet reports with more winning trades and blanking out losers. What a lame lazy sleazoid, and I was an early dupe for falling for it.

Its funny how all these clowns landed at some bucket chop shop in NJ.

Especially between 1990-2005. Redbank NJ was littered with them at one time. You could walk out of one place and join another the same day. Some guys would work at 3 places , using someone else’s license and just split commish pushing shitty IPO’s of the week. Ahh , the good old days ..

Just face it.. If you see some firm in NJ you never heard of before on any Brokers rap sheet , chances are its a bucket shop and they are a POS.

As for Ninja Trader, they are enablers . They basically endorse anyone who will apply their API’s to their platform. They dont really have any other revenue stream. No way they make much on commissions, and there are so many dummy license keys available to get their software for free, they have to enable the crooks to push pricey add ons to survive.

Ninja eco-system is the new chop shop for sleaze merchants .

If I had an account with Ninja Trader I would be closing it. I simply do not trust any company that continually promotes garbage like this.

Also says a lot about Big Mike that he has a financial partnership with Ninja Trader. So much for vetting his sponsors/advertisers and holding them to a high standard! LOL!!

I would also suggest that everyone start putting their complaints up on consumer fraud oriented websites such as RipOffReport.com so they will come up in google searches. I had a look and for all the complaining about scam educators there are surprisingly few public complaints being lodged anywhere. People really need to get the word out instead of just emailing Emmett and hoping he finds time to do a review.

Victims of cons, when they finally take responsibility for the actions, generally wise up, and simply move on. They, as a rule, do not find any need to advertise their mistake, even if they are willing to admit it when asked directly. The ones who keep yelling about it all over the place, have usually not accepted their part in helping the conman, and are just seeking to blame someone else for their own mistake.

The funny thing is I remember not that long ago you were defending Ninja Trader’s cesspool saying how they were trying to clean up their act. Yea Right! They have no interest in cleaning up their act because there money flows from the customers send their way from these con artist. This whole industry is corrupt with one partner feeding off the other. If they truly wanted to clean up their act all they have to do is say, “Nice Vendor of course you can be part of trader’s education. All you have to do is show actual proof of your claims” Now, how hard is that. Apparently impossible!

I think they need to appoint a special council to investigate this industry before they investigate Trump and Russia IMHO.

Oh I am sure that Ninja Trader will be emailing/calling me shortly. Promising to clean things up. Removing the shady vendor and asking me to remove the content. Of course, I will remove the review as a token, and they promise to do a better job. No end to this game. Always trying to find a balance between unbridled capitalism and its sometimes negative side effects.

This guy hit the jackpot once he realized he no longer had to register with FINRA and jeopardize getting fined again. He realized that the online trading education and signals space was much easier to bilk investors out of their money. The con men are giddy because they know it is so easy, just claim a 100 percent winning percentage and the herd will flock to your site. Furthermore, there will be little if any repercussions from regulators. This blog is like a bad accident, I can not stop reading, but it is so sad that the shills are still running rampant.

Great point Mike…. I come here knowing there will just be more 1 star scam websites ( look at the past 8 or so reviews ) and I then ask myself why I do. I like the reinforcement that these rooms are all bullshit just in case I get the stupid idea to trade again… Even if I found a good room I’m sure I would be in the wrong direction of one of these ‘flash crashes’ that seem to happen with more and more regularity… Stop losses would be useless in such a scenario and even if you were in the correct direction they would break the trade anyway!!

Better odds these days at a Roulette Table!!!

Indeed stop losses can be in some cases an artificially safety net. If there is no one buying on the other side it does not matter that you have a stop loss.

Trading volume is your friend, you may sacrifice volatility and percentage moves but you have a much better chance of getting in and out at the price that you want. However, don’t forget about “gaps.” AMD is a lovely stock in the $10-$20 range, great volume but if you tried to trade it through the release of earnings “ouch.”