FX Signals Live/iMarkets Live

-

Honesty

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(1)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

Chris Terry of FX Signals Live and iMarkets Live is a long time financial hustler. Currently is peddling a day trading room, combined with multi-level marketing.

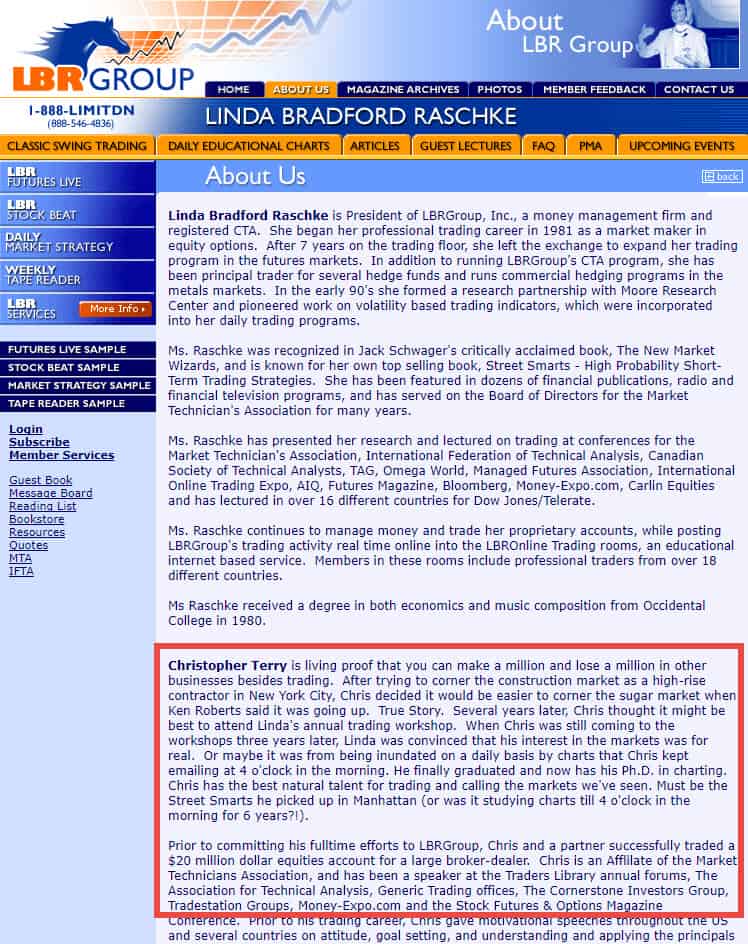

Prior ventures include a now defunct live trading room and partnership with so-called Market Wizard, Linda Raschke.

The most recent venture was a $600 million dollar fraud that the SEC halted, and described as an “online pyramid and Ponzi scheme.”

An absolute shit-show of a human being. Avoid.

Thanks for reading today’s review of iMarkets Live and FX Signals Live

It’s not too often that a Forex broker contacts me, asking that I write a review about a Forex trading program. Remarkably, this is exactly what has happened.

Generally speaking, Forex brokers could care less if a trading product is a scam. They are only concerned with trading volumes and opening new customer accounts.

You will never find a Forex broker shedding a tear over the losses of a customer. Unless those tears pool into a swamp, in which the Forex broker might actually drown.

Apparently, this is exactly what has happened. A Forex broker accepted hundreds of thousands of dollars in client deposits…via credit cards. Only to later discover that the credit card numbers were illegally obtained, and illegally charged by this so-called Forex and Futures trading educator named Chris Terry.

Who is Chris Terry?

Back in the 1990’s, a popular book was published titled, Market Wizards. It’s a famous book, written by Jack Schwager. Pretty much required reading material for all aspiring traders.

Essentially, the book is a collection of stories about supposedly famous traders. And how they made their fortunes trading the markets. It’s been quite some time since the book was published, but it was later discovered that Jack Schwager was hustled into believing that several of his “millionaire traders” were not actually very successful at trading.

In spite of this, the book is an excellent read. In particular, there is a chapter about a lady trader named Linda Raschke. Yes, Linda is a real trader. And a very good trader at that.

Wizards and Con Artists?

Long story short…after the book was published, Linda Raschke became the darling of the day trading educational scene. She eventually opened a day trading room, where hundreds of people paid a boatload of money to learn her supposed trading secrets.

Her business partner and trading room moderator was a guy named, Chris Terry. Another supposedly super-trader that made millions of dollars day trading.

Supposedly, $85 million or $185 million…the story has changed over the years.

Eventually, the trading room went bust. Chris Terry and Linda Raschke went separate ways.

Linda went back to doing what she does best…trading.

A lot of my readers adore and admire Linda Rachke. Sorry to burst your bubble, my friends. But her live trading room was a financial disaster, and a lot of people were burned. Screen shot below confirms her partnership with Chris Terry.

Anyway, after the demise of Linda Raschke’s live day trading room. She went back to full-time trading, successfully managing a hedge fund, and being a good citizen. What about Chris Terry? He went into MLM or Multi Level Marketing.

But not just any Multi Level Marketing, he helped promote a company named Zeek Rewards (now defunct).

What in the heck is Zeek Rewards?

The company was organized as a multi-level marketing/pyramid type investment scheme. Essentially, a person would purchase shares of ‘stock’, along with a ‘business opportunity package’ that would attempt to sell the stock to next person down the pyramid.

The scheme was wildly successful. In total, the company sold $600 million dollars of ‘shares’.

Pyramid investment schemes are remarkably easy to sell and market. It relies upon the trust and friendship of a close acquaintance. They are essentially social viruses that prey upon our herd mentality.

All pyramid investment schemes eventually collapse. One of two things will eventually happen, either you run out of fools, or the authorities shut it down. In this case, the SEC shut this one down. You can read about the entire scheme here: SEC Shuts Down $600 Million Online Pyramid and Ponzi Scheme.

This scheme was shut down in August 2012. So what does Chris Terry do next? Just start another investment fraud.

iMarkets Live and FX Signals Live is launched

After Chris Terry ripped off customers in his fraudulent securities scheme named Zeek Rewards. Within a few months, he launched a brand new investment scheme named iMarkets Live and FX Signals Live.

What is iMarkets Live and FX Signals Live? Its just another Zeke Rewards! But with an interesting new twist. Essentially, it is a live trading room that delivers trading signals for Forex and Futures markets. You simply pay an upfront fee of $195, and $145 per month to be part of the live day trading room.

And the best part of this live day trading room is that the trades are ‘auto-traded’ by Chris Terry and his trading morons that manage the trading room.

How are people doing trading room and auto-trading signal service? Not so good. In fact, the situation has become so egregious that Forex brokers are contacting TradingSchools.Org, asking that we write something about this con artist.

Of course, Chris Terry would have you believe otherwise. In fact, his website heartily proclaims:

Whether you’re sleeping, partying, working, or all three, your trading account will automatically mirror the trades our experts make.

What if a master trader who’s made millions in the markets sat down with you and made live trades right in front of your eyes…would you sign up for that?

How the iMarkets Live and FX Signals Live fraud is executed

Step one. A fool signs up for the ‘live trading room’ and his supposed trading education begins.

Step two. The fool is recommended to open a trading account with a Forex and CFD (Contracts For Difference) broker in which Chris Terry receives a kick back on all trading volume.

Step three. The fool is lured into the auto trading program. Approximately half of the fools will randomly make money because the trading signals are binary.

Step four. The fool that is lucky enough to make money is pitched the pyramid scheme. The fool contacts his family and friends and tells them about these amazing trading signals.

Step five. The process begins anew. With a new fool.

This is the exact same business model of Zeke Rewards. As long as a greater fool exists…the scheme continues.

Wrapping things up

Truth be told, I didn’t even want to write this review. It’s a completely stupid and ridiculous scheme. At some point, you have to wonder–who would be foolish enough to fall for this stuff? But then I think about my own past history of running scams and hustles...and the words of PT Barnum come flooding back, “There is a sucker born every minute.”

FX Signals Live: Chris Terry pitching his BS to a room full of suckers. Sad.

Thanks for reading. Would love to know your opinion.

Getting to this post late, but I can confirm that the LBR chatroom posted calls that on the whole lost money consistently, at least during the time I followed it, from 2009 to 2011. As I recall, Raschke mostly left the trade-calling to Chris Terry, as she was focused on her own trading — for a small fund, likely less than $25M, so I am not surprised that it fails to show on hedge-fund rankings. Raschke’s general advice on how to approach trading seemed solid and well-intended. It would not surprise me if the methods to her pattern-based trading had worked well for her over the years. But as trading became dominated by computer algorithms and HFT, these patterns seemed to fail more often.

It’s really comical that all the 20 something morons come on here to defend it. Go get a job you little shit heads instead of scamming. All of these little clowns can’t trade for shit – and no making a $60 FX trade does not mean you’re a successful trader you little cunts. This entire era of social media BS and gurus has to come to an end.

i joined to imarkets 4 months ago and is not what you said. . Pleanty of guys teaching his methods in a honest way. Very useful

Just another hater pouring another venom. I hope you choke on your own venom

I joined up for the use of swipetrades but only lost money. There is good information for learning but its heavily reliant on software which makes it easy enter in this fast paced world. I learnt a lot but also lost alot.

Its over priced and a massive pyramid scheme.

All the chat groups only show winning trades and screen shots. no losing trades which certainly makes you try harder. Most are from demo accounts and not live. Many so called winning trades are from the Web Analyser which is a form of scalping. very small profits and certainly not a good form of trading

I liked the Harmonic Scanner and at first sight thought it was really accurate. When i started losing I noticed that the entry points would change after I would enter and the trade would stop out. Failed trades would not appear on the previous history giving a false impression that it was very accurate (only winning trades would show or the scanner would re adjust to compensate for a poor entry signal) I constantly lost money over 3 months and wish I had the money back in my account.

Swipetades had hit and miss weeks. I think it really comes down to aggressive money management. You are not going to get rich off this!

learn yourself and save the monthly subscription for your own trading.

Buyer beware!!

The review started rally good. Them all the bad words and insults came in más the objectivity thrown away. Seems more an emotional review than an impartial one. So bad and so hard to believe a review like this…

Sometimes I start writing a review, with a clear mind. And then, the more I wonder about the

You mentioned that Chris Terry was apart of the ZeekReward Scam. But according to the SEC link you used in your article “https://www.tradingschools.org/reviews/fx-signals-live/”, Chris’s name was never mentioned in the complaint. Do you have any other proof that he was apart of that scam and that FX Signals Live and iMarkets Live resembles ZeekReward?

didn’t mean to flag sorry

Where was the real review of iMarkets Live? Have you used the Fusion Trader, SwipeTrades, IML Academy, IML TV, Harmonic Scanner, Daily Swing Trades, or FX Signals? I’ve made money from each of those products and services without being part of the MLM “scam” of signing people up. Sure Chris Terry has some shady past, but not every direct marketing company is a pyramid scheme. Look at Tesla, no commercials, yet they’re worth more than Ford.

If people are looking for a get rich quick by duping their friends, I’d agree with this review, but the fact that nothing is mentioned about any of the above products in detail is kind of misleading in my opinion. Christopher Terry doesn’t manage any of the auto-traders. There is a very transparent list of each of the traders, their open trades, past trades and profit simulator. So I’m a little confused how there can be 1 star ratings when nothing was reviewed by the CEO.

https://youtu.be/UfdEdh3o21Y

True. This is NOT a review at all. An honest review of such a scheme implies to sign up, perhaps for the money back warranty time only, and grab useful information.

I had the same experience

Just to mention for the tradingschools webmaster, the link to Raschke’s site(s) on this page automatically attempts to force the browser to communicate over an untrusted certificate from the server “lindaraschke.net” along with some sort of popup. (not surprising coming from the lbr shamshow empire, imo)

Emmett, when I saw that you were finally going to a review of this course, I was really happy. I have had a co-worker, that I has been with iml for about 8months. He is more focused on the mlm side instead of the trading side. I wanted a review of the products that they are using by someone, like you, that goes in and get the real story. I was hoping that you would have done a review from the standpoint of using the tools yourself, to see if they really work. I appreciate the history lesson on Chris Terry, but a by the numbers review that you do of their products would be really nice.

IML is scamming people worldwide ,Emmett I hope your review reaches far and wide .Chris terry is a cornball charlatan.

Why wasn’t my comment approved? Was it the repeated references to the other fufu MLM clown, previously featured on Trading Schools? I have been following this MLM-niche for the past year and made some observations that I thought were relevant.

There is some serious fufu-ness going on in this niche. People want answers, I was hoping my comment would spur some additional debate and research among the trading community.

There were things that I think that were overlooked and not included.

I would like to resubmit.

Let me know,

Farooq

I see my comment was approved, I apologize first and thank you.

No worries Farooq. I appreciate all comments. And I love the nasty and snarky comments.

This is a rough venue. People should be able to express themselves. Even the most offensive and vulgar trolls have a home here. Readers should be able to quickly mute and ignore the voices they do not enjoy, and attempt to extract value from the voices that have something of value.

Emmett – Could you seek clarification/further verification from the broker?

Was it directly linked to Chris Terry or was it indirectly linked to Chris Terry.

There are several of so-called “groups” that recruit for companies like IML and Kaizen/Kaizen Global (ran by Reza Mokhtarian). These groups make money by broker sign-ups and deals. I know of one who specifically tells people to fund a forex account using a credit card. This particular broker accepts the credit card and uses a front company for this purpose.

It would be interesting why this broker is not strictly following any KYC or AML policy. Perhaps it is a hit-piece from a competitor.

Right now Chris Terry is making a ton of money just from sign-ups alone. The “element” from Kaizen/Kaizen Global (ran by Reza Mokhtarian formerly of Capital Trust Markets/CTM Group. Ltd) had recently broke ranks from Kaizen and ran to IML with THOUSANDS of people.

Disclosure: I was in IML for 2-3 months in the summer of 2016. As of this date of publication, I have no affiliation with IML or Chris Terry (or Linda Raschke).

You should reach out to Scott Carney, through Robert Halterman who has chronicled the naughty behaviour of Reza Mokhtairan about the alleged- controversy concerning IML’s Harmonic Scanner. I’m shocked it is not in the review.

So, I am not disputing the veracity of this review – but I think that more verification of the claims is necessary.

BTW, Whatever happened to Kaizen Global? Whatever happened to Reza Mokhtarian? We need a followup! 🙂

Cheers!

Farooq

Linda Raschke I know for a fact is as dumb as a box of hammers.

She was a regular on Top Step when my son had to listen to that garbage for his funded account.

She is in the same camp as Woodie, Brooks, and Dalton. They been around long enough to have thousands of old farts who remember them and think they know what their doing because the been around and have grey hair….

This clown is nothing but a blow hard , who never has anything concrete to deliver and although I never personally been in his room, I know 3 people who confirmed he is fulls of shit and nothing more than a generalizer who tries to always claim , “Look I said it would do that “.

Thanks for uncovering another scum merchant ..

Emmett, I am impressed of your scalping numbers back in 2008. That is, you had more skills than just scamming OPM. I would be very grateful if you reviewed Jigsaw. It really is puzzling without an unbiased review.

I remember reading about LBR many years ago in the Market Wizards book. I am confused, was she ever profitable? I guess a trader does well then they sell out to hock their wares to the retail public. I ascertain that most of these popular traders that now are on book signing tour just don’t trade anymore because it is much easier to just sell to retail. I have to reread her history because I always wondered about her after she became a regular on the retail vending circuit. Can someone clear this up for me? was she the real deal that just decided to sell books instead?

Many of these great are complete fakes, but some made a lot of money on one lucky trade and just lost everything after that. But they ride that one lucky trade like there is no tomorrow and never mentioned that ever since they have done nothing but lose money. Like one person with a lucky copper trade. Some will know who I am talking about. Just think of the folks that made a fortune during the NASDAQ bubble but then lost it all. They make a fortune during the bubble write and book even thought the then lost it all.

As far as Linda goes I cannot imagine a top ranted hedge fund manager doing the nonsense crap she talks about. Seriously could you imagine David Tepper doing day trading webinars????? BTW I have gotten many great ideas off Tepper advice.

Exactly, an example that comes to my mind is Wasendorf of PFGBest in the episode of American Greed where he early correctly called out folks to stay out of the market before the 2008 collapse, and ripped off the guy who made “BestDirect” one of the pioneering earliest futures trading software for retailers. He rode that fame and early rep, until the truth was completely opposite where all his investments since, mostly failed, and his brokerage, the new mega office and his property was turned into a massive ponzi and literal cut and paste with shredders shown in his fed seized house, and stymieing electronic audit for years. There’s still an ongoing clawback notice on the pfg site to this day. You can still link to other pages still hosted on the cordoned server through archive.org and see their hilarious “future” plans for kicks before the car tailpipe fumes hit the fans.

Rusty Wasendorf. To this day, am still shocked. Never, ever would have imagined.

Which just goes to show you how bad it is to average down. Even those with big pockets full of other people’s money eventually blow up from averaging down.

Which is what makes it so sad that so many TR are actually teaching that crap.

Despite the recent charade of smellypete here, I am still enjoying how we exposed James/JamesII and DrChump in the previous recent reviews, again as all alters of gollum petedetithb__ks. What is this like the 3rd or 4th time he’s used alters in disguise since the pagetrader “blowup” tantrum? some “better man”, LOL. he must have been sick saying that when he knows he’s anything but and his exposed over and over again for being fake with alter id’s. That was sweet how he stumbled all over himselfas JamesII. . Yeah I know he read every word in my posts on this thread and could see the refrences to them without saying guttysnipe this time. I’ll get that post of his gutty picture out sometime even though it’s modded out for now. It exists, all that disguting history of his on these comments exists and nothing will change that fact. lol. Saying nothing in response this time doesn’t work either in masking the b__ks disease, LOL.

I’ve already told you dtchum and toto aren’t me. I told you that you reek of Brooks disease warmly as a fellow victim, you chose to be a Brooks shill as the comments show. I too have been suffering from the Brooks disease for years. Thanks for proving the dogwhistle hate I previously accused you and one other of, there’s nothing disgusting about manning up to what Brooks has done to our hindquarters.

Pete, Brooks is a parasite and should be ashamed of himself especially after taking the hippocratic oath as a doctor. Personally, I believe this blog could use some vitriol towards the scammers that deserve it. IMHO most of the regular posters aren’t shills especially for Brooks. Anyway, I enjoy reading about your distaste for the man, just as long as you are using that in a constructive manner. No one should be attacked personally on this blog, but if one disagrees then by all means let everyone know.

He had a long history of attacking me personally MikeM. Al l I did was respond while he escalated it with more crude insults as I’ve demonstrated with the links. Let not tradingschools history forget. If Pete wants to truly reform then he needs to stop guttysniping in reaction to my posts. No you didn’t “warmly”. it’s you who have been infected with b__Ks disease all this time. Anyone can see back then you picked a fight with me liar in the most disgusting insults from the beginning. And cowardly not mentioning it was Cyn who was the “other”, LOL, who shut you up for good, well about at least 5 reviews ago before you started using alters again to snipe at me and RobB. and troll ridiculous statements of starting a trading room in an attempt to call me or RobB a shill which I defended RobB about the free too. Then petedetithbrooks lies about me suffering from Books when I’ve clearly mentioned way back enough times I dtiched his teachings and had moved on. Dang, this liar will say anything to change the past even say crap supporting shills to try to tear me and others down from behind alters.

dtchurn I hear you and hope to hear more about your experiences. I truly enjoy the discussions on strategy along with con men being taken down.

Yes, we have done vitriol to other review scams when it was called for MikeM and I agree others who had been scammed should join also. Just that all too often my posts were attacked by gollum’s alters because I believe he no longer really cares about b__ks just the spite he has for me from the past as a psycho job. In fact, I was the last of the “wolfpack” to realize his trolling. As anyone can see the others were calling his bs long before me and he tried to stick it to me just because he gained no ground with the others, pathetic, so much for “manning” up, lol. Evidence. he did not attend the b__ks event or even post in the b__ks thread on the beachforum. All during this time in the same month the tradingschools b__ks review came out. He did not send his own CFTC complaint yet. I had long ditched Brooks long before I even discovered Tradingschools. All I said was my past years ago impression of reading his book that he was like a detailed professor like researcher even though he was scammer. Then this idiot started arguing with me, and next thing I know I get these insults about I being in b__ks rear. Then he started escalating it completely without any respectable debate as he can’t because others called him out on his previous inane posts before I’d even bothered to read his posts. This “manned” up baboon up to now won’t learn his lesson and stop trying to justify his inane crude sentences he slips into his postings , completely trollish, then continues to snipe at my posts from behind alters, pathetic, insane, and enraged b__ks diseased sickness is the logical conclusion.

If you want to give him a chance, I respect that as you had not seen the crap he tried to get away with in the hundreds of posts. The links I posted are only a small sampling of the other outrageous crude crap of this gollum. And then he lies about it even after having been caught by Stray , myself and others. Plus the new alters taking snipes. I was willing to let it all go, but then I saw the new posts and saw the references to my posts, and then the new snipes but the recent JamesII alter. dtchump may have been originally a vendor shill but the baboon often takes over their id’s. I can tell, it’s all too easy to sense the b__ks disease in his alter’s posts.

All you’ve proven is your own hate in sneaking in more attacks via your alters liar. You are just a more well faked mannered baboon as Cyn so artfully put it back then, with your latest alter, LOL. Everyone’s whose read your past vitriol that started your crap and losing out to all the arguments in the past knows you have resorted to using multiple alter ideas so you can speak from any side losing complete credibility. Glad you’ve finally come out and reminded everyone how low you are willing to go “smellypete” raging gesticulating from the cave with NOSHOW at the b__ks even last year. Here are the links again , pathetic you posted far away from the links LOL.

https://www.tradingschools.org/reviews/mojo-day-trading/comment-page-1/#comment-27989

https://www.tradingschools.org/reviews/mook-trader/#comment-10708

https://www.tradingschools.org/reviews/page-trader/#comments-12345

https://www.tradingschools.org/reviews/al-brooks-trading/comment-page-2/#comments

Finally the truth of new “smellypete” alter is revealed.

I missed this one by Rob B about David Tepper. He is certainly the real deal with billions under management. Think about a successful hedge fund manager such as David Tepper, would he be talking about scalp trades to retail on a forum. That optic doesn’t sit well when you really let it sink in. You don’t need to go that far. A trader that earns millions trading the market would not go on a lecture circuit to sell services. The time spent pitching material would cost a successful trader a ton of money. It just doesn’t add up. I’m sure we will never know for sure about LBR’s success in the market over the long term.

OK, where is your proof to back up your poorly written post? You say “some made a lot of money on one lucky trade and just lost everything after that” – put some names out there. Oh, you don’t have proof? Kind of like trading rooms that can’t show real track records, right? You spout nonsense, so let’s see you back it up with facts. My guess is you cannot, becuz you just say shi*%^ to sound knowledgeable.

Proof proof proof – isn’t that what you always require? Why don’t you follow your own advice?

Dtchum,

You post is so stupid how can anyone take your seriously. You are the embodiment of a Troll!!

In fact I can only draw 3 conclusions. 1) You are a child of 10 years old, 2) You lived in an Afghan cave all your life and never read a financial article in your life or 3) you are being willfully stupid and for god’s sake I hope it is number 3.

Let’s say you are illiterate and never read a financial article in your entire life, even a complete imbecile would realize what I wrote was true. Did you not know anyone that made a lot of money betting on some high flying tech stock during the NASDAQ bubble to then just lose it all. If not there have been so many articles written about it both individuals and funds that did just that. Seriously do you have some mental disease where you forget what happened yesterday like the movie 50 first dates.

The problem is it is impossible to have an intelligent conversation with someone that is a complete moron or bing willfully stupid. I could write a book on the number of people that made it rich off a trade or even a series of trades then became famous and then lost it all and yet you never hear of one such person. I will pick someone that was sooooooooo much in the news you have to have been brain dead not to have heard what happened. Of course the problem is no matter what I write you will just respond with a willfully stupid post, so I will just respond back to your future idiotic post with the same image I am including in this post.

So hear goes. You are telling me you lived under a rock and never hear of John Paulson? I will include a link to one of many articles about him and his fund. But being it is obvious you are to illiterate to read I will try explain what happened in 1st grade simple bullet like English so you can understand.

1) There was this man name John Paulson,

2) He ran a mediocre fund (that means so so fund for you)

3) He shorted the housing market and made a lot of money (you can understand that right – you know what a house is)

4) He became famous for shorting the housing market,

5) He made the financial circuit with all the news shows saying he was a genius,

6) Everyone thought he was the next massa and invested in his fund,

7) His so so fund became huge,

8) He then started to lose these investors money like there was no tomorrow.

Now remember I tried to keep this at your reading level. Hopefully you understood.

https://www.nytimes.com/2017/05/01/business/dealbook/john-paulsons-fall-from-hedge-fund-stardom.html

And Mike you say I am not nice. How in the world can you be nice to some moron like this.

drchump == jamesII == RobB III == smellypete == drchumpNO == Pete ==> and on and on. I am just going to leave it at that for the new readership to be aware of this guy flaps both sides of any issue just like the shills and shams and also uses alters showing the scammer-like disgusting lack of integrity, lack of respect for commenters who contribute the best to the ts comments,all in order to snipe out of spite and to try to rewrite the comment history. Good use of the Cyn baboon pic Rob.

DTChump IMO and his many alias are clearly associated with a vendor and will post anything to harass anyone that calls out these con artist TR, because they effect the number of suckers he is able to con. I cannot remember him ever making any informative post.

In fact his lost post was so stupid he is not only a shill but not a very intelligent shill.

I agree RobB that drchump and drchumpno may have been vendor shills and perhaps still post once in a while, but gollum has all too often taken over their id’s to snipe with and the original vendor shills don’t care since the spotlight of tradingschools has long since passed from the reviews those shilled aliases were made. drchump posts now to be contrary to my assertion drchump=gollumpete in one of my posts yesterday. And the other new alter, smellypete posts again to attempt to marginalize the untrustworthy implication of using alter ids obviously including “pete” in the new alter name to be ambiguous and confusing. It’s just too obvious to me among other things.

Churn – Your posts would make so much more sense if you actually wrote in proper English. I thought English was your first language – guess not.

The funny thing you and I have actually had dealings outside this site. Ring a bell?

Wow, having lost all the arguments and now jumping to insane unrelated imaginary delusions gollumepiet. You’re just showing yourself as an idiot dipstick who doesn’t know proper English from your own imaginary trolling blabber. RobB was right “Mr.Willfully Stupid” imbecilic baboon. Stop pretending to be someone other than your own gollummy self.

I should mention again I agree completely that drchump flailing idiotically at you and other commenters who call out these scams, in effect hurts the readership’s waking up from the kool-aid and number of new dupes conned who are willing to give the shills “another chance” just because they believe the undermining spouted nonsense. To me, it just goes to show the depth of which gollumpiet is willing to sputter for the shills as drchump, both sides of his mouth , and the alters mainly out of childish trollspit-e, which long invalidates any credibility or trustworthiness in his posting. Take a look at the new posts in the b__ks review and it’s the same nonsense again even now. No, no CFTC complaint was sent. He didn’t care enough to post questions in the b__ks thread while you and Stray posted the real proof questioning until the ecuadorian banned you maybe twice. It’s only trollish spite about wanting to be “right” about trolling something. The CFTC will get to fining insignificant b__ks someday whenever they get to him probably never, since there are so many other more serious scams out there such as Kunal. And no post-retirement retro-radioactive gollumfingers clawbacks either or “low level genetic markers” testing either, lol.

“Raschke’s hedge fund has been ranked 17th out of 4,500 for best 5 year performance by BarclaysHedge.” – Wikipedia

She´s not doing massive marketing for her seminars, to find some dreaming kids and take their money for scam. And as i know, she wrote only one book and that is over 25 years ago. Please do not start throwing all traders and services of the trading scene into the same bucket.

Familiar with Linda but know nothing about her hedge fund. Maybe she wrote that entry. I tried searching BarclaysHedge.com by her name and by LBRGroup as shown below and nothing came up. Here is the top 100 in 2017 and no Linda there or maybe I missed it.

http://www.institutionalinvestorsalpha.com/profile/3287866/4689/hedge-fund-100-firm-profiles.htm

I also checked Barrons and did not see it. Can you point out which one is her fund or provide a link by a reputable place that ranks hedge funds where her fund is coming up in the top 20.

Again she may well be number 17 I just cannot find it. So please provide a link besides Wikipedia.

Wikipedia took the sentence from her webpage.

http://lindaraschke.net/about/

“Since then, she has been the principle trader for several funds and started her own hedge fund in 2002 for which she was the CPO (Commodity Pool Operator). Linda’s hedge fund was ranked 17th out of 4500 for best 5 year performance by BarclaysHedge and her early successes were recognized by Jack Schwager in his renowned Market Wizards series. Linda retired as a CPO and CTA in 2015.”

So her fund should be in the database until 2015.

I looked at both Barclayshedge and Barrons and did not see her fund. Maybe it was under another name. If you have a link from a reputable rating source I would be curious. I assume she must have made money (but maybe not) some point in time to have gotten so well known and in the Market Wizard book. If she never made a dime then I have to recant a statement I said and that was Ross was the greatest promoter, because if she never made any money she get the crown.

I also found a PDF on a site for another fund where it shows her fund in the top 10 CTAs in 2007:

http://www.migfx.co.uk/Barclay%27s%20Rankings%20Nov%202007.pdf

There’s some good discussion of her trading room on the Elite Trader forum and it gives and idea of how it evolved over time:

https://www.elitetrader.com/et/threads/linda-b.70422/

https://www.elitetrader.com/et/threads/linda-raschke.211735/

Maybe trading the fund and the trading room was too much over time and so the unfortunate connection (in hindsight) with Chris Terry came about. It’s a pity Emmett didn’t just contact her and ask about it.

You really believe that?? Top hedge fund managers make hundreds of millions and even if the manager left they would just put another one trading the same method.

The only reason I have ever seen a hedge fund close is because they lost so much money they would never get their 20% off the top so they close and open a new one.

Something happened in my opinion for it to close and my guess would be they lost money big time.

Exactly RobB. the fund looks small at less than 50 mill. And it looks like it’s a private group. Perhaps it was ponzi-like. very few trades and more funding came in like Karen the supertrader boasted her fund went up from 20 mil to over 150 mil. So when the investors demanded more returns and more trades, it bellied up quick and had to be closed.

Btw, Remember folks, “smileypete” and “Pete” & “drchump” are the same. Don’t be confused later.

@Rob B

I believe the info on the IASG site is accurate – links posted earlier.

Maybe, but count me suspicious. I just know how the world of investing works. If you had the 17th best performing hedge fund you would have so many investors pouring money in and you would not be some person going around doing day trading webinars and certainly not be closing your hedge fund. And when I search for that amazing hedge fund I would find lots articles instead of virtually nothing. The whole things smells fishy to me. Others can do their own research and come to their own conclusions.

I only participated in this topic because Emmett came to a completely crazy conclusion due lack of any thorough research whatsoever. (sorry Emmett) To his credit at least the penny has dropped.

I’d heard about the fund failing over a year ago. There’s probably more to it when the shtf among the pebble beached rich floridians investors. No duh, when smellypetedetithb__ks looked up the fund because he had nothing else to post about, it showed it failing in 2014 and going , gone in 2015. My post linking to her active shilling in the ecuadorian beachforum among others’ anecdotes instead of just looking up knowing nothing about lbr previously, is far more relevant to the retail industry since it was after having ditched the fund, lbr group tried to make headway into retail.

Before others think otherwise, I was actually in attendance at the lbr hubby’s sham webinar out of curiosity on the beachforum where it was rumored on the web the fund had closed, all before I discovered tradingschools, unlike gollum cowardly hiding in his hole during the b__ks event on beachforum last year during the b__ks review. LOL.

I can’t find any information related to her fund with a reputable source. As far as making money, she started in the pit, correct me if I’m wrong, many years ago when you had a repeatable edge where a lot of people made money and lots of it. I think she most likely made money for a while to get portrayed in Market Wizards. I just seem to struggle with an all start trader with talents to consistently take money out of the market then decide to work with retail. A successful trader or money manager is usually so busy studying the gyrations in the markets that he or she would just not have the time and energy to teach retail for peanuts compared to what is at stake. I feel that running a service or trading room will kill the competitive edge the trader needed to stay on top of market trends.

I would go out on a limb and say that probably some may have had some success at first, but once the monthly fees were collected most stopped trading live. These vendors realized it was much easier to fleece retail. I can’t say from experience because I am no rock start trader, but I know for sure from working close to funds that no one had the time and energy to teach. A trader managing a long short fund can barely get enough time for his family. Possibly, a day trader that concentrates only on a handful of trades a week could possibly have the time and inclination to teach, but I don’t know a successful trader that would teach their edge. Even if it is simple strategies like Emmett posted. No one likes to publish the ATM thus speeding up it’s eventual demise. Eventually, a profitable trading room with a good service will sell out to stay afloat.

Thanks for the info MikeM. I’d agree from what you’ve relayed about busy funds you’ve seen why would they even bother to teach or rum a sim show room. I would assume they are working hard to keep their fund operational and for earning their management fees studying the market, researching companies and stocks all the time etc. I never worked in wall st. on in financials, just basing what i’ve seen in documentarys like “wall st. warriors” , and anecdotes from former claimed pit traders on the beachforum and elite as forum members not retail vendors. In contrast Levin really went to the dark side once his pit edge dried up and started fleecing retailers.

Ranked 17th out of 4,500 at BarclaysHedge? OK. Show me. Go to BarclaysHedge, sign up for a free account, and search…nothing appears.

The problem with Wikipedia, the information is user generated. Although most of the information is very good, I have also found a lot of puffery.

Linda is very popular. And I knew I would catch a ton of flak about putting her in the same bucket as Chris Terry. But the facts are the facts, she was partners with Chris Terry at LBR Group, and the live trading room burned many folks.

I have her book as well. Have programmed all of her strategies…they are crap. No edge. Would be more than happy to include code and testing parameters.

Emmett are you saying that entirely discretionary patterns that focus on pattern recognition are not valid. I’m curious to your thought on the subject.

Apophenia is a dirty, bottom-feeding, nasty, female dog. You do know the word for a female dog, do you not?

Omigosh,…I wondered if I should comment as I’m currently worn out from responding to the absurd shilling in the otg comments and recently where a shill probably the sham vendor tried to ludicrously state as fact Awesome Calls as a legit room with no proof. Well, the entertaining thread in otg in the last two days had a lot of contribution, so I may as well relay my thoughts of LBR. Yep, sometimes our journeys intersect as points. Migosh, my first thoughts about retail trading about ten years ago had me looking up the Rashke’s book “Street Smarts” with that sham Larry Connors. the good ‘ol “Stochastics, RSI” and “tick tock”, ding/dong , every 3 days then ping-pong gobbledook. Needless to say my forward testing of those ideas failed miserably. I even tried to mix it up with Bbbbary Clothespin nosed BBurns. idea of the “5 forces” of trading. I considered joining LBR’s room which still had that horsehead logo site on it back then, and there was sample of her internet chat relay trade calling service. I recall seeing “stop” after “stop” after “stop” almost every scalpy trade. I had as a newb learned “stops” were good, but how could this lady make any profits being “stopped out” all the time? So I dtiched the idea and stupidly went to Larry Connors site and tried out his RSI(2) newsletter and even bought one of his RSI(2) thin paperback books. What I would later realize, a lot of these “professional” looking legacy shams were always so lazy or neglectful in following up losing trades even worse the “signals” were always so late, like you were following signals that were already after the fact anyways due to the signals based on a daily time frame, and daily bars. I soon ditched that and moved on to droning happy Robert Miner and his elliot wave gobbledygook but that’s another story. What was hilarious looking back now was that Connor’s site had a bunch of the usual “market” commentary with other supposedly “pro” staff , probably paid shills. And it was funny how eventually all those “pro” shills seemed to have been fired because conman Conners (Con-ners) seemed to have got mad at his shills for not shilling enough. So as I continued to get the spam email, Con-ners would eventually write the emails himself conjoling the newbs on the email list to attend his “special” webinar to “witness” his supposed algo-trading RSI-based “The MACHINE” product of course costing thousand$ to subscribe to , in action. The Machine was blabbed in his spam email all the rest of the year. Eventually I auto filleted my dummy email used to funnel all the shammers’ email lists I’d subscribed to, so they went in scores of folders I’d accumulated over the years of the dummy email so i would get a bunch of unread email in con-ners folder there, CTU(fake) folder there, Busby folder there, and on and on. I’m guessing some of you guys may have had similar spam ad folders. Now connorsresearch.com just has commentary and an ad for a book with the ridiculous title on “how markets really work”. Maybe the Con-ners is now like David Adams who purports to be a “consultant” to non-retail financial business, lol. If Con-ners was so successful why was his site still shamming retailer products just like every other scam for years except under a better looking suit, lol. Ok, back to LBR. Even the ecuadorian beachforum shilled LBR’s husband’s forex sham site with a webinar where he demonstrated a retail trading method.

futures.io/reviews-brokers-data-feeds/30129-futurepath-trading-brokerage-www-futurepathtrading-com.html

Apparently the Rashke’s also have some facetime with the “Pebble Beach Hedge Fund Association” of billionaires in their Floridian abodes.

pbhfa.org/photos-from-pbhfas-spectacular-spring-social/

Geez, has it already been three years since? As some LBR fans know there was also the LBR “8/20″method. where the SMA 8 and 20 were used in some crossover method. so woefully outdated in the history of shams nowadays. Like Woody’s and john Carter’s indicators, the LBR 8/20 is also featured on the included “free” indicators on Thinkorswim like they are still monuments as “famous” indicators. And guys, if you look at “Kel’s” video he even has the SMA 8 on there , lol! A shill’s lazy originality in evidence, as we know most of their efforts are in the shilled blurb and comments on tradingschools or web media before they start there “new trader/no not really, I am 5 year, but now suddenly profitable” chat (free to visit at first) room. Geez, like you said RobB, the shills are relentless! Quick comment on the review. Good thoughts and words on this “financial” MLM. An mlm is still an mlm by any disguise even if it stinks less under a better legit-looking suit.

You can never just trade a strategy of a crossover with RSI, MACD and so on. Every single trade must be sought after in context to volatility. Those cookie cutter strategies that all those legacy guys teach, Busby, Burns, LBR and God only knows how many more are destined to fail because every situation is different and must be traded with context. IMO, that’s where the rubber meets the road. The more you can think for yourself with managing your risk so you always have a chance to continue will give one fighting chance. After learning the basics, trend versus range, inside or outside day coupled with understanding the bigger picture with some framework. I.E. simple sector rotation situations or risk on and risk off trades. This is where the vendors are making it worse or retail. They teach specific set ups that are supposed to work on a daily basis with very little deviation. A trade may work for 2 or 3 days then market will pivot and change personality all together thus rendering that set up useless. These guys teach robotic trading when in fact the more rigid you trade will keep you out of sync with the market. At the very least, they can provide value to their customers by preaching realistic money management principles. Definitely not implying that anyone can turn $500 into six figures without replenishing in anyway All this in months. LOL just ludicrous 10,000 percent returns for a new trader that just learned what a bid and offer means.

“Every single trade must be sought after in context to volatility.”

You are going to make me bring up another one of my Holy Grails (and my HGs have nothing to do with setups).

Nothing can be arbitrary!! You must trade the market structure. It took me awhile to really accept this one. I remember being in trading rooms where every trade ever day every market condition it was the same 4 tick SL 8 tick gain or something along those lines. How could every market condition have the same trade parameters? And why do these TR teach this nonsense, because most can not trade in the real world so they setup the fantasy world where everything is just arbitrary. The exact opposite of my HGs. If you do not have the funding to trade the market structure you do not take the damn trade.

Your post takes away the whole premise of a trading room and why they don’t work. As soon as you believe to have the market in your cross hairs the market structure will be altered in some way. That is on the intra day time frames. The bull market is years old, but the daily price structure is changing so rapidly now. Those arbitrary price points will bleed you dry.

You are right on the money. What works one day, week or month does not work the next day, week or month.

I was in one TR (in my mindless days) that was profitable for 3 months and thought finally found a TR that new what it was doing and then wam bam the market changed and they lost everything back they made and then some. That is why I say 1 month of or even 3 months track record is statistically meaningless.

I knew one person that traded open ranging BO it worked perfectly until it did not work. I could go on for days.

I’d agree the market changes conditions to throw off any rigid set system not prepared for changing context or otherwise the trader should have an alternate plan to trade the different type of current market condition or the other touted adage of trading advice commonly worded in sham authors’ books to “stay out of he market when conditions don’t fit the plan”. Exactly, that’s why I don’t think those topstep combine wormshells should be trusted either as they seem designed to capture temporary streaks of a luck of a tradingplan more than anything else. I hadn’t been keeping up to date how topstep had been doing the live funding recently, so it was telling when the “Francis/Kel” shill mentioned someone who finally passed the combine hoops got “funded” for a measly $4.5k to start trading. What a farce of a starting account when most of it was probably funded from prior combine fees or the other combine applicants who failed to make it to funding stage for the season.

on nijasim now…i shorted CL @ 44.51 1 car

This is the kind of crap I expected. Meaningless trade calls in every thread. Unless you post a trade entry before you make it and give a stop loss and a profit target it is meaningless and just confirms my opinion you are shill or something worse.

The time stamp here is not accurate enough for anything. I am showing 56 minutes ago CL did not even trade at 44.51. But it has been a long time since I brought up a CL chart. So unless you just like to read your own post this is meaningless. You would have to post a picture of CL prior to the trade and it be posted here before the entry point so it can be verified along with a stop loss and profit target. Attached is CL where you claim to have traded it as best I can tell from the timestamp.

I think I saw where he entered RobB,. now the post says 2 hours and 15 minutes ago. I did check at 56 min ago earlier and 44.51 nicked the vwap. so if he got out at 44.40 all well and good for a scalp. But now it’s retraced back above 44.50 and trying to the opening high. Very low volume of course until a few choice minutes by the movers. Very hard to trade unless you’re a scalper with “Chuck Norris” skill. Not saying this legitimizes anything. It’s usually the shills who would post trades, charts, spreadsheets claiming to be “new” and all over the place with their story as their main goal is to fool the bystander readers into some monthly churn future room so I’m still leaning to the must-be-shill side like RobB.

All I know is CL is right now at 44.60 and calls like this are meaningless. He can claim victory no matter what. In fact his entry could be called after it drops down. I hope this is not what he plans to post.

Ok, I found that my browser doesn’t update this page’s “timestamps” all the time and erased the local cache before reloading this page. So now I’ve got caps of both the post and my platforms CL data at the same time. As you can see it’s within the range from 5 hours before the data end. I’m not legitimizing the shill in any way, just showing a 10 tick scalp was possible, or if the trade was on a higher time frame, then tough luck, in any case hardly a single example to be hyped about.

I don’t think the time stamps here are accurate enough to verify anything on a high volatile instrument like CL. Plus I am not aware Francis ever called an exit. Which is the problem, he can claim he exited anywhere. So if he shorts and explodes up he says well got out with a 2 tick loss when I saw it was not moving down. And if it drop like a rock and then rebounds, he can say he got out of the bottom. That is why these type of hindsight calls are meaningless. If he is expecting me to take his word on it he is sorely mistaken. In fact trying to post trades here is not very meaningful. I do not ever remember telling him to make trade calls here. I said he could show his TST combo results on a regular basis and show the only thing that matter verified brokerage statements.

I hear you RobB and completely agree a shill could say they could have exited anywhere or any time. I was just sure I saw where he could have entered when he posted when I saw his post pretty soon which seemed to be a reaction post to one of my previous posts, so I actually checked and saw where he entered about 30 minutes after he posted his calls and before you remarked about it. So my chart post was actually more for myself because I was so sure I saw where he entered (near the vwap at the time). I actually watched the market during that time in the two hours and stupidly made my own live trade (opposite direction. my own methods completely so nothing to do with his call except the time period after he made the call made me itch to trade) even though it wasn’t the best volume and time to even be trading. Yeah, the other trolls will blast me the slipped words, i.e. ‘get back to my positive trading’. I don’t care. Goodnight all.

covered 43.75 took 76 ticks (the sim) on 1 contract little over 10 ticks of “heat”for a cool $760. imagine 3 contracts! the trade was realtime not after the fact. in the combine i’d be well on my way. after paycheck this friday i’ll have enough to sign meanwhile i’ll continue to practice on the ninjasim.

So you held CL throughout the night. I have a feeling no matter what CL did you would be claiming victory. Look if you are able to do what you claim then you should be able to take that $1000 you say you have saved open an account and already made a Cool $760 and actually be able to show a verified brokerage statement showing proof of your claims. But instead you are posting silly hindsight trading calls. Do you seriously believe anyone is taking your word on it?

I will give you some credit though at least you are not micro scalping.

But post hindsight calls with no proof is silly, especially doing in this thread. If you want to post something as I said post your TST combine results and when you are trading live show the only thing that matters and that is real live trading results via verified brokerage statements.

I cannot wait to see what happens when you trade 3 CL cars live. I think you will be in for the shock of your life.

ok, rob i will have a little over $1000 saved come friday from my paycheck. i’m on a SIM i don’t have any proof except calls in realtime here.

i will post my TST combine results when i hit sim target of 9K…i joing next Monday. win or lose i’ll post it here for you..

The problem is making generic trade calls is easy, but trading a real life account with real stop losses and real target is something else. My guess is if you made the trade you claimed you probably when have been stopped out by the heat. But only a real account will tell the truth. So start that TST combo and post the TST results regularly.

You’re an asshat ..

Those combines are worthless pieces of garbage.

Do yourself a favor, take $500, open a futures account and trade 1 contract of NQ for a month and use the same rules as the dopey combine.

In the end you’ll end up spending less money , not have any crazy Exchange fees, and keep 100% of what you gain if you’re successful.

And dont give any excuses that you cant trade the NQ. If you can trade 1 contract of that sucessfully with that little amount of money, you are on your way to being a successful trader.

If you fail, you only lost $500 bucks, and live to trade another day.

Dont be a moron and pay $160 / month for a combine to trade SIM. Take it from someone who has been funded many times .. When your funded, they fund you with money you made from profits while qualifying . Its never their money at risk. The business model is brilliant , but the opportunity for people to succeed is impossible .

Everyone here is not bashing TopStep for the hell of it. Most are doing it because we been in the hamster wheel before and know it all bullshit …

But keep drinking the Gator Aide flavored cool-aide ..

i’m up all night working 3rd shift..was watching it on my fone

Indeed. In heat for close to 5 hours, and not in real profit until after close to 8 hours practically an entire session. The entry looks shaky on anything less than a 4 hour chart, unless the 10-20 tick scalp was taken in the first 30 minutes after the entry. Not to mention if the 5 hours holding in heat was over the session close, then there would likely be a margin call for most brokers on the CL contract of a 1k account size. Yep, exactly RobB, if the market continued to go higher he could have just said he took the early scalp trade soon after entry without real proof. I guess since “Kel” was caught changing his story about being new then 5 years “new” and other flubs all over the place, now it’s up to the other tag-team shill member (very possibly acted by the same shamster) to try to convince the bystander new readers that glossing over the difference between a short time frame and holding 5 hours in heat on a supposed 4 hour bar chart somehow makes sense in day trading strategy to pigeon hole fit in a TST 150k dream simdogbucks account ‘combine’.

Dang, the shill just made another ‘call’ at 44.56!? intentionally looking like the 44.51 entry post made yesterday. No wonder I couldn’t believe it said 44.56 and thought it was my imagination. So it was up to 16 ticks in heat, not 10 ticks after all. Dang these shills are so relentless and sneaky with their smokescreen! That’s what you get folks with all this blurry fudgy smoke where 16 ticks is somehow magically only 10 ticks in heat and 4 hour or daily price bars is somehow a day trading strategy to squeeze into a 10 day TST combover combin-ation pizzazz.

That’s the thing, even assuming he entered where he did, which I doubt he did, he took at least 16 tick heat. And he said he could go 3 cars. Sounds easy in sim when real money is on the line, but when you are down $480 dollars in real life not so easy to hold on. That is the difference in making nonsense trading calls like he is doing and trading a real account.

on nijasim now …i shorted CL @ 44.56 1 car

What nonsense.

Just as in the SalaryTradeRoom, we went long /ES at 2420. Wait till the end of the session and we shall tell you where we got out.

See? I told you that we are grandmasters at hindsight trading in the SalaryTradeRoom. You can take away your nonsense hindsight trading. Bullshit.

We told you how to report your funny trades, and yet you continue to do your nonsensical bullshit. Truth to tell, even those theoretical trades mean diddly.

There is only one way to prove that trades were taken. A brokerage statement. Yes, even the statement from scam TST, shown as the quasi-brokerage statement will be some kind of verification. Of course, you must post the pdf, not your forged text. We can tell if a pdf has been altered or forged.

If you will not post the entire trade BEFORE it is filled, please stop wasting our eyes with your stupid crap.

Exactly what nonsense. So a 10 day combine where it takes 5 to 8 hours to see how a trade turns out. And what was the trade based on, a 4 hour or daily bar chart? Plus the best time to trade was 7 hour ago when the volume was there with the big money making their moves on the market, not at near noon time on the lunch hour when volume has dried up. Or was there a bunch of loser flubbed sim trades before this latest call, which is typically not reported , predictable of shamshows, hmm?? Truth be told, a lot of these lucky streak combine passers are probably trading CL on a much smaller time frame than 4 hour bars or they can somehow magically always get the “Code” from the David Kuvelas , OilTradingAcademy sham, ie. precise pinpoints when the CL swings are making their big moves. Maybe David uses a time machine blindfolded and “shoots” his squirt gun marking his trade at the “Code I and II” ($800 churned per duped customer) points in time.

These type of post are silly. What is the point?? Even if you gave a SL and profit target they still could not be verified, but without even providing that information your post are completely meaningless and should not even be in this thread. Why not start a journal at BMT and post this kind of silliness.

another 35 ticks lower i’m out, if not stopped out higher

Francis, we are going to find you a nice page to post your trades. A proper venue to express yourself.

Emmett i am really sorry, i will stop placing sim trades.

i’m sorry i will still read your great site.

Oh no worries Francis. You just want to share your experience and enthusiasm. I want you to succeed.

What’s going to happen now “9k a week’ shill? Are you going to “scratch” like clothespin voiced topsimdog Burns? If it was a live account, are you going to hold it past the close to incur a margin call on a 1k account? Good riddance. Chalk up another same actored shill tag-team dispatched, R0bB

This is the difference in trading sim where you can do virtually anything and trading in the real world where there are real consequences including margin.

This is a perfect example why your trade calls are meaningless. Right now CL is 44.85, but you can in hindsight come back and say you covered at any price with zero proof. By the way Tom posted the exact same thing I have been saying about TST.

Well being you did not call an exit, I say you exited right here at 45.25 for a huge loss.

Rob, since you asked it’s just a sim trade however i exited for a 13 tick loss

I shorted here @ 45.20 1 car Sim trade

I hope to sign with TST next week, taking lot of sim trades now to try build confidence.

I think you should take Tom’s advice and just open your account and start trading.

I wish you luck with TST. And keep us up to date.

Rob, thanks for the advice truly believe you are trying to help here.

Going to take a shot at there money…4500 bucks for 375 plus data fee. i think i can game them…but we will see.

once i make 9K in there account i’ll withdraw 5K open my own account. the skies the limit after that..

i’ll throw them a bone fromthere..i’ll do both

” i think i can game them”

To me that is like someone saying they will game Madoff. TST is the master at gaming people. That is what they do. If you game them you might be the first ever. I cannot wait to hear how that goes.

If you really want to game someone tell all your family member how you are a great trader and get them to fund you.

Rob you should be a therapist. When someone tells you about their problems you can tell them to wake up. Get off the bed and lose the weight if that’s their problem. Unfortunately you are absolutely correct. TST is playing the perfect con game with their support from pre selected vendors. They are after those combine fees and risk absolutely not 1 dime of their money. Just like a young kid that is great in baseball and believes they are going pro one day. That dream definitely is a reality for a small percentage, but they can monitor their performance by making it through the various obstacles. High school, college, minor leagues, major leagues. There are realistic coaches guiding that player through the various obstacles. With TST, you will pay those combine fees without anyone telling you that it is time to stop. Just like a trading vendor telling you that you are almost there, buy another session.

Maybe we should start calling Rob, Dr. Fill? lol

I’ll risk about 500 to get my hands on 4500, no brainer as far a I am concerned.

That’s funny. I like the name, appropriate for this blog. What will you do if it takes longer than expected? I know you are confident, but nothing is guaranteed. That is why I keep saying make a plan for your time with TST. I know you think you are different, but there are many that have been on the wheel for years thinking next month will be the right time. You are obviously going for it which is fine just plan your time with them. Report back here win lose or draw so others interested can make an educated decision.

Trying to get money from TST is harder than getting blood from a turnip.

@Francis – you said “risk about 500 to get my hands on 4500 – no brainer” OK, let’s look at this as a trade. For that to be a “winning trade,” you have to have more than a 10% chance of winning. If you look at the results of combines of others, you will see that the odds of passing combine, passing FTP, getting funded and then making that much money – in other words, winning the “trade” – are exceedingly small. Probably less than 1% chance of success. THAT MEANS THIS IS A BAD TRADE, and the numbers say don’t do it.

Part of becoming a trader is knowing what trades to take. This one is screaming AVOID – will you listen? If you listen, congrats, you are on the road to becoming a real trader. If you ignore the numbers and take the combine anyhow, you are merely a gambler, and you will soon be a statistic – just another losing participant who did not understand expectancy.

Good Luck in your decision. I hope you make the right one.

If you want to give trading advice to a shill, drchump aka Pete, then stop using an unoriginal mockery of my id for starters. It only reeks of petedetith spite especially if the moniker was made by tradingfratboy months ago and now only shows up when you reply as Pete and is too ridiculously obvious trying to differentiate drchump as some non-shill. Give the advice as yourself. I’m not going to even bother responding to the “advice” itself. I don’t care even if it just rips off what others have posted already about TST at this point.

Do a little digging, and you will see I was here before you were. You should change your nick in deference to me.

Lol, what an insane lie gollumpeet. The b__ks disease must be overwhelming in its resurgence. “drchump” only came into existence because of the moniker ‘dtchurn’ back in tradingfratboy’s review. If you are referring to “Pete” before “dtchurn” you just outed yourself again as collumpeet, LOL. which while true only shows readers who care to look back that he was trolling a cessmess called out by others before I was even aware of it, lol.

I understand what all you guys are saying and it all makes sense. However, hear me out.

I have an aversion to risk because like what you guys say that’s true I’m underfunded. I know this, and I appreciate and have learned a lot here.

I’m scared to death trading my own account with real money. Trading on the sim is easier for me and thats not surprising lol. It frees me up to carry out trades that I would make if I was a millionaire trading a handful of contracts for fun without worry of the outcome, win or lose.

I try to stay in mindset this is real money because i want to go live with real money at some point in near future. For about $500 I have a MONTH of trades to make on TST sim combine taking trades like I do now. If I lose the 500, ok i’m not happy but i can live with it. If I pass that, the sub is shut off and now all time in world to pass their next sim the FTP which is really about same thing. Another sim with play money.

If i pass FTP I get $4500 which still feels like sim money to me because its not my $4500! I don’t think I could trade my own 4500 without freezing up. As a new trader I need a little help to get over my fear of trading and risking money. Once into a rhythm should this happen I can build an account up a little bit. Trading is what I want to do. At least try, doesn’t work out I will move on to something else. I think TST might be able to help me in this regard. However, I appreciate what you guys are saying here, and I appreciate Emmett for help he has brought to me.

I don’t want to belabor this any more, I’ll throw up a screenshot later should it be ok with Emmett. Thanks Emmett, Rob B and mike and all the rest. Good luck to all of us.

Hey Francis good luck going forward. I get what you are saying. Just try to have a plan for how you will proceed and be rational about what you are going to embark on. Learn to manage the risk that is available to you.

Francis,

I look forward to your TST experience. I just think it will not be the paradise you are expecting.

“Rob you should be a therapist”

Apparently not! I look at the TST rules and they just scream scam. Why in the hell would traders be charged continuous monthly fees to trade a sim account, except if it is as scam. If I cannot convince someone that is a scam then I clearly would not be a good therapist.

I agree MikeM, RobB when he is helping others to wake up from the kool-aid is the best there is on these comments. Thee has been a great many classic advice posts by RobB among those over a year ago outlining steps to figure out the shams. I can see a lot of the sham tricks from experience myself, but RobB can display it in a guided learning way that can make great headways for recovery for those still intoxicated by the shilled kool-aid. Too bad many of those helpful essays are lost in the cluttered pages of comments past.

That said, I can’t but help but be surprised RobB. You no longer think Francis is a shill for TST? just playing along? giving him a chance to prove he’s not a tst shill? Or because he’s been brought back down to Earth from his “9k a week” into a more realistic newb trading attitude. Ok maybe a possibility, but I’m still in doubt. He held on 5 hours in heat from the first trade. Now he supposedly got out for a small loss but not reporting it until asked and then just saying any old exit still smells shillish to me. Well I guess we’ll see. I’m betting he doesn’t come back except to shill after a long while if at all.

Yes I wish it would be easier to read posts for a particular guest. Rob does seem to have his facts right. I can’t remember when I disagreed with his comments. Unfortunately, until recently I still held fantasy numbers in my head a s a possibility. It’s hard to break from the hang over. Why do you think time and time again frauds are successfully committed.

Hey Mike said I need to be nicer. Even when I am 99% sure someone is a shill I will nice to some extent depending on what one post. I agree I am not sure TST will even allow Francis to trade the way his is trading.

Rob I never said be nicer. You keep saying that. I have been a proponent of the way you come with the cold hard truth of trading. I can not argue against your facts when the numbers are true. The only response close to being nicer I posted is that it is better when everyone posts their thoughts. Although they may not have the information correct at first, it is still better to have an honest discussion without personal attacks none of which you seem to participate in. If you don’t agree then by all means make it known. I would rather hear the truth than the trickled down bs world that these TR’s operate in. Some may not like to hear it, but I would venture a guess and say most need to hear the real numbers. This blog wouldn’t be the same if we just cheered people on without informing them of our honest opinion. That’s just what it is our opinion along with facts we can support with concrete evidence.

Good luck Francis. At the very least, you should create a plan for your time with TST. Just like a trade, plan out beforehand how much money you intend to risk with them and how much time you are willing to waste with them.

I hate to throw salt on the wound but that 45.20 trade is not going so well as CL is now 45.76 and I doubt in real life you could take that pain. So far your batting average for day trading is not looking to good.

It took me several years of donating to scammers before i finally found a good mentor. Regarding trade rooms i’m reminded of the old adage: “A fool & his money love to part ways” – and god knows i’ve parted with my money one-too many times.

A few might disagree with me but from my experience Day trading is possible…however, (major emphasis on the ‘however’) there are so many variables involved that at ‘best’ you can only make money some of the time. For example, i haven’t day traded in over 4 months since volatility has been at historic lows, plus volume for some of the instruments i trade has not met my minimum threshold, and the ATR barely gives room for any potential profit. So what do i do? i sit & wait.. When the conditions are met i can be profitable 60-65% of the time but since the only way i can be profitable is only when a lot of things come together at the same time it means very few trades are made throughout the year. I can’t afford to buy a bike let alone a Lamborghini. Real day-trading is seldom glamorous, it’s boring, boring, boring and when you have a good probabilistically justified trading model you should be VERY well capitalized to score mediocore wins a ‘few times’ based on the market.

Simon,

I guess because of the complete nonsense the TR teach what you describe I do not think of as day trading. So when I say Day Trading I think of what most TR teach:

1) You can trade a highly leverage highly volatile instrument such as CL,

2) You can do this with some small account like $5,000,

3) You will have an 80% win rate,

4) You will have virtually no drawdown,

5) You can come in everyday rain or shine no matter what the market condition and take numerous scalps in CL every single day,

6) You will have a straight up Equity Curve and

7) And you can quit your day job as you make money every day trading like a salary. Day after day, week after week, month after month, year after year.

In fact I will go a step further, I do not even think of Emmett’s new algo trading he is talking about as day trading and I tell you why. He is trying to come up with some way to judge market condition. He is using the VIX so when the market condition has a certain characteristic that is the only time he takes the trade. And another thing I like is when he does take the trade he does not then set an arbitrary 10 tick stop loss with a 5 tick profit target for every trade every day, but instead lets price movement be his guide in exiting the trade. BTW my comments are in no way an endorsement of algo trading, but it is more inline with how I personally trade (when I do technical trading).

Day trading the way these notorious sham shows teach just doesn’t work. How could a TR exist if they traded 3 times a week when volatility conditions are met? Analyzing the markets to wait for the correct conditions is very boring especially the last couple of months. We are in a raging bull market, but volatility until just the last couple of weeks has been non existent. Most intraday trend trades would’ve chopped you up to pieces. You could have played some very tight ranges, but I don’t know many traders that can do that profitably over time. Now we have broken out of the tight squeeze which created some nice intraday moves, but that lasts a day or 2 then right back to very tight ranges. I suppose a good TR would be a room that has the discipline to not trade everyday.

That is why a trader needs the correct funding to take advantage of the market when it does move. The Turtle Traders would be down 3/4 of the year then hit a trending market, make all the money back and then some. There are so many real life examples. Anyone that has traded knows how it feels to be in a good trend and on the right side. A trader then says wow this is easy. After which he grinds his gains to losses when the market stops trending. IMO less is absolutely more in trading. That is why arbitrary set ups with predefined stops and targets is a recipe for disaster. The market is always churning keeping a day trader off balance.

“The Turtle Traders would be down 3/4 of the year then hit a trending market, make all the money back and then some. ”

That is how real trading actually works. But as I have stated 1000 times folks rather lose money trading the fantasy world than have a chance of making money trading the real world.

Yes of course I did not mean to imply simple crossovers with RSI or others of the like could be traded blindly in any market conditions. I thought readers of my post could easily ascertain that point through my slight sarcasm about the relative uselessness of these indicators taken in such a simple context such as Con-ners simple RSI(2) newsletter. As Emmett has mentioned before, it used to be a big deal with the old software platforms starting to display and calculate the simplest of indicators where many legacy shams tried to sell their own brand of those indicators as a main attraction of their traducation products. What can I say, in my first year, I was kool-aided with that nonsense as a fresh newb where I was brand new to the term “stochastics”. Burns and the others with their magical fixed indicators at “special” “unique” settings of course knowing their trading school method was a sham all the way and had stopped attempted to trade live ever since they could procure a monthly churn of income would try to add “qualifier” indicators such as the “5 forces” an extra time frame, but I had yet to see any sham trading educator ever come up with a consistent method to gauge “context” either despite all the different types of market “days’ Dalton and Stedlymeyer had come with market and volume profile. I’d agree volatility and context come into play, but the proof of a working method to gauge all these elements including price action is still lacking imo.

RobB , this is also part of why I don’t put much stock into sold algos even the retail education ones touted that have had too long a shilled history , kool-aid sychophants, and self-promotion on the beachforum. Even if they had a good algo method that works a few months they wouldn’t even sell it to their clients and instead sell a shammy inferioir one. pathetic and monthly churn greedy.

dtchurn, I was just elaborating on your post about the legacy vendors and why TR’s don’t work. You made the comment and we ran with it.

MikeM, allright then, fair enough.