Dekmar Trades

-

Honesty

(4)

-

Quality

(4)

-

Cost

(5)

-

Support

(4)

-

Verified Trades

(4)

-

User Experience

(3)

Summary

Not easy finding a penny stock, day trading service that actually makes money. Sean Dekmar of Dekmar Trades is a pretty good day trader. A little light on trading performance, but he is also a young guy with a lot of upside potential.

If your dream is to sling penny stocks for daily profits, then Dekmar Trades might be a good place to start learning and earning.

Performance verified with actual brokerage statements.

Thanks for reading today’s review of Dekmar Trades

Dekmar Trades a live day trading room and a stock trading educational business. The owner of the company is Sean Dekmar. The cost of the service is a flat $60 per month. At the time of this review, there are no “upsell” courses, mentorships, DVD’s, or super-secret indicators that members must also subscribe too. It is just a cheap little trading room at $60 per month.

Before I go any further, let me first state that TradingSchools.Org signed up as an affiliate marketer for Dekmar Trades. So if you subscribe to the monthly chat room then TradingSchools.Org receives the princely sum of $12 per subscriber. Nothing to get excited about. But I wanted the audience to be aware of this potential conflict of interest.

The next thing I want to discuss is my initial impression of Dekmar Trades–from Day 1, I went into this review 100% sure that Dekmar Trades was a scam. In fact, I was not even going to write about the company. The website has nearly zero web traffic, and hardly anyone contacted TradingSchools.Org to write a review. In the past year, only three people asked about Dekmar Trades. I am pretty sure that the “three people” that asked for the review were actually Sean Dekmar himself.

Why write a review?

Sean Dekmar pestered the hell out of me to write a review. Normally, trading vendors will squirm and avoid a TradingSchools.Org review at all costs. The TradingSchools.Org website is 99.9% negative reviews. And so I usually have to create multiple personas in order to initiate a conversation about a potential review. Vendors are fearful that something negative will be written.

What is interesting about Sean Dekmar of Dekmar Trades is that he just kept after me and demanded that I attend the live trading room. Eventually, using an alias, I attended the live day trading room for several days.

Inside the Live Trading Room

Penny stocks are delicious.

One of the first things that I noticed about the chat room is that the community is pretty vibrant. For a relatively unknown stock trading chat room, I was surprised to see dozens of people communicating, with plenty of interesting banter going back and forth.

The next thing I noticed and caused me immediate concern is that Sean Dekmar loves stocks priced $1 – $10 per share. The dreaded penny stocks. Normally, when I see anything even remotely affiliated with penny stocks…I think of Tim Sykes. Visions of “trader porn” fill my head. At any moment I thought that I was going to hear Sean Dekmar start rambling about his newest Lamborghini or 5-star vacation to a tropical paradise. To my surprise, Sean Dekmar doesn’t do “trader porn.”

Instead, what I witnessed was a single guy that is totally obsessed with day trading the market. And I mean really obsessed. For the time that I spent inside of the trading room, it was not uncommon to see Sean commenting for 8 consecutive hours. There is no way in hell that I would be able to sit in front of a screen, hour after hour, day after day.

I guess the point that I am trying to make is that Sean Dekmar is very focused on that trading screen. He obviously has no other job, unless he is doing something extra in the evening.

Trading Results

Penny stocks day trading is definitely not my thing. In fact, I am highly suspicious of just about all day trading services. What really intrigued me was whether this guy could sling penny stocks and actually make any money (using a retail brokerage account). So the next step was to track his alerts and keep a record of what he was recommending.

After keeping a decent ‘scorecard’ of his intraday trading alerts, I next contacted Sean and revealed that TradingSchools.Org was actually trolling him with an anonymous persona. It was time for the litmus test, I wanted to see brokerage statements. I wanted to verify that this dude was actually trading. To my surprise, he actually complied and sent me a virtual swimming pool of brokerage statements. One thing I can say for sure, he does trade…a lot. And his trade size is very, very small.

Impressed as I was about having something that was actually verifiable, I could not help but cringe at how much time and effort was being expended for so many ‘rinky-dink’ trades. And my next big concern was that many of his trades were not actually called within the live trading room.

Tracking Live Results

Instead of publishing a swamp of brokerage statements, containing trades that were not actually called within the live trading room, I asked Sean Dekmar to clean things up. What I really wanted to see was an actual brokerage statement that contained each and every trade that was actually called in front of the live trading room.

We next agreed that for an entire month, he would only execute exactly the trades being called inside of the live trading room. And for the entire month, I wanted to see the end of day live brokerage statement that verified, each and every trade. And I wanted the daily account statements sent via email. The pressure was really on. But he really wanted a good review, so I laid out the framework and he agreed to everything. What I was hoping was to create a scenario where a “newbie” could see, in black and white, in granular detail what this guy was actually doing.

Truth be told, I thought he would fail miserably. To my surprise, he did the following…

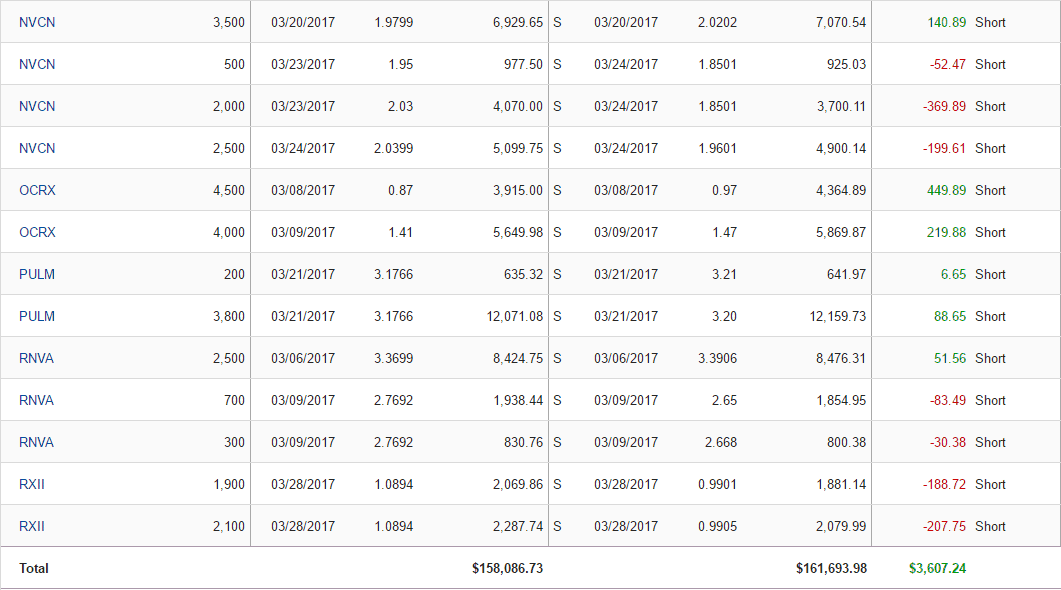

TradingSchools.Org started tracking daily account statements on March 6, 2017. The following are all recorded trades from March 6 – March 29.

So, for the 20 days that we live tracked the trades, Sean Dekmar earned a total of $3,607 in trading income. These were the actual trades that were live tracked from just the live trading room. There were a couple of trades that TradingSchools.Org missed during our live tracking which actually increased the monthly total to $4,062, but was not included because they were out of the tracking time range. We kept the final tally at $3.6k.

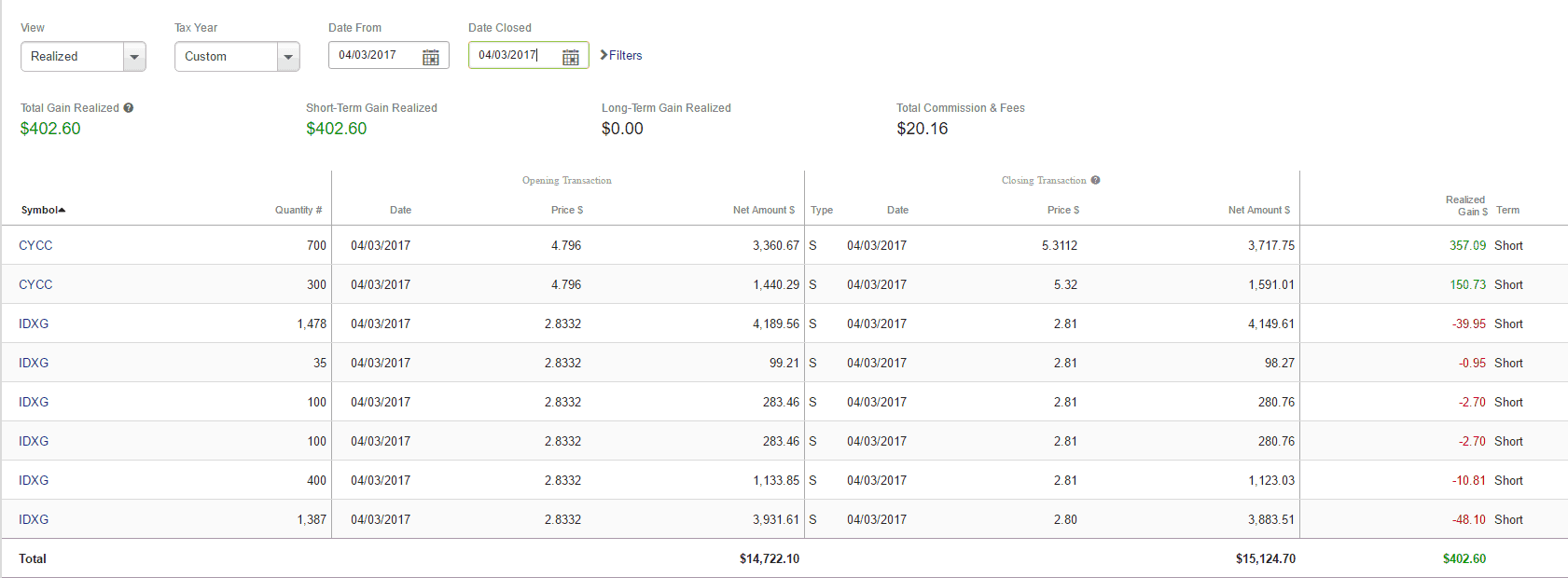

For the month of April 2017, we are only at 2 trading days. I decided to include both days, which gives us a month of live tracking. +$402 and +$78 for April 2017.

What Sean Dekmar Learned

In speaking with Sean Dekmar about this last month of live tracking, he learned a few things. The first is that it was incredibly stressful having me watching his every move for an entire month. It is one thing to ‘sling’ trading advice like a rowdy drunk, but it’s an entirely different animal when someone is eyeballing and recording his every move. I can imagine it was not fun. But I also believe it was a good experience because it really sharpened his focus and forced him into only taking the most choice trading setups.

It would have been a real disaster if he would have crashed and burned. But it would have made a great story to write about (people love crash and burn stories). In fact, I was 99.99% sure that the review was going to be a dire warning for anyone day trading penny stocks. This did not turn out the way I had imagined.

Penny stock day-trading is not for everyone

Personally, the amount of effort and stress involved with day trading penny stocks does not fit my personality. Too stressful. And for the majority of people, this type of trading is going to end badly. But for a few, that are willing to sit in front of a trading screen for 8-hours at a stretch…it might a good job. I think that the best thing that Sean Dekmar has going for him is his extreme competitiveness and his youth. Old guys like myself just don’t have the mental horsepower to remain engaged for such long stretches of time.

Also, I am really curious if Sean can keep this thing going for the long term. I can only imagine the stress and efforts that this young guy is putting into trading and running a live trading room. It is one thing to trade, it’s a whole different animal when you have to trade all day, and then sit for hours and teach people how to trade. Time will tell. Hopefully, I can report back in a few months with more solid performance.

And if he crashes and burns, that will also make a fine story.

Thanks for reading. Don’t forget to comment. And if you sign up, remind him that you are a TradingSchools.Org reader…and we continue to watch.

Sean Dekmar (Dekmar Trades, TradeCaster) He is a Cheater, DO not try the small account challenge that dekmar trades provides. He is a total fraud and accumulates small amounts of money from newbie investors mentioning this is part of a new program and learning and eventually he will cheat at the end by not providing anything in return. Please do not take the small account challenge and don’t become a fool like me. #SeanDekmar #TradeCaster #DekmarTrades #Fraud #Cheater #Investement #DekmarCheates?

Did you trade with him , or you are just another scammer. Give me proof, not talk.

Do yoou think That the Dekmar Trades are still a good place to be?

Costs have gone up a lot and what would be the total cost to make his trades work?

There looks to be other services yoou need to reakky work his system.

Thanks in advance for your work

You will just be wasting your time and money with this shady guy. Be warned that this guy only makes his money through his subscribers. I used to be a subscriber and followed him and his alerts. He’s a con artist. I lost tons of money.

GuruLeaks

@Guruleaks1

UnlicensedFinancialAdviser Sean Dekmar

@Dekmartrades

has Vehemently Denied paper trading while claiming Large Profits (and subsequently deleting his tweets) so we asked

@thinkorswim

for their opinion on the matter: The account Sean showed people his trades on was a “paper trading” account. Not a real live account.

hhhhmmmm, Where do i start? This guy is a chatterbox, talks waaay too much and at least if he would say something different but repeats the same idea over and over again to a point where it gets annoying after a while. Sean is limited to one thing only, which is buying breakout for 5-10 cents and that’s about it. His risk/reward ratio is probably 1/1. Very limited technical knowledge and set to one thing only. He has a shorting chatroom, but he has no idea how to short. Pure clueless when shorting stocks. He does not stay in the trade more than 10 -20 seconds, when buying a breakout. That is what scalpers do, but I would not call him a true scalper. In general, if you attempt to copy a scalper, most of the time, traders lose their dollars, because they would buy/sell after their “mentor” .He lets the chatroom know that he is in the trade few seconds after he submitted a market order. If you have 1000 folks following, this will push your shares up few cents 10 seconds later, so profiting makes it easier for him. Sometimes, he draws support and resistance lines incorrectly. As a member , you do not expand your knowledge about new strategies or indicators besides, u shape pattern, ascending triangle and that’s about it. Bottom line, he is a sub-par trader. He may be decent for beginner traders but do not waste your time in him chatroom for a long time if you want to expand your trading knowledge and be a better trader in the long run.

By the way, he calls bollinger bands, boiling bands..:LOL. This guy needs to open up a book.

These comments are pathetic! I am a new member to Sean Dekmar’s room. I was losing badly until I came across his Youtube videos and became a member. He offers the first 15 days free and within 2 days following his trade I made $1,000 (half of the money I had already lost the week before), by the following week, I was up another $800 before it even came time for my subscription to be due. I am forever thankful that I came across Dekmar because the guy is an absolute genius! He is very nice, customer service oriented, and gives everyone a chance to speak to him personally about any concerns non like these major “gurus”. Plus he is very cautious and teaches us to be cautious when it comes to trading. I use to be a student of Tim Sykes and I learned crap from him, all I did was lose money and a big chunk of my life watching his stupid DVDs. Compared to Tim, I honestly feel Dekmar does and offers a little too much to his subscribers and I don’t know how he does it, but he will reap the rewards due to him for such great service. I also want to mention, his video library is all you’ll ever need to master the world of penny stocks. It has TONS of information which I am surprised he doesn’t put on DVD’s and sell. His video library is a freaking GOLD MINE compared to Tim Sykes’, Grettani, Warrior trader, and all those dudes who sell their crap. and I’m on my third week now and I can go on and on about Derkmar. The only reason I came across this article is because I wanted to research more on Dekmar to get more of sense of his personal life and I came across this fairly decent article about him. I am happy to see that the review wasn’t terrible, but these negative comments sure are!

who cares he paper trades lol, he’s already been busted, just google it for evidence

Another scam PUMP and DUMP trade room like Warrior–avoid this guy at all costs.

This chatroom is absolutely a disgrace, sean dekmar is a pumper and he does not know how to read charts. All he does is trade low float breakouts. That is all he knows how to do, I spent 2 months in this chatroom and every alert he has made was a quick pump and dump ( if you are not in before he makes the call you are screwed), lost right under 3500 in his chatroom gained most back on my own strategies . The only thing great is his price and the fact he streams live news and has scanners. This guy will only help you be profitable if you are a momentum quick pump and dump type trader. He does not practice anything else but low float pumps. Great video library great knowledge but I will never commit to this chatroom again because you are bound to eventually lose following his strategy.

He grew a $4,000 account to 20k in november ( low float pump month) and he bets big on low float pumps and flashes his profits to get people in and after november his chatroom is pretty much a fail if you plan to follow his strategy and trade style.

@Terry You are absolutely correct. I’m surprised Emmett gave such a good review for this room. He makes very few trades, reminded me of Hoffman, nice guy that talks all the time, but in the end does not deliver. My main concern is that there was no risk management, he would go all in with his ‘small account’. He also used the excuse of a small account to limit his trades to few a week. I saw all kinds of cowboy trader behaviors: chasing a trade, huge size for the account, not closing a trade at proper time, etc. In addition, few pump and dumps (not sure if he did this on purpose, but he definitely left the trade and then announced). Dekmar is a nice guy, but a truly beginner trader. The only good thing is that he tries to be transparent by showing his statements. The sad thing is that he doesn’t know what he doesn’t know. He has no place running a room, and will destroy many of his members accounts unfortunately (mostly college students that think they will be buying a Ferrari next year).

I was tasked with getting into Dekmar Trades and do an honest review. This is what I found:

Dekmar trades is honestly a disaster. Sean does not know how to read a chart correctly. He does not know how shorts effect price movement(squeezes), he constantly had major lines of support and resistance wrong, he doesn’t understand the concept of a chart being extended, and he does not utilize different time frames AT ALL. He also trades with NO risk. Most traders buy off of a support level to minimize risk, but Sean does not understand this concept. When he trades, he just sets a 10-15 cent risk, regardless of the lines of support or resistance. I am absolutely AMAZED that this trader makes upwards of 70,000 dollars a month, and has over 1,000 ‘followers’, when he does not know how to correctly read a chart. Sean has one style.. he buys low float breakouts. (with no set risk) Point blank. He does not know how to trade anything else. Sean also trades behind the scenes QUITE FREQUENTLY, meaning he will make trades without alerting it to the room. This is due to lack of confidence in my honest opinion. Now, he has been successful with this low float breakout strategy, and continues to be, but if you are looking for a knowledgeable trader that will mentor you with solid trading strategies, THIS IS NOT YOUR GUY. Sean has done an outstanding job at ‘building his brand’ and he attracts novice traders by posting sizeable wins (never losses), I highly suggest trying the 2 week trial before committing to this chatroom.

Thank you for your review – from a few years ago on Dekmar. Just browsing. I notice you really seem to have a strong tech analysis of the method vs the tradingschools review.

Is there a particular tool you recommend for beginner traders to learn the aspects of what you are saying a bit at a time with a methodology. I know it probably comes from experience and know how – but since people are looking for mentoring – even those new to trading as myself, what do you suggest that would not be as over my head as your tutelage vs. the insulting your intelligence simplicity of Dekmar?

You would think someone running a trading chat room would be able to make more than that a month.

Decided to take a Trial with Dekmar Trades. Well all the hype and “Alert Box” trades and non sense and not do-able. Today he posted a trade on MDRX,,,, said watching for a Break out of $2.10,,,,, it finally broke out and he posted his alert entry AFTER the Breakout at $2.05. Then as it fell down he said i’m going to pull the trade. He posted on the ALERT a winner with entry at $2.05 and exit at $2.12. Then a little later he posted a short on the same stock and then another entry short again at $2.23 (AFTER it hit $2.23 – the high of the day)! By the time it was posted the price had already dropped down to $2.15. Of course he posted it at entry short of $2.23. Then he rambles on non stop about how honest and transparent he is etc,,,, Stay Away!

He’s pushing Trade Ideas, Scanners and stuff he’s trying to sell at a discount. Not to mention he keeps saying to watch his videos, which you only get a very limited access too unless you’re a paying member. Then he keeps mentioning to look at HIS equity feed, which looks like it costs $150 or more per month.

Oh one last thing, of all of the “Alert Box” trades he may take 1 or 2. Need I say more!

Joined this chat room in April 2017. Initially, I thought this guy knows what he is talking about, but after spending 2 months in his chat room, I realized that he is forcing trades. when the market is slow, He puts alerts in the alert box with 5 cents profit target. I mean why would you bet your money for 5 cents of gain where loss can be more than 20 cents within less than seconds. Definitely not recommended for new traders. Sean trades news and it is very hard to catch the fired stocks for new traders.

Same exact experience here and I have been mystified by all thisl. Today he sent out an Email about his $1800 trade yet announced in chat he had done no trading that day, I realized finally what he was up to. Tiny profits to build up his success percentage -and he NEVER trades in the afternoon. It seems like a bunch of 20 year olds following the quarterback no matter what.

He usually makes 3 small trades in AM and that is it. But you get to sit through it all plus odd ball training strategies that he never uses.

There is more when you add it all up…a waste

Unfortunately, this is starting to smell skamy. Another new trick of pushing up a w/l % and 5 cent target sounds alarmingly like Warrior’s m.o. Have seen the smokescreen of a tradecuator smorgasboarding a bunch of oddball trading ideas to keep the dupe “busy” before.

Sadly Emmett giving this guy 4 stars make him look like he is on the VIG. No follow up, no one taking his trades showing any proof of his wild profitable claims. It is sad.

I am certainly on the VIG. No denying that. But it sure ain’t much!

Will try and get an update on Dekmar.

Someone Skyped me something from Sean’s Room, as he know it would rile me up. A member apparently asked how long does it take to turn $2500 into $25,000. In other words how long to make a 900% return. As long as folks believe this, the scammers will continue to win and continue to scam. They will never be stopped.

So I will not only answer that question but I will answer the real question he should have asked.

Q1) How long will it take you to turn $2,500 into $25,000 by Day Trading Penny Stocks for a few cents scalp at a time – Can’t be answered as the odds of you winning the Powerball are greater than that happening.

Now for the Real Question:

Q2) How long will it take me to blow my $2500 account by Day Trading Penny Stocks for a few cents scalp at a time – You will quickly find out, but I would guess pretty darn quickly.

I know Evil Rob B the non believer!! So forget my post and just keep believing and let us all know how it turns out.

It is probably more realistic to wait for a trade set up that comes along when the market is ripe for a significant move. Churning your account runs the risk of a death by a thousand paper cuts.

It would take me just over 5 months to turn $2,500 into $25,000; here’s my method. I do it by scrimping and saving every cent I can from my salary. Education, sacrifice, a budget, hard work and years of doing it- still the surest way to make good money. I guess no one wants to hear that either.

@Stray@Rob B… I know that inevitably new traders will learn the hard way. When you speak the truth, there will be traders that may not believe the cold hard facts, at first. In the long term it is beneficial for some lacking experience to read about trading results in line with reality. I truly wish I had the opportunity to read these reviews and comments when I ventured into trading for myself.

I have been critical of Emmett on occasions, but prior to this blog there was no place for the truth to come forth. All scam review sites like Scam-0-pedia, Lying Dean Handly, BM and his nonsense, Ninja Trader and their cesspool of con artist and so forth and so forth. Prior to Emmett, no one and I mean absolutely no one asked these con artist to show even a lick of evidence they could trade profitably.

Thank Goodness there is a new Sheriff in Town. Sheriff Emmett

Chad,

If your such a great trader then why are you afraid to post your brokerage statements?

BINGO!!

People ask me how do I know Chad is a shill. It is because only shills post the nonsense he post. A legit person would state in a rational manner the pros and cons and then say something like, I cannot speak for others, but Sean’s trading has worked for me and I turned profitable X months ago to show prove I will provide Emmett with my last X months of brokerage statements and keep you updated to my future results.

That would have been so much easier than post after post of nonsense.

Love to see that you did a review on Dekmar Trades. I feel it is a great service and love being a part of the team.

I will try and post once again as my post are not showing up. Maybe this time it will.

I read Emmett’s latest review on Trading Advantage with Larry Levine and cannot help but think how could anyone believe that person is for real, yet then I try out this complete Smoke and Mirrors Trading Room that Emmett gives a 5 star review and wonder WTF!

After being in this Trading Room for a while now, yesterday was my breaking point as I almost threw my monitor out the window listening to the complete lies of Sean.

I am going to show proof the whole thing is a complete scam, show how the scam is done and make 3 challenges.

Sean is running the same scam; to buy big gap up and run low float stock; that Tim Sykes, Warrior Trading, Live Traders and the rest of the low float stock buying con artist run. Not to mention he is doing webinars with Trade Ideas which is also associated with many of these con artist. The whole thing is so unbelievable. In fact, some of his stock picks the bid ask spread is greater than the small profit target he is even shooting for.

The reason I am writing this is because when the members lose money and think they must be doing something wrong and they only need to pay for private lessons or education, I want to let you know you are not doing anything wrong. No one by Sean and Emmett are making money. Sean is making money selling memberships and education and Emmett via the membership kickbacks.

Right out of the gate I am going to make my first challenge. Sean states his Official Alerts shown in his Alert Box has an 80% win rate (80% win rate only in his mind, as I will shortly show it is more like an 80% lose rate), so challenge number 1 is to Emmett. Get out of your boat with the bikini model fanning you and open a brokerage account and actually live trade Sean’s Trade Calls. You know the ones with the 80% win rate shown in the Alert Box. I mean 80% win rate, you will be making money hands over fist. Then after 3 months show us the actual P/L of those brokerage statements. I would think everyone would agree if the only person making money is Sean something has to be wrong.

It is going to take quite a bit to explain this scam. First this guy is no dummy. The scam is brilliant and elaborate. There is a reason he and the other scammer pick low float stocks. It is because they are very volatile and explode up or down and it is so easy to show a chart in hindsight and say, “See how easy it was to make money”. But then you develop a trading plan and make the trades live and reality hits. It is like Mike Tyson says; everyone has a plan until you are hit in the face. And when you trade these non-sense calls live you are going to be hit in the face, as this stuff only works in a complete fantasy world. It is one big brilliant magician’s illusion act of profitable trading.

I previously posted the reality of his trade with CYCC and how that was a complete joke as people got a 75 cent slips when executing the order which was greater than his small profit target. Please re-read that post as it was important, especially after Rajnish stated Sean made $1900 in 20 seconds. That $1900 was on that CYCC trade that I showed proof anyone taking the trade in a live account would have lost money. That is the difference in fantasy and real world.

In this post, I am going through one of his trades from today, that made me want to throw my monitor out the window when he just lied through his teeth. But this trade is characteristic of all his trades and the whole fantasy illusion being presented.

Let’s start with those trade alerts, with the 80% win rate, from the Alert Box. The 1st attachment shows Sean’s alerts from this morning. I am going to show the SAEX Trade Alert. As you can see from the Alert Box here was the trade:

Buy SAEX at $6.25; Stop Loss set to $6.10; and Profit Target set to $6.50.

So we are going for a 25 cent profit target on a stock with an 8 cent bid ask spread. Fine, let’s see what happened in Reality. Then I will show what happened in Sean’s Fantasy World.

The next attachment shows the 1 minute chart of SAEX and yes Sean is using the 1 minute chart during trading.

See the Big Green up bar with the blue circle. The Blue Circle shows where the $6.25 entry would have been executed. Now in reality with an 8 cent bid ask spread your entry would more than likely be at the top of that bar, but let’s ignore that for right now and say you got a $6.25 entry. Right after you got the entry, SAEX’s price dropped on the next bar, red bar, and you would be stopped out immediately (as shown by the red circle). 2 bars later it finally just touches the Profit Target. If you were not stopped out by some miracle the odds of you getting a fill on a touch is virtually zero. And to add more pain, I must point out that your loss in realty would be much greater than 1R due to the large bid ask spread. But that is reality. Now for Sean’s fantasy world.

Sean then claims to make money on that trade. That’s right he made money. It is important to note Sean never shows a chart trader or DOM during his trades, even though that would be easy to do and the reason he does not show a Chart Trader is because he then could not do the scam as I will explain in a little bit. You see Sean is not going to enter or exit as shown in his Alert Box. But before I explain how Sean mysteriously made money on a trade that clearly was stopped out, I have to tell you what got me to almost throw my monitor out the window. In Sean’s recap later in the day, he says even though he entered here and exited here that if you followed the alert box you still made money as the price hit $6.50. THE DAMN THING WAS STOPPED OUT BEFORE IT EVEN TOUCHED $6.50 (Touched Only). No one but Sean made money and that win was in his fantasy mind. So that alert is a winner in his fantasy and thus his 80% win rate, when in reality that trades was a complete loser. And this exact same scenario plays out again and again with every one of his trades.

So how does Sean claim to have made money on a clear losing trade? This is where using low float volatile stocks and trading the break out allows the illusion to happen. First Sean does not even trade his alert. Second during the trade, Sean is constantly talking and saying you could buy here or here and you could sell here or here. So whatever entry and exit he makes he can say, “See I told you to buy here and sell here”. As I stated these scammers are brilliant and Sean is no exception. He listens to Emmett and knows people want to see something that looks like a brokerage statement and not just some Excel looking sheet. But he cannot show a real brokerage statement as his trades just lost money over time. So now enters the “Snipping” tool. I have seen others scammer use this same tool. Snipping is the con man’s greatest tool. It looks like something from a brokerage account, yet it shows simulated trades. How do I know this? I know that as I have seen it used by another one of these con artists. It is hard to tell on winning trades but on his losing trades he would lose exact $1000 the amount he risked. With bid ask spreads that can only happen in a simulated trade not live trading. That is how I know the Snipping tool will show simulated trades and make them look like live trades.

The next attachment is what Sean showed from his “Snipping” tool. First you will notice he miraculous made money on the SAEX trade and next you will notice he did make the trade he alerted his members to take. And here is where the scam is so brilliant. Members say, “OK Sean did not trade his alert as he is a trading GOD (after all Emmett gave him 5 stars) and he knows when to enter and exit and if I just sign up for his training I to will learn”. YOU WILL LEARN NOTHING, AS THERE IS NOTHING TO LEARN. So how does he do it?

I saw this same scam in another trading room before there was a “Snipping” tool. That con artist used Ninja Trader and took lots of simulated trades and then selected which ones he wanted to show. In my opinion Sean took many simulated trades in SAEX and then picked the won that made money to show in the “Snipping” Tool.

Ah, I know I am a conspiracy theorist; after all he has Emmett’s gold star approval. So my 2nd challenge is to Sean. Show you Chart Trader live, it should be easy to do, so all the members can see your actual entries and exits being they are not the ones you are telling the members to take in the Alert Box. Somehow I have a feeling that will not happen.

And now for my final challenge. Sean says thanks to Emmett’s 5 star review, he now has over 500 members. That is over 500 people making a fortune trading low float stocks who’s bid and ask spread is sometimes greater than the profit target. Truly Amazing!!! But now for the challenge. I challenge these member to show 3 months of live brokerage statement to Emmett of all the money they are making trading these low float stocks. Emmett your email should be full in no time and your phone ringing off the hook after all Sean claims to have an 80% win rate. Yet I am 100% confident no one will be showing you any real proof of consistent profitable trading this nonsense method. Prove me wrong!!

Unlike “One of his Subscribers” I am showing the actual Real World results of Sean’s Nonsense Trading Calls.

BTW, “One of his Subscribers” that challenge goes out to you also. Put up or shut up!!

Jack,

That chart indicates a stop out if those parameters were followed according to plan. You made some concise points. Although I don’t know about the specifics, I believe you raise some valid points to investigate. Do you trade his alerts live or are you trading in sim? Also, This trade would’ve been stopped, but that could just mean the levels were too tight for this particular trade. Anyway, you do raise valid questions. I would like to hear the answer. I trade futures exclusively, but I wanted to diversify what I trade. As a result, I was going to look into this site. I would love to hear other perspectives.

Most folks trading futures are doing it using 500 to 1 leverage and micro scalping and losing their shirts. IMHO most people are way underfunded to be trading futures.

But if you are trading futures profitable you should be teaching a class not taking one.

I was curious to diversify into other aspects of trading. I am not here claiming to be a world class trader. I have been trading futures for years and I trade when there is a clear definable edge which allows for a great deal of down time. That is why I am curious about other aspects of trading. I am curious because finance is my background and my passion. This is why I love to read about all aspects of trading.

I think I remember many people posting about interest in other rooms and what they have to offer. I have no intention of teaching a class and my funding is just fine. I’m here like you with an interest in seeing the shills get taken down a peg where the regulators fall short. Don’t know why you even have to make a comment about teaching futures. Just because I mentioned that’s what I trade. I never endorsed it.

I enjoy your comments when directed at the shills looking to take advantage of people. However, I feel you should save those comments to people that deserve them.

I will give some advice, take it for the amount paid, instead of diversifying into other ways of trading, I would recommend diversifying into other ways of investing. And preferable into something you know about. As I have stated I am a full time investor which also includes Real Estate. Real Estate once again is in boom mode. But it does not have to be Real Estate, you could be a venture capitalist in a business or start your own business. Heck if you know rare coins you will make more money doing that than trying to day trade.

I have said this many times before, but hedge funds, mutual funds, CTAs and so on performance is open to the public and none of them can make the returns these TR operators claim. In fact the best make hundreds of millions of dollars and most cannot even beat the S&P.

In fact even the day trading tournament winners cannot make the returns these con artist claim. And those returns are not anything real as they risk 30% or more in order to try and win a competition. 99.99% blow there account all hoping to win that competition. No one can take that risk on a real account with their savings.

The facts are if you look at the richest men in the world none were day traders. That should tell you something. They were all investors and that is were wealth is made.

I hear you Rob. Trading represents a small portion of my income. Thankfully, I invested in real estate at a young age. I don’t flip houses, but from my family background in real estate and the mindset to have a diversified investment portfolio, I am exposed to real estate income.

You also make another good point. I may look to trade a longer time frame and diversify my investments in that manner. I worked on an equity trading floor for most of my life so the daily interaction with capital markets is something I immerse myself in. This is in no way a testament to my risk taking abilities. In fact, working on a trading floor and taking risks for customers is much different than taking risks with your own capital. The losses just didn’t hurt as much.

Mike,

If there was PM here, I would give you my Skype ID to talk, but no way giving it out in a public forum like this one.

Rob,

Is there a way for PM’s here? Hopefully we kept it on topic. I’m going to be away for weekend, but will check back in with the site. We can figure it out.

I also agree with you about the difficulty in micro scalping futures with an underfunded account. I wouldn’t risk more than 1 percent per trade and even then that is probably too much. IMHO everyone should continue to explore other aspects of making money. Obviously, most attempts will be futile, but creativity should be rewarded with proper investigation. I believe it was you that said trading penny stocks may be a better way to manage risk when trading. I am not looking for 500 percent months. I am much more realistic than that.

Actually it was not meant to be a harsh comment. I have meet successful traders who then go and take some TR con artist course and I am like you should be teaching the class not taking it. It was meant in that vane.

Actually, I have read your posts and you write logical arguments. I have a suggestion. I have been in other similar Trading Rooms to this and my experience was not good. We need someone that is objective to be the investigator report here, so here is my suggestion if you are willing to take one for the team.

Join for his free trial only. Take his trades using very small risk maybe 100 or even just 50 shares and then each day show the his trade calls and what your results were trading it live. I would not trust the results the TR operator claims or any paper trading results, but I think it would be very enlightening if you posted your daily results. Anyway some food for thought.

The nice thing is it being stocks and not futures you can take a very small risk. And if you are not profitable while the TR operator is I think that will tell everyone everything they need to know.

I think that I have very little respect for TR operators which made me jump to judgement when you said I should teach a room if profitable. I truly believe that it might be a smart way to control your risk while trying trade another product. However, I always believed that trading penny stocks was for true con artists, but I really want to keep an open mind. This is where my curiosity comes into play. Unfortunately I am not ready to invest time and money because I have always had such a negative view of penny stocks. Emmett’s review made me stop to do a further evaluation. Do you think the previous negative posts have made valid points? I thought I had enough knowledge to spot fraudulent activity, but I just don’t know sometimes. My experience with penny stocks is next to nothing.

Lets see he has all these subscribers buying penny stocks at the same time for basically a microscalp trade and unlike futures they do not normally have a 1 cent bid and ask spread. And he was able to produce all of a single month’s brokerage statements. What did he just start to trade 1 month ago?

IMHO opinion there is not a single, yes not one, day trading micro scalping Trading Room Operator that trades profitable over any reasonable time period and I have seen so many do anything to fake their results. For reference look up the review on Jaquar Club on BM where at the end his subscribers talked about his scam.

Too bad you are going to pass on taking the plunge, as unlike these nonsense shills that post with no proof, It would be nice to see the results you get.

And to your comment, “I thought I had enough knowledge to spot fraudulent activity”. The best con artist are hard to prove they are con artist. That is how they make the members think it is themselves that are just not getting it and not the Trading Room Operator is a con man.

Trading is hard, very hard and everyone wants to believe what these guys are selling. You can come in everyday and microscalp and make a living day trading. Piece of cake until you try and do it.

It is a piece of cake. All you have to do is look at the chart in hindsight, mark off where you got in and got out and voila! Profitable microscalping. Piece of cake.

But, but, that is not live trading, you say. no problem.

Do NOT put up a chart or DOM. Just watch the chart.

Call the trade.

Do not take it.

Wait for the trade to reach some arbitrary target, preferably a really small target like 2 or 3 ticks in futures, or about 10 or 15 cents in some stock.

Shout how you nailed it.

Give yourself a little verbal praise to the room.

Tell them how you are nailing it so easily.

Get some of the room shills to say how they are killing it.

The trade did not go into profit? Ho ho ho, very simple. Just tell them that you have a feel for the market, so you did not take the trade.

After all, you make so much profit everyday. But these no-good, losers Rob, and Emmett, and Cyn, and Stray Dog keep making these nonsense posts about how you are not really trading.

Does that sound too much like Warrior Trading? Oh well, that is the template. See? Piece of cake. Told ya!

For those who have a challenge with idiomatic English, this entire post is meant to be sarcasm.

what were your profits during the period that sean was sending his to emmet? that way we can evaluate the legitimacy of your criticism…

I trade penny stocks profitably as do many people I know….. penny stocks are more predictable than people. i love that so many traders from other market are completely blind to how easy scalping can be…. “its picking up pennies in front of a steam roller” “no one has more than a 50% win rate”……. I love the fact that I left roofing and can be profitable at something that you geniuses from other markets cant seem to do…. dont trade penny stocks if you suck at trading or are going to try to trade them thru the lens of another market. most of you buy and hold people just suck at trading and cant tell the difference between a front loading scam and an actual valuable penny stock service.

You make excellent point. I have seen TR operators telling people how they can risk 5% per trade. They set up a fantasy world where nothing is linked to each other. But in the real world everything is linked. In other words in their fantasy world you can take high risk and have virtually do drawdowns, yet in the real world the 2 are linked.

I do not even risk 1% as the more you risk per trade the more drawdown you will have. And how many people can take the next trade when your account is down 30%, 40%, 50% or more.

My point on penny stocks was in relationship to what the TR teach in future trading sites. At least with Penny Stocks you can lower the shares you buy and not trade with 500 to 1 leverage or any leverage. By the time anyone figures out the future TR is a scam they have lost thousands of dollars.

There is a reason none of these TR operators can show any real proof of profitability and the view that get a good review eventually suffer from the Emmett’s Curse.

I lived in a fantasy world where risk didn’t matter because I believed I could achieve an 80 percent win rate. Honestly, to achieve an 80 percent win rate over an extended period of time is most likely fantasy. When the trading floor was pertinent and floor traders could read if the locals where too short or they would front run a large order then maybe 80 percent. Even if you achieve a large winning percentage, a losing streak may come all at once. You better be ready to take the next set up when your down 10 percent because that next one could bring you into the green.

As far as this room, I may still give it a free trial just for curiosity. I will do it when I feel I have a portion of time to allocate to getting set up. I am not sure I can trade penny stocks with my brokerage account. Hopefully we can hear more reviews from current subscribers.

Most penny stock traders are not trading stocks under $1.00 though some do. I would be surprised if your broker did not let you take longs in the stocks. Also you have to have low commission so look at IB at $1.00 per trade (depending on the shares traded).

BTW win rate alone really means very little. You go for small targets with large stop outs and you will have a high win rate and then lose everything on the stop out.

“BTW win rate alone really means very little. You go for small targets with large stop outs and you will have a high win rate and then lose everything on the stop out.”

Exactly. What counts is the statistical Expected Value of the trading method. That takes into account the size of the target, the size of the stop and the probability that they will be reached.

If Emmett gives permission, I can post some links for our perusal.

Yes, I’m familiar with expected value. I remember a time when I believed I could achieve a very high win rate, but even then I would try to at least go for a 2 to 1 ratio with a high probability of success. Most people that have traded for a period of time realize that 80 percent is very hard to accomplish over a longer duration. For me personally, I trade better when I can take a larger chunk out of the market and trade less. 2 to 1 is the absolute minimum for me to be profitable.

Could you post those links? I don’t believe Emmett would mind.

This is a really brutal takedown. Jack has filled in the gap between the “Signals Box” and the “Account Statements”. So essentially what Jack is saying is that the Signals Box is pointless and irrelevant because the vast majority of the trade suggestions posted within the signals box cannot be executed. They are a mirage. And to attempt to copy/paste these trades will lead to failure.

Additionally, the “signals box” signals employ the same sort of marketing chicanery that we often witness with some of the “Guru’s” (Scammeron, Kunal, Sykes, et al).

Darn, Jack you really need to be writing for the blog.

So does this mean you will re-write and change the rating of the original review?

Man, I wrote the same kind of statement last week about this room but it didn’t post, tried a few times different computers and gave up.. I consider myself fairly experienced with trading and how it works. I signed up for the trial, seen what happened with his first trade cancelled my paypal . If this comment goes through, I’ll post a more detailed comment

Sorry your post didn’t make it onto the page. I recently changed hosting and some of the comments were lost during the transfer.

As far a censoring…I dont do it. People can say whatever they like.

jack is trying as hard as he can to take a good service and pretend it isnt. emett-if you spent a month in Seans room, you know he works his ass off to come up with good content and education. no service is for mirroring trades ….so it clearly isnt the best way to rate a service. All of my lessons there are centered around teaching new traders how to identify their own entries and proper risk/reward. impossible to front load doing that!! a ton of the people commenting here are thinking that you can mirror trades, and if that doesnt work out for you then its Seans fault…..of course you are not all going to get the same fill, are you new to trading!!! Jack has written a ton of words that mean absolutely nothing……

The problem you FAIL to understand Chad is that Dekmar is posting 80% wins, he is marketing himself with that % rate so he kinda pawns off IMO as the rest of the trash Emmet has reviewed. Its all over his website so why not just say I want to teach you how to trade pennystocks and maybe you can make some money and NOT put all the flair of 80% dialy wins or whatever is on that site. Most here will understand what I am saying since we have seen it all. Golden review by Emmet I am sure is not hurting his business at all. good luck.

I have experienced many scam rooms and feel that jason bond is the worse. Sean is a great trader and I experience it every day. A ton of people have drastically improved their trading in the room and the proof is in the pudding. I have been there for over a year and really enjoy it. that 80% rate goes up and down a bit and is higher than many peoples win rate due to reduced amount of trades and waiting for proper set ups. I personally go after as many 10 to 15 cent ranges as possible thru the day both long and short. I dont load up on large position size, just a lot of base hits and I wait for them.

most of these fake “critics” on here cant even tell you the four phases of a stock move- what are the phases of a move eh rob or stray dog????

@chad nystrom your question another silly one as it does nothing to prove the legitimacy of the service offered by Dekmar Trades. It’s a bit like asking “What’s my auntie Mary’s middle name?” I haven’t met your aunt nor have I looked at Dekmar Trades education material. But the four phases of a stock are 1. accumulation phase, 2. markup phase, 3. distribution phase, 4. mark down phase. Other educators call them phase 1,2, 3 & 4 and still others have 6 phases; 1. Recovery phase, 2. Accumulation phase, 3. Bullish phase, 4. Warning phase, 5. Distribution phase, & 6. Bearish phase. I have a question for you, When are you going to fulfill your obligations when you accepted Jack’s challenge?

Stray Dog,

I do not follow anyone stock trading method per se, but the closet guru I come closest to is Wycoff, so when you mention Accumulation and Distribution it warms my heart.

But I have to laugh a bit when this Penny Stock Trader trading for 10 cent targets is talking about phases.

See? I told you that it was a piece of cake. 10-cent to 15-cent targets. No stops. LOL.

Average down when you get it wrong.

Insult everybody who says that averaging down is a bad idea or scalping for 10 cents is the way to the poorhouse.

Why the dissertation on technical analysis? The site owner asked to be reviewed. Most people on this site have been scammed at one point in time by TR operator shills. Why is it so hard to comprehend that there will be questions and the bar to cross will be high? Most comments on this site have been cautiously optimistic until Jack raised some valid points, especially about the statements being created by a computer program.

IMO the only person that needs to prove that he can trade is the site operator. He claims to be a highly skilled trader and he should have to answer questions when they arise. I would love to hear from the owner. Until then, I now have doubts whereas before I was extremely optimistic. Don’t you you think it would benefit his business immensely if he can have an intelligent discussion and allay some concerns?

Darn you Mike M for post an actual intelligent logical argument.

deks alerts are already proven and backed up by his win and loss rate and backed up by emmett. so you guys moved the goal post to “well now wee need more data” so have emmett grab more data, its been 3 months already since he started his “investigation”. But the lot of fake “critics” here will never be happy and just keep moving the goal post that proof must pass. The simple truth is that you guys are 90%ers who cant trade penny stocks because they take better discipline than mid cap day trading and larger cap trading. a lot easier to be a critic than a 10%er

so stray dog-why would you even know the phases of a move if you are correct that there is no way to profitably day trade? why would the terms even exist if they didnt exist on the charts? you are already proving that day trading can be taught, otherwise you would have responded with: there is no such thing as the 4 phases of a move. you are just as predictable as penny stocks are! you should come trade with us!

In addition to the challenge you accepted from Jack, but have yet to produce a single shred of proof to support, the other challenge you have is to comprehend what people write. I have not said that there is no way to trade penny stocks profitably, I’m asking for you to make good on your claims and provide proof. No one has moved the goal posts, the messages have been consistent from the beginning, 1 month is not enough proof of anything. 3 months isn’t definitive but at least it’s something. We’ve all done this dance many times with people like you. We all know that proof will not be provided but go on, be the first one to surprise us.

emmett- there is no signals box. most of what goes in the alert box is talked about in depth before the market opens and reasons for the entry. what chicanery are you talking about? how is watching the pre market scanners and developing trade plans based on what is moving-chicanery? no front loading and no chicanery, no guru mentality and no lambos and bimbos approach.

Nice work Jack perhaps you should have done the original review, I felt a little strange when Emmet did not have that assistant in the Philippines try and copy the trades like he usually does. 4 years trading only and penny stock guru is all the alerts you needed to have. I hope someone from that room can prove Jack wrong.

Jack – thanks so much for sounding the alarm. These people are damned clever. I am done with all of this and the 99% scammers.

Now I see. Sean picks the top trades from the scanner, jumps in on the green and out quickly with a small win that he then touts that one and stops there for the whole day, much more than I can stand listening and watching. He is following a pile of stocks – very hard to follow. Too boring for me with the small gains. Also spreads can hurt. A great place to learn and then go from there. Paper trade this for no less than a month.

“He is following a pile of stocks – very hard to follow.”

My guess he does this to divert focus from his actual trades. One suggest is not to paper trade. Real Trading is where the rubber hits the road. It is the only way to really see what kind of slippage you get trading these type of stocks. Plus in Paper trading I see folks not use stops or just keep moving their stops as they want to see the trade play out. A lot different when you have real money on the line. And speaking of Penny stocks wait until you are in one of those and it is halted and your fall out of your chair when it reopens and you lose your shirt at the new price. Anyway my suggestion is just trade 20 shares or so and report back to us on your results from Sean’s trade.

Ill take that challenge and show that you clearly know nothing about how to trade penny stocks and cant tell the difference between one of the penny stock scams and a very valuable education service and trading room. lets go! first you think you can write an algo off of a penny stock alert and then prove that it didnt profit…that means you think you are applying the rules of high float stocks and applying them to low float stocks and that is clearly ignorant. If you are a profitable penny stock trader, as I am, you would be able to critique the service thru the eyes of a low float trader and clearly you cannot. I have a totally different strategy than sean and sometimes we are long and short on the same stocks at the same time…..never once been asked not to talk about a position that goes against the “guru” as I have been in other rooms and even kicked out of jason bonds room for. Day traders trade low float for a reason called volatility and volatile stocks move fast and require actual learning of how to be a trader. Sean spends hours teaching-how does that lead to increased profits from frontloading or scamming? some of you are the dumbest critics ive ever read and dont understand basics of the market being traded….. again-I put my name behind the service and you will see it in the chat room

Wow!

“Ill take that challenge ”

I read all your post of Nonsense Motherhood Statement after Motherhood Statement, yet you show no proof of anything. Where did you take any challenge? Show Emmett several months of you trading Sean’s calls profitable. But then you state:

“I have a totally different strategy than sean”

This thread is about if Sean’s Method can be trade profitably not Chad’s method which is apparently a totally different strategy.

We must live on different planets because you post make no logical sense to me what so ever. You state you can trade some other strategy profitable, yet show no proof of that or proof that Sean can trade profitable. I do not get your point what so ever.

This guy asked for a review. He must have the ability to withstand the scrutiny that comes with exposure. IMHO Jack made some exceptional points to the legitimacy of new traders producing similar results.

tell us about your profits rob- only a good scalper would be able to evaluate another good scalper… you are asking for people to show that mirroring is is the way to evaluate a service and that shows that you know nothing about the world of low float stock scalping. its about learning to be a good trader, not blindly following someone thinking your going to get the same fills. you seem to think that mirroring IS the strategy. are you even a day trader? you dont seem to grasp the basic concepts of scalping or day trading in general. Emmet already showed proof of profitability and you cant seem to grasp that either. that is the point. the proof is right in front of you and you dont know enough about day trading to see it…..thats ok! it just means you have a lot to learn. Thankfully sean offers a free two week trial. you will be a better critic after you learn enough to make sense to other day traders. you sound like a “flat earther” of day trading….

Another nonsense post from you chad nystrom, all bluster and no substance. Your words; “Ill take that challenge and show that you clearly know nothing about how to trade penny stocks and cant tell the difference between one of the penny stock scams and a very valuable education service and trading room. lets go!” We’re still waiting for you to answer the challenge that Jack issued. To refresh your memory it was this: ” I challenge these member to show 3 months of live brokerage statement to Emmett of all the money they are making trading these low float stocks.” So far all you’ve shown us is that you don’t know how to use capital letters when writing sentences. Dekmar Trades sell education that says subscribers can make money trading the stocks that he alerts. That’s the proof that we’re waiting for. Rather than asking for Rob B’s statements, which he has provided in the past by the way, show yours using the method that Dekmar Traders teaches and trading the stocks he alerts.

again-lets set up a simulator or real money and have a competition. no one cares if you join the service or not! emmett just showed results and you cant handle it. I personally doubt that you even know how to trade. take the 2 week trial and i will give you 4 alerts per day and you can evaluate them yourself.

why would I want to go and mirror someones trades as exactly as I can, as you suggest that I do with sean? its a straw man argument created by someone who clearly does not know how to trade this market. You need to know the difference between a scam and a real service. so step up and take my challenge lil doggie

You need to look up what a straw-man argument is chad nystrom. Issuing challenges to people online is an example of one. You are trying to counter the sound arguments put forward here with a distraction. You don’t trade/mirror Dekmar’s trades, I’m pretty sure that in one of your posts you stated that you trade your own method so how does a trading contest with you help readers evaluate the worth of Dekmar Trade’s service? I know what would; 3 months of statements showing that the stocks traded were those alerted by Dekmar Trade’s and were traded using the methodology that he teaches. That’s the challenge that you accepted and we’re still waiting for the proof.

i issued a challenge too …. his alerts speak for themselves. unlike your alerts or experience. you fake “critics” are the only shills with an agenda. cant trade and only know how to be rude to real traders.

oh yeah retard dog- go back and re-read your “You need to look up what a straw-man argument is chad nystrom. Issuing challenges to people online is an example of one” ok so are you proving my point again? damn you are predictable lil doggie…. I trade my own method and I am a student there and I am not as good as sean and I will still beat you any time in a live trading competition. only stocks between $1-20 both traders start with the same amount of money and no chat room alerting of any trades, market open to market close, no limit on amounts of trades made—- lets see the critics take on the real traders

“and only know how to be rude to real traders.” Reread my posts chad and then reread yours. ” I trade my own method” Damn it’s easy when the shills prove my points for me. After reading all of your posts now I do not think that you are willfully stupid, I do however, think that you have issues.

I really have to get a live and stop responding to these crazy post. If you are not willfully stupid you have to be just plain stupid and yes that is meant to be an insult after reading all your post.

“his alerts speak for themselves.”

First it has been shown his alerts are not even profitable and 2nd you are the one that stated no one can duplicate his trades or alerts and expect to be profitable. So his alerts do not speak for themselves. I swear nothing you write makes sense to me. We must be from different planets. Are you now saying his alerts can be traded profitable as given??

Instead of showing any proof of any kind you now make nonsense challenges. I seriously doubt your can trade the Penny Stocks for 10 cent targets as you claim profitably, so here you go I will not take a single trade in the challenge so all you have to do is make 1 Cent and you will beat me. So now trade live for 3 months and then show Emmett your brokerage statements showing how profitable you are. I am not sure what this proves as you say you do not even trade Sean’s method, but I guess it will be something. And honest if you can show any profitability I will probably die of shock so you get rid of me.

BTW, you stated I can get you a free Guess Pass. Are you associated with this room, because it sure sounds like it.

This chad guy works for Sean. From what I’ve seen he does video lessons and sim trades when Sean is not around. The reason he’s so vocal is because Sean is paying him to run the trading room alongside with him.

WTF, this guy who acts like an unaffiliated student actually works for Sean.

I HATE SHILLS!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Does this mean we can expect another review?

Chad appears to have the temper of a pre pubesent teen and is clearly out of his league trying to make his point to Rob and StrayDog which we can only determine him to be a paid cult like mentality shill for Dekmar. What our dullard friend Chad fails to grasp is the burden of proof is on him and dekmar lets see how long that room can sustain before imploding when not one member can produce 3 month profitable broker statement from dekmars system.

” If you are not willfully stupid you have to be just plain stupid” Pretty much my assessment too Rob B. I’ll be surprised if chad turns a profit but I’d also be surprised if he can tie his own shoes.

what methodology are you even talking about? you are soo far from knowing anything about the service that you are just pulling stuff out of your ass. you just cant see that all of the data is there to show that sean is a good trader and an excellent educator. you never learned to progress as traders because YOU were the ones blindly trying to mirror and follow and chase and NOW you think you are critics of those who actually can trade well. your entire test: A) has already been proven over and over and you dont actually care about that and B) is the test that only a fool would come up with… and it shows that your still locked into the mentality that made you a shitty trader in the first place. there is a reason you are not 10%ers and only found a home in the “stock market traders critic “market…..

Chad,

Your post make so little sense to me in how it proves anything about Sean’s TR that I can only come up with one response and it is better than, “Release the Kraken” and that is:

“Time to Release the Stray Dog”

Chad, you post sounds to me like all shill posts, which sound like a broken record. They praise the TR operator, yet never show any proof of their claims and then blast the members when they lose money trying to follow the TR operator Trade Calls. Truly Amazing?

I have answered all your questions in past posts on this blog.

I am going to paraphrase your comments from your posts. Please correct me if I got anything wrong, but I think it is right on the money.

1) You have stated you are a “Profitable Penny Stock Day Trader” – Yet you have not shown any proof of that, which is fine but –

2) Then you state you do not even trade Sean’s Method – Which is OK, but then how do you know Sean is trading profitable? Ah you then say:

3) That only “You” or a “Profitable Penny Stock Day Trader” can evaluate Sean’s Trading – OK, If that is true then it becomes critical that you show you are indeed a ‘Profitable Penny Stock Day Trader’, otherwise how can you evaluate Sean’s trading by your own argument?

4) You say, Sean’s trade alerts and calls and 80% win rate claim cannot be duplicated by someone else and that this service is about getting trading education ONLY and theoretically after that education you too will be able to be a “Profitable Penny Stock Day Trade”.

So based on all that does it not seem EXTREMELY important that Sean be a consistently long term profitable day trader???? After all, you say you cannot use his trade calls to make money, but instead this is about getting an education from a “Profitable Penny Stock Day Trader”. So surely we can agree upon this; I would hope!

Now here is the rub, just as I do not blindly believe any of the TR Operator’s claims, I do not blindly believe Emmett’s reviews. And here is my take from a long history at this blog. Emmett got into this thinking he actually would finds lots of profitable day trader’s like Lying Dean Handley. Emmett even tried to work with DH in the beginning. But as time has shown DH is a con artist just like all the rooms he reviews. What Emmett found, as you can see for yourself if you read this blog, is that this industry is full of nothing but con artist. Seriously 99.9% of these TR operators cannot even show proof they have ever even taken single live trade more less can trade profitably. So IMHO Emmett out of desperation to have at least a few decent reviews grades on a ridiculous curve, where if you can show you can trade 1 month profitably you are a 5 Star Review. Again IMHO a month’s performance record is meaningless. Thus this is why the Emmett curse exits. I believe just like Alex’s Futures Trading Room, Sean’s room will also suffer from the Emmett Kiss of Death.

So Chad here i

s my compromise that any reasonable person should be able to agree with. I would hope unless you are in shill city, you would agree 1 months of trading performance is meaningless and also agree that Sean’s trading performance is critical being as you stated you are paying for education not trade calls. So here is what I propose; Emmett dust out his robot and have it take Sean’s trades live. The robot in case you are not familiar actually takes Sean’s trades, not his alert calls, but actual trades. And then those results are automatically posted daily. So one can see how his Actual Results compare to his trade calls and his claimed trade calls over time.

Now how much fairer can you be than that? Even you cannot disagree with that, unless you are just here as a mindless shill in which case nothing anyone says will matter.

Now to the rest of your question. I have talked about the way I trade in the past and posted brokerage statements. The problem is I am just arguing with shills such as you and there is nothing they will accept as there real goal is just to promote the TR. I will agree to show my trades for an entire year to Emmett, something none of the TR operators can do and show I was profitable over that time if, as I have stated in the past, Emmett gives me a page that says verified trader and I will write an article about how to actually trade, not the nonsense Sean and others are teaching people. And people can then ask Qs and I will Answer. I will point out though as I have talked about in my past post recently I have spent more time investing in Real Estate, as Real Estate is once again in at least a mini bubble mode, so most of trades over the past year were just over a few months period when I was trading. Anyway, I will sell nothing as I have nothing to sell. And I will tell you a secret, nothing I am going to say is new as once I figured out these day TR operators are all con artist I just went and looked how real traders trade and just started to trade that way, which gets me to your other point.

YES, I think all the Day TR Operators are con artist. 100% of them!! They teach complete nonsense. Whether it is futures or Penny Stock Day TRs. All the honest TR were run out of business by these con artist promising fantasy, like Sean’s 80% win rate trading Penny stocks for a few cents. That is complete nonsense. Yes, it can work during periods of complete irrational behavior like the NASDAQ bubble where a stock broke out and just went Up! Up! Up!, but not in today’s market.

I spent years in Day TR, both futures and stocks and thousands of hours testing, back testing, trading live and kept detailed stats. And my conclusion is there is no edge to any of the nonsense they teach. But look I understand the lure of day trade scalping, so if one of these TR operators can actual provide some actual proof of their claims over a reasonable time period I will be the first to jump in and try it.

So lets get that robot dusted off and working again. Anyone willing to take a side bet on this site shortly after the robot is run suffering the from the Emmett’s Curse?? I will give 2 to 1 odds.

how about we just have a trade competition live! me vs you if you know anything about day trading it should be easy. we can do a simulator or anything you want. 2 out of 3 or 10 times. Ill out trade you any day of the week. I dont need to spoon feed you 3 months of anything. just step up and have a trading competition. You have no clue what you are talking about and you have no clue what sean teaches or what I teach. you are just another stock market “flat earther”

Chad, I read your post replies and just shake my head. Nothing you say makes any logically sense to me, which only leaves me to conclude you are a shill and being willfully stupid. No one would respond in this manner unless they are a shill. As I have said in the past I could have a more intelligent conversation with my cat. Did you even read my post? It is difficult to respond to someone that is just being willfully stupid, but I will give it my best shot.

You stated you were a “Profitable Penny Stock Day Trader” and that only a “Profitable Penny Stock Day Trader” such as yourself can judge Sean’s trading method. So for shits and grins, let’s say we accept this concept.

Therefore I stated you should show Emmett your brokerage statement proving you are indeed a “Profitable Penny Stock Day Trader”, otherwise by your own argument you cannot judge Sean’s Trading Method. And your response is:

“I dont need to spoon feed you 3 months of anything”

On what planet did I post anything about you spoon feeding anything to anyone? I just stated you could show Emmett your brokerage statement to proof you are a indeed a, “Profitable Penny Stock Day Trader” as you have claimed. Not exactly rocket science. But instead you come back with that reply which IMHO speaks volumes about the truth.

Then you stated something interesting in your post as shown below, maybe a Freudian slip:

“You have no clue what you are talking about and you have no clue what sean teaches or what I teach.”

So you are now saying your teach something. Interesting!! I think that explains a lot.

Then you post:

“we can do a simulator or anything you want. 2 out of 3 or 10 times. “

Seriously if you beat me trading 2 out of 3 times on a trade, that will proof Sean’s Trading Method will make you a profitable trader? How does one even respond to a nonsense statement like this?

Then in a another post you state:

“i will give you 4 alerts per day and you can evaluate them yourself.”

I am pretty sure just as your post are being willfully stupid you will be equally willfully stupid with your alerts by posting general alerts and then in hindsight state how you could have done this and that and made money. But here is the part that had me falling to the ground laughing, you said early that no one could expect to trade Sean’s Alerts and it was about education. So how the heck is someone supposed to trade your alerts? Nothing you post makes sense to me.

But you know I would take the trial to see those alerts of yours if they are “REAL” alerts, not BS alerts. That means Time Stamped, Entries with Stop Loss and Targets given ahead of time. No market order nonsense on Penny stocks, but stop limits. And if you say go for a 5 cent profit target and the bid ask spread is 10 cents and you blow past your target on entry then that trade is a lost. I would love to see the results of 10 of your alerts, because based on your nonsense replies I seriously doubt you could trade your way out of paper bag. And if you are posting a bunch of short alerts on a Penny Stock that you cannot borrow from your broker then it is a complete waste of time.

any time fake “critic”….. free two week trial. show up and learn 90%er. how about we just have a trade competition as stated… feel free to watch any lesson ive done! how about tomorrow ill get you a guest pass and you can trade right alongside me.

Absolutely the best response I have ever read in any blog. Hats off to you Rob B you deconstructed the obvious shill masterfully it was a clinic. Thank you.

If all TR operators were as transparent as Rob then we wouldn’t need a site like this. I can’t wait for the response because there is nothing left to say.

I am still holding out hope in the fantasy. Apparently I am more delusional than ever. I have to admit, as much as I want to believe, Rob brings me down to earth. Nice job!!

A 5 Star Review from a Trading Room that showed a whole month’s of profitable trading; Give me a Break! Talk about suspicious, therefore I decided to take the plunge of a free trial and actually take his recommended trades to see if it was another scam or the real deal. And so far it looks 100% SCAM to me.

Talk about a review with a complete lack of due diligence, where do I even start. First this trading room is associated with Tim Sykes. That should tell anyone with ½ a brain to stay clear. But I wanted to be fair and gave it a shot, yet so far all I have seen is scam city. He is telling members to buy low float stocks on Break Outs. I could give example after example of his nonsense calls, but this site seems to limit attachments, so I will just show a couple of many examples:

Sean put out the following trade alert last week:

Buy CYCC at $6.01

Now this call looks great on a chart, but the problem is a chart does not tell you the real story. When these low float stocks break out, they jump straight up and no one gets the Break Out price except Sean. Yes Sean mysterious is able to get the BO price when no one else can. You do not have to take my word on it, attached is the actual comments from the chat box that day:

Like User Harsh_129, I too had a reasonable stop limit order on a low float stock and got no fill. But Sean says do market orders, which I think is foolish on low float stocks, but fine let’s see what happens when you do that. Notice user Koreice did market order for a $6.01 entry and was filled 75 cents higher at $6.76. Trying to do multiple attachments, but not clear if this site will show them or not as I see no preview to show your attachments. But if you pull up the chart of CYCC that morning you will see by the time Koreice got filled the stock was mostly done and in fact he probably lost money, as the stock on that 1 minute bar shot up to around $6.85 where he got his fill and then fell back to around $6.40. And as another user named Bricardona stated, “I got Killed by the spread”. And this is what typically happens with stock calls like these. Explodes up you get horrible fill and then it goes straight back to your stop loss for a huge stop out.

But here is where it gets even worst. Sean’s alert have small stop loss and profit targets. So let’s say he had a 15 cent stop loss and a 15 cent profit target on any particular stock. The actual entry price you get would already have blasted past his profit target and here is it where it gets even worst. On most of his stock alerts, at the original entry you basically would around a 1:1 Risk to Reward, but when the stock blows past the entry point and you get no fill until 75 cents later you now have a major inverted risk to reward. So the only one making money on these calls is in Sean’s fantasy world of trading. A few stop outs and all your gains will be wiped out plus some.

I could go on with example after example, but I will just talk about one more stock alert from last week and that was GNCA and here was his alert: