Trading Crude Oil Futures with the OVX

-

Statistically Valid

(4)

-

Ease Of Use

(4)

-

Simple To Master

(3)

-

Robustness

(5)

-

Durability

(4)

Summary

Day trading crude oil futures contracts are extremely popular.

But do you really know what you are doing? Are you a customer of the casino, or do you own the casino? The choice is yours.

When day trading crude oil futures contracts, use the OVX or Oil Volatility Index as a directional proxy. Or don’t, and lose your money.

The following trading strategy will keep you on the dominant side of the crude oil market, and provide you with a little-known and seldom-used options volatility model that serves as a reliable trading filter.

Learn to test trading theories. Take control of your future. Stop being a victim.

An Intraday Approach to Trading Crude Oil Futures Contracts

Thanks for reading. Today, let’s talk about developing a consistently reliable approach to trading crude oil futures. And then we will expand from an ‘approach’ into a fully automated trading strategy that you can quickly, and easily implement.

First things first…before we jump into the actual strategy. It is important to note that many TradingSchools.Org readers might not be familiar with crude oil futures contracts. In a nutshell:

- One contract of crude oil equals 1,000 barrels of crude oil.

- The minimum price move is .01, or 1 penny.

- 1 penny in price movement equals $10.

To simplify things, if you purchase a single contract of crude oil for $50.00, and then quickly sell for $50.01, then your profit would be $10.

Crude Oil futures contracts are highly liquid. Typically, a million contracts will trade on any given day.

The best time of day to trade crude oil futures contracts is during the ‘day session’. The day session would be defined as 9 AM (EST) – 11:30 AM (EST). If you trade within this time frame, you will be participating with the majority of the daily trading volume. The advantage of only trading within the day session is that the heavy volume keeps the Bid/Ask spread (usually) at 1 penny.

It is also important to liquidate your crude oil futures contracts before the day session ends. If you do not, then you will be expected to have a maintenance margin of $2,500 – $3,000 per crude oil futures contract.

For the purposes of this blog post, we are going to be only focusing on trading crude oil futures contracts intraday. We do not want any overnight exposure or additional margin requirement. We are looking to get the most trading bang for our trading buck.

An approach to trading crude oil futures contracts

Whenever you are in a trade, you should be asking yourself a simple question — do I currently have a statistical advantage? If you do not, then you are the old lady playing the penny slot machine at the Indian casino. Or the sucker putting his casino chips on red or black. Or the butthead wagering that Bruno ‘The Magnificent’ Beefcake will defeat Rocky via TKO in the 8th round. You are gambling.

When you are gambling, you are making a wager where the house has a statistical advantage. Enough wagers and the house will grind you to nothing.

You don’t want to gamble. You want to own the slot machine, or the Roulette table, or the sports book. But in order to achieve this, you need a statistical edge. Let others play against your edge, and watch them lose.

In a prior blog post, we talked about a simple and robust trading strategy that we applied to the Emini SP500 futures contract. The concept is exceptionally simple. That we only want to be trading in the direction of the dominant trend of the day. We called this strategy, the Mid-Point trading strategy. You can read all about that trading strategy here.

In an additional blog post, we expanded the concept of the Mid-Point trading strategy with a VIX volatility filter. The end result was a fully functional trading strategy.

Today, let’s take the Mid-Point trading strategy and apply the strategy to the crude oil futures contract.

Exact Rules

Using only the day session of the crude oil futures contract, we are going to be only focusing on the Buy side, or the Long side.

Entry rules as follows:

- Wait 2 hours after the market opens.

- Calculate the Mid-Point of the daily range.

- When the low of a 5-minute bar crosses the Mid-Point, then we want to buy Crude Oil at the market.

Exit rules as follows:

- If the high of a 5-minute bar crosses below the Mid-Point, then exit the trade at the market.

- Exit the trade at the close of the day session.

Stupid simple. Nothing fancy here. Let’s take a look at the results:

Crude Oil Trading with a stupid simple entry technique.

Now let’s take a closer look at the individual trade performance:

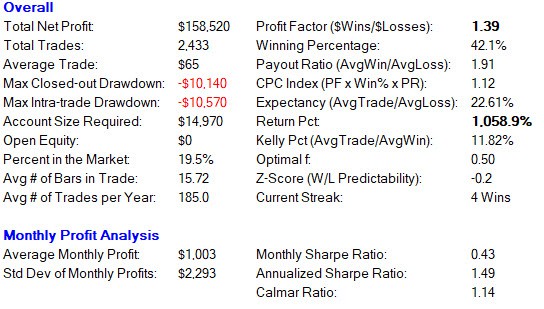

2,443 trades, Ave Trade $65, $10k drawdown. Can we improve?

The first thing that should jump off the screen is the sample size. With a total 2,433 trades and an average trade size of $65 per trade, this is way beyond a random outcome. What is so promising is that the sample size gives us plenty of latitude to add an additional filter. We don’t need this much tortilla to make a delicious burrito. We need just enough tortilla to keep this thing together, keep it stable, make it tasty enough to eat.

How can we improve individual trading performance? And how can we do this without over optimization? How can we preserve the underlying logic, without overfitting and introducing the chance of a random outcome?

For this particular strategy, I would like to introduce a volatility filter, specifically the OVX.

What is the OVX?

Many readers are probably scratching their heads and wondering, “what in the hell is the OVX?”

The OVX (Oil Vix) was introduced by Chicago Board of Trade back in 2008. It is a measurement of the expected 30-day volatility of crude oil prices by applying the VIX calculation to the USO or United States Oil Fund. The calculation encompasses a broad spectrum of options prices.

The calculation encompasses a broad spectrum of options prices. I know, it sure sounds confusing. But don’t let it!

In a nutshell, when the OVX is down, then fear is leaving the oil market. And we can reasonably expect a rally in oil prices.

When the OVX is up, then fear has entered the market, and we can reasonably expect oil prices to drop.

Like the VIX, the OVX is not a perfect predictor. But in the land of the blind, the one-eyed man is king.

Is there any scientific evidence that supports the theory that the OVX can predict crude oil prices? Yes. In fact, there have been several academic findings to support the theory. I don’t expect the audience to quickly understand the calculations referenced in the article. I simply peeled out the theory, and then tested the theory on my own platform, using my own data.

Crude Oil Trading Strategy: Using the OVX as a filter

Ok, so lets now take our original Mid-Point trading strategy and add the OVX as a filter. Exact rules as follows:

- Wait 2 hours after the market opens.

- If the OVX is down 2%

- Calculate the Mid-Point of the daily range of crude oil.

- When the low of a 5-minute bar crosses the Mid-Point, then we want to buy Crude Oil at the market.

Exit rules as follows:

- If the high of a 5-minute bar crosses below the Mid-Point, then exit the trade at the market.

- Exit the trade at the close of the day session.

Now let’s take a closer look at the individual trade performance:

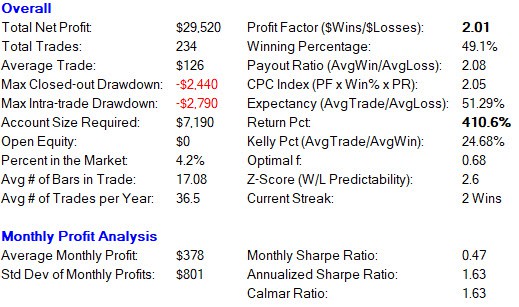

By introducing a volatility filter, our profit jumps higher.

Now we are looking at something nice. Our average trades size has jumped from $65 to $126 per trade. We have reduced the sample size of trades to what I consider to be the “sweet spot” of 200 trades. And most importantly, our drawdown has decreased from $10k to $2.7k. A major improvement.

When to turn this strategy OFF

All strategies break. The markets are efficient, other participants will eventually find this edge and attempt to exploit it. Once this happens, then the edge disappears. So you need to have a mechanism in place, that shuts the system off.

If you notice on the above equity curve, there is a blue line. This line is a 100-period moving average of the equity curve. Once the real-time performance pierces the equity curve–the gig is up. The edge is gone. Probably never to return. So it’s important to have this already in place.

Wrapping things up

Once again, thanks for reading. A bit of a long post. And truth be told, I am a horrible technical writer. Applying an explanation to the obscure is definitely not my strong suit.

The key takeaway is that if an ex-con, high school dropout with little math skills can figure this stuff out…then so can you. You don’t need a bunch of fancy indicators or a mentor that runs a 5 trillion dollar hedge fund. You just need to sit down and start asking questions of the data. The answers are in plain site. But you have to ask the questions.

Once you start to ask questions…your imagination will take root. Your questions will turn into a fever swamp of research and discovery. You will become quickly obsessed, who in the hell knows where your research will lead.

But the key is research and testing.

Another fruitful benefit of testing and researching…you will quickly discover what does not work. When some trading guru professes that his “institutional order flow, hyper delta gamma kappa trading indicator is flashing a buy signal…you can pause and test the theory.

That’s it for today. If you have any questions or need any help testing your theories or ideas…please reach out. I can program just about any idea in a few minutes.

Hello Emmet Moore,

That’s really a very nice write up. Observing all the past data with your theory & found it relatively good compared with other strategies & indicators. The point to keep it simple is absolutely cool idea. But i need one clarity with the chart.

if:

1. After 2 hours, the current trade range is above the median average by almost 100 base points, can we still enter the trade for a long..?

2. OVX indicator shows green by +3% or +4% but the price trend is still on up side of median average then how to decide whether to buy long or short in the market..?

Any reply on this is highly appreciated.

– G J

Hi Emmett,

I m unable to reproduce these results on WTI crude data.

I have the data from CME. Can you tell me what time would this be tested, on GMT?

You mentioned between 6am PST to 11.30am PST.

If I am not wrong, that’s 9am EST to 2.30pm EST right?

So, in this case, you keep the first 2 hours for midpoint calculation (6-8am PST / 9-11am EST) and thereafter do a rolling calculation of midpoint with every 5 minute bar, right?

Use only the day session for crude oil. The open for crude oil day session is the same for everyone.

For calculating the midpoint, you have this correct.

Since the article was published, the equity curved peaked in late 2018 and then the system shut down March 2019. I use a 100 period moving average of the equity curve as an on/off switch because all day trading systems eventually lose their edge.

The system on/off switch reactivated November 2020, so it’s back online.

When you said the market open, you don’t mean the actual intraday hours but the pre market hours too

Just the open of the day session.

call me

Hi Emmet can you give your opininion on John Carter simplertrading.com. when you do please focuse more on his indicator subscription. Thanks

Hi,

Forgive me if i missed it but at no point you mentioned you were using intraday data when you apply the filter based on option implied volatility on crude oil.

If you do use end of day data for the filter then your strategy will suffer from a look ahead biased . Could you clarify that point?

Yes, use intraday data only.

I am trying to replicate this myself in Trade Navigator and seem to be getting close, but a couple of questions

What symbol are you using to test this? I am using CL1-067 and the start time appears to be 9:00 while OVX is 9:30. How are you matching the first 2 hours of data?

Were you able to import the strategy OK? Any error messages?

If so, then you should be able to simply place on the standard CL1-067 chart and it should work.

Glad you sent me the message. I had no idea whether anyone really cared about the posting of strategies. Wasnt sure I if I should keep pushing content in that direction.

Thanks Emmett, still amazes me the systems that people will happily shell out big bucks for when nuggets are these are available for free right under their noses… Most definitely please keep it up!!

Where can I find the strategy to import?

Hi Emmett, Yes, by all means, post strategies; I’m new here and it is an eye-opener, to say the least! Sacred cows flying this way, that way…I especially like how you described the psychology of amateur traders (me) – it was spot on. Thanks

Please keep it up. It’s allways nice to have a source of ideas to worth with.

I also noticed that on TOS, OVX doesn’t open until 9:30.

Hello everyone, long time reader. Does anyone know if /CL has any internals? I looked everywhere, no luck.

waqar, what do you mean by ‘internals’?

Hi Emmett, how do you code the Crude Oil entry?

IF Time >= 1130 And Crosses Below (Low , (High Of Daily + Low Of Daily) / 2)

?

Kris, I answer this on the assumption that ‘Mid-Point of the daily range’ refers to the current uncomplete Daily Bar. If you reference the Daily bar I am pretty sure it would reference the most recent complete bar (ie yesterday). I’Ve only just stumbled onto this forum but from the graphics it appears this is backtested in Trade Navigator. If so, in this case one approach to get an accurate calculation would be (Highest High(40). Bars since(Time = 1100) – Lowest Low(40).Bars Since(Time=1100))/2 (40 5 minute bars in 2 hours)

I haven’t checked this so logic/syntax yet so may not be exactly correct.

This appears to get me something close to the results in the article (pre OVX filter)

IF Time > 1100 and Time < 1500 and Crosses Above (Low , (Highest High (24).Bars Since (Time = 1100) + Lowest Low (24).Bars Since (Time = 1100)) / 2)

(number of bars in 2 hours is 24, not 40…. can't count…..)

I would be interested in seeing the original code though

Appreciate your article in explaining this profitable technique, hope you had introduced some indicators which would give a clear idea for traders

Hi, how could i automate trade it (for free)?? and what about backtest? would python be a good idea??

do you have any other great strategy out there?

Hi Emmett, a great post on trading CL futures using the OVX. Do you have a course or booklet on how I can do this? i.e. Step-by-Step guide on how to carry out the trade, how to do the necessary calculations etc.

Very interesting, Emmet! I’d like to backtest this strategy in R. Where can I get intra day historical data of OVX? Did you buy the data directly on the CBOE website?

Cheers Ingo

nice stuff Emmet! I’d personally recommend using Fibo lines for deriving a session midpoint, whereas a 50% level acts as a session midpoint and 61.8% will serve as Line In Sand (LIS) with your stops (which is a must as we don’t trade in news vacuum…) just a few ticks (two or three ticks will do the job for ES) below the LIS. If LIS gets broken, consider the intraday trend being broken, too, call it the day and come back tomorrow. You my try and finetune this approach even further, e.g. wait for the price to come back to the 50% and try to enter off the level, just make sure you have you $TICK (NYSE) data in front, and enter when the TICK is below 400 at very least. Opposite is true for short selling. A simple thing I observed with this strategy is that the larger a timeframe the better, and here is where I will you guys to think the things for your self by playing with your charts.

Peace

Add a $tick filter? Thats interesting. Think i will test that.

You have to test everything. Our minds are uniquely wired to see patterns where no patterns exist.

There is VIX for nearly every major trading product, e.g. FX, energy, interest rates, indexes:

http://www.cboe.com/publish/volheatmap/volatility-heat-map.jpg

there is even VIX of VIX Index (!): http://www.cboe.com/products/vix-index-volatility/volatility-on-stock-indexes/the-cboe-vvix-index

No! Dont tell everyone my secrets! I use all of those.

Oh well, you cannot stop Diffusion of Innovations.

Yep with personal trading edges gets dulled with the diffusion as HFT and big money algos frontrun them. No wonder it’s been heard the best hedge funds won’t expose their trading secrets even for a million. And dupes think a typical shamshow is going to share anything useful that works better than 50/50 usually worse. They are all failed former traders willingly debasing themselves into a lying fraud to attempt to procure a monthly churn.

You’re going Long when $TICK is at least -400? I prefer $TICK high for Longs. But of the internals indicators I prefer the A/D line and upvol-dvol more. When they’re above or below zero or have made clear reversals in trend i trade in the direction of the trend only. I wish I had the programming and backtesting skills because I have several fairly similar setups to Emmett’s posts I’d like to test

I should have said that my first comment was about trading ES emini futrures, not CL (oil), thoiugh obvious for experiencd folks but probably not as clean not for newbies. Yeah, I dont wanna be a seller of low TICK, as I dont wanna be a buyer of high TICK, correct. When you sell low TICK is like pushing down a ballon, which is already deep enough under water and prone to shoot up any second. I will need to see TICK making at least -400 AND the price being at a predetermined level of interest where I planned to go long, should the market context permit to do so. As for internal indicators to get your bias for any given day in the market, here is a very, very good read for a very respectfull person: http://traderfeed.blogspot.com/2006/09/cumulative-nyse-tick-valuable-measure.html

Good stuff Emmet, moar we need!

I remember this sham artist, TomGentile of the former team of of the legacy sham, “Optionetics” said in one of their “educational” cd’s:

“When the VIX is low, it’s time to go. When the VIX is high, it’s time to buy”.

Supposedly part of his self-proclaimed “contrarian” trading style.

Of course these shams never teach the timing or wherewithal to pull it off because they are still simmy shamshows, but then they try to sell you an affiliate software such as AdvGET costing thousands to “enter” on a wave4,5 and then their ghost forum only has a few complaints that it never works. Where most duped and churned just write off their losses in wasting multiple k’s on optionetics “master” packages and AdvGET! (no, i never got caught doling out for their hotdogs, luckily i tested their ideas in sim, and they always failed; it did waste my time for several months simming their ideas since monthly options plays took so long to figure out their end results, well compared to daytrading or even short swingtrading. )

Unfortunately tradingschools wasn’t around then, but perhaps there could be a token review/recap of sham that was Optionetics.

So you are just using these internals for entry RobB? I’m just surprised because I thought you didn’t like daytrading anymore. btw, did you happen to attend Peter Rescnik’s”Shadowtraders” chatroom on Thinkorswim? Those internals are what he uses everyday in his screenshare. Just curious, I’m sure you know what you’re doing far more than that bs artist just calling movement as it happens, and his hindsight babble.

“RobR”, not “Rob B”. Different folks.

Shoot, I missed that. First time I’d seen a RobR, unless it’s a typo. I don’t have the best vision, and crammed windows in tiny rez with my trading screens.

Dtchurn,

That is not me!!!!! That is RobR

Sorry RobB. I have had so much distraction of the constantly lying and instigating pest’s stinking alter disguises’ guttysnipes, my tired vision got confused with the legit id’s mistaken someone else for you.

dtchurn, you are going to need a vacation after all your posts. lol. You better check your blood pressure. I got so angry when that TST shill attacked everyone for just being opinionated. I know how it feels.

Thanks MikeM, I was going to take a break awhile back and then the gollum and his alter tag team tried to kick me on the way out just because I mentioned in a few words going back to “+” trading. But now drchump, drchumpNO and drchum have all been exposed as gollumespite taking snipes in their gut post way, everyone’s on to it by now, so maybe I can breath easy and take that longer break. I’ve done my part against the shilling and the alters attempting to undermine the truthful posting such as that ridiculous implication that RobB was a shill for mentioning the free tool at tipranks.com I am actually the nicest of the bunch. The coward tries to stick it to me because of that while the others shut him up , Cyn recently for one.

Which software are you using for testing?

I am not sure that your description is clear, so I am going to rewrite it as I understand it. Please confirm whether or not my rewrite is correct.

1. At 0900 ET, when the “day session” opens, calculate the midpoint of the range from 0700 ET to 0900ET.

2. If during the day, the OVX is down by 2 percentage points, we prepare for a long trade entry. (Example: if OVX drops from 15% to 13%, that is a drop of 2%).

3. At the close of the first 5-minute bar whose low is above the Mid-Point, we want to buy Crude Oil at the market.

Did I get your explanation of the percentage drop right? In other words, are we looking for a drop of 2 percentage points, as I described, or did you mean a drop of 2% of the previous days OVX, which using the 15% that I used, would mean a drop from 15% to 14.7%, 0.3 being 2% of 15.

Maybe Emmett can post entry/exit chart with both the instruments on the chart, like they say a picture is worth thousand words.

Sure, I will post a pic tomorrow. A picture is definitely worth a thousand words.

This trading set-up is quite easy. The key is declining options volatility prices–fear leaving the market.

Hi

thanks for the info,could you clarify when start to calculate midpoint?

Sure. You start the calculation on the very first bar. As the market makes new highs or new lows, then the midpoint will adjust.

Hopefully, this will help.

The traditional regular open for crude is 9am eastern time. What time zone are you showing in this chart? Also, what is the calculation for the OVX percent change? Is it % change from the open of the oil market?

I am PST. And so it’s 6 am for me.

Then it would appear that your times are seriously off. Your write up says to trade only from 9 to 1130 ET. Your picture shows you starting at 6 and ending at 1130. If those are PT, that is a total of 5 hours, 30 minutes, whereas the ET that you state in the write up is only 2 hours, 30 minutes, so would allow only 30 minutes to actually be in the market if one were to wait for 2 hours to get the reference midpoint.

Which is it?

So your mid-point span is from 0600 ET to 0800 ET?

Still not sure how you are calculating the percentage drop. is it points or relative to the previous day’s absolute value?

I don’t understand this article. is this a training website you are reviewing or what? I don’t see a link or domain name.

Dan,

This article is not a review of a vendor, but part of a series of articles Emmett is writing on for lack of better words, “Make you think for yourself” trading. He is using algo trading, probably based on his teaching from Kevin, and programming various parameters and back testing them.

He probably could use a better title to distinguish his review article from this Algo Trading Articles. And probably a bit confusing that he is rating his own Algorithm.

Thank you Emmett for this simple yet pretty efficient algo and its interesting OVX based variation. I’m having a hard time though finding what data you’re actually working with. Your chart above refers to the 25th feb 2016 and at that time WTI was trading around 30 (Brent was not far and USO was below 10…) far from the 40 handle I see on your chart… Could you pls clarify that particular aspect ? Thx

Thanks for a great article.

Is your OVX index expressed in percentage change a custom indicator?

What should stand out to most is the fact that a robust strategy will have draw downs along with days where you will not have a signal. The winning percentage is right in the sweet spot for me at almost 50 percent because I usually couldn’t maintain a strategy where I would lose much more than I win. IMO this will help new traders think for themselves and have realistic expectations when one starts to trade. Most importantly new traders will run away from someone trying to sell them a system that has a winning percentage of 90 with monthly triple digit returns.

These types of strategies need to be programmed. And set to fire when the conditions are met.

I have some other strategies that go through long, long periods where nothing happens. And then BOOM, they start to spin off money. This upcoming Fall period, probably starting in September…things are really going to start popping.

Emmett, You said that there will be some scalping strategies posted along with the trend strategies. I am extremely curious to read about a scalping strategy that you tested because that has been difficult to find. I believe once a market goes range bound which is 70 percent of the time any trend strategy will not be profitable. As a result, a trader would also need a mean reversion strategy to add along with a trend strategy in order to possibly smooth out the equity curve.

In my experience, if the market trended more often there would be more profitable traders or maybe I would be more profitable. Unfortunately, once the market starts to trade in a range one would have to find another market or possibly use a scalping strategy. I have never seen an automated scalping strategy that was worth it. Hopefully, I didn’t misread what you wrote. Look forward to the scalping strategy to satisfy some curiosity.

Look over Elitetrader’s threads by NoDoji and JackHershey for lessons in day trading scalping. Baron of Elitetrader apparently was a master scalper and trading-course seller as well. https://www.elitetrader.com/et/threads/what-did-you-do-with-the-1st-million-you-earned.309659/

Thanks Pete, I will look into it. I have never met anyone that could scalp successfully unless they traded in the pit. Once they left the pit, not one of the successful pit traders that I knew were able to reproduce success electronically. I know we heard of sham rooms that claimed to scalp successfully, but I still haven’t seen any proof and that’s the only way to know for sure. I do believe there is that rare person that can do it over a long period, but IMO I don’t believe it to be the norm.

That depends on what you mean by “scalping”. Is trying for 8 ticks a trade scalping, or is scalping getting into trades for 2 to 3 ticks a pop? I do not know anyone who successfully does the latter, despite the many gurus teaching such methods. Now, the former on the other hand …

Cyn, Scalping for 2 or 3 ticks is beyond the realm of retail depending on commissions and just too hard IMO. I also believe scalping to mean 2 to 4 points on the ES. Capturing the bid and ask seems to be extremely hard work. I always seemed to over trade when I went into the session with mind set of scalping, trending days make it much easier. After analyzing my work, it appeared to me that most of my profits came from 25percent of my trading days. I would like to hear other opinions on the subject.

OK, here is my opinion. I started to make money trading (this would be technical trading) when I realize what all the TR teach is a nothing but nonsense. They teach you to trade white noise. I then developed my Holly Grails based on what real traders talked about. In fact when I tell people my HGs they are like that is nothing new and I say no none of it is new. But it requires you to accept reality of trading, which is quite different than the fantasy world the TR teach. And BTW they teach that nonsense for a reason. Sadly that is what a lot of folks want to hear, so that is what they tell them. These folks rather believe in pure fantasy where with a small account they will make a living off day trading.

As for scalping, it goes against my one of my HGs and that is cut your losers and let your winners run. No one and I mean on one knows when they take a trade if it will be a winner or loser. In fact some of the trades I think will do so well turn out to be the biggest losers. And most my trades are losers. I have a very low win rate, but most of my loser are small maybe 1/4 R or so, but I let my winners run and that is the hard part. If you can let your winners run they will overcome all the losers and then some.

What a great discussion on scalping. I agree with everyone. I also started to improve when I let my winners run which obviously happened when the market makes an extended move. It is so much harder to preach than to practice. Thanks for your responses.

Hi Mike, I’m surprised the bully-mob got so warmed up by my post but I’m used to it by now as you know. Jack Hershey and NoDoji had some interesting ideas on scalping, especially NoDoji’s use of 1 minute entries while using a highertime of 5 minutes for longterm trend, but the truth I was hinting at is that all scalpers were profitable only before HFT took over the markets and even then they were usually selling trading stuff as their primary income, even in the rare event that they were profitable at scalping prior to HFT’s now total dominance of the markets.

Completely useless info everyone already knew from elite .HFT made retail even worse no duh. It was discussed adnausem on bmt and even here in comments months back now regurgitated by gollumtroll. Even tophotdog Bburns back in the last decade would teach dual time frame. That used to be the fad of having a 5-15 min over a 1 to 3 min chart. like I said, ignore and have a nice laugh especially at the new posts in b__ks review.

I think it’s time we gave Pete a rest. Yes he went on too long about his losses with Brooks, but maybe he’s got it out of his system (in any case he lost the money, he’s got to live with that). As readers here, we need to respect all opinions and if you don’t like it, ignore it; if you do, go do some research, see if the person posting has it right.

But mostly we need to stop this disrespecting others who post here. There’s no quicker way for a website to become obsolete or unattractive than to keep putting posters down for commenting. If you do it to one, new viewers will think you can do it to anyone.

Allow Pete his opinion without putting him down as someone who doesn’t know anything. Maybe he does, maybe he learned from his disaster with Brooks. Maybe a new trader coming to this site may save some money from Pete’s experience. Let Pete be Pete. Rant almost over.

As to the higher time frame over lower issue, I do that and do it on all the markets I trade — multiple time frames — and for day trading. Simply put, the big fish eat the little fish, so you might want to know what’s above the time frame you are trading and what’s below the time frame of your trade. Both over and below represent roadblocks to your profit and even more, represent the large bus you didn’t see coming.

rtchoke, I agreed on every point you made. Most people get emotional when it comes to money, especially if duped. The regular posters are trying to keep the vendors honest and I appreciate that. My view of trading profits happens to be inline with reality now thanks to this blog and the contributors.

As far as multiple time frames, IMO you must go with the top down approach or be prepared to get run over.

Well when the troll stops taking guttysnipe potshots on singular posts against other members for being a sore loser in the commentary in months past especially using up to four different alter id’s to pathetically support himself pretending to be different people, then maybe it’s time to let the rest of the readership decide for themselves how much of a “better baboon” he’s become. Great pic post Cyn back then.

Like am I supposed to let it slide when smellypete instigated homo jokes which started this whole fracus and he didn’t dare do to Stray and the others who have said as bad or worse in response, and told me to eat read end waste slide when he continues to disrespect my posts subtlely even though they are many posts away physically? I can tell when he’s referring to me and my posts easily. And I am so sick of the alters he’s made up and used especially the dt-chump, dt-churnnos and all the rest of the crap ids to continue to take potshots. He won’t just give it up like a mad psycho.

Maybe your posts stand out, I would be flattered. I have noticed those screen names with an attempt to single you out. It’s crazy because I have only read your comments on the sham shows that are hurting regular people. Who would be upset with that except cons themselves?

Thanks MikeM, I’m glad I’m not the only one seeing it. When I was leaving to take a break about a month or so back, they tried knocking me on the way out, the baboon and one of the alters tried to insinuate I was going to start my own churn trading shamroom. Amazingly, those alters, dtchump, drchurnNO, showed up usually when the sniping is going on at me again . I am 99% sure (just like the shamshow percentage) they are all the same person. Even worse those alters can often be in support of the shilling just because I’m against it. I am guessing perhaps one of them was from the tradingfraternity shills probably the tradingfratboy vendor himself, but then the individual who has been hounding me even assumes the name when the shill quits probably because the tradingschools spotlight has moved on and they don’t bother anymore since it’s on another vendor. Anyways I was glad RobB finally caught on it was likely Pete acting as James&JamesII in his absurd playing around with the idea of starting his own churn room and asking how much should be charged, and even slammed me with another rear end insult when I defended RobB when James II called recommendation of a free web tool hypocritical and shllling. I would think it would be rational to not be so trusting of someone who uses or assumes alternate names on this blog as a tool to indirectly snipe, have it both ways of a viewpoint, and have done so for a long time. He used to be openly ridiculous and disgusting but finally quieted down when most of the active posters had enough of it, but now regularly uses alters to set the crude bait or alternately feign a new spotless persona. ( he used to be toto over half year ago)

Hey churn – did you ever consider that other people here really dislike you and your rants? Maybe you should becuz I am one of those people. And I am not Pete.

You add absolutely NOTHING to this site. And I will be here as long as you are. So you better get used to me.

Anyone who makes up an alias copying another person’s name and just constantly post insults is not exactly on sturdy grounds.

As for adding value, I cannot remember you ever making a post except to insult Dtchurn. Can you please show a link to the valuable post you added.

Lastly you showed up exactly when Pete and Dtchurn where battling so it is very believable you are Pete or associated with him.

nope, only you gollumpeet wearing the drchump stinky costume like a mad pscyho objects to my postings other than the shills. Because you’ve been proven wrong and a troll and won’t accept it. And your fake postings in the b__ks review talking to yourself. No one who knows your history is buying it, LOL.

rtchoke,

It is like Thrilla in Manila II. Personally when Pete or one of his alias start posting wacky stuff these days I just try and ignore it. I will respond if the post is somewhat rational.

But he did go over the top making up Dtchurn alias. Could you imagine what Trump would be doing if that happened to him. So maybe there is no peace to be made and like I said Thrilla in Manila II

I am not Pete, genius. Guess again.

There are literally no words to express my thoughts on your post, so I will just say I am sure Mike is just thrilled and jumping with joy with the advice and link you posted.

And in the back of my mind I hope to god your post like mine was sarcasm.

yeah, ignore gollum-troll try to play catchup with elite since we’ve mentioned it often and long ago. no proof shown there is as bad as the ecadorian beachforum. elite’s saving grace is it’s a far more open forum for both shills and angry wised up former dupes alike, so you actually hear some truthful posts on occasion. They finally moderated the cussing that was rampant years ago much of it not surprisingly spouted by the psycho vendors who live there.

Did I miss something? It seems like Pete was trying to help me satisfy some curiosity with scalping. I wasn’t around in the beginning for the back and forth, but I hope it stays civil.

Anyway, my experience with scalping, very small profit for too much effort. I still get duped into believing the guys that make money in futures on a daily basis are scalpers, maybe not the guys that just capture the spread, but the scalpers for larger profit. I would read something and then convince myself this is why I’m not profitable everyday. I know that to be mostly fantasy now. Just wanted to read Emmett’s stated strategy.

No problem. I will write about scalping strategies. That’s easy.

Scalping strategies are all about capturing the bid/ask spread. Nothing more.

I remember back in 2008, I executed 3600 single round turns in the YM. I made a profit. But the biggest profit went to the broker. I remember thinking to myself–wow that was stressful and time-consuming. At times, it was a lot of fun. But other times, it just consumed me.

Oh geez, this is bringing back memories…another scalping strategy I executed on the EuroStoxx 50. So many thousands of trades, so little profit. And trading at midnight. Scalping is emotionally and physically taxing.

I started to believe in Jigsaw and No BS Day Trading to be the answer to smooth out my equity curve. These guys state that the top producers at prop shops are dom scalpers. Now I never bought anything from them so I can not comment on their products, but I just couldn’t find any value in order flow only scalping. I did learn some decent tips on improving my entry with the dom, but I remain so curious on the validity of their products. I would love to know if anyone knows about anyone that has been profitable on a regular basis with order flow only. It didn’t work for me, but maybe there are some. I know you guys are going to tell me it doesn’t work, but I was so convinced. If it didn’t work for then that’s all that matters.

I hear you MikeM. Yes, that was the story repeated over and over about jigsaw how supposedly “pros” use an extended dom. I tried for a while with Gomi’s orderflow tools and for a while with the free version of market delta. Also “privatebankers” ideas mentioned in another comment. I could never get to a convincing edge scalping for small ticks looking at bid ask “ladders” on each 1-5min bar. I know some people claim to be able to do it. There was a guy who I pm’d who claimed he could even detect an orderflow edge on the bare ninja tape. But I was left wondering who to believe and why there was never proof any vendor who specialized in orderflow. I gave it up and now just watching how the price bars develop is kind of my adhoc idea of “flow” now.

“No problem. I will write about scalping strategies. That’s easy.” – that would be a nice topic Emmett , looking forward to it & discussions(comments) around it.

As much as I love SW, I also see glitches all the time. You can test it to death and still get unexpected problems in the real world. I can not imagine letting some computer trade my saving. How about if something unexpected happens like a flash crash that sends the program into some unexpected loop where it just buys and sells in a manner you never expected.

But I do agree the only way this strategy makes any sense is for it to be on autopilot.

Well said. I’ve found forward testing the real make or break testing that proves if a strategy can actually make headway. Much of the time the platform’s “backtesting” framework has significant flaws one of which is failing to account for slippage accurately. The new strategy by Emmett in this article look interesting as I’d never thought to use VIX or even the OVX before. I’ll think about coding it for NT sometimes maybe just to see how it does. I’d think it would be tough to actually follow and forward trial it year after year with a low win % and having many days without trades. I was under the impression most firms that use trading algos at least have a staff member watching the trading. For myself, I would also never feel comfortable letting a program auto-trade funds I couldn’t afford to lose. Agreed it’s impressive Emmett that you’ve come up with this without a stem degree or background.

One thing about RobB that should be realized by the readership here is that we’re lucky to have him calling out the shills as well as his background as an engineer. I did catch the comment many months ago where your daughter graduated from an engineering university so belated but deserved congrats and I’d been wondering if I should ever comment about it. I think it helps prove how ridiculous that any troll could ever call RobB a shill. I remember some months back where a shill was proclaiming he was an engineer promoting one of the vendor shams and RobB shut him up as he was a non-shill engineer which I found satisfyingly foolish of the tech shill. Too many degreed vendors , and even plastic mutilator doctors had turned to the dark side not to mention Handley, so this snakeoil disease of sham has affected so many no matter the background. Indeed it’s disgusting to see a lost “family” sham business like the Busbys pass on generational sham or young adults go into sham traducation business incredibly believing it’s “legit” such as InfiniteProsperity or tradingfratboy. It was sad to hear about the firefighter friend dreaming he could quit his job and follow Ross of WarriorTrading and thought trading was better for his son than college. So the trolls should shut up about RobB being a shill as it’s already proved he and his family are nowhere near shilling a scam for a family business.