Clueless8 Trading

-

Honesty

(4)

-

Quality

(1.5)

-

Cost

(1.5)

-

Support

(2)

-

Verified Trades

(1)

-

User Experience

(1.5)

Summary

A stock day and swing trading service about as enticing as a lukewarm jacuzzi. No official track record of trades. Owner refuses to disclose personal trading performance. However, the owner is not a bullshit con artist claiming to something he is not. Owner of company can probably trade successfully, but to what degree is as mysterious as a big foot sighting. Trading recommendations about as useful as using Egyptian hieroglyphs on a job application. Owner of company needs to improve the service by being more precise with trading recommendations. More transparency required.

User Review

( votes)Thanks for reading today’s review of Clueless8.com

What is Clueless8.com? Cluesless8 is a day and swing trading informational website that is selling a quasi advisory, informational type trading service without specific entry and exit of trades. The company is offering a silver, gold, and platinum trading service that ranges in price from $40 to $80 each month. The $40 a month plan allows a viewer to simply read the blog and watch daily and end of week video’s. The gold package at $60 per month also includes a private, live twitter feed as well as live chat, and a long term basket of stocks that the company likes. The platinum package at $80 per month also includes a 1/2 hour phone session with Clueless8 and a weekly webinar.

There is no official track record of trades for the Clueless8.com trading service.

Clueless8 can be found on several social media channels including (as of 02/16/2016): Twitter (122 followers), StockTwits (21,000 followers), Facebook (118 likes), And YouTube (105 subscribers) with a little over 100 videos.

A review of Archive.Org and domain name registry shows that the website has been active for about 1.5 years.

During the past 6 months, I have received approximately 6 requests to review the Clueless8 trading service. Typically, I do not initiate a review unless I get a dozen requests. There are quite literally thousands of people with hastily thrown together day trading websites, located all over the planet, all offering stock, futures, and forex trading advice. They all want money to learn some sort of secret. Why did I jump on the Clueless8 review with only a few requests? A reader sent me a private message with a very detailed story of their individual experience. It was not a good story. However, everyday I receive a boatload of complaints about various vendors, so I do not take any negative email as a confirmation as to whether a trading service is good or poor. In fact, several months ago I received a review request on B12Trader.com and the reader was absolutely positive that the vendor was a scam. He was not. He turned out to be a very good trader running an excellent service. With this in mind, lets jump into the particulars of Clueless8.com.

Clueless8.com is owned and operated by person named FrankR. The information was pulled from the Clueless8 Linkedin page. The last name of Frank is never revealed on any social media or on the companies website. With the commercial grade sleuthing tools that I employ, I was actually able to identify the person, however they wish to remain anonymous and I will honor this. However, I can confirm that FrankR is a graduate of Boston University and aged approximately mid 50’s.

Trial Membership

During the first week of February, I signed up for the trial membership. The very first thing I look for is a track record of trades that the moderator has called with the advisory. Often, this is where you can immediately spot the fraud. Many vendors will claim that they consistently earn $50k each month, with no losing months, and you can watch them trade and learn the secrets for only $89 a month. Of course, if you read my reviews, the vast majority of these guys are full of horse manure. With Clueless8, you will not find any such horse manure. Rather, all of the trading recommendations are posted on the private Twitter feed.

Next, I spent approximately 3 hours watching various YouTube videos of Frank talking about the markets. At no time does Frank talk about his amazing profits, the red Ferrari that he just purchased with his trading profits, or the newest bikini model that he is dating. Unlike this bozo. Rather, I did find the YouTube video’s mildly useful and entertaining. To the newbie trader, I am sure that they could find some value here, for free.

After observing various YouTube video’s, I next spent a good deal of time reviewing the StockTwits page. The StockTwits page is filled with different charts, indicator overlays, and general commentary on what Frank believes is happening in the market. Nothing fancy here. However, I did notice a good deal of overlap between the StockTwits page and the private Twitter channel. On the StockTwits page, you will not find Frank boasting about the latest massive profits that he earned buying some obscure penny stock company that manufactures reusable condoms or the color of his newest mega yacht.

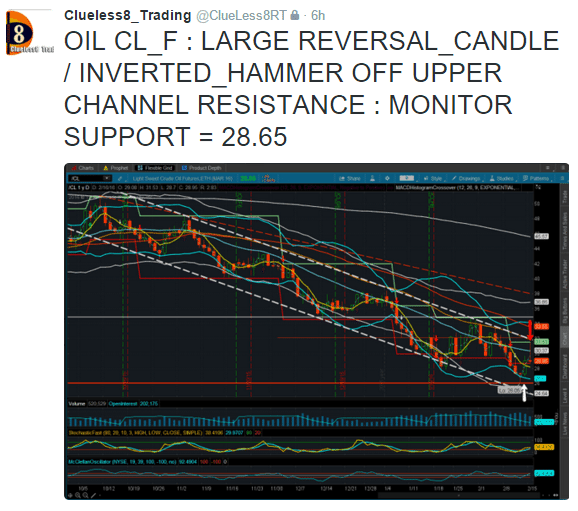

One of the things that you will not find with Frank and his Clueless8 trading service is specific trading recommendations. There is no “buy here, sell there” type of stock picking. Rather, the twitter feed contains, what I describe as chunks and pieces of information that you may or may not find useful. For instance, the following is a private Twitter alert that says, “OIL: Large Reversal Candle, inverted hammer off resistance, monitor support.

twitter feed contains, what I describe as chunks and pieces of information that you may or may not find useful. For instance, the following is a private Twitter alert that says, “OIL: Large Reversal Candle, inverted hammer off resistance, monitor support.

Honestly, I am not too sure exactly what he is saying in this truncated Twitter romp. I believe he is saying that oil is going down. But perhaps he is looking for a long side entry? The truth is that I had a hard time figuring out exactly what he is trying to convey in the vast majority of the trading alerts. There are no attempts by Frank to deceive or confuse, however the lack of clear instruction I found to be annoying.

For me, I like very specific set ups. Perhaps he could of said, “Sell oil at 31.50 with a price target of 28.65 and a protective stop at 33”. As traders, we need to be exact else we get our heads handed to us. I can only imagine the poor guy that perhaps took Frank’s advise of this trade and then oil rallied $5 on a rumor of a supply cut. And so Frank, if you are reading this, maybe you now know why I got a few bad messages about you. The lack of preciseness in your trading calls is where the Devil lays his trap and burns your subscribers.

With all of this information and research in hand, I next reached out to Frank and revealed that I was going to be writing a review about his trading service. I sent him an email that detailed my concerns and requested that he call me immediately. Nobody likes getting my emails, they are accusatory, snarky, often nasty, and full of little threats that if I don’t get full disclosure then a negative review will be released. Frank called me pretty quick, which is a good sign.

Speaking with Frank over the phone

For the next 30 minutes, I spoke with Frank over the telephone. He very much has an New Yorker’s attitude and was really annoyed that anyone would criticize his trading service. Frank is definitely not used to being critiqued, and boy did I give him my usual mud stomp, where I lay out the long list of what I perceive to be gaping holes in his trading service. Of course, my biggest complaint is that there is no official track record for calls made inside of the private twitter feed. The calls are all highly subjective and as I told Frank, as about as useful a carnival palm reader. He didnt like that analogy and so we go round and round and I do my best to coerce him into releasing his personal trading performance. I explain that his personal trading performance can be used as baseline to determine if his methods are valid or BS. Whom would want to spend the time and resources learning a method from a person teaching a method that they cannot make work for themselves? As hard as I tried to get Frank to release personal trading performance, he simply refuses.

Many times, the vendor will make a blanket statement that they earn XYZ dollars each year from their trading. But Frank simply wouldn’t budge. I explained that this guaranteed a poor review, but he stood firm. He explained that he did not want to be boxed into a situation with subscribers need to have their hand held at every interval of the trade. They can take the information that he is offering and do with it as they pleased. If that was not good enough for me, then he was prepared to receive a bad review.

At this point, I usually start bashing the vendor. However, with Frank I have to actually give him some credit here. He is not a liar and he is not dishonest. He is simply only willing to give, what I consider to be of marginal value while he considers it to be of high value. Does Frank trade successfully? Who knows! Would I subscribe to such a service? Heck no. I prefer my trading advisories to have a verifiable track record like B12Trader.com, where he is willing to show brokerage account statements.

Wrapping Things Up

Frank, you are going to read this review and you are going to think it really sucks ass. And that is OK because in my opinion, your unwillingness to keep a track record of trades or disclose any personal trading information really sucks ass. So we are going to just disagree on this. However, in speaking with you over the telephone, I do sense that you are probably successful at trading, at least to some degree. And you are clearly not a dishonest individual looking to scam people for a few bucks each month. I would love if you would bring more clarity and disclosure to the trading community. It would be a massive leap if you would start to be more clear on your trading recommendations. Include specific set ups that give the newbie more guidance. Your current method of tossing out ideas is actually hurting people because some are getting stuck in trades and not sure when to exit. Think about this just a moment, someone takes your set up and then the trade moves against them. They are getting no guidance from you on when to exit, and then they start emailing me and complaining. Hopefully you take this as constructive criticism and made some changes. When this happens, I will be back to write a new review. Hopefully the next review will actually endorse your trading service. However, at this time, I have to recommend that readers avoid.

Thanks for reading today’s review. Please do not forget to leave your questions and comments below. And where are my haters? Miss my haters.

Acting Attorney General Matthew J. Platkin today announced that the New Jersey Bureau of Securities (“the Bureau”) issued a civil Summary Penalty and Cease and Desist Order against Fida Frank Rahman a/k/a Frank Rahman, ClueLess8 Trading, and FAS Holdings, LLC for the offer and sale of $130,000 of unregistered securities, and misuse of investors’ funds.

The Bureau found that Rahman preyed upon aspiring investors by cultivating relationships with them through operation of his “ClueLess8” website and online trading school, which sold memberships for information on different trading strategies.

Specifically, once gaining the trust of investors:

Rahman solicited them to allow him to trade securities with their money;

Rahman promised each investor that he would return their investment capital within one year, along with a substantial return on their investments; and

Rahman illegally sold unregistered securities, acted as an agent without being registered, and engaged in other acts constituting securities fraud.

Read more:

https://www.njoag.gov/nj-bureau-of-securities-assesses-450000-penalty-against-hudson-county-website-operator-for-defrauding-investors/

I found out from someone who was former member that he’s under investigation by the New Jersey Bureau of Securities. Be careful out their, so many people in this field take advantage of new and experienced traders.

I recently was a member of this guy’s service for a few months and I’ll have to say I was really not impressed. I thought his attitude at first was a bit funny, but after a while I saw the guy for what he really was, a total a-hole who probably runs his service to toot his horn nonstop about how great of a trader he is, and how right he always is.

Granted, he made some trades that hit it big, and others that went absolutely nowhere. Let’s just say his service is the worst possible service you can sign up for if you’re a beginner. His strategy is very high risk, mostly buying a lot of way out of the money options and hoping for the home run. I’ve had days following him where my portfolio would grow or shrink by 20% in a single day.

He constantly pushes his ACS courses and they are a total ripoff. You pay $270 to be told basic things like what a bull flag is, and occasionally hearing him rant about China, Trump, and calling his subscribers a bunch of fucking stupid idiots for not following 100% of his trades. He offered me a 50% discount for an ACS course, but beware, I’ve never received that still to this day. I was willing to overlook it since I thought he was a decent guy and I made my money back anyway.

On his Twitter feed, he’ll nonstop post about all the big wins he made, but all of his losers are never to be mentioned again. I had some of my best days following his moves, but by far my worst as well. One day he made about 12 calls on his twitter page and 11 of them were big losers. His advice was to dollar cost average if the option prices decrease in value, and a bunch of those were positions I dollar cost averaged all the way to zero. I never believed in dollar cost averaging but assumed he knew what he was talking about, so I followed blindly and paid huge for it. Of course I know better than to do that now, but I was an options newbie blindly following his ‘expert’ opinion.

One huge weakness of his service is he never mentions what a good exit criteria is for his trades, unless they’re big winners. He’ll post those on his twitter page that he sold for a huge gain, but will never mention what he does with any of his losing trades. His answer to trades that go against you is to DCA, but sometimes you may just be throwing extra money into a black hole.

Of course, this kind of trading is really nerve racking if you’re still new to the game, so I took a break from it. Mostly to get educated (signed up for another service based around education and not trade alerts) and avoid the mistakes that were made. Even though I was no longer on his service, we stayed friends for a little while.

One day, I was thinking of rejoining the service and I hit him up, but he was super disrespectful. I thought we could chat as buddies and I told him I reworked my trading system to manage risk and emotions, and he was like “Why the fuck do I care? I make $4000 every day!”. At this point, I got tired of the bullshit and asked him where my 50% discount was, because I was still waiting for it.

He immediately flipped out at me saying to never judge his character, and that “Real traders don’t ask for welfare / handouts”. I told him that HE was the one who offered me the discount, and I didn’t ask him for shit. I thought as a reputable business owner, the guy would stick true to his word. He then said he only offered me a discount cause I was poor and not a baller like his other members (which is NOT the case, i know a few of his members who went broke following his trades lol).

He asked for my # so he could call me, but knowing him, I knew he just wanted to get on the horn to curse me out, and that’s exactly what happened.

I will say though, it wasn’t a total waste of money, I learned a lot through his service. Unfortunately a lot of it was learning what NOT to do, especially from a risk management perspective. Following this guy’s moves like I said, could get you either a huge payday, or seeing your net worth disappear by 40% in a day.

His service is probably more geared to someone who wants to adopt a high risk strategy, but I wouldn’t recommend anyone new to options trading to follow this guy. You have to be comfortable swinging for the fences and possibly losing everything, since this guy’s strategy is based almost purely on buying way OTM calls for cheap and hoping for the home run

I’ve been a member of Clueless8 Trading and I took a five figure account with Frank’s real time alerts and turned it into over a 6-figure account with his service. Frank’s service is not for the novice. He believes in $ cost avg. and his predictions on where stocks and indexes are moving are right about 90% of the time. Did I have losing trades based on his recommendations, hell yes I did. It’s trading, but the winners I had made up for the losses. I consistently had options that went up 300-500% on avg.

Frank is a grade A scam artist, i spoke to him several times. He is an excellent verbal manipulator, he makes up lots of stories of grandeur from his lineage and family. I don’t believe any of it is true.

The truth is that he operates a martingale system using weekly options on various stocks/etfs at support and resistance levels. He does not understand options or the risk of what is he doing, I realized I was paying an amateur who has no risk control. I am fairly confident that this guy isn’t making money…

Ironically trading with him was the best thing that happened to me, i learned what not to do and got an eye opener on just how rotten this industry is. This guy intentionally sells you on dreams of grandeur but listen to him at your own peril. Hope he gets banned from stocktwits and his site gets shut down.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

The guy is an idiot. His trades sucked.

You forgot to mention that the owner is banned from trading, that he has 5 open lawsuits against him for aggressive trading.

How do you know this?

Another fun “meh”-like cat pic. http://s44.photobucket.com/user/fmrdubflava/media/Kelly/Dunce_Cat.jpg.html ; maybe it can be used for another title pic review.

In response to the comments that real traders do not run trading rooms. From what I read it is not just trading rooms but also prop firms and etc. Most traders leave prop firms after a few months with heavy losses and from what I can gather most prop firms make their money off commissions not profitable traders. Here is an older article that I think is interesting (and day trading was easier back then)

http://www.businessinsider.com/henry-blodget-heres-what-day-traders-dont-get-2010-3

If anyone knows how to get the real stats from prop firms I would love to see them. One way to bring some light to the actual stats is if Emmett could get Top Step to share their stats. I personally believe TS makes their money through fees and commissions, not off profitable traders. I would like to see the following stats.

1) What percentage of traders taking the test get funded,

2) What percentage of those traders last 1 year, and

3) Detailed stats on the surviving traders performance.

But of course If I am right about TS, then they would be foolish to provide any real information. As that might put them out of business. Apparently in this industry truth being knows is not a good thing.

Such information won’t be ever published. It’d be a sad reading.

Thanks for your comments on this web btw.

Rob B,

Much appreciate your comments! We’ve had the opportunity to converse in past, and you are always to point with insight that set the stage with a dose of reality and honesty. I read all the great books way back when, starting with Trading for a Living by the Dr himself. The more I read, the more I deluded myself that I can actually trade for a living. It’s been 5 years, it cannot be done. I did not have any grandiose goals, I simply wanted to proof to myself that I can “average” 200 bucks a week over 6 months, and slowly work that number up to about 300-400 bucks a week, again “AVERAGE PER WEEK” over let’s say 1 year. The only good thing is I have not blown my account “yet”.

The Bullshit on Wallstreet review really hit home for me. Kunal seemed to have integrity, I totally get he needs to promote the biz, and like the “insider”, the straw that broke the camel’s back was the revelation of Kunal’s 2015 trading “PALTRY” profits. I truly was considering signing up for the BWS training, thinking to get that missing link in how to do it!

Anyways, sorry about the rant,…Emmet, keep up the good work!

Peace out

P.S. your dialogue with Jason over at “Bills Trading Room” is GOLDEN! 🙂

and my real name is not Yogikeung,..and yes I can offer “proof”, LOL

Thanks, not use to anyone here posting anything nice to me.

I will expand upon my view of day trading. And to the vendors and shill posters out there remember this is my view so take it or leave it and keep the hate mail down.

The way I day trade is like 180 degrees the opposite of what most day trading rooms teach. And I am not bragging that I came up with my way of trading. I trade the way the truly great traders said they trade. To me the day trading rooms are just try to sell a system of trading to underfunded investors that IMO is just nonsense. And I am still looking for any proof anyone can do it profitably.

There was a period when the markets were very volatile and lots of people made a killing in day trading. Right now the volatility is way down and it is very hard to day trade. But worst these scam operators have to sell something so they teach IMO absolute crap.

So here is what most of the trading room operators teach .vs the way I trade.

Trading Room Operators and Vendors Teachings:

1) You can have no or few losing days,

2) You can have no or small draw downs,

3) You will have essentially a straight up equity curve,

4) You will have a high win rate,

5) You can trade a highly leverage instrument like futures with a small account,

6) You will be able to get paid regularly like a salary,

7) You can come in every single day and take 20 micro scalp trades in an instrument like CL for 4 ticks,

8) You do not need to be properly funded and can just set the exact same arbitrary targets and stop losses for every single trade such as 4 tick target with an 8 tick stop loss.

And I am sure I am forgetting many of their other promises such as the jet style lifestyle.

And here is the way I trade:

1) No instrument is tradeable every single day. I spend around 1.5 hours looking through tons of various instruments to find one that is out of balance, the anomaly, that I think is tradeable that day,

2) I am properly funded and trade the actual market structure which means holding a proper stop loss and my stop loss is different for every single trade. In fact every thing I do is based on the actual market structure,

3) I cut my losers as all the great traders say to do,

4) I add to my winners as all the great traders say to do,

5) And I let me winners run as all the great traders say to do,

6) I only risk an extremely small amount of my account per trade otherwise I would blow my account or the draw downs would be so large I would not be able to hit the buy/sell button for the next trade.

And guess what I get lots of losing days and long periods of drawdowns and worst of all my return are horrible compared to what the trading rooms promise. The funny thing is any hedge fund manager would do cartwheels to get my return. But in the fantasy day trading world you are suppose to do 100% plus returns year after year. So bottom line; no one is going to be buying my book.

No one has to trade my way or believe a word I say. I just say if you are going to buy an educational package or trading software from someone get actual proof that person can trade profitable. That is the best advice I can give.

I think Emmitt writes extremely well although the subject matter in this review leaves a lot to be desired. My first response was who cares about this fly on the wall operation, that touts stocks? I’d venture out on a limb that most of the readers here are more interested in Futures trade room calling vendors.

Hi Emmet,

Please consider me as your hater. I am finding your reviews to be boring. Needless to say, this is not your fault; clearly, the trading industry has nothing else to offer, but scammers and Ferrari Top Gun Acrobats, like that guy from “F” Alerts. I posted the fact that I am not able to trade for a living a while back, and that just because I am not able to, it does not mean nobody else can.

I am going to stand my ground and say nobody can trade for a living. Each day, I look forward to bringing up your site to find a review of an actual trader that can make a living from trading. Each day, I find the usual boring reviews of “scammers”.

Putting aside your value added to the community,…your stuff is getting “BORING”! Please, with all my heart, give me something. Please publish a review of an actual trader paying all his/her bills with trading profits. There will be many that will come on and say they are currently not working and get all their income from dividend payouts, real estate income, along with a well-diversified portfolio, and trading newsletters/advisories, blah, blah , blah,…I am not interested in those smart folks. I am looking to hear from folks that trade each day to pay their bill, and if they do not trade and make profits that month, they will not be able to pay their bills. I look forward to others comments, but please, let’s keep this simple and stay on topic. Can anyone pay their monthly bills from a trading account of let’s say $50,000? Please feel free to move that account size to $100,000, and please try to stay away from “depends on your standard of living”. Let’s put it this way, I have a full time job, I pay my bills from this job. Can a trader pay their bills using this same context.

OK! Emmett, your stuff is not that boring, your reviews are done elegantly in fact,…but, you know what I’m after.

Yogikeung,

I am hesitant to respond as I am sure I will get flack. But being no one else has responded I will. First, I must say; “Yogikeung”; cool name!!

I got to tell you I think you are asking for a lot. I will give you my opinion for what it is worth. You can take it or ignore it or call me names (You can Donald Trump me LOL).

I want to set parameters based on your post. Let me know if I am in error. You are looking for a trader making a living trading with a $50K – $100K account. First I think it is important to set the parameters for this trader.

First, this person is not living in his parent’s basement eating their food, he is not living off his wife’s income, and he has no other source of income for the draw down periods.

Second, this person is paying all his monthly bills purely off his day trading profits including housing, car expenses, medical insurance and bill, clothing, utilities, taxes and he has to make extra money to increase his account in order to keep up with inflation.

So this trader not only has to make around 100% return year after year to be able to pay for these expenses, but he has to do it with very little draw downs in order to be able to pay his monthly bills. IMO, you will find 99% of day traders have some other source of income.

The other thing Emmett needs to find is someone that can do this 100% return year after year (not for 1 week or 3 months) with little draw downs, otherwise how would they be able to pay their monthly bills. And you are looking for real proof of they can do this. I assume you are not looking for Dean Handley Trading Titans scam that he claims make $50K a year, but no one else can duplicate these claims. (I am being nice here as the Trading Titans is beyond scam, but I will not get into that here).

I want to point out the ability to do this type of return over a long period is critical. I know people who joined that collective 2 and right after they joined the trader they are following starts to lose money. Don’t think it happens; join and find out for yourself.

IMO most people are suckered out of their money believing this person exits without ever asking for proof. You are asking for proof, so you clearly are not one of those suckers.

Now here is my opinion.

Just like someone lucks out and wins the power ball someone will luck out and turn a small account into a large account but the odds IMO are 1 in a million. I am assuming that is not what you are looking for.

In my opinion. Yes I think it is possible under the right market conditions when you are firing on all cylinders to do exactly what you are looking for on any given year, but that IMO that is a rare year, not typical. For example the end of last years quarter I was nailing it and was Superman and then in Jan. nothing I did worked and went into draw down. BTW that is how real trading works in my experience.

All I can say is I think you have a better chance of finding Big Foot, but if Emmett finds this mysterious trader, I will be the 1st to join his room along with about a 1000 other people.

And I will give my personal experience. Take it for what it is worth. I find no one investment method works all the time and I find my diversified investments balance each other out. So during periods when my method of day trading is just not working (Yes I have draw downs) my swing trading is working and balances out things and visa versa.

So Emmett where is the amazing trader nailing it every day?? I am ready to sign up!!

http://screencast.com/t/wzXoG09t

Yogikeung,

Real traders don’t run trading rooms full of noobs!

Thanks Yogi! Haha!

When I started this project, over a year ago, I honestly felt that I would of found many more profitable trading rooms and verifiable trading educators. Boy was I wrong. Its been really frustrating. But I have many, many more to write about, so onward I go.

Thanks for continue to read. I know that there is so much negativity to consume. I wears on my soul. Humans can be so horrible to each other.

I sent you can email Emmett. There was a website I’ve heard is doing pretty well. A couple people I’ve talked to say they are winning more than losing. I didn’t post the name here, because I don’t want people thinking it is endorsed or anything. I haven’t used the site, just heard it has done well overall in the short time it has been opened.

On this one, I took one look at the chart in the pic above and knew the person was either just guessing or a fraud. It isn’t that you can’t have a crowded chart, but that chart doesn’t look like it was well thought out at all. If you don’t why you have something on your chart and what it is telling you, you have a bad chart.

Yes, there are definitely people who trade and make a living doing it full time, don’t let Butthurt Rob B convince you otherwise, you have to remember that these services don’t sum up all traders, I personally know traders who earn their living trading and have no desire to ever start any service, they make more then enough trading without the headaches and social media smear that follows by failed traders.

People takes Rob B’s (and mine) comments way too seriously. He loves to be snarky and cynical. His comments are really just condensed versions of my reviews. People should not take comments so seriously, its just a place to vent, rant, laugh, and say whatever comes to mind. Keep this in mind before you get into a back and forth with a bridge troll.

And yes, very often the vendor comes on and post his own positive comments. I see the IP addresses coming from the same people. But I always let them pass. Eventually the truth always bubbles to the surface, no matter how much a vendor stuffs fake positive comments.

LG, I want to be clear I never said no one can day trade profitable. What I have said IMO the unrealistic fantasy results promoted by 99% of the trading room operators and vendor is just that a fantasy. From what I have seen their goal is simple to sucker underfunded investors into believing trading futures with a small account is easy. And many posters here have an ulterior motive to promote that fantasy such as running a trading room or selling trading products. The fantasy being promoted varies such as no losing days, no draw downs, the capability to make a regular salary like clockwork from day trading, making a living day trading futures with a small account and so forth.

Apparently you know tons of traders doing it. But you were unclear on providing any details about those traders such as their account size, their win rate, their draw downs, the return they are making and is day trading their only source of income and so forth. All these factors make a big difference. I am pretty good with money and understanding realistic returns. I hear a lot of talk but this Butthurt (BTW I am so out of touch I had to look this word up LOL) is still waiting to see anyone show proof of being able to do it. And I know a lot of traders. I still say it will be easier to find a needle in a very large haystack.

Emmett begs these folks just to be able to show 3 months of profitability and they cannot even do that. That should speak volumes to you.

If you have ever read my posts I have stated I day trade profitable. The difference is I admit I have lots of losing day and draw down periods that can last months and I cannot achieve those amazing returns without also risking blowing my account. I have even talked about my expected returns, which I am sure would disappoint you, but I will even disappoint you more. You know what my real return goal is. I want to beat investment grade bond returns, otherwise I should just be investing in bonds with little to no risk. I have a feeling you will not understand that statement, but other real investors will.

Like I said I hear lots of people talk about making the fantasy returns, I just never seen anyone do it. And I still wait for Emmett to find that amazing trader so I too can join his/her room. Come on Emmett find that person so I can buy my Lamborghini and sell that piece of crap I currently drive.

Can anyone pay their monthly bills from a trading account of let’s say $50,000? Please feel free to move that account size to $100,000, and please try to stay away from “depends on your standard of living”.

This isn’t a realistic question. Can someone pay their bills with a $50k account? in theory, sure. The reality is simply not there. What moron that can trade would always stay on $50k, or $100k, etc. I started with less than $50k once upon a time. I pay my bills off the market. I don’t do it trading off $50k.

Can you make a living off trading using $50K as starting capital? put that way, the answer is yes. Will it happen the first month of trading? no.

If you can trade and start with 50k, it might take you 2-5 years to build to an amount that would more than provide a great living. Trading isn’t supposed to provide normal returns, but abnormally high returns when successful. However, you aren’t likely to cram millions and millions of dollars into a stock pick like you could buy and hold. It does tend to have its limits depending on too many factors to list.

If you could make 50% a year, you could turn $50k into a nice sum of money in 4-5 years, then you could live off profits. Still wouldn’t be comfortable enough for me personally, but in theory its enough. 50% isn’t some crazy figure. I can make well over that off such a small sum of money. However, the larger the account, the harder the % growth. I would rather make 20% on $5 million than be cool and make 200% on $50k, so why would I go back to trade a tiny sum of money. People move on if they’re good, so you’re not going to find a legit person trading $50k on the internet year after year making a living on trading profits.

If you had a $1 million account, it’s a different story. You can build that $50k into a million, it will depend on how good of a trader you are as to how long it takes. It isn’t likely to happen in a year, likely not even 3-5 years for almost everyone (people have done it, but rarely), but probably 5+ years to take conservative risks and do a safer job of trading. You want to gamble on high risk stuff, I guess you could get lucky and make a bunch quickly, but likely you’re a terrible trader and will lose it all back quickly too. There are people out there that could turn the $50k into a lot of money in a year or two (not many and none selling stuff on the internet), but once they’ve done it they have zero incentive to go back and do it again since they can make more with their new bankrolls.

The problem is simple. No one wants to pay me $5k for a 10 year plan to trade. People on these websites are as greedy as the con artists. You want to rip me off by being able to give me a few hundred dollars to show you how to turn a thousand into a million in a couple years. That is such a stupid bargain for my side of the deal it is stunning how many people fall for it constantly. Obviously, I’m not going to sell you something for $1k that will make you $1k per week off $50k. I get 1 week for my time and effort and you get that much every week for life? To expect something like that makes the buyer as greedy as the seller. The only difference is the seller is preying on your greed and lack of common sense.

I’ve often wondered something else. There has to be a limit to any trading strategy. I don’t need 1,000 people suddenly trying to buy 10-100 contracts of ES at my price. I don’t need someone figuring out there are now 20k-50k contracts going in at this price and likely that stop and they might be able to squeeze the position. I personally have no idea how big is too big, but there has to be a limit to where even successful systems fall apart for becoming too successful.

Hello David R,

Your response is appreciated. I have to admit, most of what you said went above my head,and your answer is very comprehensive. If I read your post correctly, you are basically saying, “yes” you can trade for a living with starting capital of $50,000. The amount of money gained by “wins” exceeds the amount of money lost by “losers”, hence, positive expectancy, enough to pay bills!, and then ultimately, overtime, the $50,000 grows to a much larger sum with 50% return per year (I think this is what you alluded to?),…anyways, thanks for the response!

Emmett, any chance you will consider setting up a forum, nothing too complicated, perhaps a simple “Who can trade for a living” thread??

I would love to hear more of people like DavidR!

Peace

Lol. Good pic of the bored “meh” kitten. Another pic that was a good laugh was the carnival potshots booth for tradershelpdesk finally exposing that scam of worthless yearly increasing priced indicators.

It would be a hoot if all your tradereview icons were displayed as a mural where bypassers could see as an attraction on las vegas blvd!

thats funny as hell love the verbage there all fking phonies, thanks for the review

2 stars for someone that shows a channel and an inverted hammer bar. Man this industry is in sad shape. A picture is worth a thousand words and I could not say it better.

http://screencast.com/t/4koKFW9Th

Thanks for the laugh, Rob.

“where are my haters? Miss my haters.” Let me help you out Emmett – I don’t want to talk to you no more, you empty-headed animal food trough wiper! I fart in your general direction! Your mother was a hamster and your father smelt of elderberries! Hope that the words of Monty Python make you feel better.

Finally some love.

Stray Dog, the best, man. You ought to copyright that. It’s way better than the real hater stuff I see on most sites. You have a real way with words.