Axia Futures

-

Honesty

(5)

-

Quality

(5)

-

Cost

(4.5)

-

Support

(5)

-

Verified Trades

(4)

-

Prop Trading Opportunity

(3.5)

Summary

In 2017, TradingSchools.Org published a negative and scathing review of Axia Futures. We got it wrong.

This updated review describes in exact detail how badly I misinterpreted Axia Futures.

Axia Futures, a London based Prop Trading organization presents a compelling argument and is offering a high-value opportunity. In particular, the company gives traders the opportunity to interact with 100% verified futures traders that are currently earning a full-time income at trading. You will not find any posers or fakers congregating at Axia Futures.

TradingSchools.Org interviewed several individuals and financial institutions that verify the veracity of their unique proposition as well as their financial and regulatory requirements.

I would like to issue a public apology to Axia Futures for any reputational harm that my original review caused.

Furthermore, I would like to personally thank Demetris Mavrommatis for spending an entire week with TradingSchools.Org that included many hours of live trading, a telling of his compelling personal story, and his patience and gracious attitude towards such a vocal critic.

Thanks for reading today’s updated review of Axia Futures

On August 8, 2017, TradingSchools.Org published a highly negative review of Axia Futures. You can read the original review here.

In particular, I gave Axia Futures a single star rating for Honesty, Support, and Verified Trades. Let me explain why. Axia Futures is offering an 8-week educational program that is quite expensive at $5,000 as well as a live trading room priced at $100 per month.

The trading room was moderated by Brannigan Barret, and while I found the live trading room quite entertaining, my direct questions regarding trader performance were ignored.

In particular, I wanted to know if Brannigan was actually trading or just talking about trading. My experience reviewing live trading rooms has turned me into a grizzled old troll that believes nearly nothing. I need undeniable, verifiable proof. And I hate shiny objects meant to distract my attention away from the ugliness in which I naturally seek.

Inside the ‘shiny’ house of Axia Futures

Axia Futures is quite ‘shiny’. They have a fancy office in Lond0n, with banks of computer monitors all whizzing and blinking with fancy colored lights. There are professional looking people all milling about and clicking their mouses, doing whatever they appeared to be doing. The impression was that the environment is somehow exciting and created from the imagination of a Hollywood film producer–tasked with the job of creating the ‘image’ of a successful Prop Trading Firm.

Axia Futures has all of the sizzle that one can possibly imagine. Everything is top tier and classy. All of the latest technology is on full display. Whiteboard computer boards where supposedly smart looking persons are pointing at price ladders and using exaggerated hand signals while pointing at ‘FED MEETING BEWARE’ on the whiteboard.

It all looked so well scripted. Too good to be true. Like if a beautiful woman were to suddenly walk up to me at the grocery store and quietly declare, ” You are so handsome. I want to sleep with you right now.” You would be suspicious (especially if you look like me) But a part of you would also be incredibly excited at this wonderful potential dalliance.

As with all things in life, nothing good is for free. And the young woman certainly wants your handsome face, but you need to fork over $5k. This was my suspicion with Axia Futures. That all of the glitter and fancy things on display were just a prop. And not an actual prop trading company. That everything was just a beautiful figure that sang a Siren song, meant to lure my credit card from my wallet, ultimately crashing my finances upon the shores of past mistake.

With a jaundiced eye and a great deal of skepticism, I decided to dig a bit deeper. Absolutely sure that a turd would soon magically surface within the proverbial punch bowl. I dug and digged and let my angry imagination lead me to an article about a company named Futex.

Ha! I had found the turd. A company named Futex, that was a so-called prop trading firm located in London had stolen all of the funds of everyone involved. They too offered an education course, and it was priced at $5k–just like Axia Futures.

I dug and next discovered that an evil scoundrel named Demetris Mavrommatis was somehow involved with Futex. And some other names started to be attached that were connected to Futex: like Alex Haywood and Stephanos Mavrommatis. They had weird sounding names that didn’t inspire much trust. Surely, I had these scoundrels trapped at the end of my pen. And so I started to write.

And I weaved a tale that systematically chopped this company down. My bias was dark. I was absolutely sure of the following:

- That Axia Futures was just another Futex scam.

- That the educational package was just regurgitated Futex training materials.

- That there was no prop trading firm.

- Since this Demetris character was involved in Futex, he was a scoundrel.

- That Axia was just a shiny prop.

I concluded that Axia Futures was not a prop trading firm in any sense. The only ‘Prop’ involved were the shiny objects and fancy accouterments.

And so I published, and I waited. Soon enough Google would index the review and the entire world would soon discover that I, the supreme God of trading reviews had squished another scoundrel under my boot.

Ready to bask in my glory, I waited for the comments to start hitting the comments section. I was so sure that the Futex victims would emerge and their truth would soon be heard. Justice would soon be dealt.

The Reaction

Not a peep. Not a god damned peep. Something was wrong. Page one rankings on Google and I have no complaints? No shitstorm whatsoever? Uh oh.

Comments eventually started to trickle in. All gave me poor marks on my “so-called review.” In fact, if there were a rating system on my review, I am sure that I would have gotten single stars down the entire line. The victims never emerged. The complaints never arrived. Had I gotten this wrong?

Next, using an alias email, I began sending messages to the inbox of Axia Futures. I wanted a god damned reaction! Someone over there was surely angry that I had written such a scathing article! Like a petulant child that was ignored by Santa Claus, I began to whimper and sulk at my lack of attention.

Controversy and intrigue is the life force that drives a review blog. Why weren’t they giving this whiny blogger baby any attention?

Finally A Reaction

On February 14, 2018, (Valentines Day) I finally received a written response from Alex Haywood of Axia Futures. It is a day I remember with much chagrin, I had just spent $89 for a dozen roses that cost only $19 on February 13. I was in no mood for being friendly.

The response from Alex Haywood was not what I expected. He delivered a nearly 1000 word statement in the comments section that detailed exactly what I got wrong. The wording was incredibly gracious and devoid of any anger or hostility. I know when someone has taken a great deal of time and effort to write something–Alex Haywood very carefully chose his words and delivered a masterful response.

Immediately after Alex published his response, the ‘UP Votes’ on the comment began to pop like corn at a movie theater. My humiliation was now complete.

Conversations with Alex Haywood of Axia Futures

Over the next several weeks, Alex Haywood and I began a dialogue via Skype. Things started off a little rough as Alex had to weed through my persistently negative attitude and suspicious nature.

The very first thing we talked about was Futex. He presented me with court documents that showed that nearly everyone at Axia Futures was actually the victim of the crime that was committed at Futex Prop Trading. The owner of Futex had simply absconded with the life savings of everyone that had been working as a trader at Futex.

He detailed the persons that were affected by the theft, and how this crashed the dreams of many of the traders within the company. Nearly all of the traders were now at Axia Futures. Their life savings had been stolen. One person, in particular, was reduced to temporary homelessness. The stories were painful to hear.

At that moment, never before in my writing of hundreds of reviews, had I ever felt so remorseful about something I had written. My negative review had only exacerbated the pain and losses of the victims of Futex.

Alex Haywood explained to me that from the pain and ashes of Futex, the dream of Axia Futures was born.

Axia Futures: real prop trading and high-quality education

Alex Haywood next explained that Axia Futures is a prop trading firm in its truest definition. All of the traders on the trading floor are seasoned veterans with verifiable track records and varying degrees of success.

One by one, he told the different narratives of each person. How each was uniquely different. How each traded differently. How each brought their own style and perspective to the daily struggle of earning a living by actually trading. And not just talking about trading.

He recommended that I profile each trader. Write their story. Give their background and perspective. Talk about the money they typically make. Their greatest victories and most painful defeats. He completely opened the book to me. I was free to ask and everything would be answered. And everything would be verified.

Most importantly, Alex explained to me that the 8-week training course was actually a group effort, where the best and most proven traders at Axia Futures were tasked with the deed of creating a curriculum that matched their successful trading experience.

In short, the 8-week course is like a nourishing bowl of soup. The ingredients contain only the best aspects of the most successful traders at Axia Futures.

Demetris Mavrommatis: Head Trader of Axia Futures

Demetris is the head trader at Axia Futures. That does not mean he is the best trader at Axia Futures. But he is the co-founder of Axia Futures and his track record of successful trading is very impressive.

How much money does Demetris typically earn trading futures contracts? I can verify through shared account statements dating back to 2010, that Demetris Mavrommatis regularly earns over $1,000,000 per year. Why include performance metrics dating back to 2010? Because they tell the complete story. A story that begins with nothing, and grows into something wonderful.

In 2010, Demetris had recently graduated from University. He arrived in London with starry-eyed dreams of becoming a prop trader. In fact, just like everyone else, he walked into the Futex office with little knowledge of trading. At that time, Futex was offering a several thousand dollar ‘educational’ experience for people ‘fresh off the street.’ Futex was a trading arcade. Individuals arrive knowing little and usually pay something to learn the basics.

Once they complete the education. The person is usually required to make a deposit into a grouped investment account in which all of the traders share and enjoy larger amounts of leverage.

Demetris spent roughly 6-years at Futex. At times, he was the best trader in the company. At times he was the worst trader in the company. In particular, there are multiple instances of consecutive $30k daily losses. At that time, his account size was much smaller. Comparatively speaking, these were extremely painful moments. When asked about this experience, Demtretis explained, “the markets changed, and I did not.”

This statement has huge implications. Demetris explained to me that he has seen hundreds of people be great in year A, and then lose it all in year B. All because the trader failed to recognize that the fundamentals of the markets changed. You have to always be changing and quickly adapting. He kept hammering me with the same point…” markets change, you must change.”

During the month of May 2018, Demetris invited me to spend a week with him–live trading. He wanted to give me a ‘tour of the slaughterhouse’. The place where decisions are presented on the cutting edge of profits and losses. Of course, I accepted. No, I did not fly to London and camp out. Instead, Demetris live shared his trading screen with me 24/7.

For an entire week, it was just Demetris and I. Talking and talking and listening to music and sharing stories and telling bad jokes. Truth be told, 99% of the time Demetris is just watching a screen. I would describe the experience as financial sightseeing. But instead of seeing something interesting, like a bridge or a tower or a woman wearing a bikini, we just watched the prices of futures contracts meander around. By day number two, I came to realize that his job is boring as hell. This was factory work.

Everyone once in a while, Demetris would become animated and prepare himself for the release of an economic report, or a geopolitical event. For instance, I got to watch in real time how Demetris reacted to one of Donald Trump’s tweets about tariffs. The market would go bonkers for only a few moments. But Demetris was well prepared. In fact, he pre-prepared with a range of possible scenarios planned for these ‘strange’ events. “If event A happens, then market participants will reposition and I will respond with X, Y, or Z” as Demetris explained.

Demetris is very much a fundamentalist. He contemplates the underlying economics of a situation and prepares for a specific game plan with a range of possible trades. What I find very interesting and very revealing is Demetris intense curiosity regarding economics. As short-term traders, the current view is that economics doesn’t really matter. The only thing that matters is price and technical analysis relationships.

We spoke great lengths about technical analysis. He does not use it. At all. He firmly believes that it is an industry filled with carnival barkers and charlatans. As he explained, “people like me react to situations, we don’t wait for some sort of indicator to flash buy or sell.” By the time an indicator has flashed buy or sell, I have already entered and exited my trade. For just a moment, think about the implications of this statement. No indicators.

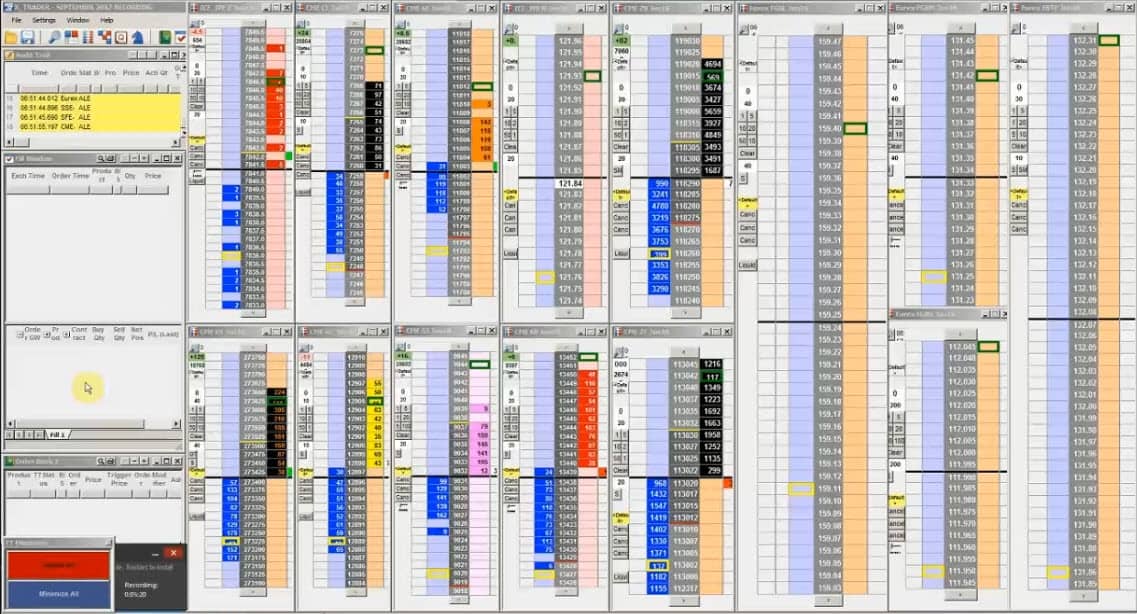

So what does Demetris actually look at? First and foremost, swirling around his head are his fundamental views and opinions regarding underlying economics. His trading scenarios are locked and loaded inside of his mind. The only thing he is ‘staring’ at is a series of price ladders. I have included a screenshot below. This is exactly what I witnessed for the entire week. This is pretty much his entire business…

I know, this screenshot is absolutely devoid of anything helpful. But this is quite literally the only thing that I watched for an entire week.

I asked Demetris how simply staring at this screen could possibly be helpful to my readers. He explained, “what you are looking at encompasses a great deal of the world economy” and “you are watching the reactions of entire nation-states economic policies unfold before your very eyes. To me, this is a beautiful mosaic. The is art in motion.”

To give the audience a deeper revelation of an actual trade that I witnessed, that netted a profit of nearly $70k. There was a specific trade that revolved around the upcoming political election in Italy.

Demetris had waited for a statement to be released by the opposition party. He felt that his statement would affect the price of Italian bonds. Was he looking to trade Italian bonds? Nope. They are highly illiquid. However, he anticipated that the statement would cause the highly illiquid Italian bonds (not tradeable) to quickly shift, then this reaction would be followed by the opposite reaction in the highly liquid German Bund.

So, he walked me through the entire trade scenario before it happened. He had planned for the exact situation and simply waited. When the price of the Italian bond quickly shifted because of the political event, he quickly began taking a position on German Bunds.

Did he fiddle and finesse his entry? Did he attempt to buy on the Bid? Waiting for a better price? Not a chance. He paid the spread ($500) because he was convinced that the move was imminent. And in a flash, the move happened. And it immediately went in his favor.

Did he quickly exit the trade for a profit with the same vigor and enthusiasm as the entry? Not a chance. He explained, “people are trapped” and “I will now slowly finesse myself from the position.” So I watched in real time as he would paint the dom with limit orders to exit. I had never seen anything like this before. He literally covered the entire dom with color.

After the successful trade, did he scream and holler? Proclaim a celebration of unlimited shrimp cocktail and a new diamond encrusted Rolex? Nope. He replied that he was now done for the day.

Wrapping things up

Demetris is not a flashy goy. In fact, I am concerned he wouldn’t last an hour in a 3rd world country. We talked about his trading success and how he felt that this could possibly make him a target. Especially in other countries without a robust police system. He was concerned my review might bring about unwanted attention.

Demetris is 32 years of age. Very humble. Very quiet. He doesn’t think about his profits and losses how ‘normal’ people do. He sees his trading as a game he enjoys playing. Like online chess or any other online game.

But Demetris is also very curious. Especially regarding economics, politics, art, culture, and how humans interact daily. He is an observer that waits to form his opinion. Is willing to wager upon that opinion. But also malleable and understands that he is just flesh. That the markets are like himself, an organic creature that is always changing. Hence he is always changing and adapting. But he does it with a simple gracefulness that ‘normal’ people, with hardened principles, would have difficulty with.

On the surface, it appears that Demetris is calm and measured with his trading activities. However, in speaking with his co-workers, they describe a completely different animal outside of the trading floor.

He is a guy that knows how to live. And he likes to live large. Yes, he has a huge home in Cyprus and an enviable spread in London. Yes, he likes expensive sports cars and beautiful women (though I am not sure I should be mentioning this) and he likes to travel.

Demetris also loves high stakes poker games, he loves the nightlife, he might even indulge a bit too much. But hey, he is in his early 30’s and drinking as much of life as one can possibly consume. Why not? If you were earning a million dollars a year from trading, and only 33 years old, what would you be doing?

In conclusion, it was a real pleasure spending a week with Demetris. Though it was also very boring. Not very much screen excitement. Perhaps this is something that aspiring traders should consider.

As Demetris explained to me, “the educational course contains a deep part of me, everything I know and use is there for all to see and use for themselves” and “every day I record my entire trading session, and I can review it and contemplate how I performed.” Another important lesson to consider.

Additionally, Demetris also makes his daily recordings available to all members of Axia Futures. He wants everyone to see exactly what he is doing. He explained, “this also keeps me accountable.”

As I thought about this, I couldn’t help but appreciate the benefit of having that sort of resource and refinement available for learning purposes.

Thanks for reading. I am receiving no compensation for the writing of this updated review. Though I would like too! (you reading this Alex?)

To do something like this takes tremendous character and balls, I’ve never heard of you, but I am now a fan.

Thanks, Chris.

Yeah, I missed the mark on the original Axia Futures review. I would have no credibility if I did not draft a new review that negated the original derogatory review. It’s only fair and just.

It’s true — I am human — and I sometimes get it wrong.

Never in my life have I seen the internet have place for people who must have failed as journalists. I went to AXIA Futures new premises in London end of last year on a scholarship internship which they supported me on. I sat behind some incredible traders and learnt incredible amounts and next year when i finish my studies I will be joining them as in their new blood recruitment program. I know two of thier traders who made more than 4 million last year. Further to that I learnt that prop traders are setup as partnerships within thier own company structures under the prop arm partnership of FCT. FCT been around since 1984 and Roger Carlsson who if you investigate further was one of the largest options traders on the planet. I’m sure they structure different company arrangements for all thier different traders. I think the internet is awash with non -believers as thier so many scams out thier that people cant believe there is a group of traders making money. They also have young guys not making money who they support to turn them into pro traders. Phone them and organise a meeting to go to thier building and see if they are who you think they are and do proper investigation before wiping them with troll fake news. No one on these feeds ever takes up the opportunity to visit thier building in London as they don’t want to escape thier imaginary internet world of trolling and spreading fake news. I will fiercely defend them as they have given me an opportunity no bank has which actually the investment banks should be investigated instead of honest prop traders who live and die by the sword. Also Emett when will you go visit them in London so you too can say you visited them. I saw in past blogs they invited you and so why have you not gone to visit? Top journalism and investigators should also go to the source!!!!!

Hi Daniel,

Thanks for the comment.

I would love to visit Axia Futures in London. Truthfully, if I had the time, I would have already done it. With my youngest boy recently flown the nest, I have much more time.

I don’t know where you’re getting your information, but perhaps you should read through this thread on Elitetrader.com, particularly the last 3 pages: https://www.elitetrader.com/et/threads/trading-bigger-and-better-81-live-trade-videos-500-000-trading-day.336206/

The whole thing is a sham – there are no prop traders, there is no money, and there is no live trading which can be verified. There is even more to the story which I will not post here. I suggest you do a real fact check and revise your opinion once again.

Please post more information! I am always willing to change my opinion.

A smart person takes new information and is willing to adapt. I am open to new information!

I think Axia’s financial statement says it all – it’s posted on the link I gave you. I uploaded here as well. But here’s the big thing: there are no live trades, no brokerage statements, no opportunity to see what they do in real time. As you can read in the thread I posted, Mr. Jigsaw is endorsing them but won’t ask any of these “geniuses” to trade a live account on the Jigsaw Leaderboard. The story of the 19 year old kid who’s trading 300 lots is a joke. If any of this was real, at least one of these “geniuses” should not be afraid to have their trades posted live on the Leaderboard. Instead, Mr. Jigsaw and Axia ignore and run for the hills when someone requests verification of live trading. You don’t have to be a rocket scientist to see through this disingenuous propaganda.

If you read that thread thoroughly, you’ll see that I’m not alone in my assessment.

Ok, its a pretty long thread. Am trying to get through it all now.

Also so you are clear. They have two arms. The Education arm which supplies talent to the prop arm and the education arm does not clear any prop business and is its own entity as its is not regulated to do so under FCA. Whereas the prop arm FCT is FCA regulated which does all the prop business. And remember all prop traders have thier own business in partnership with the prop company. This is traditional model. So do your investigation proper mate. Again go visit them and all you will find is honest hard working market men who also help with the development in their education arm. If AXIA education was making millions then people would complain. The fact they are apparently now a break even business makes people also wonder. So to get your story straight AXIA does not deal in prop business of backing traders, hence why they don’t have prop company trader capital!!!!

Thanks. I saw that elitetrader thread too. Jigsaw has long been full of it. Long time bigmikes/futures.io resident vendor promoted. This latest shamshow was to showcase more jigsaw’s product with that crass “$500k” “winnings” but only if you subscribe ,sign up to crap, and pay a fee nonsense. cess show.

I have watched both the footprint and volume profile courses from Axia, taught by the same instructor, and would have to conclude that the courses are worth probably less than $50. The course consists of several modules, and each module consists of theory, summary, and exercise. Looks pretty organized, right?

As it turns out, the theory part only shows a bunch of slides with the instructor narrating probably reading his notes. This is often confusing since he reads sentences like “there are two low volume areas on the third day the first one on the top and the second one near the bottom” and we see a chart on the screen and have to figure out ourselves which is which, probably incorrectly. As he only says it and not shows it to us. Just like attending a power point presentation where the presenter lost his laser pointer.

The Summary part is where things get interactive meaning he does write and draw things on a blank blackboard. However, this lasts for only five minutes or so.

The exercise is mostly DIY. Again he only reads what’s on the screen and ends it by confirming that the exercise (he calls it playbook) is very important and wishing a good luck.

In summary, I conclude that the course is worth less than $50 because you could get an ebook on the subject for less than $50 and let your computer or tablet read the book for you outloud. You will not miss anything. And if you get an good ebook on volume profile you would probably learn more.

Specifically regarding their Footprint Course: Good course to point you in a practical direction using Footprint. However, not worth the price, nor the many hours of video time required v.s. solid content delivered.

Being video based, it is hard for them to fix errors and sloppy work. There is a lot that needs fixing/improving.

My main concern is that it appears that the instructor himself does not actually trade using the footprint tool. Maybe he did once. You can tell this by signing up for the free trial to their “live feed”. It is very discouraging, but also revealing. The lack of course content follow through is disheartening. I decided not to take the DOM course as a result.

I stand corrected from my previous post on your previous review.

As I throught originally the guys at Axia Futures are the real deal. Made me laugh about just watching the ladder as when I was at a well known prop firm all the traders used to take the mickey out of my for looking at my “Magic Charts!”

It was very honourable of you to eat the humble pie.

“Next, using an alias email, I began sending messages to the inbox of Axia Futures… Like a petulant child that was ignored by Santa Claus, I began to whimper and sulk at my lack of attention.”

This should be reason enough that no one should ever trust anything you say, ever. Your reviews are, in general, devoid of any objectivity and reek of immature adolescence.

Fair review Mr Emmett. I didn’t take Axia course but I subscribed to the live streaming service which helped me massively in developing as a trader. Really good stuff from people who know what they are talking about. Having said that, the road to success in trading is very very long. There is no holy grail and no education or system that can guarantee success. Over 90% of traders will always be losing money no matter what. So it takes a lot more than just taking a course to make it. Anyone who thinks he can do it as a hobby or part-time might as well never even bother to try

The 1million dude is NOT teaching mate, trust me thats the last thing that a big trader of his size would be doing. The trainer guys are sometimes using his recordings to demonstrate how he trades. They use this top guy’s skills as training material. The more you see the more you understand his thought process and reaction function and how he manages a trade, which is actually extremely insightful. Not just some random simulator trades by losers like other vendors. Seen a lot of the stuff they post on youtube, and its actually really good quality. Trading on ladders (DOM) than charts is a game changer and this is what these guys do and show in most videos. Axia is one of the very few prop houses in London who have big traders swinging size. So I suppose getting education from such a place must worth more than other education websites.

The 1million dude is NOT teaching mate, trust me thats the last thing a big trader of his size would be doing. The trainer guys are sometimes using his recordings to demonstrate how he trades. They use this top guy’s skills as training material. The more you see the more you understand his thought process and reaction function and how he manages a trade, which is actually extremely insightful. Not just some random simulator trades by losers like other vendors. Seen a lot of the stuff they post on youtube, and its actually really good quality. Trading on ladders (DOM) than charts is a game changer and this is what these guys do and show in most videos. Axia is one of the very few prop houses in London who have big traders swinging size. So I suppose getting education from such a place must worth more than other education websites.

Hi, last month I thinking about some trading course where i develope more my ability. I found Axia but when i reading this review and commentaries. Clearly something told me there is not like seems.

Like here said ” Also what you need to understand is that there are no “secrets” or “holy grails” in trading. Seeing how a top trader traded an event does not mean that you or me can replicate it.”

What seems realy strange for me

1. 1milion guy will teatch you

2. No broker results or something similar

3. Nobody who absolvented course and is able to make money

(some close person) not sotry from internet.

Hi, last month I thinking about some trading course where I can develope more my ability. I found Axia but when i reading this review and commentaries. Clearly something told me there is not like seems.

Like here said ” Also what you need to understand is that there are no “secrets” or “holy grails” in trading. Seeing how a top trader traded an event does not mean that you or me can replicate it.”

What seems realy strange for me

1. 1 milion guy will teatch you

2. No broker results or something similar

3. Nobody who absolvented course and is able to make money

(some close person) not sotry from internet.

Hi I just want to know if any you his making money trading with Axis futures

After they take their course and join they livetrading room can any one tell me

Please,it’s no good giving 4.5 stars if no one is making money lol.

Hi, last month I thinking about some trading course where i develope more my ability. I found Axia but when i reading this review and commentaries. Clearly something told me there is not like seems.

Like here said ” Also what you need to understand is that there are no “secrets” or “holy grails” in trading. Seeing how a top trader traded an event does not mean that you or me can replicate it.”

What seems realy strange for me

1. 1milion guy will teatch you

2. No broker results or something similar

3. Nobody who absolvented course and is able to make money

(some close person) not sotry from internet.

Hi! I am brand new to day trading. I just watched How to Use NinjaTrader 8 – Complete Beginners Tutorial posted by DayTradeToWin.com. After duckduckgo-ing DTTW reviews, you popped up! I read your review plus your backstory — quite interesting — and cannot wait to dig down into all of this information.

On October 10, 2018, Hurricane Michael decimated where I live and work. While my home was spared, my job at a local beach restaurant is gone forever. I’ve just started studying futures day trading. I haven’t even downloaded a demo platform yet. So, I guess I’m writing to say thanks for putting all of this out here. I enjoyed reading about Demetris. His instincts, among other things, reminded me of fictional Alexrod in Billions! If you have any tips for a novice or one book on futures trading that would have an impact, please share.

I look forward to reading your stuff!

Hi Victoria, as a person who has cost his (extended) family a great deal of wealth and hope, may I suggest focusing on developing a clear non-forex based career trajectory, and focusing on learning. There is plenty here, for free, that can propel you in your learning from forex books, tradingeconomics.com, seakingalpha, dailyfx, forexfactory.com etc

I have not taken the footprint course by AXIA but I have taken the order flow course which was a game changer for me in the sense that it gave me a framework and approach to develop strategies and made me really understand the auctioning nature of the market especially velocity. I actually think for all the course material including the last section of some live execution trades and the learning and approach this course is well worth the sum that they charge. Its really a great training. Now although your comment is on the footprint course which i am looking to buy next all i can say is that i went to a free workshop they hosted which Brannigan delivered over an entire day in their new trading floor premises it was really an amazing learning day and solidified further my reason to executing on the price ladder. Once I do the footprint course i will give feedback here but if its remotely as good as the ladder course then I will be happy. Also before i purchased any of AXIA courses I watched their youtube channel for over a year where they give loads of learning material and i learnt a lot there. Anyway thats my view. Suppose different strokes for different folks.

4.5 STARS? I am sorry man, but I am sure you got it wrong now and not back then. Have you bought their courses? I am sorry, but all those courses are a complete JOKE! Let’s take a footprint course as an example.There are like 10 strategies and in every single strategy the guy starts off from Motivation! What kind of joke is that? I am sorry but when you are paying thousands of £ for a course you don’t need to be any more motivated, do you? I mean come on, he just talks and talks and talks, and only 10 last minutes he dedicates for explanation of how the strategy works on the actual chart. 10 pity minutes with 3 examples!!!! Do you really believe you can learn anything just by looking at that? 30 minutes of Motivation and 10 last minutes of the examples, which btw don’t bring any real world applicable value at all, as you can find ALL THAT and MORE for FREE on the internet, instead of paying THOUSANDS of dollars for a course.

I am sorry man, but I thought your website was legit. This review has really changed my mind. I guess you can’t trust anyone in this industry.

Good luck and hope people who will read this will think twice before pissing their money away on nicely wrapped candy that in the end will only leave them heartbroken.

Harsh. But all opinions are appreciated.

D, I try my best to enrich the community. Sometimes my content is great, sometimes not so great. A mater of opinion. Regarding Axia, I do believe they offer value. Especially considering that you have access to some very successful people, that I believe, do care about your success.

I am not being paid to write anything positive or negative about Axia. It’s just my honest experience.

Regarding whatever they charge for their materials, I am completely unaware of their fee’s, etc. Truthfully, this is a question of comparability. And when you consider that the vast majority of the “free” content readily available on the internet is poppycock, you must also weigh this evidence as well.

Your opinion is appreciated. And I hope to read more of your colorful opinions in the future.

And one last thing, D, your comments regarding your disappointment will surely hit home with Axia. They read these comments section.

How else will they truly know what people feel, unless individuals like yourself, express your biting opinion?

Stumbled onto your site through Google, then found this review. GREAT INVESTIGATIVE REPORTING!

Hey, I’m the guy that runs the Axia YouTube page – awesome to read the positive comments about the content that goes up! It’s hard work, so thanks 🙂

I was also one of the grads on the South African desk that Axia setup with some SA partners. Unfortunately things didn’t work out with the company helping to support the project, so the desk closed up, but we had Alex and quite a few of the UK guys fly down to mentor and trade with us over the time that we were operating.

If you have any questions about the experience, training, and especially requests for YouTube content, you’re welcome to drop me a mail: craig@axiafutures.com

Codey I think you got a bit confused there. You are very right in saying that no top trader has time to teach and I personally don’t know anyone successful who is teaching. But the guy that Emmett is talking about, he is definitely not teaching, I can tell you that. I did a graduate course at Futex 4 years ago, the prop shop that he used to trade at, and I remember him since those days. He wasn’t that massive back then then but he was still one of the biggest traders they had. Judging by how much he increased his size last couple of years and by seeing some of his videos, making over a million a year is probably an understatement.

I know that none of the big traders in Axia are teaching or are involved in the educational part of the business. But it seems that some of them record their trading ladders, probably for their own debrief and to analyse their trading. I think they give those recordings to the educators/trainers who then use it as educational material to explain and analyse how the senior trader executed the trade. Also what you need to understand is that there are no “secrets” or “holy grails” in trading. Seeing how a top trader traded an event does not mean that you or me can replicate it. There are many nuances on every trade and the context is always different. It’s not black and white and there is no system or “recipe” that always works. Being successful is a very long process and requires a million things including unbelievable mental discipline, risk management, trading execution skills and years of experience. So to sum up, to be able to see a top trader’s trading video, this does not mean that you will be able to steal his magic recipe..

Anyway, I have seen a lot of content from Axia, and I have to say that not all material is to the same high standard. Some stuff they do are quite basic and vanilla but some of the price ladder videos are really good and gained a lot of insight from them. I never did any of their courses or subscribed to their streaming channel but I follow mainly their youtube channel which has regular updates. Overall, one of the good players out there.

I mean, dude, think about it, a million a year?

You serious?

Lambo, Ferrari, what’s next G6 with a Maybach?

Two houses, blondes to go with.

Should I suspect that he’s friend with Eminem?

Maybe he’s good with 50 cent and g unit.

But even 50 cent doesn’t teach, cuz he too busy making money. You ever heard about Kanye West offering tutor lesson on rapping? No.

And this dude’s willing to teach?

Blows my mind.

Who do you know, in your friend list, or not in your friend list, that makes a million a year, and is still teaching?

If I’m making that much I wouldn’t wanna share my secret.

Paul Tudor Jones actually got a video clip of his early career documentary removed, due to concern it might reveal trading secrets.

The turtle traders taught by Richard Dennis were tight lipped as hell about ratting out their trading recipes.

And now, you’re telling me, this 32 year old alpha male, literally on the same level with a medium sized hedge fund salary wise, is willing to give out his secrets for 5 grand?

I think out of all the marketers, you gotta be on the top 5, because you pulled it off real well.

Peace

Yo man, all this great talk but no broker statement, how am I supposed to believe any of this? I mean all of this could be staged???

Besides if he’s so good, why is he teaching?

All of the traders I know that make money trade but don’t teach, I mean if he’s that good why isn’t he running his own fund? Then we’ll all see him in the top fund manager list.

George Soros

Paul Tudor Jones

Bruce Kovner

These dudes above are legit traders but they don’t teach, because they’re too busy making money.

So my question is, is this some marketing bs?

This fella in the youtube video link is showing a recording of this big dog trader there trading the events, and he explains in detail how he is trading it. Pretty impressive skills man. Broker records or not, for me this is one of the most useful trading tutorial i ever seen. I woud do a course with these guys but unfortunately im a poor f*cker atm. #neverstopbelieving

https://www.youtube.com/watch?v=ns9ssd908BM&t=1151s

https://www.youtube.com/watch?v=012mIX_8meo&t=1102s

et tu autem, Emmet!

I’d like to add that I personally find it unlikely that human traders can trade off of economic news faster then the bots and algos. The only real advantage humans have over bots is in discretionary technical trading.

Even if I’m wrong, which I don’t think I am, I will be right in the future. Bots will eventually trade the economic reactions to news faster than we can blink an eye, if they aren’t already. It is a waste of time, money and effort to try to learn from scratch how to ‘trade the news’ at this time.

I was in one forum (www.futures.io) and there a serious broker wrote that the prop firms on these days usually earn money from teaching, not from trading. So, if I don’t see any yearly performance – I would stay away.

I see several comments ( which could be from fake accounts or acquaintances ) saying how great this training is but not even a single person including Emmett has posted broker statement. This marketing strategy looks very similar to how snake oil salesman brainwash for selling their products.

When other trading rooms get negative reviews their owner/ acquaintances start posting in comments on how great those systems are , the only difference here i see is instead of posting in comments Emmett has posted a review.

When other trading rooms/courses/training cannot get positive review without broker statement then why is this service getting positive review ?

Although broker statements could have clearly dampened speculation on whether axia is a scam, on the other hand there are a million reasons why top traders wouldn’t want those records publicly available to everyone online. I know you are the kind of guy that you will say this is coming from a fake account or whatever but I actually know these guys as I have been in the futures industry in london for the last 4 years. I traded in marex, one of biggest futures clearer in london, and most of the axia guys come from futex and marex (btw marex was clearing futex back in the day before the futex collapse). I know a junior trader who is currently there and i heard legendary stories about Demetris and a few others who are among the biggest traders in the industry. I have seen some of the videos of live trading they post and these guys don’t joke around. Big clips, over 500 lots positions in bonds and fx, and profits over 100k on single trades, you can tell that that these guys have serious trading accounts. From my experience it is indeed only a handful of traders that can achieve such a performance at such high level, but the point is that even now with the markets being dominated by algos, there are people out there that can achieve it. Fact!

I could not agree more Dom, and these guys just use ladders, not charts and indicators, just flows. Orders in and out. Confidence is a must and prep, and debrief.

Would love to see some of these videos if you have the link, unless they are on Axia youtube, for which I have already seen them.

Best

About time you wrote the truth given the ridiculous falsities that you concocted from the ether. I did an in-house training with them end of last year and had learnt so much from the team. I have never been on a trading floor till this time and realised the intensity it takes to be a pro. Also they give so much to the community with so much great free YouTube content. That’s how I first found them and I first learnt from their YouTube channel before I decided to pay for really great in-depth and hands on training. Again I have no affiliation with them except I have learnt so much and the team lead by the 2 founders is truly great foundation to develop your trading. They also say that at the end of the day they can supply the approach and development framework but it’s up to us to develop the edge. They know there is no short cut or holy grail. Axia futures is so important for our community and without them there would be a great learning void in the futures market.

“About time you wrote the truth given the ridiculous falsities that you concocted from the ether.” That’s a beauty. Such a way with words.

Cool story Oly, now that you ‘learned a lot’ (if I got a dollar every time I heard this I would be filthy rich) can you make money trading consistently, because at the end of the day that is all that matters?

Just found this from one of the sites Tradeceity that was probably reviewed by Tradingschools. However, this research article gives some stats of successful/unsuccessful trading etc. Just posting a link as article is long: https://www.tradeciety.com/24-statistics-why-most-traders-lose-money/

Hope I am not violating any rules of Emmet’s website. If so, then apologies and kindly remove this comment.

Somewhere I read that one big bank professional trader said that those who do not trade the news i.e. economic, political etc. simply give away lots of easy profits to be made. However, it may take a lot of practice, paper trading, time and research to make a game plan for trading economic/political news and also how to determine if news/event has already been priced into the markets. Also, in this style of trading emotions kick in a “hyper gear” due fast moving markets. Guess different strokes for different folks. But glad to find that there is a trader out there making $1M a year consistently.

hey i’m new here, love your website man. jesus it’s about time someone did this. i’m pretty late, still glad i found my way here.

Emmet – if you were fooled the first time by them what’s to say you weren’t fooled this time? Maybe they took 6 months to come up with a plan to fool you to believing they are legit and in that time created fake documents to show you they were making all of that money?

Do most successful trading firms care about a bad review from tradingschools.org? Would most successful trading firms go to the same extend and effort that this head trader went to convince you that his trading firm is legit? Food for thought.

I am not saying that I am convinced that these guys are scammers. But I am not convinced either that they are not scammers, at least not from this last update.

Great comment Mike.

Time will tell if I got it wrong. And that is a real possibility.

However, all of the negative comments, which I greatly appreciate will be used in follow up reviews of Axia Futures. I can address the dark spaces and blind spots that readers bring to my attention.

I will ask the toughest and most brutal questions that readers want to be answered. Once again, I love negative comments from readers. They often smell BS where I only smell flowers and virgins.

Hi Emmett, could you email me please? I have a private question to ask about your time with Axia..

Thanks

S

Eventually an update!! I actually visited them last year after I took a training programme with them. I sat next to two of their live account traders that were backed financially backed by Demetris. Learnt so much and they such a professional team and have a family feel about them. Also they have some incredible traders and will never forget my experience. Was very angry when I saw your first review and now at least the truth of them has come out. Never knew though Demetris was such a party boy;)…he certainly is a great trader along with many others at this firm. Thanks for eating humble pie and painting truth Emmett.

Hi Emmett,

I don’t understand why sometimes you comprimise on your principles. If a trading room operator/owner or voucher for such a room cannot show atleast past 6months to 1 yesr of broker statements, then that room/service should not be given 4/5 stars under any circumstances. Period. I do not see any broker statement above.

Dear Philip,

Did you even read the article?

I quote:

How much money does Demetris typically earn trading futures contracts? I can verify through shared account statements dating back to 2010, that Demetris Mavrommatis regularly earns over $1,000,000 per year.

Emmett has new information and is therefore acting upon it, and rightly so, Axia is trading FCT Group’s money from what I can see, for a cut, and clearing is through a merchant bank, not a broker as you 90,90,90 retail traders do.

It is obvious that you would not know a professional trading firm if it hit you in the face .

I did a lot of training with Futex, and they were the real deal as well, until it went wrong, and I was gutted when it did happen, I knew a few of those traders, and they were very open about giving you their edge, in fact the stuff Futex and Axia give away for free on youtube would make you profitable.

I am so glad that Emmett has come to his senses and rectified his initial observation, but Axia ARE real, and you would get your money back inside a year. I can tell you that trading from just a ladder is very difficult for a long time, no charts, but it starts to make sense after a while, and then you can never go back to charts, because you cannot see the flows.

Congratulations Emmett for coming to your senses,, and a disclaimer: I have never subscribed to anything from Axia, because I learned everything from Futex, that I would from Axia, but they are high quality traders and educators, and you should look at their you- tube channel.

I cannot imagine looking at a chart now, just ladders and time and sales. Money management is the holy grail. cutting your losses very short, and I mean 1-2 ticks as I now do, it is the only way you can survive in this highly competitive business. Trading is a business, not a hobby, so treat it as such.

There is a lot of prep before you start, and debrief after your day, so it is long hours if you want to succeed, but that is what separates the pros from the amateurs.

Emmett, kudos to you my friend, and happy hunting, most out there are sharks, but this one is the real deal.

Best

The updated review was fair. The only thing that was unfair was the amount of time that it took to complete.

Truth be told, I would have had this completed 60 days ago but I am truly a lazy human being.

A few red flags:

1) Looking at the comments & abnormally high votes on those comments in a single day it seems this business is either asking it’s acquaintances or using multiple fake accounts to manipulate the system. So I would not waste my time going back & forth with the conversation here.

2) Unless a person is living under a rock, it’s no brainer that a positive review on this site would increase sales, so if Axia futures was really so good it would have furnished all the details to Emmett the first time itself.

3) a person making millions would not be running a coaching center. There are better businesses to run like hedge fund etc etc

4) Before replying just understand : instead of spending time writing long comments , fake voting , it would be much more effective if you just show proof I.e your broker statements for last 1 year. Save yourself time & effort typing.

All good comments Philip.

Regarding comments and votes, I am pretty sure that the traders at Axia were pissed off with my original review. There are plenty of people working at this organization that has a tremendous amount of emotional capital invested. Emotional capital is actually a strong motivator. Yes it true that many vendors post fake comments that puff a review. This works in the short term, but over the long term…the truth always wins. It just takes time to catch up to the lies. As time progresses, we will see if negative reviews start hitting the board.

Regarding whether Axia furnishing details to me for the original review. Hardly anyone ever cooperates with an initial review. I just research and write. Only when a negative review becomes a toothache do they take notice. Eventually, the toothache becomes an infection and they beg for a root canal. That’s when the hard work is accomplished. That’s when I climb into their most private places and have a look around. Rest assured, I climbed into their wives underwear drawer and made a full inspection.

Emmett

Can you show us broker statement.

Emmett, stop contradicting yourself. You are going to lose credibility. You’ve been had

“I can verify through shared account statements…”

LOL!