Avenge Trading Software

-

Honesty

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(3)

-

Verified Trades

(1)

-

User Experience

(1)

Summary

At $25,000 for this trading software, it needs to be perfect. Its not. But it has potential. Ownership attempting to remain anonymous, which is a red flag. No trading DOM in trading room. No live trades. However, owners are committed to delivering a quality product, but they are just not there yet.

User Review

( votes)UPDATE TO REVIEW – DECEMBER 21, 2015 – ***Please Read***

UPDATE TO REVIEW***Please Read***

Today’s review is Avenge Trading and Avenge Trading Software

What is Avenge Trading and Avenge Trading Software? Avenge Trading Software is a trading signal software that operates as an indicator add on for the ensign trading platform. Avenge Trading is a day trading room that displays and trades the software that potential customers as well as paying customers may watch and trade along with the room moderator.

How much is the trading software and the trading room? The total cost of the trading software is $25,000. In addition to the cost of the trading software, there is a monthly fee of $2,500 to attend the trading room. Yes, you are reading this correctly, $25,000 for the software as well as $2,500 each month to attend the trading room. However, there is a financing plan where a customer may made a down payment of $7,500 and then 60 days later, in order to keep the software functional the next payment of $7,500 must be made, and then 30 days later another payment of $7,500, and then 30 days later another payment of $7,500 is required.

If a person requires additional training, after the $30,000 in total payments, then additional training comes at a price of $2,500 per month. There is no refund.

If you are like me, then you are pretty flabbergasted at the price of this software and trading room. Of all of the trading rooms that I attended and reviewed, I have never seen a trading product offered at such a high cost. And considering that this product is the highest price of every trading product on the internet, then I figured that I must apply an extra layer of scrutiny to this product.

A Closer Look at Avenge Trading Software

A quick look at Avenge Trading on Archive.Org shows that the company has been around for a short period of time. I can only find several months worth of website updates. It appears that the website was built about one year ago. The Avenge Trading domain name was registered about 16 months ago, and the registration name is not disclosed. In addition to the registration name being hidden, there is also no mention of whom actually owns Avenge Trading on the official website. I found that the lack of disclosure of whom is behind this company particularly odd, especially considering the hefty price tag. I certainly would never give an unnamed person $25,000 and $2,500 each month unless I was absolutely sure of whom this person or people are.

that the lack of disclosure of whom is behind this company particularly odd, especially considering the hefty price tag. I certainly would never give an unnamed person $25,000 and $2,500 each month unless I was absolutely sure of whom this person or people are.

Another thing that I found both exciting and worrisome is that on the front page of the Avenge Trading Website is the proclamation that the trading software had generated a total of 657 total ES points for the year of 2014. In other words, if a person were to trade only one contract, then the total profit would be 657 X $50 for a total profit of $32,850. The company states that if you want to make more, simply trade more contracts for more profits. The statement that I could make more by simply trading more contracts is certainly true, however the big question is what do I have to give up for those additional returns? The website makes no mention of potential draw down or downside. With my curiosity piqued, I picked up the phone and called the telephone number: 888-900-4034. To my surprise, someone actually picked up the phone. A trading vendor that actually picks up the phone is an extreme rarity, I was impressed.

After a brief conversation with the customer rep, Brandon, he invited me to attend the daily webinar that displays all of trades being executed by the trading room moderators.

The Trading Room Experience

From the week of Monday, July 6th through Friday, July 10th I attended each trading room session. The trading room lasted an average of two hours each day. For week number one, I recorded approximately 13 hours of screen recordings. After my free, one week trial of the trading room ended, I then signed up using a another name, IP address, and email address. I then attended another three days of the live trading room. In total, I recorded 20 hours of screen recordings.

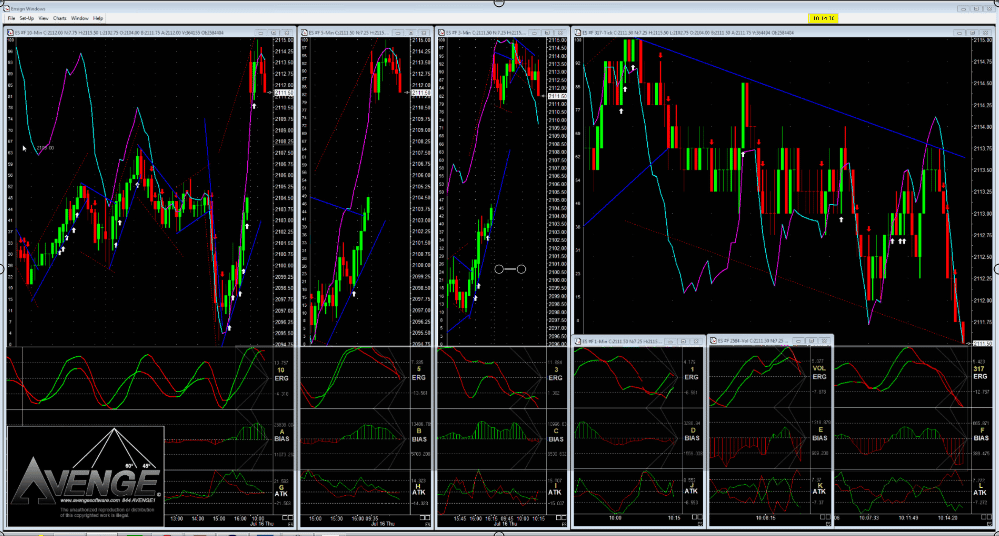

What do you see inside of the trading room? Inside of the trading room, a viewer will see a series of charts. The left most chart is a ten minute time frame, and then as you move to the right side of the screen, the resolution begins to drill down to a 317 tick time frame. The following picture is how the trading room is layed out:

Generally speaking, I would say that layout is pretty well organized. I also received some supporting documentation from Melissa, that gave a description for each of the charts. There was also a handy video that took the time to explain what each section means and how they relate to each other. You can watch the video here:

No Trading DOM

Once of the things in the trading room that I found upsetting was that there was never a trading dom shown live on the screen. We were simply told that we had an entry. As the price moved towards the profit target, and then subsequently kissed the limit price, we where then informed that we were now out of the trade with the profit target. If you have spent anytime reading my prior reviews, then you know that I am really a jerk about trading rooms that use limit order entry and exists. Why? Because getting a fill at a limit price for either a buy or a sell is very difficult. Sometimes a price can kiss the limit order price many, many times and never actually fill the price. Newbies of course have no idea what I am talking about, and they mistakenly believe that they can replicate the orders that they are seeing on the screen, but the real world reality is something entirely different.

As I spent my 10 days in the trading room, I found that trades on the 10 minute chart were slower moving and a person stood a very good chance of replication. However, the 5 min, the 3 min, and the tick charts were faster moving trades. I would guesstimate that on the 5 min and the 3 min, a trader has about a 50/50 chance at exact replication of what the software is displaying. The tick chart? Not a chance. The market moved way too fast and these trades have nearly zero chance of replication. The following short video are several trades on shorter time frames. Watch these videos and ask yourself if you feel that these trades are presented in such a manner where replication is a possibility?

http://moore-emmett.wistia.com/medias/54nxuekv79?embedType=iframe&videoWidth=640

Why Does Replication Matter?

Replication matters because when we make a purchase of trading software or a trading room, part of our decision process is evaluating prior results and effective replication. And I am not talking hypothetical, or simulated results, I am talking about about being able to replicate somewhere close to the signals that are being projected onto the screen, by the software or the moderator. Granted, it would be unrealistic to expect that we would be able to copy all trades exactly, but for a price of $25k, we need to be damn sure that we stand a hell of a good chance of replicating the majority of the trades.

The moderator was never able to show, with a live trading DOM present, that he was able to actually fill any of these limit orders. I was frustrated by this. The more I attended the trading room, the more frustrated I became because I simply could not replicate the signals on my own trading software.

Calling Avenge Trading About The Reported Results

After becoming frustrated with not being able to replicate the trades, I decided that if a live moderator could replicate the trades with a real money account, then perhaps with practice I could also replicate the trades. And so I called the toll free number once again and asked Brandon if he could send me over the real time performance of the trading moderators in the trading room. Brandon was cordial and emailed me the following PDF documents that give a detailed performance of each trade called live in the room. He sent me the following, which supposedly represents all of the trades for the entire year of 2014, as well February 2015 until present:

Avenge-Performance-2014 Avenge-Performance-2015-Feb-17-15-onwardIf you took a quick look at this, you were probably a bit confused by all of the numbers and little boxes. I certainly was. And so I called back and spoke with Brandon, but before I continued with my conversation, I asked Brandon is he had any problem with me recording our conversations with him or any company representatives regarding Avenge Trading. He agreed to allow me to record all conversations related to his company. Since our conversation was taking place over state lines, I needed singular consent in order to record any conversation. A telephone call has a reasonable expectation of privacy, before I can record any conversation, I needed to make sure that a company representative would consent. Brandon consented, and so I continued with my line of questioning. My first, and most important question was related to the numbers reported in the spreadsheet. Specifically, I wanted to know if these were real time trades, executed in an actual brokerage statement, Brandon confirmed that every single trade was a live trade. Next, I asked him if he could please send me a copy of the brokerage statements, I wanted to match the brokerage statements to the trades reported in spreadsheet. Brandon said that I needed to speak with the trading room moderators and that they may or may not release this information.

Brandon then recommend that I have a conversation with the trading room moderators. I agreed. And I told Brandon that since I was spending $25,000 for his trading product, that I needed to be extra careful and verify every detail. He agreed. Before I ended the phone call, I asked Brandon for his last name. He refused.

Speaking With The Room Moderator

Next I received a phone call from Brandon and he commenced a three way conversation with the trading room moderator. He said that his name was Darren and that he was an attorney. I asked him for his last name, he refused to give his last name. I found this a very uncomfortable situation, he wants me to give him $25,000 and $2,500 each month, and yet he will not even give me his last name. It was awkward. Thankfully, Brandon had consented to the recording of the conversation, and I was able to capture the awkward moment in all its splendor and weirdness.

Next, I asked Darren if the trades from the spreadsheet were actual trades taken in a real account. He confirmed that all of the trades were real. After about 15 minutes of conversation and awkward question asking on my part, I decided to turn up the heat and see if I could get Darren the Lawyer to admit that the trades were not actually executed with a real money account. Begrudgingly he relented and said that the trades were a combination of both real and simulated. I felt getting him to admit the truth took a herculean effort.

After I got Darren the lawyer to admit that the spreadsheets were not actually real trading, I next attempted to figure out whom actually owned this company. Everything is well hidden. Nobody at the organization will use a last name, the domain name registration is hidden, all of my questions regarding ownership were rebuffed. The conversation was a clumsy and indelicate dance of Darren the Lawyer trying to convince me his company was for real, and me trying to press him into admitting the truth as well as catch him in a lie. He wanting my $25k, and we wanting to watch him stumble and get caught in a lie. Since I had consent to record the conversation, I felt like I had to really open up the throttle on the poor guy and start calling him bad names. Not so much because I felt he was a bad guy, but because I wanted to see his reaction.

At the end of my 20+ minute, heated conversation with Darren the Lawyer, I walked away feeling like he wasn’t such a bad guy. Anyone else would of simply hung up on me. I called him a scoundrel, scammer, and bunch of other fun words, but he just kept trying to convince me that his software is the real deal. In my opinion, he really believes his software is a good product. But Darren is certainly no market professional, or computer geek.

Plenty Of Red Flags

Looking at these guys in its entirety, and from a distance, there are several red flags:

- They wont reveal whom they are.

- They wont display a trading DOM in real time.

- There are no account statements that prove performance.

- There is no information on whom developed these trading indicators.

- The trades in the trading room were not clearly given.

- The scalp trades cannot be replicated in real time market conditions.

A Few White Flags

They also have a few positives:

- Excellent customer support, they answer the phone and quickly respond to email inquiry.

- The signals from the longer time frames were reliable.

- Lawyer Darren, in spite of my badgering and hateful remarks kept calm and tried his best to help me.

- The company is very, very serious about marketing. Which is a good thing.

Conclusion

At the end of the day, at $25k…the product needs to be completely devoid of any red flags. This is the most expensive trading product I have ever seen. And the higher cost demands a higher level of scrutiny. Is Avenge Trading a scam? I dont think so. In fact, I think they might have something positive to offer. However, they need to prove it not only to the audience, but also to themselves. They need to either trade with a live money account, or at the very least trade with a simulated DOM present on the screen. My personal opinion, is that the tick scalping and the 3 minute charts will need to be removed from their program. They are simply unrealistic. However, the 10 minute and the 5 minute do have some potential.

Avenge Trading is currently spending a great deal of money on marketing. And I want to give them credit for this. They made the investment in two separate one hour radio shows, that are scripted sales presentations for sure, but the investment shows commitment to their product. They also spent a great deal of money on a Michael Medved radio infomercial, which I am sure cost big bucks to produce. In addition to these radio infomercials, they have also produced some well constructed sales videos. A little cheesy, but shows good effort.

In addition to the radio and video production, I checked Google ads inventory and they are probably spending $500 each day in Google ads. Not a small sum of money. Some of you reading this might be suspicious of all of the advertising, professional production, and slick marketing. However, I see this as a positive. They honestly feel like their trading product is ready for prime time, they feel like they have a product that can withstand serious scrutiny and that the risk of advertising costs will be borne out through the gains in sales. Its interesting for sure.

For What Its Worth

My opinion is not worth much, however if I were running the Avenge Trading Software company, I would start investing in more transparency. Who in the heck is going to give you $25k if you wont even give your last name? And why not just go ahead and trade with a DOM on the screen? This is 2015, not 2005 when trading rooms could get away with that nonsense. Nowadays, all of the legit vendors are all trading with a DOM on the screen. And if you are trading with a simulator, just admit it. And if you are going to start emailing out performance reports, then stop saying that the trades are real, when they are not real. Not even close to being real.

I have a sneaking suspicion that I am going to be hearing from these Avenge guys again. And with the level of investment they are making, I do believe that they could deliver a good product. It is my sincere hope that I can come back in a few months and write a new review, a highly positive review that recommends the product.

Well, that’s if for today. Yet another room that didn’t get a bunch of shiny gold stars. If you read this far, then you are a champ and I certainly appreciate your vigor and enthusiasm in what is mostly a depressing endeavor. Don’t forget to leave your comments below. Especially the haters, and the trolls, I like you guys the most.

Speaking of POS scam artists…I think Emmett takes the cake. Nice Job Emmett on this rave review of just how trustworthy and honest your endorsements are…who’d listen to a fraudulent con artist such as yourself…just idiots who can’t think for themselves.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

Major Moron is one of the vendor (probably Ace Trade Review) who got an honest and bad review from Emmett. He’s back trying to discredit this blog which can only mean that Emmett’s investigations and record of the numerous scams are hurting these scammers. That’s the reason they set up the site Major Moron refers to, it’s a clumsy attempt to discredit him. You can read all about Emmett’s past on his own blog under the “Warning” tab.

All Emmett is asking for from these vendors is to provide him 1month of verified, real trades and none of them can even demonstrate that minimal amount of success. It would be the easiest thing is the world for a vendor to discredit Emmett, simple provide your verified trading statements that support your claims. To date only 3 or 4 have been able to do this. The rest are fraudulent scammers.

Name: GORDON DRIVER

Register Number: 47270-048

Age: 58

Race: White

Sex: Male

Release Date: 11/28/2026

Located At: FCI Terminal Island

“Investigators said in court documents that Driver is currently “deceptively” marketing a $25,000 commodities trading software package for E-mini S&P 500 futures contracts through a company called Avenge LLC that uses a website (www.avengesoftware.com), radio podcasts and social media. According to investigators, the website and other Internet marketing materials

for the current venture do not disclose that Driver runs the company.”

https://m.fbi.gov/#https://www.fbi.gov/losangeles/press-releases/2015/nevada-man-sentenced-to-more-than-12-years-in-federal-prison-for-running-ponzi-scheme-involving-e-mini-s-p-futures

This is for Emmett –

I just found your website, and have been reading your reviews – I am rather puzzled by this review, and your subsequent comments, as well as your “silence” as of late – since apparently someone who ran the company has just been sentenced to 12 years in prison. People, including myself – would like to know your opinion on this issue, especially since you are holding yourself out there as someone with some knowledge about this outfit, giving them a 3 star review – if “Brandon” would care to opine, we would welcome that input as well

Yes, I will be writing about this shortly.

Gordon Deceiver of Access, Ascend and Avenge gets 12 1/2 yrs.

https://m.fbi.gov/#https://www.fbi.gov/losangeles/press-releases/2015/nevada-man-sentenced-to-more-than-12-years-in-federal-prison-for-running-ponzi-scheme-involving-e-mini-s-p-futures

Wow Alex, thanks for sharing that, I got suckered into Gordons scam, sadly let go of a lot of hard earned money in exchange for dreams of a better life, reason I’m even here on this site today is that I just got an email from them showing a lower price to get in. they call it avenge lite, so I decided to google.

I remember seeing the rip off report and had concern, that was after I ran out of money and “went on vacation” as they call it to suspend my membership til I can pay again…

anyways, I followed Gordons right hand man to a new group…interesting he was named in the rip off report, and since goes by a different name…

good luck, wonder if I am able to get any of my membership dues back, sure could use it to pay bills.

Good luck with that, Captain! These people knew what they were doing. Now instead of taking your money and “trading” for you they are trying to sell you the delusion of operating the faulty software yourself so that they are not liable…

…anyway Gordon probably needs the money to keep his prison commissary stocked for the next 12.5 years with good things for himself.

Gord Driver setenced

https://m.fbi.gov/#https://www.fbi.gov/losangeles/press-releases/2015/nevada-man-sentenced-to-more-than-12-years-in-federal-prison-for-running-ponzi-scheme-involving-e-mini-s-p-futures

Also one more thing, you don’t get software, you get the invite to their webinar, that’s it. No software .

Have you monitored nqtrader?

I was with ascend for about a month. Their entry and exits were off

Every time they said they had a setup, waiting for green arrow, they would always get a better entry then myself. They would get in 2 ticks ahead of me and when they exit, they don’t tell you right away, so right there I lost on the trade and they made a tick profit.

Scalp trades were fast moving and that was always called late. Setup 0,1,2 were ok long term setups but they were taking so many trades, that if you followed them, you would lose money. I was also with avenge as my second stint with the group. They added like 15 more setups but most were scalp trades . They would always seem to be better positioned then me. My advice is I would not spend 25 k on this, it’s too hard to replicate the moderators.

Hi folks,

I stumbled across your review and glad you wrote this. Hopefully it prevents others from falling for this scam. “Avenge” is former “Asend” trading software as we dealt with them a few years back. See more info here: http://www.ripoffreport.com/r/Asend-LLC-Asend-Trading-Group-Asend-Software-Group/internet/Asend-LLC-Asend-Trading-Group-Asend-Software-Group-Fake-Investment-Scam-Las-Vegas-In-1050465 The guy always changes his names and phone number. I met him once in person. I should have listened to my instinct, if someone tells you he takes part in a system which generates so much profit but then he comes driving up in a 1996 5series BMW with rust and all kinds of issues… well, the red flag was up but we still tried it. Simply said, the reason they don’t show any real trading accounts is because they DONT MAKE A DIME of trading… they solely live of people buying their scam. It’s that easy. My advise, run away and keep your money. Don’t fall for them!

Unfortunately we lost quite some money with them. They are good in scamming AND you kind of want to believe that it is true what they say since you like to find the real deal… but it’s not it. Hope this helps some guys to make the right decision.

By the way, a name change of course will happen again once there are more reviews about them… read the ripoff report… it’s all true!

Cheers.

TraderGuy

Recently, I did get them to start showing a trading DOM inside of the trading room. This way people could at least evaluate the software on some sort of real time performance.

Am glad that you reached out and have written to the audience. Thanks, Emmett

Good point in the ripoffreport about their advertising on KDWN, Las Vegas. Unfortunately, these AM talk radio stations have no idea how scammy these businesses are. I would hear other ads on trading early in the morning while driving to or after work. If you are a listener to AM talk radio in general you might have heard those. Here’s one “We teach you how to trade when the market is up AND when it goes down!”, or another ” he smiles as he close his computer, because he just made more than his day job”. Sometimes at late night after 9pm “pirate” Preston James would have his radio ad go on. He and “first mate” Karson Keith would try to sell a newsletter or education then it would turn out to be risky and expensive covered calls which would mostly fail. They change a new site or “product” every couple of years. So hopefully Emmett will review their current site:

http://www.tradersedgenetwork.com/

I really enjoyed the back and forth from everyone. I think

emmetts review is spot on. Great comments from everyone.

I wrote an update for Avenge Trading. They are now showing a live trading DOM inside of the trading room. Very, very positive.

Readers can now take a trial and trust what they are seeing.

Yes, trial are good but they can’t prove consistency.

I was in a trading room with good results for few months in a row and after that revenge trades are taken with double up once and even twice and all losing trades.

Guess what ? They have Excel trade log and those trades were not be logged. They have even picture with charts for every trade except those I mentioned. You can lose about 5k in 2 days with this approach b ut you will never know until you face it because they are not logged in those Excel sheet.

So, better pay for someone willing to show his broker statement or expect unpleasant surprises.

Many do not know but with NinjaTrader you can create a “combined account”: this mean you can create an virtual account that will mirror your trades in multiple accounts at once. If your future trading mentor do not bother at least to copy his trades this way to a SIM account and show this as a prove my advice is to not bother with him too.

Hi Christian,

Integrity is important with Avenge. Can you give exact days when this happened? Each session is video recorded, we would like to review this information and compare it with our records.

As well, we have no record of a guest named Christian having registered with Avenge for a trial. If you would like to provide your real name, we would be able to access the dates you attended.

Brandon, Brandon, come in Brandon, do not see any comment or feedback from you since your last post on August 27th. You and Janet Driver are two pivotal agents taking calls and issuing contracts to prospective members. Would like to hear your rebuttal to posts since then, including the imprisonment of the supposed mastermind and former NASA rocket-scientist behind Avenge named Gordon Driver (the person who was in charge of new member training). You knew of Mr. Driver’s guilty plea as of April 23rd, but continued to support Avenge through posts on this site. Would like to know your background? Who is Janet Driver? Is Avenge a spinoff of Asend ()? What about the sentencing of Mr. Driver on October 22nd ()?

If no defense is issued by you, will assume that all that has been posted about Avenge since September is true.

Any one who buys this software is a FOOL.

Hey, we have to give them credit for making this big change. I am desperately hopeful that they start some sort of trend towards transparency. Have to start somewhere. This is great start.

Good to read Tom’s post, I don’t agree Emmett is a bully (there’s no slander there).

He’s entitle to write his experience and views, IMO he’s not harassing nor lying.

If anything he’s giving them free publicity to everyone that can’t trade and would rather rely on software/indicators, but that’s my opinion.

I think the live room is mostly for training.. so why even ask for trade results…

I guess they were surprise at someone asking for that and have nothing real to show because it’s not real… it’s training…

I don’t know if it’s advertised as training or as a single provider service?

Tom, Im curious, you must have deep pockets or something because what made you give 25k to a website that doesnt even list who created it or runs it. Faceless company.

I did my homework. I also am a bit of a skeptic. I looked at this company for over a year before I made a decision to join. Since joining, I have personally met the owner and the people who run it. I can tell you this……there is a tremendous difference between “taking a look” at the company and “being a member”.

I am not an employee of Avenge nor am I being paid to write a review……I was however made aware of this review and asked for my opinion of it……..I have been with Avenge for over 1 year now and am 100% satisfied. Their help and support has been way more than I could have asked for. I think that their software is worth way more than the $25,000 asking price. I actually have heard of companies paying upwards of $1,000,000 for software. Then again, I have friends in the industry. The old cliche comes to mind here. (You’re comparing an apple to oranges) If someone can’t afford it, oh well plenty of oranges out there to choose from. As far as asking for personal statements……YES I have the statements to prove it and NO I wouldn’t show them to anyone either. Who are you to ask? Would you like to see my bank statements as well? Are you crazy? Let me just put a target on my back while I’m at it. I find your review to be mostly inaccurate and more on the “bullying” side of things. Maybe you have to be like that when reviewing companies and I don’t know you personally but it seems to me like you just got upset when you didn’t get what you wanted. Did you try asking for some random days of the recordings to verify what they have on paper? I did before I joined and find them to be 100% honest and accurate. I have listened for over a year now and can say this about the quicker trades…..sometimes the market is too fast to copy those trades….BUT after some experience using the software, it’s pretty easy to catch on your own……AND if I miss a trade, no big deal. I don’t have to get every single one in order to be successful. Personally I often beat the performance of the moderators, but in fairness, they have to take every trade set up that presents itself. (I take what trades I choose) If this was my company, I would probably sue you due to the inaccurate remarks that you have made. I’m not a lawyer but defamation and slander come quickly to mind. I don’t see other companies offering up performance history. (If there is, please let me know) I assume that your job is to be a bully in order to try and protect people…..but in this case, I simply find you to be harming others.

Thanks for your comment. I agree, I am sort of a bully when it comes to these reviews. But I have to be. Regarding account statements, I view account statements from vendors nearly every day. All they have to do is remove the account number and name. Simple, really. Since Avenge did not want to show account statements, then I would of settled for a trading DOM present on the screen, again they refused. They only left me with one choice, and that was to record the trades and attempt to figure out if replication were possible. As I mentioned in my review, I found the higher time frame trades to be good and valid. However, the lower time frame…that is another story. The bottom line is that anyone looking to spend $25k on a business should vet that business.

For instance, suppose you were to buy a Subway franchise. The owner of the existing location wants to sell you his location for $25k. You agree on the price, but you want to see his receipts to make sure that the Subway is not losing 10k per month. Wouldnt you want to see account statements when purchasing a business?

Suppose you were to buy a new home, or a new car. And the bank asks you for tax returns. Is the bank really so horrible for attempting to verify that you actually have a job?

I just dont understand why Avenge Trading is so incredulous about a simple verification. They want folks to send them 25k, and yet when these same folks ask for even the slightest bit of proof…they howl and cry and declare that anyone that wants to verify is a bully and a turd.

While I am on this subject of verification. Avenge wants us to send them $25k of our hard earned money. But they wont even give us a last name. Everyone at Avenge goes by first names only…shame on use bullies for wanting to know whom we are sending our $25k.

Your car and house arguments make no sense. The bank will want proof of a job because they are giving you a car/house that you haven’t paid for and they want proof that you have the ability to pay them back. Pay cash = not an issue. But your argument is more like asking the bank or dealership to see their tax returns and bank statements in order to buy their car/house. ???? Again, makes no sense. Your Subway example however, I would agree with. But like I said before…..did you try asking for any random day’s recording or a few or them and verify it for yourself like I did? I’m sure that is a no, otherwise you wouldn’t be so skeptical. All good though…….I love how people believe the media about how you shouldn’t travel to places like Mexico or Colombia too. The general public can keep believing that, the prices will stay down, they won’t be over run by tons of tourists and I will keep enjoying those countries. 🙂

Tom how about you address Emmett’s concerns rather than comment on his analogies or tell us about your holiday plans. Why is it unreasonable for potential customers to want full disclosure of verified trading results and to know exactly who they are dealing with and where they are located?

Also, I tried clicking on 5 stars for my “user review” here but it checked off at a .5 star rating and I can’t seem to change that. How can that be changed?

“I’m not a lawyer but defamation and slander come quickly to mind.” No Tom, you certainly are not a lawyer. There is nothing in Emmett’s review that could be considered defamation or slander. However, I find it strange that you think it is unreasonable for Avenge Trading to provide full financial details to people who are being asked to pay $25,000 + $2,500 a month or $30,000 + $2,500 a month if you choose to pay by installments. If Avenge were serious and if their results were so wonderful they would provide redacted trading statements because this would be the best marketing tool they could possibly have. They’d be shouting from the mountain tops “Look at our results that are 100% verified.” The fact that they are not and will not provide this information speaks volumes about how much confidence they have in their software.

The trading DOM was a really positive move for this company. Now there is a lot more transparency and we can judge the product on its merits.

Have to give them credit where credit is due. This also sets a precedent for other companies.

Whom am I to say if the product is worth the price. Let the market determine the price, based upon the merits of the product.

intersting review and comments.

The thing with software/indicators/etc it’s still subjective on the user.

I’m sure avenge has it’s niche and users, which do make money.

But, It’s like saying you can make a lot of money on ninja trader.

Which is both true and false.

I think it defeats the point of joining a room where no live trades are shown.

I think the reason why most don’t show the DOM is for legal reasons.

Ie: they can’t legally give investment advice.. but only provide training.

But i’m not sure.

Thanks for reviewing Avenge. I had requested it be reviewed, along with deltatradinggroup.com several weeks ago on your review requests section, but my post is still awaiting moderation. Delta Trading group, like Avenge also has a heavy advertising budget. I hear their 1 hour info commercials a lot so I am interested in hearing about them too. Thanks.

Glad I found this website, even though I had to get to page 3 on google to find it. Good review and pretty much asked all the questions I was afraid to ask. I called them today and was blown away by the $25000 asking price. I mean I can afford it and would pay for it only if there wasnt so many red flags as listed by you. I asked for verification of the trades and they send me some excel sheets, like really? Thats supposed to mean something? I have seen nothing that warrants me paying you $25000 and then another $2500 monthly. I want to hear from the users who using this right now.

Maybe they do have a good product, but am i willing to fork over $25000 to find out? No. I will wait until the issues mentioned in this review are addressed or wait for further reviews. Right now I will hang on to my money.

Hi G8,

Trading is a risky endeavor no matter how you slice it, and at Avenge, we are serious about communicating the risk to each member. By no means do we wish to scare anyone from asking the important questions. You should know exactly what you are getting into before you join any trading group or purchase any services.

We run a fiercely competitive software, the performance of which is very high. Hence the price.

Our excel sheets show the trades of our moderating duo’s trades. Not only do those sheets show the profit/loss of each day since January 2014, but they represent specifically which algorithms were traded on our software. Our moderators track this for the benefit of the group, disclosing which algorithmic trends pay off better month to month, especially in light of global news such as Greece and China affecting the market. (The email I sent you specifies that we are happy to help you interpret the spreadsheets if you have trouble reading them.) The verification we provide is better than account statements: we release actual video recordings of each trade that took place on those spreadsheets. If you want to see any of our significant winning days or losing days on the S&P 500 after viewing the spreadsheets, let us know which dates you want to see and we’ll send you those videos.

Also note that we now display a trading ladder on our Webinar, showing each trade we take. Solid, real-time proof.

Feel free to call the Avenge number, we are happy to connect you to some of our current members.

Brandon, I don’t know what trading software are you using but I can assure you with most of them (including NinjaTrader) you can record on Market Replay Data any trade you want after the market is closed on past data. So, in other words you cant prove with your video that your trades are taken real time.

Believe me, nothing better than broker statement. Worst case scenario is trading platform report with account name shown.

For 25k USD I can make a lot of videos on past data.

Mr. Brandon, I am sure many of your customers are ready and willing to show their brokerage account status to prove you being a real deal and them being so smart making this investment.

$25,000 upfront for trading software…. Safe to say that rules out 99.5% of folk reading this blog, with the other 0.5% being I suspect too stupid or too rich to care.

Well its actually $7500 every month until your debt is paid.

Hey, the company motto is Avenge! the 99% can now be part of the 1%! Too bad only the 1% can afford the software. Tears of sadness.

Hi Emmett, this is Brandon from Avenge.

I’d like to ask you to rewrite your review. There are a few key elements that are misrepresented here about our group.

A. I would have been happy to explain the spreadsheets had I known you were having difficulty reading them. In your email, you said that the spreadsheets looked impressive. In your review, you said that you were confused by all of the numbers and little boxes.

We offer our trial as a “sneak-peek” of how our group functions. Once you join, we offer a plethora of resources to aid you in trading with us, as well as 4 2-hour sessions with our trainer. Had we known you were going to write a review on us, we likely would have offered you a training session for free. Without us teaching you how to read the charts accurately, we don’t expect much success after only seeing the charts for a few days.

B. I mentioned over the phone in our conversations, as well as in our emails, that all of our 2-hour trading sessions are video-recorded, and I offered to let you see any day you’d like from the spreadsheets. If you’d like to see any of our most impressive winning days, or any of our least impressive losing days, we release those videos. The right side of the spreadsheets shows our profit/loss for each day. We’re very honest about our performance, and in each video, you can hear the moderators speak about the trends settling into place before taking their trades, then announcing the indicators they take their trades on, as well as entry and exit points.

C. I spoke with Darren after your conversation with him, which came across as belligerence. It was my understanding that it makes no sense to provide any personal information to a belligerent guest attendee. In fact we do reveal our personal information to people we trust. I was informed that you were not trusted based on your aggressiveness.

D. You seemed to take great issue with the fact that the moderators trade some days live, some days in simulation mode. The Avenge Moderators’ job is to trade every indicator as it appears on the software, regardless of other information we have on the market. This shows the Avenge Software’s performance even on a day when we foresee bad trading. On a day when the moderators know the market will potentially behave erratically (as we saw recently with Greece and China news), then of course they will be uncomfortable trading live. But even when they trade in simulation, they still track the trades and post their numbers on our twitter and facebook pages.

E. We don’t show a trading DOM/trading ladder in real time on our software on purpose. Up until this point, it has been a company decision that we would not do so. Our indicators appear very quickly, and we wish to avoid people simply “copy-catting” trades on a trading ladder. By the time you enter to copy the moderators based on the broadcast of their ladders, you may have missed 1-2 ticks of profit. This was something that was also explained to you, but I say it for the purpose of accountability in front of any other interested people.

In fact, we’re still considering displaying one of the moderators’ trading ladders on the Webinar anyways, just for more solidarity and proof that the trades we take are real. Thank you for your input.

F. We actually have much more than only two radio shows. Our top supporters in terms of radio shows across the US are Geraldo Rivera, Michael Medved, and Ben Shapiro, all of whom are established radio hosts who have seen the software and now advertise for us based on their positive experience.

G. I watched your video posted just above the title “Why Does Replication Matter?”, and am sad to see that you did not indicate that you were confused, as myself or the moderators would have explained those trades to you. The arrows appear at the opposing end of the candlestick. The moderator claimed that he acquired 1 point of profit in the trade at 0:20 seconds into the video. He took the arrow that appeared at the opposite end of the candlestick at 2113.00, but secured 1 point of profit at 2111.75, indicating that his entry point was a tick lower than when the arrow appeared. This is due to human reaction time, and he was honest that he did not acquire the perfect entry point with the arrow. He also indicated that he moved his bracket to the 2111.75 level, where he expected the market to continue downward (as seen in the red information on the 3-ERG, VOL-ERG, E-BIAS, 317-ERG, and F-BIAS charts, which were red before the movement actually took place). As the market did not continue downward and stayed at that level, his bracket removed him from the trade. I would have been happy to explain this to you over the phone had you have asked. In the next trade, the moderator similarly enters the trade based on the red arrow and red trending charts that are in place. Your skepticism and confusion are understandable, but mistakenly represented in assuming the trades are false.

Bottom Line:

Avenge is real. We have real members, with real satisfaction, making real money. Our software is good. Really good. We charge $25,000 to begin (or $7,500 as an initial payment if you’re a skeptic), and we think our software is worth even more than that. Trading is not easy, but we teach you how to do it. If you still don’t get it, we keep teaching you. We care about our clients, and we show it. We offer everything we can to get you to trade successfully with us, short of trading for you.

Please consider my request to rewrite your review.

Brandon,

My review was fair. And I left you plenty of room for improvement. And yes, I was aggressive. But no more, or less aggressive than with any of the other rooms that I review. My role is to ask the tough questions that most readers, out of politeness are afraid to ask. I have to dig down, drill down, dive down into the muck, beyond the deception and hyped performance figures to find the truth. Its uncomfortable and painful for everyone involved. You should also know that I have written negative reviews in the past, only to come back later and write a new review with a highly positive tone and tenor. The point I am trying to make is that you can get a highly positive review, but you just need more transparency. I am doing you the favor of telling you what others are thinking, but are too afraid to say.

Your product offering is not the casual, or the ordinary offering that we see in the trading education business. Your offering is the highest priced product of all known trading products. You really put yourself up on a perch, above everyone else. And with that, you get a little extra scrutiny. You should not be afraid of my challenge at proving authenticity, you should embrace it.

I like the confidence that you have in your product. But you need to put that DOM on the screen and show trades. Heck, even in simulator mode. I gave Rios Quant a highly positive review, and he trades on a simulator. Having a DOM present is the new standard for trading room vendors. No DOM, then you better be willing to show account statements.

So where do we go from here? You really only have three choices. You can attempt to sue me, which is a great option because your boss is a lawyer and he can harass me for free. You can ignore me, and hope this review ends up on page 5 of google search, or you improve your product and have me write a new review. My personal feeling is that you might actually have a good product, but it needs to be refined and proven in real markets. I hope you take this path. If you put as much effort into the product as your exceptional marketing and customer service, then I am confident you can bring an excellent product. Come on Brandon, push for transparency.

You guys want $25,000 up front + $2,500 a month with no refund and you won’t display a DOM or provide authenticated trading statements! Doesn’t pass the sniff test and you are foolish to think otherwise. I’ll tell you what I think your payment structure means. You’ll grab my $25,000 + another $2,500 for the first month. In that first month, because I’m new and a believer in the product, I’ll see that your product isn’t working but because I’m a true believer I’ll think it’s just because I haven’t mastered the product. Maybe I cough up another $2,5000 at which point you’ll rub your grubby little hands together and think we’ve got a real sucker on the line here. Here comes month number 3 and I still haven’t mastered the software but I can’t afford to hang around to make it work because it’s costing me $2,500 a month to do so. At this point I’ll go away believing that I couldn’t figure out the software, you keep all my cash and go on to find the next sucker.

And anyway my money worries are over. A nice man from Nigeria has just sent me an email telling me that he wants to split $35,000,000 with me if I give him my bank account details. Plus he has a lovely sister who thinks I’m very attractive and would like to meet me.

I recommend asking a couple of friends for their advice before going with that one. 🙂

Hi Mr. Dog,

We offer a lot of materials to show you more before you pay any large fee. Yeah, $25,000 is a lot to some. (We let you start with $7,500 if you’re a skeptic, and you pay the rest later.) But we prove how good we are. And we go the extra mile to teach you everything you could want to know before you trade live with us. We have a trainer who trains all of our new members 1-on-1, for a minimum of 8 hours with him, more if you still don’t get it. If you’re interested (or just want to argue with someone), feel free to call the Avenge number, 888-900-4034. Any of our customer service reps would be happy to talk with you.

I told you Brandon is feisty. He is a true believer! I have little doubt he is going to make this trading business work, but he needs to just provide a little more transparency in those trades.

In my opinion, those lower time frame scalp trades are something found at Disneyland. But the higher time frames can be replicated. Come one Brandon, get that DOM up and prove it to yourself whether it can be replicated. Finding out the truth is going to make your product very strong and a good review is going to justify the price.

My review wasn’t that bad. You are close. You can do it. Just get that DOM up and find out what works and dump what does not work.

Hi Emmett,

We are now displaying a DOM/trading ladder. This was a suggestion that we had received from other members before receiving your critique, and we already are having positive feedback. This link is a screenshot from today’s session. Again, we appreciate your review, and thank you for your critique.

http://s9.postimg.org/ak8q1b165/Avenge_Webinar_7_28_15.png

Your turn. Shall we expect a call?

Oh right. $7,500 + $2,500 for the first month so that’s only $10,000 for the month for a product that has no proven track record and not refund. Well that’s OK then.

Tell you what. You let me have the software for free and no monthly access fee and I’ll pay you what I owe you from the profits generated by your product. Come on, I’ve $100,000 sitting in my Etrade account right now. It’s just itching to be put to work.

I listened to your hour radio ad and you made it a point that this opportunity was aimed at the 99%. To give them an advantage that previously only the 1%ers had. I’m not sure how many people you know that are in the 99%, but rest assured not many of them can afford to pay $25K for software and then $2,500 a month on top of that. That is the most absurd thing I’ve ever heard. Until your prices come down dramatically there is no way in heck I can afford to even think about trying this program out.

I am a retired man that bought in with trading to make an extra income. Avenge software used to be called Ascend Trading. They lost everyone’s money and closed down the shop. Now they are re-opened with a new name, same software that is slightly tweaked. I bought in for 15k and 1k per month. Started out ok but then tanked my account from their overall horrible trades. Nobody has a last name and I come to find out that the names they use are not even their own legal names. I see nothing good with this new so-called company called Avenge. Spread the word Emmett

This reminds me of the 4xMade Easy/Wizetrade marketing back in the 1990’s.

Nice review but I do not think they will ever be worth what they are asking.

I love their radio show where they say now the average person has a chance.

That is exactly what 4xmade Easy/Wizetrade pitched and they suckered a lot of people.

I said no at $25,000 + $2,500 a month. That’s about 4 years of school fees for my son, a generous deposit on an investment property, a year long holiday … I could go on. I should get into the stock market education business but somehow “Stray Dog Trading” doesn’t instill confidence in the product.

Great comment. LOL.

Are you not aware that the person that came up with this software is right now in jail. Brandon’s father is a guy named Gordon Driver. Gordon is a sociopath, and he came up with this scam some years ago. And Brandon is his son, and selling smoke.

Google “Gordon Driver” and Axcess Automation.”

GOrdon is currently at Terminal Island serving 12 years for wire fraud.

Hi Darren,

Thanks for reaching out. Actually, I did write an update on the situation with Gordon.

Emmett