Nearly every week, someone sends TradingSchools.Org a request, asking about various topics related to technical analysis tools used to analyze stocks, futures, Forex or options. Nearly all modern trading platforms contain a plethora of basic trading tools. Some of the more common technical analysis tools are moving averages, stochastics, volume analysis, Japanese candlesticks, Heiken Ashi, MACD, divergence, Bollinger Bands, to name a few.

It seems like every few years, we get an entirely new set of tools that capture the imagination of the investing public. Crafty vendors and trading educators quickly pick up on these consumer trends and create their own “secret sauce” trading indicator that supposedly predicts future price direction. I like to call these sorts of characters “Indicator Hustlers”, as they put a little shine and spin on increasingly complex mathematical formulas. Slap a clever-sounding name on it and sell it to the next round of suckers. For instance, during the 1980’s, at the dawn of the personal computer, a few clever marketers created very rough looking programs that charted moving averages of stocks and commodities prices, and sold the idea as a “method of prediction”. A new industry was born.

As personal computers became cheaper and cheaper, the natural evolution was for trading platforms to offer more advanced feature sets. At some point, we dived off the deep end…into the esoteric. Some of those early esoteric hipsters include Wells Wilder, who claimed that future price direction could be universally predicted by charting the stars in the sky, or the gravitational pull of the moon. Yet others claimed to be able to predict future price direction through bible passages. Further down the rabbit hole we continually venture.

The truth is that even the most esoteric hipster, like a broken clock, will be correct at least twice-a-day. And being correct only twice a day is enough to sell the masses of desperate consumers the ‘next great thing’ in trading technology. Which brings me to Heiken Ashi Candlesticks.

What in the heck is a Heiken Ashi Candlestick? Quite simply, it is just a Japanese Candlestick with a tiny little trend component built into the equation. I will not be writing about Japanese Candlestick charting techniques. Have already spent a good deal of time writing about various hustlers in this particular niche. Hustler A, and Hustler B. Candlesticks are just another way to apply meaning to price charts.

Heiken Ashi Candlesticks are the next level of evolution of the original Japanese Candlestick. When you look at the Japenese Candlestick, you can see trend a little more clearly than a standard bar chart. A Heiken Ashi adds another subtle layer or calculation into the mix. Let’s take a look at the calculation for a Heiken Ashi bar, there are four calculations to form a bar.

Open of a Heiken Ashi Bar is calculated by adding the Open of the previous bar, plus the close of the previous bar, divided by 2. The exact formula is:

- Heiken Ashi Open = (Open of previous bar + Close of previous bar) / 2

Close of a Heiken Ashi Bar is calculated by adding the Open, plus the High, plus the Low, plus the Close, divided by 4. The exact formula is:

- Heiken Ashi Close = (Open + High + Low + Close) / 4

High of a Heiken Ashi Bar is calculated as the highest value of the High, Open, or Close. This might sound confusing. How could the Open or Close be higher than the High? Remember, the Heiken Ashi uses an average of the previous bar. So there are instances where the Open or Close can be higher than the High of the current bar. If still confused, these bars are easily seen as solid bars with no ‘tail’ or ‘candle wick’.

Low of a Heiken Ashi Bar is calculated as the lowest value of the Low, Open, or Close. Once again, if confused, these bars will be easily seen as solid bars with no tail.

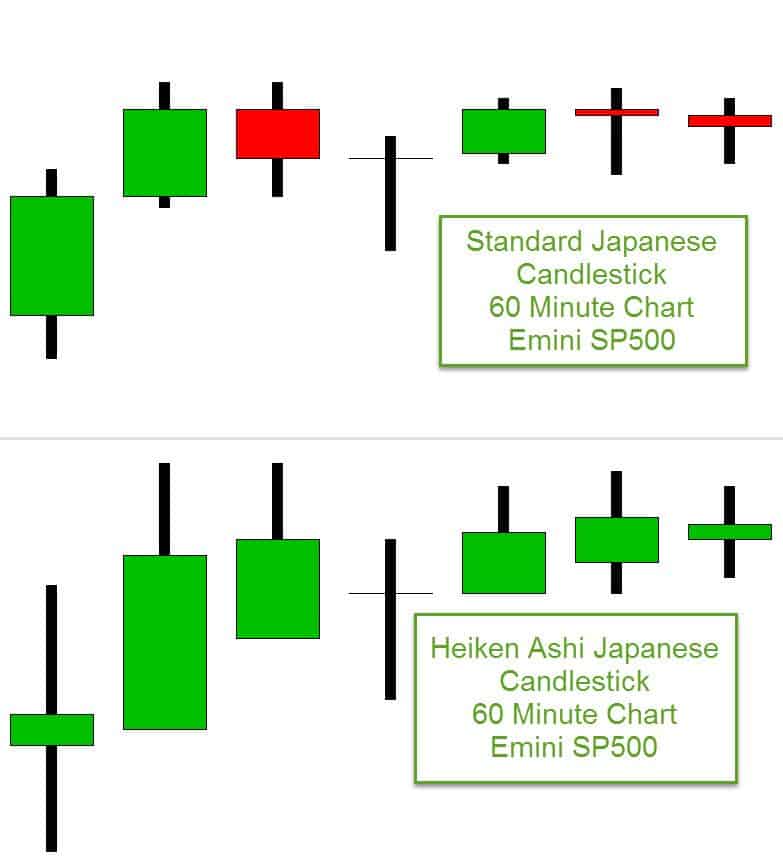

Next, let us take a look at a Heiken Ashi Candlestick vs a standard Japanese Candlestick. The following screenshot is a 60-minute chart of the Emini SP500, with standard Japanese Candlestick on the top, and a Heiken Ashi Candlestick on the bottom.

As you can see, in this particular instance the Heiken Ashi did a better job of signaling a continuing uptrend for 60-minute Emini SP500 market. So why am I including this screenshot of a Heiken Ashi vs a regular Japanese Candlestick?

Day Trading Room Example

As many readers are aware, TradingSchools.Org records a massive amount of trading sessions within live day trading rooms being offered by various trading vendors. Recently, we spent a week inside of a popular trading room where the head moderator was using a 60 minute Heiken Ashi as his ‘anchor chart’ for day trading the Emini SP500 futures contract. The concept of an anchor chart is pretty simple. You would only trade in the direction of the dominant trend as per the anchor chart. If the ‘anchor chart’ is green and signalling higher prices, then you would only take trades in the direction of (hopefully) higher prices.

In this particular example, the trading vendor did OK by avoiding the possible trend change heading downwards, that was flashing on the RED as per the standard Japanese candlestick chart. Many traders might have been duped into taking a short trade, only to quickly discover that the signal was false. The market continued to grind higher.

After the market closed for the day. The trading vendor gave a ‘post-market’ wrap up and continued to talk about the amazing wonders of using a Heiken Ashi as a trend filter. In fact, he stated that for the prior 5 years of “being a full-time professional day trader” that specialized in the Emini SP 500, the Heiken Ashi 60 minute candlestick contains a robust and definitive trading edge. That it was as reliable and predictable as the sun setting in the west and rising in the east.” This guy was a true believer.

Next, I called him on the telephone and had a very pleasant conversation. We talked about Heiken Ashi and the use of the 60-minute bar as an anchor bar to determine the primary trend. I asked him if he had ever programmed the Heiken Ashi 60-minute bar and tested it on the Emini SP500? He explained that through many years of trial and error as well as visual observation, he simply ‘knew’ it was a valid concept. The thousands of hours of trading screen time gave him an intrinsic feel of the market that expressed itself through the Heiken Ashi. There is nothing like personal experience, right?

And so next, I offered to program his Heiken Ashi strategy in exact detail. And then present the results in a scientific manner. He thought this was a great idea. He was eager to prove how wonderful his method works for his paying subscribers.

Heiken Ashi Trading Strategy Number One

Rule A: If the 60 minute, Emini SP500 is flashing a Heiken Ashi green bar. Which is signaling an uptrend, then buy the close of the green bar. Simply exit 60 minutes later.

Rule B: If the 60 minute, Emini SP500 is flashing a Heiken Ashi red bar. Which is signaling a downtrend, then sell short the close of the red bar. Simply exit 60 minutes later.

The system trades only the day session. No trades taken overnight. All trades exited at the close of the day session.

We deducted $4 per trade in commission costs. We just wanted to test the raw signal. If an edge was present, it would have emerged. We got the following results…and they were not good.

Profit Factor of 1.03 with an average trade of $6 profit with a $37k drawdown. Very ugly equity curve.

Heiken Ashi Trading Strategy

The vendor was pretty shocked to discover that his supposed ‘edge’ of using a 60-minute Heiken Ashi bar chart contained no statistical advantage. When I have these sorts of conversations with trading vendors, about their trading indicators, it is usually filled with long silences. And there is a lot of initial disbelief.

The truth of the matter is that many well-intentioned trading Guru’s really, truly believe that their kool-aid contains magical properties. When presented (confronted) with hard evidence, most are pretty sad and depressed. The usual excuse from the Guru is that they have a ‘feel’ for which signals to take, and which signals to not take. And so they cherry pick based upon hunch or some other form of anecdotal evidence that cannot be defined. This would be akin to a medical doctor deciding which patient should be vaccinated and which patient should not be vaccinated.

pretty sad and depressed. The usual excuse from the Guru is that they have a ‘feel’ for which signals to take, and which signals to not take. And so they cherry pick based upon hunch or some other form of anecdotal evidence that cannot be defined. This would be akin to a medical doctor deciding which patient should be vaccinated and which patient should not be vaccinated.

Trading system rule sets are a lot like vaccinations. Either they work on the entire population, or they do not. The larger the population in which to test the theory, the better in which to evaluate the results.

Markets are just groups of people taking action. And within these groups of people are incredibly complex ecosystems of motivation. No trading indicator has the ability to encapsulate the motivations of all participants. A trading indicator does not predict anything, it simply displays what has already happened. The beauty of today’s modern backtesting platforms is that we now have the ability to define micro events being revealed by trading indicators. Once we have these micro events isolated, we can then ask the tough question…what typically happens after a micro event, or what happens after a 60 minute Heiken Ashi bar is signaling higher prices.

As we can see from the prior test, it simply does not work. But should we just toss the results and forget about Heiken Ashi charts? Does this mean that Heiken Ashi is not a valid concept? Many readers are probably quick to stop reading and hastily decide that Heiken Ashi charts and Heiken Ashi trading systems are useless. But this is not the truth.

The truth is that every single trading indicator in existence is guaranteed to work sometime. The hard part of this game is figuring out when to use it. And when to put it on the shelf. The next section, I am going to do my best to walk the audience through a research scenario and provide a look into how I would incorporate Heiken Ashi into an actual trading strategy.

Developing a Heiken Ashi Trading Strategy

For me, when I develop a trading strategy, the most important thing is the sample size. I want a massive amount of data in which to work within and analyze. The larger the amount of data, the greater the chance that I might accidentally stumble onto a genuine and exploitable bias. A bias that other market participants are not seeing. Once I stumble onto a bias, I then analyze the bias and attempt to form a logical hypothesis at to why the market is repeating the same behavior.

Let’s first look at the data that I personally use. First things first, since I mostly trade during the daytime, I want to focus on just the day session data. And since I like to sleep at night, without worry or being anxious about the evening session, I like to omit evening session data. Yes, there is plenty of overnight/evening session financial data, but since I like to sleep and watch TV like every other regular Joe, I don’t want to be bothered with night time anxiety. So the following are the trading symbols that I typically test different trading ideas.

Financial Futures:

- Emini SP500

- Emini Russell 2000

- Emini Dow

- Emini Nasdaq

US Treasury Bond and Note Futures

- Ultra Bond

- 30-Year Treasury Bond

- 10-Year Treasury Note

- 5-Year Treasury Note

Softs and Meats Futures

- Cotton

- Feeder Cattle

- Coffee

Grain Futures

- Corn

- Soybean Oil

- Soybeans

- Soybean Meal

- Wheat

Precious Metals Futures

- Gold

- Silver

- Copper

- Palladium

- Platinum

Currency Futures

- Australian Dollar

- British Pound

- Canadian Dollar

- Euro FX

- Japanese Yen

In addition to futures contracts that have enough volume to actually trade, I also include the following stocks and ETF’s:

- 75 various ETF’s or exchange traded funds

- Dow 30 stocks

- Nasdaq 100 stocks

- SP500 stocks

- Russell 3000 stocks

As you can see, its nearly 4000 symbols! In addition, I test on 5-minute bars, 15-minute bars, 30-minute bars, 60-minute bars, daily bars, and weekly bars. So when I run a test for a particular pattern, you can imagine the hundreds of thousands of potential combinations in which I am testing. It is quite a time suck.

Most readers contemplating this sort of heavy lift will assume that a super fast, super high powered PC is the best option. Wrong! On the contrary, the best option for this sort of grunt work are cheap $200 laptop computers. For me, I install my backtesting software and data on 5 cheap little laptops. When I want to run a long test, using thousands of symbols on a multitude of time frames, I will spread out the workload. Since 99.9% of the patterns and ideas that I test will most likely prove worthless, then why should I expend so many resources on expensive computers? I work the poor little laptop until the bearings in the hard drive eventually give out. And they all eventually give out.

Since 99.9% of the patterns and ideas that I test will most likely prove worthless, then why should I expend so many resources on expensive computers? I work the poor little laptop until the bearings in the hard drive eventually give out. And they all eventually give out.

The point that I am trying to make is that when you are developing a trading strategy, cast a wide net. The wider the better. Capture as much information into the net as possible. After you begin programming and testing different trading strategies, you will find that the most precious catch will be the fish that you did not expect to find.

Heiken Ashi: a workable trading bias. A possible trading strategy.

To show the power of casting a wide net, in hopes that something tasty turns up inside of the net. I took the original idea of the 60-minute Heiken Ashi that the trading room moderator was touting as an amazing anchor chart with ES500 futures contract, and simply tested the idea on my vast ocean of data. Hoping that something would wash into the net. When you cast as wide as net as me, the chance that something workable will magically appear is quite good. What I want to see is an exploitable bias. A clear direction of where prices are headed. I want to know that the dice are loaded. So let’s take a look at a pattern that you might find as valuable.

Rule 1. Copper Futures. Using a 60-minute Heiken Ashi chart. Imagine that there are only two hours remaining in the day session. The Heiken Ashi chart is pointing down, the candle is Red. Market participants are anticipating a down market, are assuming the market will close lower still. However, as the market moves toward the close, we begin to see measurable buying coming into the copper futures market. The price begins to rally. With only one hour remaining in the trading day, the final Heiken Ashi bar flips from Red to Green. A signal that the final 60 minutes of the trading session is going to hopefully witness additional buying pressure and higher prices.

Rule 2. With only 60 minutes remaining in the day trading session, the Heiken Ashi candle is now Green and pointing higher. We enter to buy Copper futures at the market, and hope that there is an angry ninja about to bust out of the Heiken Ashi candle. We want that copper market to move higher for the final hour of the day. We wager it will. We exit this trade at the end of the day, without exception. And our copper futures trade is based on the following evidence…

Buy copper futures when the Heiken Ashi flips green. Last hour of the trading day.

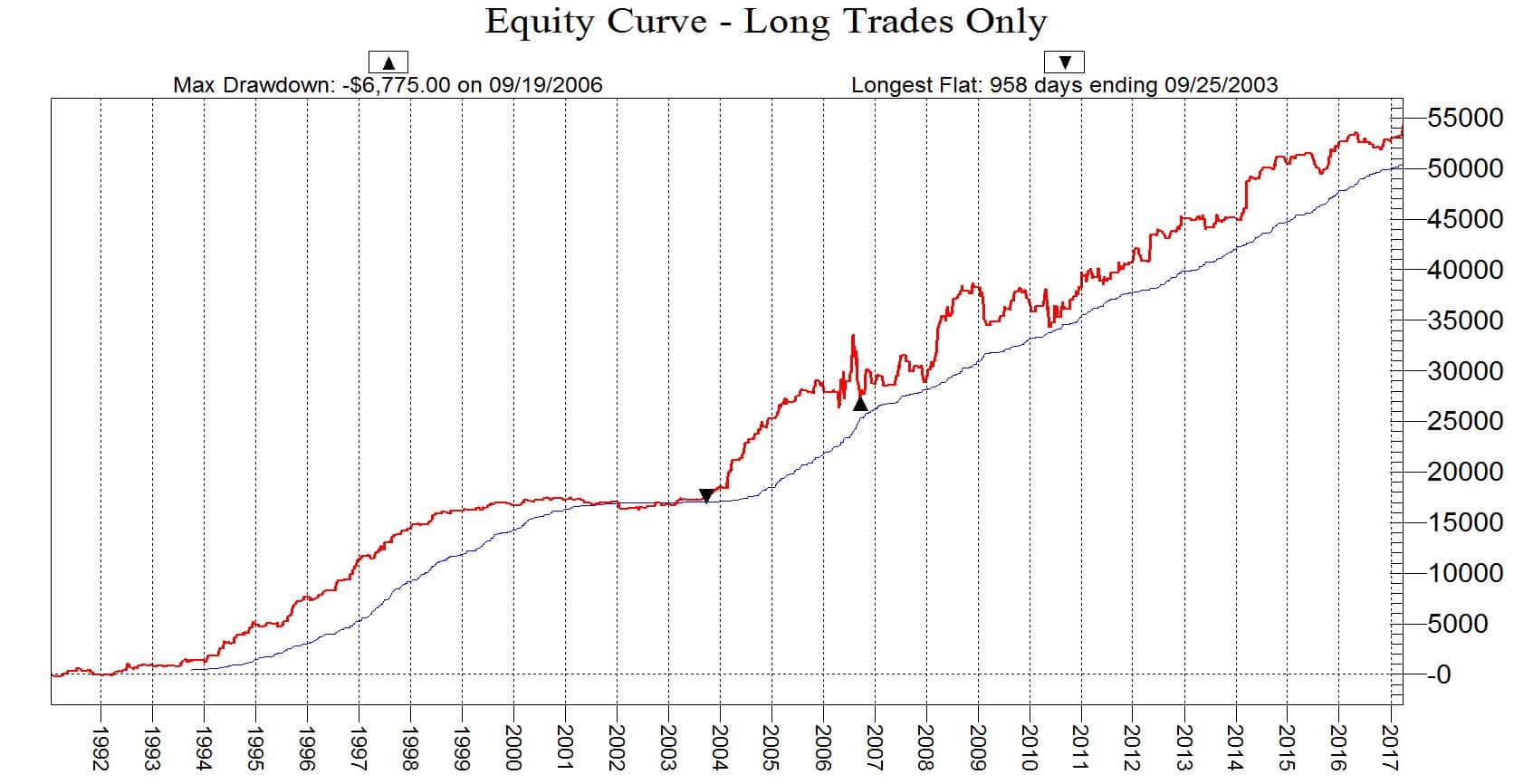

What is this equity curve telling us? This equity curve is telling us quite plainly that the final hour of the day, with Copper Futures, the market tends to drift higher. Our trigger is when the 60- minute Heiken Ashi candle flips from (Red) down to up (Green) up. Let me remind folks, there is nothing fantastical or magical about a 60-minute Heiken Ashi candlestick. The Heiken Ashi candlestick did not predict the future. It simply gave us a trading signal that Copper prices were likely heading higher. Truth be told, there are hundreds of indicators that do the exact same thing. But that is not important, what is important is that we have found a tendency for Copper prices to rally into the close of the day if the price of Copper had been drifting lower the previous 60 minutes.

minute Heiken Ashi candle flips from (Red) down to up (Green) up. Let me remind folks, there is nothing fantastical or magical about a 60-minute Heiken Ashi candlestick. The Heiken Ashi candlestick did not predict the future. It simply gave us a trading signal that Copper prices were likely heading higher. Truth be told, there are hundreds of indicators that do the exact same thing. But that is not important, what is important is that we have found a tendency for Copper prices to rally into the close of the day if the price of Copper had been drifting lower the previous 60 minutes.

Refining our Heiken Ashi Strategy

Is an average trade size of $69 good enough as a standalone trading strategy. For me, it is not. I like to see an average trade size, for Copper futures to be +$90. So we are not that far away. How can we improve this strategy to increase average trade size? The good news is that we have a sample size of 786 trades. So we can add a few qualifiers that decrease the number of trades, and increase the average profit per trade over $100 per trade.

Without giving away the store, and to inspire you to take this concept further, I will give you a few hints on how you can ‘supercharge’ this bias into a very robust trading strategy. The following a few hints:

- What happens to this bias when the price of copper (intraday) is highly correlated with the price of gold (intraday)?

- Are certain ETFs and stocks that are highly correlated with Copper prices a good candidate for this strategy?

- What happens to this strategy when GDP or Gross Domestic Product is expanding?

- What happens to this strategy when the COT of Commitment of Traders Report reveals that producers are accumulating copper?

Let your imagination lead you forward. The answers to these questions are in plain site.

Using Stops with this Heiken Ashi Strategy

I have a simple philosophy regarding trading stops. Use the widest stop loss as possible. Yes, you can turn a losing strategy into a winning strategy by employing different stop sizes. But if your strategy requires a tight stop or a small stop, then you are playing with a delicate trading strategy. And a delicate trading strategy, that requires a lot of input is a strategy doomed to failure. Avoid this problem by only employing strategies that work across a wide spectrum of stop amounts. Let’s take a look at our Heiken Ashi 60-minute Copper Futures strategy, using stop losses ranging from $100 to $1000. We will backtest using increments of $100.

Stop loss size is irrelevant.

As you can see, the size of the stop loss is pretty irrelevant. The bias remains apparent, irrespective of the amount of the stop loss. For me, I would choose a stop loss of $1000 per contract. I want to give the market enough time and room in order for the bias to reveal itself.

When to turn off the Heiken Ashi Strategy Off?

Every system developer is going to have their own ‘special sauce’. No two developers are going to give the same answer as to when a trading strategy should be retired. The truth is that there is NO CORRECT ANSWER. But, I will tell you my own procedure for turning a strategy off. I simply calculate a 100 periods simple moving average of the equity curve. Please notice on the above equity curve, which you will see as a jagged red line. And then notice that under the equity curve is a smooth blue line.

The smooth blue line would be 100 periods, simple moving average of the equity curve. Once the equity curve dips below the average, then it would be time to turn off this trading strategy.

Once again, there is much debate as to when to turn on or turn off a trading strategy. But the hard and ugly truth about trading strategies is that all trading strategies are eventually doomed to failure. All markets change over time. Nothing lasts forever. So you need to have something built into all of your trading strategies that put them into the graveyard. This might be disappointing for many to read, but its the hard truth.

The key to long-term systematic trading success

In my opinion, the key to surviving is to accept that the markets are always in a state of change. What is apparent today, will be gone tomorrow. So you have to be always be searching. Always researching. Never give up asking questions and backtesting different hypothesis. Always keep digging. The moment you stop researching is the moment you seal your fate. Failure will never stop chasing you.

Wow, this blog post is now over 3000 words. Sorry, I took so much of your time. Thanks for making it this far!

I will wrap this up by stating the obvious…whenever a trading vendor begins howling that we “just had a moving average crossover!” or “big time hedge funds are hitting the bid!”. Stay calm. And use the backtesting tools the are readily available. Test stuff! Once you figure out how to code your own strategies and test differing trading indicators, a whole new world is going to open up.

Thanks for reading. And if you need help testing your own ideas, you can always email me with questions. I can usually code any trading idea in less than a minute.

From a reading standpoint your write up is just amazing .. sheer pleasure to read…laughed like hell….

Hello I’m from Brazil.

My name is Rafael

I’ve traded in the futures market for a year.

I have a favorable record of 70 to 80% of success in operations, but my results have been ruinous and closed almost every month at a loss.

I would like to know how to restore confidence and turn these negative results into positive results.

I have studied the behavioral part a lot.

Thank you.

Rob B – Do you still have links to your brokerage statements? I must have missed the posting to your statements but would be interested in looking at them if still avail

I am sure the link is somewhere, but it was a complete WOT (Waste of Time) as just had insane shills commenting. I think I showed around $4K in profit over a 3 month period and they just said fake statement and what a loser I was for so little gain. These folks have no clue about Real Return on Money. Plus honestly your brokerage statement does not show the whole story. If it was a million dollar account with a 4K / 3 month period that is not so great but if it is a $20 K account with annualized $16K gain that is Great ROI.

As I have stated I am a full time investor and with Real Estate once again exploding in value (at least in my area) I am currently mostly focused on Real Estate as right now there is more money to be made in that than in short term Stock Trading. In fact when DTChurn mentioned me being absent for awhile I was in another state rehabbing a house. Though I must admit I was surprised anyone even noticed me being gone.

Last bit of advice. I do not microscalp futures for 4 ticks and make 20 trades a day. In fact even when actively trading I find nothing worth trading most days.

OK — What do you think of shorting stuff like UVXY and TVIX as a long term trade idea?

Personally, I do not short or trade options except as a hedge. In fact I think you will find most successfully investors use options in that manner.

Even during the NASDAQ bubble when prices where insane and going hyperbolic, shorts got killed (unless they nailed the top) as the prices just kept going higher.

I think your most successfully short traders have some inside information or create the news story, like short lumber liquidators and then have a news story they are not carb compliant.

The problem with shorts is your risk is infinity while with longs you are limited to your investment. What I try to do is see if there is a way to find a long. And I will give you an example of a true story in this regards.

During the NASDAQ bubble everyone thought I was anti tech, but that was far from the Truth as I had invested in Intel before the bubble began when it trader for PE of 10 and had great earning growth. But when you started to have tech companies with no earnings or earnings prospect trading for greater market cap than Walmart, I said this is a bubble and I recommended buying Real Estate. This was before anyone ever heard of a Real Estate bubble. And no one was interested. I was told I was out of touch and it was about eye balls. Well we all knew how that movie ended. At that time there were radio shows telling people do not buy a house because it was dumb and instead buy NASDAQ stocks. The point I am trying to make is if you keep you head on your shoulders when there is a bubble instead of shorting it; look for other investments that are being beaten down because no one is investing in them. Anyway that is my advice, and it is worth the price of admission.

Great advice, but really only apposite if you already have the money to buy the Real Estate.

Yes, I know, I know. So many of the Real Estate educators claim that one does not need money to buy real estate, and come on the tee vee in the late night to tell us so. Guess what, all those folks are just the Real Estate equivalent of the TR that Emmett has been skewering in here. In Real Estate, as in EVERY investment, cash is King, and don’t you forget it.

So you want some names?

Cyn,

You are right there are no shortage of scam artist in the Real Estate world. And I have seen people lose their shirt. Real Estate is more like a business and you better know the business or you will lose money. I have yet to meet anyone make money in Real Estate that are clueless or make a fortune sitting on your butt like some vendors promise.

The successful ones are Real Estate Brokers or Business men who understand construction or like me who are a combination of both.

I will say once you prove yourself it is easier then you think to get hard money lenders. Have you not had a cousin or uncle tell you about the money he lost investing in some real estate scam. I sure have.

Once they see you are in the Real Estate business and profitable, you will have no problem getting money. But just like stock investing do not go out and buy a bunch of properties and leverage yourself to death like many did in the Real Estate Bubble days.

I am numbers person, If I had not majored in engineering I would have majored in finance. You must know your numbers. My advice is if you are thinking about buying a property, for goodness sake do your due diligence. You need to do a CMA and know what that home’s worth will be when fixed up. You need to create a punch list of all repairs required and know what it will cost to make those repairs and add a 10% safety of margin, because when you open those walls you always find something unexpected. And you better add holding cost and cost to sell the property. And for goodness sake this is a business and you need to treat it like one and stick to your schedule and you better oversea those contractors, because no one will care about your money more than you do.

Most of the shows on TV regarding Real Estate are bogus to me as they do not show the cost of selling and holding, but I do like a new show called, “The Deed”, because it shows just how you can lose your shirt if you do not run this business like a business.

I could write a book on Real Estate, so I better stop here before I get too many complaints about being off topic thread.

You are not an expert at trading, not a savant at real estate investment, and not a world expert at goodness knows what else, and you still have time to grace the ignorant masses here with many many off topic and sometimes violent posts. We bow down to your lack of greatness.

Look in the mirror dtchump.

DTChump,

You and Pete are either the same person or clearly closely associated. This is another post by the willfully stupid.

I trade, it does not make me an expert nor do I claim to be one. I invest in Real Estate and again it does not make be a savant nor do I claim to be one. Lastly my post are not violent. I threaten no one, but when you write one willfully stupid post after another, it finally drove me crazy and I called you out on them. Stop writing nonsense post and I will stop responding.

Gosh I almost forgo to include your image.

Good info and article about Heiken Ashi and magical indicators in general, Emmett. Thanks for sharing an observation of what you’ve found in your research. I did my own testing of strategies about five years ago mainly on ninjatrader, but much smaller in sample in comparison to what’s described in this article as I only tried a basket of futures instruments. Very hard to come up with a strategy of a profit factor of 1.5 or greater much less even breaking 1.0 ; Disgustingly I saw quite a few websites selling simple indicators with cosmetics anyone with basic coding of ninjascript could come up with and selling them for $50-100 each of course with no proven track record. I also think a few paragraphs are great help and insight to any aspiring traders such as bits in the Nison review and others. Sometimes I don’t know why I should bother commenting anymore since my posts are often tagged and crudely insulted by pests and shills. The past reviews and comments have more than enough shown by sample how thorough a 99.9%+ scam this shamshow retail vendor industry is. I know RobB gets the vanguard flak, but I’m not RobB and this is wearing me out where I should just take a break and stick to my own positive trading methods I’ve discovered without useless distraction.

Arguing with random people on the internet is an exercise in frustration and futility. I read the comments and barely dip my toe into an argument. Mainly I just express my opinion and hope nobody picks on me. You really cannot allow yourself to become emotionally invested in an argument. When someone writes something nasty…just have a good laugh. I do.

Going to start writing more about strategies. And purposely keep the pesky ‘off topic’ comments out these specific posts. Sure, people can complain about my crappy backtesting methods, and perhaps nutty market theory. I enjoy this sort of banter and criticism.

There are many new traders that read those comments and initially may not totally comprehend, but it stays in the back of consciousness. I never listened to the traders that tried to convince me not to over trade and money management should be a main focus of my trading plan. Thankfully, after my own failures, I turned a corner and focused on managing my downside first then try to turn a profit. Unfortunately, that realization can cost a great deal of time, money, and mental well being. Everyone will follow their own timetable to the correct path. As a result, I believe good advice from traders that have made those mistakes will always be valuable.

churn says: “stick to my own positive trading methods”

OK, let’s see some proof. You call out everyone else who claims Internet profitability without proof, and now you are doing the same thing. Does not matter if you sell something or not.

Proving your claim would establish your credibility, since you attack every single review on this site – even the skinny few that appear to make money.

I cannot wait to hear your excuses, because I know they are a comin’

Pete AKA dtchum, How many posts is it now under this name? Regardless the number of posts that are relevant to the person or product being reviewed are ZERO.

DTChump,

At this point I have to agree with the Stray Dog, no one can be this stupid, which only leaves you are being willfully stupid.

But I think you are also stupid in thinking any rational person would think your post have any meaning. It is as bad as Assad saying the chemical attacks was a made up story by the US and the dead kids were all actors. Are you planning on become a despot?

It is hard to talk common sense to someone that is completely mentally ill, but in case you are not completely in fantasy land, this entire industry is nothing but con artist and that is why virtually non can show proof and the few that show any prove at all do it over a very short time frame, because just like Heiken Ashi Candle the strategy works for short periods. And it is sad folks like DTChurn who are helping to point out the facts about this industry, have to deal with morons like yourself.

And this goes to a major point I have made Trading Room operators and their associated shills like DTchump have the financial incentive to post nonsense out of desperation in order to scam folks out of their money so they can make their next mortgage payment, while folks like DTChurn have nothing to gain for doing the right thing.

DTChump and his fellow shills care nothing about anyone but finding their next Goat to Screw.

I think I might die of shock the day DTChump post anything relevant to the thread and helpful to anyone. And no DTChump telling people to just close their eyes and believe whatever the con artist TR is selling is not helpful.

Thanks guys, I appreciate it. (excluding irrelevant postings)

Thank you for the nice words churn. I kindly appreciate it.

Now back to our other conversation: you had boasted about your trading profitability. It is my opinion and opinion of many traders I have spoken with that it is only fair that you show proof of your claims — just as you demand other boasters show proof.

I know you agree that it would be hypocritical for you to continue to bash those who brag yet show no proof, unless you back up your boasts of trading profits with verifiable proof.

Like you have said earlier, those who make claims need to be able to back them up. And you did claim to be profitable.

Now then, what is your plan to show us that you practice what you preach?

dtchum, aka Pete, aka dtchurnNO, aka toto, your animosity towards dtchurn is pathological and disturbing. It’s becoming exhausting replying to your nonsense posts and frankly it is annoying that you continue to highjack legitimate comments and discussion about trading vendors to pursue your childish vendetta against dtchurn.

Here is the post that dtchurn made in the Dekmar Trades review that started you off on your latest stream of rants against him: “Good find. On the surface, hard to see how this guy is any different from the other yahoos in the past reviews, but I guess we have “proof” for a month. Reserving judgement until further notice. For now, I guess enjoy the “$7k in 15 min” video.”

(all the Ws dot youtube dot com forward slash watch?v=m3uLi3B53CE)

I am still struggling to understand what you found to be so terrible in this post that you have had to pollute that review the two reviews that followed it with your lunacy.

dtchurn is not sell any trading product and doesn’t have to disclose his trading results. He has said that he follows his own method of trading and that works for him but he has made no boast as you claim, it was simply a statement. However, you have claimed “It is my opinion and opinion of many traders I have spoken with that it is only fair that you show proof of your claims” so let’s have the names and contact details of all these traders you claim to have spoken to so that we can verify if this is correct. By the way voices in your head don’t count.

DTChump or whatever current alias you are going by, it is impossible to please someone who’s sole purpose is to be willfully stupid. You are not interested in facts or truth, but just interested in being willfully stupid. You have no other purpose in life. As other will point out DTChurn is not selling anything, so who cares about his brokerage statements. But here is the real fact, even if he showed you his brokerage statement you would not care, as once again your sole purpose is just to be willfully stupid. And I know this from personal experience dealing with another moronic shills such as yourself. I will give you a little history lesson.

I have stated many times in this blog I am a full time profitable investor, both stocks and real estate. I argued in this blog with another willfully stupid shill and posted my brokerage statements showing I traded profitably, but it was all a waste of time, as you cannot have an intelligent argument with someone who’s only purpose is to be willfully stupid. Even though I posted my brokerage statements straight out of my IB account, the willfully stupid nut claimed they were false and also I made so little, which only showed he had no clue about realistic returns on money. One might argue anything less than the fantasy returns being promised by TR operators where you turn a $5000 account into a million dollars is too little. But the truth was he was a shill just like you and his sole purpose was to be willfully stupid like yourself. Anyone that is not mentally ill can see how silly your posts are. You provide no intelligent argument about the thread topic and only attack other posters who make useful contributions. Sometimes I feel sorry for shills like yourself as your posts are such nonsense. It reeks of desperation to make folks believe in the con artist trading room.

My advice to DTChurn is just to realizes DTChump, who cannot even come up with his own user name, adds no value and it is a complete waste of time to even argue with someone of this nature as you cannot ague with someone that is mentally insane. I could have a more intelligent conversation with my cat.

DTChump,

I think this will be my go to response to your nonsense posts.

Moreover I would like to see critiques of Brooks’ sham strategies, the OHLC of daily, monthly and weekly “bars” as well as 5, 15, 60 minute bars on ES futures, my backtesting suggests profit factors are random or negative when reward exeeds risk. This huckster and d-bag and colostomy-bag Brooks knows his sham doesn’t stand up to backtesting or realtime brutal trading just like Heikin-Ashi, it looks great in retrospect when cherry-picked for marketing purposes. I’m wondering what Brooks’ daughters think, maybe “Daddy turned from being a doctor to a piece of shit but I’m “always in” because I got in to Harvard. Eat me.” dtchurn makes it sound like he/she found some static holy grail and is going into hiding like a hermit, Brooks already pulled the institutionally-profitable trading hermit shtick and was dragged out into public due to selflessly answering mindless newbie traders’ pleas for help.

If I read another one of Pete’s insane post I am going to blow my brains out.

Emmett, is there no way to have some feature that I can select posters to not show up. In the mean time I guess I will just have to really watch the user name and pass over all of Pete’s Post.

exactly. his “backtesting” based on never reading the books and blindly losing a 20k high interest loan after viewing the video course sounds as imaginary as the never sent CFTC complaints, lol.

“reward > risk” ~ random profit factors, pfft.

I do not understand the photo above. Is the Poster in favor of violence against African Americans? In this day and age I find this highly offensive.

Please explain yourself OP, becuz that is a disturbing photo.

Hardly, the most mr. hydey insane b__ks diseased gollum using fake and unoriginal id’s to post to himself especially after his trainwreck in pagetrader and mooky hoping no one noticed after he screamed about never coming back and then tiptoeing on tagging my posts at the outskirts initially while everyone else is dumping on him about nonsensical posts, then whining infantily to Stray about my Felton & JaguarEd reference ,laughingly pathetic. While tradingschools is much fun exposing the shamshows it can get wearing with all the shilling and hate-filled potshot post tagging full of b__Ks bs and taking a break is healthy knowing the others will keep the shill comments in check just as we did when RobB and others had their breaks.

You shilling for Brooks now? Profit factor is dependent upon risk management/stop placement.You think Brooks provides an edge? ONly thing Brooks gives is Russian roulette for his audience and you know it. Brooks manipulates audience by not revealing stop placement or any real edge. We are in hell.

So Pete, your animosity towards dtchurn all comes down to him finding some value in Brooks’ material and teaching. You can’t simply disagree with him on that point? Please treat this community with respect and stop this nonsense and your incessant posts about Brooks.

dtchurn callously attacks and belittles me for losing money trading and not having an edge from false teachings from trading gurus, as can be seen above. It’s irony at a base level, for someone to act so viciously while presenting themselves as an advocate of transparency and as against deception in trading education.

Everyone has lost money trading at some point in their life (assuming they did any day trading). And I seriously doubt anyone is getting any type of edge from any of these con artist trading rooms.

I have an idea, I bet if you agree to stop posting about Brooks in virtually every single post, DTchurn will not say anything to you. Aah Dayton at last.

hardly, you made your own mess and many others called out your bs besides myself on blaming b__ks for it. you’re the one who dragged me into your mess all because I pointed out your ridiculous posts so well several times, and that you hadn’t even read the book nor attended the room, and you responded in a mental gutter tantrum. it’s all there to see in mook and pagetrader. completely hypocritical gollum never showed up during the b__ks event. I doubt you really care anymore about b__ks. you have no face left and nothing relevant to contribute anymore as it becomes apparent with every post.

Where have you been, bitch? No one cares what petty arguments you think you triumphed in, and this Brooks fraud is about a lot more than my trading losses, whether they be with borrowed funds or not. Try thinking of someone other than your own pathetic and mean bitch-ass.

I appreciate it Stray, but actually I use none of b__ks ideas in my trading now. The mental patient isn’t arguing about b__ks anymore, he is just using any bs, even alters to take tagging potshots just for revenge. b__ks is a con, a slick variation, but so insignificant I ditched his material long ago, mainly his used book for $10, and never had to look back. There were few newer books on trading back in 2009 where sites like bmt, forex bucket sites and smirks like Sykes renewed the retail fad for the next generations of the disgruntled fading middle class. The book forced you to look at charts so in that way maybe helpful for a newb back then, but now there are so many alternate intro materials such as cheep kindle ebooks.

Hi churn –

I and the rest of the community will be looking forward to your proof of profitability you will no doubt provide upon your return.

As they say “what is good for the goose is good for the gander.”

As we will also be looking forward to your proof dtchump that many traders agree with you that dtchurn, who sells no trading product, should produce his trading statements. Once again, the voices in your head don’t count.

TURDS

Trusting

Unverified

Results from

Dtchurn is dangerous and

Stupid

lol, coming from the proven biggest mental idiot gollum cftc hypocrite ever seen on the site himself and his innervoices drchump alters.

everyone remembers when the books review came out and the questioning went around on bmt on and on. We say Stray and RobB at the vanguard there. Where was Petedetithbrooks? you all got that right, LOL

I was already banned a long time ago for questioning Mike, how about you? This anti-“magical indicators” and secret holy grail derived from backtesting you’re gloating about smell like the TURDS of a secret EA trading vendor and trading mentor. If you acted half as bad as you do on here you’d be banned from “BMT” very fast.The mean bitch persona is a clue you’re selling something. I know it and now I just have to prove it.

I doubt that, I bet you were never on bmt back then, more imaginary bs you came up with to make up for your continued trainwrecks, just like the imaginary backtesting, LOL. face your own cessmess, it’s all evident folks as you can see, lol.

Pete,

This can’t be healthy for you. In my opinion, learn from this mistake and really try to move forward. I won’t comment again on this topic after this final take from me. Every minute you spend fuming about this deplorable human being is another minute that he has stolen from your life. You can not change what happened, but you can decide on how to react to what happened to you. I know you are young and this feels like the worst thing that can happen to you and it is horrible. However, life is too short to spend arguing on message boards. Don’t let this define you. For what it’s worth, people want to discuss the new scams that Emmett uncovers going forward. That is not a personal dig on you. If it is cathartic to comment on these scams then just try to keep it on topic. I hope it gets better for you.

Mike,

When Pete first started posting myself and others were very nice and posted similar comments to yours. But he would not stop. Even Emmett must of gotten so sick of it, that he finally reviewed Al Brooks and everyone was like finally Pete has gotten his day. But it just did not end. He just continued to post about Brooks and Brooks’s daughter again and again in every thread. It is beyond insane and that is why the response to Pete are not so nice anymore. Personally I am trying to set a resolution to just skip Pete’s post

Rob B,

I know you guys were not rude to him. I have been reading for a while. I thought maybe he can hear it from another poster and not feel like he is being attacked by the masses. I remember the responses were constructive and even when he would comment on his nemesis, other people would steer him away.

Hopefully, we can try to keep it on topic. I know from the experience losing money just sucks and if someone is responsible for flawed teachings then by all means make the point where applicable. I promise this will be my last response toward this issue. I feel this blog provides a service to new traders that just might not understand what they signed up for. The discussions on realistic returns, past experiences with trading rooms, day trading and strategies are valuable because it is honest and comes from experienced users. Unfortunately, one has to respond when a comment is directed towards a personal statement which then veers discussions off topic. Inevitably, deviating from any discussion related to trading topics.

I read a post on Warrior Trading where the man asked if it is possible to make a $100,000 when starting with $500 in only 4 months. He was starting to question whether the sales pitch matched reality. For this individual, TS is an extremely valuable unbiased source where he can possibly save money, time, and aggravation. I never got a chance to respond to his post , but I will. I am an avid reader and learned a lot from Rob B, Stray Dog, dtchurn, CYN, Emmett and the list goes on. I would like to keep reading about trading experiences and shedding a light in dark corners of online trading scams. I do understand that there will be some people that don’t agree with me and that’s fine.

Whenever someone sends a nasty comment my way…I nearly always have a hearty laugh. I actually like the nasty comments like “this review totally sucks!”

At the end of the day, we all have an opinion. If you don’t agree with somebody’s nasty opinion, you have to just let it roll off.

It is also important to understand that the person on the other end of a nasty comment might be a 12-year-old kid. So you just have to learn to enjoy criticism and not allow yourself to become too emotionally invested in an argument.

As one pundit put it, “Opinions are like ass holes. Everybody has one, and it usually stinks.”

Still lacking originality I see Pete but I guess it’s to be expected.

You have to go way back, MikeM. What RobB mentioned happened long before I was even caught in his mess. I was civil too, until he started making nasty crude insults anyone w9uld be offended by except instead of facing up to the dumping by everyone else he just tried to blame it all on me again and again and again ad infinitum. It’s all there to see if you go back in the hundreds of b__ks baits posts in the past 50 or so review comments. It escalated because he escalated it. Rob Stray, Cyn, Hillary, etc. they saw all of that and know how it went. He has continued to tag my posts taking potshots even though he quit for a while since pagetrader, but still used his alters to post and I actually let it be as RobB suggested above until he recently tagged under my post with more nonsense as all can see along with the alters drno and invervoices mad drchum. He is mental and doesn’t know when to quit trying to get revenge on me when it was entirely his fault to begin with. Plus even if he was banned shortly before the b__ks event which I highly doubt, anyone whose been around on bmt/fio knows someone can get registered to post again even after a ban if they really want it, so a big exposed LOL of a noshow on the b__ks fio thread. I think RobB even got banned twice during that. He and Stray put up a good respectable questioning while gollum was in his hole. As for me, I repeatedly said I ditched b__ks long ago and b__ks is insignificant to me. People have been warned enough. If a gollum wants recompense they need to sue and stop whining to others to send cftc complaints he didn’t send himself and no one cares to even bother.

Yeah it’s weird how he’s zeroed in on you dtchurn. It’s got to be debilitating to get up every day with that much animosity towards some anonymous person who posts on a blog. He should relax, get a pet, follow Trump’s advice and grab Rob B’s …

That’s funny. It took a few minutes for the last comment to register. At first I was confused then it hit me when I was reading something else.

I may be wrong, but even though I am not a biology major, I suspect that Rob B does not actually have any poontang pie. So that animal describes the wrong part. LOL

Great article Emmett, it is worth mentioning that we have to accept losing trades and that is the big problem here, every one is looking for a strategy without losing trades. Keep up the good work.

What software do you use for testing?

Hi John,

I currently use Trade Navigator Platinum. But I do not recommend it! The owner of the company, Glen Larson is lazy and pathetic. He has invested very little in technology.

Emmett