F1 Trade: The latest scam of Guy Gentile?

-

Honesty

(1)

-

Legality

(1)

-

Cost

(1)

-

Guy Gentile

(1)

Summary

F1 Trade appears to be the latest scam of Guy Gentile.

F1 Trade is yet another illegal, unlicensed, and unregistered Contracts For Difference broker located in a lawless pirate cove in the Carribean. Guy Gentile appears to have his fingerprints all over this shitshow. In fact, the F1 Trade website, which was hastily constructed, includes numerous references to the now-defunct Sure Trader.

Many F1 Trade customers located in the United States have contacted TradingSchools.Org and are reporting “its the same people.” Which includes Guy Gentile and his ex-wife Karen Gentile, who is providing the infrastructure through the DAS trading platform.

Let me be very clear — trading CFD’s in the United States is a potential felony for the trader, and especially the broker. Trading of these highly toxic securities is simply not worth the risk.

TradingSchools.Org is currently involved in a Whistleblower complaint filed against F1Trade, at the CFTC and the SEC.

Avoid F1 Trade.

Pros

Nothing to recommend

Cons

Trading unregistered CFD’s are a felony in the United States

US regulators will shut down F1 Trade — the question is when

A serial pump and dump scam artist has his fingers all over this

Thanks for reading today’s review of F1 Trade. What is F1 Trade? The company is an offshore CFD broker, located at Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont, Kingstown, St. Vincent, and the Grenadines.

As the company readily admits on their promotional materials, “We are an unlicensed, uninsured, unregulated, and unregistered CFD broker.” In other words, “we are going to steal your money.”

The company is offering what is known as Contracts For Difference. Which is classified as a commodity.

Contracts For Difference trading is essentially a gambling wager. A person places a wager and is given a ‘ticket.’ If the wager is correct, then the gambling operation is supposed to pay off the ‘ticket.’

Contracts for Difference trading is not investing. Not even close.

Two classifications of Contracts For Difference

A Contract For Difference is technically defined as a swap commodity. There are two types of swap commodities.

The first type of swap commodity is a securities-based swap commodity. Suppose that you want to gamble that the price of Apple stock is going higher, then you would be placing a wager on a securities-based swap commodity.

The second type of swap commodity is a commodities-based swap commodity. Any Contract For Difference that is based upon the underlying price of a commodity is a swap commodity.

Suppose that you want to trade an ETF based upon the price of Crude oil, gold, or currency. This is a commodities-based swap commodity.

Some popular commodity ETF’s include GLD or SPDR Gold Trust, or USO or United States Oil Fund.

The Regulatory Framework — SEC or CFTC.

If you are trading a securities based CFD, then this product would be under the regulatory jurisdiction of the SEC, or United States Securities and Exchange Commission.

If you are trading any CFD that is based upon the price of a commodity, then this product would be under the jurisdiction of the CFTC, or Commodity Futures Trading Commission.

Many of these offshore CFD brokers mistakenly believe that they are under the exclusive regulatory jurisdiction of the SEC. They are mistaken.

In fact, most of the criminal and civil regulatory actions brought by United States regulators regarding CFD trading, are brought by the CFTC.

The SEC is a larger (and much nicer) regulator than the CFTC. However, the CFTC is the cruel little brother of the regulatory world.

The last thing anyone wants is the CFTC knocking on your door. If the CFTC gets involved, then FBI agents are usually close at hand.

Contracts For Difference Trading — It’s a Felony

Let there be no mistake, Contracts For Difference trading has been banned in the United States.

According to Dodd/Frank regulations, if you are caught trading unregistered Contracts for Difference swaps contracts, you are looking at a felony, 10 years in prison and a $1,000,000 fine.

This is true for either the “broker” or the “investor.” However, there are additional penalties for the broker.

At TradingSchools.Org, we comb through the regulatory actions of both the CFTC, SEC, and the Department of Justice.

Nearly every single month, someone is arrested or fined for trading or brokering Contracts For Difference. I find it sometimes laughable and oftentimes tragic that many people get themselves caught up in CFD trading.

Most folks will unwittingly get themselves ensnared in these illegal bookmaking operations. They open an account, lose all their money, and then sometime later, they get a ‘target’ letter from the SEC, CFTC, or the Department of Justice. These ‘target’ letters are very scary.

Then the problems are multiplied because they now have to hire a lawyer to represent them in potential criminal and civil violations. Of course, this is after they have lost all of their money at the illegal CFD broker.

Why are Contracts For Difference a Felony? Can you really go to prison?

This is a great question. On the surface, CFD trading might seem harmless. After all, it’s just a bookie located in the Bahamas or some other third world country, right?

Wrong. Let me give you an example of why the US regulators are determined to throw people in prison or levy huge fines over CFD trading.

Suppose that you are the regional sales manager of a publicly-traded company. You somehow discover that next quarter sales are going to plummet. Additionally, you discover that the company has been “cooking the books” and eventually this information is going to leak.

Once this information leaks, then the price of the stock is going to plummet and the company might go bankrupt.

This information is extremely valuable. However, since you are an employee, then you cannot use this information unless it has been publicly released. (Insider trading is illegal)

But you are worried that the 401k containing your life savings is going to disappear. And so, you borrow against your 401k and then open a CFD account at an offshore, unlicensed and unregulated broker. Since insider trading is also a felony, you must go “offshore” to hide the activity.

You then place a huge short wager that the stock is going to crash. Additionally, you tell your wife, parents, family, friends, and whoever might also make some easy cash.

Pretty soon, everyone at the company knows the company is doomed and needs to dump their shares (without anyone knowing).

A short time later, the stock crashes and the company goes bankrupt. You lose everything in your 401k, but you make everything back, and more, from the offshore bookmaker.

Additionally, your family, friends, coworkers, the CEO of the company, and even the local dog catcher also make a few million dollars by shorting the stock.

However, when you attempt to collect your bet from the CFD broker, he simply refuses to pay. (Hint: CFD brokers rarely pay off bets over $250)

In your frustration, you contact the SEC and the CFTC and report the company for not paying. This complaint triggers an investigation and the website of the CFD broker simply disappears.

A short time later, you find yourself being charged with securities fraud by an FBI agent.

As crazy as this sounds, this exact same scenario has happened hundreds of times.

This is why Contracts For Difference trading is a felony. The financial system is set up to protect long term investors. Not short term gamblers or crooked company insiders.

The regulators absolutely abhor offshore CFD brokers. These companies come and go like a fart in the wind.

People go to jail for long, long periods of time over CFD trading.

F1 Trade is SECURITIES FRAUD

If you are currently a customer of F1 Trade. Then you are probably an ex-customer of Guy Gentile at Sure Trader.

In fact, dozens of people have contacted TradingSchools.Org and reported that their brokerage accounts were automatically transferred from Sure Trader to F1 Trade.

As multiple reports suggest, “F1 Trade is the same people as Sure Trader.”

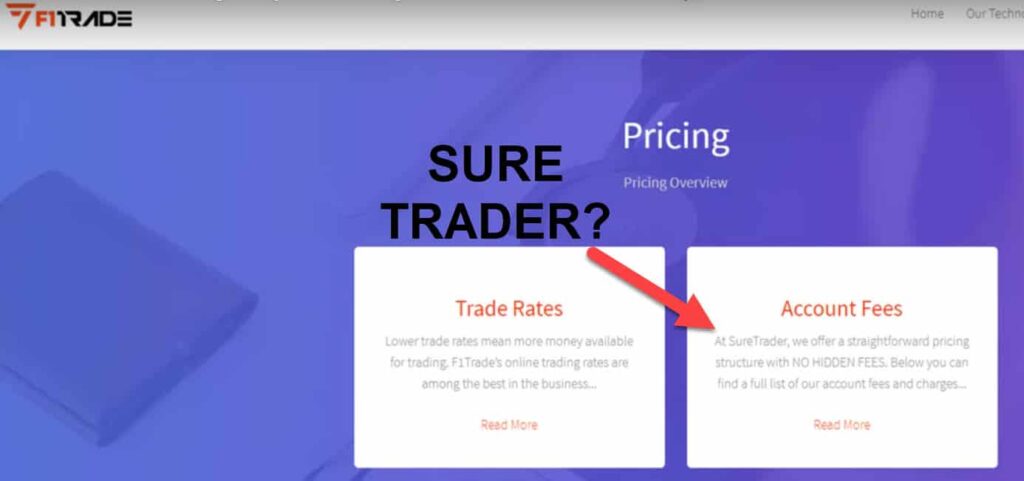

In fact, TradingSchools.Org took a screenshot of F1 Trade only a few days after Guy Gentile announced he was closing Sure Trader because of numerous securities violations. As you can see below, the F1 Trade website contained numerous references to Sure Trader.

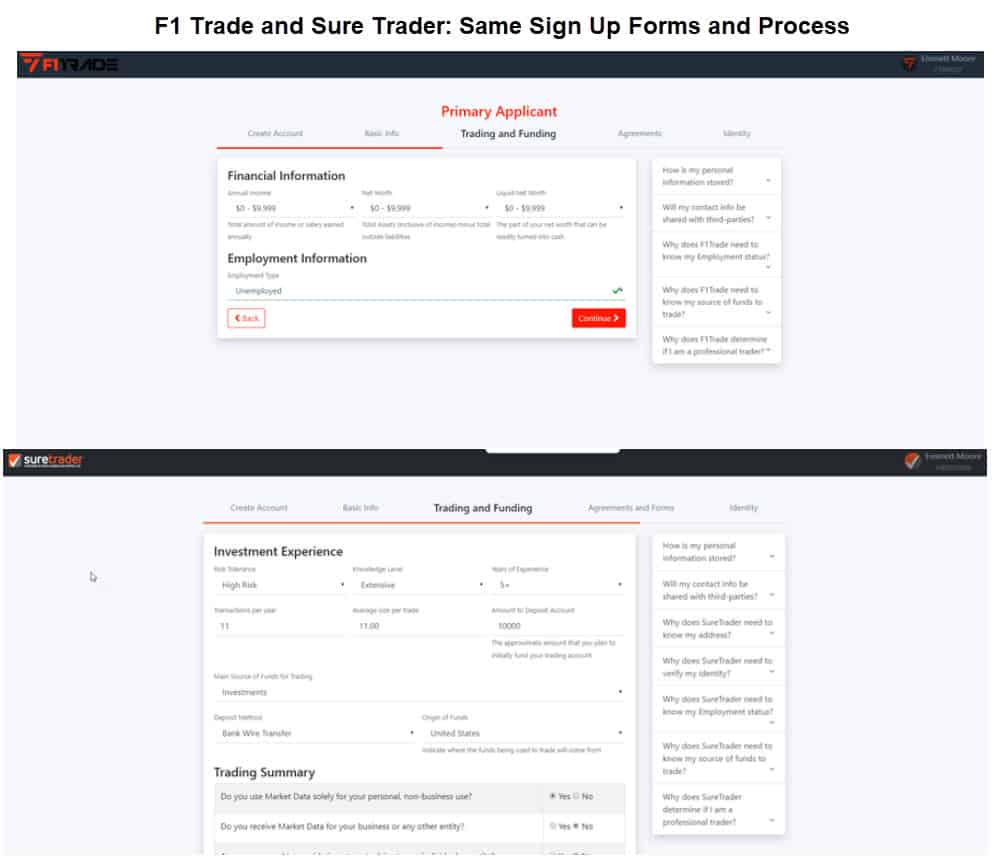

Additionally, TradingSchools.Org documented and recorded the signup processes for F1 Trade and Sure Trader. As you can see from the following screenshot, the F1 Trade and Sure Trader account sign up process is nearly identical.

Guy Gentile: Yet another SCAM?

Of course, TradingSchools.Org has written extensively on the many financial scams of Guy Gentile and Sure Trader.

It seems like every other month, he is arrested or being dragged into court over some ridiculous penny stock pump and dump scam. Laughably, this douchebag actually thinks he is some sort of maverick activist investor. He is not. He is a serial pump and dump scam artist.

At last count, we are talking about four pump and dump schemes. The first two nearly landed him in Federal prison. After admitting involvement to FBI agents, he then agreed to become a rat and a whole bunch of his scammer friends went to prison. Everyone but him.

A short time later, he reemerges with two more, multi-million dollar pump and dump schemes which are currently under investigation with the SEC and he is being sued by both public companies.

As one lawyer wrote, “Guy Gentile is a connoisseur of scams.”

Additionally, affiliates of Sure Trader are also under Federal investigation in Miami for potentially accepting United States clients illegally in the Bahamas.

Amongst this shit storm of securities fraud, he apparently has concocted this whacky F1 Trade CFD scheme, which is currently accepting funds from United States citizens.

If Guy Gentile can be connected in any way to F1 Trade, then there is a high likelihood that he will be charged yet again. And let me repeat, offering CFD trading to United States citizens, and not being properly registered…IS A FELONY.

F1 Trade: the ultimate address for securities fraud

The exact address of F1 Trade is a well known location for securities fraudsters around the world. In fact, the F1 Trade physical address shares the exact same address as all of the following illegal CFD brokers. Have a look:

- https://www.f1trade.com/

- https://www.tradegf.com/

- https://fxfinest.com/

- https://www.wsmfx.com/

- https://yorkcg.com/

- https://finoperate.com/en/

- https://instinct.trade/index.php

- https://www.lucrotrade.com/

- https://cfdtrend.com/

- https://www.bithandel.com/

Additionally, this is the exact address also used by Lee Albaz of Binary Book and Big Option.

Lee Albaz was recently convicted in a Maryland Federal Court for running an illegal CFD and binary options brokerage. She is slated to be sentenced on December 9. The US Attorney is recommending a life sentence.

For those that remember, Lee Elbaz sued me for defamation over an article that I published about her illegal operation in 2017.

Recently, Guy Gentile has been offering a “free one-year subscription” to his latest pump and dump trading room “Day Trader Pro.” But in order to win the prize, you must “guess who I am going to sue next.”

But I digress.

What should you do now?

Let me repeat. If you are a United States citizen, and you are currently an F1 Trade customer — you are committing a felony. So what should you do? (Hint: get your money out)

According to the CFTC and the SEC, there is a small window to escape any potential criminal or civil violations. In particular, the regulators understand that many “small fish” get themselves caught up in these internet scams unknowingly.

Just like many people commit insider trading unknowingly, the regulators look favorably upon anyone that files a whistleblower complaint against the offending company.

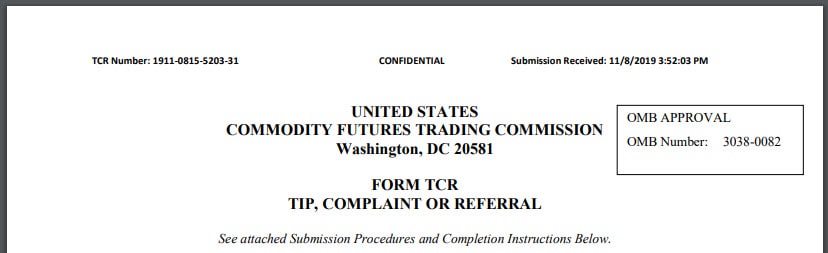

Example: we opened an account at F1 Trade and then immediately filed a whistleblower complaint with the sole purpose of triggering an investigation, as well as forwarding the contact information of individuals that have been ensnared in this F1 Trade CFD trading scam. The following is a screenshot of just the header of the CFTC complaint.

Additionally, we filed a separate complaint with the SEC Office of the Whistleblower.

After you file a whistleblower complaint, what happens next? Considering that TradingSchools.Org has filed dozens of complaints, the process is simple and straight forward.

You will usually be contacted and interviewed by an investigator at the CFTC or the SEC within a couple of weeks. They will ask a few questions and the process takes about 20 minutes. Its very simple. Nobody threatens you. Just be honest about what happened and why you filed the complaint.

If the case moves forward, then you will receive a subpoena, which is an official request to produce your evidence. The subpoena is straightforward and simple to understand. The following is a screenshot of the header of a subpoena we recently received.

Earn Big Money as a Whistleblower

As many readers are aware, TradingSchools.Org has been very active with whistleblower cases since 2014. We have participated in too many to count.

These cases encompass both the CFTC and the SEC Whistleblower programs. To give you an example of how lucrative whistleblower cases have become…have a look at the SEC website. https://www.sec.gov/page/whistleblower-100million

Since 2011, the SEC has awarded $300 million to whistleblowers. The numbers are similar with the CFTC whistleblower program.

How much has TradingSchools.Org been awarded in Whistleblower cases? That’s a great question. I am not going to give you the exact amount. However, the following screenshot is a list of some recent large cases, one of which we were involved in.

Wrapping Things Up

Once again, if you are a United States citizen, and your account was transferred from Sure Trader to F1 Trade, then you need to get your money out immediately.

I have little doubt that F1 Trade is going to suffer the same fate as everything else Guy Gentile touches — a regulatory action. But this latest scheme appears to be his most audacious yet. F1 Trade will be shut down.

Once your money is out, then immediately file a whistleblower complaint with both the SEC and the CFTC. The following links will take you to the proper venue.

SEC Whistleblower Complaint Form

CFTC Whistleblower Complaint Form

Thanks for reading.

-Emmett

They took $75,228 from me. I did a trade before a split reversal took place and I wanted out of my trade before it happened to my shares and my profit was $75,228 when I sold and they took it from me and unsold my shares and put me back in -300. They did similar things to me draining my account over and over the last 2 years. The problem is alot of the trading teachers are partnering with these company’s to get new traders to their platforms so they can drain the new traders account. They make you believe that you need suretrader or F1 to day trade but as long as you have a cash account you can day trade in the USA, you need $25,000 in your account to use margin to day trade and that means borrowing money, so if you have a cash account then the day trading rule does not apply. A fact teachers are teaching us this to send you to these fraud sites to get taken advantage of and they have contracts with them. They are just as guilty. As the teachers that promote these sites are just as responsible because they are exchanging discounts and other services and or cash to these teachers in exchange of the new traders. The front line “teachers that are USA citations” that are working with them, should be exposed as well. As thats how I got there and unloaded all my money for it to get sucked away. This company F1 can only use money coming in and from bitcoin a crypto wallet which enters you in another trade as soon as it gets your money. Bitcoin will also let you know that no government of any kind anywhere can touch it, so that tell you how bad F1 has gotten. They cant even have a real money exchange on there site, you literally can only get money to and from it from a crypto wallet that no one can police. To bad I trusted the wrong people as I searched to learn the market my first 2 years but its been two years of getting my money sucked away and I am a good trader about 90% of my trades are good but they would purposely do things so I couldnt sell at a profit, or lock me out of my account for a day on big moves in the market with my stocks then say you need to change your password, only for me to miss selling which they probably sold and reentered me in like they did recently. There is so much more as well.. wish I knew more but I think this is good to start 😉

Hi Emmett, unfortunately I’ve been caught up in this shit-storm because I didn’t withdraw my funds from SureTrader. As of now I’m trying to withdraw my money from F1Trade and they’re giving me a hell of a time. I’ve been doing a lot of investigation, and have contacted the company that F1 has registered through, Wilfred International Services (this is the company located at the 305 address you listed above). There I spoke to a lady who said that F1 is not actually located in St. Vincent and the Grenadines, but is only registered there. She told me that the company is located in the Bahamas, namely Nassau, on New Providence…..which is also where SureTrader was located.

It appears she has the exact address of the company mailbox, but she said she could not give that out, but she said the company is using P.O box N, which corresponds to: General Post Office (New Providence) N . http://www.upu.int/fileadmin/documentsFiles/activities/addressingUnit/bhsEn.pdf

She also gave me the number of the advising group that F1 uses, Zitadelle: https://zitadelleag.com/contact-us/ I tried dialing them but seeing as they are located in Cyprus (scam capital of the trade world) and it’s 9 pm there at the moment, they are closed.

Anyway, I’m still going to try to get my money directly through F1, and I have filed an SEC complaint and will file one through the CFTC, but I’m wondering if there’s anything else I/we who have been affected by this can do to burn this shit to the ground, and reap as much as we can from it. Do you know of any other authorities to contact, etc.?

You need to file a whistleblower complaint with the CFTC — do it now. https://forms.cftc.gov/Forms/TipsAndComplaints.aspx

Save all of your documents, correspondences, make notes of everyone you spoke with and include the date and time. Sometimes these cases turn on the tiniest and most seemingly insignificant pieces of evidence.

Thanks, I have now filed both. Sent them screens of all the conversations I have had with F1.

Why is the offshore CFD trading different than the “regulated” UStocktrade.com ? isn’t this website also buying and selling “fake” shares and has to ability to daytrade ?

Hi Steve,

UStockTrade vs F1 Trade? Much different. Actually, this would be a great blog post, where I can describe the differences.

The big question is going to be…”can I circumvent the PDT rule?” through this peer to peer network? I will get this answered.

And we will look at the regulatory regime, how the trades move and are settled, and advantage and disadvantages.

Really glad you brought this up.

-Emmett

Hi Emmet,

Also please note that even a highly regulated, absolutely legit and very popular broker such as Interactive Brokers, offers CFD trading (not for US citizens, though). This may confuse people into believing offshore brokers providing the same service (CFD trading) are also legit, when nothing can be farther from the truth, as it is quite obvious IBs’ trading platform and trade settlement mechanisms are well regulated and are not in any (at least, any illegal) form skewed towards the house to have a statistical advantage, such as in the case for most shady, laxly regulated offshore brokers.

It would be nice if, in your future blog post, you’d compared well regulated brokers such as IB with some shady offshore brokers.

Aslo note: I am not affiliated with IB in any form.

Thanks,

CG

Actually, that is a very good idea.

Great work as usual Emmett, thank you! Just one remark. I don’t believe that CFD’s are illegal for Americans because of the reasons mentioned above, the same insider trading would apply to Australians or British yet the CFD’s are legal for them. American lawmakers did not want low-fee CFD providers competing with established US brokers and there was a lot of lobbying effort at the time by those financial groups which lead to a prohibition. Regulators can and should go after fraud everywhere but this should not be used as an excuse to violate private property rights by those in favor of a nanny state. Let people do with their money what they want after all their money is their property.

Hi Fredrick,

CFD trading is also a problem in the UK and Australia — namely insider trading. I don’t even know where to start…one that comes to mind would be the Choucair case in London. Long story short, a UBS insider was feeding tips to a “friend” for money.

The “friend” then used the information to make $5 million on Rackspace and Pharmacyclics. They specifically used CFD’s to cover their tracks.

The United States effectively banned CFD type trading with the Securities Act of 1933 aka “The Bucket Shop Act” which banned unregistered securities trading. They updated it in 1934 which founded the Securities and Exchange Commission. Many readers might be surprised to learn that the most famous bucket shop was the American Stock Exchange, where shares were traded on the street, one block away from the New York Stock Exchange.

The problem with bucket shops is one of accountability. Namely, who is the counterparty? And can the counterparty pay the bet?

I wish the world were simple, black and white. But it is complicated and gray, we need just a little bit of the nanny state. And besides, do we want a generation of our young investors to become acclimated to CFD trading, aka playing on a stock video game? Better that we protect our markets, our youth, our retirees, and our integrity.

One last mention, I did not include details of the exact criminal codes for violation the Dodd Frank Reform Act. Namely, because the Act is nearly 848 pages long. However, for the legal nerds that “want to see it for themselves” you can find the exact legal provisions as follows:

Title VII, Sections 723, 724, 724(a), 728, 730, 731, 733, 741, 746, 747 and 753. These sections are now part of the existing Commodities Exchange Act[7] and would be punishable under 7 U.S.C. Section 13(a)(5) which provides for a maximum of a $1,000,000 fine and 10 years imprisonment.

Interestingly, however, 7 U.S.C. Section 13(a)(5) has a provision that “no person shall be imprisoned under this paragraph for the violation of any rule or regulation if such person proves that he had no knowledge of such rule or regulation.” This means that as to these particular offenses, ignorance of the regulation, is not a defense to the charge but may be a defense to going to prison.

In other words, they built the regulation to let the unsophisticated trader a pass from criminal prosecution, but not a pass on the civil monetary penalty. However, a “broker” would never receive such a free pass. Guy Gentile is a sophisticated operator. He should know better. And if he does not, then he is dumber than we all thought.

All good info about existing laws but I don’t see why CFDs could not be regulated in America. Is there something about the product itself? If we could regulate trading futures surely we can regulate trading CFDs. Besides, making them illegal does not stop trading CFDs any more than the prohibition stopped alcohol trade in the 1920s. I find more value in what you are doing by informing the public, it’s a better market solution. If Americans could trade CFDs legally at home they would be less likely to fall victim to fraudulent offshore operations and insider trading would be harder to conceal.

Technically, we have a regulated commodities swaps market in America…its called Nadex. Not very popular.

As far as a new regulatory regime in the US, expanding CFD trading? Why bother? And besides, the offshore gangsters are never going to abide by those, or any rules.

With the advent of “free” stock trading with every major US brokerage, this free-market approach will effectively snuff many offshore CFD gangsters.

My guess is that the “educational” community will start pushing into stock options trading. This is the best venue for the small account speculator.

Actually, the best venue for tiny account day traders is futures trading. Why not just go where the market is liquid, inexpensive, regulated, and (mostly) fair?

Thank you Emmett once again for exposing that RAT Gentile.

now, was the Rat too dumb to emulate what another Rat is currently doing, this one you did 2 write up articles ..yes yes the stock whisperer himself Mierda Barak from tradenet. Some how he evades all the regulators with his educational products ( CFD nintendo acccounts) when is that guy going down?

I agree, for Americans futures are the best option but as you can see there are no good reasons CFDs should be illegal in the first place. We may disagree on whether CFDs are needed but that’s not a reason to ban them, IMHO.