Emini Trading System: Cash Market Shorty

-

Statistically Valid

(5)

-

Ease of Use

(4)

-

Simple To Master

(4)

-

Robustness

(4)

-

Durability

(4)

Summary

Shorting the financial Futures markets is darn near impossible. Market forces are designed to punish short sellers and dissuade opinions that encourage investors to bet against the US stock market.

When attempting to short the US stock market, the logic and statistical inference must be established on solid bedrock. The logic must be flawless. Completely devoid of anecdotal evidence, perceived fantasies, leprechauns, and unicorn logic.

The ‘Cash Market Shorty’ financial Futures trading strategy attempts to exploit selling pressure that releases near the close of the NYSE and NASDAQ stock markets.

Exploit this Futures trading edge for quick short trades with extremely limited risk.

Emini Trading Strategy: The Short Side.

Today, we are going to develop an emini trading system from start to finish. This trading system is going to be a ‘scalping’ day trading strategy that is focused on the Emini financial futures contracts, including:

- Emini SP500

- Emini Russell

- Emini Dow

- Emini Nasdaq

This financial Futures, emini trading system will be a ‘shorting’ or short side only trading strategy.

Step One: Simple Observation

When I develop an Emini Futures trading strategy, I always begin by analyzing what is most obvious. I want to know what is most TRUE.

A casual observation of the Emini Financial Futures, as well as the overall stock market, is that it has a long-term UP bias. Yes, there are corrections, crashes, and crisis along the timeline. But the general drift is UP.

And when its not going UP, then we can count on the politicians, the Federal Reserve, or the US Treasury to do what they have always done. Which is start printing money and lowering interest rates below the rate of inflation. Predictably, the stock market moves higher in a jagged process. The cycle repeats itself over and over.

With this in mind, we know from simple observation that the Emini Futures and financial assets in general, will tend to outpace the rate of inflation.

Step Two: Drilling Deeper Into the Bias

The next step is drilling deeper into the data in hopes of gleaning more powerful information.

Since we know that the stock market drifts higher, we want to start asking some very basic questions, and testing some very basic ideas.

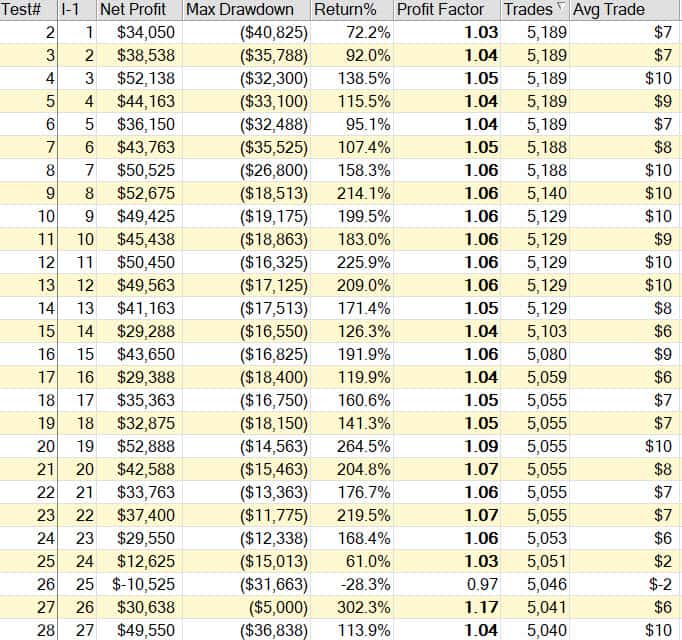

The first test is going to be very simple. We are going to be testing the ES or Emini SP500 Futures contract using only 15-minute bars. The test is outrageously simple in that we are going to buy at the open of each 15-minute bar and then immediately sell at the close of each 15-minute bar.

There are 27 (15-minute) bars total for each trading day. We just want to see what typically happens.

The following test results go back since the inception of the Emini SP500 futures contract:

I want you to now focus on the column titled Profit Factor. Anything with a test result over 1.0 has a positive expectancy.

This test is telling us that if we simply buy (Long) at the opening of a 15-minute bar, and sell it at the close, then we can expect a positive result. However, notice that the Average Trade is never higher than $10 per trade. This is not enough of a bias for a stand-alone trading system.

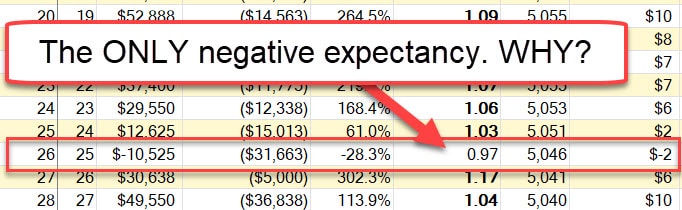

Now, our next step is to look at these results and see if anything ‘sticks out’ or looks odd. I want you to focus once again on the Profit Factor Column….do you see it? Do you see anything odd or out of place?

Test number 26 is the ONLY 15-minute period where there is a negative expectancy.

To the untrained eye or the casual observer, this would not register as much of an event. The casual observer is biased towards looking for what does work. However, you need to look for ‘what does not fit’ or ‘what does not look truthful’ in our testing, observation, or theory.

The truth is hidden in the nuance. Your profits are hiding in the nuance. I want to draw your attention to test #26…

Notice test #26. This is the only 15-minute trading period where going LONG or being a buyer of the Emini SP500 futures contract yields a negative result.

What is this telling us? The 25th bar of the day is 15 minutes before the close of the cash stock market, ie NYSE and NASDAQ. The 25th bar of the day (15-minute window) is when nearly all futures traders will exit their positions to become flat for the day. Most day traders do not want, or cannot hold overnight positions because of the margin requirement. They must flatten.

Think about your own trading. When you are day trading a futures contract, and you are net long. At some point, you will need to sell, because you need to flatten your position.

This 15-minute window of time is statistically proven to be the very moment that selling pressure is going to most likely enter the financial Futures markets. We want to now focus on this particular tendency…the selling pressure around the cash NYSE and NASDAQ close.

The Close of the CASH market

Ok, so we now know that just before the NYSE or NASDAQ cash market closes at 4 pm EST, then the vast majority of Emini futures contracts holders will look to flatten long positions during this 15 minute period.

Let’s now take a closer look at how much selling pressure this will likely cause. And whether this selling pressure is enough for us to join the selling frenzy and earn a quick scalp profit to the short side.

The next series of tests will look at look at what happens if we short the Emini Financial Futures contracts if the stock market is higher or lower, as determined by the percentage change at exactly 4 pm of the trading day…

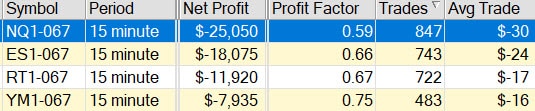

TEST #1: Shorting a bullish stock market close. Don’t do it!

If the stock market, at 3:45 pm EST is up 1% or greater, then sell any financial Futures Emini contract at 3:45 pm EST and exit the trade at 4:00 pm EST.

As you can see, if the stock market is up 1% at the 3:45 pm EST close, and you attempt to short…you will have you’re headed handed to you! Don’t attempt to short a bullish rally!

However, what if we eliminate those ‘ bullish rally’ days where the market is up 1% intraday and focus our shorting activity when the market is not aggressively bullish?

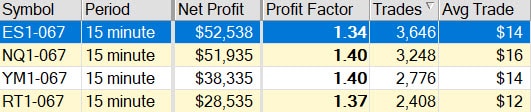

TEST #2: Shorting a ‘less’ bullish stock market.

If the stock market, at 3:45 pm EST is less than 1% higher, then sell short the financial Futures Emini contract and exit the trade at 4:00 EST.

See what just happened? The results completely flipped and this suddenly became a profitable short trade.

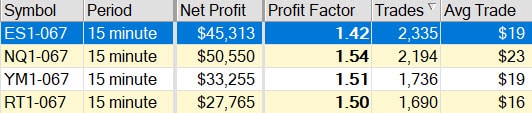

TEST #3: Shorting and even ‘lesser’ bullish stock market.

If the stock market, at 3:45 pm EST is less than .5% higher, then sell short the financial Futures Emini contract and exit the trade at 4:00 EST.

The positive results continue to creep higher. Confirming that if the stock market is not outlandishly higher at 3:45 pm EST, then we have an exploitable downside bias during this 15-minute window.

Lets now take it a step further and only attempt to short the financial Futures Emini contract on a ‘weak’ stock market close.

TEST #4: Shorting a ‘weak’ stock market close.

If the stock market, at 3:45 pm EST is negative, then sell short the financial Futures Emini contract at 3:45 pm EST and exit the trade at 4:00 EST.

The results keep getting better. If the stock market, at 3:45 pm EST is negative, then we can expect the weakness to continue to 4:00 pm EST.

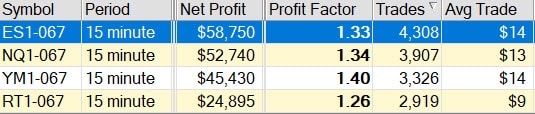

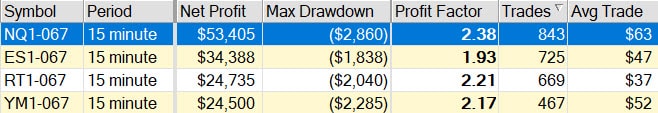

TEST #5: Shorting a very ‘weak’ stock market close.

If the stock market, at 3:45 pm EST is down 1% or greater, then sell short the financial Futures Emini contract at 3:45 pm EST and exit the trade at 4:00 EST.

Holy moly. We have something. A profit factor +2 with a generous average trade size for all of the financial Futures Emini Contracts.

And look at the sample size of hundreds of trades. A large sample size is really what you want to see. Why? Because of the larger the sample size, the more valid or truthful the results become. In other words, anyone can get lucky with a single lottery ticket, but if that same person were to continue to purchase lottery tickets…they would eventually lose all of their money. However, if a person purchased hundreds of lottery tickets and won the lottery dozens of times, then whatever method they are using is valid. In probability theory, this is called the Law of Large Numbers.

Conversely, our shorting strategy has a massive sample size. So if you continue to push this strategy, then the odds are exceedingly in your favor that you will profit over a long period of time.

Let’s do one last test…

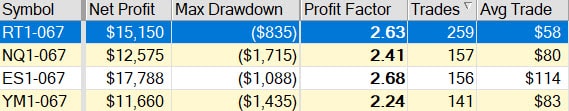

TEST #6: Shorting an extremely weak ‘stock’ market close.

If the stock market, at 3:45 pm EST is down 2% or greater, then sell short the financial Futures Emini contract at 3:45 pm EST and exit the trade at 4:00 EST.

Even better results. I especially like the Emini SP500 results with an average trade of $114 and a minor drawdown.

Where else can you earn $114 per trade…with only 15-minutes of exposure?

Wrapping Things Up

This was a really long blog post. So if you made it this far, then I have to congratulate you. My writing is terrible. Hopefully, the content makes up for the poorly expressed prose.

About this strategy, or any others that I have written…if you are confused by anything, just leave a comment below and I will do my best to explain.

For newbie systems traders and developers, the only stupid question is the question that you do not ask. Everyone starts someplace. The starting line, for all of us, is pretty comical.

To get off the starting line, and heading in the right direction…you need to ask questions.

Sadly, for many of us, we started the race by heading in the wrong direction. Which means that we started our Futures trading journey by reading crappy books on technical analysis, or bought a suite of useless invalidated trading indicators, or purchased a trading system not rooted in solid logic or joined a chat room moderated by a con artist.

The only solution is to turn around and head back to the starting line. Once you have arrived back at the starting line, then put your efforts into building a stable of ‘edges’ in which to exploit throughout the trading day. Today’s article is an example.

Here are some more examples of day trading strategies:

- “Afternoon Delight” Trading Strategy for the Emini SP500 Futures contracts

- Emini SP500 Scalping Strategy

- Crude Oil Trading: A strategy that works

- Intraday Trend Trading: Using Volatility To Your Advantage

- Intraday Trend Trading: Is the Trend Really Your Friend?

Thanks again for reading. And don’t forget to leave a comment below.

Why are all the images gone from the article?

There is only text left, as far as I can see in Chrome and FireFox browsers.

Doing this with the emini, wouldn’t a short squeeze occurr in bad days? Wouldn’t a lot of buying occur to cover shorts? Perhaps I just don’t understand what a short squeeze actually is.

No, the data test shows that fear begets fear on bad days.

When the stock market is down roughly 1%, and we are only 15 minutes from the close, then a rally higher is VERY unlikely.

This is an easy money play. Short the financial futures until the cash close of the NYSE at 4 pm EST.

Fear begets fear into the close.

And the next question you should be asking…what happens if the financial futures close < 1%...what typically happens overnight into the next morning close? You will discover that an overnight rally is HIGHLY likely. But of course, you will need to be awake, which for me is a real problem.

Hi,

Thanks for creating this web site. It it helpful.

1.

While reading your reviews I came across the “Emini Trading System” but I am confused as to its source. Is it someone else’s system that you are reviewing/explaining or is it your own system and technical thinking that you are explaining?

https://www.tradingschools.org/emini-trading-system/

2.

I have the same question about the following titles on the bottom of the same page.

“Afternoon Delight” Trading Strategy for the Emini SP500 Futures contracts

Emini SP500 Scalping Strategy

Crude Oil Trading: A strategy that works

Intraday Trend Trading: Using Volatility To Your Advantage

Intraday Trend Trading: Is the Trend Really Your Friend?

3.

What software is able to generate this equity curve – “Combined Equity Curve”?

https://www.tradingschools.org/reviews/afternoon-delight-trading-strategy/

4.

You should have a donate button so we can donate to your effort via paypal.com.

Thanks,

Sean

Hi Emmett,

I just want to make sure I understand what you are saying. In your writing you say it’s the 25th bar, the stats came up that the 25th bar was negative, but that would correspond with 3:30-3:45 and not 3:45-4:00? If your starting time for the test was 9:30 then that would put the 25th bar at 3:30-3:45. I’m just trying to understand why the discrepancy???

Hi Rob,

What platform are you performing the backtest? If TradeNav, I can send you the code.

I should probably create a video for this. It would be much easier to understand.

Emmett

I’m not trying to code it, I was going to check it out old school, look over the charts for a few months, I just couldn’t figure out why you’re saying the 25th bar is at 3:45-4:00. If you start at 9:30, 4 bars is 1 hour, so 24 bars are 6 hours which gets you to 3:30, that means the 25th bar is at 3:30 to 3:45, I even counted the bars one by one, still came up with the 25th bar being 3:30 to 3:45. Unless you mean the 26th bar?

Thanks, Rob

Oh no! By hand? You poor man. Oh geez. That’s like trying to dig an oil well with a teaspoon. We have to get you using software. Lol. (sitting in my chair laughing and smiling over this) Dude, you have to learn a few new tricks. Without testing, you will always be chasing the rainbow.

But if you are going to do it by hand…its really simple — if you live on the west coast, then you simply want to short at 12:45 pm. And then exit the position at 1 pm.

The logic is really simple — most people are long during the day, but need to flatten before the market closes at 1pm to avoid overnight margin. This creates selling pressure. You just jump on board and ride the pressure lower. Really simple.

Still not clear? No problem. I can create a video just for you. And don’t stress over not understanding. I am a horrible communicator of the written word.

LOL, you don’t need to make a video, I was just trying to understand the discrepancy, your data says the 25th candle yet you’re saying the last 15 minutes which is the 26th candle. I think you’re communicating just fine I just don’t understand why you’re using the 26th candle and not the 25th based on your data. Based on your data the 26th candle is definitely not the one to take.

Hey, would you mind sharing the code for this system? (I’m a lurker on your website, but wanted to start experimenting with code!)

Thank you for all you do.

Hi Emmett,

I just want to make sure I understand what you are saying. In your writing you say it’s the 25th bar, the stats came up that the 25th bar was negative, but that would correspond with 12:30-12:45 and not 12:45-1:00? If your starting time for the test was 6:30 then that would put the 25th bar at 12:30-12:45. The 26th bar is obviously not good for a short looking at your results so I don’t want to go there, I’m just trying to understand why the discrepancy. Also, as to if the market is up or down for the day, did you use the close of the previous day or are you using the start of the new day, the intraday, to determine that?

Sorry west coast, 3:30-3:45PM EST

I’m not sure how you measure the performance of the stock market. You mention NYSE and NASDAQ is you post. So which is it? I know they have some correlation but they don’t always mirror each other. I was thinking of testing this out myself. Oh wait I’m a newbie so I don’t even have a platform data feed or even a sim account yet.

I’m curious has anyone else here tried to reproduce these results?

NYSE and NASDAQ exchanges are not markets in this context, to get market exposure we would trade Emini futures since these are tradable contracts and are priced according to an underlying index. He backtested Emini SP500, Emini Russell, Emini Dow, Emini Nasdaq which are the most common US markets.

this is very good, thanks for your hard work!

Why do you believe TA is crappy? or are you just saying we choose shitty TA books in the beginning haha

Has anyone been trading this strategy? what are your real results?

First time poster. I read a lot of reviews and posts today searching for gurus that I could follow until I was a guro. Pretty disappointing that I couldn’t find one that has passed the test of time.

I appreciate your work, Emmett.

“The test is outrageously simple in that we are going to buy at the open of each 15-minute bar and then immediately sell at the close of each 15-minute bar.”

I don’t get it. Why buy/sell? Why not just hold into the next 15 min open? Is there something I’m missing? On a neg trend this would be disastrous.

Hi Bill,

The test is to see if any particular 15-minute window will reveal a long or short bias.

In simplistic terms, suppose that you get up every morning at 9:30 am and Buy. And then exactly 15-minutes later, you close your position by selling. You then track this activity over the course of several years to see if this yields a positive or a negative result.

In the strategy that I published, we essentially tested this strategy of buying and then liquidating the position, every 15 minutes. All day, every day. In hopes of revealing a bias.

Yes very interested in the Tbond analysis and system!!

Your lack of knowledge on the base subject matter that this course covers is laughable. Stay in your lane, Emmett.

“Stay in my lane” Ok Gordon. I will try and stay in my lane.

What is this ridiculous comment supposed to mean “stay in your own lane”? This is good analysis and if you see flaws…point them out.

This sort of rant is pointless and counterproductive unless you’re more specific. What “lack of knowledge” are you talking about and what are you basing it on?

Just stumbled on your site and spent a lot of time reading through your reports and reviews. Awesome and noble service you are doing to the trading community and your readers!

And, I didn’t expect to see this kind of strategy research and writeup – shared so generously! This definitely looks like a system with a positive edge! Thanks for sharing!

I have been publishing daily S&P 500 Outlook and trading plan for anyone interested to see some thoughts out there. Started as a one-off attempt and then got serious into it based on the feedback I was getting. Currently have a facebook page. I am a professional trader/advisor but do NOT mix it with the publication (hence do not use my real identity). I let the readers come for what they get out of the forecasts rather than who is behind it and what she/he claims to be. So far so good. I was kind of surprised at the naivety of many people asking strangers on the internet what to do with their money or what to buy or, worse still, where to learn trading (paying money)! A few people were suggesting why not open a trading room, which I heard of before but was not sure what it is or how it works – thus, landed here after googling. It confirmed my hunch that most such “operations” are scams and border on illegal practices. Thank God I didn’t even entertain to start thinking of one :).

Please do update your findings on the t-bond strategy that you mentioned, if you are okay with sharing it.

Btw, what was your period of backtesting on the e-mini?

Thank you for the great service! This is the kind of service and people that make the cyberspace still relevant and useful, despite all the scamsters and hypsters and criminals out there luring naive people into their schemes and cheating them of their hard earned money! Keep up the great job!

Hi Emmett,

Great article. I stumbled upon your site while searching about ProfitUnity. Didn’t expect to see such a golden nugget from a badly designed website 😉

I am at the point of my trading journey where I’ve tried many strategies and indicators and markets. Lately I’ve been focusing all my efforts into the ES and it is yielding me good results. Like you said, building and acting on a “stable of edges” is key.

Did you ever try to see what happens to that statistic if you took only the past 5 years? the past 1 year? the past month? Are the short term results consistent with the longer term past?

What software and data did you use to test?

P.S. I recently came across Marcello Arrambide of http://daytradingacademy.com/master-traders/, have you checked these guys out? Looks sketchy to me.

Hope I am not being obtuse but are you calculating the percentage move of the S&P from the previous days close of 4:00pm EST or 4:15pm EST?

If I understood correctly, direction is determined from the PDC (prior day close) of the cash session (16:00) to the close of the 15 min bar at 15:45 of the cash session of the equity index such as SPY. If using ES for the futures trade, entry order is at the open of the 16:00 bar and exit at the close of the 16:00 bar, which is the last 15 min bar of the cash session.

When the market continues to sell off for most of the cash session, would you not expect the large futures traders to start buying into the close so that they are not in a short position after the close if not already hedged?

Great question. The best answer is that you should test 1-minute bars, instead of 15-minute bars. This reveals the downward leaning, closing bias will be clustered right at the cash close. Once the selling dissipates, like a bobber, it usually pops higher.

Although the SPY was down -1.85% from the PDC to the 15:45 close of the 15 min bar (-1.69% for the entire session), the ES short opened at 2687.50 and closed at 2692.50 on the 16:00 bar of the 15 min chart for a loss of 5 points or -$250/contract. I noticed that the 1 min bars flipped up during the session. Although the expected gain did not occur, one transaction is not representative of the broad data set.

in the test#1 shorting the bullish market that up 1+% get you the -$30, so actually in big bullish days, buying the future in the last minute is good then, right?

Yes, exactly. When the market is up 1%, you want nothing to do with shorting! In fact, you want to be buying.

Who designed this system?

is there a link to this system website?

Huh? You are on the site. The entire system is described in this very article where you are asking the question!

Is there a link to the Emini Trading System website????

Do you take into account some kind of spread in your study ?

Stock index emini Futures contracts rarely have a spread. Its a deep and wide market.

Actually, let me rephrase that…the spread is 1 tick, nearly 99.9% of the time.

Yes, generally. But do you consider that you can at least buy and sell at the same price because of limit orders or that you have to pay the spread ? When we want to enter and exit fast, especially at a given time, we generally have to pay the spread.

So getting closer to 4 was more ideal than say 3:46 or like 3:50? Also did you try this on the bullish side ? Thanks Emmett.

Initially, I was looking for just the most bullish cluster of 1-minute data points. Since the market is so heavily biased to go higher, then the rationale was to develop a strategy that focuses on the most bullish times.

However, I kept getting that persistent cluster of bearish 1-minute data points, and so the bias was revealed.

Usually, when I find a really good pattern, it is discovered while looking for something else.

The key takeaway from this published strategy is that programmers, developers, etc, they should be extremely wary of taking a long position just prior to the Cash market close of the stock market.

On what period did you test this system?

I’m confused. If there are 27 bars in an ES day from 9:30am until 4:15pm with bar 27 ending at 4:15 then bar 26 would begin at 3:45 and end at 4:00 and bar 25 would begin at 3:30 and end at 3:45. What am I missing?

Technical writing is definitely not my strength.

I should have simply described the entry to be 15 minutes before the cash close of the NYSE.

The logic is that 10, 15, or even 20 minutes before the cash close, you can expect like results.

You mentioned using Trade Navigator in previous posts to conduct your backtesting. I was wondering if Trade Navigator provides the data or if you would have to purchase it from a different service.

Yes, TradeNavigator includes all of the data. It auto updates the entire portfolio of symbols. No need to save symbols for download.

you know that markets stops at 4.15 pm, right? so you can’t really get out of a position then.

Correct.

The ‘secret sauce’ is to surround 4:00 pm on a big down day. Its a really high probability trade.

I went back and reread what I had written…you are correct! I screwed up the description. So glad you brought that to my attention! Thank you!

Descriptor fixed.

Going to follow up this post with another system that draws in the Treasury Bond and Notes market. Really surprised at the results. The bond market really pulls the stock market around.

Emmett, I’m curious about your follow up testing with Tbond and notes market?