John Bollinger

-

Honesty

(5)

-

Quality

(3)

-

Cost

(3)

-

Support

(4)

-

Verified Trades

(4)

-

User Experience

(3)

Summary

John Bollinger has a permanent hut at the Money Show and Traders Expo seminar circuit. A place that is best known for carnival barkers and financial soothsayers. Is he just another piece of fraudulent furniture that is collecting spare change from naive attendees?

For the past 30 years, he has been peddling Bollinger Bands as some sort of magical trading indicator that predicts the future. In my opinion, Bollinger Bands are useless. But his verifiable trading performance simply contradicts my opinion. In fact, John Bollinger has an enviable and long-term history of success; not only as a trader but also as a money manager.

John Bollinger is a kind and honest person. A pretty good stock picker. His wife does most of the hard work.

Thanks for reading today’s review of John Bollinger

John Bollinger is one of the ‘elder statesman’ of the technical analysis community. In fact, nearly every single trading platform comes prebuilt with his original work: Bollinger Bands.

I won’t spend more than a moment talking about Bollinger Bands. They have been around since before the time that Jesus walked the earth. The Romans probably used a Bollinger Band to predict how long Jesus would survive the cross. The Bollinger Band predicted that Jesus would be a ‘day trade’. And the Bollinger Band was correct! Jesus lasted until about the end of the day.

But the Bollinger Band did not predict the resurrection. And that’s the problem with technical analysis – the predictive quality is often too fleeting to use consistently.

And yet, John Bollinger of Bollinger Bands persists to even this day. Peddling the predictive quality of the Bollinger Band through a series of seminars, books, indicator packages, speaking engagements, and even money management services.

Let’s take a closer look at John Bollinger…

Bollinger Bands: the early days

I have met John Bollinger several times. Typically at the Money Show or the Traders Expo. John is usually the ‘centerpiece’ of the seminar. Folks from far and wide will pile into these seminars to hear this sage financial wizard waylay some sort of financial prediction.

He will usually begin his presentation and speak about his past and how he accidentally stumbled into the financial services industry. It goes something like this…many years ago, back in the 1980’s, John was a just a puppy fresh out of film school with dreams of being the next George Lucas. He landed a job at a hardscrabble financial news network named FNN or Financial News Network. This was a ground floor opportunity.

After a few years of floating in the financial soup of the stocks and commodities markets, he began to develop his own theories as to why markets gyrate from area to area. He came up with a corny little idea that prices tend to move in cycles that push the boundaries of 2 standard deviations from a moving average.

Don’t let the math dazzle your eyes. This is truly simple stuff folks. John certainly has not broken through to some unknown theory of physics. God wasn’t hiding this ‘secret’ from anyone. The truth is that Bollinger Bands have a tendency to comfortably couch prices within a visual envelope. This visual envelope tends to leak into our imagination and beckons the mind into believing that the Bollinger Band predicted the price–when in reality the Bollinger Band is simply shadowing what has already happened.

If any reader swears that Bollinger Bands are the ‘holy grail’ of trading, I suggest that you immediately seek medical attention. Because you are suffering from a psychological disorder named Apophenia. In a nutshell, you are seeing Jesus appear on your toast. You are the owner of a miraculous toaster: The Jesus Toaster.

If you refuse to seek out medical attention, then I suggest that you read an excellent article the was published in Scientific American back in 2008. It talks about Patternicity and how humans are uniquely wired to be fooled by visual stimulus. Patternicity: Finding Meaningful Patterns in Meaningless Noise.

The Bollinger Band Bandwagon

John Bollinger has been riding this Bollinger Band thing for a very long time. He works it. Like a topless dancer on Superbowl weekend. He is the Stormy Daniels of technical analysis. But is any of this real? Or is this just a financial fantasy conjured up by a skilled storyteller? And yes, John is a skilled storyteller.

Does John Bollinger deserve to be coddled by Bloomberg and the CNBC talking heads? Is he really a financial guru? We dug deeper in hopes of answering this question.

Bollinger Capital Management

According to Finra.Org, John Bollinger is a registered money manager with NO COMPLAINTS.

Next, we dug deeper and investigated his disclosure filings with the Securities and Exchange Commission. The disclosures reveal that John Bollinger and Bollinger Capital Management are in good standing. And have been registered since 2006. You can find a detailed report here.

However, neither Finra, the SEC, or the Bollinger Capital website contains any information regarding investment performance for managed accounts. So we continued to dig.

During the month of April 2018, TradingSchools.Org created a fictional character and proceeded to dig for the truth. This fictional character was a phony hair coloring heiress named Lady Beatrice. Yep, I acted like the beneficiary of a company that makes hair coloring for women. I described myself as very rich, and with 5 cats. My primary goal was to invest my phony millions and earn a consistent income. I did my best to impersonate the voice of Lady Beatrice.

I spoke with a lovely person named Dorit Kehr. She explained that Bollinger Capital is a two-person operation and she handles the important stuff. She explained that Bollinger Capital currently manages $16 million and charges an annual fee of 1.5%. Doing some quick math, that’s $240k each year. Not bad!

Dorit Kehr of Bollinger Capital (John’s wife)

She next explained that I needed to open a TD Ameritrade account with a minimum balance of $250k in order to participate. Once the account was opened, then John would log in daily and manage the account, making trades on my behalf.

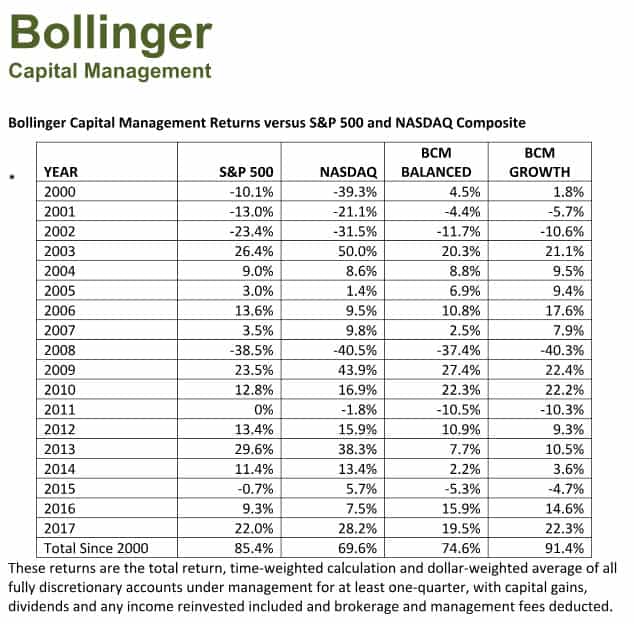

I next asked for an audited track record of returns. She was more than happy to send me whatever I needed. A short time later, I received a breakdown of returns for Bollinger Capital. Screenshot below:

If you take a closer look at this… it’s not bad. John Bollinger beat the stock market by a few percentage points over a 17-year span. This includes all of his management fee’s subtracted. A lot of readers are probably poo-pooing these returns. However, I would like to remind the audience that according to Ryan Poirier, an analyst for S&P Dow Jones, only about 30% of money managers are actually able to beat the S&P 500.

Yes, John Bollinger deserves to be in the rarified air. He is, in fact, a world-class money manager. Great job John.

However, many readers are probably already griping. Who in the heck has $250k laying around? Not me.

The ‘backdoor’ to John Bollinger’s picks

John Bollinger is not a day trader. He is a position trader. Not an active or frantic trading style. He is very passive. A great option for people looking to simply invest, at least in the traditional sense. But the ‘catch’ is that $250k minimum.

Is there a workaround? Yep.

I next contacted Dorit Kehr using yet another identity. This time, I was a pizza delivery professional. With only about $250 in my pocket. I explained that I desperately needed John’s picks, but my $250 was missing three zeroes. I could hear her sigh over the telephone. She said, “OK, well if you really want to duplicate John’s picks without sending me $250k, then you can just subscribe to John’s picks by paying $39 for his monthly newsletter.

I next explained that $39 was a stretch. She felt sorry for me. And immediately sent me the most current version for free.

I immediately called her back and thanked her for the freebie. And then I kindly asked if I could share it with a few of my friends. She said yes. I am not sure she realizes that about 100k ‘friends’ read this stupid blog each month. Thanks Dorit! The following is a current version of the Bollinger Bands Newsletter:

Bollinger Bands LetterJohn Bollinger ‘Secret Sauce’

In truth, I have pulled my little scam on Dorit a few times. Have gotten more than a few free newsletters. She has a soft heart and is the type of person that gives the homeless guy her last dollar for his heroin fix. Sorry Dorit, but its the truth. I have been surfing your liberal tears.

Earlier in this article, I talked about how Bollinger Bands are not very predictive. But this assertion contradicts the verified performance results of John Bollinger. So what gives?

In my opinion, after reading quite a few of the Bollinger Bands Letters, I am convinced that John’s secret is that he uses quite a few different tools to help him make his picks. He references all sorts of technical tools and attempts to apply common sense to his stock picking methodology.

He also mixes in quite a bit of ‘popular culture’ and creates analogies that infuse plain old common sense that coincides with technical indicators. He say’s that he does not rely upon fundamental analysis. But its plain to the reader that popular culture helps to formulate his worldview. I wonder if he even realizes it.

Wrapping things up

Thanks for reading. John Bollinger is certainly not a scammer or a trading con artist. The guy really does trade. And he trades well.

Most importantly, he has the confidence to trade the life savings of his customers. In my opinion, that is a scary proposition. So he deserves a lot of credit.

That’s it for today. Love to read your comments below.

-Emmett

Were those annual returns from Bollinger third-party audited? If not, they are as real as my 30 inch d***. Anyone who isn’t asking for TPA returns is a novice.

I’ve really enjoyed the reviews on this website until I came across this review. Using God’s love of humanity as a joke in this article tells a lot about the person writing the review and their ignorance and lack of knowledge of what’s to come. We should only use God’s name, title, etc. in a manner that shows reverence, respect, and honor. You’ve disrespected the name of Jesus (He is God) which is punishable in due time as He is very patient. Repent and remove His name from this article.

“You shall not take the name of the Lord your God in vain, for the Lord will not leave him unpunished who takes His name in vain,” (Exodus 20:7).

You think the court and regulators have power. They can give fines, prison time, even death penalty, but God can deliver the second death, which is eternity in hell fire. Heed the warning!

Pros

Cons

Did you find this review helpful? Yes (2) No (6)

Great review Emmett. Is that the only track record of returns they provided? Suffice to say that they use live account and they are performing well based on that screenshot? Could you please put up the rest of it too. Thanks!

Also, the IAPD link seems to return error page, Emmett.

Nice review, Emmett (Emmett, by the way, is the Hebrew word for truth). The only inaccuracy I found in your report is that anyone who gives her or his last dollar to a homeless person is much more likely to be a conservative than a liberal.

You wrote, “anyone that gives his last dollar to a homeless person is much more likely to be a conservative than a liberal.”

Isn’t that so true! I can’t wrap my head around it. Of course, this is just my anecdotal observation.

Is there any article that you can direct us to objectively saying Bollinger Band is not very predictive?

Hey Emmett, Excellent review of John Bollinger and his B’bands. Thanks for your honest opinion.