Thanks for reading. Today we are going to talk about an excellent trading strategy based upon the RSI or Relative Strength Index. As much as I would love to take all of the credit for this trading strategy, the real credit goes to Larry Connors and Cesar Alvarez.

On August 31, 2017, TradingSchools.Org published are an article titled: High Probability ETF Trading: 3-Day High Low Method.

In that article, I simply coded the exact strategy that Larry and Cesar described in their book. Nothing more and nothing less. The results were excellent. Considering that the book and the strategy were published in 2009, it is remarkable that the strategy has actually outperformed the original sample period. In other words, the strategy has stood the test of time. The real-time performance is actually much better than the sample performance.

If you have spent any amount of time programming trading strategies, then you probably already know that this is a nearly impossible feat.

So, I have to give a lot of credit to Larry and Cesar for gifting the trading community with this precious public gem. And considering that the book costs only $10, its an amazing value.

Lets now jump into yet another excellent trading strategy published in the book. The title of the trading strategy is The RSI 25 and RSI 75.

Yep, you guessed it. This simple strategy is based upon one of the most common technical indicators, the Relative Strength Index. I will not be spending too much time talking about the RSI or Relative Strength Index because most traders are already familiar with this common indicator. So let’s jump into the strategy, and talk about the tools that I personally use to research the market.

Trade Navigator: my favorite research platform

All of the strategies published on TradingSchools.Org were developed and tested using Trade Navigator. They are all freely available and can be obtained by simply emailing me directly at emmett@tradingschools.org. I am also in the process of creating a resource page where all strategies and research can be downloaded and openly discussed. Yes, I am endorsing Trade Navigator. However, I am not being paid to write nice things about them. (though I should be!)

Trade Navigator is ridiculously easy to learn. In my opinion, it is the very best trading and research platform for aspiring systems traders that have zero technical skills and no desire to learn a ridiculously difficult scripting language like C#, R, Python, or .Net.

In addition, with Trade Navigator you can pick up the phone and quickly speak with an actual human being that will bend over backward to help you code your trading strategies. A big thanks to Glen Larson for providing TradingSchools.Org readers will a free trial of the Platinum Edition of Trade Navigator. The free trial also includes the entire database of historical data.

Most “free trial” trading software includes only a snippet of usable historical data. Glen makes sure that your free trial includes the full arsenal of data: tick, bar, daily, custom. The whole enchilada.

Now that I got that “plug” out of the way, lets dive into the trading strategy.

The RSI 25 and RSI 75 ETF trading strategy: LONG SIDE

The following are the exact rules for Long signals, using only ‘daily’ bar data:

- The ETF is above its 200-day moving average.

- The 4-period RSI closes under 25. Buy on the close.

- Exit when the 4-period RSI closes above 55.

Test the strategy on the recommended 20 highly diversified ETF’s. List and description included below:

| Symbol | Linked to Complete Description | Quick Description |

| DIA | Diamonds Trust | The Dow Jones Industrial AverageSM (DJIA) is composed of 30 “blue-chip” U.S. stocks. |

| EEM | iShares Emerging Markets | Exposure to large and mid-sized companies in emerging markets. |

| EFA | iShares MSCI EAFE | Exposure to a broad range of companies in Europe, Australia, Asia, and the Far East. |

| EWH | iShares Hong Kong | Exposure to large and mid-sized companies in Hong Kong. |

| EWJ | iShares Japan | Exposure to large and mid-sized companies in Japan. |

| EWT | iShares Taiwan | Exposure to large and mid-sized companies in Taiwan. |

| EWZ | iShares Brazil | Exposure to large and mid-sized companies in Brazil. |

| FXI | iShares China | Exposure to large and mid-sized companies in China. |

| GLD | SPDR Gold Shares | The first US traded gold ETF and the first US-listed ETF backed by a physical asset. |

| ILF | iShares Latin America | Exposure to large, established companies in Latin America. |

| IWM | iShares Russell 2000 | Exposure to small public U.S. companies. |

| IYR | iShares Dow US Real Estate | Exposure to U.S. real estate companies and REITs, which invest in real estate directly and trade like stocks. |

| QQQ | PowerShares NASDAQ 100 | Exposure to largest non-financial stocks on Nasdaq. |

| SPY | SPDR SP500 | The S&P 500 Index is a diversifed large cap U.S. index that holds companies across all eleven GICS sectors. |

| XHB | SPDR SP500 Home Builders | Exposure to home building products and producers. |

| XLB | SPDR Materials | Exposure to materials producers: chemical, construction, packaging, mining, paper, etc. |

| XLE | SPDR Energy Sector | Exposure to the energy sector of the SP500. |

| XLF | SPDR Financial Sector | Exposure to insurance, banks, thrifts, RE trusts, mortgage finance, consumer finance of SP500. |

| XLI | SPDR Industrial | Exposure to defense, aerospace, marine, machinery, airlines and air freight. |

| XLV | SPDR Health Care | Exposure to pharmaceuticals, health care equipment, health care related produces and services. |

Note: the book makes no mention of position size or stop loss. For the benefit of the audience, I have tested the strategy using a position size of $2,000, with a $500 stop loss per trade.

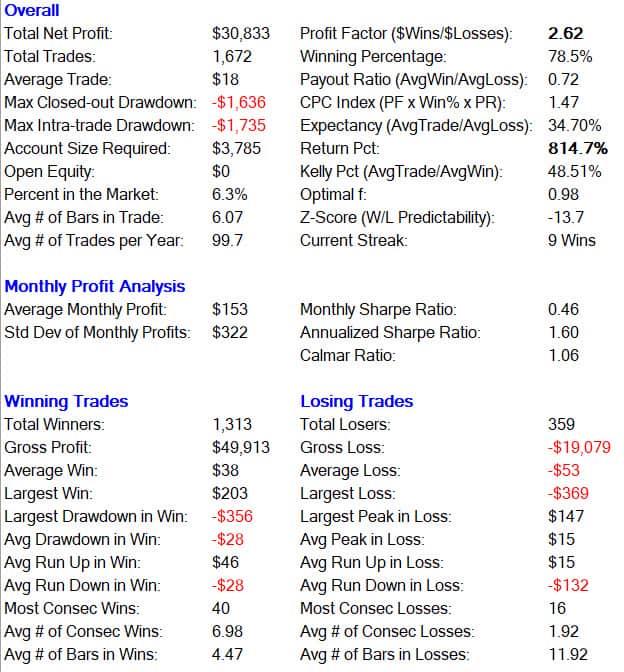

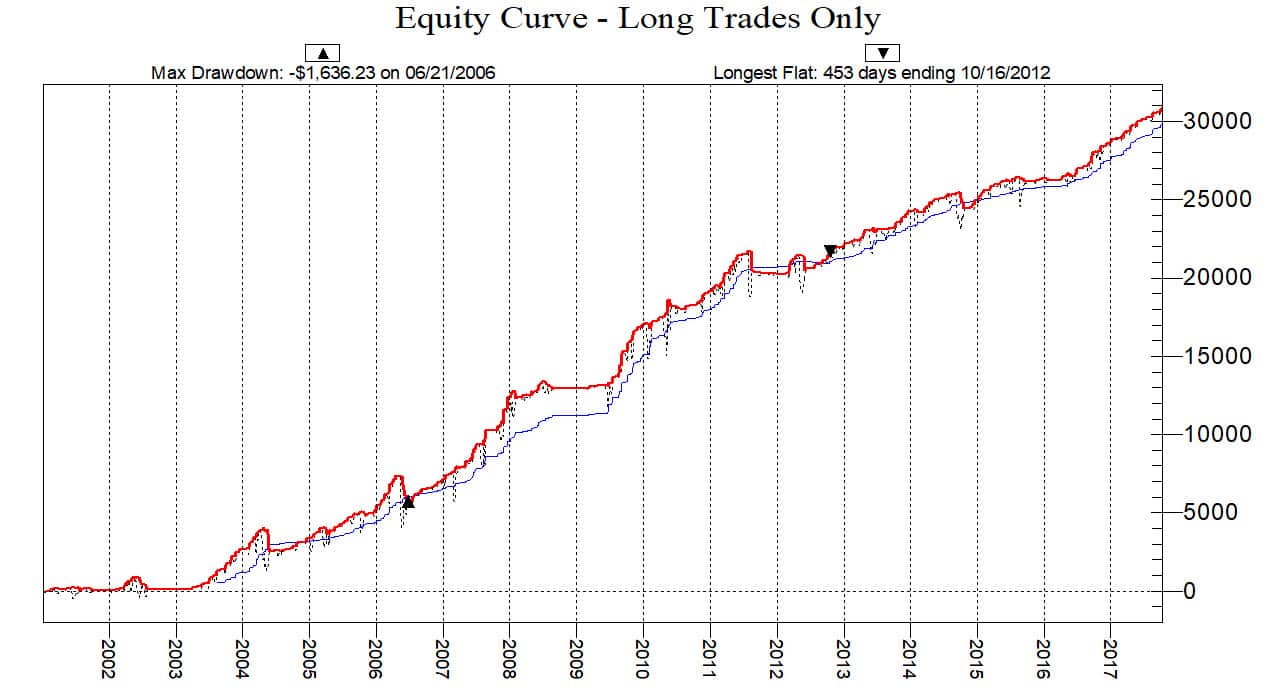

The following are results of just the long-only trades:

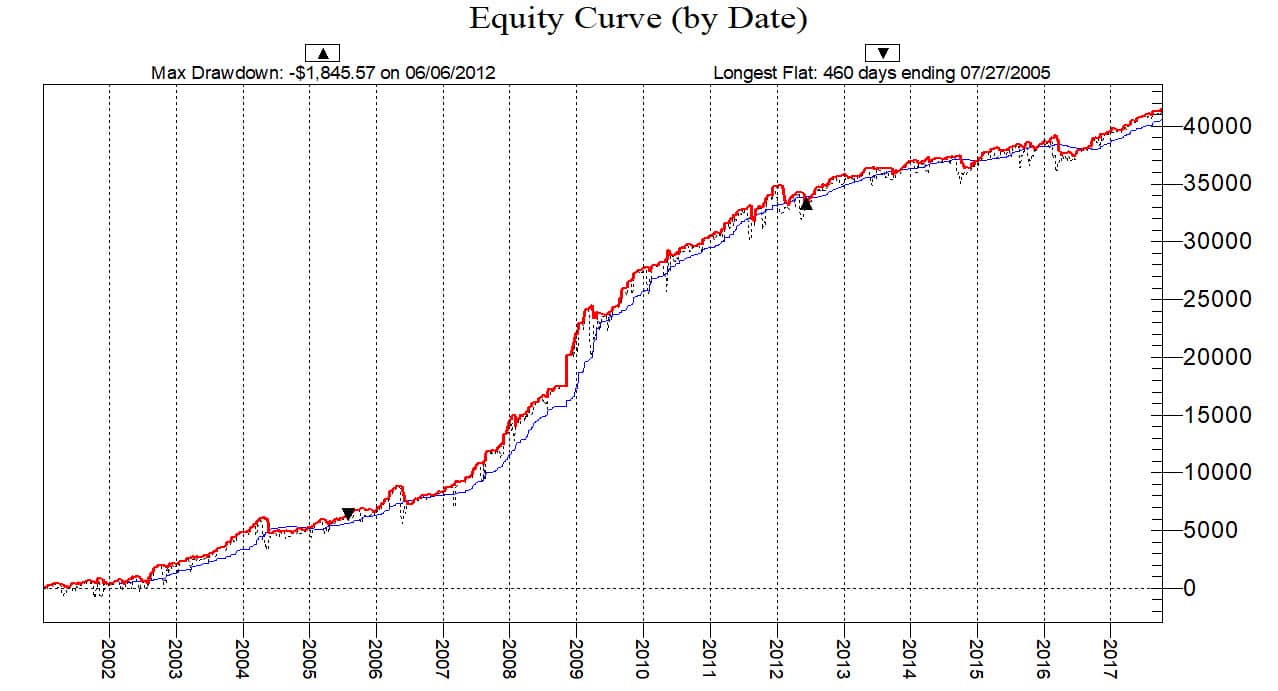

What really jumps out is smoothness of the equity curve. The profit factor of 2.62, with a sample size of over 1600 trades is just awesome. What makes this strategy nice and easy is that traders with a puny trading account can easily implement the strategy without overleveraging and exposing themselves to massive risk per trade.

The RSI 25 and RSI 75 ETF trading strategy: SHORT SIDE

The following are the exact rules for Short signals, using only ‘daily’ bar data:

- The ETF is below its 200-day moving average.

- The 4-period RSI closes above 75. Sell Short on the close.

- Exit when the 4-period RSI closes below 45.

Test the strategy on the recommended 20 highly diversified ETF’s. Use a $2000 per trade size and a $500 stop loss.

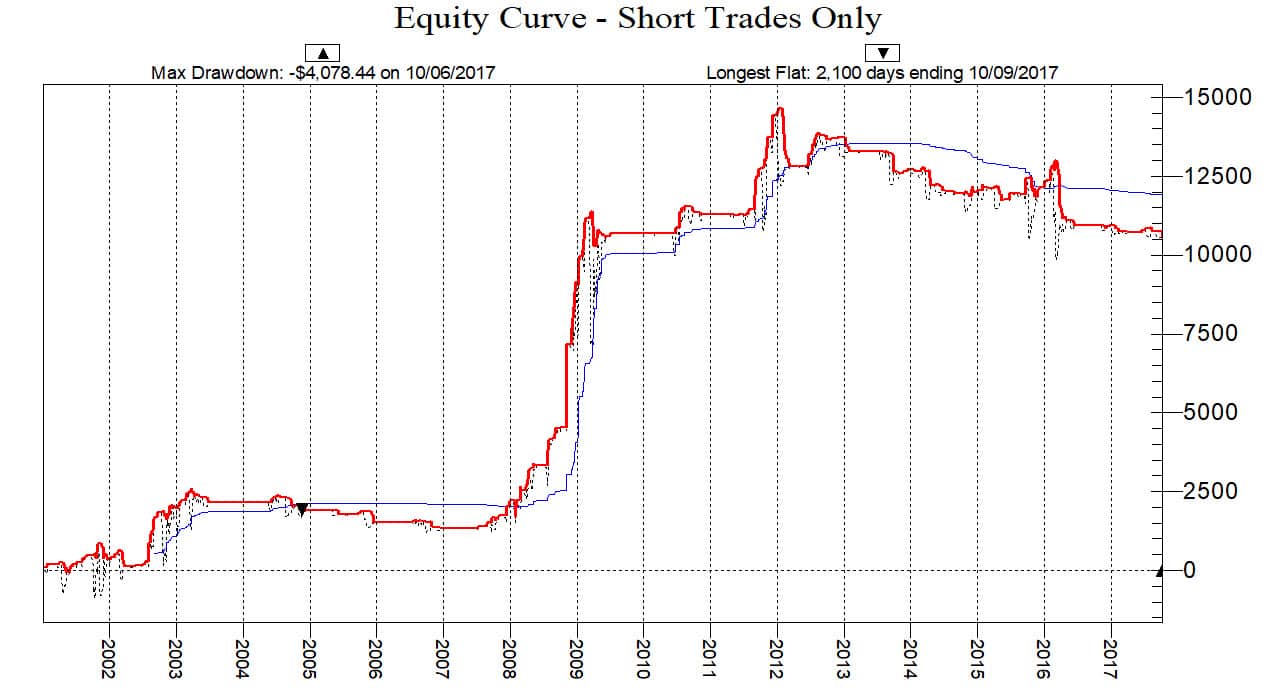

The following are results of just the short-only trades:

Some readers are probably looking at the short side results and might be thinking “ugg, this doesnt look very good.” Wrong answer. For the 15 years, global asset prices have basically only gone UP. Whenever you can find a short side strategy catches the ‘Bear’ then you better take notice. The next ‘Bear’ will eventually happen, it always does. You need to have short side strategies in place. Personally, this short side equity curve looks beautiful. You simply must keep the short side as part of the arsenal.

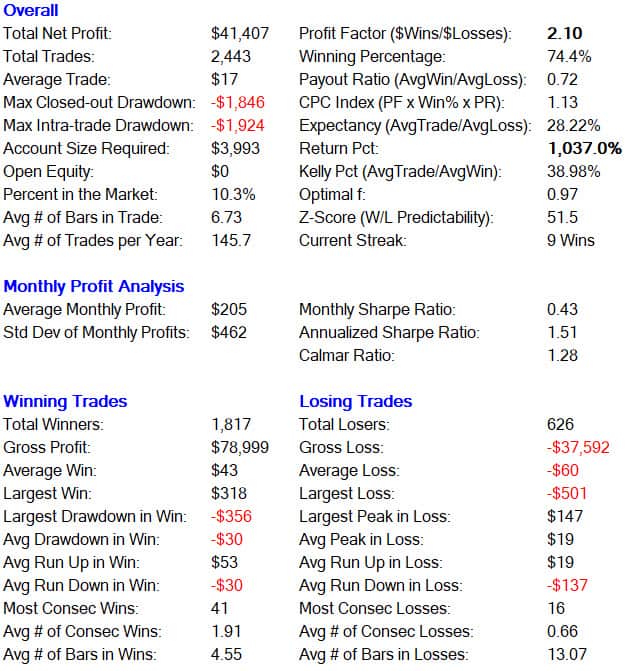

The RSI 25 and RSI 75 ETF trading strategy: Both LONG and SHORT

The following are the results of the Long side and the Short side combined into a uniform trading strategy. This is where the ‘rubber hits the road.’

Notice the symmetrical consistency? This is an obvious edge. For the past 15+ years, this simple strategy just keeps chugging along. Catching the BULLS and the BEARS. Anyone that has been around this game for awhile knows how difficult finding this sort of trading strategy.

Wrapping things up

Thanks for making it this far! Truth be told, I can talk about trading strategies until I am blue in the face. For me, trading and investing isn’t so much about making money…its about the discovery. Its about uncovering and discovering what nobody else it seeing. Its just fun.

Will the edge continue? I believe so. The sad and pathetic truth is that most people cling to the distorted fantasy of ‘day trading’. That they can quickly buy and sell stocks in a fraction of a second, and make $1k per day. The hard and cold reality is that the only people that make money at day trading are the people selling fantasy trading educational courses, software, and expensive mentoring.

Yes, its true than some folks can pull off the day trading dream. For awhile. But over the long haul, they usually pay whatever profits to the broker executing the trades. Its a terrible mountain of pain that newbies should avoid.

Instead, focus on doing what everyone else is not doing.

- Stop buying expensive and useless indicators.

- Stop listening to trading Guru’s and day trading charlatans.

- Invest your time and energy into learning how to program and test trading strategies.

- Zone out the world. Let your intuition lead you. Validate everything with science.

Once again, thanks for reading. For those interested, you can download a free copy of Trade Navigator through this link. (No, am not being paid)

And if you are interested in purchasing the book in which this review was written, you can find the link below: (Yes, I earn .70 cents if you purchase the book)

Dont forget to leave a comment below. And for all my ‘haters’ please pick apart this strategy, I am confident that I can defend this little dandy.

Im completely geeking out on coding. Its….cathartic. Does that even make sense? like….its enjoyable. Anyways….sorry. not trying to spam ya. I was trying to look up Al Brooks net worth, and found your website talking mad logical shit. Kinda love it.

Hi Morgan,

Got your email. Will try and respond in a day or two.

Regarding “coding.” It sounds like you got bitten by the bug. Once you get bitten by the bug, you will never pay attention to another “guru” ever again.

Once you can apply your imagination in written form (code) and then start testing theories and finding your own niche…you will never look back or see things as you once saw them.

For me, the process of coding and discovering something new and unique is very satisfying.

You just….post free shit like this!? Thats awesome.

I also saw you saying someone could email you for coding help!?!? my man! I love how salty your reviews are! Thanks brother

Emmit,

Now that brokers like TDAT have free commissions on stocks, would you please run a new equity curve on the method and paste it into the web page, using a time period when commissions are free – Please?

— Well, I guess if free commissions are going to have any effect on method performance then the data base you use has to be from a broker that has free stock commissions.

What software and database is generating the equity curve?

I was able to get the Long and Short equity curve to load by right clicking on an icon that was there where the curve should be – Right Click – Load Image.

Emmitt, I think the “Both LONG and SHORT” equity curve is missing.

“ The 4-period RSI closes under 25. Buy on the close.”

Herein lies the problem – you cannot buy (or sell for the short side) on the close after the close. Rerun your back tests using buy on the open the next day and you will see what I mean…

i tried tradenavigator on your recommendation specifically with the hopes of running a few of Larry Connors’ screens. as you say the screen is not hard to program with a little head-scratching and trial and error. and it worked, and i went to pay for it to get the live streaming, thinking i could run the screens in the live market. nope. it only lets you run screens after the market has closed. If you want to check at 3:45pm, to make your purchases as the market closes (i trade mainly options, which can’t be done after hours.) it turns out that tradenavigator won’t run a screen with current info as if it’s the end of the day – not even at 3:45pm. you can run a screen for today, after the market closes. this can severely limit your entries, unless you want to buy shares after hours – a bit unpredictable, shall we say?

about a lot of these screens – particularly larry connors’ strategies – the real runners gap up – some higher, some down, but – they all gapped up. pretty frustrating to not be able to get in at the end of the day, let me tell you.

Great response.

For me, I use the Trade Navigator platform strictly for research and testing. This is where it excels.

However, you are absolutely correct that setting up intraday screens is a major pain in the butt. It can be done, but you need to build your strategies using daily in conjunction with intraday bars — a big pain.

There are also a few other areas where Trade Navigator excels, primarily building custom symbol lists for portfolio backtesting. I really like this. I also like the very robust support at Trade Navigator. You can pick up the phone and screen share with a live human — this is invaluable.

The next step for traders, after pushing Trade Navigator to the limits is to build strategies using Python. But lets be honest, most people don’t have the time to learn a full blown computing language. I think Trade Navigator provides a good balance of features and actual usability. Many of the retail platforms on the market, that contain backtesting functionality, will primarily go unused (TradeStation, etc.)

hi can u give me specifics on how you set your stop-loss prices? was it a % of the stock amount? if u can give me an actual example i dont know where to put the stops – and i assume you dont do a sell order ahead of time because u dont know the take profit price you just sell when rsi is in the wrong zone? Also did u place market buy and sell orders for the long trades? Also- are these numbers from actual trades or did u get them from testing? And Last ? – do u automate your trades? or did u make each of these trades manually and just use alerts to know when rsi was in the right or wrong level?

Sure, let me answer each as best as possible:

1) For stocks, with long positions, I don’t use stops. For shorts, I typically use stops of 20% of the stock price.

2) Do I use a market order to buy and sell? Nearly everything I buy is highly liquid. So, if I have time and not being lazy, I will use a limit. Sometimes I just pay the spread, because I am lazy or need to get my dog walked. If shorting, these are usually illiquid stocks, so I always use a limit order.

3) Everything from the book is backtested. However, I actually trade this strategy but not with the symbols used in the article. Why? Because once something is published in a very public way, like this strategy, its usually stops working! So you have to be little more creative and build original portfolios of stocks and tweak the time frames into something original.

4) I do not automate my trades. You should do everything manually. It avoids mistakes and forces you to engage with the market, and more importantly…your emotions.

FYI, I am working a free course that will take you from A to Z of how to develop, code, backtest, and execute the trades. It will be everything you will need to take full command and get off the endless carousel of buying signals, shitty trading systems, and whack-a-doodle indicators that will destroy your savings and blow up your credit card. The only investment for the individual will be a modest cost to buy the backtesting platform (which I have no affiliations) and data.

I have additional question. In this strategy, we will enter into a long position as soon as the RSI is less than 25. We will exit the long position as soon as the RSI is more than 55. Will it be useful if we can continue to be in the long position until the RSI starts going downwards. The reason I say this is because if it is above 55 for several days, then potentially the price is increasing and it may allow us to lock in more profits. In other words, it is kind of simulating a trailing stoploss. The same can be used for entering into a long position where we perhaps do not enter into a trade that they RSI is less than 25 may be wait a day or two and see if it continues to be below 25 and then only enter into the trade. I was thinking about this once I saw some of the trade enter and exit on the technical charts.

Thank you for a useful blog post. I reproduced your results in my own in-house setup. How did you choose this list of ETF? The choice of ETF can also make a lot of difference to the outcome and that is why I am asking this question. Also, when you actually deployed this strategy, do you remove the worst performing ETF from the list? I understand you cannot cherry pick but I guess I’ve never understood how to include or exclude an ETF or for that matter, or stock from a given strategy/

Emmett, after doing this for awhile do you have a sense about where these guys with their rooms get their subscribers? How and where do they go about their recruitment? I’m shocked at the large amount of interest about trading out there. It’s not as easy as just making a webpage surely.

I put this question here didn’t know where else to place it.

@Emmett. I work with Glen from TN often. Instead of me or getting one of the TN coders could you send me the scripts for TN, please? Can use my email if you don’t want to post here.

Sent an email.

Don’t bother about sending the code for the RSI Strategy. I’ve built it. On the same subject, I realise Emmett you are busy nevertheless it’s not cool to say you will do something and don’t.

Thank you so much for sharing this ! I litteraly abused this strategy on multiple Forex pairings. Here’s the cumulative result of 4 bots I crafted over the last 2 months based off this strategy. I’m currently adding more and more robot to this curve. The more I add, the more the curve is thightening and it is soooo satisfying !

I hope someday you will give us another gem like this 🙂

Did you use standard lots or micro lots in your test? It is a hard stop of $500 or a 50 pip stop?

G’day Emmet, your discussion might have brought Larry Connors’ web marketing back to life, as I’ve now started receieving emails from Larry’s Trading Market research, which I haven’t seen for a while. Here is some good refreshing update from him: http://tradingmarkets.com/recent/does-mean-reversion-still-work-1593757.html

This was great, I’ve since purchased this book on the basis of Moore’s review and it’s worth every dollar (paid $49 on a popular online book retailer). Emmett, please do Ezeetrader. I know you are US based but lots of US residents buy Ezeetrader’s courses and they are Not cheap. And have been in their free trial trading room, it seems they don’t want to give up any strategies until you’ve parted with your money.

Hi i went back to 2010 and if you would have bought and held 1000 spy vs this system buy and hold won, Am i missing something ? Please help

Good article. The info on max drawdown is interesting: about the size of one position, as it happens. This helps decide position sizing a lot. I will implement this strategy bearing this in mind, and also using volatility adjusted position sizing. I will also use a slightly larger and different basket of ETFs, including TLT and a couple of currency ETFs and eliminating the duplications you have (e.g. Latin America and Brazil).

Read this article the other day, thought this may be of interest to some of you, as it shows some profitable algos with backtested results.

https://hackernoon.com/hacking-8-algos-161d1f28dcf3

Oh thats a great article. I can backtest that easily. Thanks for the link. Am always desperate for good material.

I hardly even come to this site anymore. What you did to expose these con artist day trading room vendors was inspirational, courageous and hopefully opened at least some folk’s eyes. As I have learned though you can lead a horse to water but you cannot make them drink.

But these back tested strategies is another story. So easy to make money back testing strategies on paper. Yet most folks who then try them in live markets lose money and how many countless hedge funds and ETF have closed and lost money based on some strategy. Back testing and live forward testing are not the same. If they were, where are all the rich strategy investors?

This is not the way to invest and generate wealth. You look at investors that did not inherit money or use some crocked insider trading method and became wealth you see the same story again and again. Let’s take Buffett one of the best know great investors of our time. Ask him which trading strategy did he use to obtain his wealth and he would look at you like you are crazy.

These guys became wealth because they invested in something they knew and understood. It does not matter what they invested in; real estate (Trump), stocks, oil (T Boone) or so forth. They bought during times when the investment was cheap and out of favor and let it grow. They understood what they were investing in and why.

Here is the problem, even if the strategy worked when it has its draw downs folks will abandon it as they have no understanding or commitment to why they followed it in the first place.

I will give you one last true story that may or may not help you see the light. I read this article on this hot fund that went up around 100% in a year and yet most folks who bought the fund lost money. How is that possible you ask. Here is what happened, the fund only had a few investors and then bought some hot stocks and went up 150% and guess what happened? That is the point all the investors jumped on the fund. None of them had a clue why they were buying it except it was hot. So what happens when the fund gets all this new money and have to invest it; the fund drops like a rock. So even though the fund ended up 100% on the year, most folks lost money. And sadly this is how most people invest.

Wealth is made over time by making sound investments that one understands. Why don’t you start to preach about that, ah of course that is boring and no one wants to hear about that. So instead they give $5K or more to some con artist telling them how they will make a fortune day trading or so forth.

Did you actually read the entire post? There are 2 problems with your comment:

1) This strategy has outperformed its backtested result for 8 years. That’s very impressive and very unusual.

2) This is not a $5K “con artist” strategy, trading room, seminar, day trading strategy, questionable automated system, etc. It’s a strategy from a cheap book that’s outperformed buy-and-hold on a risk-adjusted basis. No one is claiming you’ll make 100% in a day/month/year with it. The only way to possibly get really high returns is to take way too much risk (i.e., using options or eminis in an account that’s too small).

” This strategy has outperformed its backtested result for 8 years.”

As stated by Mkt, ” According to Cesar Alvarez, most of their strategies (very similar mean reversion approaches) haven’t worked as well since they introduced them. ”

There are no shortage of funds that have tried every strategy under the sun.

Seriously how many of these strategies that could not fail do you have to see fail before you wake up and smell the coffee. Do you remember the Black–Scholes model that could not fail? I could write a book on failed strategies.

I am still waiting to meet those rich investors that are strategy traders.

I apparently cannot convince you that back testing on paper with simulators is not the same as live trading in a real world market.

So heck, don’t listen to me. Take your money and go ahead and invest away in this strategy in a live market and you will quickly see for yourself.

You say, “I am still waiting to meet those rich investors that are strategy traders.”

Richard Dennis, who created the group called the “Turtle Traders” was entirely a strategy trader. Most of those he trained are still pretty successful, and are using strategy trading methods. The founder of “Investor’s Business Daily”, William J. O’Neil, has some momentum strategy that he calls by the acronym CANSLIM. He has been audited and shown to have been successful with it. So Warren Buffet style value investing is not the only method to making money from the markets.

A Google search should turn up the story of the “Turtle Traders”, and of CANSLIM.

Actually I am a member of AAII and familiar with CANSLIM. Now in full honestly I did not and do not think of CANSLIM or the Turtles (gee when I trade I trade trend) as the same as an RSI trading strategy (which to me is trading based on an indicator similar be RSI, MACD, Stochastics or so forth), but so many funds have tried to duplicate other trading strategy and their results have been less than stellar:

http://awealthofcommonsense.com/2014/08/closer-look-can-slim-performance-numbers/

But I did not think of trading like the Turtles as the same category as trading off an indicator so my comment in general where not meant to cover that type of trading. There are other types of trading that I do think can be profitable, but they are based on actually thinking not mindless RSI trading such as seeing something in the news that oil prices are going up so you short the airlines.

Backtesting or as Mkt keeps commenting backtesting again is not the same as forward live test with real money.

There are countless strategies out there, so by pure Gassian Distribution some are going to work longer than others.

As for Mkt I am very familiar with LTCM and it was funds implementing the Black-Scholes mathematial model that failed:

www dot en.wikipedia.org/wiki/Long-Term_Capital_Management

www dot theguardian.com/science/2012/feb/12/black-scholes-equation-credit-crunch

Well I have given my 2 cents worth, which is worth the price paid.

“Backtesting or as Mkt keeps commenting backtesting again is not the same as forward live test with real money.”

I (and many others) actually traded Connor-Alvarez’ strategies between 2009 and 2017. So we weren’t “backtesting again.” Plus any time you test a strategy after it’s been released publicly, it’s walk-forward testing. This is system trading 101 stuff that you don’t get.

A few links re: Black-Scholes don’t help you nor do they cover up your clear ignorance.

As for this being “mindless RSI trading,” you clearly don’t understand it. They tested RSI and many other indicators and found the best results were contrary to what everyone else said…so they formulated several simple strategies. Again, they’re based on principles with very long-term evidence: trading on the side of the long-term trend, but trading mean reversion in the short-term. This is very different than randomly trading indicators, which is what most people do when they blindly look at charts with no objective system.

It is clear to me nothing I will say will convince you so I suggest others just do the simplest search on Connors/Alvarez’ strategies and you will see others have tested it and not had the same results Mkt claims. Here is one that was at least somewhat positive.

http://jbmarwood.com/rsi-2-trading-strategy/

But as you can tell some work and some did not over time and that is how data mining works.

Instead of having any type of intelligent arguments you just insult me and change my words. I said live forward testing with real money. Do you seriously not understand the difference. There are at least 3 difference that I talked about:

1) Data Mining,

2) Real world Bid and Ask fills and commissionk

3) Human Factor

And the human factor is a big component. A Trading Strategy that even makes money means nothing if a person cannot follow it.

When people post like you are doing Mkt there is always an ulterior motive. But heck if you have been trading this strategy for 8 years and been performing as the chart suggests you should be very well off. Why don’t you show Emmett actual proof how this strategy has worked so well with real live money in a real market. Now this would be powerful evidence, as I can provide many links of RSI strategies that have not been shown to work.

Just thought I would throw in another link of someone testing Conner’s RSI strategy. Again if you try enough combinations some will work. So you can now insult this person also.

http://systemtradersuccess.com/connors-2-period-rsi-update-2014/

Again showing proof of your profitability trading this strategy over an 8 year period will be powerful evidence. I cannot wait to see it.

Maybe you mis-wrote, but your comment shows exactly what I am talking about, so I will try one last time to explain my position and if you don’t agree we will have to just agree to disagree. Of course I am still anxiously awaiting to see proof of your live money RSI trading results. Somehow I doubt that will ever happen.

Anyway you wrote, “If a 75/25 RSI system is profitable but 76/24 or 77/23 versions aren’t, you throw out your results. ”

That is my point, not all RSI trading parameters were profitable. Maybe they threw out if 75 is profitable and 76 is not, but they could not have thrown out all RSI trading parameters or they would have ended up throwing out everything. They just varied the parameters enough.

We have to have some ground basis to have an intelligent discussion. You have to understand basic statistics and agree there are literally 1000s of articles and book written by folks claiming to have found the holly grail strategy that works.

So lets start simple and keep it simple, you have Mr. 1 through Mr. 10, all doing some type of indicator strategy. Mr.1 does RSI only. He back test for 5 years and tries various RSI parameters and finds out the 75/25 worked (along with close numbers like 76/24). Well by sure white noise one of them is going to work, so that one worked over the past 5 years. So now he publishes an article, the cannot fail RSI Strategy trading using 75/25.

At the same time Mr. 2 does similar testing using MACD and so forth and each write an article stating which parameter worked.

So now you have 10 articles by 10 different folks on strategies that worked. So now 5 years later Mr. Mkt, you thinks gosh I will back test all those 10 strategies and see which one still works. And you find that the RSI one still works. Again by sure probability something is likely to have worked if your sample size is big enough. And again you forget to mention all the other strategies that failed over time.

But in a million years it does not mean that strategy will work in the future. The market is not dumb and everyone is looking for an edge. The second some paper gets written someone is testing that strategy and when folks start trading it the market changes. I would mention random walk, but I am sure you would just belittle it.

There is not much more I can say about this topic. You can agree or disagree. I bring up a different point of view and hope folks would do there own research before blindly trading live money following some indicator strategy. There are just wiser ways to make money IMHO.

And again please provide those broker’s statements showing 8 years worth of RSI trading.

When I test a strategy, I look for a “best neighborhoods.”

In other words, if the RSI strategy works with a 75/25, then it should also work with a 70/20, 65/15, etc.

If I the entire neighborhood of variables looks good, then we have something.

I recommend that readers test this stuff themselves and look at the neighborhood.

Exactly.

Mkt,

You are so dump you cannot even comprehend the statistical point I am making. I was giving examples of why taking some published strategy and back testing and back testing again or even sim forward testing does not equal live forward testing with real money. If it did every fund and individual out there would be doing it and making amazing returns.

I even provided a link where they back tested a strategy that a fund implemented in a live market and yet the back testing results looked great, but the live testing was piss poor.

I give up I am talking to a moron, you will never understand. You should actually try and trade the strategy you claimed you traded and then you will see.

“I even provided a link where they back tested a strategy that a fund implemented in a live market”

You posted a different system by the same authors. Yes, it had a rough patch for a few years. Guess what…even your heroes like Warren Buffett have multi-year losses and have failed to beat buy-and-hold for periods of 7+ years. If you actually knew the data and literature better, you’d know that already. You can cherry pick bad periods in any strategy.

The bottom line is that many of us have known about short-term mean reversion strategies like this for a decade plus. Whether it uses RSI or actual price action (7 day low/highs) is immaterial. Your attack on indicators and bringing up MACD and Stochastics (which can’t be traded like short-term RSI) is yet another fallacy. (BTW, that fallacy is a “red herring.” A good study of logic would do you a world of good.) And yes, I have traded this and similar strategies for 10 years.

The fact that you’ve messed around with CANSLIM so long and didn’t know about short-term mean reversion until now is what’s really telling. BTW, this strategy in this post has had 5 or 6 profitable trades (and no losses) for the SPY this year alone. I’ll get back to trading it and other profitable systems and let you get your childish “last word” in. I mean, you hardly ever come to this site, right… except when your posting 12 times a day??

Mkt,

Impossible to have an intelligent argument with someone that just makes up facts. I never said I messed around with CANSLIM. In fact your post are 99% fact free and clearly you completed missed my argument about stochastic and MACD. You seriously cannot be this dumb. I used that as examples of why BACKTESTING DOES NOT EQUAL LIVE REAL MONEY TESTING!!! Everything else you stated are your words not mine and just pure made up nonsense.

You continue to lie and BS saying you have traded this method for 8 years yet provide no proof, just excuses. That is the red herring as you state. In fact I have called out BS like yours over the years and still waiting for one BS to ever show proof of their claims.

It is obvious you are not interested in facts or an intelligent conversation, but there might be some folks new to trading that truly do not understand why back testing and live real money trading is the not the same. And maybe I am not doing a good job of explaining it. I could provide lots of links explain, but this site only seems to allow 1 link or so per post. So here is just one of many sites that explains part of the reason:

https://www.blue-point-trading.com/trader-toolbox/specific-topics/algorithmic/backtesting-results-do-not-equal-live-trading-results

Mkt, I have had these kind of conversation with many BS that have never traded and some even have come back after they actually traded a system live to apologize and say yea it is not the same. If you ever actually take a live trade I think you will quickly learn the truth. But right now talking to you is like talking to a wall.

So go back to your fantasy Holly Grail sim trading, posting lies and up voting your nonsense post and down voting mine.

I think that is your only real ability.

I am only posting to respond to your non sense, so that means you too are posting the same amount as me. Maybe you need to look in a mirror and see the real problem.

You have some serious anger issues. I’d guess that being a failed trader for many years is probably a big part of it. I’ve clearly shown I’m the one who understands the difference between backtesting/live trading and other industry standards (parameter sensitivity, realistic expectations of drawdowns, etc.).

I wish you the best….and go get professional help if you need it…sounds like you might.

When someone posts a comment that I do not agree with, I simply ignore it.

Though I love when everyone is civil, it’s just not possible. Nor can it be expected.

Rather than spike our blood pressure, its better to laugh at off-handed comments.

Regarding trading systems strategy…in particular, the Connor ETF strategies, obviously, I love it. But I don’t take it personally when others disagree. Rob is great at pushing buttons, and that’s OK. If I don’t agree, I just read a different comment.

“Rob is great at pushing buttons, ”

Or as the younger generation says, making people get “triggered.” Good advice, BTW. Thanks.

Yes Mkt I do not mindless go along with group think. I actual think for myself and that means sometimes I disagree with even Emmett. And in this case certainly disagree with you and you unsubstantiated claims and wild accusations.

I really appreciate your comments Rob. They make a lot of sense. When testing strategies it seems an almost unconscious temptation to cherry pick and not even realize it.

Actually I was quite civil until you started to post any insults you could just like above. You claim to have traded the RSI strategy for 8 years and yet refuse to show any evidence of your claim. Instead you deflect by just making wild accusations.

And as for you other statement you have not show anything and clearly have no understanding that backtesting does not equal live real money forward testing.

Hey Mkt – My advice is to ignore the irrelevant troll Rob B. As you can see, when he does not have a leg to stand on, he starts hurling insults, calling you delusional, etc. Everyone else is wrong, except him. A psychologist would find him an excellent case study for the DSM. Most of us who have been here for a while have learnt to just ignore him. You simply cannot win an argument with a troll such as he.

Thanks, dtchum. His last post was a great example. He’s grasping for straws, trying to show that it may occasionally be hard to implement this strategy. In reality, this barely ever happens, and there are several workarounds. However, it’s easier to make excuses and say something doesn’t work–than admit you’re wrong.

I guess he can simply rely on buy-and-hope…great timing since most valuations are at or near record highs. The non-stop bull market since 2009 won’t continue forever, and traders will soon have the edge again–at least those who use disciplined, tested strategies.

What a shocker the long term troll DTCHUM once again shows up.

So predictable. Not a single bit of useful information about the topic or about using the RSI. I doubt you even read the thread, know what I have been debating about or have any clue about the RSI. Just any opportunity to take cheap shots at me about a topic you have no clue about.

Man, you are truly the text book case of a useless troll.

I haven’t been to the site lately, but saw one comment here. I see little Robby B has been fiddling around with the votes again…It’s pretty sad that a grown man is that worried about other people’s approval. Grow up, dude.

Once again you just post nonsense:

“Warren Buffett have multi-year losses”

You cannot compare long term investing in dividend yielding stocks to blindly trading some indicator. I have already explained why most folks will not be able to hold during draw downs when blindly trading an indicator. Seriously did you not understand my post or what.

Buffett can live off the dividend during down times and he understand why he bought the company. He can go visit the company and see how it is doing. He does not worry about the price of the company as that is effected by many factors, he looks at the fundamentals of the company. Is it growing earnings and increasing dividends over time.

Gee, if you cannot see the difference, you are beyond hope and anything I can say.

As for your other comment about a different system. That is the one of the many points I keep making that you do not get. By statistics …. Lets forget statistics as you clearly do not understand. So let’s try this, by pure luck some of the strategies are going to work. That does not mean those strategies will work trading them forward with live money.

I will try one last time. If someone back test 100 strategies by pure luck some will work. And if you forward test the ones that worked, again by pure luck some will work. That in no way means if you live trade those strategies they will make money.

This is only one of several reasons I have repeatedly stated back testing does not equal forward testing. Otherwise everyone and his brother could easily make money trading back tested strategies.

Again are you not able to comprehend this?

“I have already explained why most folks will not be able to hold during draw downs when blindly trading an indicator.”

That’s simply your opinion, but study after study has shown that investors abandon buy-and-hold near market lows. So it’s no panacea either.

Touché, snowflake.

We finally agree on something, investing is not easy. If you had been as honest about your RSI trading strategy we might have gotten off to a better start.

BTW, when you only support is long term troll DTCHUM you know you are in trouble.

Mkt,

This is Rob B II not that ahole Rob B. Man you are right on the money. Stochastics and MACD and all those other indicators are fraud, but RSI is the real deal. Shhh! We don’t want others to know about this Holly Grail indicator otherwise every fund and individual on the planet would be trading it.

I cannot believe the nerve of Rob B stating back testing does not equal live testing. What a moron he is. And then he has the nerve to show links to sites that prove his point and that the RSI did not work and even a link to a site that showed a fund trading a strategy live and the live results were completely different than the back tested results over the exact same period. What a Dick Head to post such facts.

I have had it with that arrogant know it all. I got an idea why don’t you show Emmett using Team View your brokerage statement showing the RSI value and how you traded it exactly per your RSI strategy for 8 years as you stated and how you are knocking it out of the park with this Holly Grail indicator and finally shut that ahole up!!

“We have to have some ground basis to have an intelligent discussion. You have to understand basic statistics”

Projection much? You’re the one who continues to confuse backtesting and real-time walk forward testing…and still doesn’t understand parameter analysis. How about doing a bit of research before shotgun posting like an angry 13-year old.

https://www.quantconnect.com/forum/discussion/1249/do-you-trust-your-backtest–what-is-system-parameter-permutation-and-is-it-a-better-way

Mkt,

To no surprise you have said anything about showing proof of your profitability trading the RSI strategy. You are a typical BS. You are shouting from the mountain top about the RSI holly grail strategy and it is clear you have never traded the RSI strategy profitability. By the way I fully understand back testing and forward testing. And it is not the same as live trading with real money otherwise we all be rich.

I honestly cannot believe I am even having this conversation about a holly grail indicator. It is like deja vu and I have been transported back in time when indicators where the rage. Gee I remember when stochastics was going to make everyone rich from trading. Maybe you are too young, but I have seen this movie and how it ended and it did not end profitable. Folks then moved on to price action then to market profile and foot prints and so forth and now we are going 180 degrees back to believing some indicator strategy will work with real world real money forward testing. I say good luck.

Mkt, you need to quit talking about how great the strategy is and actually trade it with real money. For goodness sake you are not going to sit here and tell us for 8 years you have been forward testing it in sim. And stop down voting my post for simple saying there is NO HOLLY GRAIL Indicator trading strategy.

And one final point it is easy to say a strategy works and it is easy to write articles and publish books claiming something works. Heck Madoff said his method worked. But unless you see actual real verified proof it means little. This is why I look at actually funds that get started and trade various strategies as their performance can be actually verified that and virtually all of them ended up underperforming.

But once again I say show your documented proof of actually live trading the strategy for 8 years and then I will at least say this guy actually did put his money where his mouth is.

Robby,

1) Your first comment on this thread was “I hardly even come to this site anymore.” Yet you flood this thread with one moronic comment after another like a bad case of diarrhea. That was your first lie.

2) There’s no such thing as a “holly grail.” You have problems with spelling, grammar and 3rd-grade level critical thinking. Work on those areas before attempting to analyze a trading system. That’s even more embarrassing than your earlier comment about Black-Scholes.

3) I have traded this strategy with real money. I’ve already stated that. I’m not going to dig up trading statements to prove it to someone as disingenuous as you. It would do no good.

4) Emmet, I suggest you ban this troll. Part of having a site like this is maintaining control of the comments.

Mkt,

Just more nonsense comments by you. Nothing showing any proof or evidence of your BS claims.

I have been a regular poster here from almost the beginning of this site, unlike you who just popped up out of the blue and the fact is I planned to do one post on the topic until we got into a fight, after that I have mostly been responding to your relentless nonsense.

” I’ve already stated that. I’m not going to dig up trading statements to prove it to someone as disingenuous as you.”

This tells the whole story. You are a complete fraud and full of nothing but BS. As I stated I started off this conversation politely showing links proving my point, but it is clear now you have never traded the RSI system as you claimed. I doubt you have ever traded at all. Show Emmett those brokers statements if you don’t want to share them here. Then he can an update saying here are the results of someone actually trading the RSI system with live money.

But you cannot do that!! As you are all BS. Nothing Else!

As far as Black-Scholes you are clearly too dumb to even understand the model and what happened. You clearly missed the whole point of systems that cannot fail. Talking to you is like talking to a 1st grader at this point. Actually that is an insult to 1st graders.

“As far as Black-Scholes you are clearly too dumb to even understand the model and what happened. You clearly missed the whole point of systems that cannot fail. ”

For the umpteenth time, Black-Scholes is a PRICING model. It’s not a trading system. You can use it within a trading system and it may or may not give accurate pricing. And yes, one of LTCM’s founders helped create Black-Scholes. But it didn’t fail, the strategy used by LTCM did. Here’s a recap from an options/hedging expert, and he nowhere says that BS “failed”:

https://seekingalpha.com/article/3618296-lessons-long-term-capital-management

Man responding to you is so draining. Once again you clearly missed the point. It is one thing to come up with a mathematical model, but an entirely different thing to trade it live with actual money. That was the point I was trying to make. I give up!! You clearly will never get the point. And at this point you are just being willfully stupid.

I am almost tempted to offer a CASH reward to see proof of your claims of trading the RSI strategy profitable for 8 years. I have no doubt my money would be safe.

Go back to you BS. That is what you are best at.

Emmett has shown that live trading has been more profitable than backtesting. Do you really believe that no one read their first books in 2008/2009 and never traded their approaches? If they have, they would have made at least some of the trades in the forward test. I first read Connors/Alvarez in ’08 and have traded their methods along with many other things. I didn’t dedicate an account to Connors/Alvarez and have no reason to spend hours isolating their trades on old statements.

You keep referring to me, Emmett and others as BS artists, but I don’t make a dime by stating the truth. I’m not selling anything and have no reason to lie. You act like everyone else here is a vendor selling a $5,000 course.

Get a life and some help for your anger issues.

” I’m not selling anything and have no reason to lie. ”

No one know what your reasons are. Maybe you work for an indicator Software place, who knows. Maybe you are completely delusional. What I do know is you claim to have traded the RSI for 8 years now and yet cannot show any proof of that claim.

And now you say:

” have no reason to spend hours isolating their trades on old statements”

That is not what you said before. You are now saying the RSI was so profitable you stopped trading it. You are nothing but complete BS.

I showed links to sites that showed the RSI method you talked about has not worked out like you claimed and links to site showing real word trading is not the same as back testing a strategy.

But you ignore all this and just insult me and take my words complete out of context to post nonsense, because you have never traded the RSI profitable and just posting complete BS.

Yes one of us need mental help, but I do not think it is me.

Mkt,

Actually I claimed you were a BS artist based on your claims and comments and nasty response to me. You talked about the S&P and its performance year to date using the RSI. I marked up a chart and will get to that in a little bit.

I like most traders have traded various strategies and I talk to other traders who have traded various strategies and anyone that has actually traded strategies do not comment as you have making claims and not backing them up and essentially stating the RSI is the Holly Grail, which it is not.

The fact is all Strategies have good and bad points. Some times they work and sometimes they do not. Under the right market condition a RSI strategy cannot miss and under the wrong market conditions you will lose your shirt. And frankly I doubt many can stick with an RSI trading strategy during those draw down periods.

One problem with implementing a strategy is actually implementing the strategy in the real world. For instance if the RSI just cross before the close do you and would you be able to sell at the close. In fact I marked up a chart with the RSI and quickly came across these type of issues. Easy to do on computer back testing, not so easy to do in real life.

Before I mention the chart, I have to say we have been in a Bull Market this year with every pullback being a great buying opportunity. Under those market conditions one would expect the RSI strategy to shine bright.

I have attached that chart and I surely might have gotten some of the rules wrong. We have been above the 200 day MA so that was not an issue. 4 Period RSI (I am sure the 4 period is not a factor of data mining) shown on the bottom. Buy when dips below 25 and then close the trade at the end of the day when it hits 55. Marked the 55 point with a line. I show all the trades I see and the results for 2017. Which is a period that this strategy should be making money hands over fist.

By the way I calculate the SPY to be up 15% for the year.

Now in all honesty I did this fast and I surely might have gotten the rules wrong, so let me know if I made a mistake. Yes I make mistakes all the time and I am curious if I even did this strategy right.

Also some other critical points. I used the close price. In reality you buy at the ask and sell at the bid. So in real world trading your results will be worse and I did not include any commissions.

Assuming I did this right you can see the results of this strategy on the SPY under what I would call great market conditions for such a strategy.

What methods do you use to trade stocks?

I believe CANSLIM uses fundamentals? Now that would be fun to test.

Hi Emmett, It has been done see link in my previous post.

AAII publishes results of numerous trading strategy like CANSLIM, they even have a modified CANSLIM. I use to trade the Martin Zweig one.

Zweig, huh?

“Rob B, losing money, switching systems and getting irritated at more successful traders since the 1980s” There’s a tagline for you!

Mkt,

You are just being willfully stupid at this point and clearly making up alias to vote me down, as I can see when you post the votes are changed in a very short period.

You claimed to have traded the RSI for 8 years and when I called you out to show proof of your claim you just post complete nonsense.

I tried being nice and show you proof that there is no Holly Grail indicator and links to sites that have not had the success you claimed trading the RSI method you talked about. But instead you are not interested in any intelligent conversation. You are an Fin idiott.

“Mkt, You are just being willfully stupid at this point and clearly making up alias to vote me down”

I did it as a joke after noticing the quirk and seeing you do it multiple times already. I can honestly care less about “likes” and affirmation, but it sure means a lot to you. That projection thing again, Robby…

First, I commend you for admitting you manipulated the votes. But the accusation you made are false, so I must correct the record:

1) You accused me of manipulating the votes – Actual the votes prior to your manipulation was from actual readers. I have better things to do than manipulate the votes, otherwise I would do it now to undo what you did.

2) The votes mean a lot to me – I have been a long time poster here and I state my opinion, which means sometimes I post contrary views to even Emmett, so I am not here to win a popularity contest. If reader’s don’t like want I post ,I have no issue with that, but when the votes were obviously manipulated I call it out as it shows something about the person’s character who manipulated them. I have been around long enough to know when the votes are being manipulated. And when all my post are down voted and all your post are up voted in a matter of minutes something is wrong. That just does not happen naturally.

That is the problem with a voting system when you don’t have a paid membership.

But I will tell you something else; most of the readers that come here are intelligent and genuinely looking for information on investing / trading with the exception of a few trolls who everyone knows. In general they are not looking for group mind think of YES men. If you want a site of Yes men and women and where you get banned if you voice any disagreement with the blogger go to Big Mike. In general folks here do not down vote you for expressing a different view point as long as you are making a legit argument backed up by facts as I did. They down vote people who just come here to promote or who add no value to the topic and come here just to insult others.

Now in fairness they prefer a lively, yet none personal attack debate that is centered around the facts, but once you started to get nasty and manipulate the votes, I felt compelled to counter punch.

Rob B,

I think the best point you brought up is the human factor during draw downs. Will the trader/investor have the discipline to stick with the strategy through a series of losses? Of course, that will depend on the level of sophistication of the trader and his or her knowledge of the strategy being traded. It’s impressive something so simple created a smooth upward sloping equity curve, but the ability of a trader to have the inner fortitude to stick with the strategy has and always will be a factor in long term profitability.

I have seen it countless times in new and veteran traders to have a strategy that works then encounter some difficulty to only abandon it for something new that makes the trader feel corrected so to speak. This will not happen to everyone, but this is why the success rate is so low even sometimes with the directions.

Mike,

Indeed. Even if you had an indicator trading strategy that worked when forward testing with real money, it can be very difficult for one to trade. Every strategy goes through draw downs. And when you are losing money trading based on an indicator and nothing else, will ones belief in the strategy hold out? How about if the draw down last for years?

In the fantasytradingroom dot com, we never have drawdowns. What the hell are you smoking. 🙂

Coming soon, just as I said before.

You continue to miss the point. It’s almost like you’re trying to. The strategy was released in 2009 and has been even more profitable than its backtest (from some time in the 1990s to 2008, I believe). Yes, some of the Connors/Alvarez’ strategies haven’t been AS profitable going forward, but they’ve remained profitable.

Black-Scholes is an options pricing strategy…it can’t really “fail.” I think you’re mixing it up with Long-Term Capital Management. Not trying to be ugly, but you really don’t have the background or experience to be having this discussion. Learn some things about backtesting, forward-testing, various strategies (trend-following, mean-reversion, non-directional options, etc.) before you discuss these things.

As for “strategy traders,” here’s one for you:

https://www.forbes.com/sites/prestonpysh/2017/03/13/edward-thorp-blackjack-beat-the-dealer/#3649a5bf13de

Ed Thorp had 20% returns for 30 years using very complex options/hedging strategies (not buy-and-hold). He had VERY few losing months, unlike someone like Warren Buffett, who loses in bear markets along with all other long-only stock investors.

I am not missing the point at all. I understand back testing, but I also understand data mining and statistics. So let me try to explain in another way.

Lets say you take 2000 strategies (I am talking about strategies like in this article not Turtle Trading) using various indicators and heck several can be using the RSI with 75 25 and 80 20 and so forth.

Now back test and say 20% outperform. You forgot about the 80% that underperform and write an article or a book, “Look at these 400 amazing strategies that outperformed”.

Now move fast forward X years and you take those same strategies and once again back test. By sure Gaussian Distribution some % will once again outperform, lets say 20% so now you have 80 strategies that once again outperformed. Once again you forget about the 80% of the other strategies that underperformed.

Do you really think if you forward test those strategies you will make money? Only if you have a crystal ball and know which ones will be the 20% that outperform.

This is just one of the reasons that when funds try and forward test these strategies most underperform.

But if trading these type of strategies is working for you stick to it. IMHO they are not worth the paper they are printed on.

“Now back test and say 20% outperform. You forgot about the 80% that underperform and write an article or a book, “Look at these 400 amazing strategies that outperformed”. ”

Good system traders like Connors and Alvarez understand this and that’s why they do parameter sensitivity tests and other measures. If a 75/25 RSI system is profitable but 76/24 or 77/23 versions aren’t, you throw out your results. You clearly haven’t studied the literature in this area.

can u guys stfup i m trying to read new informartion not this bs.. both of u guys are dump.. now next please..

Hi Emmett

Interesting! But you should consider to add some sort of room for slippage and comissions!

All 20 symbols have deep, deep liquidity. Slip isn’t a big concern with this portfolio.

Hi Emmet. Thanks for the article. Have u tested the strategy with real live results? If so how do they match up to back tested results? How would commissions factor in to results? I love your site! Keep up the great work!

Hi Joe,

The strategy was published in 2009, so we have 7 years out-of-sample. Whats great is that the out-of-sample results are actually better than the sample results. In other words, 7 years of blind results have proven the strategy is very robust.

Commissions are tricky on this strategy because I calculated $2k per trade. So if the share price is $100 per share, then we are talking only 20 shares. As a good reference point, I simply deducted a $1 per trade.

If you are clever and want zero commissions, then opt for Robinhood, which is free trading.

Has it really performed better out-of-sample? According to Cesar Alvarez, most of their strategies (very similar mean reversion approaches) haven’t worked as well since they introduced them. He writes a lot, so I’m not sure where I read this, but I did see it on his blog a year or two ago:

http://alvarezquanttrading.com/blog/

The strategies have remained profitable, though, which is still impressive. When something is released to the public, it usually doesn’t perform as well, especially when many people trade it. I’ve traded the Connors-Alvarez strategies, along with many other traders, automated systems, hedge funds, etc.

You may want to review Cesar’s trading signal services some time:

http://alvarezquanttrading.com/tranquil-trades/

He’s split off from Larry Connors, but both of them do very thorough, quantitative work. That doesn’t mean everything they do will always be profitable, but they’re definitely not in the overhyped/snake oil camp.

This particular strategy was originally published in 2009, by simply looking at the equity curve from 2009-2017 we can see out-of-sample performance has actually improved. No big mystery to solve. As well as the average trade size has increased, as well as numerous metrics that confirm.

I see–well that’s good to know. It may be some of their other strategies that didn’t perform as well going forward. They’re still profitable, though. Most of their strategies are very similar, whether they use short-term RSI, 7 day high/lows, etc.

I think such strategies will have good longevity, because they meet several criteria:

1) Not overly complex or curve-fit

2) Trade in the direction of the long-term trend (200-day MA). Always trade with the wind at your back.

3) In the short term, go counter-trend and “buy fear and sell greed” (or vice versa).

If you listen to his latest interviews on the “Better System Trader” podcast he also says the short-term RSI strategies have held up. Cesar’s strategies in general have held up surprisingly well post-publication and I still refer to them for inspiration.

Also, I traded using RSI(4) on ETFs as well as high priced stocks last year by using put credit spreads. I can’t easily isolate how much of the performance was due to the price move and how much from overstated volatility, but I will say this stuff is useful to real money traders. I did backtest my modification on the underlyings prior to trading and results were in line with his book.

Emmett, how are the fills of Robinhood vrs others like IB. Have heard many times and especially for wall street “there is no free lunch out there”. For a person taking 3 trades a day Robinhood can mean good $500 savings each month, which is substantial.

Good day. Has anyone applied this systematic trade to shorter time-frames for day-trading? I am looking at testing this for the index futures. Thank you