KJ Trading Systems

-

Honesty

(5)

-

Quality

(5)

-

Cost

(5)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

TradingSchools.Org originally reviewed Kevin Davey of KJ Trading Systems back in January 2015. He received an excellent review. Its been two years and many individuals have requested an update. Not much has changed.

In fact, Kevin Davey continues to produce stellar trading results. 100% verifiable. 100% transparent.

If you have ever wanted to take a sneak peak at the inner working of a professional retail trader, that consistently earns an enviable income, this is your chance.

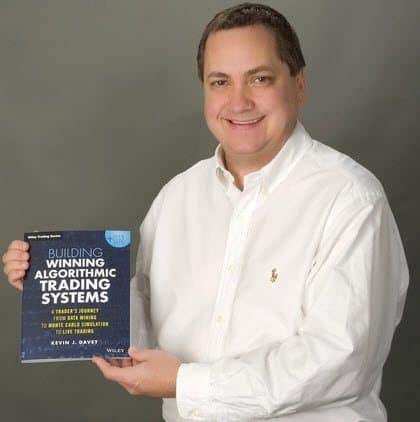

And Kevin’s book remains an indisputable classic for every aspiring trader.

Thanks for reading today’s update on Kevin Davey and KJ Trading Systems

A little over two years ago, TradingSchools.org wrote a highly positive review of Kevin Davey and KJ Trading Systems. Today, we are going to update that review. In addition, we are going to be taking a closer look at a couple of things:

- Tax Returns for years 2014 and 2015.

- A TradeStation Brokerage Statement for January 2017.

- What a professional trader actually looks like.

- And, a post-mortem biopsy of the monthly account statement. We will be looking for clues, fingerprints, and analyzing footsteps of a professional trader.

During the month of February 2017, Kevin Davey reached out to me directly. He asked for an updated review, not because he wanted to show-off his results, but because he wanted to afford the audience a ‘behind-the-curtain’ peak at how an actual professional, full-time trader conducts his business. And a reveal of the type of income that Kevin Davey earns each year.

Its important to note that Kevin Davey is very much a ‘normal’ human being. He is not flashy. You will not find ‘social proof’ or ‘trader porn’ images of Kevin on social media. He does not drive a Ferrari, Mazerati, Lamborghini, or S-class Mercedes Benz. There are no pictures of Kevin with bikini models or eating lobster. You will not find Kevin taking a limousine to the Opera. No carefully propped photos of Kevin in a $1,500 a night hotel suite, holding a glass of champaign, with a gold Rolex wristwatch prominently centered within the image. No yachts, or private jets. No boasting of owning a private spaceship (true story). He works from a small, unadorned desk. Which contains only an old laptop computer, a pad of paper, and an old wooden chair. A very old wooden chair. There is nothing shiny, slippery, or flashy about Kevin Davey. He offers no ‘social proof’ of success.

Trading educators that display ‘social proof’ or ‘trader porn’ is by far the clearest and most reliable indicator that you are witnessing a fraud. The dangling of shiny objects is nothing more than a piece of bait, a lure, the Sirens song. All meant to draw the victim closer to the con-artist, where the victim willingly sacrifices himself upon the altar of a false profit. Spending thousands of dollars for a ‘secret trading method’ and yet more money on a ‘live trading room’. The end is predictable, the meager ark in which so many place their hopes and dreams of a better life, are smashed upon the cold hard reef of market realities. All the while, the false profit continues to proclaim their riches and success, the victim of the fraud is left penniless and in despair. The false profit needs more money, to teach the next layer of ‘secret knowledge.’ Always tempting the victim further along the primrose path.

So many people repeat this cycle. Over and over. Always looking for the next financial guru, with even more shiny objects than the previous financial guru. Stuck in a cycle of financial misery and despair. Most traders lose. Why? The answer is clear and obvious. Flawed market assumptions are passed from teacher to student like venereal warts spread through a Bangkok whorehouse. Ignorance begets ignorance.

Enough with the dark language. Let’s jump into the light.

Tax Returns

The following 2014 and 2015 tax returns are authentic. How do I know? Because I sent the tax returns to my CPA, and we verified that they are authentic. Why do this? Because in the past two years, several trading educators have submitted fraudulently produced tax returns to TradingSchools.Org, in an attempt to trick us into writing a positive review. We learned this lesson the hard way. I won’t say whom, you know who you are.

So let’s take a look at Section 1256, Form 6781 which displays gains and losses of futures contracts. Notice how I said futures contracts. This is important because some trading gurus will show tax returns with a massive income on page one of the tax return. But what they are not revealing is that the massive income did not come from investing or trading, it came from selling trading courses, DVD’s, live trading rooms, trading software, etc. We are concerned with none of the promotional income, we simply want to verify the actual trading income. So here is Kevin’s income from trading futures, for 2014 and 2015.

scan0002 (1) (3)Many individuals reading this have not been through the subjective torture of filing United States income tax returns. They are confusing. So, for the layman, Kevin Davey earned $162,000 for 2014, and $302,000 for 2015. On average, Kevin Davey earned over $19,000 per month, over the prior two years.

When TradingSchools.Org writes a review, this is the type of stuff we like to see. Actual tax returns. That we can verify.

Account size, exposure, and leverage

Some readers might be looking at these tax returns and say, “but what sort of leverage does he typically employ?” This is a fair question. Example: if Kevin is trading with a massive account, and he takes massive positions of 20 contracts per trade, then these results do not look very impressive. If you are exposing yourself to potential losses of $25,000 per trade, then an annual income of $150,000 doesn’t look very attractive.

Now, lets take a look a recent account statement from TradeStation. And yes, TradingSchools.Org contacted TradeStation and verified the authenticity of the account statement. The following account statement is for January 2017, which showed a profit of nearly $8,000.

Kevin Davey Account StatementMost people will take a quick glance at this account statement, and then quickly move to the very last page. They are only interested in the ending monthly income. But contained within this account statement is a ‘treasure trove’ of very revealing information. Let’s take a closer look:

The first thing that pops out to me is that Kevin Davey is not a big position trader. The overwhelming majority of trades are only single contract trades. So his leverage is very light. On a few occasions, he will take a larger position size of 2 contracts or rare 3 contracts. His largest position was 6 contracts in the 10-year treasury note futures.

What I also find fascinating is the distribution of different products that he trades.

- Copper

- Crude Oil

- 30-year, T-bonds

- Cocoa

- Russell 2k

- Japanese Yen

- Wheat

- Lean Hogs

- 10-year, T-notes

- Platinum

- Gasoline

- Swiss Franc

- Soybeans

- Silver

- emini SP500

- Lean Hogs

- Soybeans

For the month of January 2017, he traded an amazing 17 different products. This is just nuts, and I never would have expected this. What does this tell us? Quite simply, this screams hyper-selectivity. Kevin is not chasing any particular market. He is scanning ALL markets and taking only the juiciest and most attractive trades. Never in a million years would I have expected to see Lean Hogs, Gasoline, and Cocoa. Whom in the hell trades those markets? This distribution of instruments reveals that Kevin is waiting for only ‘loaded dice’ before he takes any risk on an outcome. He isn’t predicting anything. Only waiting for the statistical pattern to emerge, and then he pounces on the opportunity. Pouncing might not be the best word to use, more like gingerly taking a tiny position.

Furthermore, his hold times are short. Most trades are opened and closed within the day. So he is not leaving himself open to overnight events, or pre-market crop or earnings reports. This is hugely important. My mind still cringes about the time I held an overnight position in wheat and it lock limited on me, for three straight days. Wiped my account out.

Another big reveal is the distribution of wins vs losses. The losses clearly cluster around $800 to $1500 per trade. The winning trades distribute in a range of $1,000 to $3,000 per trade, with an occasional ‘fat chunk’ of $5,000. What does this tell us? This is a clear indication that Kevin is getting into a winning trade and letting it run as long as possible. This indicates that his strategies are waiting for a potential trend day to emerge, where the market opens and closes at extremes. This is immensely helpful in our own research.

This tells us that overtrading and shooting for small target profits are not the path to success.

Who knew that analyzing a simple account statement would reveal so much? My only wish is to have years of account statements from Kevin. Oh, the information that I could glean. But getting Kevin to release this much information took a Herculean effort. He certainly is not revealing so much for my benefit, he is doing it for the trading community as a whole.

What is Kevin selling?

Yes, Kevin is selling something. A course. And no, I have no financial interest in the course whatsoever. Not an affiliate commission or anything at all (I wish I did). He offers an online course, and a live workshop, both are priced at about $3k. Several of my readers have emailed me about the course and their eyes were opened wide regarding the realities and exhausting hard work that goes into finding these ‘juicy patterns’ and ‘loaded dice’ situations.

Kevin also sells a book. I consider this book to be pretty much the starting point for all aspiring professional traders. If you want to become a ‘trading Jesus’ you better learn a few things about one of the ‘holy books of trading.’ Kevin’s book is one of the classics. In a damned swamp full of ridiculously stupid trading books, Kevin’s book is the cream that rises to the top.

In fact, before anyone even contemplates spending $3k on a course, a person should invest a few bucks and read the book. Read the book first. If what you read makes sense, then you should take the next step and start developing your own strategies. The book contains the path, the road map to take you where you need to go. You just need to apply what you read. It really is as simple as that.

If you cannot convert the material from the book into digestible and actionable trading ideas, then consider the course. But I would recommend you start with the book.

Why you should not like Kevin Davey

Damn you, Kevin Davey. Trading is a zero-sum game. For every winner, there is a loser. And unfortunately, just about everyone reading this blog post (myself included) is a victim to your outrageous machinations. Your sneaky, devilish little schemes to enrich yourself at our expense. Unmercilessly draining our trading accounts, with little regard for the pain and frustration that you have subjected upon us all.

You are a little rat. Scurrilously sneaking out of your little hole. Stealing our sandwich and drinking our milkshake. Leaving only crumbs behind. We all have suffered at your (tiny) hands for far-too-long. And now, to add insult to injury…we must buy your crappy little book and attend your seminar to potentially free ourselves from your persistent thievery.

Or maybe, I should stop complaining and adapt my behavior. Maybe I should just surrender my bevy of worthless indicators in which I paid thousands of dollars, and start to approach my trading from that of an engineer. Like yourself, a mechanical engineer, that developed cutting edge efficiencies in various technologies. Maybe its time that many of us stop listening to the nonstop parade of financial charlatans. All peddling stupidity like ‘order flow’ and ‘Fibonacci.’

Maybe if we all start approaching our trading with the seriousness that is required, and use a scientific approach, then perhaps many of us can escape the cycle of never-ending losses.

Thanks for reading. And if you buy something from Kevin. Let him know that reading this review played a part in your decision.

It’s possible that both sides are right:

1) Kevin is a stand-up guy who carefully designed systems that *should* perform well

2) There’s no objective evidence his systems have performed well in the long-term. They may do well in favorable markets for the short-term (that’s why he’s won a few trading contests and has had triple-digit profits in certain 1 to 6 month periods).

I used his system back in 2015-6. It looked amazing for a while, but lost 6 months of profits in a single month. I got out of it around break-even (I wish I’d done that with some other systems I traded…) For the last 3 months it’s up over $13K, but is still down over $27K since starting in 2015. I’ve seen no evidence the methods he teaches his students are doing any better. If there is, someone is welcome to provide third-party verified results.

The bottom line is that it’s VERY hard to beat the markets in the long term. Some “Turtle” type traders did in the late 70s and 80s when there was a technology barrier: only certain traders had the knowledge and patience to design and backtest simple trend following systems (either with primitive computers or by hand). Now anyone can do that for a low price or even free.

Someone suggested using a real CTA instead, but I’ve had them blow up accounts as well. Only a very small percentage of them beat the S&P 500, and you never know when their systems will stop working.

Bottom line: unless you can afford to invest in a Renaissance Technologies fund, you’ll almost certainly underperform the stock market or a decent real estate investor. And even Renaissance funds are underperforming this year (last I checked).

Hi -do you do FOREX REVIEWS ,THAT’S MY INTEREST !

WANDA

So basically what you are saying is YOU are Kevin Davey? This site is not only a joke it is pure cancer. It smells of boomer garbage. Also that Rob character must love the taste of your nuts. BTW! Ad Block and VPN on so no money or doxxing (like you’ve done to others that disagree w/ you) for you, my man.

Seek professional help Mette Bidler

PS Art’s book Beating the Financial Markets is (as far as i’ve gotten) great; difficult to read, in a good sense ..i do algo/RBT but like that not code ..

Oh I love Art Collins. What a cool dude. One of my favorite guys in the trading game. And he is so honest it is irritable.

Better 🙂 honest than not, huh ..Emmett, can you please email me; i need to get you leads plus talk to you ..Art’s actually the only one (every ‘good guy’of mine has) that didn’t reply ..hope i didn’t piss him off ..i did say i can’t get a handle on ppl in the futures arena ..

Art is a good guy, I have created multiple strategies based off his “Beating Financial Futures” book. We were in e-mail contact a while back. Shoot me an e-mail and I’ll send you last contact info I had for him.

Kevin, your record is impressive. Why are you not managing a hedge fund instead of rubbing shoulders with these snake oil salesmen?

Kevin i feel to be a grounded, honest guy. Just look at him/his face already. Nothing bad. .. my problem is not necessarily the methods but that he takes after Bob Pardo;Pardo (and this relates to Alexander Elder as well) i was hoping would’ve been good ‘t least before Evaluation and Optimization of Trading Strategies (he refers to Covel ..Curtis Faith is one thing i really don’t take after character assassinations, particularly when he revealed Covel and Rich Dennis in fact is also upset with him S&C mag./2004) (interviewer actually was Art 🙂 Collins which is kinda interesting. Karma. .. i got wind of him thru Tiger Shark (..eh .. er…) but he did, ppl don’t change; either they always were like that, we just didn’t know it, or if they do it not usually is for the better.

Usually. Like i said above..)

But, no, in his 1992 ed. – original – DTOTS he refers to John Ehlers. Right .. who got his encouragement from..Elder? .. who i’ll be writing to Emmett about but he says ppl get in at the bottom of the move and suffocate it..er: um .. no .. they push it up. Or they can’t get in ‘cos everyone is trying..certainly doesn’t extinguish it..

i stopped reading right there..

you see this cycles (no pun intended) and all comes together

Then after i let him know of me connecting with a prop firm still approached me ..left a bad taste in my mouth ..

Kevin i wanted to read up on .. It’s also sad that he happens to hang around futures.io .. for trading ideas fine but webinars ..

This just shows how difficult this is.

Please learn to construct sentences properly in English. I wish I could read what you have written.

The tax return is from 2014 and shows the majority of profits is from LONG TERM capital gains. The brokerage statement is from 2017 and is only 1 month (yet does support the SHORT TERM gain claims, for 1 month only, but NOT supported by a tax return). As a standard for a positive review, is there a specific criteria of supporting documentation required?

For example, 12 months broker statements, or a year end summary statement, with a MATCHING tax return year. That seems to be the only way to be 100% clear (for at least that one year).

With Section 1256 contracts, the gains are split into 60% for long term gains and 40% for short term gains. This means that 60% of total gains are taxed as long term gains and 40% of gains are taxed as short term gains.

Mike, the tax return is just a sheet of paper unless it is verified. There is no mention how it was verified. If someone knows that it leads one to believe there is no credit-ability about the website. I wonder if Kevin Davey is the owner of this site?

I think you are totally full of shit!

I’d like to briefly, quickly provide some info on Kevin. I own a few of his products. At some point, I had a question for him and emailed him. Within minutes he emailed me back. I had more questions, and he carefully, kindly answered them. He might not do this for everyone (how could someone — too much time), but he did it for me. I also know of some of his work with competitions. Kevin’s one of the good guys.

Just want to let you know, Even though he reply ur message and he according to here tax return 2014 ( we are in 2017 ) making profit, his strategy does not work. I invest my fund through infinity Futures n makes me loss $15K in 1 month. Now, his trading strategy does not show up at infinity futures anymore. There is no transparency such as open trade loss or profit. DONT USE HIS MODELS. IT DOES NOT WORK AND MAKE U LOSS MONEY. Btw, when you see this website gave 5 stars. Good luck if you use this website to measure how good KJ trading performance. I will suggest if u use a professional trader who has license and license, such as CFA or CTA. Remember, KJ can only generate signal but he does not care about ur portfolio, risk management. AVOID THIS MODEL

Currently on Striker, it looks like Kevin’s strategies are having quite a hard time. There are two (APSEN NQ and KJ Diversified O) that are not available for performance review. However, there are 3 that are…

KJ Diversified A – tracked since August 13, 2015 is at an overall loss of $1,578.85

KJ Diversified II – tracked since December 14, 2015 is at an overall loss of $31,733

Tritium – tracked since February 21, 2013 is at an overall loss of $665.94

I have created a few strategies myself and I have found Kevin’s book to be very useful during their development. He states in his book, strategies that produce consistent profit don’t last forever, so it looks like from where I am standing, KJII has run its course. Just my thoughts…

Hi Guys,

Great site!

Could you tell me which is the best live trading room for FX and also the most profitable system you have come across?

If you could recommend one product for intermediate/advanced traders which would it be?

Thanks in advance for your response.

I don’t trust his face. I’m a hunch guy.

A better photo

I hope you’re not a hunch type of guy when it comes to trading.

Huh!!

When you buy stock in any major corporation or invest in any mutual fund do you check the face of the CEO and maybe the CFO as they could be embezzling money.

I have seem more people slickered by some smooth talking 3 piece suit wearing salesman than I care to mention.

Maybe if he was missing half his teeth or looked like a mafia hit man.

By the way this is in no way is meant to be an endorsement of Mr. Davey, but I think his face tells you little about his ability to or not to trade profitably. Just my humble opinion.

P.S. Can you send a picture of a face you trust and it better not be some sweet looking baby girl.

Lastly, hopefully I got the right image. Would you trust this face?

https://www.screencast.com/t/7ollKFHRU

Hi Emmet,

I really enjoy your reviews and writing style.

That said, spellcheck will not correct “false profit” in your introduction to this review.

You should read my old reviews. Wow, written at a 3rd-grade level. Mishmash of word soup.

With much practice and dedication to the art of writing, I am now at a 6th-grade level.

I saw that wordsmithing as intentional: “false profit” is kind of a neat way of describing a false prophet for the financial world! Kind of the way these people are also called “furus” as short for “false gurus.”

Emmett – I think you started a trend by calling these hacks “fale profits!”

*false in last line

+1 for fail profits!

Every time I close a losing trade–an image of Kevin and his little hands appears in my head.

Kind of fitting that you called me a little rat too – my Dad owned a pest control company in addition to being a 30 year firefighter, and I spent 4 summers killing rats and other critters for him way back when…

Ah yes, now we know the know the full story.

Kevin Davey’s trading merits five stars. Does his paid courses deserve five stars? For that we need to hear from his customers! Where are they? My conjecture is that they can’t duplicate the master’s achievement. Michael Jordan is great on the court, but paying for his tricks won’t make me play like him. It seems to me that greatness in trading is akin to greatness in sports: it’s a personal trait honed by training and dedication. That’s why we wanna-be-traders look for a model to follow and duplicate. Apparently the 10 profitable automated strategies promised in the past with a hefty seminar fee hasn’t panned out for customers. His automated system on Striker.com is not okay with a 78% drawdown and hasn’t seen profit year over year in a long time.

Summary: Thanks, Emmett for the effort in showing what a trading champion trades like. But I am disappointed that we still don’t know the potential return of sending a few thousand dollars his way. Buying the book doesn’t make one a trader by any stretch of the imagination, which leads to a perceived necessity of the full course. Much like someone going to the doctor or dentist. A conversation with the doctor won’t do without the follow-up costly treatments.

Good question Joao! If you go to the other review of me on this site, you’ll see comments from actual students. https://www.tradingschools.org/reviews/kj-trading-systems/#comments Also, there is a thread on my course at futures.io: https://futures.io/vendors-product-reviews/37240-kj-trading-systems-strategy-factory.html

But I can’t guarantee success for anyone, of course. I’ll I can do is show what has worked for me, and then it is up to the student trader to actually do the hard work and develop some strategies. I’m also there to support them during their learning phase. Ultimately, the people who succeed with this course will be the people who show up and put the hard work in.

The process I teach works, but it is not always smooth (as you can see with Striker performance). But like you so said well “training and dedication” are big parts of success. I can provide training, but I can’t teach dedication.

For anyone, including yourself, who’d like to talk to students, just e-mail me at kdavey@kjtradingsystems.com. Some will say the course was great, and some will not – I do not cherry pick these.

I am one of Kevin’s Students and took his class last year. I have literally sent him 100s of emails since then to clarify various trading points and he has honestly answered them all promptly with many pears of real trading wisdom.

I have followed his methodology and put in a HUGE amount of work but it is paying off. I am systematically profitable following his approach /guideline. Of course , there is a lot of your own tricks and tweaks you must put in.

Net-Net Trading is a very hard game and no trading educator can hand over trading success on a platter. But I can safely say that Kevin is one of the few trading educators who can put you on the right path and teach you to fish.

Too bad some of us cannot trade futures. 🙁

The statistics from Strike.com for ‘KJ Diversified A Trading System’does not look so impressive:

Hi Emmett, How was KJ performance in 2016 & wondering why 2016 performance/tax return was not included in the review. After 2015 performance it goes to 2017 performance.

I sent Emmett my info in February, before my taxes for 2016 were completed. I only wanted to include info that matched what the IRS received, which could be verified by the IRS via Form 4506-T. I included 2017 info just to show I was still actively trading, and that I wasn’t one of those “he used to trade live, but now is just a sim guy” vendor.

Hi Kevin, I am going through your book and I had a question. Would you recommend those wanting to learn to code their own strategies to learn python or just get familiar with trade-station’s easy language. What language do you mainly use for automating your strategies?

Thanks for the question. I use Tradestation for most of my development and most of my live automated trading. Most traders who I work with use Tradestation or Multicharts (both have same basic language) too. I have no experience with Python. THANKS. Please feel free to e-mail me questions too, if you wish.

At least one person voted down on this comment. Why?

I have noticed in this and the other kevin davey thread , that most comments that says anything that can be interpreted as negative towards kevin will get vote downs – even the post you made which was just a copy of a review on amazon 🙂 .

I think you can assume its just fanatic shills and not care too much about if they vote up or down, as there likely will be no reasoning behind it except “must protect master” pounding in their heads.

How can you say this doesn’t look good? Are you even looking at it?

Only if you’re just looking at total PnL and RoR. How about this for the latest stats: Most profit was made in a single month (11/2015), then given all back in a single month (03/2016), and has been in 95% drawdown for 15 months ever since. The actual unrealized DD is already over 100% (no joke). Full market exposure at ALL time. You would have to be a true believer with nerve of steel to sit through every single major market event last year with this guy’s style of trading.

I posted screenshot of the latest stats but it didn’t past moderation. It shows a whoping 95% 15-month drawdown since 02/2016. The actual unrealized DD is +100%. This program is wildly volatile and it’s in the market 100% of the time. Just look at the performance ratios.

Wow, I’m impressed!

I kind of felt bad for Kevin as I read the exchange that led to this reveal, seeing a guy who seemed to be a decent fellow be under such scrutiny. But such is the nature of this education business. There is so much fraud that now everyone is viewed with a skeptical eye.

I haven’t taken his course but if I do, it is nice to know that I could have confidence that my success/failure is 100% on me. Unlike other vendors where there is no chance of success no matter how hard you work because they are teaching BS and as Emmett says, passing down bad habits like venereal disease in a whorehouse.

Everyone gets beaten up on these message boards. And I post it all. Even the stuff about me…a few good remarks include:

“Emmett beat up his 24-year-old wife and baby daughter, sending both to the hospital.” (I am nearly 50 years of age and have no daughters or 24-year-old wife)

“That TradingSchools guy robbed my grandmother at gunpoint in London.” (Never been to London. Though I have robbed a few grandmothers over the telephone)

On and on it goes. You have to laugh or it will drive you nuts. Regarding Kevin, he is a good guy. Very much a humble mutt. And yes, he loses trades and goes through drawdowns like everyone else. But the important point is that he is transparent. And, he is the guy that is taking money from the markets, and its your money.

Any chance on doing a review on tradenet, Meir Barak. And Trade empowered? These 2 pop up all the time on youtube recommendations…

As far as i could see on his website; What’s being offered is an understanding of how to test and build your own trading systems, as well as being taught a similar “brother” of the system that he currently uses to trade profitably.

Perhaps one reason that it’s a ‘brother’ is to avoid diluting his edge? My brother for example is dim-witted and can barely tie his shoe laces.

In which case what are we rewarding the high reviews for? I understand he passes the Emmett criteria of providing proof of profitable trading but his exact algorithm or methodology will not be shared. The whole thing is moot in my opinion.

Thanks for the comment Simon. Sorry about your brother. Earlier today I was teaching my youngest son how to tie his own shoes…

Of the strategies I give you, 2 are EXACTLY what I trade. The other strategy has one difference – it enters at a different time than the version I trade. The one I give out is actually a slightly better performer.

BUT, do NOT sign up for the class for the 3 strategies. That is not the point of the class. The class teaches you how to develop your own strategies, using the same process I use to get my verified results – that is the point of taking the class.

Thanks, and feel free to e-mail me if you have more questions.

Thanks for the clarification Kevin.

“Dim-witted brother” LOL! What a great analogy.

Amazon reviewer says “I have to give this 3 stars because it is badly mistitled. The correct title of this book should be “Testing Algorithmic Trading Systems” because that is exactly what the book is all about. There is virtually nothing in the book about BUILDING algorithmic trading systems (winning or otherwise), or providing ideas on how to build a WINNING strategy (such as a discussion of successful approaches to trade entries, exits, managing trades in the areas of stop losses, profit stops, trailing stops, etc. … all of which combine to make a “winning” system).”

5 thumbs down and no replies that contradict this review.

I was hoping someone would offer a “rebuttal.”

The big question is “What’s in it for me”? He trades great; does his course buyers duplicated his results?

I have a reply with links awaiting moderation, for your other similar comment. I can tell you that I have received around 100 strategies created by students, using my methods, that have performed well for at least 6 months AFTER the student traders developed the strategies (I personally monitored and verified the results as part of the Strategy Factory® Club). So, students can and do create successful strategies, not just in back test, but in real time too.

How many strategies did you received that didn’t perform well the following 6 months ?

Are the results better than, say strategies made and optimized with a strategy builder (builder, strategy quant etc.) .

I have no idea what the pass rate is for those products, so I can’t compare my student results to those products.

but you may have an idea of the failure rate (ie. the ones submitted that didn’t perform well over the following 6 months) ?

Of course I do, and I will be more than happy to answer that and any and all questions you (or anyone else) has, just e-mail me: kdavey at kjtradingsystems.com

He’s been paid at least 5 figures to give this a 5 star, I have no doubt. He extorts people money or he writes bad “reviews”, THEN he pays to get his “review” on top of first page. This dude has no life. A fat greesy lowlife that probably collects a SS check.

Wow. That was quite the rant. Sure wish I was “being paid 5 figures.”

When I read your “fat greesy” comment, it made me think of a grilled cheese sandwich.

Best wishes. Love your comments.

From another post by Mette Bidler ” Also that Rob character must love the taste of your nuts.” I have a few questions. Are those nuts shaved or plucked? With or without the scrotum? If we add them to that cheese sandwich could we pass them of as a Mongolian dish?

Very nice to see someone having success as a retail trader. Good job.

was that full tax returns or just the form 6781 page? The tradestation statement shows net 2.9k profit, and about 5k open equity which isn’t exactly closed profit. Which isn’t bad for a small retail account. nah, I doubt KJ’s trading is taking most seasons trader’s money, maybe a few newbs. The HFT billionaires and insiders are leeching the most, so I don’t blame KJ at all for my previous losses as single contracts are insignificant in moving the market much less doing any accum/distr. Holding on to profitable trades is fine, i’ll give it that.

Great review of Kevin Davey…. Must be a pleasure to write a raving review on that rarest of occasions… ESPECIALLY a second one!

Hi Emmett, Thanks for the updated review.

Thank you Mr. Davey for draining the swamp. God bless Mr. Davey and President Trump. Make America Great Again.

Yes to Trump.A president for the people by the people.Fuck the fake news and the extreme leftests standing in his way and America’s way!

A the hallmark of a “great” country, is that it practices the principle of “justice for all.” America was never great. Can it be great? Conceptually, yes. Practically, no.

Roger,

Exactly which country do you think is Great? Maybe Venezuela or maybe Saudi Arabia. Which county would you rather live in.

Here is what I know after the good old USA was formed; after thousands of years whereby man seemingly accomplished very little and advanced very little; man went from riding horses to putting a man on the moon.

But maybe you liked the Kings and feudal system.

By any rational historic standard the good old USA is the best or one of the best countries to live in whereby even poor people that are willing to work hard can become successful, where we actually have contract law, where Gay are not killed, where woman can vote and drive cars, and where most of the world population would give anything to move to. Perfect, absolutely not especially with crony capitalism, but a heck better than most places and man (implies woman also) have it better than they ever had it in the past.

Perhaps you should develop some reading skills and read my comment again. Let me help you out. I am not advocating that any country is great. I am talking about America. Until it treats all its citizens fairly, it is not a great country.

Let me guess, you are one of those white supremacists, right?

Roger,

Sadly this is what America is degrading into. If you do not follow an insane liberal believe of hating America you are labeled a white supremacist racist. This is what people do when they have no intelligent argument to make. The funny thing is I fall into a couple of categories the hate groups hate.

I guess it depends on how one defines Great. Is America perfect, by no means. But it is the one or one of the best countries to live in throughout history. I am not sure any country would ever met your utopia view of great as countries are occupied by humans and as such perfection will never exits. It is impossible to ever meet such a requirement. And frankly the statement, “Until it treats all its citizens fairly” is so broad it could mean anything and 100 people could take it to mean 100 different things.

I will add another factor America is unlike virtually any other country in the world in that it is a melting pot of different nationalities and religions. Try and be Catholic in Saudi Arabia and see how that goes for you. Most countries are monolithic in nature.

I for one will stick up for America. I think it is the greatest country in the history of mankind. Yes that is my humble opinion. Perfect of course not!

Is America perfect? Certainly not but which global super power would be a better model to adopt? Russia? China? Do you think that the moral and civil ideals of the Muddle (yes muddle) East, or those of the Russians, the Chinese should be the prevailing social norms?

You can’t fault American for not being perfect, no country is. Personally I think that the US has an irrational fear of anything that even slightly related to socialist policies and if they could get over that they could create better domestic social policies but you can’t deny that the US has been the country to spearhead many social reforms that have had the aim of delivering greater equality for minorities. It also has to be acknowledged that many of the ideals the US stands for are ideals that are shared by other civilized, tolerant and enlightened countries.

Are they the greatest country in the world? No because our own countries are but it is inaccurate to say they aren’t great or that their contribution to civilized society has not be significant.

I’m not a supremacist but I do believe the earth is too small to allow North Korea to exist in its current state and Islam to continue. One of the most backward, perverted excuses for a religion which subjugates women and children, promotes death to non believers, all religion has blood on their hands but all have evolved over time, Islam is still as backwards as it was 800 years ago. Both should be abolished, and wiped off the face of this earth as safely as possible.