The Lincoln List

-

Honesty

(2)

-

Quality

(2)

-

Cost

(2)

-

Support

(2)

-

Verified Trades

(1)

-

User Experience

(2)

Summary

The Lincoln List is a day trading educational company with a live day trading room that specializes in stock day trading.

The “real” track record of supposed day trades is pure fiction. But hey, at least the owner of the company, Doug Rumer admits it. Not too often a day trading educator tells the truth about performance.

I suspect the owner of the company probably does trade. And probably does offer some basic and useful day trading advice. But the supposed track record of trades is so far-fetched and ridiculous that only the most naive and ignorant would believe it.

Until Doug Rumer cleans up his act, and starts being real about actual trading performance, readers should be as serious as attached video.

Thanks for reading today’s review of The Lincoln List

What is The Lincoln List? The company is a one-man trading company, owned by Doug Rumer. The Lincoln List offers the following day trading products and services:

- Live Day Trading Room $79.95 per month.

- Trading As An Art DVD $99.

- Champ Camp “How to make trading a career in less than 3 months” $999.

- Clique Fund Access $2500.

The Lincoln List maintains the following social media profiles:

A review of Archive.org reveals that The Lincoln List website originated sometime in 2010.

Trading Performance

Doug Rumer has made several claims as to profitability.

In 2013, he claims to have turned $25k into $1,700,000 in trading profits.

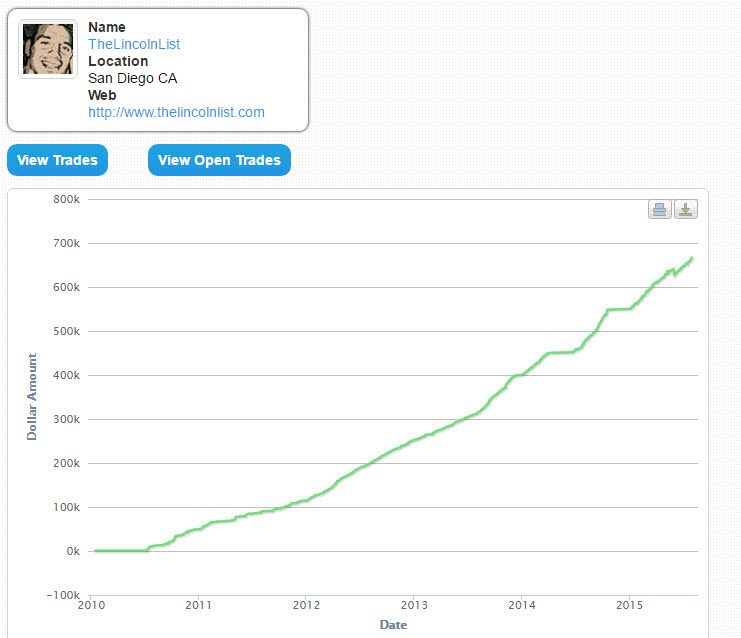

From mid-2010 through 2015 Doug reported the following trades on Profit.ly (self-reported) It appears that he went years without ever losing a single trade.

In addition, on The Lincoln List website, Doug claims that he has alerted his subscribers $1,722,631 in trading profits.

Doug also claims that since 2010, he has returned an average annual 150% return on investment.

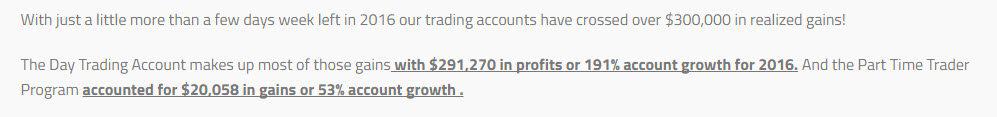

On December 31, 2016, the attached blog post, Doug Rumer claims that his “Day Trading Account had gains of $291,270 in trading profit, or 191% account growth.” Furthermore, he claims that 90% of these profits were made shorting stocks. If true, this would be a herculean achievement. Considering that 2016, the stock market went up nearly ever single day, this claim of 90% winning trades at shorting stocks is akin to building an atomic bomb in the spare bedroom.

If any of this performance is true, then Doug Rumer has to be one of the greatest and most successful traders currently living on planet earth. With such amazing profits, it makes you wonder why anyone would be aggressively selling a day trading room for $79.95 per month.

With these types of supposed performance figures, it really isn’t a surprise that TradingSchools.Org has received over a dozen inquiries to review The Lincoln List. The vast majority of the questions that readers have been asking, “Is this performance real?”

Is the performance real?

During the month of December 2016, I reached out to Doug Rumer via email. I was very plain in describing that a review would be written, that several readers had asked about the supposed performance, and could he provide some sort of proof of the truly incredible track record of trades. To my surprise, Doug actually responded, and was quite pleasant during our conversation.

So is the performance real? No. And Doug admitted it. Truth be told, I was pretty shocked that he just came right out and said it. A Trading Schools.Org first! Pretty refreshing actually. Usually, I have to weed through multiple layers of BS, using fake names and fake email addresses to get near the truth.

So what about that track record Doug? In speaking with Doug, my sense is that he feels like “everyone else is doing it, so why shouldnt I?” That might sound like a pretty callous response, but the truth is that he is right Everyone Else Is Doing It. And since the financial regulators have largely ignored the day trading educational world, it has created this environment where people like Timothy Sykes, Bulls On Walls Street, Fous Alerts, Warrior Trading, etc….have been able to mass market with little fear of regulatory retaliation. It’s just a big fucking shit show of fraud and misrepresentation, where small time investors get the short end of the stick.

With Doug’s refreshing (tiny) bit of honesty regarding performance, I promised him that I would try and figure out someway to give him an extra star on the review.

Wrapping things up

Doug, if you are reading this. I would encourage you to dump the ridiculous performance claims. This type of marketing nonsense has worked really well in the past. But the universe has definitely shifted. The vast majority of people that are contacting me about your trading service are doing so out of comedy and humor. People are quite literally laughing at you. I feel like someone should be honest with you, and let you know that your socks are not matching. People are laughing. You can hear the laughs, Doug. But what you don’t seem to understand is that they are actually laughing at you.

Doug, I would love to come back at a later date and craft a new review. But it has to be on real numbers. And you know what? You might be surprised to learn that you can offer a trading product that allows you to be proud of what you are doing. To be able to live with yourself. You don’t need to claim millions of dollars in profits in order to build a loyal following.

Thanks for reading. And don’t forget to leave a comment below.

Has Doug responded in anyway? Or are the claims of big profits still posted on the site?

Has doug responded too this in anyway? Email or perhaps verified proof? If not then this should be updated too a 1 star review on yet another pos bullshit fcking trash service!

While waiting for the next entertaining review from TS, was curious to see other mentions of tradingschools on other sites. imo, Sykes was one of the ‘pioneers’ of the dream of young wunderkind makes it rich quick continued to be propagated by the likes of WillStocksPicks & Infinite-Prosperity aka IP. btw, the IP shills have massively upvoted their shilling posts in the IP review comments while they thought no one was noticing. A couple of reviewing pages on Sykes with mentions of TS,

http://www.pissedconsumer.com/company/profit-ly/timothy-sykes-profit-ly-tim-sykes-got-ripped-off-for-400-on-a-membership-and-poorly-made-online-only-dvd-20151008712806.html

A shill site and comments probably in reaction to TS:

http://www.goodetrades.com/2009/08/the-truth-about-tim-sykes-from-a-former-critic/

I’ve been in Doug’s trading room and he can trade, I dont know about this track record but when I was there it was easy to track his progress because he called out, entries, exits, size and stops in real time..he didn’t adhere to stop though. Although he was trading well (averaged around 400-$500 a day) it was impossible to follow his trades, he traded a lot of low volume stocks with wide spreads, cheap stocks etc. He’s good at position sizing, he has wide stops and sometimes even averaged into losers..this was his strategy

“So is the performance real? No. And Doug admitted it.”

Are you having some sort of reading disability, or did you just not read Emmett’s review at all? Or are you in denial about the time and money lost in Doug’s room, and don’t want to hear the truth even when it comes from the man himself?

You’ve been had. Learn from it and move on.

Wow bud, u need to get off the yeyo and relax (maybe get laid) First off there is nothing for me to ‘learn’ and I was not ‘had’, I was in his room watching, I noticed very early on that his trades can’t be followed, however, I learned that he CAN trade and make money and I also learned some reality of trading, not the fake nonsense put out by many. Exaggerating his performance is obviously not putting him in a good light but he still has something on his side, he was making a decent amount of money daily and it was easy to track his progress, sounds like u mad 4 buying up Doug’s shares as he was selling his low float shares…suckkaaa

Hopefully, 2017 is the year of realistic marketing for stock day trading educators.

Until then, going to keep on writing.

“Hopefully, 2017 is the year of realistic marketing for stock day trading educators.” – lol! will not happen they all are fake/losers.

——————————————–

Emmett/Others,

Have you guys ever come across anyone(day or short term trader 2-3days hold time) who has a verified record of being consistently profitable?

Had to comment as something you stated Bugged me.

“Have you guys ever come across anyone(day or short term trader 2-3 days hold time) who has a verified record of being consistently profitable?”

So you have a winning trade and you want to close that winning trade on Day 3. I became a profitable trader when I finally accepted my Holly Grails. And they are all known as the real traders talked about them. And one of them is so simple. Cut you losers and let your winners run. How do you let your winners run if you just arbitrary cut it off at 3 days?

Rob B,

I have found your answers to be knowledgeable in other cases so i am assuming this time you rushed into replying without giving it much thought.

I specified “2-3days” to clarify i didn’t mean couple of weeks or months by short term trader.

“And one of them is so simple. Cut you losers and let your winners run. How do you let your winners run if you just arbitrary cut it off at 3 days?” – we can apply same logic to day traders. So your question would become “How do you let your winners run if you just arbitrary cut it off before end of the day?”

If a trade is winning then regardless of time there is no guarantee that it would continue winning in the future too. the whole profit can be wiped out within few hours or in a single day.

So going by “Cut you losers and let your winners run. ” we will close the trade that was profitable in the past with a loss.

Phillip,

What you are looking for is the fantasy world the Day Trading Rooms promise. The is a reason none of them can show you proof of their claims. This is just not how the real world of trading works. But I am sure there are lots and lots of them that will promise you this world of trading. I wish you the best of luck in finding it. But I became a profitable trader when I realize what they are selling is complete nonsense. I fully understand it sounds so good.

I Skype with traders all the time that want to believe in the nonsense so I know I cannot convince you and you will just have to come to see it for yourself. But you are looking to apply basic scalp methods over a bit longer time period such as 2 to 3 days. I spent 1000s of hours trying that nonsense and I say it cannot be done consistently profitably. Yes I know others will come on here and say he is just a loser and that is why he can not do it and then sell you some method. And I say get any of them to show you any real proof of their claims.

It is hard to explain how to trade in this little text box, but I will try and respond to your statement:

“So going by “Cut you losers and let your winners run. ” we will close the trade that was profitable in the past with a loss.”

I hear something so similar by other traders when I tell them to quit the non sense trading the Day TR teach.

I am sorry but the whole fantasy world they teach is just that. You are not going to get that 80% win rate with straight up equity curve. You are not going to get that amazing ROI that no one else on the planet gets. It is not going to happen or let me say you have a better chance of making money playing Powerball than you do of that happening.

You HAVE TO LET YOUR WINNERS RUN!!!!!!!!! And I do not care what anyone says you will never be profitable until you realize this.

My win rate is very low. Yes no 80%, no 70%. Heck not even 50%. My win rate is in the low 30%. And the reason I make money is by letting my winners run. There is a reason every true great traders says this.

Most of your trades are going to be LOSERS, yes LOSERS. But most will be small losers. A few full R losers. And the only way you can overcome those losers is by letting your winners run and letting those winners become your 10 baggers or even more as I add to winning trades. If you cut off the head of every winner then you will never be able to overcome your losers.

Ah, but there is the miracle world of Day TR where none of what I said applies as you are able to catch exact bottoms and tops and just scalp away. Good luck and let us know how that goes.

Rob B,

what i gather from your response is – you have not come across any short term(0-3days hold time) trader who has been consistently profitable & you do not believe it can be done on short term basis. Fair enough & thank you for your response.

Let’s see what others have to say.

The purpose of my question above is not to dispute/debate anybody’s response as everyone is entitled to their opinion ,but to know about other people’s experiences & get an overview based on the responses.

It’s easy to say “Let Your Winners Run” but the reality is much more difficult. How do you know which trade is going to run? In my experience, the most painful trade is the one where I have a substantial profit, but let it come all the way back (and in some cases, if you’re trading stocks, you get the overnight gap and not just out at B/E but with a loss).

On the other hand, if you have a system that gives you a target or profit objective to shoot for (and there are many ways to get those targets) and you take profit at the target, then you’ve done the right thing, you’ve rung the cash register and if it goes beyond that, don’t cry about it, you did the Right Thing, you followed your system. One other thing: a daytrader is most likely using a much smaller time frame (say 5 or 15 min chart) as opposed to a longer term investor or trader. The daytrader may in fact make substantial profit trading those smaller charts (and I’m not saying those scalpers for 3-4 ticks, but rather a daytrader who gets 15-40 ticks on a trade and maybe takes 10-15 ticks on his losers). But you can’t confuse the two, either you are daytrading and you take the profit at the smaller time frame targets or you are swing trading and have bigger targets (and probably bigger risk). Turning a daytrade into a longer trade most likely will leave you wishing you had taken the profit (my experience). So it depends on what you are comfortable with. Just my 2 cents.

Rtchoke,

Very difficult to provide any type of meaningful response in this little text area. In fact I would give you my Skype and we could Skype if there was a PM system here. I will respond to a couple of your questions the best I can.

“How do you know which trade is going to run? “

You don’t otherwise I would not also be making all the losing trades I have.

“In my experience, the most painful trade is the one where I have a substantial profit, but let it come all the way back (and in some cases, if you’re trading stocks, you get the overnight gap and not just out at B/E but with a loss).”

This is harder to respond to in a few sentences. When I was in those Day TRs they would teach if you that if a trade goes up a few ticks, take your SL to BE that way you cannot lose. Yet I would always lose as the price is always testing and retesting. So what sounded like a safe bet was not. You suffer all the losers and cut off all your winners. The market is always testing and retesting. When trading; nothing can be arbitrary, including moving to BE based on arbitrary nothingness. That kind of thinking did nothing but lose me money. I trade market structure and until structure is formed I do not move my SL anywhere. So yes originally I am risking 1R. But here is where the 1000s of hours of trading and doing analysis comes in. After time I have come up with my way of looking at price action. If I see price doing certain things I will close out the trade before I take a 1R lose. In fact I very seldom take a 1R lose. And I use the same logic when I am in the Green. Price does not have to hit my SL for me to exit a trade.

On your second point about the market gapping open or down, you are right. But first, if you have read my post over time, I keep saying quit using 500 to 1 leverage. I USE NO, NADA LEVERAGE!! You have to use proper trade management, which means no single trade should make up a large percentage of your account. There is just as much chance for the stock I own to gap up as gap down. And here is the cool part if gaps down the most I can lose is my investment in that particular stock, but on the way up the stock could go to infinity. Yes I know infinity is not possible, but I hope you get my point.

The reason most people look to day trade of 1 or 2 day trade is the reason most fail. They are underfunded, somehow they are going to make miraculous returns that no one gets, they have to have an 80% win rate and can handle no drawdowns. The problem is that only exits in a fantasy world. And believe me I wish it existed, but I have yet to ever find it. Real trading in the Real World is RISK and your stock gapping down is part of that risk. And hoping and praying there is this mysterious way the Day TR teach you trade is the answer will not make it come true. This entire Day TR industry is a BIG SCAM. But as I have repeatedly said, most folks would rather lose money trading in the fantasy world than have a chance to actual make money trading in the real world and I fully understand why.

Phillip,

Everyone wants to be able to do what you are looking for. It would be so great.

“short term(0-3days hold time) trader who has been consistently profitable & you do not believe it can be done on short term basis.”

Sure I have had winners I have held for those time periods. But don’t you think if what you want to do could be done in the current market, GS and every great trader investor out there would be doing it. Believe me everyone would love to be able to do this. Never hold a stock longer than 3 days max and consistently make money hand over fist by taking little risk.

But I understand you do not want hear that. So I will just say when the Con Artist Day TR operators reply and they will. Demand to see actual proof of their claims before sending them 1 Penny.

Hi Rob, would love to Skype with you sometime. Maybe we can work that out. But in any case, I agree with most of what you are saying here. But I too have spent thousands of hours at this. I developed my own system which gives me an entry point, a stop loss and several targets and I use the same system whether I’m daytrading, swing trading, both futures and stocks. Most of the time I take profits at one of my targets. I learned a long time ago not to regret those that keep on going but instead rejoice as when the cash register rings. Most of the key to any trading is risk control and management. If you can learn to do that, you will do well (assuming you’re not going for those 2-4 ticks scalping situations):)

Of course, as I first started trading I gave money away like I was some sort of philanthropist.:)

Hey rtchoke You can search Skype for Stray Dog or straydogtrades but I have a 12 hour time difference with US east coast time.

Stray Dog, I’m in California, what’s the time difference.

I’ve been on the ‘thousands of hours’ journey with daytrading for years as well. Well said points about risk and trade management. Almost as rare as showing proof is a trading “school” site/room whatever going over trade management and risk. I don’t know why there is no “reply” link under RobB’s post above. btw. good to see the post voting was taken out. Infinite Prosperity had like all their friends and family etc. upvote their shill posts to like +15 to +25. I guess they all got to meet Miss Sangster at IP Ball 2016 if they upvoted. RobB has a good point about losers. Practically none of these sham vendors ever cover losers. You might have a faux crocodile tears video like the one by Ross of WT eating ice cream about a losing day in his attempt to offset the TS review of WT. But nothing about handling losers or showing the realistic % of losers, when to get out of a loser. Instead more often than not, the dream journals on bmt are discovered even after months of sim posting that many posters don’t even show their losers and rationalize it as showing their “best” trades of the session. The 2009 post on bmt about Mohan’s “live” room kept mentioning loser after loser in a session and his headless goose chase failing to put a winning shamshow before bmt closed the thread to divert it to the wrong indicatorwarehouse vendor thread.

My time difference with California is 8 hours now and 9 hours once day light saving time comes into effect. I’m 8 hours ahead of you.

I don’t know what’s happened to the reply buttons either but dtchurn, I came across another post from Mohan on a Forex trader’s site in Singapore. He wanted to know if it was possible to automate his trading system so we may yet see Mohan reinvent himself into a forex trading guru.

I have been in Doug’s room for about a week. He can probably get a winner here and there but he really lacks direction in the morning and based on how confused things were I would not recommend learning from him. Lots low brow jokes and good entertainment but he does not have the killer instinct I have seen in some other rooms.

Funny thing is – If Doug was honest with his performance he’d (assuming it was positive over the medium term) get heaps of signups and probably better quality traders who know its not a get-rich-quick pursuit… I follow Doug on various SM although have never joined up. I’m sure there’s an honest man in there – Come on Doug – be true to yourself and differentiate yourself from all the BS folk out there

I hope as you implied later when you stated, “The vast majority of the questions that readers have been asking, “Is this performance real?”” , they were joking. If not then that is the saddest part oft the article.

Clean up his act. How can he do that. He can not trade profitable. Clean up his act would be to admit he is not trading and it is all a scam.

Once again I do not see how in the world this scammer gets a 2 star review. Heck, maybe it is just me but when I look for a hotel I look for a 2 star rated hotel. The 5 stars are way to expensive and charge $15 for the can of nuts they leave on the table. The 2 star is a basic hotel like Motel 6 (maybe that is 1 star) and that is perfect for me. But this TR is like a fancy hotel that has pictures of luxury pools, gym, and 5 star restaurant then takes your money and you arrive at the hotel and there is no hotel. Not even a tent! Just some trashed out parking lot full of broken whiskey bottles, needles and some junkies strung out laying on the ground and they did not even leave you a pillow to sleep on. Gosh that reminds me of trip to CA and a beach I visited there.

This review is a travesty. I used to go online and check out reviews of rooms in order to scrutinize them – generally believing the reviews were accurate and well researched or based on extensive experience with the room. Now i guess I know better. There is incredible irony in the accusations leveled here relative to the outlandish inaccuracy of this review.

I have been in The Lincoln List trading room alongside Doug for 3+ years now. Every trade is called live (entry, size, and exit), seen on the charts that he screen shares, and cataloged in the room’s session notes. I’ve never seen a losing month. The trading system (counter-trend shorting mostly) may not be for everyone, but it has been mastered by him and many in the room and is consistently profitable. I don’t have Doug’s financial records in front of me, but the numbers I have seen over the years are entirely consistent with the information shared by Doug on his website which has been questioned by this “reviewer”.

There may be traders more profitable, more exciting, and maybe even with more easily traded systems, but there is no trader more transparent in the room as trades are happening, humble, and honest as Doug. If anybody reading this cares to hear from a member of the trading room who has spent multiple years there, feel free to email me at bish74@hotmail.com (title your email “trading review” in case it hits my spam folder), and I’ll be happy to give you my cell number and spend as much time as you need to get the truth about this room.

Chris Bishop

I never said that I don’t like Doug. On the contrary, I find him a “lovable rogue.” He is very entertaining and puts on a good show. A lot of running a day trading room is building community and providing entertainment. Doug is great at that.

The only issue is the wild track record. The impression that $300k last year and $1.7 million in profits plays to the worst in the day trading business. The newbie piles into the trading service, thinking to themselves that if I spent $1k on education and set up a Clique Fund account, then in only 3 months I will also be making big bucks. That’s just not the truth.

I have talked to Doug about this. He agrees with me. This isn’t a binary argument. The issue is portraying the business of day trading in a more accurate light. The truth is that its god damn hard as hell to make consistent money.

Now I am happy you are seeing some good trades and enjoy his trading room. But actually executing these trades versus “conversation execution” are worlds apart.

Doug aint driving no Lamborghini, and he sure as hell doesn’t have bikini models on a boat popping champaign bottles. And you know whom I am talking about, right? The bottom line is that the performance numbers are simply not true. Maybe 2017 is the year that Doug starts reporting % returns? Maybe it starts to look at least a little bit like it’s real. I have faith that Doug will start doing a better job at portraying the business for it really looks like.

The only reason why you believe this review is a travesty is because you are probably hoping that 2017 is going to be the year where you are finally driving that Maserati and partying with bikini models in Miami or Colombia. Sorry to burst your bubble, but the dream is only a dream. The reality is something entirely different. No guru is going to get you where you need to go. Only you can do that. And I sincerely hope you do.

This reply is laughable. I didn’t accuse you of not “liking” Doug. Simply your review is a bad one because Doug makes the money he claims to make for his account in the manner that he claims to make it. That doesn’t mean everybody in the room makes the same money or any money at all. Certainly depends on how good each has mastered Doug’s system if they even choose to follow it.

As for me…there is no “hope” attached to what happens in the room and/or what luxuries or freedoms that may bring me (and for sure they wouldn’t be Maseratis or bikini models) as it pertains to the veracity/accuracy of your review. There is simply 3 years of witnessing – every trading day for 3 years – the truth of what goes on in there. Simply put…your review is just wrong. I’ll trust from here forward that anyone reading this that cares to receive information about the room from an actual room participant, will take me up on my offer 🙂

I am sure Emmett would be open to seeing proof of all that money you are making.

” but there is no trader more transparent in the room as trades are happening, humble, and honest as Doug”

Is this a joke. He is posting a complete Profit.ly fake trade results.

Look Shill Doug, if you are real then you are an intelligent guy. Surely you realize anyone can make up an alias lets say Chris Bishop for shits and grins and say how this TR operator is really hitting it out of the park. That is easy. What is hard is for for the TR operator to actual show any proof of his claims. I am 100% (yes that is right 100%) sure he does not even trade a live account. So instead of posing complete nonsense here, tell him to show actual proof of this claims to Emmett and not some joke Profit.ly results that we all know is nonsense. It is worst than even Myfxbooks results.

Chris / Doug / Shill Boy,

Did you read the same review as I did? Doug admitted that his results are pure fiction. If they are not then all he had to do and can still do is to shove real proof of those results down Emmett’s throat and shut him up. All of your bluster and indignation counts for nothing without proof. The word of someone posting on a blog, who claims to have been in the room for 3 years isn’t proof of anything except that you think the audience who reads Emmett’s blog are as gullible as the people who believe Doug’s performance claims.

These TR are not use to people call them out and demanding proof of their claims. Poor Doug is shaking in his pants that he wont be able to continue to con folks and make his mortgage payment. So out come Chris his brother or maybe just himself. So typical.

Another shill. Whether it’s the vendor, a partner, or family etc., sometimes they will come out and shill especially if there is a decent ongoing kool-aid monthly churning of newbs. I agree, probably can’t trade profitably , maybe not even breakeven minus. ah well, it seemed to be a good rep while it lasted, but TS leaves no stone for proof unturned. Maybe they ought to sell extra merchandise like “1% winning trader” similar to the startrek IDIC medals by Lincoln Enterprises.

Hey Emmett…you are messing with the wrong person. I have been in Doug’s room for over 2 years and he is the only honest guru out there. I witness first hand every day and every month his trading prowess. Go after the real crooks you asshole.

Ari, I was also in the chat as well, anyone can alert trades… but very few can actually make money trading. I had asked him in the past for some proof as well and got ignored everytime, i still gave em the benefit of the doubt but here is emmett giving him a chance too not only show his true track record, but also gain a 5 star review and a ton of new subs.. just show the fcking proof if you are really making what you claim

ask Doug about his Bluebird bio trade last year.

The “Only Honest Guru”, irrespective of the review, that quote is fucking hilarious. The Only Honest Guru. OMG, a trading educator has got take that name. I love it.

I call dibs on “Only Honest Guru.com” and “The Only Honest Guru.com”

And while I’m at it “The Only Honest Guru You Asshole.com” too.

I’m pretty sure that one is taken and probably applied for by anyone, anywhere who’s been taken by anyone selling anything.

Omg not the lincoln… he is the last guy I had trust in 🙁 please doug just show some proof and get a 5 star review!

Am hopefully that Doug takes the righteous path and decides to clean it up. Nobody is buying that performance record. It’s right out of Comedy Central.