Follow Me Trades

-

Honesty

(5)

-

Quality

(5)

-

Cost

(4)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

Dean Jenkins of Follow Me Trades is the real deal. The track record is real, the trading signals are simple and easy to follow, the service transparent.

This is not a day trading service. Average trades last 4-6 weeks in length, and are primarily trend following. Lots to like. A very nice, and very genuine person is running this business.

Thanks for today’s review of Follow Me Trades

What is Follow Me Trades? The business is a stock picking, and trading educational service. The business is owned by Dean Jenkins, operating out of Olympia, Washington.

Follow Me Trades operates a website located at www.followmetrades.com. In addition to the website, a social media profile/Facebook page can be found at the here.

Follow Me Trades offers several products:

- $7 trial period for stock picks

- $97 per month for the stock picking service

- $497 “Master Trader” program

- $497 “Options Basics” program

- $139 “Ichimoku Cloud” module

The stock picking service comes with a 10-day money back guarantee with no questions asked.

The business was launched August 2015.

Performance Claims

TradingSchools.Org began receiving requests to review Follow Me Trades as early as February 2016. In total, TradingSchools.Org received 10 requests to review the service.

During the month of August 2016, I reached out to Dean Jenkins and requested confirmation of the supposed profit and losses. The website claimed healthy returns on the stock picking service.

- 2013 a return of 57%

- 2014 a return of 37%

- 2015 a return of 28%

The above returns represent a beginning account balance of $100,000. Each trade of the service represents 2% of the current account balance. Obviously, these sorts of returns seem almost too good to be true. And so my next step was to start actively following the service.

From August 2016 through October 2016, TradingSchools.Org began tracking the results.

For the recorded period, everything appeared to be accurate, easy to track, and easy to record. The trades are sent out via email and website update, the night before the market opens. The entry price has a clear stop-order entry price, a stop-order loss, and a profit target. Very simple. And very easy to execute.

In addition to the daily update, the service also includes a Wednesday evening, screen sharing update with Dean. He goes over each of the trades, the winners and the losers, and gives an update on where he feels the market is going. Truth be told, I found the Weds evening update pretty boring. He talks about Fibonacci, Ichimoku clouds, areas of support and resistance etc. If I could condense his approach, and remove the technical jargon, it would be that Dean Jenkins is a trend trader. He goes with the trend. I am not a big proponent of Fibonacci and Ichimoku, and feel that most of this sort of stuff is just carnival show mumbo jumbo. In my opinion, the ‘secret sauce’ is quite simply…trend following.

A closer analysis of the performance record, which included over 125 trades, revealed that the trades are an even mix of long and short. If the trades were all long trades (ie buy and hold) then I would be suspicious of the track record. Why? Because the stock market, since 2008, has only gone higher. A monkey wearing a costume, randomly throwing darts at stock picks can make money in a bull market. However, the outsize performance of short trades, during a bull market indicates a high level of skill. It is fair to say that Dean’s record at shorting is very good.

Some readers might be tempted to conclude that 125 listed trades is quite low. However, I would counter this argument by reviewing the average hold time of the trades. Each trade lasts 4-6 weeks.

Verifying Performance

During the month of November 2016, I once again reached out to Dean Jenkins. What I really wanted to know…is he actually trading? It is one thing to simply recommend trades, but it’s quite another to actually pull the trigger with real money. On the Follow Me Trades website, he claims that he is trading with a live trading account. And so my next step was to obtain actual account statements and review the trades for authenticity.

To my surprise, reviewing the account statement was not a problem. As a matter of fact, with a screen share, we logged into his TradeStation Brokerage account and began randomly reviewing trades. The trades on the official track record matched the brokerage statement. However, he does make some trades “off the record” that is not included in the advisory. My goal was to ignore anything and everything that was not part of the service. I can confirm he is actually trading with a live trading account, and the amount is significant.

One of the things I really liked

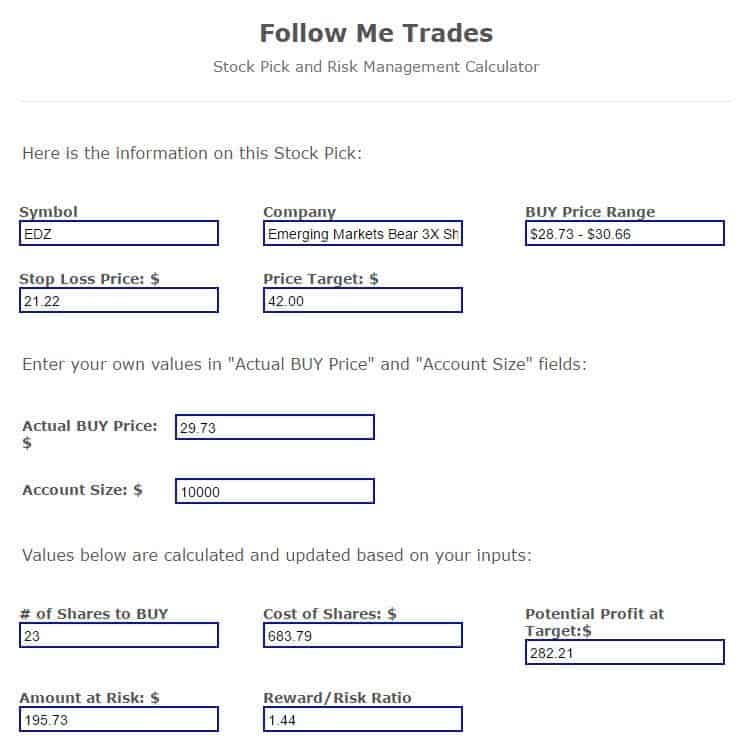

With stock picking services, one of the problems that I often hear from subscribers is “how many shares should I trade?” For instance, one person might have a $200k account while another might have $2k. How many shares should each person trade? Dean created a very handy, risk management calculator for subscribers that answers this question. Example…Dean recommends a maximum position size of no more than 2% of the account balance. The following is a screen capture of what the calculator looks like, for a person trading with a $10k account.

As you can see the instructions are very clear and include

- # of Shares to Buy

- Cost of Shares

- Potential Profit at Target

- Amount at Risk

- Reward/Risk Ratio

It is very simple and very easy to understand.

About Dean Jenkins

One of the first things that you will notice on the Follow Me Trades website is a big picture of Dean Jenkins. He is holding a highlight pen and looking really authoritative. In my opinion, he looks like an asshole. A mean, grumpy asshole. The sort of guy that doesn’t answer his door on Halloween. Have a look…

However, when I called Dean on the telephone, it was not was I was expecting. He is very warm. Very down to earth. Patient and kind hearted. And very open to all of my probing questions…and my questions are meant as 100% ‘gotcha’ questions. In my experience, 99% of the guys selling trading products are guilty of various levels of chicanery. But Dean flowed through my intense questions with no delay or shady stumbles. Truth be told, my telephone conversations hardly ever go very well, but I was really surprised at his level of openness, hospitality, and lack of ego.

Once I got past my FBI level of questioning regarding performance disclosure and verification, I next ventured into the back history of Dean Jenkins. I was once again pleasantly surprised. Prior to starting the advisory, Dean spent over 20 years working at NEC and then Intel Corp (MBA University of Washington). He was plainly honest in describing how his career at Intel, and the long time investments in Intel allowed him to stop worrying about money in 2006.

After leaving Intel in 2006, he decided that he wanted to go into the Ministry. He next earned an MA in Pastoral Ministry from Northwest Nazarene University and subsequently founded a church. I know that many of you are probably scratching your heads and wondering “this sounds too good to be true”. Well it’s true. I confirmed it. The church is named Real Life Communities Church, and a Facebook page can be found here. Yes, it is an actual Church, a non-profit that focuses on helping the local community.

What is funny is that I had to practically pull teeth getting Dean to talk about his Church. I have profiled many scammers and hustlers that talk about Jesus and trading profits, looking to fleece the flock, preaching the prosperity gospel. But you will not find this with Dean. He is very quiet about his ministry. Its very interesting, and very refreshing. I guess what I am trying to say, this guy is actually really nice. And the following is picture more accurately reflects his personality…

Ok, so now that I have spent a bit of time talking about what I do like about Dean Jenkins. Let me take a moment to talk about what I don’t like…list sharing. I am on his email list. And there are several other affiliate promoters on the internet that are promoting Dean Jenkins. And they have lumped him into various promotional efforts, with several other “trading guru’s” that are of negative value. So if you receive a marketing email that includes Dean and a few other random turds selling something, try and ignore the turds.

Affiliate Marketing and Promotional Efforts

I want to be 100% upfront and honest with my readers…I signed up for an affiliate relationship with Dean Jenkins. Certainly, some readers are going to frown on me, and this is going to taint my positive review. But I would like to remind the audience that over the past 2+ years of writing these reviews, I have only agreed to market 3 vendors. Nearly 99.9% of vendors get poor reviews, and I earn nothing from poor reviews. So if you decide that Dean Jenkins is of value, then I appreciate letting him know that you read this review. And it factored into your decision making.

The only way this blog can cover expenses and the multitudes of legal hassles are to forge relationships with vendors that have something actually worth purchasing.

Also, I want the audience to know that I have not purchased the Master Trader, Options Basics, or Ichimoku Cloud course. So I can offer no opinion on its value. My focus and scope has been primarily pointed towards verifying that the performance is real. Once we have a baseline of verified performance, then we can judge whether the concepts are valid.

Wrapping Things Up

Thanks for reading. Don’t forget to leave a comment below. If you have subscribed to Dean in the past, would certainly appreciate your opinion below. Well that’s it for today. Once again, thank you for reading and commenting.

If this person is legitimate and offers something that works well enough you want to be associated with him (as an affiliate) how do you figure that $99 per month is expensive?! You have reviewed another service here that charges $5000 per course and they received 5 stars.

If anything I would regard the low price as a red flag.

Don’t be deceived by pricing. “Expensive” does not necessarily mean it’s a superior quality or service. Most of the time what it boils down to is clever marketing. Also, I would be inclined to find out why I’m being charged with top dollar. What am I getting that’s different from other competitors? ((This advise is coming from a person who got sucked into purchasing a $62k course with OTA. I wished I had the review on OTA available to me last year October when I bought into it. Sadly for some it’s a very expensive lesson especially if it’s your only retirement fund.))

I’m looking into Dean Jenkins. Thanks have a 3 day trial.

I have been using followmetrades.com for the past 6 months using his stock alerts. To be clear three months paper trading three months do true option trading. I just started taking his master trader course and am very satisfied with all of his services. He openly admits you need at least $10,000 to make his service worth the cost. I have spoken with him on the phone and he always seems like a person that is quiet but willing to give an answer to any question and doesn’t seem rushed. I do like like the slow pace of his trading it is something I can do while I work at my regular job. Also he does use technical indicators from TradersCoach.com that he calls better but not essential. But he is willing to tell you how to set indicators using TradeStation or ThinkOrSwim that will give similar results. I found him based on this sites original recommendation and would encourage all to at least check him out.

I’m not seeing a chat room.

I just joined the $39 first month trial. Didn’t look like your affiliate link worked. I’ll let you know how it works out.

Who belives in any of this reviews?? All for the affiliate dolaaaaaaa…. smh

Thanks for your honest review .

I cant , however see any Master Trader program on his web site .

Can u help ? If there is , please send mke a lonk so I may evaluate it for purchace

Emmett, do you know or have a “wild guess” of the number of traders under Dean in this one particular program. I didn’t want to try to fight my way in on a trade with 5000 others?

I agree. That is a big problem. This is a question better left to Dean himself. Hopefully he is reading these comments.

Fake! The entry price on alot of his stocks aren’t even real.

http://www.followmetrades.com/2016-trades

You are going to have to provide more detail than a link to his closed trades page.

It seems this site is only meant to promote trading schools that pay Emmett for a good review. The only two good reviews I see on the front page are receiving complaints from users that they are known stock promoters, buying a thin stock and then convincing others to buy behind him so he can sell high, and neither are actually verified despite what emmet says…

Well, Emmett was scammed by some of the pump and dump artist in the earlier days. Exactly which 2 sites on the front page are you referring to. I do not even see 2 sites on the front page with good reviews. If you are sincere then reply, but most people who post as you have done, have an ulterior motive.

Yeah, I too want to know which sites you’re talking about. Come on, don’t be coy.

The only site that I know of that got a positive review from Emmett that could fall into that category is K Capital. However, at the time that Emmett’s review was written the service was good. Trades were verified and he wasn’t trading rubbish but sadly that’s not the case today. There’s no longer a record kept of trades and the stocks he pushes out to members are perfect candidates for a pump and dump. Stocks with less than 80K, 60K and I think even less have been alerted to subscribers. Kyle from K Capital gets my “Jason Bond Wanna Be” award. Seems that his returns have slipped a lot too which is why he may be desperate to get some big percentage wins to boost the return that no subscriber can possible match because you can’t get his fill price.

None of the “good” reviews are actually that good. They are just breakeven vendors that people are willing to pay some change to see sometimes live trading in action. These breakeven showrooms serve a well enough introductory purpose purporse for newbs who want to see real trading in action and get toes wet even if it’s not the dream. The ones that make a living would not be running a trading room for retailers. There was some stat or study by a university that showed only 2% did not lose their money trading overall. Of that 2% only a few. The chances to make the retail “trading dream” is more like lucking out on a lottery or doing well enough to play in major league sports. Of the sites that got initial good reviews, some have turned out to have outwitted Emmett or just showed a record of live trading temporarily. MarcSachs showed a fake business ph.d. DTPower fooled Reina then continued to falsify results in the room using typical delay tactics with no live account execution window or DOM. DavidAdams fooled the robot, then continued to dishonor refunds. Some other breakeveners tried to take advantage by raise their prices by at least 75% such as TFIA and FollowMe started a “live” futures room trying to get going another stream of monthly churn of newbs even though it seemed like his first time starting a futures scalping room. Tradingschools serves it up straight and the best advice is testing and finding your own edge, because heck hedge funds wouldn’t even sell a good edge for a million dollars. It may take a while for the kool-aid intoxication to wear off to realize this reality. bmt/fio has a few good tools and past anecdotes, but too much of the site is geared to staying in kool-aid dream zone.

Looking at all the reviews done on this site, a logical person should come to the conclusion that there no such thing as an edge in trading. Trading is no different than gambling, and the faster more people realize this the better off they are.

Big Mike’s mantra “Don’t follow vendors” is one of the few things that comes out of his mouth that you can believe. Even if the vendor is legitimate and that’s a big IF it’s very unlikely that their style of trading will match up with your own temperament.

Follow Me Trades has targets that make no sense to me, they’re pure fantasy and wishful thinking. His stop losses are so wide that any fool could see that the trade was a fail long before price reached the stop and I can’t even understand why he takes certain trades but he’s making money, or at least he was.

Is trading like gambling? Only if when you gamble you play probabilities. Humans don’t like randomness and so they try to impose order to randomness. That’s why they see faces in random patterns, why people develop routines and why they believe in God. But there is no order there is only a way of giving some structure to dealing with the random outcomes. That’s what your system/edge does, it gives you away to trade the randomness by putting the probabilities of success on your side. A bit like showering, combing your hair, brushing your teeth and wearing ironed clothes increased the probability of a date turning out the way you wanted when you were a young man. Apply to different systems (being clean or not being clean) to the same random possible outcome (a good night kiss or better) and although one puts the odds in your favor the outcome could still go either way – Randomness. If only trading was like visiting a red light district. Our system would be simple and the outcome would be certain.

First glad to see you back in the discussion/comment section.

Fara, just as there are 7 stages to acceptance, I think there are multiple stages to becoming a profitable trader and most people cannot accept the reality of trading to even get to the final stage.

I do not want to write my usual book reply so I will say it looks like you have finally come around to Stage 1 and that is: Realizing all TR are run by Con artist. Yes not 99%, but 100% of them. The sad part is so few can even accept this stage and it is the easiest one to accept and the first one I had to accept once I got off the Kool-Aide.

As far as “there is no edge in trading”, if you are referring to catching the exact bottom or top and being able to make 20 microscalps each and every day with an underfunded account trading a highly volatile instrument like CL using 500 to 1 leverage then Yes I agree with you. If you are referring to the fact you will make some fantasy returns and virtually never have a draw down, then yes once again I agree with you.

I will also say one of the best way to use trading, which you will never hear at some trading site is that trading is used by many successful investors as a hedge to their portfolio and not as a means onto itself as their main source of income.

It is nice to see people like Rob, Stray, Cyn, and others in here posting things the way they are. I just wanted to say thanks, and please keep posting your thoughts!

Just curios, why don’t the “real” traders in here start up a chat room? No scams, No money to join, just real folks trading that can share ideas and have other like minded people to talk with? Just a thought.

Well. Thanks glad to hear someone likes me as opposed to the hate post I normally get.

I will tell you why as I Skype with other traders and none want to hear what I a say. They all want to belive in the fantasy where you scalp each day, have an 80% win rate and virtually no draw down. I refer to it as the fantasy world of trading. And they rather lose money there then make money in the real world.

The real world just does not work like that. You are not going to consistently make insane returns on your money.

I have learned the hard way you can lead a horse to water but cannot force them to drink.

And I will tell you another fact. I am sure you already know all you need to know to trade. When I tell people my Holly Grails of trading they are always say everyone knows that, that is not new. No they are not, but following them is the difficult part.

And the worst part is when I talk to many of these folks, trading is their only form of investment and think somehow this will make them rich. I am like maybe you should start with something else. But you cannot convince them so they continue to go to these silly TR and lose money.

I am telling you it is like talking to Pete. You cannot have a rational discussion.

Fara, If you are young invest in property and let your tenants buy most that asset for you over the next 20 years. Once you’ve made some progress with the first one buy another one and another and another. Remember you are buying something that someone else will live in, not you and what do renters want? Cheap rent in a property where the roof doesn’t leak and things work. It doesn’t have to be beautiful, a cheap property that’s orderly and secure will never be vacant.

Just remember that finding the correct tenant, who will not destroy your property can be a bitch.

Well, you are kinda right..BUT…I found an honest trading site. It involves value stocks, so we hold for a year or two or three. He buys the pick 24 hours after announcing the pick. Every positive thing you would want in a trading site….EXCEPT…….I started out 3 years ago with $83,700 and now have $81,900. So….watch what you wish for….LOL

It’s hard to tell isn’t it? Then again comments like yours Chris have been allowed to stay over a long period. At least the discussion is open and Moore doesn’t shutdown criticism. Further, re the ‘stock promoters’ you mention… I geuss they could have a verified trading performance AND be promoting? In which case they are both honest and dodgy to varying degrees. The whole world is a gray area and I’m glad tradingschools.org is a part of it… even if it’s a little gray itself.

I appreciate the rigorous discussion! If you have questions, feel free to drop me an email: dean@followmetrades.com or give me a call: 360-561-6137

149 comments and only 1 (Stray Dog’s “I paid for the $7 trial…”) is relevant to this review. Is this a new record for pointless blabber?

Hmmm, I think an example of pointless blabber would be your post. Thank God you are not in charge of what is pointless blabber.

My post was not pointless, I was trying to help a newcomer skip the 148 useless posts and go directly to the only one that’s informative.

The threads do tend to take on a life of their own but Rob made some good points about the link between high returns and high risk but his best comment was ” I do not know a single person, I am sure they exist; making money by following someone else’s trading. You have to be able to think and invest for yourself.” and “When you follow someone else and have no clue why they are entering or existing and have no confidence in the method and when there is a drawdown phase of 30% will you take the next trade? And that is the problem when following someone else’s method.” After a while of subscribing to trading rooms the truth of Rob’s words will sink in. Would you send someone else out to buy your clothes for you? They may know you’re looking for trousers, shirt and coat but they don’t know your size or your style.

There are things that I like about Dean’s service, clear entries, stops and targets and he doesn’t waffle on in his videos, he’s clear and succinct but I found his stop loss placements were so wide that I would have concluded that the trade was a fail long before the stop was hit. I think he’s trading breakout within a trend trading system but I’d prefer to try to get in earlier in the move. If he is trend trading then wide stops are part of that type of trading and he does have a good track record so whatever he’s been doing have been successful for at least the last 3 years. Overall, I think I prefer to find and try on my own clothes.

I was about to ask you whether Dean explains his picks. From what you’re saying it sounds to me like he doesn’t explain anything. Am I right?

Dean gives a brief explanation of the type of entry he is making, e.g. this is a stage 5 wave (Elliot Wave) entry but I wouldn’t consider them to be detailed. His reason for entering the trade is his reason for picking the stock in the first place.

Basically what you are getting are his picks with a very brief explanation as to why he’s entering it and you either enter or don’t. Personally I like that he’s not long winded in his videos but I’d like a little more explanation so that I understood his reasons for his picks.

This week I didn’t enter any of his trades because I had my own opinions about his picks which kept me out. 10 calendar days is not enough time to evaluate the service so I’m mulling over whether to pay $97 to have a further month.

I have a pretty busy life so if someone else did the finding possible trades for me it’d be worth me paying for it but for $144 a year I can subscribe to critical charts at Tradersfly and although he didn’t review well with Emmet I like many of his picks. BUT … Dean has a track record that Emmet has checked out.

I see. So if you want to understand why he’s doing what he’s doing you have to buy his courses.

Just like you, I’m very busy with work and stuff and don’t mind paying for somebody to do the legwork for me. But I still want to understand what he’s doing for all the reasons others have mentioned in this comments thread.

Thanks for the information, it’s been very helpful.

@Goagal I don’t think he sells a course. Apparently he’s trying to sell some software in his futures room. As far as I know he’s selling his weekly picks I think over time as you listen to his weekly videos and read his comments about trades then you would learn about his approach to trading but I don’t think he teaching is any formal way.

Hmm, you’re right, I checked his site(s) and couldn’t find any courses that he’s selling.

But then Emmett says at the beginning of this review that:

Follow Me Trades offers several products:

$7 trial period for stock picks

$97 per month for the stock picking service

$497 “Master Trader” program

$497 “Options Basics” program

$139 “Ichimoku Cloud” module

I’m confused.

He has mentioned his Ichimoku Cloud course in his futures room. I also would guess he has private tutoring.

@Goagal I have received email about his Ichimoku software but not about the other courses and I also cannot find anything about them on his site. Ichimoku Cloud is the latest fad but it will turn out to be just like any other indicator. It will work sometimes and then it won’t. Just more bright lights to bedazzle the customer.

OK, this guy can’t trade futures, so what? Is his stock trading performance as represented and does he call trades that can indeed get filed?

Emmitt never said anything about this guy’s futures trading prowess, only stocks.

Emmett said he was honest and transparent. You can decide from there.

Well, it is an ethical dilemma, is it the Christian thing to do, to charge a fee for a futures room if you aren’t a highly consistent live trader?

I paid for the $7 trial followed by $97/month if I choose to continue with an option of an annual subscription that is effectively a 50%+ saving on the month by month sub fees.

Stock Trading Performance 11/28/2016 – 12/2/2016

Whether going long of short, Dean alerts a price range at which to buy or short shares. He suggests that you place a good till cancelled order so that when the price range is hit you are entered into the trade.

Below are the trades (not the ticker symbols) that he has said he is in or that he has alerted this week or had a “Pending Trade” alert for. The stock price has achieved the price range needed to trigger either a buy or sell order. I have not displayed the current price of the stock here for the same reason that I have not displayed the ticker symbols.

New Trades & Trades that have triggered this week

Short: $109.47-$108 (Dean’s listed entry price $109)

Stop: $111.22

Target: $103.82

Shares: 900

P&L: -$810

Long: $74.06 – $76.50 (Dean’s listed entry price $74.66)

Stop: $69.40

Target: $90.92

Shares: 379

P&L: -$811.06

Long: $57.85 – $59.00 (Dean’s listed entry price $57.85)

Stop: $52.57

Target: $68.12

Shares: 450

P&L: -$99.00

Short: $39.19 – $38 (Dean’s listed entry price $39.19)

Stop: $46

Target: $22.98

Shares: 293

P&L: -$609.44

Long: $9.10 – $10.50 (Dean’s listed entry price $9.10)

Stop: $7.03

Target: $19.37

Shares: 379

P&L: +$200.87

Overall down -$2,128.63

This is only one week so it is of limited value and Dean does use wide stops so the trades do have room to move and come good. However, my question is how far does a trade have to go against you before you know that you are wrong? I’d prefer tighter stops and would probable enter with a .5% to 1% risk on a $100,000 account and add more later.

Stray Dog,

I had to respond. Thanks for being the guinea pig and signing up and reporting the stats so far. I know nothing about his stock trading room, but I do understand money and investing.

There are so many things to talk about. First people look at his annual returns and say that is great. But high annual returns also mean you are taking higher risk. I am sorry but that is how investing works. There is no free lunch in this business. Second annual returns by themselves mean nothing. You have to look at the overall stats. What was his drawdowns? What was the standard deviation? What was the risk level in comparison to what he is trading? If you are trading options and a bunch of high flying stocks you are taking on a lot more risk. All of this has to be looked at in the entirety to make any type of wise decision. For example if he is taking more risk with less return than the index of what he is trading, then that is not someone you want to follow.

But here is the most important factor of all. I do not know a single person, I am sure they exist; making money by following someone else’s trading. You have to be able to think and invest for yourself. To me this is the only way to be successful. I could go on for days about this, but will just ask one question and give one real world story.

When you follow someone else and have no clue why they are entering or existing and have no confidence in the method and when there is a drawdown phase of 30% will you take the next trade? And that is the problem when following someone else’s method. And I will give a perfect example of this with a mutual fund I read a true story about.

This fund had an amazing close to 100% return one year and yet when they analyzed the investors, most people lost money in the fund. How could that be possible?????????? Well here is what happened. The fund exploded during the 1st part of the year up around 150%. So guess what happens. A bunch of clueless folks who knew nothing about the fund or what it invest in or why; just jump on board at the peak and this once small fund now has tons of money it has to invest. So what happens after all these people jump on board, the fund starts to lose money and then when it loses 30% of its value and only has 100% return for the year everyone jumps off and they lose money.

My best advice is quit chasing hot stocks or funds or newsletter and learn to invest for yourself. I do not know if they still offer them but when I was young I took a course at a community college taught by NAIC, where they taught you how to analyze companies, their earning their sales growth and put in relationship to their current valuation. I even joined a club that meet regular where you had to present a stock and be able to defend your reasons for buying it. And if you said I am buying because it is hot and just exploded up, you would be laughed off the podium. I think this was a great lesson for me and helped start me on my investment journey. And anyone that says they do not have time to learn to invest, then I say, “good luck on counting on others to make investment decisions for you”.

True words of wisdom on the value of investing over trading. I think Al Brooks is a big time investor who just talks and writes about daytrading becuase of his low opinion of day trading students… like a Dr Evil of finance

I’m surprised you still rant about Al Brooks even after Emmett complied and wrote your review. I sincerely think you’re broken…Like padded white room with scribbles of Al Brooks all over the walls type of broken. Please stop the incessant Al Brooks rants. You’ve single handedly turned the man into a legend.

Rob.

I totally agree with what you said there, especially after being burned countless times by “gurus”. But I think a lot of people who sign up for these services do so in hopes to learn how to trade themselves eventually. So the problem is — how do you teach yourself to become a profitable trader, when all the teachers out there suck? I would love nothing more than to teach myself, but I have no idea where to start if all the courses and trading rooms are scams. There doesn’t seem to be anyone good to learn from. If you have any suggestions, it would be greatly appreciate.

Trader X,

I which I had an answer for you. My path was the path of hard knocks. I which I had someone to have guided me.

I think one advantage I have and maybe it is genetic, but I am “GOOD” with money. I just always understood investments and return on money. Anytime I invest in something my first question is what will be my return on that investment.

I have talked about the fact I am a Real Estate investor. I had so many people come up to me during the bubble and ask me about buying this or that property and my response was always the same, “Show me the Numbers” I would even give them sheets on how to calculate Return on Investment and they just threw them in the trash and tell me real estate just goes up. Give me a break!!! We all know how that movie ended.

So my 1st question to you is what is your goal? Is it realistic or based on the fantasy promises the day TR preach. You say profitable trader. Do you mean Day Trader using 500 to 1 leverage? If so I wish you good luck as you will need it.

My advice is look at what you know and start investing in that area. Also, look at the really great investors, not the scam artist. Vlad, use to have a site where he mentioned many of them, not sure if it is still around or not.

I can tell you I am a very diversified investor, which even includes bonds. Many people have no idea you can actually make more money in bonds sometimes than in stocks. I will even give you an example. During the BP Oil disaster and BP stocks were tanking, I did not buy the stock but bought the bonds as they too tanked, but where higher up the corporate structure. And guess what I made more money off the bonds than someone that bought the stocks.

I hate to say I follow a specific method, as I do not. But in stock trading, where I use technical analysis not fundamentals, the closest method to my method would be Wyckoff. I am not advocating Wycoff because I do not follow it exactly, but I am a trend follower.

For a guy without answers you sure post a lot of long, beside-the-point posts. The guy asked you for advice re TRADING, and you went off about INVESTING in real-estate and bonds. Do you know the difference between “trading” and “investing”, or should I send you an English dictionary? Look at Cyn’s answer just below yours to see a to-the-point answer.

Goagal,

From your post I would not expect you to understand how important diversification is. Just because you do not understand my answer, does not mean it is not an answer. Successful individuals, at least the ones I know, do not solely short trade stocks I will give you another example, which I doubt you will understand either.

As I had said many times I am also a Real Estate Investor. Many people I know start off just buying and flipping making a few thousand here and there, but you know what happens; they slowly realize real wealth is made by holding the properties and renting them over long periods of time. I know you do not understand or probably believe what I just said. I have learned you cannot help many people and I think you fall into that category.

But I will throw you a bone. I wish this site had the ability to create new threads or sub threads so the main thread did not get as diluted.

Yeah, I’m the exact opposite of what you think you understand about me from my posts. I do all sorts of investments (except real-estate, for personal reasons): swing trading, long-term value investing, bonds, gold, oil, ETFs (North American and international).

So, as Trump would say: “Wrooong”.

@Goagal: Your name and mannerism conjure an image of an angry troll living under a bridge. Relax-a-little. At least all of Rob B’s posts were about either trading or investing. Your posts are all about Rob B.

@Sam Watson: You’re right, I am angry, because after months of reviewing shitty TR operators Emmett finally claims to have found a good one, and instead of discussing and dissecting the review the forum is full with unrelated posts. I came here to find out more about Dean’s service, not to hear about Rob’s value investing and real-estate and bonds, so to accomplish my goal I had to read 147 useless posts to finally get to the 1 relevant one. Something that I doubt you have done, or else you would have noticed that I made 7 posts (excluding this one): 3 were about Dean’s service, 2 were my attempt to bring the discussion back on track, and only 2 were me attacking Rob for diverting the discussion away from Dean’s stock picking service and onto his futures trading room (somewhat relevant), value-investing (irrelevant), real-estate investing (irrelevant) and bond investing (irrelevant).

2 out of 7 is hardly “all”. I might lack manners and be an angry troll, but at least my math is better than yours.

Your math may be better than mine, but sarcasm is surely lost on you. Giving me a breakdown analysis of your posts was an unnecessary wastage of bits & bytes.

Goagal,

The part I find amazing is just like your post above was a response to someone else’s post, my responses were to someone else’s post.

Other people might find value in other people’s post or even mine that you do not.

And BTW, once I got off the Kool-Aide and realized what the TR teach is nonsense and became a successful trader I found the concept used for long term investing have more in common with my short term trading than you think.

But again I will throw you a bone, this site needs to allow sub threads. There is no way for someone to create a thread, so anything you have to say about Follow me trades ends up here.

Where I do disagree with you some what is in Emmett’s review he calls Dean honest and trustworthy. So if Dean is running a future’s trading room that does not exhibit those traits then I think it is fair game.

But maybe you are purist and think the thread can only be about Deans Stock Room and nothing else can be mentioned or it is, “Off with Your Heads”.

So here is my olive branch. I do not agree with that opinion but you certainly have the right to it. But unless moderators are established who decide what is and what is not allowed, I think at least some branching such as talking about his future’s room is acceptable and certainly responding to people’s questions is acceptable.

Now see how nice my post was.

Trader X,

One other important point I forgot to mention. The reason most people are not successful is they believe what the TR teach; that investing is easy and making a fortune is quick and easy. It is not. Most successful investors build their wealth over time. You think Buffet become rich immediately. This is what I hate about TR and why none of them can show proof of their claims. Investing is hard work and takes time, discipline and patience. Anyone telling you something else, my advice is run the other way.

“There doesn’t seem to be anyone good to learn from. If you have any suggestions, it would be greatly appreciate.”

I can say with certainty that there are those who are willing to help others, but most of those people do not advertise, and are not running trading rooms. You have to get to them by word of mouth. There may be those who will do it for free, but I do not know any of those.

Just for starters, I will tell you the same questions that I was asked when I was finally put in touch with the one who helped me. Until I had answers, he said that I was not serious about trading. Here were the questions. Can you answer them? You do not have to answer then in this public forum, but do you have the answers?

1. How much money are you willing to lose in a day and then completely quit?

2. How much money are you willing to lose on a single trade, that will make you decide that you are wrong, and exit the trade?

3. What percentage of your equity is the amount you are willing to lose on a single trade? Why that percentage and amount?

4. Do you have a journal and how many trades are in it, and how many months does the journal cover?

Until I could give what he considered to be reasonable answers to those questions, he said that there was nothing to discuss, and he would not take the tuition money that I was offering.

No, he did not teach me for free, and he told me why, but he would not even discuss arrangements until I could answer those questions. With the benefit of hindsight, I now completely understand those questions, and why they are way more important than I thought. Just in passing, do you notice that there was no question about how much money I wanted to make? That question came later, and by then my head was out of the fantasy clouds.

Cyn, a good friend of mine is a hedge fund manager (he manages 20 traders to decide if they will be funded and they follows their progress). Here’s what he told me re your post above: Nonprofessional traders (retail) – the first question they ask is “how much can I make?” The professional trader – the first question he asks is “how much can I lose?”

Good lesson. I’m just a retailer, but eventually learned that question “how much can I lose?” is just as important or moreso than thinking about the size of gains. This kind of question is usually glossed over on most trading forums until occasionally someone points out how important it is. An old thread on elite. https://www.elitetrader.com/et/threads/what-is-the-worst-one-day-loss-you-ever-had.74408/

excellent share!

@Trader X as a place to start I like this site www dot swing-trade-stocks dot com Read everything on that site then click on the link to Trading Master Plan. For $50 you’ll get a good introduction to trading, risk management, position sizing and technical analysis. Pete posted a link to this free trading course adamhgrimes dot com/TAAS/ and you could look at the free education on investopedia dot com and on babypips dot com

Earnings and sales growth are doctored by publicly traded companies all the time, and current valuations can suffer from irrational exuberance, so they mean next to squat. The world is full of companies like WorldCom and Lehman Brothers that investment clubs like yours were touting as good and sound investments only a year or so before they went bust. Investment is fraught with dangers just like trading, so please stick to discussing the topic of this forum dedicated to trading.

Wrong. Time and commissions are not variables for investments, unlike in trading, therefore investing has much less in common with gambling compared to trading. Brooks’ public image as a day trader pushes time to the lowest level imaginable and pushes commissions to the highest level imaginable, what an inelegant math equation Brooks has created for the unwashed masses as Emmett calls us.

“current valuations can suffer from irrational exuberance”

Indeed which is why I do not invest in irrational exuberance. I was giving a short reader’s digest response to just blindly following the TR presented here. It would take a book to fully discuss trading – short, medium, and long term and investing.

The concept I was trying to move forward is you need to learn to invest on your own and not just blindly follow someone else stock picks. Do you disagree with that concept as you did not provide an opposing view, just critic of my post.

Actually regarding Lehman I am pretty familiar with them. Lehman survived the great depression but could not survive the great recession. The fact is many were caught up in the real estate bubble. One of the points I tried to convey but apparently did not do very well, is you have to think for yourself. If everyone is jumping on a bubble, whether it be the NASDAQ bubble or Real Estate bubble, maybe you should avoid it or at least be diversified in other investment outside the bubble.

I will add one more point, if you truly believe that earnings and sales growth are doctored by publicly traded companies all the time, then invest in what you do know. Buy some local real estate or invest in a business. Heck if you understand art invest in that. Anything you understand and invest in is better IMHO than blindly following someone else.

Did you ask Dean about whether this month was typical? Curious to know what Dean’s perspective is.

I’d say that my information covers only 1 week so in the scheme of things it doesn’t count for much. It’s a 2% draw down on positions that have not been closed yet and if you look at his results many of his trades are open for weeks before they are closed. They could still turn out to be profitable trades but in this small snapshot of time they are underwater. He doesn’t seem worried about them and he says that he’s got good entry prices. This may be typical for his entries since he is working on a longer term time frame than day traders. Get the trend right, give the stock enough wriggle room and time for it to resume its trend, cash in a few months later.

UPDATE:

I paid for the $7 trial followed by $97/month if I continued. The 10 calendar day trial period went by so quickly that by the time I thought about making a decision as to whether to continue or not I had already been billed for the next month. No complaints, that’s what I agreed to but it does reinforce that the 10-day trial is too short but then any service needs at least a month to try it out.

Below are the running totals of trades since I began the trial. I will add new trades that are entered and continue to post trades that were stopped out so that I have a record of potential profit or loss since starting the trial.

Stock Trading Performance 11/28/2016 – 12/9/2016

Short: $109.47-$108 (Dean’s listed entry price $109)

Stop: $111.22

Target: $103.82

Shares: 900

P&L: Stop Out Loss (12/08/2016) – $1,998

Long: $74.66 – $76.50 (Dean’s listed entry price $74.66)

Stop: $69.40

Target: $90.92

Shares: 379

P&L: -$621.56

Long: $57.85 – $59.00 (Dean’s listed entry price $57.85)

Stop: $52.57

Target: $68.12

Shares: 450

P&L: +$567.00

Short: $39.19 – $38 (Dean’s listed entry price $39.19)

Stop: $46

Target: $22.98

Shares: 293

P&L: -$1,119.26

Long: $9.10 – $10.50 (Dean’s listed entry price $9.10)

Stop: $7.03

Target: $19.37

Shares: 379

P&L: +$720.10

Profit and Loss since 11/28/2016 Currently a loss of -$2,451.72

One trade that was entered before I began following Dean’s trades was closed for a $20 profit. This was a short trade that was entered at $101.08 with a stop loss of $104.98 and a sell target of $88.06. The stock price went as low as $97.35 at which point the trade would have been in profit of $1909.76 but then it began to reverse. It takes a lot of discipline and belief in your method to stick to the plan as you watch a profit of $1,900 dwindle to $20. Part of Dean’s plan for that trade was to move his stop loss and to start scaling out by thirds. It does indicate that he is very disciplined and that he trades his plan because he is confident that over time his system will be profitable.

Hmmm, Kind of a bad sign he is losing money in the mist of a Trump Explosive Rally. This is the time that, at least, trend traders should be laughing all the way to the bank. I know I am.

Yes, I agree. Dean’s stops are wide and his targets are huge so they aren’t what I’d choose. The best type of service would be a small skype group where everyone brings a few potential trades to the table and you go over entries, stops and targets. But it would be near impossible to find a group of people who saw the same chart the same way.

Great idea though, if, and if and if a group could agree on the chart. On the other hand, if each one brings their stocks which they think are going up or going down and then allowing the rest of the group to check out that stock and see if their system would agree with the direction, entry and stop. Might be worth a shot.

Any more updates? 🙂

And if you post any, can you please put them in a new post, so that the information doesn’t get buried in a long string of nested replies?

Thanks.

So how did this endeavour end? Or … is it still ongoing?

Time differences have made communicating difficult/impractical so a group never formed but if you send an email to aceisanahole@outlook.com I’ll give you skype details.

Even I cannot believe it. A picture is worth a 1000 words. Dean lost over $1200 again today.

http://www.screencast.com/t/vA40RaqO

And this is in Sim, with no slippage, no exchange fee being added, and lenient sim generator fills. In Real live those loses would be 10%-20% higher.

And the part that is most amazing he loses on virtually every trade, even though he start with an inverted Risk to Reward. It is almost mathematically impossible. His initial stop loss can be 40 ticks or greater.

I am starting to think the way to make money would be to take the opposite of his trades.

Anyone starting a church and doing investments; immediately is suspicious to me. A congregation of gullible people that will believe anything he says. Should he not be busy full time running his church instead of a day trading room?

I guess in the mind of the greatest criminal mind of our time this is what honest and genuine looks like.

My advice is stay away from this Future’s Trading Room, which makes me very suspicious of his stock trading room.

Emmett needs to immediately stop any financial arrangement with these trading rooms and explain why he is endorsing someone running this scam Day Trading room. Why not record the sessions like you use to and have the girl from the Philippines make the trades and document the results.

Maybe Dean is a good shepherd encouraging the flock to stick to stocks instead of trading futures, by showing the terrible reality of futures for retail traders? These negative results you report show how necessary the CFTC investigation and litigation against wrbtrader and Brooks, with their grandiose claims of consistent, daily, futures day trading profitability is coming very soon.

If you post anti Al Brooks post in every single thread it not only clutters up the threads, but you lose your message and people will question the messenger.

Let me try it this way. Emmett has reviewed 100s of con artist and if everyone ripped off by them posted in this thread do you think that would be a “GOOD” thing. So you come here to get information on FollowMeTrade and instead you are bombarded with reviews about Warrior Trading, GTR and so forth and so forth/

And please do not reply with another Al Brook’s post which I am sure you will do. WE ALL KNOW AL BROOKS IS A CON!!! Only the scammers and Kool-Aide drinkers over at BMT defend him.

Thanks for the screencap RobB. With your description of his “consistent” negative p/l, a 40 tick s/l which keeps getting hit, and the lagging indicators on the screenshot, I’m leaning to suspect this guy has never achieved even on sim, breakeven on daytrading futures. Where the good review of the position trading somehow got his daytrading practice going again. I would agree as you mentioned earlier, it looks more like a showcase for selling the itchimoku cloud indicators. And the windows are too small making the indicators look blocky and squished with the price bars. Hard to read if being serious about actual trading.

Dean should stick to his bread and butter, stocks and options. Only faux trader Grinch claims to daytrade futures, stocks, and options for a living. BTW serious actual traders look at the DOM not Grinch price bars falsely marketed as for “serious traders”..

Grinch trades forex too, like Santa Claus he can go down multiple chimneys and be in different areas simultaneously.

Is that loss on 1 contract? Or is he trading multiple contracts? IOW, what is his average loss per contract? That is a more meaningful measure than the absolute size of the loss.

He mostly, 99%, of the time is only trading 1 car. But it is worst than just the things I mentioned. He shows no stats or keeps any track record and as far as I know TS starts you out with a $100K account in sim and if you look at the purchasing power on that screenshot, that would mean he has already lost 1/2 his buying power.

But to even confuse his members more he will all of a sudden introduce a longer term options buy. Just more of a circus act to confuse and IMO a smoke screen. If it makes money, then that will be bragged about as his big winner and if it loses money it will be brushed under the table.

He sounds like a sincere caring person as most of the best TR sound like. But no profitable day trader is trading sim and running a TR. Sorry to burst people’s bubble.

He does not have set profit targets and that large SL is just an initial SL. The 2nd it goes in his favor he lowers his SL and keeps it tight, which IMO is part of the problem. Prices test and retest and eventually his tight SL is hit so you end up with small winners, but the potential for HUGH losers.

IMHO this was $27 down the tube. I saw no value. I thought with Emmett’s 5 star review and comments about honesty and transparency, I would check it out. But I guess I will not find that unicorn that can consistently and profitable microscalp here.

I will be interested in seeing others post over time on his stock picking website. As I said yearly return is only one factor to look at. You have to look at standard deviation and other factors during the year.

Thanks for the report. As you have said multiple times, “microscalping?” Play the Powerball instead. 🙂

Someone that actually read my posts. Cool!!!

I still am the BIG fool and check these microscalpers out once in awhile, though very very rarely these days.

I think Emmett’s only highly rated microscalping site suffered the Emmett’s curse.

I think the microscalper TR’s are doing that because they know that the beginning traders are thinking they can risk $40-$50 and then make $400 (that’s the dream that Rob B is talking about). Using a 40 tick stop to daytrade? Seriously. How many times during the day do you think you’ll get the 40 tick move and if you lose the first 40 ticks then the next 40 profit only gets you to b/e. You can daytrade successfully but not using that sort of stop and most likely not microscalping for a couple of ticks. It’s the microscalper “dream” that entices the new trader.

Actually 40 ticks on /CL is $400. Not an unreasonable initial stop, provided your targets are large enough, where they probably are feasible on an instrument with such large volatility. NB: such a large stop would be necessary on anything as volatile as /CL. That is why /CL should really be left alone by retail traders, and left only for institutions that are trading other people’s money, and have no real skin in the game.

However, per Rob’s report, the real issue is that he does not seem to have reasonably sized cojones to be trading /CL, and brings the stop in so tight that the volatility takes out his stops regularly. It shows that he does not even understand the instrument that he is trading. If he did, he would know the noise value for the moves, and keep the stop out of the noise. If the noise value/stops are too large, then one should not be trading the instrument.

Stops must be appropriate for the movement of the instrument and the size of the account. As he is so clearly demonstrating, without steel cojones, hard enough to maintain a large enough stop, even a $100,000 account may be too small to day-trade /CL.

Hi Cyn, my take on CL is somewhat different. (1) retail traders can trade CL. It depends on what time frame you are trading. If you entering on a 3 or 5 min chart and basing it on the entries and targets on a 15 chart, then you can use a much smaller stop than 40 ticks, assuming none of the bars is larger than your stop. One of the problems new traders face is determining where the trend is and that is defined by the time frame you are trading, ie, the daily may be in an up move, but the 15 may be down, so if you trade the 15, you might be looking for a short (at least on a daytrade). (2) while CL can move 40 or more ticks in a day, my point is that using that large a stop on a daytrade assumes there will be multiple 40 tick moves during the day and once you lose, it becomes infinitely more difficult to get those 40 ticks back during that day (and as you point out, large cajones will be needed to trade CL on any time frame) Stops have to be not only appropriate for the current move that you are in, but also set at points where, if it takes you out, you are just wrong about that move (and probably so are other traders as stops are usually set around certain “pivots”).It’s okay to be wrong, but controlling the amount you risk and lose will ultimately define whether you are successful or not. It’s not rocket science, just HH’s and LL’s and follow the “swing” of the market.

Trading /CL on a timeframe as fast as you are talking about, it just asking to get murdered. I have seen /CL jump 9 ticks between trades. 4 to 6 ticks is not uncommon. 3 minutes on /CL is buried by the usual volatility of the instrument.

Of course, you can use tighter stops than 40 ticks, (especially if one is intemperate enough to try to trade as volatile an instrument as /CL, on a 3-minute chart).

I was just pointing out that for /CL in particular, 40 ticks is not an unreasonable INITIAL stop (on a reasonable time frame). But that does not mean that one should then move the stop so tight that it is within the noise of the time frame being traded. That poor decision is what Rob is reporting that this person seems to be making.

As you say, the time frame counts as part of the decision making process.

/CL pretty routinely makes several 40 tick moves in a day. Heck 100 ticks moves are not that uncommon.

Yes, there can often be several 40 tick moves in CL during the day. My point is “are you in at the bottom of a move up or entering nearer the top” (vice versa for a short). Yes the moves are there. Can you actually get in one in time to grab the 40 ticks. That’s the catch. Easy to say (or see), harder to do.

One more thing. I’m suspect of someone using a stop that has nothing to do with the actual chart that’s being traded. 40 ticks or 100 or 500 doesn’t matter to the market just like saying 2% or 3% of my account is what I will risk because that is the amount of financial pain I can endure. The market doesn’t care about your pain or endurance level.

If the stop has nothing to do with the chart, then odds are the market will find you.

Using an INITIAL stop is the same as a “stop”. In markets like CL, as Cyn and I agree, the moves can be very very volatile and once you enter, it can immediately go against you to your 40 tick stop. So you can’t really move that initial stop unless the market starts to move in your favor.

That’s the other reason I favor a stop based on the chart. If it hits my stop, which is based on the chart I’m trading, I’m out, I was wrong. Why risk more than what the market is telling me?

Remember when I said this: “Stops must be appropriate for the movement of the instrument and the size of the account. “?

That is pretty much what you are saying, in much better detail. I assumed from the way that you comment, that you already knew that, which is why I did not bother to go into so much detail.

I agree with everything that you say in this last post.

“Yes the moves are there. Can you actually get in one in time to grab the 40 ticks. That’s the catch. Easy to say (or see), harder to do.”

On that one, you will never get any disagreement from me. Like everybody else, I am a gazillionaire hindsight trader. Now real time, I am just mildly successful. My methods are so boring, that if I started a TR, nobody would stay.

Haha. Yes, my paper trades were always winners. In hindsight I’m still probably only 80/40!!!. i’ve been trading since 1998 and it took me a long time to develop a system that worked. So when you say your methods are boring, I say “boring is good.” And “mildly successful” puts you in the 5% of all traders. Congratulations.

Good point, it sounds like from Rob’s trial that the room doesn’t seem to indicate much prior experience on scalping CL and it also sounds like not much of edge if he is trying to scale down some of his longer time frame methods to a couple hours of intraday scalping futures, where his target wins are not making a consistent ratio edge to the stoplosses. I suppose the room was started to lure in those still buying into the intraday scalper dream and then pitching the itchimoku and other courses, after overall attention was brought to the good review of the site’s longer term trading.

Rob B, i think trade maker is the only one showing positive P&L so far

Please dont use my name in context of promoting some trading website. Where is there any proof Trade Maker day trades profitably. I do not even see where he has a trading room, just educational nonsense.

Promoting a website? I did no such thing, I looked up a trade room that received a positive review from Emmette and simply looked at their PnL posted on their site.

Are you implying that Emmette is promoting these fraudulent websites by giving them positive reviews?

Give me a break. A 2 year old review with not a single update. Even Emmette admits he got scammed in the past.

This guy showed no brokerage statements or proof he is even trading live.

I commented about his website and how I saw no slippage in that thread.

Also, not sure about now, but back then no free trail. You had to pay $3500 or so first.

If this is guy is for real then he must do the following. Anything less than this for me is just TR scam artist 101

1) Offer a free or low cost trial for a reasonable time and 1 day is not reasonable.

1) Trade an actual Live account – Sim is meaningless and as said before if you do not trust your method why would anyone else,

2) Clearly show your DOM or Chart Trader for every trade taken,

3) Start Posting a Real Track Record Updating it Every Single Day,

a. Post accurate record of your trades showing entries, exits and P/L,

b. Post Brokerage Statement Proving his entries and exits.

4) Open up the Brokerage Account Live in front of people every day showing there is no trickery, and

5) Members must be able to achieve the same or close to the same results, so there is no pump and dump BS going on.

Sorry Farah, but anything short of that is typical day trading scamming 101. And I see no evidence he is doing any of this.

But I challenge you to show me any proof he is trading live and consistently profitable. And no I give zero evidence to Emmett’s 2 year old review where he tried out the TR for all of a full month and did not get a single brokerage statement from the guy.

Do you see how Emmett now demands a brokerage statement as he has learned that anything else is meaningless. It is just so easy to fake Sim results. They are meaningless!!!!!!!

Then Emmett must do the logical and decent thing and pull down these old reviews if he can no longer vouch for them. There are people who are making their purchases solely based on the positive review done by Emmett,

There we do agree. I think Emmett really does not give this site the attention it needs to do it justice.

Even his Best TR is not up to date.

I guess it is way to much work and no money to be made.

I think you can safely assume to avoid a trading room or service if either of the following is true:

– it has a negative review on tradingschools.org

– it has no review on tradingschools.org

-it has a positive review on tradingschools.org

– it has a neutral review on tradingschools.org

LOL!!

That is one of the most truth post I have read.

Look anyone that can consistently trade profitable is not running a trading room. Everyone taking their entries would effect their own trading. That is how trading works.

All you have is unprofitable traders teaching trading. Actually it is worst than even that, as mostly what you have is con artist teaching complete nonsense fantasy world trading.

It’s a shame this was a good review too at least on position trading on stocks and options. Why self-sabotage starting a futures morning trading room only after Emmett’s review? A room showing a bunch of losing scalps on sim. Not much different from watching a bmt newb playing trading on sim. Thought the review said he was already financially well off. The itchimoku fad was long past on bmt. Makes me wonder if Emmett really saw what he saw as proof. Some of these sham vendors hire expert web designers and coders and also spend churn money from newbs to wipe their oafal from archive.org; Now you have WT showing statements in low rez .jpgs showing a 15 million balance magically appearing the past summer. Some vendor could have a coder post a dummy mirror site looking like a broker platform access to trading results on a screenshare.

itchimoku cloud – another magically indicator. You could just as easily substitute it for a lots of other indicators.

The number of indicators I use to Trade – Zero.

The question is whether day trading futures can be done profitably with or without indicators to earn a living. No it cannot. Move on, legal escort work, organ donation, sperm donation, blood donation all offer more possibilities with less risk than day trading futures. Emmett when are you going to expose the predatory futures brokerages sponsored by shady forum owners?

Then where and who can new traders learn from? They have to learn from someone or somewhere. Even the profitable traders must learn from someone or some places at the beginning. Do you have any recommendations?

Most people that come to this type of site when they say trade are talking about day trading where you micro-scalp some highly leverage highly volatile instrument. And why do they want to do that, because they are complete underfunded and think they will make their fortune day trading. Yes so many of the riches folks in the world are day traders. Hmmm, actually there is not one. I give it the same odds as making money playing PowerBall and would give you much high odds of success by betting on the ponies.

So actual my advice would be to first study investing and return on money and how to properly manage money. Understood how much capital you really need and how much you can really risk on a single trade. Trading is no miracle cure for underfunded and clueless folks who have no concept of realistic returns on money. For most it is a quick way to just lose their capital. Every profitable trader I know, including me, do not just trade and I do not recommend trading as you first endeavor into investing. Read Peter Lynch’s book and other books by actual proven investors. I have suggested in the past take an NAIC course at college if they still teach it and join an investment club. Heck go back to school and study finance and really learn how to analyze investments.

My 1st investment was buying a duplex that was used as a single family that I converted back into a duplex.

If you held a gun to my head, I would say the way I trade comes closest to Wyckoff method.

And I know some clueless person will write, “You did not answer her question which was, even the profitable traders must learn from someone or some places at the beginning”. And my answer to that is most profitable traders did not start off as profitable traders. They became successful investors and expanded into trading. I know that is not a popular thing to say on these forum and most do not want to hear it. I am sure there will be tons of shill that will now post on how you can join there TR and learn everything you need to know to make a fortune at trading.

So before you join any TR or take any education from a trader, make sure they really made money trading. And not someone that just lucked out on a once in a life time copper trade and has milked it out ever since or won a trading competition followed by his daughter winning a trading competition and then loses money for all that invest in him or made their fortune during the NASDAQ bubble. Yes easy to make money during bubbles, but hard to keep it afterwards.

And for Goodness sake do not trust anyone in this industry. 99% of reviews are by shills. Lying Dean Handley names TR to his Trading Titans list that are then investigated by the regulators for having completely faked results. BMT is nothing but shills. Do not trust any of those amazing journal results. It is all one big scam. I could go on for days and days.

Dr Grinch still has a lot of believers in his skewed risk:reward ES microscalping, in fact, his church following is stronger than Dean’s as we can see on futures.io blather rinsing and repeating. The foul smell left lingering by Dr. Grinch explains the glowing review for Dean Jenkins, quite a contrast indeed. Dr. Grinch wrote in the books poker felt too much like gambling compared to trading. I guess “trading” is a user-defined variable, starting a trading room can be seen as a trade, a high-probability trade not to be found in futures trading.

I recall Shadowtraders would show their entries yet their sessions were short and separate and spread out over the day and week. So the sim losses would be glossed and the track record inconsistent. And all the while they claimed it was “live trading” until the CFTC caught up to them and fined them.

http://www.cftc.gov/PressRoom/PressReleases/pr7253-15

Interesting stuff. I signed up for his options and stock pick service as his track record seems good, and his trades have been going well (for me too) the last few months. Then this great review of Emmett happened over a month ago, which further reaffirmed my believe.

In any case, he just recently started trying to sell the relaunch of his trading room:

————————————————————-

List Price for this service will be $59/month

Pre-Launch special for just $39/month

a 35% Discount!

If you subscribe now, you keep the discount price for life

Cancel at any time

No questions asked, No hard feelings

This new service launches on 1/2/2017

Deadline to get the introductory, pre-launch pricing

is Midnight, 1/1/2017

————————————————————-

Limited time sign up for a huge discount for life! Smells of a classic scam, but I didn’t notice or think much at first. His normal followmetrades stock and options pick service ad also is a bit scammish the way its written up and advertised but the service APPEARED legit….

Anyway, so I signed up. Once signed up, you can see all his recorded sessions since April. So I watched a bunch. He only trades futures, and I noticed in Trade Station the account number always starts with SIM and that the status bar always says ‘Trading: Sim’.

So this got me suspicious. I looked at a few more vids. Then googled ‘followmetrades trading sim’ and found all the discussion here.

If you go back to his earliest vid he seems to have started with a $50k account (not $100k) and in November his account was around $46k. Not that that means much. I didn’t thoroughly check all the vids, and he appears to have at least 3 SIM accounts anyway. Sometimes he switches to another one.

So yeah. I don’t know what the f*** is the point of the live trading room if he just f***s about in a sim account? Like, really?

It’s also funny how none of his subs can see each others chat or talk to each other. So who knows how many of his subscribers have noticed it’s a sim account, have asked him about it or called him out about it, or what is happening.

Who even knows how many people are actually there. He loves saying ‘we have a great turn out this morning’ all the time and ‘we have a great turnout this evening’ in the weekly stock and picks live chatroom…. but what if you are the only one there? We would never know?

None of it feels like a live chatroom or trading room as it is just him talking and what he chooses to read out from what people are saying or asking…

Dean’s a terrible day trader. I think he wants be a good day trader. I told him to stick with his “day job” which is swing trading.

But him being a terrible day trader doesn’t keep him from selling his day trading room service and make statements about how fantastic it is… It speaks volumes about the guys honesty and integrity. For me it means I can’t trust anything this guy is doing, including his swing-service.

Yeah, I don’t know. His ‘swing’ stock picking seems to work okay. Well, I hope? We actually only have Emmett to trust that his performance claims are accurate and match his actual account statements because only Emmet has seen those.

As for his day trading, idk. He started pushing it lately. I signed up, haven’t actually been to one yet (first one is Jan 3 when market opens) but I saw all the recorded videos for 2016 on his site, so went and started watching them and this is what I saw.

You don’t have to take my word for it, anyone can sign up and see for themselves. He’s literally uploaded all the evidence. I guess the $39/month discount has expired by now though.

I’ll stick to the stock and options pick service for now (I already paid for 12month at a steep discount) but won’t keep paying for the futures day trading room beyond this first month.

Thanks for sharing your experience in the new live trading room Leela, which confirms my suspicions it was probably motivated from the good review on TS, similar to how Soares’ TFIA raised their monthly churn room fee from $150 to $300 after it’s own good TS review , and now the fee is $400/month. You also bring up two common scam tricks in your anecdote. Using multiple sim accounts is what Felton did to seem like he was starting off with an ongoing “winner” in his trade room, or otherwise used to fudge up a winning record choosing among the sim accounts. Very common trick these shams use. The other sham trick is not being able to chat to other members, so exactly you never know who else in the room is actually a member or a shill plant, possibly the host himself masquerading as a “member”. WT and Jason Carter’s room often have magically puffed up 500 to 1500 members at various times. And there always seem to be some “members” who start bashing anyone who asks real questions, like the Netpicks room.

this review doesn’t make any sense at all, Emmett,

Please dig a little deeper on what this guy is doing besides the stock picking service, before calling him honest and genuine.

Well, this is a post that’s crying out for more detail.

In his Future’s Room he is trading sim and showing no track record. He lost $450 Today and $850 yesterday on numerous trades. And that was in Sim, if live I am sure the losses would be much greater.

I see no evidence this guy can day trade profitable and is using it a ways to sell his ichimoku cloud trading course.

Emmett did not specifically review this room, but he did give him 5 stars for honesty.

Thanks RobB for checking out the room and relaying what you found. Disappointing to hear it was another sim sham and not even a good one. In the review it sounded like he was financially well off, yet he still does the same vendor marketing nonsense such as “30% off”, “limited time for seats”, emails passed on to ‘random turds selling something’ that seasoned retail traders are so tired and sick of. Ok, anyone would want to keep up a new income stream, but doing a similar sham as a regular scam vendor really puts a damper on the goodwill of this review and ignores the wised up history of tradingschools.

Atleast he showed his losing trades. If I read he said he day traded futures for a living I might be disappointed. They are some gurus who are worshipped without even showing trades at all, just loud-mouthed blathering, can you believe that?

RobB already said the host is showing no track record. The room sounds like any other sham room making calls and trying to gloss over the losers with occasional distractions and smokescreens. The sign in page says “Live Trading Room” in the biggest letters yet, RobB said it was just sim. He isn’t very good at putting on a slick kool-aid show like seasoned room vendors like ValdemaKonzaganaga as it seems to be his first daytrading room.

Subtle slickness is the best way to enthrall, manipulate, exploit and destroy, as Doctor He-Who-Must-Not-Be-Named has shown.

The fact that Rob_b has an idea of where he entered, lack of profit target, where his tight stops got taken out, etc shows he is showing some trading info compared to some trading room scammers who just mention their winning trades after the fact.