Righline Trading

-

Honesty

(2)

-

Quality

(3)

-

Cost

(1.5)

-

Support

(4)

-

Verified Trades

(1)

-

User Experience

(2)

Summary

Please read update dated November 17, 2015

A very honest trading vendor, with what appears to be a pretty good trading product, however he refuses to show a live trading DOM inside of the trading room. Vendor needs to make that final step to complete and total transparency by showing the live trading DOM or trading from the charts. I recommend that the trading community band together, reach consensus, and convince vendor to take that final step. Prospective purchasers currently in the evaluation stage should protest by requesting more transparency.

User Review

( votes)Please Read UPDATE Dated November 17, 2015

Thanks for reading today’s review of Rightline Trading

What is Rightline Trading? Rightline Trading is a live trading room, an accompanying indicator suite, a personal mentorship package, and a Ninja DOM trade execution add on module. Each of these products can be purchased individually.

The live trading room is moderated Monday-Friday from 8:15 am EST until 12:30 pm EST. The cost of the live trading room is $299 per month, or a lifetime pass at $2,499. The indicator suite comes at a cost of $3,999 and includes: 2 months of the live trading room, indicators, videos that describe how the indicators are to be used, as well as phone and email support. The personal mentorship program is an 8 week, one on one course with the owner of the company Mr. Mark Sachs. Finally, there is a Ninja trader auto execution module where some interesting entry and exit combinations can be auto programmed into Ninja Trader.

A quick review of Archive.Org shows that Rightline Trading came online and began operations in late 2013. They are listed as a Ninja trader educational partner. A deep web search also shows a parallel website titled: Rightlinetrading-Forex.com.

Rightline Trading Online Reputation

A deeper search of Rightline Trading, specifically looking for any negative information pertaining to the company could not be found. I searched the usual sites where negative comments can usually be found: BigMikes (futures.io), RipOff Report, as well as ten levels deep searching on Google for any negative commentary or red flags. None could be found.

Next, I searched the owner’s name, Mark Sachs, specifically looking for any negative online commentary. Once again, I went several levels deep on Google and could find no negative information whatsoever. This is not too surprising considering that the company has only been in operation since 2013. I also searched for variations in the company name and as well on Mark Sachs at the CFTC, NFA, SEC, and any prison records at BOP.Gov. (Bureau of Prisons). Once again, I could find nothing.

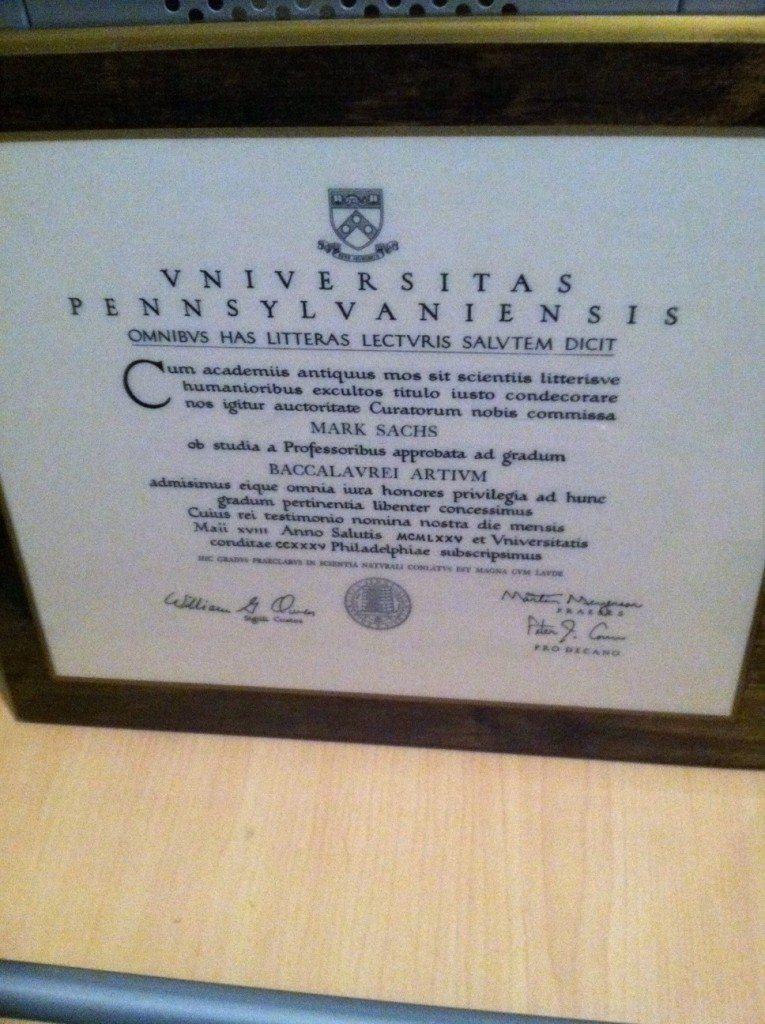

Finally, I did a background search on a few specifics regarding Mark Sachs. He claims to have a Phd in Finance. Whenever I see PhD, the red flags starts flying. The last PhD trading educator that I reviewed turned out to be Dr. Vance Cast, a charlatan scam artist that got a mail order Phd and spent 18 of the past 20 years in prison for two separate drug trafficking convictions. When I saw PhD in finance for Mark Sachs, the alarms began howling in protest. In addition, Mark Sachs claims the following: “Mark Sachs has a PhD. in Finance from the University of Pennsylvania, Wharton School of Business. He is a former professor at Jefferson College, Philadelphia”. This is pretty loud resume, the Wharton School of Business is a very famous business school the turned Donald Trump, Warren Buffett, Elon Musk, etc. You can read the names here.

To be quite honest, I was 99% sure that this Mark Sachs character had no PhD in Finance from Wharton, and so I picked up the phone and did what I do best…ruffle feathers and make people feel uncomfortable. However, my phone call was met with quite a nice personality named Rory, whom then passed the phone to an equally nice personality…the PhD himself, Mark Sachs. I quickly explained to Mark that I have had more than a few people lie to me regarding resumes and I would appreciate if he would please take a picture of this supposed PhD and send it over. Approximately 10 minutes later I got the following picture…

Ok, so I guess Mark Sachs is actually a PhD and went to Wharton. Yep, I was pretty shocked and little embarrassed. But at least everyone now knows the truth. Let’s move to the live trading room.

Inside of the RightLine Trading Room

From October 5th through October 16th, we recorded each live trading session in its entirety. During this time, we used 3 different alias’s to gain access as trial members. We also logged into each trading session using three different IP addresses to remain anonymous.

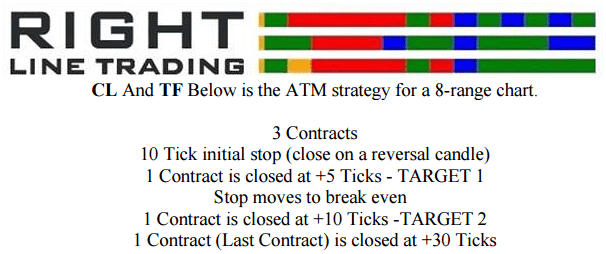

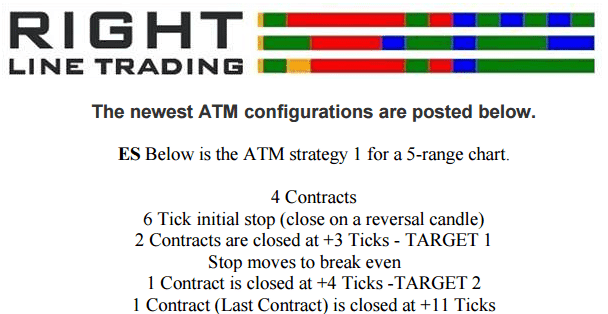

The live trading room is moderated by Mark Sachs. Before the trading day commences, Mark gives detailed instructions on how each trade should be exited. In fact, he has a web page dedicated to how each trade should be managed, he refers to these as ATM configurations. Below you will see two screen shots. The first screen shot is for the ES, please notice that Mark builds the ES chart as a 5 tick range bar. Each trade is entered using 4 contracts, with a 6 tick initial stop. The trades are exited as per below. What I really like about this disclosure is that I was able to very clearly build out the automated exits on my own trading platform. The following screen shot would be for the CL and the TF configurations.

After I built out the auto exits for each market, I then created the charts as described by Mark. Once everything was set up and ready to go, I then assigned my assistant, Reyna, to do her best and attempt to replicate the trades as per Mark inside of the live trade room. It is important to note that Reyna is located in the Philippines and so we can usually expect that with limit orders, such as what Mark prescribes, are going to have a bit of performance slippage. In other words, a trader that is collocated with a box within the CME’s Aurora, Colorada data center can expect to get better limit order fills than a trader located in Manila, Philippines. Regardless, Reyna did her best to copy the trades as they were called within the live trading room.

What You Will Not See Inside The Live Trading Room

If you have spent any amount of time reading my reviews then you know that I am very critical of trading rooms that do not show a live trading DOM, or do not trade directly from the charts. At no time during the review period were we able to witness the use of a trading DOM or trading from the charts. Big red flag. All of the trades that are called within the Rightline trading room are called out in a verbal manner. To Marc’s credit, ample time is given for order entry. He describes the entries as, “on next bar enter at price X, on a stop”. However, on several occasions the market gapped past the entry price. Sometimes Mark would call the trade as missed, and other times he would take credit for the trade. To Mark’s credit, on one particular trade in crude oil, we were able to get a fill using a simulator and Mark called the trade as missed. However, we managed the trade as prescribed via the ATM (automated trade management) and the trade turned out to be a big winner of $450.

Overall, during the two weeks of watching and attempting to execute the trades called by Mark, we noticed a disturbing trend. For whatever reason, Mark would get nervous and begin hollering, “GET OUT GET OUT”. This created lots of confusion as the automated exits were already pre-programmed to exit at certain price points. Every time we took his advice and liquidated at the market, we had to take a one tick hit to execute at the market. All of these market order exits robbed of us hard earned ticks from from prior trades. Another thing, after watching hour upon hour of Mark trading, he gets nervous pretty quickly and has a delicate psyche. This might be construed as a person of weak emotional fortitude, however it was my impression that he just wanted everyone to make profits, even small profits, and felt responsible for the performance of the room members.

My overall impression of Mark Sachs is that he is honest and really wants room members to succeed. Sort of like a shepherd tending to his flock, he is a little too afraid that every shadow is a wolf looking to cause harm to the flock. Far too often, the wolf never arrived and if he would of simply stuck with the automated exits, then he would of experienced more winning trades. In particular, on October 13, this was a active trading day and we executed 12 trades. If a person had followed Mark exactly as he called the trades live in the trading room, then this person would of earned approximately $240 gross, and only $100 gross after commissions. However, if a person simply took Mark’s entries and managed the trades in an automated manner, then the same person would of earned $920 after commissions. A big difference. Too often, Mark would cave and liquidate “the runner”, that last unit meant to capture a larger chunk of profits.

Mark maybe a really smart guy with a PhD, but after watching him trade for a couple of weeks, you quickly realize that he is entirely human and has the same emotional reactions as the guy without the PhD. Not sure he is the dude that I want with me in a bar fight.

Tracking Performance

During the trading day, as each trade is exited, Mark will add a snippet of text onto the chart. Each snippet of text would give the performance for the last trade. For instance, he would mark +10 or -10 that signifies if the trade made or lost 10 ticks. I found that his marking up of the charts with text to be completely useless. Why? Sometimes he would mark the charts with the correct amount of ticks and other times he would get it all wrong. For instance, one time he marked the chart as +17 ticks, but only 30 seconds prior, the trade was clearly a winner at +45 ticks. This went both ways, on winning and losing trades. Is he being dishonest or manipulative? No. There was no intentional dishonesty. However, his memory is either getting a little slippery with age, or the markets and managing the room for so many hours is just too much for him to remain an effective thinker.

With the shoddy, in market reporting from within the trading room, I very nearly decided to just scratch the room as a waste of time. However, at the end of each trading session, a person named Leo would come onto the mic with Mark. They would then go over each trade in a verbal replay. I found that Leo’s reporting was really accurate. Very often, Leo and myself would have each days trading session match perfectly. Other days, the ticks reported would be out of whack by +-5 to 10 ticks. Overall, when Leo came onto the mic, I knew that the real results were about to expressed, and not the marked up charts that Mark produced during the trading day. Leo’s end of day reporting is quite good.

If you would like to see the performance for the Rightline Trading room, the results are posted here. How accurate are these results? On average about 85% would be a good and conservative point of reference. In other words, if Mark is reporting $5k in profits, then a more accurate reflection would be $4,250.

Another major issue that is not talked about, nor is mentioned on the performance page is the cost of commissions. The Rightline trading room averages about 35 trades per week. Each of these trades averages 3.5 contracts per trade. So if a trader is paying $4.25 per round turn, and executing 122.5 trades per week, then they would be spending $520 in commissions per week. This big bite of commission will consume about 25% of any profitable trading week. Do not underestimate the cost of commissions. Its spendy, and Mark should mention this.

A Telephone Call To Mark Sachs

After I had recorded the trading sessions, collected the evidence, reviewed everything, made a list of positives and negatives…I will usually call the trading vendor on the phone. I introduce myself and explain that I am writing a review and that I have a few questions. What the vendor does not know is that I have all of my bullets ready to be fired off. Some of these vendors get really touchy, clam up, and some even get downright nasty and begin screaming like a lunatic (That would be you, Mr Rev). Most have heard of me, that nasty ex-convict at TradingSchools.org and its quite shocking to hear that I have already spent a couple of weeks inside of the trading room, recording every little detail. They know a grilling is about to commence. I have to say that Mark took it like a champ and we actually agreed on most every point of contention.

I grilled him on the use of verbal limit orders and how I quite often was not able to get filled at specific price targets. I was totally shocked what he said next, “Yes, I am aware of this and agree with you. At the end of each trading day, Rory will come into the trading room and report what he was actually able to get filled”. How can I argue with someone that agrees? As we went through the list, I was quite surprised that he was absolutely aware of each point of contention. Refreshing to have such brutal honesty coming from a trading vendor.

My Overall Impression

Mark Sachs is not a hustler. The guy is honest. Really honest. And he is really, really smart. He doesn’t proclaim to have any magic indicators or “hidden order within the universe” or Gann crystal ball, magic order flow analysis, or any of that BS. Rather, in speaking with him, he attempts to explain that the basis of his trading was formed over 30 years ago,

For my thesis I helped develop, along with the US Navy “AESOP”, Automated Engineering and Scientific Optimization Program. Thirty years ago it was a breakthrough, back in the day when the University of Pennsylvania had the only computer in the United States and it was programmed via the use of punch cards. The mathematical principals of AESOP are what drive our trading software today.

Mark Sachs is credible, and he gets in that live trading room everyday, in front everyone. On that brutal stage and does his best to guide everyone to a daily profit. Its tough. He does it live for all to see. But the one big hiccup is that trading DOM. He needs to make that final step, that one final push that so many others have now taken. That last piece of ultimate transparency and credibility…the live trading DOM.

Wrapping Things Up

I so badly want to give Mark an awesome, 5 star review. But I cannot. In the past year, I feel like I have done an effective job at convincing many trading vendors to make the leap and show the DOM or trade from the charts. I dont know what’s holding Mark back, but at this time, he just wont commit to doing it. The trading educational industry is now quickly adopting this new standard, and the folks that resist are going to see their businesses suffer. I hope to bring just enough suffering and pain to Mark so that he makes that final move into the grand pantheon of complete transparency. I hope that my review is warm and bright, but not so glowing that Mark continues on the current path. Come on Mark!

The path to sustainability for this wretched industry needs to be begin with a standardized minimum of showing a trading DOM for all live trading rooms. Once the trading rooms are on this path of transparency, then the focus needs to be an all out, brutal offensive on the indicator salesman.

Well that its it for today. Thanks for reading. And don’t forget to leave your comments below. Even the most vicious, hateful, vulgar ornery trolls with find that their voices are heard.

Mark K Sachs Is a Convicted Drug Trafficker

This review is either written by Mark Sachs himself or the reviewer is the worse investigator. Mark Sachs was convicted of running a pill mill in Miami. (https://www.jacksonville.com/story/news/crime/2011/10/11/doctor-charged-oxycodone-trafficking-miami-saw-significant-number/15887349007/) He was also a horrible doctor based on his reviews (check out reviews of Mark Kenneth Sachs on vitals.com). I also researched his claim of his PhD and I believe he was showing a different degree at that time that I was able to distinguish it was fake (this is over 8 yrs ago so I don’t remember the specifics).

Pros

Cons

Did you find this review helpful? Yes No

Yes, he was arrested. But not convicted. I believe he took a plea or some sort of deal with the prosecution.

Regardless, running a pill mill is a horrible thing. I believe the review was fair, and I did a follow up where I talked about some of the pill mill issues.

Thanks for commenting.

your article is very information . Thanks for sharing such a beneficial information.

the degree pic from U of P for his baccalaurei artium is his bachelor of arts degree

ihttps://mymemory.translated.net/en/Latin/English/gradum-artium-baccalaurei

not his PhD

What does the DOM mean or refer to?

Thanks

After watching a lengthy webinar sales pitch, I asked this vendor to provide an equity curve from a live trade account. No response. I asked if their indicators could be used in an auto traded strategy. No response. I unsubscribed but kept getting emails from them. Several times I asked them to stop sending me spam. They kept sending me spam anyways. I warned them I would contact the Federal Trade Commission (FTC) if they didn’t stop spamming me. They ignored that warning. I then forwarded the response I got from the FTC which said spam from Rightline Trading was now being automatically monitored and collected. Within just 64 minutes of that email I got a response from RightLine trying to shame me for contacting the FTC. I recommend to steer clear of these folks. They know their trading stuff isn’t profitable and are only in the business of selling hope, not results.

Mark Sachs is an EX CON

Dr Mark K Sachs at right line trading is an EX CONVICT! he is a oxycodobe pain dr! he was arrested by the state and fbi for running scam pain clinics. he served a year in miami county jail for lying about his alimony and scamming his wife out of millions. he was a scammer fake plastic surgeon who messed up countless women.

Pros

Cons

Did you find this review helpful? Yes (7) No (1)

https://miami.cbslocal.com/tag/dr-mark-sachs/

The degree picture he sent was for a BA, Baccalavrei Artivm, not a PhD.

And it dosen’t even matter if the Dr has a good trade record , so he can’t trade his own system so what, can some one who has some trading skills be able to make money using his system that he has created, in your opinion which I value

“so he can’t trade his own system so what”

So what? Coming up with a system entails trying out various ideas, seeing what works and what doesn’t, keeping the former and tweaking the latter until the whole is optimized and becomes “the system”. So by definition “coming up with a system” === “successfully trading the system”, and hence your statements make no sense. Please stop giving others advice.

If guy has created a system that can look at 6 correlated markets at once if true , thats something to pay attention to dip shit, who cares who he is or his past its about getting an edge – Hows that for advice Dummy, doesn’t matter how long or successful you are at trading , this business is always changing market conditions and recognizing that will give an edge and you never stop looking to improve your edge. Just because you or him can’t find the edge in ways that can be useful doesn’t mean others can’t, Yes I will give advice because I know the pain of losing and have found being consistent comes from open mind and seeing things others refuse too see from being ignorant.

Emmett, no one should care about Sachs past or anyone’s, all have a shady past some worst than others, this is all about business and if anyone here thinks they are only doing business with righteous people in their daily lives then they are delusional, we are are all business men when it comes to trading the only thing that matters is does this system work and can produce signals, and make money, that’s all that matters. If so than the DR has provide a good service but is a shitty person more than others so what, its about making money with good business decisions, I don’t make money judging other peoples fucked up past, wish I could. So can a person make money with this system that is all the matters.

Speaking of POS scam artists…I think Emmett takes the cake. Nice Job Emmett on this rave review of just how trustworthy and honest your endorsements are…who’d listen to a fraudulent con artist such as yourself…just idiots who can’t think for themselves.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

On July 7 there was a $1847 loss not counting fees. I tried uploading a pic and it didn’t work. Let’s see if he posts this on his performance report or waits until the end of the month to just post the monthly profit/loss.

What is the normal size of a losing day?

What is the normal size of a winning day?

Until we know the norm, values are just meaningless values.

That is not the point of my post. Will he log it on his performance report or not is the issue. In June another poster said he had a big losing day in June and never posted it, just the monthly report was posted. As far as your question, just look at his performance report.

I see 6 down votes on my question, as if the voters think that I am supporting the Trade Room. I find that funny as I really believe that between Rob and I, it would be a bit hard to see who has been excoriating trade rooms harder. But that does not change that fact that we have to have all the facts on any case.

Yes, I misunderstood the import of your question, but as far as trading was concerned, all that I read was a report of a certain size of loss. I was simply trying to clarify if that is the norm. I really should have looked harder at your last statement.

Unfortunately, in the kind of English grammar that I was taught, the lead statement in the paragraph is the import of the paragraph. If your statements were put the other way around, I would have grasped it at once.

Of course, that does not change the fact that I missed your point, and for that I apologize.

Here is the pic

I just want to thank everyone here for making comments! They are not only entertaining, but informative and eye-opening. I appreciate Emmett’s extensive research and the research of the posters here. But I also appreciate the poster who was happy with Right Line Trading, not to mention the people who tried it and found that it failed. And I appreciate the person who is trying to learn more info from the person who is happy with the platform. I love the posters who point out logical fallacies from the other poster’s statements (on both sides of the argument).

I tend to be a trusting person and really have a hard time believing that someone who sounds earnest and intelligent (like Mark Sachs) could possibly be lying. So I need posters like you guys to remind me that practically every trading educator is probably a pathological liar. Lord knows, I’ve lost sooooo much money trying to follow various educators out there (not just on education fees, but on the trades themselves).

For a long time, I tried to follow John Carter’s trades and somehow I only managed to get in on his losing trades – over and over again. It seems without exception, I could never get filled on his big winning trades. It just made me sick to watch him make so much money on trades that I either (a) couldn’t afford the risk, or (b) couldn’t get filled anywhere near the price he got filled. Then he posts pictures from his vacations in Grand Cayman with his family. It seems like he goes on vacation every month. Oh, and he doesn’t trade on Mondays or Fridays (unless he does, in which case I never find out until it’s too late). Gees, it must be nice. While here I am — the bozo who can only place losing trades when trying to follow him and he’s sitting there in his infinity pool looking out over the caribbean ocean. But I’m not bitter or anything (LOL!). Sorry for the rant… just got carried away.

So anyway, I want to thank Emmett and everyone on this site for posting their experiences. It helps me understand that winning in the stock market (or options market, in my case) is really tough. And that an inordinate percentage of scammers sell trading education at exorbitant prices to suckers like me.

Keep up the hard work and diligence. It is sincerely appreciated!

Deb do yourself a favor don’t ever follow someones trades in a room, if you do only do maybe swing trades that way, but learn to trade on your own, I have never found a vendor that can truly trade their own system lol and i mean ever. learn the 4 diff market conditions, and only trade in the trend condition, the first pull back in a new trend, once a day in only one market, and what ever your profit is for that trade your done for the rest of the day, that is the only way I have ever made money consistently in futures trading

Matchell, I have a few comments on your advice to Deb. (1) How do you define the “4 dff market conditions”?

(2) you say trade in the trend condition. Trend is determined by the time frame you are trading. So if the daily is trending down but the 15 min chart is trending up and you are trading the 15, then the trend is up. So as a trader, you have to decide which time frame to trade and how that is affected by the higher and lower time frames. For example, if you are trading the 15 min chart, what are the roadblocks on the 60 chart and the 3 min chart?

(3) you say trade the first pull back. How do you define that and where would you enter? You probably wouldn’t want to be the bottom feeder so how do you define when the pullback is over? Probably when the market starts to move in the direction you want to trade. But again, a trader has to determine what that point is. Higher high, lower low?

(4) You say trade once a day in only one market. Now focusing on one market is probably a good idea as you are learning to trade. But if you’re only taking 1 trade a day, what do you do if that first trade is a losing trade? You stop?

That would mean you’d probably have to have a very very high percentage of winners. Why not develop a system that allows for a loser but overall will produce an abundance of winners. That way, you continue to trade, you limit your losses and accept them but count on the winning trades to outperform the losers and overall contribute to a profitable system of trading.

If you trade once a day and then are done for the day, then I’m assuming you must have a good trading system, and a high percentage of winners, which would mean you could probably trade any market and more than once a day.

Just my 2 cents.

rtchoke, your correct on all levels, thats why I told her to learn to trade her self, I just point out some real time advise that could get her in the right direction, instead dittering around for a long time and not knowing maybe where to start, what I told her is not a system or method just a starting place of how everyone that makes money at this , looks at the market , focusing on one market and one and done is a great place to start, if starting out – her emotions are the biggest factor not any system she will trade, she will quit after a loss anyway and should to preserve her capitol until she knows more and builds confidence, but if she develops her skills around what I said she will have a lot more winning days than losing as long as she figures out how the structure and right market and conditions are, and the right bar type to use or time frame to using multi time frames like you say, but I use the multi time frame momentum not just trend, but I was just telling where to start case eventually she will end up there anyways. And yes be one and done and just compound your capitol instead of giving it back when there is no more strength in the market, you know its there for the first hour after that your a fool to put your business at risk anymore, she gets confident and learn her market she can take all the trades she wants in that first hour.

And yes I can, and do have a wonderful system as long as I follow the rule of one and done, 1 ES Point is 50.00 x that by 20 and it is 1000.00, trade to make a living not to be right or prove your a great trader I had a 45 day winning streak last summer of making 1 point in the ES, NO STESS and money in the bank my first consistency ever. And what I know is theres not a lot of people that can say that. GET YOUR WIN AND STAY OUT.

matchell, Very nice. Everyone has there own system and finding one that works for you is very important and especially for someone just starting out. I congratulate you on a successful system. You’re right, not many people have 45 consecutive winning days. I’ve traded for more than 15 years, use multiple time frames and trade several markets and I don’t stop after 1 trade, so our systems are very different. That’s fine, yours works for you, mine for me.

I actually don’t trade the ES (too sexy for me). (Old joke: you go to a party and tell people you trade the ES, they flock to hear who you are and how you do it — very sexy. You go to the same party and tell people you trade corn, they ignore you, figuring you’re some redneck who knows something about fertilizer.)

No I don’t currently trade corn but there are plenty of markets and plenty of different systems you can learn or explore using any of the indicators or ideas already in the market — no need to reinvent the wheel. Just as you say, develop your own system instead of traveling from trading room to trading room waiting for the guru to lead you to your millions. You can be your own guru.

Nice to hear you are doing so well.

Lol Es I don’t trade anymore,it was just moving good and predictable at first hour a year ago, Now only ZB 4 Ticks a day if trending, if its ranging then I look at NQ or I don’t trade, CL overshoots every thing so I stay away and only trade what is predictable volatility at moments. Its now been 10 years, futures only 3.

“… only trade in the trend condition, the first pull back in a new trend”

How do you know it is a pullback, and not a reversal of the trend into the other direction?

You can never know 100% But There are many ways to measure the market at that moment – I use a 20 and 50 mov avg and the slope of both plus a momentum indicator MACD, when all line up and price pulls all the way back to a sloped 50 and touches , and a higher time frame confirms the trend and momentum then I will enter on break of the prior bar high if going long or low of prior bar if going short, Target the last pivot, place stop at pivot and dont move , if price goes against you get out when price isnt doing what you expected. Just a simple method nothing fancy, pay attention to all the supp and resist areas. And only do it once a day first hour of trading.

‘I tend to be a trusting person and really have a hard time believing that someone who sounds earnest and intelligent (like Mark Sachs) could possibly be lying.”

This is what they count on. This industry is nothing but low life scum bag scam artist. I know that is hard to believe if you are a trusting person. There is a reason Emmett begs these guys for any proof what so ever of profitable trading and they can produce none. These guys are masterminds with shills claiming to be hitting it out of the park. They sound so caring and sincere, but they have only one goal and that is to depart you from your money. These people prey on foolish people looking to get rich fast. And there is no shortage of people for them to prey on.

Unless you want to be scammed do not trust anyone in this industry unless they show actual proof with live brokerage statements showing profitable trading. Not some Excel spreadsheet or Tradervue non sense. Live brokerage statement only.

I was in the room maybe 6 weeks ago or so. He seemed to take trades that didn’t ‘line up’ with the majority of his indicators that he would say he is looking to line up. I am on his mailing list and all he is putting out there as far as advertising, he is pushing his “Algorithmic Trading System” which he claims is now active on 6 markets but he will only allow you to use it on two, for the amazing price of “3999.00” which is a whopping discount off of the normal price of $5999.00. If you go on his website, it shows 22 trades with 19 winners and 3 losers since January 19th, which is over 2 months, if you were to even believe a spreadsheet as proof ( ha ha) and the last trade was apparently on March 18th. Whatever he was trying to do as a result of his original review to have any integrity looks to have caused him to crash and burn fast

Did you find this review helpful? Yes (1) No

Today marks the one month anniversary since the Feb. 24 collapse of the discretionary trade account in which in that one day the loss was greater than the entire years gain. Since Feb 24, there have been 16 losing days and 4 winning days. Based Right Lines minimum recommended account size of $5000, the last months losses would be 130% of account size or a blown account and then some. Right Line obviously does not want a newbie to know this since Right Line has stopped showing discretionary performance on their website.

This industry is nothing but con artist. Remember that when you read all those fake posters saying how great it is. I will point out one other thing, right now I hear via the grapevine there is a trading room that Emmett might give a high star ranking too. Lets say he does and then 200 people join it; you think when 200 people all take the same trade it will still work?? People making the same trade effects the market.

Right Line has not updated their discretionary performance since Feb 24. On Feb 25, they lost the entire year of profit in one gigantic losing day. Since that catastrophic day, there has been an additional 18 trading days to date. I counted 14 of those 18 days as losing days. Of course, you would never know this because after February 24, Right Line has just given up and no longer posts their discretionary performance. If at some point in the future they ever do update the performance it will BS. Right Line thinks that if enough time lapses in updating performance (a month or more), no one will notice them posting BS performance hiding the overwhelming losses. That may work for those who not keeping track or for the naive, but it cannot be hidden from those who have had their accounts wiped out. The problem I see with Mark is fairly common in amateurs … trading with no patience and no discipline.

Tamiaya,

Welcome to the world of trading rooms. From my experience every day trading room is a “SCAM” I still check out trading rooms going to their free trial and even paying for a month to see if I can find that unicorn and so far I have yet to find one. I am in a trading room right now that must read Emmett’s blog because they know all the right words. They claim to trade live and show you their brokerage statements. But the whole thing is a scam. The results they post are not only inaccurate they do not even show slippage. Just the other day they traded PLCE and at the time of the trade this stock had a 60 cent bid/ask spread and they used a $1.00 stop on a this stock with a 60 cent spread. And they were entering and exiting on stop market orders. The price went up and then fell. The trading room operators states he is going to BE and on the posted results it shows they broke even. What a bunch of crap. If you traded it live you took a 60 cent hit on the entry and another one of the stop. So while they claimed they broke even you lost over 1 R and that is how all their trading goes. They make 1 R you are lucky to BE and when they lose 1 R you end up losing 1.5 or 2 R. The only way they make money is off their non stop pushing of their education courses and their trading room fees. No wonder there are no long term subscribers. Which is another thing to look for. If a TR operator could really trade profitably then they would have a waiting list to join as no one would leave the room.

If you find a day trading room that truly trades live, shows their DOM or Chart Trader, clearly calls out the trades in time for a human to react, opens up their brokerage account live to show you their exact entries and exits and accurately post those results, and can trade profitable over time you have found the Unicorn and please let me know. In fact I would pay money to find that person. But so would everyone else which is why they do not exist.

Exactly RobB, some of these trading rooms use every trick to churn members in and out. They would like to have long-term subscribers, but they know when most have lost more than half of their account in a couple months those members will have checked out and most of them will not even dare to comment on review boards. Like I saw the chat room in Warrior Trading recently. They change their chat room plants about. Often they supposedly take trades not even mentioned by Ross or Ed, I suspect to pretend they are long time “successful” chat room members who can trade on their own. Occasionally a real member, a new dupe will complain they lost half their gains from the previous week or so. Or one would blurt out they had enough of the room after six months and continuously losing money and don’t get how others are making money in the room and the plant members will feign sympathy and say they need to work on their money management or some other nonsense etc. when the hosts don’t even follow their own rooms and average down or up all over the place like a magic show. Since Emmett’s review, members are quickly shushed or muted or booted or whatever to leave the plants talking about their sim trading nonsense. Whatever works to keep people in the room for at least a month while they go on full marketing for new members on investi-scamma and other places.

Tony C., are you still using Right Line’s system? It looks like it has been losing serious money lately. I’m not trying to criticize it, just trying to see if you have any variations or angles on it that make it work better. Thanks again.

Hi Paul.. I just saw your question and that is the reason that I did not answer sooner. YES I still trade the Right System and it is profitable. It undoubtelly gives many Excellent high probability signals that have over 80% success rate in my opinion. I could and will do better and be more profitable with it as I conquer my lack of discipline and fear of missing out on trades.

I’ve made the system my own by making the chart easier to read and adding two other indicators that are not really needed, but I had them from way back.. One is a candlestick pattern indicator which is free on Ninja. It prints the various candlestick patterns. I especially look at the Engulfing candles and their location. The other indicator I’ve added is Jeffs Dots from Big Mike.

I think that we must understand that any system can be profitable or looser depending on who, when or how it’s traded. Everyone can trade it differently and take conservative or aggressive trades and get different results. Even the best system in the world can be a looser at times or always depending upon how it’s traded.

Now I don’t follow all of Mark’s trades. Sometimes he has taken some very aggressive trades and lost serious money. He shows the Dom but still trades in Sim I believe. He does not show statements as some here keep on repeating and insisting as being the absolute criteria to evaluate a system. But let’s think about it.. Suppose a trading room did show his statements and they show a profit. Does that mean that anyone can trade that system and make a profit? Of course not. Does it mean that the room trader will continue to make a profit? Of course Not.

His strategies are continuously being updated and improved. So a lot of testing is being done.

When I update my computer monitors I plan to do better in that I will be able to follow more instruments. The ones I like in sequence are Crude, Russel, EMD, Emini, Gold and the 30 year Bond. The Right Line system gives excellent signals on these markets. Take care

” Suppose a trading room did show his statements and they show a profit. Does that mean that anyone can trade that system and make a profit?”

No, but if the trading room operator can not trade his own system profitably it is virtually impossible that someone else will somehow miraculous figure out how to do it.

As a wise judge once said, “victims of con artists sing the praises of their victimizers until they realize they have been fleeced.”

Being Rightline cannot show any proof he can trade profitably, I am sure Emmett would love to see proof of profitable trading by his students. I am sure you are an honest real person and not some shill so why don’t you provide such proof or is this where you say, “well I am not actually trading live yet” or worst state, “I do not need to show proof.” Well when you are shilling and promoting a con artist you do need to show proof or what you say has zero value in my book.

BTW, “Excellent high probability signals that have over 80% success rate in my opinion.” If you are actually trading oil and getting that win rate why would it be an opinion? You should know your exact win rate from your live trades should you not?

Sorry, but I am sick of shills coming here promoting some non sense trading method and yet once again show no proof of consistent profits. The chances of some underfunded individual trading a highly leverage, highly volatile oil future with an 80% win rate (unless you go for 1 tick and risk 5 ticks) and being consistently profitable doing it is zero. Talk is so easy, it is showing any proof that is difficult, which is why non of these trading rooms can show any.

Real Simple..

Every platform provides reports to show your results.

They can easily be provided (without an account number) and we could all eat crow with some hot sauce on it .

10 years ago, putting something in Excel would have duped 80% of the non-technical crowd. Today, 80% of the public knows what the hell a spreadsheet is and they are not impressive or proof.

Amazing how all these trade room bozo’s want to be open and transparent after they get caught …

Well Golly Gee you must have been having an off day. First thing when I woke up I went long CL for 1000 ticks, yea I know it did not go up 1000 ticks but that does not matter. Then I went short for 2000 ticks. Then I realized I had traded for a whole 30 minutes and was done. Can you believe I use to work an actual job where I worked 40 hours a week. I mean with my $1,000 account I am just nailing it every day using what I learned from good old RL. I am happier than a tornado in a trailer park. Even if you never traded a day in your life you can make money using this method. No where I come from your word is your bond, so you know I am telling you straight up how it is. Forget all those naysayers asking for proof. What the hell do they know. In fact I know for a fact they are a bunch of Commie Pinko losers. They do not know how easy it is just make money hands over fist. Don’t listen to those losers, just send in your money and start trading away the RL way. In no time with that $5K account you will be making 100 ticks a day like a paycheck with an 85% win rate. Heck you will even forgot what having a losing trade even feels like.

Well I am off to buy a new Lamborghini with all those ticks I made today.

And do not forgot when some post ask for proof, you just say you are nothing but a Commie Pinko Loser. I do not need proof. I got my man Rob B word for it. Like George Washington he can not tell a lie.

The only way anyone could undoubtedly review RLT is to run a test on a live account. I’ll give my feedback from live trading. First when looking at the results posted they are without deduction of commissions. I traded a live account for a few days short of a month, for the month RLT reported a $2800 profit on their site. My commissions were around $1400. and my actual result after commissions was at -925 negative. the results calculate profits based on touch of targets and not trading through them. My loss would have been significantly larger if I didn’t start exiting my last few days positions early so as not to suffer full stop out after first target was not hit. the result posted are based on a sim account and when I saw that there was no way to replicate his trades I smartly called it a day.

Patrick,

Excellent Post. If the Trading Room provides no proof there is a reason for that. This is the problem with Tony C and other naive investors thinking and I know because I was the Fool once. You will lose thousand in order to find out the truth for yourself. It is not just the cost of the education and cost of the TR, but the only way to know is to trade live and that is when the really losing of money begins. Hundreds of dollars becomes thousands down the tube and you are like how can I be losing money trading a method with a self proclaimed 85% win rate and think you must be doing something wrong. But the fact is the method could never be traded profitable by anyone. People have got to stop going off blind faith. These TR operators are completely scum bags. Realize that going in.

Again if the TR operator can not trade his own system profitable, I serious doubt by some miracle you will be able to. I hope more people like yourself come forthward.

Hi Patrick.. Thanks for sharing your trading experience with RLT..

I’m sorry that it did not work out for you.. I give you credit for at least trying…Contrary to some on this forum who haven’t even done that. Mark is very generous like I haven’t seen in any other room in that he gives a free trial and let’s one take it even more than once..

I don’t advice one to trade live on the trial however..

I think that you may have given up too soon and not done more to learn the software and make it your own like I have..

I make money almost daily.. Just today I took one CL trade short with a C entry at 7:04 Am EST at 32.99. My last runner go out at 32.30 for about 69 ticks.

The other trade also on the CL I took at 9:40 at 32.35 which went to 31.99 for 36 ticks.. There were others during the day and also TF was good but I did not take any more..

It took me time to become profitable and I can’t understand why some people think that it’s going to be quick and inexpensive..

Trading is a great business which is meant to replace one’s job trading only a few hours from anywhere in the world. It takes time and money. Everyone in trading including myself of course has lost a lot of money. At least in the tens of thousands before becoming profitable. We still loose at times.. It’s business expenses.. It’s part of doing business.

One must take chances and try different rooms, different systems. A few hundred dollars is not much to spend. One can see in a month or two or much less if that is the right one.

Spending money is part of the investment to replace one’s full time job.

One can buy a franchise. The most popular and cheapest is probably Subway. Well this costs between 100K and 150K and one must work long hours to make about the same yearly. Trading can cost less than that and it’s more enjoyable and possibly profitable..

You must have made many on this Forum happy in that they love to hear proof that 99% fail and no statements are shown, and everyone is a fraud, and the world will end tomorrow etc..

Anyway good luck to you

I believe that Emmett provides a valuable service. His conclusions are based on a systematic evaluation of the trading room and software in question. None of his comments are based on conjecture or speculation.

He was in our trading room and provided me with some very valuable feedback. We now project Chart Trader into the trading room so that everyone can see the gross profit we make on every trade. The net profit/loss we place in our spread sheet comes directly off of chart trader. This number is the actual day by day, Ninja Trader back end tally of the trading room’s profit loss, before commissions.

Our company’s growth is driven by our clarity, openness and honesty. When we have a bad day, we post it: we hide nothing. We also help create wealth, by providing traders with precision software that works.

I invite you all into the trading room for a free trial. Than you can post your experience here in this forum from a position of certainty.

“Mark is the most professional and honest person that I’ve ever encountered in this business.” – except of course for all of the lies that have been pointed out by Emmett and other posters in this thread. I mean apart from all those lies he’s the most honest person on the planet.

OK Stray let me try to explain so that hopefully even a five year old can understand..

This is where I’m coming from…

First of all I’m assuming that Tradingschools is a site that evaluates trading systems/rooms and how accurate/profitable they are so that hopefully we can decide to join or not.

I place ABSOLUTELLY NO importance on the past, present or future personal/business life of the person who running the room…

I have followed Prof Sachs for close to 2 years.. I bought his indicators and been in his room most of the time.. It is profitable and getting better all the time..

I have also evaluated close to 100 other systems/rooms including Dean Handley’s recommended ones..

And I still confirm even more so that Prof Sachs and his staff are the most professional and honest people that I’ve ever encountered in this business…

Now regarding lies you say have been pointed out.. So What??

If someone like Emmett came to evaluate my room and system and instead also wanted to pry into my personal and professional life: I certainly would NOT have been so polite and professional as Mark was.. I may have led him on and told about all the Ponzi schemes I ran, or the bodies I helped dispose off in Brooklyn etc..

Emmett likes to brag about how bad he was etc.. Do I know whether this is all true.. Am I going to investigate.. Do I care??

Does it play a role in me deciding whether his reviews are accurate or not.. OF COURSE NOT.. In my opinion..

Who knows maybe Emmett is not telling the whole truth.. Maybe he wasn’t so bad after all.. Maybe he was way worse than what he states.. But I don’t give a Fk

I know and appreciate like most here that Emmett works hard and gives his best in the reviews.. I disagree with some of the criteria he uses. But he doing a great service to all AND is accurate.

I like the fact that he uses assistants in the Philippines to help out.

I love the people and culture of that country so much that I married a Filipina..

Of course all this is just my opinion and you can continue

to believe who and what you like..

.

Let me get this straight you think Mark the pill pushing doctor who lied about his Ph.D from Warton is honest and trustworthy?

Just out of curiosity do you think Benedict Arnold is a war hero and Bernie Madoff is a humanitarian?

Fine you say forget the past.

The one thing I noticed is Mark never showed Emmett any actual brokerage statement that he can truly trade profitable.

The sad fact is it takes the smallest manipulation to turn a losing trader into an amazing winning trader. It is just so easy to fake profitability and people fall for it again and again. Trading Sim not showing slippage means nothing. Absolutely nothing!

So I got two words for you: Got Proof?

Apparently from what I have read Mark has not shown any. So I challenge you to be the 1st to step up to the plate and show some proof of that profitable amazing 85% win rate. I will help you out. Here is what you can do.

1) Email Emmett and tell him you are a student of Rightline Trading for 6 months or what ever it is (it needs to be some reasonable time period) and you are trading their method profitable with an 85% win rate as you stated in your post.

3) Show Emmett those live brokerage statement verifying your claim,

5) Get Mark to do the same, and

9) Then ask Emmett to do an updated review.

If Mark can do this his business will explode with that 5 star review. Personally I think the odds of this happening are zero. Prove me wrong. Make me eat that horrible tasting crow! But so far all I have ever seen is these so called self-proclaimed student claiming amazing success, but somehow can not show any proof. How hard is it to show some proof. It is like 10 minutes top.

Hey Rob..First of all I DID NOT state that I or RL have a 85% win rate. I said that there are certain trade setups that have an over 85% success rate. However Winning rate is meaningless. One can take 10 trades with 9 $100 winners and one $1000 looser and have a 90% winning rate.

Regarding broker statements. I would like to see and It’s nice that one shows past brokerage statements.. However they are not absolutely necessary in my opinion. There might be one or 2 who shows them. However I don’t know of anyone.. and I’m NOT going to wait for statements before I decide on whether to follow a room or/and buy their products.. Do you know of any??? Then even if they show them. It’s only the past and doesn’t prove how they got them and of course you must have heard the statement “Prior results are not indicative of future…”

The fact of whether they show statements or not, whether they trade live or Sim or not trade at all or whatever should NOT stop someone from evaluating the system and trading room in my opinion..

Of course I know that I will miss some trade calls> Especially i in a fast market like Cl. Also i know that there will be slippage..

Some things I look to evaluate are the following……….

1) Does the Head trader call out trades and or has an ATM strategy giving me the entry, stop loss and profit target in a timely manner for me to duplicate it on my own.

2) Does the trading system make sense and meets my trading style, frequency etc.

3) Do I like it and it’s easy to trade by anyone

4) Can I duplicate it, make it my own and make money from it..

Right Line meets all of these requirements for me…

The RL indicators give excellent signals.. They use multiple-timeframe, fractal analysis, Market profile S/R lines, Quantitave analysis etc. etc.

Anytime you vet someone it only reflects the past. If you invest in a mutual fund that had great returns in the past it is no guaranty of future success. But you cannot be naive enough not to realize the Trading Room industry is full of scam artist whose sole goal is to depart you from your money. If you are not going to vet you get what you deserve.

I agree win rate means little but I was not going to bring up that issue as it is a discussion in itself with invested risk to reward trades and etc.

I disagree with you on trading Sim it means very little to real world results, especially when one is scalping.

So the Trading Room operator actually showing any proof what so ever they can trade profitably is not important to you. What can I say. Let me know how that works out for your over time.

You stated, “It’s hard to get a loosing trade if one follows the rules of Right Line. There are

about 3 trade setups that have well over 85% success rate… and stated, “Also I take most trades with Mark in the room” not to mention your statements about how honest he is.

So if it is so hard to even get a losing trade and he has these amazing setups with over 85% win rate, why do you still refuse to show any proof what so ever of your amazing profitability using the RL method. Instead it is all words with no proof what so ever.

Once again it would take 10 minutes to show some actual proof. Could it be possible you have none??????

Look I deal with Kool-Aide drinking believers all the time. They go on blind faith and logic and reason means nothing to them. But eventual they wake up and realize the truth. When Mark and no student can show any proof that speaks volumes. You need to wake up and listen.

You say..

“So the Trading Room operator actually showing any proof what so ever they can trade profitably is not important to you. What can I say. Let me know how that works out for your over time.”

I did not say that.. Mark Does show the trades and can trade profitable and does shows the DOM

Even a system that has a 85% success rate does not guarantee profits. We are humans not computers. We tend to overtrade, trade at the wrong time, take risky trades etc..

Only a computer program that has been programmed properly has a change to be consistent and unemotional to take those high probability trade setups..

Mark and his staff are working on that..

Regarding broker statements… How would anyone know that the trades taken were from

the system in question. One could have traded other setups.. Right?

Rob.. You know what.. I have tried to state my opinions. They are only my opinions. I hope they help somebody because I like helping people..

I don’t know you, and you really think that I or anyone in this world would show you his Statements????

I don’t need to prove anything to you.

Besides i don’t like your arrogant attitude

Have you been drinking???

Hi Tony,

I just wanted to interject my thoughts on your statement regarding showing account statements. You seem to believe that nobody shows account statements, you are very wrong. B12 Trader shows account statements, WatchHimTrade shows account statements, NightScalper shows account statements. I can go on for quite some time.

The reason why people get taken advantage by trading educators is because they have this mistaken belief that nobody will show brokerage account statements. This belief will only lead to failure and loss. Set a higher standard for yourself. This is the reason why I started this blog, so that people like yourself will stop being so tepid about verifying trading performance.

Unfortunately, the need to believe is strong. You want to believe so badly that a trading educator is honest because your own hopes and dreams are directly tied to the belief. This industry is filled with outrageous scoundrels.

Hi Emmett and thanks for dropping buy and your efforts to get more rooms to show their statements..

I really can’t think of any Futures traders that show them and I doubt that there are more than a few others to the few you mentioned..

For me not showing the statements is not a deal breaker. Else there would be no rooms to evaluate..

More important In my opinion are some of the following that I can verify myself in weeks and months..

1) Does the Head trader call out trades and has an ATM strategy giving me the entry, stop loss and profit target in a timely manner for me to duplicate it on my own.

2) Does the trading system make sense and meets my trading style, frequency etc.

3) Do I like it and it’s easy to trade by anyone

4) Can I duplicate it, make it my own and make money from it without having to follow the room..

5) Does it have excellent support. Can I call or email anytime i want and will get a response?

6) Does the Head trader explain reasoning he took each trade and comments on chart patterns etc.

7) Does he show his DOM or trades on chart..

8) Are daily trade results kept and are they accurate…

There may be other criteria that I look for. In summary I want to evaluate the trader and system MYSELF in real time to prove to me that it’s worth buying.

OK Emmett.. I looked at the the sites you mentioned..

I don’t see account statements for Night Scalper. And in your review of Night scalper you demolished him.

Now the only one is Watchimtrade that DOES show statements. But his results are atrocious..

You say there are many others?

I honestly can’t think of any.

Maybe Bob Amico may show statements. He’s been saying that from day 1. But i seriously doubt that he ever will. I hope that I’m wrong.

Sadly, I do not drink but after dealing with so many dilution people in this business I might start.

I do not know what to say. Maybe Emmett words will be better than mine to help you see the light. I am sure all those people that invested with Madoff now wished they ask for some actual proof.

So instead of demanding any proof your plan is to spend hundreds if not thousands of dollars on this trading room and education and then try and see if you can make it work. To me that is just insane. if the person selling the system can not get it to work I doubt you will.

One very important point, if Mark is for real then he should not have any issue with showing his brokerage statements. You think mutual funds and money mangers do not have to produce real proof? But unlike your list this would be first on my list. First verify if the person selling a system can even trade the system profitable. There are no shortage of others who do not do that who all got scammed out of money.

Even if you do not get it, hopefully I save someone else wasting their money prior to getting actual proof. And hopefully Mark will start to open up and show his brokerage statement proving he made the trades as he states he did. That would put him in the top tier of this industry.

OK Rob.. I appreciate your noble goals and to try and warn people about the many mines in this minefield of trading.. I think most of us are already aware of this..

But you seem to be stuck and obsessed in wanting to see statements. This is a prime requirement and deal breaker for you. Well there are hundreds and maybe thousands of rooms out there.

Maybe only a handful of Futures rooms show statements.. Now does that mean that there aren’t any successful and profitable trading rooms and systems out there of the ones that do not show statements?

I certainly don’t think so!

hey, it is a no brainer. Broker statement is the only way to prove whether the guy is legit. This is it, simple. Do you not get it? Do you work for this guy?

The funny thing is if your statement, “Now does that mean that there aren’t any successful and profitable trading rooms and systems out there of the ones that do not show statements?” was sincere I would say you are finally getting it. Yes I am saying 99% of the trading room are complete scams.

Think about what you are saying. You are saying the industry standards of showing no proof what so ever they can trade profitable is Great. So people join the trading room or pay for the education all on blind faith and they get screwed again and again.

This acceptance of the TR at their word is why this industry is full of crooks. If people demanded actual proof like they do mutual funds and pretty much every other industry then yes most TR would be out of business.

You act like someone running a business showing any proof is asking to much. That is just ridiculous.

I too was scammed by a TR, so I know exactly how they operate. This TR operator showed years of profitable trades, yet he could never trade profitable. All his trades were fake and it was all exposed on BM.

Maybe you think everyone is honest I do not know, but it is obvious even though you stated you can not lose taking RL trades you can show no proof what so ever you are making a dime.

For goodness sake do not take Tony C word on it, demand actual proof before spending your money or you will just be another statistic. Tony just proves a fool is born every minute. Don’t be the FOOL!!!!!

Thank you Tony C I consulted a 5 year old and he told me that if someone lies about every important detail in their past then they are likely to continue to be a “liar, liar pants on fire” person in the future. No brokerage statements from Mark and none from you – liar, liar pants on fire.

OK stray.. i also consulted a fifth grader and he told me… Why don’t you put your money where your mouth is and set an example and show us your track record and your winning system so that all of us can learn and benefit from???

Since you’re so obsessed with track records

as being a deal breaker in evaluating a system/trade room; it should be easy for you.. Right?

Really!! What is wrong with you????

Stray Dog is not the one saying a drug pushing Doctor who lied about having a Ph.d from Wharton is honest and trustworthy. Your are!!!

Stray Dog is not the one who stated and I quote, ” It’s hard to get a loosing trade if one follows the rules of Right Line. There are about 3 trade setups that have well over 85% success rate” and who says they take Marks trades, yet can show absolutely no proof of making a dime. Again you are.

What would seeing Stray Dogs brokerage statements prove about RL trading which this thread is about.

Now actual brokerage statements from Mark or one of his self proclaimed profitable students such as your self would show proof. But you do everything and I mean everything but show any proof.

It is clear to me you are either have some mental issues or completely drunk on the Kool-Aid and in the fantasy world or a shill. Are you Mark’s brother or best friend?

Maybe you next post will be to state how you finally showed Emmett some actual proof of how profitable the RL trading method is and telling us to shut up, but I seriously doubt it.

Again prove me wrong with some actual PROOF!!!!!!

Absolutely Tony C I’ll put together a statement of my trading for January. Do you prefer a word document or an excel spreadsheet? I mean if you’ll accept this “Latest RL results summary” as proof of profitable trading then I can knock together something in a few days for you. January was a fantastic month for me. Not a single losing trade and 1.2 million in profits. I’ll sell you my system for $3,000 and you to can buy you own private jet and island paradise.

Latest RL results summary

https://www.youtube.com/watch?v=euRqvAebyZ8

So instead of showing any proof what so ever you show a link to an advertisement showing a Spreadsheet that shows results based on who knows what. Seriously I would hope the time of people being naive enough to believe crap like that would be in the past. The only thing that means anything is “ACTUAL PROOF” of real trades accurately documented.

Again I ask the same question you Got Proof?????? And proof is brokerage statement showing real trades made, not hypothetical results. The fact that instead of showing any real proof you show an advertisement link screams BS Shill. Again 10 minutes to show some real proof. That is all it takes. I am pretty sure I will spot Big Foot before seeing any real proof.

Tony C, where is the PROOF?????????????????????????????????????????

Interesting the summary of the video tries to dole out advice such as don’t buy “software or gimmicks” without a posted track record. What’s the definition of a “posted track record”? A bunch of on-the-fly or after-the-fact doctored spreadsheet “records”? Many scam sites post track records. Warrior trading had to stop showing their spreadsheet “results” after years of posting due to “compliance”. It’s a sad fact that the scam industry still thrives on a significant proportion of newbies who are still in the want-to-believe the spreadsheet lies phase.

I actually get it. These trading rooms, vendors and their friends and family are in shock. Now that there is a new sheriff in town, Sheriff Emmett, they do not know what to do. They are so use to showing their straight up equity curves and fake spreadsheet results and having naive people just hand over their money they are just clueless what to do when someone actually ask for proof.

They are like proof, duh why do you need that. They do not know how to respond. Kinda of like when the regulators came and asked good old Bernie for proof.

The fact of the matter is if everyone demanded proof 99% of TRs would have to close done as they could not trade profitable if their live depended on.

Having said all that, I hope Mark will eventually show actual proof and be the exception to the rule, but until that time comes I would highly recommend no one pay a dime for this or any trading room based on bogus testimonials or blind faith. 99% of these TR all sound sincere, but there goal is not to make you a profitable trader, but to part you from your money.

Don’t be the FOOL!! DEMAND PROOF!!

Okay, thanks, Tony !

Tony, how has it been going lately with Right Line? Are you trading both CL and ES, and which one is working better for you? Have you tried the new stock trading room?

Thanks.

Hi Paul.. Yes Right Line is working excellent for me.. I do take loosing trades especially last December. But that is ENTIRELY my fault. I still take risky trades, trade at the wrong times, and overtrade because I have fear of missing out.. I’m still a crazy cowboy and love to trade. I’m confident and determined to overcome this and be more disciplined. It’s hard to get a loosing trade if one follows the rules of Right Line. There are

about 3 trade setups that have well over 85% success rate… The C trade, The power signal AFTER an MA crossover and the signal out of congestion…

I trade mainly on my own the CL.. Also I take most trades with Mark in the room. He shows the DOM. He has an excellent record this month as also has had for well over a year that I’ve followed him … He really cares that all get the trades and make money.. Mark is the most professional and honest person that I’ve ever encountered in this business..

For me I like the CL on 8 and 6 range as the best and the TF on 8 range is second best.. Also the ES on 5 range and ZB on 2 range are good. I have only one monitor and cannot watch them all until I upgrade to a new computer with multi-monitors hopefully this year…

I’m not trading stocks right now. Mark seems to be doing excellent with stocks also and he says that they are less risky..

Take care..

OK , we all understand that Tony likes it.

All I will say Tony, don’t expect your fills in a combine (SIM) to be anything like a real trading account.

Will be a wake up call for sure….

Thanks Tom.. why you say that? have you been funded at Topstep and trading a live account.. what instruments are you referring to?

Please elaborate further..

I’m more impressed now and have more respect for Prof Sachs after learning of his long career of a respected, talented and caring medical doctor and thank him for bringing his intelligence and talent to the world of trading.. Maybe his business mistake was a blessing in disguise..

Trading is one of the best businesses in the world and I’m also passionate about it. One can trade and travel etc.. His mistake has absolutely no pertinence and should not influence anyone’s from joining his training room and/or having his software.. I think some mistakes have been made by almost every human alive….

I don’t know what led to that situation.. I can only guess.. Like a good doctor, he seems to be very passionate about helping others making sure that all his students learn the system and that those in the room get filled. It seems that his Motto is “No trader left behind” He is super transparent and super available for questions always like no other room that I’ve been to. And I’ve seen close to 100 including the 14 which Dr Dean Handley posted on his Titans web site…

Also many of even the so called best trading rooms don’t even post any phone number or/and true testimonials and updated trading performance record. And of course NONE post a biography of the head trader and staff…

I bought his system and been in the training room for over a year.. I can trade his system successfully on my own. But trading is lonely and hearing the good Professor/Doctor is a welcome relief that I like always..

Someone has stated something like that Prof Sachs is very emotional in the room and probably unfit to trade live… Well the few times that he has said a throw away word that he did not like; he has quickly apologized. I don’t know why since I don’t think he needed to apologize. Since the trading world is NOT the silent environment of a monastery.. Just go to Youtube and search the environment in the Trading pits and you’ll see and hear what trading is about.. The emotions, noise, passion and roller coaster rides of actual traders there is a learning experience..

Someone also stated that the trading performance stated is not accurate and should be disregarded… Well yes I agree with this because the results stated are less than what they should be. Actually they should be higher because Prof Sachs does not count all the winning trades that were not filled by even one of the members, or were too fast for everyone to get in etc….

There were also complaints that were made about slippage.. Slippage is part of the expense of trading.. You will always have some slippage when you have traders from different parts of the worlds with different data feeds, computer speed, or internet connections..

Anyway I wish everyone lots of luck in the search for the training room that best fits your needs..

Hey Emmett.. I I think that you are doing a Great job and providing a great service to the traders by your work.. I hope you continue and check out some of the TITAN rooms that Dr. Handley has recommended. I suspect that some don’t show their performance and don’t meet the 50k a year goal any more. You know what they say about past results..

I know that Dr. Handley is very negative about you. I do respect all he has done and continues to do. He is doing an EXCELLENT job and I respect him.. However I disagree on his negativity toward you and your work. The problems of your past don’t bother me. They would of course not stop me from having you as a personal friend or Hiring you for a job etc..

I’m not sure that I agree with the need for a trading room to show the Dom all the time. There isn’t enough room on the charts. Maybe showing it at the end is OK.. For one thing they cannot show their live account because it is against regulations. Prof Sachs gives specific entry, exits and manages the trades. He has an ATM strategy and comments on the reason that trades are taken etc. This is more than other rooms that I have evaluated. And Regarding slippage, please understand that it is part of doing business. When you have traders using different data feeds, trading from different parts of the world; there has to be some slippage. This is elementary Trading 101.

Again reading some of the preceding negative posts; it makes me wonder what their motivation is. Are they competitors or just plain retarded indiviuals who have forgotten to take their medications???

WOW.. reading all these negative comments and hatred toward Prof. Mark Sachs makes me laugh..Yes I laugh all the way to the bank. I bought his system about a year ago and am in his room at least a few times per week.. I make money on a consistent basis for the first time in my trading career. I can trade on my own because the system is easy to follow. It’s hard to get a loosing trade if one follows the rules. I also take some of Mark’s trades in the room.. Sometimes I trade more contracts and trade longer hours to make more. His performance stated is accurate as much as possible considering that there will always be slippage, commissions etc. He really tries to be sure that all traders make money.He is as transparent and available like no other trader that I know.. think Mark is the most honest trader I’ve seen and I’ve evaluated probably over 100 rooms. I like Mark over the 14 Titan’s that Dr. Dean Handley has selected..

I’m now doing a combine with Topstep trader using Mark’s system and will be funded soon..

It is absolutely NOT important to me Mark’s background regarding prior career, school etc.. because it has absolutely NO importance nor EFFECT as far as the accuracy of his system and trade calls are concerned. If you disagree; please enlighten me and why.. And please come on now.. who in this world is perfect and has not had some problems etc before in life??

So i urge everyone to concentrate on making money trading because it is the best

form of work out there where one can trade from anywhere in the world. I love it and look forward to Monday to start the week and sad when Friday comes. However I enjoy my time off and trade to live not Live to trade..And I am grateful to Prof Sachs for having given me this opportunity and for being there always..

Personally the good doctor’s past isn’t the issue regarding his trading ability but he’d have been better off if he owned his past mistakes and didn’t try to deceive people. I do wonder though if you’re making so much money trading why do you need to be funded by Topstep? Why not just roll your profits into your account until you get that $25,000 – $30,000?

I plan to have more trading accounts and also a Roth Ira which my wife can trade.

I like Topstep because it will shorten my goal since it gives me more buying power now and I can trade more contracts.. Also trading other people’s money makes me feel at easy and is a good combination in my opinion.. I like Topstep..

Wow! And I thought I was going to do OK using Right Line. Just goes to show you. There isn’t too many truthful traders out there. I wish there was just one that didn’t ask an arm and a leg to learn this deceitful business. Any answers out there in Investigation land? You guys are the balls for digging up dirt. There must be at least 2 or 3 that are reputable. If you know of any besides this craig hill’s trading concepts. Please share them with the room. Great fishing guys.

Mark Sachs is the same M.D. Dr. that got convicted for some kind of scam with drug prescriptions. He’s smart he’s has degrees but he’s also a convicted criminal that does do shady stuff with his trading. I think sociopath a really good taLker I think fooled Handley and almost this review. Great blog caught it!!!

Good job, guys. This website is so good. Why no tweets are posted?:(

This site brings down another one.

Keep digging folks, it pays off. Just like Global Trade Room, the more you dig the more dirt piles up …