Update: Follow Me Trades

-

Honesty

(5)

-

Quality

(5)

-

Cost

(4)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

We originally reviewed Follow Me Trades on November 21, 2016. The review was highly positive.

TradingSchools.Org readers have been asking for an updated performance summary. Here you go. Everything has been verified with actual brokerage statements.

Dean Jenkins of Follow Me Trades continues to be a top performer. Customer feedback has been very good. The refund policy has been iron clad–no complaints.

Thus far, no problems. Which has been a major relief.

Thanks for reading today’s update of Follow Me Trades

On November 21, 2016, TradingSchools.Org published a highly positive review of a swing and position trading service named Follow Me Trades. This article is an update; with a brief history of the company and the person behind Follow Me Trades, as well as an update regarding verified performance since the last review.

Follow Me Trades is owned and operated by Dean Jenkins, living and working out of Olympia, Washington.

Dean Jenkins of Follow Me Trades

Dean Jenkins is a former Intel Corp and NEC executive that earned his MBA from the University of Washington. After 20 years of being a pitiful numbers cruncher, and as he would describe it (a slave laborer) he finally cashed out and retired. As you can probably imagine, his stock in Intel was worth more money that most people can imagine. He was in the right place, at the right time.

In 2006, after retiring from Intel Corp, Dean decided to follow his heart…he decided to become a Christian minister. Usually, at this point, we can start rolling our eyes in cynicism, disbelief, and extreme caution. The red shades of hucksterism never looked so nice, when worn by a slick talking investment guru. In fact, whenever a trading guru starts talking Jesus…whatever remains in my stomach usually curdles with indigestion.

However, with Dean Jenkins, everything regarding his supposed faith checked out. After retiring from Intel Corp, he went on to earn an MA in Pastoral Ministry from Northwest Nazarene University and then started a church. If you want to call it that.

It’s more of a soup kitchen and a refuge for people with a boatload of personal problems. Considering that Dean is pretty new to that whole minister thing, I suppose it’s easier to find folks willing to listen to his message of redemption when he is offering a kind hand and a warm meal.

Anyway, let’s talk about the performance of the trading service.

Follow Me Trades Performance Figures

On our original review, we were able to confirm the following performance, based upon a $100k portfolio:

- 2013 a return of 57%

- 2014 a return of 37%

- 2015 a return of 28%

The original review did not include the year 2016. The following are the updated trades for 2016: ($100k portfolio)

- 2016 a return of 24%.

The following link will give you a highly detailed breakdown of each and every trade.

What I find interesting is the mix of both long and short trades. As you probably already know, we have been in a bull market for nearly 8 years. So a performance summary heavily slanted towards long only trades should be highly suspect. In a bull market, a monkey throwing darts at a newspaper is proven to outperform even the smartest ‘hedge fund experts’.

Hedge Fund Geniuses

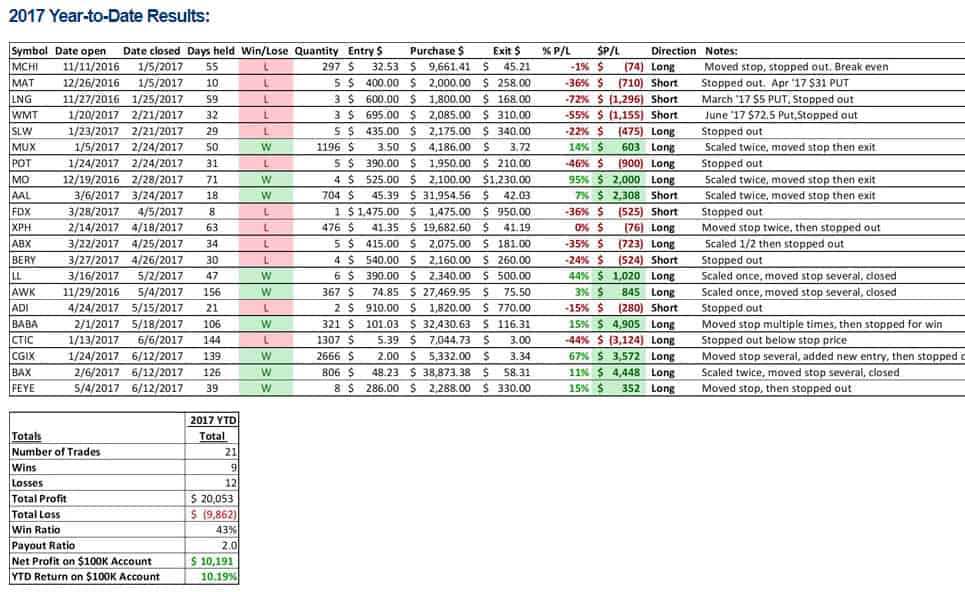

We are now half-way through 2017, and so I also want to include the performance summary for the 2017 closed trades, as well as trades that are currently active and open.

The following performance table has been confirmed and verified as authentic:

Up 10%, pretty darn good.

For 2017, there are also a handful of trades currently open. The following trades are ‘mark to market’ as of June 26, 2017. They are current and actively moving…

As so, for the year, Dean Jenkins is currently up $21k on the $100k portfolio. Looks pretty good to me.

However, these currently active trades could quickly take a turn for the worse. You also need to understand this…

Affiliate and Promotional Relationship

As I stated during the original review, TradingSchools.Org has a sales and affiliate relationship with Dean Jenkins of Follow Me Trades. This is obviously a conflict of interest. The audience needs to be aware of this. With a spirit of full transparency, I want to also inform the audience that I have earned a total of $5,724 in total revenue since this relationship began.

Some may snort with disdain regarding this relationship. However, the audience needs to also realize that running this stupid blog has been a massive time suck. With little pay. Lots of headaches. And a multitude of unpublished and unmentioned legal battles with charlatans attempting to suppress free speech. In short, I am not getting rich. More like barely breaking even.

With this in mind, this cute little link is an affiliate link, with a ‘special offer’ for TradingSchools.Org readers:

SPECIAL OFFER for Follow Me Trades

Customer Complaints and Refund Policy

Thus far, the complaints regarding Dean Jenkins have been refreshingly few. In fact, there has only been one complaint. Every business is going to have a few complaints. Even Jesus had a few complaints regarding the quality of the free wine and fish.

Dean has a liberal refund policy. If you are not happy, for any reason…your money is promptly returned. Period. End of discussion.

Interviews with Current and Former Subscribers

TradingSchools.Org has been in contact with several parties that have been subscribers of the service. Several current, and a couple of former. All of the feedback was good.

The one complaint that did stick out–the trading was boring. Quite simply, the customer was looking for “more action”.

If you are looking for lots of action, a fast pace, and scalping of stocks…this service is not going to work for you. Its slow work. Dean likes to let his trades run. And then run some more. He is the model trend trader.

Wrapping Things Up

Its really nice when I can write an updated review and people are actually doing well. It seems like the moment I write a positive review, the service turns to crap. But with Follow Me Trades, things have been working out really well. Hopefully, the trend continues. When stuff I recommend takes a dive, it makes me look terrible. Maybe that’s why I might recommend one or two trading services per year. And with extreme caution.

When stuff I recommend takes a dive, it makes me look and feel terrible. Maybe that’s why I might recommend one or two trading services per year. And with extreme caution.

If you have spent any amount of time reading this blog…good reviews are as rare as a full eclipse.

Thanks for reading. And I would love to read your opinions below. Even the haters and trolls will find some love.

I’ve been trading stocks since I was in middle school (seriously) in the early 1990’s. I’ve also traded options and futures since the early 2000’s. I’ve joined, attempted to follow, and left several different “systems” and 3 months into following along with followmetrades.com I’m thorough impressed. This is what makes Dean different and why I was comfortable following his trades:

1) You can actually follow his trades. My entries/exits are NOT identical to his, but they are very close. Sometimes mine are slightly better and sometimes slightly worse. This is EXTREMELY rare based on the previous trading rooms, newsletters, etc that I’ve tried.

2) Dean pays for an actual audit of his posted track record and alerts compared to actual live brokerage account statements. Again, I’ve never seen this occur.

3) In case you didn’t catch it in #2, Dean actually trades his own live account with his trades and it’s verified by the audit to match his alerts.

4) The risk/reward is VERY clear on every single entry.

5) Dean’s posted results are based on very modest exposure to any one position.

6) The annual cost is extremely minimal ($647/year during his Green Monday sale) and he offers a no hassle 30 day refund. I actually had started up the service earlier in 2019 but just didn’t make the time to follow along and a quick email to Dean and within a few hours he had replied and refunded me no questions asked.

7) Dean doesn’t over trade. I’d estimate there are 2-5 new entries/week. I’d have to run some analytics on the average hold time, but so far I’ve averaged 4-6 open positions at a time.

Given Dean’s very favorable risk/reward and clear alerts, I’ve been trading slightly more aggressively. Given that this trading is done in an account separate from my other accounts (and thus makes up a smallish portion of my total portfolio value), I’ve been risking approximately 4% on each position. This is higher than Dean suggests, but again something that I’m comfortable with and it doesn’t keep me up at night at all. So far, there have been about 4-6 positions open at a time, so my total risk is approximately 16-24% of the account balance. With this risk profile, I’ve been able to achieve about a 100%+ return on the initial risk capital ($24k up to $48k as of today, including commissions) by trading with him for the last 3 months. I have absolutely no wishful dreams of thinking that things will always be so successful, but for the time being I’ll enjoy the returns.

If you’ve been looking for a system you can actually follow and doesn’t cost insane amounts and that outperforms, I highly suggest you to give it a try. Even if you pay the $647 annual fee and only paper trade it for a year to get comfortable and prove it to yourself, you’ll have made a wise decision.

I do not work for Dean or receive any compensation for my review. I’m just thrilled to have finally found a system that works and wanted to offer my input for other to consider.

Oh, that is really nice to read.

You know, I have been writing these reviews for years and finding someone like Dean was like finding a diamond in a deep dark pit of coal. So rare.

I know for a fact that quite a few successful people found their initial success with Dean, and then like a butterfly…they floated away to a greater adventure. That’s what its all about, learn all you can, then venture off on your own. Become self-sufficient and a master of your own path.

Thanks for taking the time to write. It means much to me.

Certainly glad to contribute Emmett! Thanks to you as well for your review. I had not heard of Dean until find your site and reading several of the reviews you posted. I appreciate your time putting together the reviews and other information you share here! Keep up the good work!

Hi guys. I’m wondering if I could please get a reply to my July and August 2017 questions? Thanks a lot

Joe, it is hard to find previous questions in this thread, responses to responses are buried in different threads. I see that I did answer a question from a “Joe,” but cannot find the ones with those dates.

If you can restate the question, I’ll do my best to answer.

the 2018 results on the opening page is looking pretty stellar, that is, if you accept that some gains are “carry overs” from last year, some trades involved a 14% investment instead of the 2% and if you look at the actual website results for 2018, it shows trades only up until March 1st, quite a bit in the past. It’s a scam really, anyone can claim anything in a spread sheet. buyer beware

Johnny,

My trades last an average of 4-6 weeks. I’m not going to close them just because an arbitrary date passed on the calendar. I going to close them when the exit criteria is met.

Yes, sometimes that means that some trades will “Carry Over” one year to the next. I book the trade for an individual trade when it is closed, with P/L going towards the year it is closed in, win or lose.

If you look, the three “carry over” trades at the beginning of 2018 were: EA ($1010 LOSS), FIT ($1320 LOSS) and LOGI ($2040 LOSS.)

So my “Carry Over” trades from 2018, started me off -$4320 IN THE RED. It sucked and took me a while to come back from (which I have, nicely.)

If I were running a scam, trust me, I could figure out a way to look better than that!

For those interested, the page we are talking about is at this link: https://followmetrades.com/2018-trades-2/

Also, you are misunderstanding my application of the “2% Rule.” I look at the entry point and the initial stop price and ensure that i will LOSE NO MORE THAN 2% of the account, the the trade fails and the stop is hit. Up to 15% of account capital can be in any given trade.

Here is a link, from the home page, that explains this in detail: https://followmetrades.com/risk-management/

Best regards,

Dean Jenkins

dean@followmetrades.com

Shady. Chexk out his 2018 returns so far, big supposed wins carried ovee from lazt year. If you look at his rsturns that only include trades crom 2017, his return is less than 2 percent. Add in fees, you’re losing money. Scam artist like the rest of them. I paid for service, still have access, clear as day what he is doing.

Chris,

Please see my comment above to Johnny. The “Carry Overs” (three trades which are just not closed on 12/31/17 ended up closing in 2018 for a $-4320 loss, IN THE RED.

I cannot imagine how that would be perceived as “big wins” that are propping up current YTD results.

If I’m going to make some numbers up, you can be sure they won’t be over $4000 in loss for the first trades of the year!

As a customer, you are also welcome to cancel at any time with no questions asked, no hard feelings.

Also, just like every customer of mine, you are invited to set up on–on-one time to talk and answer questions. The link to do that was in your welcome email message when you signed up. If you cannot find that, just shoot me an email and I’ll get it to you again.

I have lots of customers named “Chris.” And I don’t know which Chris you are.

I’m here to answer any questions that you have and to help in any way that I can.

If have the opportunity to answer your questions and clarify any misunderstandings, I’m sure you will not continue calling me a “con man.”

Even if, after talking, you still think I am a con man (which I am sure you will not) at least you will be working from good information.

Best Regards,

Dean Jenkins

FollowMeTrades.com

Dean, What is the maximum percentage of your account do you risk?

Starting in mid-2017 I began adding a limit of 15% of account value to trades. That is still the limit I use.

It is also curious that the big winners of 2018 seem to have big upfront risk and the losers, not so much. 90% of losses have risk around 2K to 2,500 but the winners, you have 5K, 6K, 10K 15K. Seems like you know ahead of time which ones will hit big so you bet big and know ahead of time the ones that will lose so you bet small. I wish I had such powers of fortune telling.

Amount of capital put into each trade is determined by my risk management formulas.

Also, if I am going to trade with shares vs. options, there will be substantially more capital in that trade.

I wish I did know which ones would win or lose ahead of time, would make this whole trading thing a lot easier . . .

I am sure you’re all genuine and well ..can i just ask; how did you get a hold of my email address? I haven’t signed up or anything ..

Emmet is a fraud himself.

I am completely new to this website and have no opinion one way or the other about the person(s) running it but I think if you’re going to make that kind of accusation, you should at least provide some kind of evidence to back it up.

Much appreciated Emmett

Just finalized external, objective, CPA firm audit of my results. Will be done each quarter, starting with Q2 2007, first report is here: https://followmetrades.com/verified/

I’m sure there will be skeptics, but show me another advisory service doing this . . .

Dean and FMT is a scam… I’m surprised that I’m the only one that notices it. Is it just pure coincidence that most of the losing trades are option trades and most of the winning trades are stock trades? If you know anything about options, you know that you want to have options if you are going to lose, but have stocks if you are going to win – if you have equal the option price equal your risk in equities. By just doing this “magic trick”, he’s turned a break even performance into a 24% gain. I followed him for 3 months and lost money while he claimed to make money… took me a while to figure out why. I emailed TradingSchools.org about this and never received a response… How much you want to bet that FMT is paying for having this review posted. Be smart and look somewhere else… like IBD – they don’t spoon feed you… well, except for Leaderboard, but it’s a system that works very well in bull markets.

Take a look at the CTIC trade in the table that Emmett posted in the update. It gapped below my stop resulting in a bigger loss than planned (risk per trade is 2% or $2000 in $100k portfolio.) If I were trying to “shade” the results I wouldn’t post the shares trade result for one like that. The results I post are the trades I actually took in my account, shares or options.

Emmett was very clear that he is getting a commission from sales from this update.

Dean Jenkins

FollowMeTrades.com

I just look at Dean’s account statements. What he claims regarding performance is what I have been able to verify.

Everyone gets a little critique. I am still upset at Santa Claus. When I was 8, I wanted the exact same gun as Dirty Harry. But all I got was a little BB gun. Am stilled pissed off about that.

What are you crazy? You’ll shoot your eye out kid.

seems odd that most of these reviews were posted on the same day..

Hi, I have been a happy subscriber with Dean & FollowMeTrades for over a year now and I’m pleasantly satisfied! I have taken his Master Trader Training Course & also included in that is an Stock Option Basics Coures and a Ichimoku Cloud Training Course. Dean is very honest, he answers emails and best of all he will have a individual phone conference with you at anytime. What I can tell anyone that reads my review is that I’m totally satisfied with Dean & the FollowMeTrades service, I am a profitable trader now and I have found a home with FollowMeTrades.

My wife and I trade as a team. We have been trading for over 20 years and have purchased many trading products and have been in a variety of trading rooms. We have our share of war stories and victories, but we have had trouble developing a solid trading plan. Based off of just a few months of live trading with Dean we are confident that we’ve found the path to success. We like Dean’s trading plan. It is solid! We appreciate his honesty , something that is really rare in the world of trading. He shares his thoughts on stocks and options; entries, targets, and stops. He is very thorough on explaining how he develops the plan,

making his methods easy to duplicate.

I went through 3 different services that are on this site before I came across Dean’s service.. I am still pretty new to the service, but don’t see myself leaving anytime soon. Dean takes his time and goes into great detail when reviewing charts in his webinars. He has a wealth of knowledge and does not hesitate to share it. He is always eager to answer questions. The best part of Dean’s service is that I am actually in the green and making profits. Thanks Dean!!!

Dean generally buys calls and puts with the exception being a stock where options aren’t traded. The quantity is determined by the distance from the entry price to the stop loss point. The maximum quantity he’ll take on any trade is set such that if the stop loss point is hit you will lose no more than 2% of your account value. I’m certainly not a spokesman for the group but I think that is probably why you’re calculating a discrepancy.

Hi Emmett. I notice the total absolute value of all the current open positions is over $200K, but it says the results are based on a 100K account so how can this be? Based on these current open positions a 100K account would have to be maxed out on margin to hold over 200K in trades. Technically it appears the account and results are based on a minimum of a 200K account value. That means that if he has $21K in profit so far this year than his actual return is only around 10% and not 20%. Still a healthy return but only half as much as actually reported. To say that the results are based on a 100K account is therfore misleading. Or maybe there is something I am not factoring in or missing here? Are his prior year results also reported the same way and if so the returns would only be half as much as reported? Also, are these results net of commissions? One other food for thought, if he is only trading based on a 100K account, I notice some of his open positions are relatively large, for example some positions are around 30K which would be 30% of 100K portfolio. So it seems a lot of risk is being taken for the returns. Your thoughts?

Hmm. Let me get this clarified.

Joe, thanks for your question. The name of the service is “Stock and Options Picks.” When I publish the trades to my subscribers, I publish the parameters, based on analysis of the underlying chart, to trade it either with outright shares or with options. I provide the details of the option contract for the trade. I am clear with subscribers that I am taking the options trade nearly every time. There are cases where trading the shares makes more sense (I.e. lower priced shares, or which account has available capital…) The option trades use far less capital, typically about 10% of what the shares would cost. The closed trade performance that I post is based on how I actually traded, normalized to a $100k account. If you look at the closed trade details above, you’ll notice that the quantity is usually single digits and the entry price is several hundred dollars – these are option trades.

The snap shot of open trades is based on shares, and I agree with you that some of the position sizes would be too large a percent of a given account. I provide a calculator for subscribers to calculate position size, based on my risk control formula. The calculator returns a quantity based on potential loss at the stop. I provide guidelines for scaling back the trade if the calculator returns a very large position size (and I recommend using options when possible!)

The snap shot of open trades is just that, a snap shot, and as Emmett pointed out, not real until the trades are actually closed.

Dean Jenkins

FollowMeTrades

Are you stating that the following performance numbers are based on trading the options as opposed to the underlining stock. Options trading carries with it a much greater risk. And this performance period has been during a bull market in stocks. If this the option trading performance do you have the returns based on trading the actual stocks.

2013 a return of 57%

2014 a return of 37%

2015 a return of 28%

Rob, the numbers are based on the actual trades I made, using both stock and options. the detailed tables have that information. Subscribers, of course, can execute the trades however they are comfortable with. I respectfully disagree that options inherently have “much great risk.” I believe that depends entirely on the option strategy and how the trades are managed. I only go long calls and long puts and get out; if /when the stop on the underlying shares is hit, and way before expiration approaches and theta decay accelerates.

Dean Jenkins

FollowMeTrades

Thank you Dean Jenkins and Kevin Davey for standing up for transparency in the face of possible harm from the public, unlike the fraud Al Brooks. According to Al Brooks’ webmaster RichardHK showing trading profits is dangerous, as Richard the guttersnipe wrote on Futures.io futures.io/trading-reviews-vendors/23611-al-brooks-trading-course-www-brookstradingcourse-com-33.html when asked if Al should provide evidence to clear up his previous marketing claims of professional trading success “Certainly not. With the high number of idiots in the US, make that gun-toting idiots, I would not want anyone to know if I was making good money trading. Plenty of lottery winners around who have destroyed their lives disclosing their wealth, and being harassed wherever they go, worrying about their kids at school being bullied or even kidnapped, etc… Not worth the risk. Life is too valuable.” Based on Richard’s logic Al should never have said that he was a pro trader in California, which would obviously requiring making a great deal of pre-tax trading profits, as would having Ivy League-educated daughters or that botched trade for $400,000 in 1987’s market crash that Al suggests he could have made if he didn’t have to go to work. This charlatan has even inflated the monetary value of the botched ’87 trade to 1 million dollars potential lost due to work in a most recent shill interview, while not mentioning that inflation was factored into the monetary value of the trade. Al and Richard’s psychopathic attitude of contempt for aspiring traders is reminiscent of the recent Trading123.net review, which has motivated me to provide new material for an update to the Brooks review and it should serve as a catalyst for a thorough CFTC investigation, prior to Brooks’ planned November TradersExpo annual guttysnipe.

Thanks Dean for the reply. Nice to see someone who is finally providing proof of results. I am still unclear on a few things. 1)what does normalized to a 100K account mean? 2) In your year to date results you have some trades over 30K, for example you held $38K in one trade in BAX in which you made $4,448 in this one trade. This $4,448 is included in the total $21K net profit figure for the 2017 results thus far. Thus it appears this result has not been normalized? or if it has than it means you are allocating $38K to one trade on a 100K account which seems very risky? 3) What is the size of your account that you trade with and what are the actual returns for this account? Emmett maybe you can weigh in here as well as I assume you have seen the statements. 4) Are the commissions included in the net results and if not, approximately how much are your commissions for the year? Thanks, I am just trying to get the full picture of the returns versus risk.

Hi Emmett and Dean. Can I get a response to this follow up question? Many Thanks

” you are allocating $38K to one trade on a 100K account which seems very risky? ”

Jay, Jay, Jay. You are asking hard hitting questions that no one wants to answer. Surely not address in this 4.8 star review. But these are the questions that must be answered for anyone to make an intelligent decision on want is the risk .vs reward.

My take is Emmett is so desperate to even give a good review he only skims the surface. The problem is to really evaluate a service a much more in depth analysis must be done, by answering question your are bringing up. Exactly what is the risk associated with this service.

Keep on asking those questions.

Margin accounts with options can usually be double the option “buying power” of the account. As for the updated review, it sounds like clients have been more or less satisfied so far and the reporting of results sounds consistent.. It’s nice to see Emmett has been transparent about his affiliation. How else is trading schools going to keep running along with the security needed and legal needed. Though I would have preferred ts use other avenues such as donation sites etc. Though not perfect like anything is, imo it’s still a lot more rational as a review site than the typical compromised forums and sites of the decade past. Anyways, how was Stray Dog’s assessment of the options newsletter as I recall he was trying it out. Also, how was the futures trading room. Anyone who tried it want to give some idea of what they thought?

dtchurn – just a quick clarification. I was running a futures trading room last year. current trading room watches movement on ES, Gold and Oil for trend, but all trades are stocks and options only.

30 percent is a large portion allocated to one position, but I believe Dean stated that he calculates his position sizing based on his stop which never exceeds 2 percent of the portfolio. Large position size relative to portfolio could be risky but that also depends on the stock. Of course you can have event risk in a stock and lose much more than 2 percent in a catastrophe, but if he has a decent hedge on some of that risk can be mitigated. As far as leverage it comes down again to what you are risking per trade provided that you don’t lose the total investment, with the correct stocks and leverage you should most of the time hit your 2 percent per position stop loss limit. As a result if he is basing off of a 100k account and uses leverage those percentages are correct. Unless I am missing something.

As far as commissions, I would like to know if that is calculated in the total return? If not, that would obviously change the percentages.

I’ve been a subscriber to Dean’s trading room for one and a half years and plan to stay for quite a while! I checked out a lot of the webinars out there and listened to a whole lot of hucksters talk before deciding that Dean was someone I could trust and rely on. I tend to be a pretty skeptical person so many of Emmett’s one star ratings are about people I had previously checked out and fortunately had found unconvincing.

I can say from following Dean in his trading room that the historical results you see are real. He updates his trading record right in front of our eyes as he actually trades. The excel worksheets he uses to keep track are always available for subscribers to view and download from his website. He tells us his exact entries and exits and if it’s an option trade we get the precise details. He frequently enters or exits trades while he’s in the room so we actually see him go through the process. Many times he’ll say if you want to be aggressive you could go into this trade right now, but he always waits for his conditions to be met. Every trade has precise entry, stop and target points decided before he enters the trade. He also spends quite a bit of time scanning and looking for trading opportunities that match his requirements.

Being in his room has been an opportunity for me to see first-hand how a professional trader thinks and how he approaches the markets on a daily basis. To trade like Dean you have to be very patient but it’s worth it for me.